Roll Forming Machines Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435247 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Roll Forming Machines Market Size

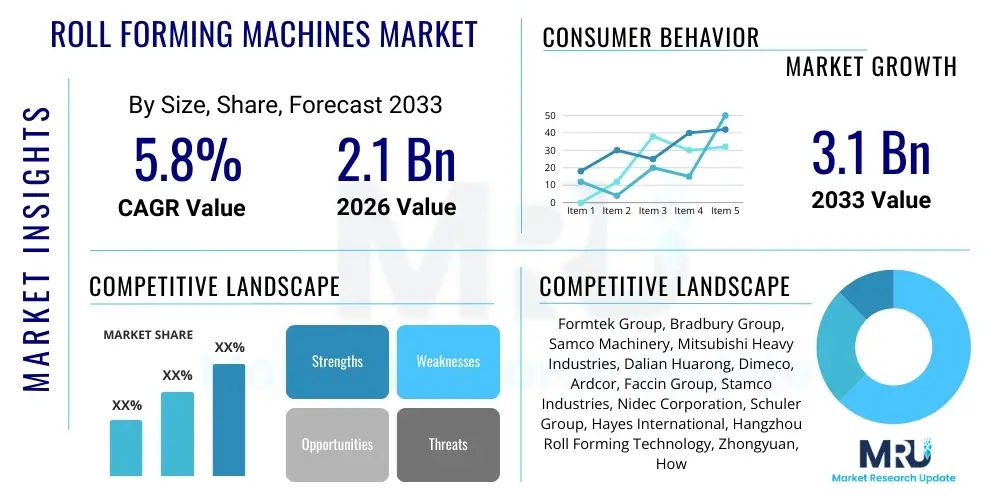

The Roll Forming Machines Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $2.1 billion in 2026 and is projected to reach $3.1 billion by the end of the forecast period in 2033.

Roll Forming Machines Market introduction

The Roll Forming Machines Market encompasses specialized industrial equipment designed to continuously bend long strips of sheet metal (coiled or cut lengths) into desired cross-sectional profiles. This cold-forming process is highly efficient, precise, and suitable for high-volume production, making it indispensable across several major industries. Roll forming technology offers significant advantages over alternative manufacturing methods like brake pressing or stamping, particularly in achieving complex geometries, superior surface finishes, and maintaining consistent dimensional accuracy over long lengths. The process involves passing the metal strip through successive sets of rolls, each set performing a small, incremental forming operation until the final shape is achieved. Key products include dedicated roll forming lines, roll tooling sets, and integrated auxiliary equipment such as punching, cutting, and stacking systems.

Major applications driving the demand for roll forming machines include the fabrication of structural components in construction (e.g., roofing, siding, purlins, and framing), the production of lightweight yet high-strength parts in the automotive sector (e.g., bumper beams, door rails, and frame components), and specialized profiles for the aerospace and appliance industries. The inherent benefits of the roll forming process, such as reduced material waste, high throughput rates, and the ability to work with high-strength materials, cement its critical position in modern manufacturing value chains. Furthermore, the technology’s adaptability allows manufacturers to quickly adjust to varying material specifications, including galvanized steel, aluminum, stainless steel, and specialized alloys, ensuring market responsiveness to evolving industrial standards and material science advancements.

Key driving factors accelerating market expansion are the global emphasis on modular and prefabricated construction techniques, requiring standardized and precisely formed components. Simultaneously, the automotive industry's continuous drive toward vehicle lightweighting to meet stringent fuel efficiency and emissions standards necessitates the precise shaping of advanced high-strength steels (AHSS), a process where specialized roll forming excels. The increasing adoption of automation and the integration of sophisticated monitoring and control systems (Industry 4.0 principles) further enhance the appeal of these machines by minimizing manual intervention, reducing operational errors, and maximizing overall equipment effectiveness (OEE).

Roll Forming Machines Market Executive Summary

The Roll Forming Machines Market is characterized by robust growth driven primarily by surging global construction activity and the technological shift towards advanced high-strength materials in the automotive and aerospace sectors. Business trends indicate a strong move toward highly automated, flexible production lines capable of managing multiple profiles and rapid changeovers, reflecting the increasing customization demands from end-users. Manufacturers are focusing on incorporating advanced sensors, predictive maintenance capabilities, and digital twins to optimize production efficiency and tooling longevity. Geographically, Asia Pacific remains the dominant market segment due to intense infrastructure development and burgeoning manufacturing bases, while North America and Europe prioritize sophisticated, high-precision systems that support complex material processing and integration with existing smart factory architectures. The market is consolidating around key players who offer comprehensive turnkey solutions encompassing design consultation, tooling manufacture, and integration services, moving away from simple machine sales toward integrated manufacturing partnerships.

Segment trends highlight the dominance of fully automatic roll forming machines, favored for their consistency, speed, and scalability in mass production environments, particularly within the steel framing and large-scale appliance manufacturing sectors. Furthermore, the rising demand for components made from high-strength steel (HSS) and aluminum alloys is necessitating investment in specialized roll sets and heavier-duty equipment capable of handling higher forming forces without compromising precision or causing material cracking. The construction application segment is expected to maintain the highest market share, fueled by urbanization and the implementation of standardized building codes globally, which mandates the use of certified, precisely manufactured structural profiles. Customization remains a key theme, influencing the tooling segment, where rapid prototyping and simulation software (FEA) are becoming standard tools for developing intricate profile designs efficiently and reducing time-to-market for new components.

Regional trends reveal that emerging economies in Southeast Asia and Latin America are increasingly adopting entry-level or semi-automatic systems to meet local infrastructure needs, offering substantial growth potential for cost-effective, durable machinery. Conversely, established markets like Germany, the United States, and Japan are leading the adoption of highly complex, multi-functional roll forming lines that integrate laser welding, piercing, and complex contour bending in-line, aiming for zero-defect manufacturing and maximum material utilization. Capital expenditure in these regions is heavily focused on retrofitting existing machines with advanced control systems and software interfaces to leverage data analytics for process optimization, demonstrating a clear commitment to Industry 4.0 standards. Regulatory requirements concerning structural integrity and safety standards also dictate regional machine specifications, pushing manufacturers towards certifications and robust quality control features.

AI Impact Analysis on Roll Forming Machines Market

Common user inquiries regarding AI in the roll forming sector revolve primarily around predictive maintenance capabilities, optimal process parameter setting, and quality control through visual inspection systems. Users frequently ask how AI can predict tooling wear and failure (minimizing costly downtime), whether machine learning algorithms can automatically adjust roll gaps and forming speeds based on material variances (optimizing yield), and how AI-driven vision systems can detect subtle defects like surface scratches or dimensional drift in real-time. The key themes summarized from user concerns focus on ROI justification for integrating complex AI infrastructure, the necessity of large, high-quality datasets for training effective models, and the need for simplified, user-friendly interfaces that allow existing machine operators to leverage AI insights without extensive specialized training. Expectations are high regarding AI’s potential to shift manufacturing operations from reactive maintenance schedules to proactive, self-optimizing systems.

- AI-powered Predictive Maintenance: Analyzing vibrational and thermal data to forecast tooling degradation and scheduling proactive maintenance, dramatically reducing unplanned downtime and maximizing asset lifespan.

- Real-time Quality Control (QC): Utilizing computer vision and machine learning models trained on acceptable profiles to instantly detect micro-defects, dimensional inconsistencies, and surface imperfections in formed metal components.

- Automated Process Optimization: Employing algorithms to dynamically adjust machine parameters (speed, roll pressure, lubrication levels) based on fluctuating material properties and ambient conditions to maintain consistent product quality and minimize scrap rate.

- Digital Twin Simulation: Creating high-fidelity virtual models of the roll forming process, powered by AI, allowing operators to simulate new profiles or material changes before physical production, thereby accelerating setup time and first-pass yield.

- Energy Efficiency Management: Machine learning models optimizing motor speed and power consumption based on production load and profile complexity, leading to reduced operational energy costs.

DRO & Impact Forces Of Roll Forming Machines Market

The Roll Forming Machines Market dynamics are defined by a complex interplay of rapid technological adoption, significant capital outlay requirements, and fluctuating demand cycles linked closely to global construction and automotive output. The primary drivers include the escalating need for lightweight, high-performance structural components, accelerated infrastructure spending worldwide, and the shift towards manufacturing processes that prioritize energy efficiency and material optimization. Conversely, the market faces restraints such as the substantial upfront investment required for sophisticated CNC-controlled roll forming lines and specialized tooling, alongside the inherent difficulties in sourcing and retaining skilled technical labor capable of programming and maintaining these advanced systems. Opportunities abound in the realm of Industry 4.0 integration, specifically through developing flexible, modular systems that utilize additive manufacturing (3D printing) for complex tooling components and expanding market reach into emerging industrial economies with nascent manufacturing sectors. These factors collectively exert powerful impact forces on market direction, forcing manufacturers to innovate rapidly in precision, speed, and automation.

Specifically, the persistent global emphasis on sustainable building materials and energy-efficient vehicle design acts as a potent positive impact force, favoring roll forming due to its high material utilization rates and capacity to handle environmentally friendly recycled materials and AHSS. However, the cyclical nature of the construction industry and geopolitical instability affecting raw material supply (especially steel and aluminum) introduce high levels of volatility, acting as a significant restraint that necessitates flexible supply chain management and hedging strategies. The opportunity derived from the digitalization of manufacturing processes is particularly impactful, enabling machine manufacturers to offer remote diagnostics, software upgrades, and performance monitoring services, thereby creating new revenue streams beyond the initial hardware sale and fostering deeper client relationships centered on continuous operational improvement.

The strategic deployment of advanced sensors and real-time monitoring capabilities constitutes a crucial impact force, allowing end-users to transition from volume manufacturing toward high-mix, low-volume production with greater economic viability. This flexibility addresses the growing consumer and industrial preference for customized products. Furthermore, increasing regulatory pressure in terms of worker safety and noise reduction in manufacturing environments drives demand for enclosed, automated roll forming lines that minimize manual interaction and comply with stringent occupational health standards. These regulations, while initially acting as a restraint on older equipment, fuel the replacement cycle and spur innovation in ergonomic machine design, ultimately accelerating the adoption of new, safer technologies across established markets.

Segmentation Analysis

The Roll Forming Machines Market is comprehensively segmented based on machine Type, the level of Operation Automation, the primary material processed, and the Application sector, allowing for a detailed understanding of diverse end-user requirements and technological preferences. The classification by type typically distinguishes between highly customized, full roll forming lines designed for dedicated high-volume production, universal or flexible roll forming lines capable of rapid profile changes, and the specialized tooling (roll sets) which represents a crucial recurring revenue stream. Segmentation by automation level—manual, semi-automatic, and fully automatic—reflects the differing capital expenditure capabilities and production volume needs of small-to-medium enterprises versus large-scale manufacturers. Analyzing these segments is essential for identifying high-growth niches, directing R&D investments toward specialized tooling materials, and customizing sales strategies for specific regional industrial characteristics.

- By Type:

- Dedicated Roll Forming Lines

- Flexible Roll Forming Lines

- Roll Tooling Sets & Accessories

- Auxiliary Equipment (Punching, Cut-off, Stacking Systems)

- By Operation:

- Manual

- Semi-Automatic

- Fully Automatic (CNC/PLC Controlled)

- By Application:

- Construction (Roofing, Siding, Framing, Purlins)

- Automotive (Structural Components, Body Panels, Frame Parts)

- Aerospace & Defense

- Appliance Manufacturing

- Racking and Storage Systems

- Transportation (Rail, Trucking)

- Others (HVAC, Solar Framing)

- By Material:

- Steel (Carbon Steel, Stainless Steel, AHSS)

- Aluminum & Alloys

- Copper & Brass

- Other Non-Ferrous Metals

Value Chain Analysis For Roll Forming Machines Market

The value chain for the Roll Forming Machines Market begins with upstream activities focused on the procurement of raw materials, primarily high-grade steel and specialized alloys required for machine construction and, crucially, for the precision manufacturing of roll tooling. Key upstream contributors include specialized steel mills and advanced machine component suppliers (e.g., servo motors, hydraulic systems, and sophisticated sensors). The core manufacturing phase involves design and engineering expertise, particularly Finite Element Analysis (FEA) and Computer-Aided Manufacturing (CAM) to ensure the accuracy and longevity of the roll sets, followed by the assembly, integration, and rigorous testing of the full machine lines. Differentiation at this stage relies heavily on engineering precision, software integration for automation, and machine robustness.

The distribution channel involves a mix of direct and indirect engagement. For complex, high-capital machinery lines targeting major automotive or infrastructure projects, manufacturers typically engage in direct sales, engineering consultation, installation, and ongoing maintenance agreements, ensuring tight control over service quality and customization. Indirect channels, involving regional distributors or specialized agents, are more prevalent for standard or semi-automatic machines targeting smaller regional contractors or lower-volume markets, allowing manufacturers to penetrate diverse geographic areas without establishing full operational subsidiaries. The effectiveness of the distribution network is crucial for providing timely after-sales support and spare parts, especially for the high-wear roll tooling components, which dictate machine uptime.

Downstream activities center on the end-users—the construction firms, automotive OEMs, and appliance manufacturers—who utilize the formed profiles in their final product assembly. Critical downstream value addition comes through the material efficiency and consistent quality delivered by the roll forming process, impacting the structural integrity and cost-efficiency of the end products. The relationship between the machine manufacturer and the end-user is often long-term, requiring continuous technical support, operator training, and consultation on material compatibility and profile optimization. This symbiotic relationship drives continuous improvement in machine design and ensures the longevity and performance of the installed systems throughout their operational lifecycle.

Roll Forming Machines Market Potential Customers

Potential customers for Roll Forming Machines span a wide spectrum of the industrial manufacturing landscape, united by the need for high-volume, precise, and consistent production of metal profiles. The primary buying segment includes large-scale construction material manufacturers specializing in standardized building components such as metal roofing, steel framing (light gauge steel or structural steel), purlins, and specialized architectural elements. These buyers demand robust, high-speed dedicated lines capable of running continuously with minimal downtime and integrating cutting and punching operations in-line to meet rigorous building codes and demanding project timelines.

A second crucial segment comprises Tier 1 and Tier 2 suppliers to the global automotive industry. These customers require highly specialized, flexible roll forming lines capable of processing advanced high-strength steels (AHSS) and aluminum alloys, specifically for manufacturing complex safety components like bumper beams, door impact beams, and frame sections essential for vehicle crashworthiness and lightweighting initiatives. Their focus is on extreme precision, repeatability, and the integration of sophisticated monitoring systems to ensure compliance with strict automotive quality standards (e.g., IATF 16949). The shift toward electric vehicles (EVs) is also creating new demand for roll-formed battery enclosures and structural platform components.

Other significant end-users include manufacturers of storage and racking systems, particularly those serving large logistics and warehouse operations, requiring high-load bearing structural components. Appliance and HVAC manufacturers also represent a consistent customer base, purchasing machines for producing cabinet frames, ductwork, and specialized housing components. Across all segments, the decision-makers prioritize Total Cost of Ownership (TCO), machine flexibility, and the manufacturer’s capability to provide bespoke tooling solutions and reliable, long-term technical service to maintain peak operational performance.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $2.1 Billion |

| Market Forecast in 2033 | $3.1 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Formtek Group, Bradbury Group, Samco Machinery, Mitsubishi Heavy Industries, Dalian Huarong, Dimeco, Ardcor, Faccin Group, Stamco Industries, Nidec Corporation, Schuler Group, Hayes International, Hangzhou Roll Forming Technology, Zhongyuan, Howick Ltd, Sames Kremlin, JESCO, Roll Forming Corporation, Dreistern, Yoder Manufacturing. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Roll Forming Machines Market Key Technology Landscape

The technological landscape of the Roll Forming Machines Market is rapidly evolving, driven by the need for increased precision, reduced material waste, and enhanced operational flexibility. A cornerstone technology is the widespread adoption of Computer Numerical Control (CNC) and advanced Programmable Logic Controllers (PLC), which govern sophisticated functions such as automatic adjustment of roll stands, synchronized cutting operations, and seamless integration with upstream coil handling systems. Modern control systems allow for the storage and rapid recall of numerous profile recipes, enabling quick changeovers and reducing non-productive time, a crucial factor for manufacturers operating in high-mix, low-volume production environments. Furthermore, integrating advanced sensor arrays—including laser measurement systems and high-speed cameras—ensures continuous, non-contact monitoring of the formed profile's dimensions, providing immediate feedback for closed-loop control adjustments and minimizing the production of out-of-specification parts.

Another pivotal area of technological advancement lies in the tooling design and manufacturing process. Finite Element Analysis (FEA) software is now standard practice for simulating the complex stresses and strain distribution during the forming process, especially when working with challenging materials like Advanced High-Strength Steels (AHSS). This simulation capability allows engineers to optimize the flower pattern (the sequence of forming stages) virtually, minimizing spring-back, edge-wave, and material thinning, thereby extending the lifespan of the costly roll sets and accelerating the design cycle for new profiles. Furthermore, specialized tooling materials, including carbide inserts and proprietary coated rolls, are becoming prevalent to withstand the abrasive nature and high forming forces associated with modern high-strength metal alloys, ensuring greater durability and consistent surface quality.

The most significant long-term technological trend impacting the market is the pervasive influence of Industry 4.0 and the Industrial Internet of Things (IIoT). Modern roll forming lines are increasingly equipped with integrated network capabilities that allow for data collection on every aspect of the machine’s operation—from motor current draw and temperature profiles to production counts and scrap rates. This data feeds into centralized manufacturing execution systems (MES) or cloud platforms, enabling predictive analytics, remote diagnostics, and condition-based monitoring. The utilization of digital twins, which are real-time virtual representations of the physical machine, is facilitating complex scenario planning, training, and maintenance scheduling, ensuring optimal OEE and transitioning the industry towards fully self-aware manufacturing cells.

Regional Highlights

- Asia Pacific (APAC) Dominance: APAC holds the largest market share and is expected to exhibit the highest growth rate due to massive governmental investments in infrastructure development, rapid urbanization, and the region's status as a global manufacturing hub for automotive components and appliances. Countries like China, India, and Southeast Asian nations are driving demand for medium-to-high speed roll forming lines to support large-scale construction projects and expanding factory production. The competitive landscape in APAC is intensifying, with both global OEMs and strong local manufacturers vying for market share by offering scalable and cost-competitive solutions.

- North America (NA) Focus on Automation and AHSS: The North American market is characterized by a strong emphasis on full automation, sophisticated control systems, and machinery specifically engineered to handle the rigorous demands of Advanced High-Strength Steels (AHSS) for automotive and high-end construction applications. Demand is heavily influenced by strict safety regulations requiring high-performance structural profiles. Manufacturers in this region prioritize precision, integration with smart factory ecosystems, and efficient energy consumption, often leading the adoption of the latest sensor and AI-driven predictive maintenance technologies.

- Europe's Commitment to Precision and Customization: Europe maintains a mature market driven by the need for high-precision profiles for specialized manufacturing sectors, including renewable energy (solar panel frames), complex architectural projects, and high-performance automotive parts. European demand centers around flexible roll forming lines capable of small-batch production with rapid changeovers. Strict environmental standards also push manufacturers towards machinery offering superior material yield and reduced energy consumption, favoring German, Italian, and Swiss machine manufacturers known for engineering excellence and quality.

- Latin America (LATAM) Infrastructure Investment: LATAM represents an emerging growth region, particularly driven by large-scale mining, energy, and residential infrastructure projects in countries like Brazil and Mexico. The market here primarily demands reliable, durable, and mid-range automated machines. Although capital constraints can favor semi-automatic options initially, the growing foreign direct investment in automotive manufacturing is accelerating the need for modern, precision roll forming capabilities tailored to global production standards.

- Middle East and Africa (MEA) Development Projects: Market growth in the MEA region is strongly correlated with mega-infrastructure and diversification projects (e.g., in Saudi Arabia and the UAE). The demand is concentrated on heavy-duty roll forming lines for structural profiles, pipeline components, and specialized HVAC systems necessitated by regional climate challenges. Long-term strategic planning and localization initiatives are driving procurement of high-capacity machines, often sourced through long-term government contracts and international partnerships ensuring robust service level agreements.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Roll Forming Machines Market.- Formtek Group

- Bradbury Group

- Samco Machinery

- Mitsubishi Heavy Industries

- Dalian Huarong

- Dimeco

- Ardcor

- Faccin Group

- Stamco Industries

- Nidec Corporation

- Schuler Group

- Hayes International

- Hangzhou Roll Forming Technology

- Zhongyuan

- Howick Ltd

- Sames Kremlin

- JESCO

- Roll Forming Corporation

- Dreistern

- Yoder Manufacturing

Frequently Asked Questions

Analyze common user questions about the Roll Forming Machines market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the adoption of fully automatic roll forming machines?

The accelerated adoption of fully automatic roll forming machines is fundamentally driven by the manufacturing industry’s push for higher throughput, consistent quality, and reduced operational costs. Fully automated lines minimize reliance on manual setup and adjustment, which are prone to human error, thereby maximizing repeatability and dimensional accuracy, especially critical in high-tolerance sectors like automotive and aerospace. Furthermore, labor costs and the scarcity of skilled roll forming operators compel businesses to invest in CNC-controlled systems that offer rapid profile changeovers via pre-programmed recipes and integrate seamlessly with upstream coil processing and downstream packaging systems. The efficiency gains in material handling and waste reduction, coupled with built-in diagnostic and predictive maintenance features (Industry 4.0), collectively provide a superior Total Cost of Ownership (TCO) compared to semi-automatic or manual alternatives. This shift allows enterprises to scale production rapidly while maintaining stringent quality control standards required by global regulatory bodies and end-user specifications, cementing automation as an economic necessity for competitive large-scale manufacturing operations.

How does the processing of Advanced High-Strength Steel (AHSS) impact the demand for specialized roll forming tooling?

The increasing use of Advanced High-Strength Steel (AHSS), particularly in the automotive industry for lightweighting initiatives, significantly elevates the demand for specialized roll forming tooling and machine robustness. AHSS exhibits much higher yield strength and lower ductility compared to traditional mild steel, leading to greater spring-back (elastic recovery) after forming and imposing vastly increased stress on the roll sets and machine components. To counter these challenges, tooling manufacturers must utilize specialized materials, such as D2 or HSS, often with advanced coatings (e.g., Titanium Nitride) to resist wear, abrasion, and micro-welding phenomena caused by high-pressure forming forces. Furthermore, the roll flower design—the sequence of forming stages—must be meticulously optimized using Finite Element Analysis (FEA) simulation software to precisely manage the material flow, prevent edge-cracking, and accurately predict and compensate for spring-back. Consequently, the AHSS trend mandates continuous investment in sophisticated tooling design, high-precision machining, and superior material science to ensure acceptable tolerance limits and tool longevity.

What role does digitalization and the Industrial Internet of Things (IIoT) play in optimizing roll forming operations?

Digitalization, powered by the Industrial Internet of Things (IIoT), is transforming roll forming operations from traditional mechanical processes into data-driven, optimized manufacturing cells. IIoT implementation involves embedding sophisticated sensors—measuring vibration, temperature, current draw, and profile dimensions—into the roll forming line, generating massive amounts of real-time operational data. This data is transmitted to centralized Manufacturing Execution Systems (MES) or cloud platforms for analysis using Machine Learning (ML) algorithms. The primary benefit is the enablement of predictive maintenance, where algorithms forecast the exact timing of component failure or tooling wear, allowing proactive intervention, thus drastically reducing unexpected machine downtime and maintenance costs. Furthermore, digitalization allows for remote monitoring and diagnostics, enabling machine manufacturers to offer high-value service contracts and minimizing the need for physical inspections. Ultimately, IIoT fosters a closed-loop control environment where data analytics autonomously suggest or execute adjustments to process parameters (speed, pressure) to maintain peak efficiency and quality, moving the entire operation toward self-optimizing manufacturing.

Which application segment holds the largest share in the Roll Forming Machines Market and why?

The Construction application segment consistently holds the largest share in the Roll Forming Machines Market. This dominance is attributable to the high-volume demand for standardized structural and non-structural metal profiles essential for global urbanization and infrastructure expansion. Roll forming is the ideal manufacturing process for producing items such as metal roofing and siding, purlins and girts, standardized steel framing components (Light Gauge Steel, or LGS), highway guardrails, and door/window frames. These products require long, consistent lengths and high-precision cross-sections, which the continuous nature of roll forming delivers efficiently and economically. Furthermore, the global shift toward prefabricated and modular construction methods relies heavily on the consistent, mass-produced components provided by roll forming technology, ensuring rapid and standardized assembly on site. The durability, versatility, and cost-effectiveness of steel profiles over traditional materials in construction secure this segment's enduring market leadership and continuous growth trajectory across both developed and emerging economies.

What are the key technical constraints machine manufacturers face when designing flexible roll forming lines?

Designing flexible roll forming lines, which are intended to produce a high variety of profiles with minimal changeover time, presents significant technical constraints primarily related to standardization and dynamic control. The main challenge is achieving dimensional accuracy across wildly varying profile thicknesses and complexities using a single machine architecture. Manufacturers must engineer universal roll stands that can accommodate different tooling widths and diameters, often relying on cassette systems or rafts, which adds mechanical complexity and necessitates highly precise alignment mechanisms. Furthermore, managing the spring-back effect for a range of materials (steel, aluminum, HSS) on a single, flexible line requires advanced, multi-axis adjustment systems governed by complex CNC algorithms that dynamically compensate for material property variations in real-time. The constraint of maximizing flexibility often conflicts with achieving the ultra-high precision typical of dedicated, fixed lines, forcing machine builders to balance versatility with the stringent tolerance requirements of the most demanding end-users. This balancing act requires extensive R&D in specialized software and tooling mechanics.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager