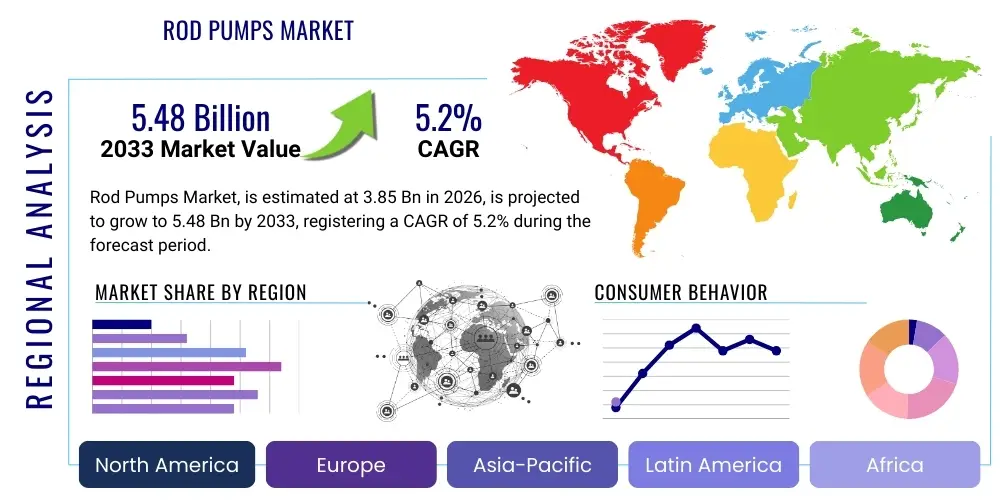

Rod Pumps Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440092 | Date : Jan, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Rod Pumps Market Size

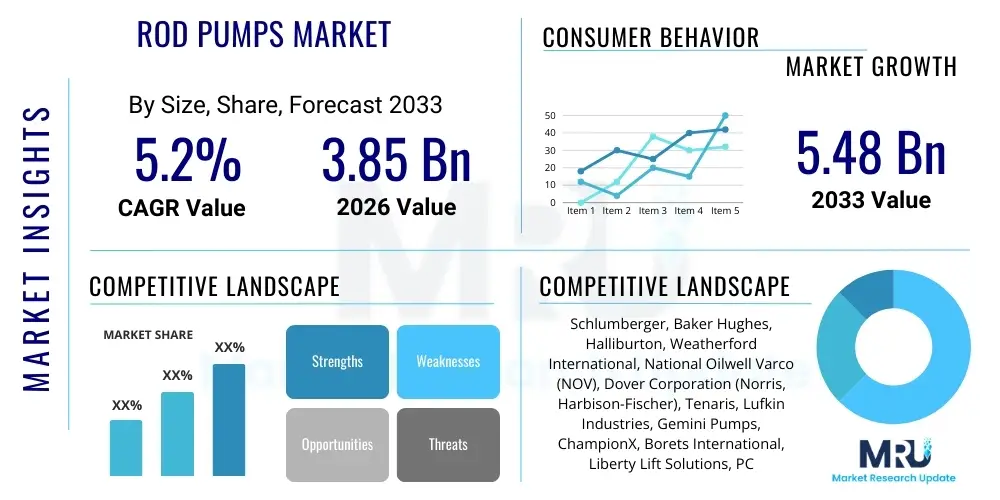

The Rod Pumps Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.2% between 2026 and 2033. The market is estimated at USD 3.85 Billion in 2026 and is projected to reach USD 5.48 Billion by the end of the forecast period in 2033.

Rod Pumps Market introduction

The Rod Pumps Market is an integral segment of the global oil and gas industry, primarily focused on artificial lift solutions for crude oil and natural gas extraction. Rod pumps, also known as beam pumps or sucker rod pumps, are mechanical devices used to lift fluids from oil and gas wells when natural reservoir pressure is insufficient. These systems consist of a surface pumping unit, a string of sucker rods, and a downhole pump. Their robust design and proven reliability make them a preferred choice for a wide range of applications, particularly in mature oil fields and wells with low production rates or high water cuts. The ongoing demand for energy across various sectors drives the sustained necessity for efficient hydrocarbon recovery, positioning rod pumps as a foundational technology in upstream operations.

The core product within this market is the complete rod pumping system, which encompasses various components engineered for specific well conditions. This includes different types of surface units such as conventional, Mark II, and specialized long-stroke units, along with various downhole pump configurations like tubing pumps and insert pumps, and the connecting sucker rod strings. Major applications span from conventional onshore oil fields, where they are ubiquitous, to more challenging environments like heavy oil recovery and some offshore platforms. The adaptability of rod pumps to diverse fluid properties, well depths, and production volumes underscores their market relevance.

Key benefits of employing rod pumps include their operational simplicity, cost-effectiveness over the long term, and their ability to handle viscous fluids and abrasive solids, which can challenge other artificial lift methods. Furthermore, the technology is well-understood, with a vast installed base and extensive service infrastructure globally. Driving factors for market growth include the steady depletion of easily accessible oil reserves, necessitating enhanced oil recovery (EOR) techniques and artificial lift solutions for mature wells. Additionally, advancements in monitoring, control, and automation technologies are improving the efficiency and lifespan of rod pump systems, making them even more attractive for optimizing production from existing assets and new developments in unconventional plays.

Rod Pumps Market Executive Summary

The Rod Pumps Market is characterized by a mature yet evolving landscape, driven by persistent global energy demand and the increasing reliance on artificial lift for maximizing production from both conventional and unconventional reservoirs. Business trends indicate a strong focus on operational efficiency, digitalization, and cost reduction across the oil and gas value chain, directly influencing investment in advanced rod pump technologies. Companies are increasingly investing in smart pumping units equipped with variable speed drives (VSDs), remote monitoring capabilities, and predictive maintenance analytics to optimize performance, minimize downtime, and reduce operational expenditures. Consolidations and strategic partnerships are also observed as industry players seek to expand their service portfolios and geographical reach, particularly in key oil-producing regions.

Regionally, the market exhibits varied dynamics. North America, particularly the United States, remains a dominant force due to extensive onshore shale oil and gas production, where rod pumps are widely deployed in conjunction with horizontal drilling and hydraulic fracturing. Latin America, with its mature oil fields in countries like Venezuela, Brazil, and Argentina, also presents significant opportunities for rod pump adoption and upgrades. The Middle East and Africa regions are experiencing growth driven by new field developments and the need for enhanced recovery from existing assets, while Asia Pacific, particularly China and India, shows increasing adoption as domestic oil and gas production expands. Europe, with its declining conventional production, focuses more on optimizing existing infrastructure.

Segmentation trends highlight the growing importance of advanced conventional sucker rod pumps and progressive cavity pumps (PCPs) within the broader rod pump category, catering to different fluid viscosities and well conditions. By application, onshore accounts for the largest share, although offshore applications, especially for smaller platforms and marginal fields, are also contributing. The component segment sees innovation in sucker rod materials for enhanced strength and corrosion resistance, and in downhole pump designs for improved efficiency and longevity. The emphasis across all segments is on integrated solutions that offer superior control, data analytics, and a lower total cost of ownership, reflecting the industry's push towards more sustainable and data-driven operations.

AI Impact Analysis on Rod Pumps Market

Users frequently inquire about how artificial intelligence (AI) and machine learning (ML) can transform the efficiency, reliability, and cost-effectiveness of rod pump operations. Key themes revolve around the potential for predictive maintenance to minimize downtime, the optimization of pumping parameters for enhanced production, and the integration of AI-driven analytics for better reservoir management. There is also significant interest in AI's role in automating routine tasks, improving safety, and enabling more effective decision-making by leveraging real-time data from downhole sensors and surface equipment. The overarching expectation is that AI will make rod pumping systems more intelligent, autonomous, and responsive to changing well conditions, leading to substantial operational improvements and a reduction in the carbon footprint associated with oil and gas extraction.

- Predictive Maintenance: AI algorithms analyze sensor data (vibration, temperature, pressure, current, torque) to predict equipment failures before they occur, reducing unscheduled downtime and maintenance costs.

- Production Optimization: Machine learning models identify optimal pumping speeds, stroke lengths, and cycles based on real-time well conditions, fluid properties, and reservoir dynamics, maximizing oil recovery and energy efficiency.

- Anomaly Detection: AI systems continuously monitor operational parameters, quickly identifying deviations from normal behavior that may indicate pump issues, rod string problems, or wellbore anomalies, enabling rapid intervention.

- Automated Control Systems: AI-powered controllers can dynamically adjust pump operations in response to changes in fluid inflow, gas interference, or other downhole conditions without human intervention, ensuring consistent performance.

- Energy Consumption Reduction: By optimizing pumping cycles and identifying inefficient operations, AI helps reduce the power consumption of rod pump units, leading to lower operating expenses and environmental impact.

- Real-time Data Analytics: AI platforms integrate and analyze vast amounts of data from multiple wells, providing operators with comprehensive insights into field-wide performance, identifying trends, and supporting strategic decisions.

- Enhanced Reservoir Management: Combining AI-driven pump data with geological and geophysical information can provide a more accurate understanding of reservoir behavior, aiding in secondary and tertiary recovery strategies.

- Remote Monitoring and Operations: AI facilitates advanced remote monitoring, allowing technicians to diagnose issues and even control pumps from off-site locations, improving operational flexibility and safety.

- Improved Safety: By predicting potential equipment malfunctions and reducing the need for manual interventions in hazardous environments, AI contributes to a safer operational setting for field personnel.

DRO & Impact Forces Of Rod Pumps Market

The Rod Pumps Market is shaped by a complex interplay of drivers, restraints, and opportunities, each contributing to its trajectory and future landscape. A primary driver is the persistent global demand for energy, predominantly from crude oil and natural gas, which necessitates efficient and reliable extraction methods, particularly from mature fields where natural reservoir pressure has diminished. The aging infrastructure of many oil fields worldwide and the growing focus on enhanced oil recovery (EOR) techniques further amplify the need for artificial lift systems like rod pumps. Moreover, the robust design and operational familiarity of rod pumps, coupled with ongoing technological advancements in automation and monitoring, make them a favored choice for cost-effective long-term production. The ability of rod pumps to handle a wide range of fluid viscosities and gas content also contributes significantly to their sustained market relevance, especially in diverse geological conditions found across various oil-producing basins.

Despite strong drivers, the market faces significant restraints. The inherent volatility of crude oil prices remains a major challenge; sustained periods of low oil prices can lead to reduced capital expenditure from exploration and production (E&P) companies, impacting investment in new artificial lift installations and upgrades. Environmental regulations and increasing pressure to reduce the carbon footprint of oil and gas operations also pose a restraint, pushing operators towards greener alternatives or more energy-efficient pumping solutions. Additionally, the high initial capital investment required for installing rod pumping units, especially for deep or complex wells, can deter smaller operators. Competition from other advanced artificial lift technologies such as electric submersible pumps (ESPs), gas lift, and hydraulic pumping systems, each with specific advantages for certain well conditions, also limits the market share of rod pumps in particular applications, forcing continuous innovation to maintain competitiveness.

Opportunities for growth in the Rod Pumps Market are substantial, largely driven by ongoing technological advancements and shifting operational paradigms. The most significant opportunity lies in the digitalization and automation of rod pumping systems, through the integration of AI, IoT, and cloud-based analytics. This allows for predictive maintenance, real-time optimization, and remote control, significantly improving efficiency and reducing operational costs. Expansion into unconventional oil and gas plays, particularly shale formations, where horizontal wells and multilateral drilling are common, presents a growing niche for specially adapted rod pump solutions. Furthermore, increasing adoption in remote and offshore marginal fields, where their reliability and relatively simpler maintenance requirements are highly valued, provides another avenue for market expansion. As E&P companies strive for greater operational efficiency and cost-effectiveness in a fluctuating market, the continuous innovation in rod pump design, materials, and control systems will unlock new growth potential and strengthen their position as a fundamental artificial lift solution.

- Drivers: Growing global energy demand; increasing production from mature fields; need for enhanced oil recovery (EOR); advancements in pump efficiency and smart control systems; cost-effectiveness and proven reliability.

- Restraints: Volatility in crude oil prices and associated E&P CAPEX fluctuations; stringent environmental regulations; high upfront capital expenditure for complex installations; competition from alternative artificial lift methods (ESPs, gas lift).

- Opportunities: Digitalization and AI/IoT integration for predictive maintenance and optimization; expansion into unconventional oil and gas resources; growth in remote and offshore marginal field applications; development of energy-efficient and low-emission pumping solutions.

- Impact Forces: Geopolitical stability affecting oil supply; technological innovation in artificial lift; environmental policies and sustainability goals; global economic growth driving energy consumption; capital allocation strategies of E&P companies.

Segmentation Analysis

The Rod Pumps Market is intricately segmented based on various operational and functional characteristics, providing a granular view of its diverse applications and technological nuances. These segments help in understanding market dynamics, identifying specific demand patterns, and tailoring product development to meet distinct industry requirements. The primary segmentation categories typically include pump type, application area, and component type, each reflecting unique demands and technological preferences within the upstream oil and gas sector. This comprehensive approach allows for a clearer analysis of where growth is most prominent and where innovation is most critical, ensuring that market offerings align with the evolving needs of oil and gas operators seeking to maximize recovery and efficiency.

- By Pump Type:

- Conventional Sucker Rod Pumps: Standard beam pumping units widely used for vertical and mildly deviated wells.

- Long-Stroke Sucker Rod Pumps: Designed for deeper wells or high-volume applications, offering increased displacement per stroke.

- Progressive Cavity Pumps (PCPs): Utilized for heavy oil, high viscosity fluids, or wells with high sand content, often driven by a surface rod string.

- Hydraulic Pumping Units: Employ hydraulic power to actuate the rod string, offering greater flexibility in stroke length and speed.

- By Application:

- Onshore: Predominant application in land-based oil and gas fields, including conventional and unconventional plays.

- Offshore: Used in specific offshore platforms, particularly for marginal fields or wells requiring robust and reliable artificial lift.

- By Well Type:

- Vertical Wells: Traditional application for vertical wellbores.

- Deviated Wells: Wells with a significant angle from vertical, requiring specific rod guidance and pump configurations.

- Horizontal Wells: Increasingly used in unconventional plays, requiring specialized downhole pump designs and rod string considerations.

- By Component:

- Surface Pumping Units: Includes beam units, long-stroke units, and hydraulic units, providing the mechanical power.

- Sucker Rods: The connecting elements transmitting power from the surface unit to the downhole pump, available in various materials and grades.

- Downhole Pumps: The actual pump assembly located at the bottom of the well, responsible for lifting fluids.

- Prime Movers: Electric motors or internal combustion engines powering the surface unit.

- Control Systems: Automation and monitoring equipment, including variable speed drives (VSDs) and real-time data acquisition units.

Value Chain Analysis For Rod Pumps Market

The value chain for the Rod Pumps Market encompasses a series of interconnected activities that bring the product from raw materials to the end-user, ensuring efficient oil and gas extraction. It begins with upstream analysis, which involves the sourcing and processing of raw materials such as steel for sucker rods, casting materials for pump components, and various electronics for control systems. This stage also includes the research and development efforts aimed at improving material strength, corrosion resistance, and overall system efficiency. Manufacturers of specialized components and sub-assemblies play a crucial role here, supplying highly engineered parts that meet stringent industry standards for durability and performance in harsh downhole environments. The quality and availability of these raw materials and components directly impact the cost-effectiveness and reliability of the final rod pump system, making strong supplier relationships vital.

Midstream activities in the value chain primarily focus on the manufacturing, assembly, and quality control of complete rod pump units. This involves precision machining of downhole pump barrels, plungers, and valves, as well as the fabrication and assembly of surface pumping units. Rigorous testing and certification processes are integral at this stage to ensure that the systems meet performance specifications and regulatory requirements. Following manufacturing, products are distributed through a complex network of channels, which can be direct or indirect. Direct channels involve manufacturers selling and servicing their products directly to major E&P companies, often through dedicated sales teams and service centers. This approach allows for direct feedback and customized solutions. Indirect channels, on the other hand, leverage distributors, agents, and local service providers who have established networks within specific regions, offering broader market reach and localized support to smaller operators or in areas where a direct presence is less feasible for the manufacturer.

The downstream segment of the value chain is centered on installation, operation, maintenance, and after-sales support. This includes the deployment of rod pump systems at well sites, ongoing monitoring, routine maintenance, and the supply of spare parts. Specialized service companies often handle the installation and commissioning, ensuring proper setup and integration with existing well infrastructure. Post-installation, monitoring and optimization services, increasingly incorporating advanced analytics and AI, become critical for maximizing production and minimizing downtime. Repair and overhaul services, as well as decommissioning, complete the life cycle management of rod pump systems. The effectiveness of these downstream activities significantly influences customer satisfaction and the long-term operational efficiency of the oil and gas wells, underscoring the importance of a well-coordinated and responsive service network.

Rod Pumps Market Potential Customers

The primary potential customers for the Rod Pumps Market are entities within the upstream oil and gas sector that are engaged in the exploration, development, and production of hydrocarbons. These include major integrated oil and gas companies, independent E&P (Exploration and Production) companies, national oil companies (NOCs), and increasingly, specialized service providers that manage field operations on behalf of asset owners. These customers share a common need for reliable and efficient artificial lift solutions to extract oil and gas from wells where natural reservoir pressure is insufficient to bring fluids to the surface. Their purchasing decisions are heavily influenced by factors such as total cost of ownership, operational efficiency, system reliability, ease of maintenance, and compliance with environmental and safety regulations, all of which rod pumps are designed to address.

Specifically, major integrated oil and gas companies like ExxonMobil, Shell, Chevron, and BP, often with extensive portfolios of mature assets globally, represent significant customers. Their vast number of wells, many of which are past their peak natural flow, necessitates continuous investment in artificial lift technologies. Similarly, independent E&P companies, which are often more agile and focused on specific basins or types of plays (e.g., shale gas, heavy oil), are also key buyers. These independents frequently operate in mature fields where rod pumps are a proven and cost-effective solution for sustaining production. Their demand is often for robust, customizable systems that can adapt to varying well conditions and help optimize cash flow from their assets.

National oil companies (NOCs) such as Saudi Aramco, Petrobras, and Pemex, which manage large national reserves, constitute another critical customer segment. These entities are responsible for maximizing national resource recovery and often deploy thousands of rod pumps across their extensive onshore and sometimes offshore operations. Their procurement often involves large-scale contracts and long-term partnerships with manufacturers. Furthermore, oilfield service companies that offer integrated production solutions also act as indirect customers, purchasing rod pumps and related equipment to include in their comprehensive service packages for operators. The decision-making process for all these customer groups increasingly incorporates data analytics, digital twins, and AI-driven insights to select and deploy the most effective artificial lift technologies for their specific well portfolios.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.85 Billion |

| Market Forecast in 2033 | USD 5.48 Billion |

| Growth Rate | 5.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Schlumberger, Baker Hughes, Halliburton, Weatherford International, National Oilwell Varco (NOV), Dover Corporation (Norris, Harbison-Fischer), Tenaris, Lufkin Industries, Gemini Pumps, ChampionX, Borets International, Liberty Lift Solutions, PCM, JJ-LAPP, Shengli Oilfield Shengji Petroleum Equipment, Dongying Zhaoxin Petroleum Equipment, PetroChina Jichai Power Equipment, Hilong Group, KERUI Petroleum |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Rod Pumps Market Key Technology Landscape

The Rod Pumps Market is undergoing significant technological evolution, moving beyond traditional mechanical systems to embrace advanced digital and automation solutions aimed at optimizing performance, reducing operational costs, and extending equipment lifespan. A central aspect of this transformation is the integration of Internet of Things (IoT) sensors and connectivity into surface and downhole components. These sensors collect vast amounts of real-time data on parameters such as motor current, pump speed, rod load, fluid levels, and temperature. This data is then transmitted to cloud-based platforms for analysis, providing operators with unprecedented visibility into well performance and potential issues, enabling proactive maintenance rather than reactive repairs. The shift towards smart pumping units equipped with variable speed drives (VSDs) is also a crucial technological advancement, allowing operators to precisely control the pump's stroke rate and length. This adaptability ensures optimal fluid lift efficiency, minimizes energy consumption, and prevents equipment damage from conditions like gas interference or fluid pound, significantly enhancing the overall operational flexibility and economic viability of rod pump systems.

Further enhancing the technology landscape is the widespread adoption of artificial intelligence (AI) and machine learning (ML) algorithms. These AI-driven systems are capable of analyzing the massive datasets generated by IoT sensors to identify complex patterns, predict equipment failures, and recommend optimal operational settings. For instance, predictive maintenance models can forecast when a sucker rod might fail or a downhole pump requires service, allowing for scheduled interventions that prevent costly unscheduled downtime. Beyond prediction, AI is also being used to create intelligent control systems that can autonomously adjust pumping parameters in real-time, responding dynamically to changing well conditions without human intervention. This level of automation not only improves efficiency but also reduces the need for constant human oversight, freeing up skilled personnel for more complex tasks. The development of digital twins, virtual replicas of physical rod pump systems, further aids in this optimization by simulating performance under various conditions, testing different operational strategies, and training personnel in a risk-free environment.

Innovations in materials science and mechanical design also continue to shape the rod pump technology landscape. Enhanced sucker rod materials, including composites and specialized alloy steels, are being developed to offer greater strength, corrosion resistance, and fatigue life, critical for extending the operational window in challenging corrosive or abrasive downhole environments. Downhole pump designs are evolving to improve volumetric efficiency, particularly in handling high gas content or viscous fluids, and to simplify maintenance with modular, easier-to-replace components. Furthermore, software platforms for real-time surveillance and production optimization are becoming more sophisticated, integrating data from multiple wells and different artificial lift types into a unified dashboard. These platforms often include advanced visualization tools, alarming systems, and reporting capabilities that provide E&P companies with actionable insights to manage their entire asset portfolio more effectively. The synergy between mechanical improvements, sensor technology, advanced analytics, and AI is propelling the rod pumps market towards a future of highly autonomous, efficient, and reliable oil and gas production.

Regional Highlights

- North America: Dominates the market, driven by extensive onshore shale oil and gas production in the United States and Canada, particularly in basins like the Permian, Eagle Ford, and Bakken. High adoption of advanced rod pump technologies for horizontal wells and a strong focus on optimizing mature assets.

- Europe: Characterized by a mature oil and gas industry, with emphasis on optimizing existing fields, particularly in the North Sea. Focus on energy efficiency, environmental compliance, and leveraging digital solutions for extending the life of current infrastructure rather than new field developments.

- Asia Pacific (APAC): Emerging as a significant growth region, propelled by increasing domestic oil and gas production in countries like China, India, and Indonesia. Investments in both conventional and unconventional resources, leading to rising demand for artificial lift solutions and technology upgrades.

- Latin America: Features vast conventional oil reserves and mature fields in countries such as Brazil, Venezuela, Argentina, and Mexico. Significant market potential due to the high number of wells requiring artificial lift, coupled with ongoing efforts to modernize infrastructure and improve production efficiency.

- Middle East and Africa (MEA): Experiencing substantial growth fueled by new field developments and enhanced oil recovery (EOR) projects in major oil-producing nations. Increased capital expenditure in Saudi Arabia, UAE, Kuwait, and African countries like Nigeria and Angola, driving demand for reliable and robust rod pumping systems.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Rod Pumps Market.- Schlumberger Limited

- Baker Hughes Company

- Halliburton Company

- Weatherford International Plc

- National Oilwell Varco (NOV)

- Dover Corporation (Norris, Harbison-Fischer)

- Tenaris S.A.

- Lufkin Industries, LLC

- Gemini Pumps

- ChampionX (part of Apergy Corporation)

- Borets International Limited

- Liberty Lift Solutions, LLC

- PCM SA

- JJ-LAPP (part of LAPP Group)

- Shengli Oilfield Shengji Petroleum Equipment Co. Ltd.

- Dongying Zhaoxin Petroleum Equipment Co., Ltd.

- PetroChina Jichai Power Equipment Company

- Hilong Group

- KERUI Petroleum Group

- CNPC Jihua Petroleum Equipment Group Co. Ltd.

Frequently Asked Questions

What is a rod pump and why is it essential in oil and gas production?

A rod pump, also known as a beam pump or sucker rod pump, is a mechanical artificial lift system used to bring crude oil and natural gas to the surface from wells where natural reservoir pressure is insufficient. It is essential because it enables continued production from mature wells, enhances recovery from declining fields, and handles diverse fluid properties, making it a reliable and cost-effective solution for maximizing hydrocarbon extraction globally.

How do AI and automation impact the efficiency of rod pumps?

AI and automation significantly enhance rod pump efficiency by enabling predictive maintenance, which minimizes downtime and reduces operational costs. AI algorithms analyze real-time data to optimize pumping speeds, stroke lengths, and cycles, maximizing oil recovery and reducing energy consumption. Automated control systems dynamically adjust operations in response to well conditions, ensuring consistent performance and extending equipment life.

What are the primary factors driving growth in the Rod Pumps Market?

The primary growth drivers include the persistent global demand for energy, increasing production from mature oil and gas fields, and the critical need for enhanced oil recovery (EOR) techniques. Additionally, ongoing technological advancements in pump efficiency, smart monitoring, and automation systems, combined with the proven reliability and cost-effectiveness of rod pumps, contribute significantly to market expansion.

What are the main types of rod pumps and their key applications?

The main types include Conventional Sucker Rod Pumps, suitable for vertical and mildly deviated wells; Long-Stroke Sucker Rod Pumps, designed for deeper wells and higher volumes; and Progressive Cavity Pumps (PCPs), ideal for viscous fluids, heavy oil, or wells with high sand content. Applications primarily span onshore oil and gas fields, with specific adaptations for challenging offshore and unconventional well environments.

Which regions are key markets for rod pump technologies?

North America, particularly the United States, is a dominant market due to extensive shale production and mature fields. Latin America, with its vast conventional reserves and aging infrastructure, also presents significant opportunities. The Middle East and Africa are growing rapidly with new field developments, while Asia Pacific, especially China and India, shows increasing adoption driven by expanding domestic oil and gas production efforts.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager