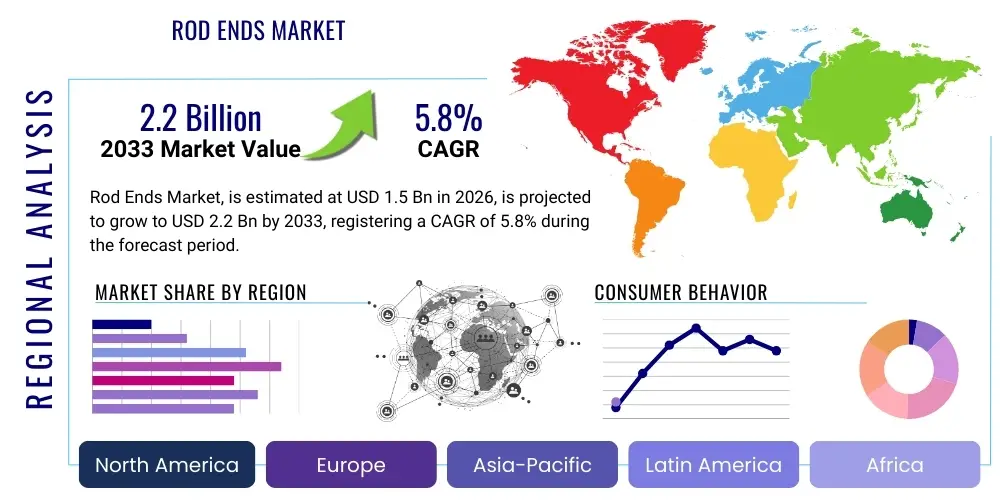

Rod Ends Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437147 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Rod Ends Market Size

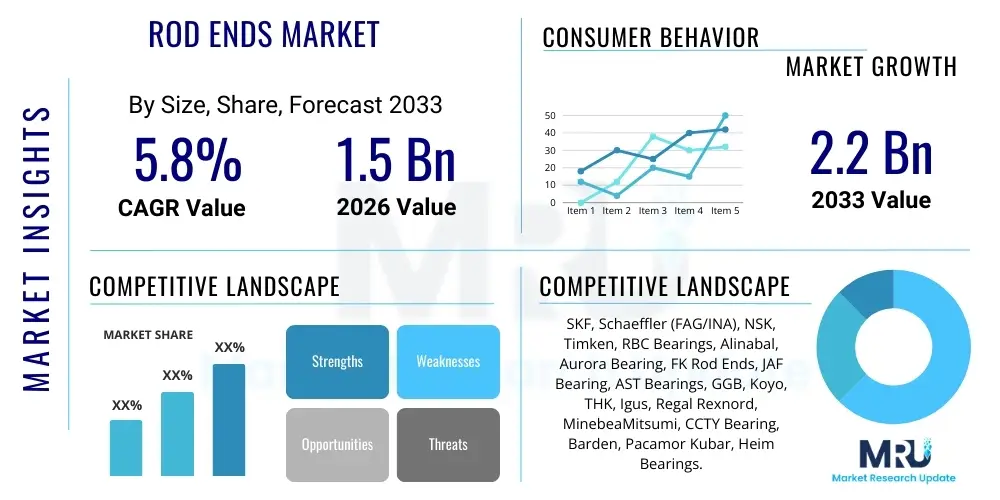

The Rod Ends Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.2 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally supported by the continuous expansion of core industrial sectors, including sophisticated automation systems and high-precision machinery used across manufacturing, aerospace, and construction applications. The intrinsic function of rod ends—to facilitate articulation between linked parts subject to angular misalignment—positions them as critical components whose demand scales directly with global industrial output and capital expenditure.

Rod Ends Market introduction

The Rod Ends Market encompasses the global trade and utilization of mechanical articulation components, specifically designed to connect the end of a cylinder or mechanical linkage to another component. These devices typically consist of a housing formed with a thread on the shank and a spherical plain bearing integrated into the bore, enabling angular movement. Rod ends are pivotal in motion control systems, translating linear motion into angular alignment or compensating for misalignment in dynamic load conditions. Their applications span critical systems requiring reliable performance under heavy loads and repetitive cycles, ensuring the structural integrity and operational efficiency of connected machinery.

Major applications of rod ends are highly diversified, extending through the automotive industry (steering and suspension linkages), aerospace and defense sectors (flight control surface actuation), construction and mining equipment (hydraulic cylinder attachments), and general industrial machinery (packaging, textiles, and robotics). The primary benefit derived from using rod ends is their capacity to handle substantial radial and axial loads while accommodating angular misalignment, thereby reducing stress on interconnected components and prolonging the equipment’s service life. Furthermore, precision rod ends contribute significantly to the accuracy and responsiveness of controlled systems.

Driving factors fueling this market include the global push toward industrial automation, requiring higher performance and precision in linkage mechanisms, particularly in robotic arms and CNC equipment. The resurgence in commercial aircraft manufacturing and the sustained demand for heavy-duty off-road vehicles also contribute significantly. The ongoing development of specialized, low-maintenance materials, such as self-lubricating PTFE liners and composite housings, further enhances the market appeal by reducing downtime and operational costs for end-users, solidifying the rod end market’s robust growth prospects across varied industrial landscapes.

Rod Ends Market Executive Summary

The Rod Ends Market is characterized by moderate but stable growth, driven primarily by macroeconomic business trends, specifically the increasing capital investment in infrastructure and next-generation manufacturing technologies across Asia Pacific. Key business trends indicate a shift towards high-performance and maintenance-free solutions, with manufacturers increasingly focusing on miniaturization for applications in robotics and medical devices, alongside robust designs for harsh environments like mining and marine. Consolidation among major bearing manufacturers is also shaping the competitive landscape, leading to enhanced product portfolios and integrated supply chain efficiencies, optimizing distribution channels and market reach globally.

Regionally, Asia Pacific (APAC) maintains its dominance and serves as the epicenter of future market expansion, fueled by massive industrialization initiatives in China, India, and Southeast Asian nations, particularly within the automotive and heavy machinery sectors. North America and Europe, while representing mature markets, exhibit strong demand for highly specialized and certified rod ends, especially those conforming to stringent aerospace and defense standards, emphasizing precision, reliability, and long service life. These mature regions are pioneering the adoption of smart bearing technologies, integrating sensors for condition monitoring and predictive maintenance protocols.

Segment trends reveal that the Heavy Duty and Precision Rod Ends segments are experiencing the fastest growth, propelled by the demand for machinery operating under extreme pressures and requiring exceptional positional accuracy. In terms of material segmentation, the adoption of composite and advanced polymer materials is rising steadily, offering benefits such as corrosion resistance and lighter weight, challenging the traditional dominance of high-strength steel. The Aftermarket segment continues to provide a stable revenue stream, necessitating continuous inventory management and localized distribution networks to serve diverse maintenance, repair, and overhaul (MRO) requirements across industries worldwide.

AI Impact Analysis on Rod Ends Market

User inquiries regarding the influence of Artificial Intelligence (AI) on the Rod Ends Market primarily revolve around three central themes: optimizing the manufacturing process, enhancing product performance through predictive maintenance, and streamlining supply chain logistics. Users are keen to understand how AI-driven simulations can refine rod end designs for specific load profiles, thereby reducing material waste and improving durability. A major concern is the integration of physical components, like rod ends, into complex digital twin environments, requiring real-time performance data gathering. Expectations are high that AI will move the market toward proactive failure prevention, utilizing sensor data to predict the remaining useful life (RUL) of critical components, transforming traditional reactive maintenance models into highly efficient, data-driven systems.

- AI-driven simulation and topology optimization accelerate the design phase of rod ends, reducing material usage while maintaining or increasing load capacity.

- Integration of machine learning algorithms for predictive maintenance analyzes vibration and temperature data from associated machinery to forecast potential rod end failure, minimizing unplanned downtime.

- AI enhances quality control during manufacturing by rapidly analyzing high-throughput sensor data (e.g., surface finish, dimensional accuracy) to identify microscopic defects missed by traditional inspection methods.

- Optimized inventory management and demand forecasting for aftermarket rod ends are achieved using AI to analyze historical consumption patterns and macro-economic indicators.

- Autonomous robotic assembly lines, managed by AI, improve the precision and consistency of integrating spherical plain bearings into the rod end housing, thereby ensuring higher overall product reliability.

DRO & Impact Forces Of Rod Ends Market

The Rod Ends Market dynamics are governed by a complex interplay of systemic drivers, manufacturing restraints, and emerging technological opportunities. Key drivers include the robust expansion of the global construction sector, necessitating durable and reliable linkages for heavy machinery, coupled with the rapid adoption of sophisticated industrial robotics across manufacturing facilities worldwide. However, the market faces significant restraints, primarily the volatile pricing and supply chain complexities associated with high-grade steel and specialized alloys required for precision rod ends. Furthermore, the necessity for extreme precision and adherence to stringent industry-specific standards (e.g., AS9100 for aerospace) presents a manufacturing complexity barrier for smaller players, influencing market structure.

Opportunities for growth are concentrated in the development and commercialization of next-generation, self-lubricating rod ends that utilize advanced polymeric and composite materials, significantly extending operational life and reducing reliance on manual maintenance cycles. The expansion into emerging applications such as renewable energy systems (wind turbine pitch controls) and high-speed rail also presents lucrative avenues. Impact forces include intense competition leading to pressure on average selling prices (ASPs), coupled with the pervasive influence of regulatory standards (such as environmental compliance and safety mandates) that necessitate continuous material innovation and testing, affecting product development timelines and costs.

Segmentation Analysis

The Rod Ends Market is extensively segmented based on type, material, application, and end-user, reflecting the component's pervasive role across highly varied industrial ecosystems. The segmentation by type differentiates products based on thread design (male or female) and operational capability (standard versus heavy duty or precision grades). Material segmentation is crucial as it determines performance characteristics, separating traditional steel solutions from advanced, corrosion-resistant, or lightweight composite alternatives. Application segmentation highlights the diverse vertical markets driving demand, with industrial machinery and automotive sectors typically accounting for the largest volumes, while aerospace commands the highest price points due to stringent quality requirements and low volume manufacturing.

- By Type:

- Male Thread Rod Ends

- Female Thread Rod Ends

- Standard Duty Rod Ends

- Heavy Duty Rod Ends

- Precision/High-Performance Rod Ends

- By Material:

- Steel (Carbon Steel, Alloy Steel)

- Stainless Steel

- Brass

- Composite/Polymer

- Specialty Alloys

- By Application:

- Aerospace & Defense

- Automotive (Passenger Vehicles, Commercial Vehicles)

- Construction & Mining Equipment

- Industrial Machinery (Textile, Packaging, Printing)

- Agriculture Equipment

- Marine and Offshore

- Robotics and Automation

- By End-User:

- Original Equipment Manufacturers (OEM)

- Aftermarket (MRO)

Value Chain Analysis For Rod Ends Market

The value chain for the Rod Ends Market begins with the Upstream Analysis, dominated by suppliers of critical raw materials, notably specialized steel alloys, brass, and advanced polymers. Raw material quality, particularly the consistency and purity of heat-treatable steel, directly impacts the load-bearing capacity and fatigue life of the final rod end product. This segment is highly sensitive to commodity price fluctuations and supply chain stability, requiring robust sourcing strategies from manufacturers. Upstream complexity also involves the supply of precision spherical plain bearings and liners (e.g., PTFE or synthetic fabric) which are critical inserts dictating the friction and wear characteristics of the rod end assembly.

The Midstream phase involves the core manufacturing processes, including forging, machining (precision turning and milling), heat treatment, grinding, and final assembly. Manufacturers often specialize in proprietary processes to achieve high dimensional accuracy and surface finish required for demanding applications like aerospace linkages. Distribution channels, forming a crucial link in the chain, rely on a mix of Direct and Indirect sales. Direct channels are utilized for large OEM contracts, enabling custom specifications and technical support. Indirect channels, primarily through industrial distributors, specialized bearing houses, and MRO service providers, manage the diverse and localized demands of the high-volume Aftermarket segment, ensuring efficient delivery and customer proximity.

Downstream Analysis focuses on the integration and utilization of rod ends by End-Users (OEMs and Aftermarket consumers). For OEMs, the rod end is a component integrated into machinery or vehicle systems, where performance and reliability are paramount. The Aftermarket segment, however, is driven by replacement cycles and maintenance schedules. The value delivered downstream includes technical consultancy, component selection support, and post-sales servicing. The increasing adoption of digitalization and e-commerce platforms is significantly optimizing the indirect distribution channel, allowing for faster order fulfillment and improved tracking of specialized inventory items across different geographic regions.

Rod Ends Market Potential Customers

Potential customers, or End-Users and Buyers, of rod ends span the heavy industrial and mobility sectors, requiring components that translate force and manage alignment in kinetic systems. The primary cohort includes Original Equipment Manufacturers (OEMs) specializing in the construction of Earth-moving equipment (e.g., excavators, loaders, dozers), demanding heavy-duty, corrosion-resistant rod ends capable of enduring high static and dynamic loads in harsh environments. Similarly, automotive OEMs integrate high-precision rod ends into steering racks, suspension systems, and gear shift linkages, where failure is not an option and requires meticulous testing and long-term durability validation to ensure vehicle safety and handling performance.

Another significant customer segment is the aerospace and defense industry, including aircraft manufacturers and military vehicle suppliers, who require specialized, certified rod ends adhering to the highest standards of quality control and traceability (e.g., military specifications and FAA regulations). These components are often custom-designed for critical applications like flap actuators, landing gear mechanisms, and engine control linkages, emphasizing lightweight construction using specialty alloys like titanium, coupled with extreme temperature resistance. The maintenance, Repair, and Overhaul (MRO) sector forms the backbone of the Aftermarket potential customer base, consistently requiring replacement parts across all industrial verticals to ensure continuous operational uptime for installed machinery.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.2 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SKF, Schaeffler (FAG/INA), NSK, Timken, RBC Bearings, Alinabal, Aurora Bearing, FK Rod Ends, JAF Bearing, AST Bearings, GGB, Koyo, THK, Igus, Regal Rexnord, MinebeaMitsumi, CCTY Bearing, Barden, Pacamor Kubar, Heim Bearings. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Rod Ends Market Key Technology Landscape

The technological landscape of the Rod Ends Market is undergoing gradual but significant evolution, moving beyond traditional metallurgy toward enhanced material science and integrated digital capabilities. A core technological area is the advancement in self-lubricating liner technology. Traditional liners required frequent manual lubrication, leading to higher maintenance costs and downtime. Modern rod ends utilize proprietary PTFE (Polytetrafluoroethylene) or composite liners that provide maintenance-free operation over extended periods, crucial for inaccessible applications such as offshore equipment or aerospace linkages. Furthermore, manufacturers are employing advanced cold-forming and heat-treatment techniques to increase the material density and hardness of the rod end housing, thereby enhancing tensile strength and overall fatigue resistance under oscillatory motion and extreme load conditions.

Precision manufacturing techniques, including advanced CNC machining and grinding processes, are vital for producing high-grade rod ends, ensuring minimal running clearance and superior dimensional tolerance, especially in the aerospace and robotics segments where sub-micron accuracy is essential for functional performance. Non-destructive testing (NDT) methodologies, such as ultrasonic inspection and magnetic particle inspection, are now standard technological requirements to guarantee zero-defect components, particularly those used in safety-critical applications. These quality control technologies ensure that internal material stresses or micro-cracks are identified before the product enters the supply chain, adhering to stringent quality assurance protocols required by regulated industries.

The emerging technological frontier involves integrating Rod Ends into the Industrial Internet of Things (IIoT). This involves embedding or attaching miniature sensors (e.g., vibration, temperature, acoustic emission sensors) onto adjacent mechanical systems to monitor the operational health of the rod end and its associated linkage in real time. This data is processed using Condition Monitoring (CM) systems and AI analytics to enable predictive maintenance strategies. While the rod end itself remains a relatively simple mechanical component, its integration into smart systems transforms its function from a passive linkage element to an active data source, offering tremendous potential for optimizing operational schedules and minimizing unexpected mechanical failures in capital-intensive machinery.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing region, driven by unparalleled growth in manufacturing output, infrastructure development, and automotive production, particularly in China and India. The region serves as a major manufacturing hub for heavy machinery and light vehicles, creating sustained, high-volume demand for standard and heavy-duty rod ends. Government initiatives supporting ‘Made in India’ and ‘Made in China 2025’ further stimulate localized production and technology adoption, positioning the region at the forefront of market volume expansion.

- North America: This region is characterized by high demand for precision and specialty rod ends, primarily due to the dominant presence of the aerospace & defense industry and advanced robotics manufacturing. The US market emphasizes highly certified components (e.g., MIL-SPEC), utilizing advanced materials. While volume growth is slower than APAC, the average selling price (ASP) is significantly higher due to the premium placed on component traceability, reliability, and long service warranties required for critical applications.

- Europe: Europe, led by Germany, France, and the UK, exhibits a strong focus on high-quality industrial machinery and sophisticated automation systems. The market is mature but innovative, showing significant uptake of self-lubricating, environmentally compliant rod ends and those tailored for renewable energy infrastructure, such as precision components for wind turbine control systems. Strict quality mandates and the adoption of Industry 4.0 principles necessitate advanced product standards and integrated digital servicing capabilities from suppliers.

- Latin America: Growth in Latin America is tied closely to commodity cycles, specifically mining and agriculture, creating variable demand for heavy-duty rod ends used in off-road and processing equipment. Brazil and Mexico are key markets due to their respective automotive manufacturing bases. The region often relies heavily on imports and localized distribution networks to meet MRO needs, making supply chain efficiency a key determinant of competitive success.

- Middle East and Africa (MEA): This region is experiencing market expansion driven by large-scale infrastructure projects, oil & gas exploration, and investments in logistics and transportation hubs. Demand is concentrated on robust, corrosion-resistant rod ends capable of operating effectively in high-temperature and abrasive environments, reflecting the unique environmental challenges of the region's dominant industrial activities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Rod Ends Market.- SKF

- Schaeffler (FAG/INA)

- NSK

- Timken

- RBC Bearings

- Alinabal

- Aurora Bearing

- FK Rod Ends

- JAF Bearing

- AST Bearings

- GGB

- Koyo

- THK

- Igus

- Regal Rexnord

- MinebeaMitsumi

- CCTY Bearing

- Barden

- Pacamor Kubar

- Heim Bearings

Frequently Asked Questions

Analyze common user questions about the Rod Ends market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary performance criteria when selecting a Rod End for heavy-duty industrial machinery?

The primary criteria include static and dynamic load ratings, material composition (e.g., chrome-plated steel or specialized alloys), alignment capability (angular misalignment), and the requirement for maintenance (self-lubricating versus lubricated types). Heavy-duty applications prioritize high ultimate static load capacity and exceptional resistance to shock and fatigue under repetitive oscillatory movement.

How is the demand for Rod Ends impacted by the shift towards electric vehicles (EVs)?

The shift to EVs modestly alters demand by reducing the complexity of powertrain linkages but increases requirements for high-precision, low-friction rod ends in steering systems and thermal management linkages. EVs emphasize weight reduction, driving increased adoption of lighter composite or aluminum-housed rod ends, often integrated with advanced sensor technology for vehicle dynamics control.

What role do advanced materials, such as composites, play in future Rod Ends market growth?

Advanced composite materials are pivotal, offering superior corrosion resistance, significant weight reduction, and maintenance-free operation due to inherent self-lubricating properties (e.g., polymer/PTFE liners). These materials are increasingly favored in marine, aerospace, and food processing applications where hygiene, chemical exposure, or weight savings are crucial operational factors.

Which geographical region holds the greatest growth potential for Rod Ends manufacturers?

Asia Pacific (APAC) represents the region with the highest volume and growth potential, driven by massive investments in infrastructure, rapidly expanding automotive manufacturing (both ICE and EV), and increasing adoption of factory automation and robotics across diverse industries, particularly in India, China, and Southeast Asian nations.

What are the key technological trends influencing the longevity and reliability of Rod Ends?

Key trends include the development of proprietary surface treatments (e.g., black oxide, zinc plating) for corrosion protection, advancements in sealing technologies to prevent contaminant ingress, and the integration of predictive maintenance capabilities using IIoT sensors and data analytics to monitor component health in real-time, thereby maximizing operational lifespan and reducing unexpected failures.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager