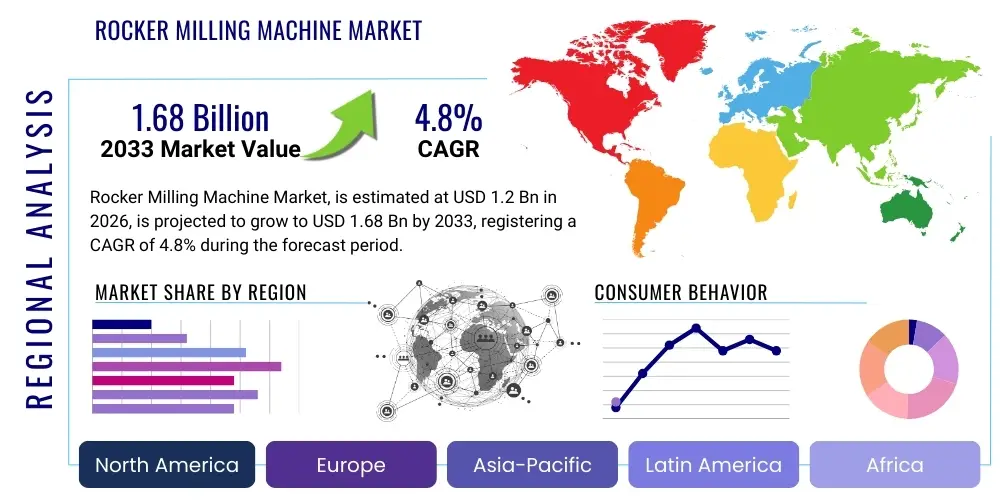

Rocker Milling Machine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437318 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Rocker Milling Machine Market Size

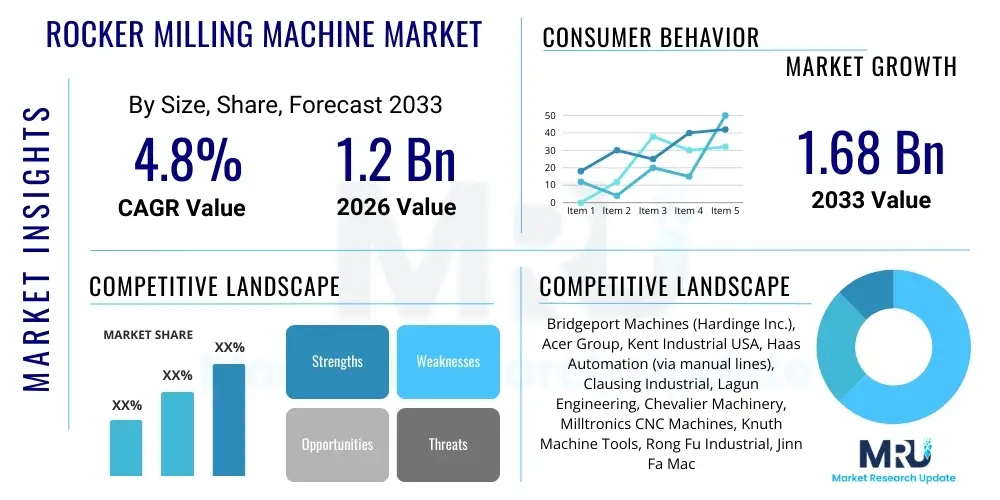

The Rocker Milling Machine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 1.68 Billion by the end of the forecast period in 2033.

Rocker Milling Machine Market introduction

The Rocker Milling Machine Market encompasses the global trade, production, and utilization of traditional manual or semi-automatic turret-style milling machines, often referred to as vertical knee-type mills. These machines are foundational in precision engineering, renowned for their versatility, rigidity, and the ability to perform complex operations such as drilling, boring, and profiling, particularly through the pivotal movement capability inherent in the rocker mechanism (the swivel or tilt function of the ram and head). While advanced CNC machining centers dominate high-volume production, rocker milling machines remain critical assets in job shops, prototyping centers, educational institutions, and maintenance, repair, and overhaul (MRO) facilities where flexibility and operator control are paramount. The enduring demand stems from their relatively lower cost of ownership, ease of maintenance, and suitability for highly customized, low-volume components.

The core product description revolves around a machine tool utilizing a rotating cutting tool (the end mill) to remove material from a workpiece affixed to a movable table. Key components include the column, knee, saddle, table, and the defining turret head assembly which allows the spindle head to swivel (rock) and nod, offering angular machining capabilities vital for specialized tooling and mold-making processes. Major applications span across the automotive aftermarket for custom components, aerospace maintenance for repair parts, defense industries for specialized tooling, and the broader tool and die sector for creating molds and jigs. The market is currently undergoing a subtle transformation, integrating digital readout (DRO) systems and minor automation features to enhance precision without sacrificing the fundamental manual control preferred by skilled machinists.

The primary benefits driving continuous demand for these machines include exceptional operational flexibility, rugged durability, and precision machining capabilities essential for surface finishing and tight tolerance requirements in non-mass production environments. Furthermore, they serve as crucial training tools for future engineers and machinists. Key driving factors accelerating market penetration include the resurgence of localized manufacturing (reshoring), increased investment in technical education and vocational training globally, and the consistent need for highly precise tooling in emerging high-tech sectors. The resilience of the aftermarket and MRO sector, which relies heavily on adaptable machinery for diverse repair tasks, further anchors the market’s stable growth trajectory amidst competitive pressure from fully automated CNC systems.

Rocker Milling Machine Market Executive Summary

The Rocker Milling Machine Market is characterized by steady, incremental growth, primarily driven by replacement cycles, expansion in vocational education sectors, and sustained demand from small to medium-sized enterprises (SMEs) focused on high-mix, low-volume production. Current business trends indicate a critical focus on blending traditional mechanical reliability with modern digital enhancements, specifically the integration of advanced Digital Readouts (DROs) and semi-closed loop feedback systems to boost accuracy and operational efficiency. Although capital expenditure for pure CNC machinery is increasing, the rocker mill niche is protected by its necessity in tooling and prototyping applications where rapid setup and manual intervention are assets. Geographically, Asia Pacific, particularly China and India, represents the largest growth engine, fueled by massive infrastructure investments and rapid industrialization requiring foundational machine tools, while North America and Europe maintain a stable market driven by replacement demand and the high-precision aerospace/defense MRO sectors. Manufacturers are strategically positioning themselves by offering modular designs and customizable automation packages to appeal to a broader customer base.

Regional trends highlight a dynamic shift in manufacturing capacity, with APAC manufacturers increasingly dominating the production side, offering competitive pricing and robust designs. Conversely, Western markets emphasize reliability, brand heritage, and superior service networks, often targeting high-end, heavy-duty machines or specialized micro-milling applications. North America is seeing renewed interest in domestic sourcing, benefiting suppliers who can demonstrate short lead times and robust spare parts availability. Segment trends reveal that the Digital Readout (DRO) equipped segment commands a premium and exhibits the highest growth rate, reflecting the industry’s pursuit of enhanced precision documentation and reduction of human error. Furthermore, demand for medium-duty machines (table sizes between 10"x50" and 12"x58") remains the strongest due to their optimal balance of footprint, power, and operational versatility suitable for most general engineering workshops.

Overall, the market landscape is moderately consolidated but highly competitive, featuring both global legacy players known for quality and specialized regional manufacturers offering cost-effective solutions. Key strategies adopted include vertical integration to control component quality, aggressive after-sales service provisioning, and strategic partnerships with technical schools to secure future market loyalty. Despite the challenges posed by automation, the Rocker Milling Machine market maintains its essential position by serving the fundamental needs of the metalworking industry where cost-effectiveness, durability, and operator skill dictate success. The market’s continued evolution will be defined by its ability to integrate smart features like basic process monitoring and preventative maintenance alerts without sacrificing the core operational flexibility that defines this machine category.

AI Impact Analysis on Rocker Milling Machine Market

Common user questions regarding AI’s influence on the Rocker Milling Machine market primarily center around themes of obsolescence versus enhancement: Will AI replace manual machinists? How can these traditional machines integrate with Industry 4.0 concepts? Users are concerned about whether AI-driven maintenance predictive systems are economically viable for lower-cost rocker mills, and if AI can assist in optimizing complex manual setups or tool wear management, bridging the gap between operator experience and empirical data. The key expectation is that AI will not automate the fundamental rock milling process entirely, but rather serve as a powerful cognitive assistant, offering real-time feedback on parameters, optimizing material removal rates based on acoustic monitoring, and streamlining preventative maintenance schedules. Users seek justification for adopting AI-related upgrades in a machine traditionally valued for its simplicity and manual control.

The direct impact of Artificial Intelligence on the Rocker Milling Machine market is primarily indirect, focusing less on controlling the tool path (which remains operator-driven or DRO-assisted) and more on enhancing the surrounding operational ecosystem. AI algorithms are increasingly being deployed in manufacturing environments for predictive maintenance (PdM). For rocker mills, this involves analyzing vibration data, temperature fluctuations in the spindle head, and power consumption signatures to forecast potential mechanical failures well before they occur. This transition from reactive to proactive maintenance significantly reduces unscheduled downtime, thereby improving the overall equipment effectiveness (OEE) of these traditional machines, which are often the backbone of smaller job shops.

Furthermore, AI is beginning to influence quality control and process optimization in manual machining settings. Computer vision systems, powered by machine learning, can be integrated alongside rocker mills to perform in-process dimensional inspection, instantly verifying component tolerances and flagging deviations that a human operator might miss during the machining cycle. This enhances the precision output of manual operations. In the context of training and upskilling, AI-driven simulation platforms and augmented reality (AR) tools are utilizing machine learning to provide realistic training environments for new machinists, allowing them to practice complex rocking and angling setups virtually, speeding up the transition to proficient operation on physical machines. This integration elevates the value proposition of the rocker mill in modern production contexts.

- AI-driven Predictive Maintenance (PdM): Analyzes operational data (vibration, heat) to minimize spindle failure and unscheduled downtime.

- Optimized Machining Parameters: Machine learning models suggest optimal feed and speed adjustments based on material and tool condition for manual operations.

- Computer Vision Quality Control: Utilizes ML for real-time, non-contact inspection of finished surfaces and component geometry.

- Augmented Reality (AR) Training: AI-enhanced AR platforms provide guidance for complex manual setups and calibration procedures.

- Supply Chain Optimization: ML algorithms forecast demand for specialized spare parts (e.g., knee mechanisms, spindle bearings) based on machine fleet usage profiles.

- Energy Consumption Monitoring: AI optimizes power usage by identifying and recommending shutdown or idle modes based on production schedules.

- Process Digitalization: Enables integration of manual machining data into broader Manufacturing Execution Systems (MES) for holistic oversight.

DRO & Impact Forces Of Rocker Milling Machine Market

The Rocker Milling Machine Market is propelled by the growing necessity for versatile, rugged, and cost-effective tooling solutions across various industrial sectors, balanced against restraints imposed by increasing automation trends and skilled labor shortages. A key driver is the enduring demand for prototyping and custom component manufacturing, areas where the flexible setup and manual precision of a rocker mill outperform high-speed CNC centers due to lower initial costs and quicker turnaround times for one-off pieces. Restraints include the perception of rocker mills as outdated technology and the difficulty in finding and training skilled operators proficient in manual milling techniques. Opportunities arise through the integration of digital technologies, particularly advanced DRO systems and affordable retrofits that enhance precision and connectivity. The collective impact forces show that while technological headwinds favor CNC, the fundamental economic advantages and niche application requirements of rocker mills ensure market stability and targeted growth.

Key drivers center on industrial robustness and educational mandates. The long lifespan and relatively low maintenance costs associated with traditional cast-iron construction make rocker mills highly attractive investments for SMEs and emerging markets where capital is scarce but durability is essential. Furthermore, the global emphasis on vocational training and hands-on mechanical engineering curricula necessitates the widespread use of manual and semi-manual machines for foundational skill development. The primary restraints relate to competitive substitution, where highly sophisticated 5-axis CNC machines are increasingly becoming more affordable, capturing potential market share for complex parts. Additionally, manual operations inherently suffer from higher rates of human error and lower repeatability compared to fully automated systems, posing quality consistency challenges in high-stakes environments.

Opportunities for market expansion are rooted in technological augmentation and geographical expansion. Offering hybrid machines—rocker mills retrofitted with basic conversational CNC controls—opens avenues for semi-automated production while retaining manual functionality. Geographically, significant opportunities exist in developing economies in Asia and Africa, where foundational industrial infrastructure is rapidly expanding. Impact forces are moderately favorable, with demand cycles tied strongly to global MRO activity and capital investment in technical infrastructure. The market is moderately susceptible to economic downturns, as rocker mills are considered long-term capital assets; however, their lower entry cost buffers them better than expensive CNC centers during periods of financial constraint. Sustainable growth hinges on manufacturers successfully marketing these machines not as relics, but as versatile, digitized tools vital for modern precision engineering workshops.

- Drivers:

- High Demand for Prototyping and Tool & Die Manufacturing.

- Lower Initial Investment and Maintenance Costs compared to CNC centers.

- Robustness and Durability ensuring long operational life.

- Essential role in Vocational Training and Technical Education institutions.

- Growth in Maintenance, Repair, and Overhaul (MRO) sectors globally.

- Restraints:

- Competitive threat from increasingly affordable and advanced CNC Milling Machines.

- Shortage of highly skilled manual machinists (skilled labor gap).

- Lower repeatability and higher potential for human error compared to automated systems.

- Slower production speeds relative to modern manufacturing requirements.

- Opportunities:

- Integration of advanced Digital Readout (DRO) systems and enhanced sensing capabilities.

- Development of hybrid manual/conversational CNC controls for increased versatility.

- Expansion into rapidly industrializing regions (APAC, MEA) needing foundational machine tools.

- Focus on specialized vertical markets such as medical device prototyping and specialized aerospace tooling.

- Impact Forces:

- High Impact: Global Industrial Production Index (positive correlation).

- Medium Impact: Availability of Skilled Labor (negative correlation).

- Moderate Impact: Technological Advancements in Affordable CNC Solutions (competitive pressure).

Segmentation Analysis

The Rocker Milling Machine market is systematically segmented based on operational capabilities, structural configurations, power type, and end-user application, allowing manufacturers to tailor offerings to specific industrial needs. Operational capabilities form a primary segmentation axis, differentiating between purely manual machines, which offer maximum tactile feedback and control, and semi-automatic machines, which incorporate power feeds or basic programmable logic controllers (PLCs) for table movement, enhancing productivity for repetitive cuts. Structural configuration typically divides the market into standard vertical knee-type mills (the most common type), which leverage the rocking head, and ram-type mills, which offer greater versatility in head positioning. This rigorous segmentation is critical for optimizing distribution channels and marketing efforts, ensuring that the specific demands of specialized customers, such as mold makers versus general job shops, are met with the appropriate machine specification.

Power source segmentation, although seemingly basic, is fundamental in determining the machine’s deployment environment, differentiating between traditional electrical power systems (3-phase) necessary for heavy-duty industrial use and single-phase models suitable for smaller workshops or hobbyist applications. However, the most commercially relevant segmentation is often by end-user, highlighting the distinct requirements of diverse sectors. Tool and Die shops require extreme precision and highly complex tilting capabilities, favoring robust, high-tolerance machines. Educational institutions prioritize ease of use, safety features, and reliability. Conversely, general job shops seek versatility and a balance between cost and performance. Analyzing these segments provides deep insight into current demand patterns, showing high growth in sectors undergoing rapid technological adoption that still requires foundational machining skills.

The segmentation by automation level—manual, semi-automatic (power feed), and light CNC assist—drives pricing and feature sets. The semi-automatic segment currently holds the largest market share due to its optimal balance of manual control for precision tasks and powered assistance for efficiency. Furthermore, the market is increasingly segmented by the inclusion of Digital Readout (DRO) systems, which is becoming a quasi-standard feature. High-end, multi-axis DRO systems provide superior accuracy and repeatability measurements, commanding higher prices and catering to demanding industries like aerospace and medical device manufacturing. Strategic differentiation through these segments allows market players to achieve targeted product placement and sustain competitive advantage despite the presence of advanced automation technologies in the broader metalworking sector.

- By Type (Configuration):

- Vertical Knee-Type Rocker Mills (Standard)

- Ram-Type Rocker Mills (Increased Head Mobility)

- Universal Rocker Mills (Capable of both horizontal and vertical operations)

- By Operation Mode:

- Manual Rocker Mills

- Semi-Automatic Rocker Mills (with Power Feed)

- CNC-Assist Rocker Mills (Hybrid Conversational Control)

- By Capacity (Table Size/Weight):

- Light Duty Rocker Mills (Benchtop/Small Workshops)

- Medium Duty Rocker Mills (Standard Job Shop Size)

- Heavy Duty Rocker Mills (Industrial Applications)

- By End-Use Industry:

- Tool and Die Manufacturing (Molds, Jigs, Fixtures)

- Automotive and Aerospace MRO (Repair Parts)

- General Engineering and Fabrication

- Educational and Research Institutions

- Energy and Heavy Equipment Industries

- By Digital Integration:

- Standard (Analog Dials)

- Digital Readout (DRO) Equipped

- Smart/Connected (IoT Ready)

Value Chain Analysis For Rocker Milling Machine Market

The value chain for the Rocker Milling Machine market begins with upstream material sourcing, primarily involving high-grade cast iron and specialized alloy steel essential for the machine's base and critical components like the spindle, ram, and gear train. Manufacturers place a high value on procuring high-quality castings, which require specialized foundry processes to ensure optimal damping characteristics and rigidity, critical for maintaining machining precision. Key upstream analysis focuses on stability of raw material prices, particularly steel and energy costs for casting. Major cost drivers at this stage include precision machining of critical components (e.g., ground ways and ballscrews) and the assembly of proprietary head mechanisms that define the rocker motion. Efficiency in this stage directly translates to the machine’s overall reliability and lifespan, which are key selling points for this traditional equipment.

The midstream segment involves the core manufacturing, assembly, and integration processes. Manufacturers often rely on in-house expertise for machine way scraping and alignment, highly skilled operations vital for ensuring geometric accuracy. After core assembly, value is added through the integration of third-party components, notably electronic control systems, motors, and high-precision Digital Readout (DRO) systems, which significantly enhance the machine’s market value. Direct distribution channels are often preferred for major industrial sales, where the manufacturer handles installation, commissioning, and direct after-sales service. This allows for deep customer relationships and feedback loops, essential for iterative product improvement and maintaining brand reputation for quality and reliability.

Downstream analysis focuses on reaching the final end-user through various distribution channels. While direct sales serve large corporations and government tenders (such as educational institution contracts), the majority of rocker mills are sold via indirect channels: specialized machine tool distributors and localized dealers. These dealers provide essential localized support, including financing options, immediate technical service, and spare parts inventory, which is crucial for customers like small job shops that cannot afford extended downtime. The downstream value is heavily influenced by after-sales service contracts, operator training packages, and the provision of specialized tooling and accessories (e.g., rotary tables, specialized vises). The aftermarket support for these durable machines represents a stable, long-term revenue stream, particularly for legacy manufacturers with extensive parts catalogs.

Rocker Milling Machine Market Potential Customers

Potential customers for Rocker Milling Machines span a broad range of industrial and institutional users who prioritize versatility, foundational precision, and cost-effectiveness over absolute high-speed automation. The primary customer segment remains the Small and Medium-sized Enterprise (SME) Job Shops specializing in contract manufacturing, especially those involved in prototyping, custom one-off parts, and highly varied batch production. These shops often cannot justify the capital expenditure of large CNC centers for irregular workloads but require the precision afforded by a robust, well-maintained rocker mill. They value the machine's ability to handle diverse materials and applications with minimal setup time changes, making them the backbone of localized manufacturing economies.

Another significant customer base lies within the Tool and Die, Mold Making, and Fixture Manufacturing sectors. These specialized industries require exceptional geometric accuracy and the unique angular machining capabilities provided by the rocking head mechanism to create complex molds, jigs, and fixtures used in mass production. For them, the machine is an essential, high-precision instrument for internal production needs. Furthermore, the Maintenance, Repair, and Overhaul (MRO) operations across aerospace, defense, and heavy equipment industries are crucial consumers. MRO facilities frequently need to fabricate replacement parts that are either obsolete or required urgently, and the flexibility of the rocker mill allows rapid reverse engineering and machining of these critical, low-volume components.

The institutional sector constitutes a high-value customer group. Technical and vocational schools, universities, and research laboratories worldwide require rocker milling machines as fundamental teaching tools. They are used to train future engineers and machinists on core principles of metal removal, tolerance management, and manual operation, skills which remain vital even in automated environments. These institutions look for reliability, robust safety features, and simplified maintenance procedures. The final, emerging customer segment includes advanced hobbyists and professional makerspaces that demand industrial-grade precision and durability in compact or light-duty formats for complex personal or low-volume commercial projects.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 1.68 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bridgeport Machines (Hardinge Inc.), Acer Group, Kent Industrial USA, Haas Automation (via manual lines), Clausing Industrial, Lagun Engineering, Chevalier Machinery, Milltronics CNC Machines, Knuth Machine Tools, Rong Fu Industrial, Jinn Fa Machine, WMT CNC Industrial, Tormach LLC, Baileigh Industrial, ZPS - Tajmac, DMG MORI (in specialty areas), Hurco Companies, South Bend Lathe, Grizzly Industrial, JET Tools |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Rocker Milling Machine Market Key Technology Landscape

The technology landscape for Rocker Milling Machines is defined less by radical reinvention and more by sophisticated augmentation, focusing on enhancing precision, efficiency, and data connectivity while preserving core manual functionality. The most critical technological advancement is the widespread adoption of high-resolution, multi-axis Digital Readout (DRO) systems. Modern DRO units employ linear scales with resolutions down to sub-micron levels, significantly improving the accuracy of position feedback and reducing operator reading error, thereby bridging the precision gap between manual and basic CNC operation. Furthermore, advanced DRO systems now offer features such as bolt-hole patterns, centerline finding, and specialized calculator functions, streamlining complex setups that were historically performed manually using dial indicators and micrometers. This integration of digital precision into traditional mechanical infrastructure is a key differentiator in the current market.

Beyond digital readouts, technological evolution involves improvements in mechanical engineering for core components. Many high-end manufacturers now incorporate hardened and ground ways, often coated with materials like Turcite-B, which minimizes stick-slip (stiction) and ensures smoother, more precise movement of the table and knee, contributing directly to better surface finish and longevity. Another key focus is the spindle technology; while traditional belt-drive systems remain popular for their torque characteristics, some advanced rocker mills now integrate Variable Frequency Drives (VFDs) with high-horsepower motors, allowing for continuous and rapid speed adjustment. This optimization of cutting parameters is crucial for machining modern, high-performance alloys and composites that require tight control over spindle RPMs and thermal management, extending tool life significantly.

The emerging technological frontier involves connecting the rocker mill to the broader Industrial Internet of Things (IIoT). Although still nascent, some manufacturers are experimenting with sensors attached to the spindle or motor to monitor vibration, temperature, and current draw. This data is wirelessly transmitted for cloud-based AI analysis, enabling preventative maintenance scheduling and performance benchmarking against fleet averages. For the operator, technology also includes enhanced safety features, such as electromagnetic spindle brakes, and ergonomic improvements, including counterbalanced knees and improved machine guarding. These technological investments demonstrate the market’s commitment to making the rocker mill a relevant, safe, and highly precise tool in the modern, data-driven manufacturing environment, ensuring its role in both production and education remains secure.

Regional Highlights

- Asia Pacific (APAC): APAC is projected to be the fastest-growing market, primarily due to rapid industrialization, extensive government investment in manufacturing capacity (e.g., in China, India, and Southeast Asia), and the explosive growth of the SME sector. These economies prioritize cost-effective and robust foundational machine tools, making rocker mills a high-demand item. The region is also a major global production hub for these machines, leading to intense competition and competitive pricing. India and China are not only large consumers but also significant exporters, impacting global pricing dynamics.

- North America: This region represents a mature market characterized by high replacement demand and strong emphasis on quality and precision, particularly from the aerospace MRO and defense contractors. North American customers typically seek machines equipped with high-end Digital Readout (DRO) systems and stringent safety certifications. The market is stable, driven less by new capacity expansion and more by the need to maintain existing fleets and support specialized prototyping required for high-tech innovation. Domestic manufacturers often compete on service quality and brand legacy.

- Europe: The European market, encompassing Western and Central Europe, values durability, energy efficiency, and high-specification machines that comply with strict EU safety and environmental regulations. Germany, Italy, and the UK are key markets, driven by specialized engineering, automotive component manufacturing, and tool-making industries. There is a notable trend towards retrofitting older, high-quality European machines with modern DROs and energy-efficient motors to extend their service life and compliance. Vocational training centers across Europe maintain a consistent demand for manual machines.

- Latin America (LATAM): LATAM is a developing market with significant potential, driven by infrastructure projects, mining, and localized automotive repair industries, particularly in Brazil and Mexico. Price sensitivity is high, leading to a strong demand for cost-effective, durable, and easily maintainable machines. The growth rate is contingent upon stable economic conditions and foreign direct investment into manufacturing capabilities, often favoring imported machines from APAC due to favorable pricing structures.

- Middle East and Africa (MEA): This region is an emerging market where demand is sporadic but growing, fueled by diversification efforts away from oil dependence (e.g., Saudi Arabia’s Vision 2030) and increased investment in localized defense and general engineering capabilities. Demand focuses on robust, basic models suitable for harsh operating environments. Investment in technical training infrastructure, particularly in nations like the UAE and South Africa, also contributes significantly to demand for foundational machine tools like rocker mills.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Rocker Milling Machine Market.- Hardinge Inc. (Parent company of Bridgeport Machines)

- Acer Group

- Kent Industrial USA

- Clausing Industrial

- Lagun Engineering

- Chevalier Machinery

- Milltronics CNC Machines (Offering hybrid solutions)

- Knuth Machine Tools

- Rong Fu Industrial

- Jinn Fa Machine

- WMT CNC Industrial

- Tormach LLC (Focusing on compact solutions)

- Baileigh Industrial

- ZPS - Tajmac

- Grizzly Industrial

- JET Tools

- Republic Lagun Machine Tool Co.

- Birmingham Tool and Manufacturing

- Enshu Limited

- Harrison Machine Tools

Frequently Asked Questions

Analyze common user questions about the Rocker Milling Machine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a Rocker Milling Machine and a standard CNC Machining Center?

The Rocker Milling Machine, often a vertical knee mill, relies primarily on manual operation and features a unique swivel or 'rocker' head for angular machining, offering high flexibility for low-volume, custom jobs. A standard CNC Machining Center is fully automated, utilizing computer numerical control for high-speed, high-volume production with superior repeatability but less manual adaptability.

How does the integration of Digital Readout (DRO) systems impact the usability and precision of rocker mills?

DRO systems enhance usability by providing high-resolution, real-time positional feedback, minimizing human error associated with reading manual dials. This dramatically improves machining precision and repeatability, making the rocker mill suitable for tighter tolerances required in modern prototyping and tool-making applications.

Which industry segment drives the highest demand for heavy-duty Rocker Milling Machines?

The Tool and Die manufacturing sector and heavy equipment Maintenance, Repair, and Overhaul (MRO) sectors drive the highest demand for heavy-duty rocker mills. These industries require robust machines capable of handling large workpieces and performing precise, angular cuts necessary for complex molds, jigs, and critical replacement components.

Is the Rocker Milling Machine market facing obsolescence due to the rise of affordable CNC technology?

No, the market is stable due to its specific niche. Rocker mills remain critical for educational training, low-volume prototyping, and specialized repair tasks where their lower capital cost, operational simplicity, and essential manual control offer distinct economic and functional advantages over fully automated CNC alternatives.

What are the key purchasing criteria for Rocker Milling Machines in emerging markets?

In emerging markets, key purchasing criteria prioritize low initial investment, extreme durability, ease of maintenance (simple mechanical structure), and access to local spare parts. Price-competitive machines from APAC manufacturers equipped with basic reliability features are generally favored over high-end models.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager