Roller Shelf System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431803 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Roller Shelf System Market Size

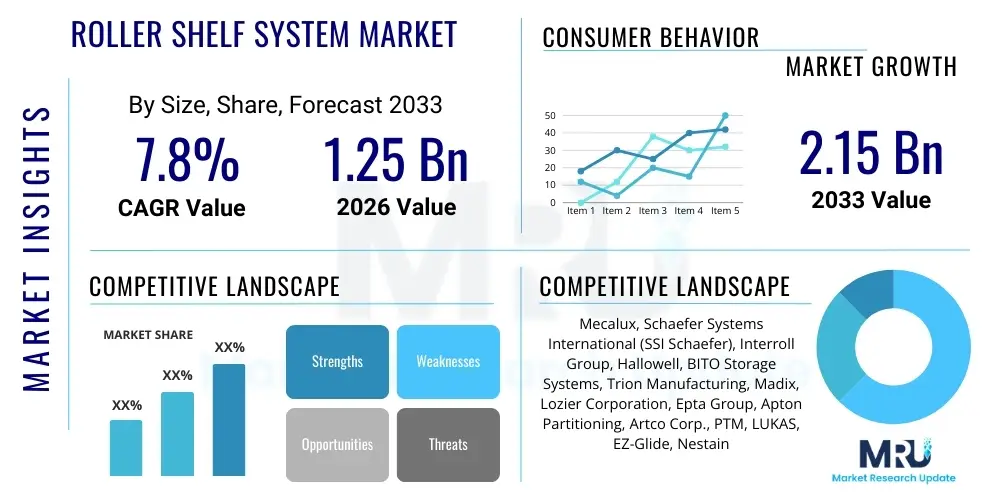

The Roller Shelf System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at $1.25 Billion USD in 2026 and is projected to reach $2.15 Billion USD by the end of the forecast period in 2033.

Roller Shelf System Market introduction

Roller shelf systems, often referred to as gravity flow shelving or roller racking, are critical components within modern retail and logistics environments designed to enhance inventory management and product accessibility. These systems utilize inclined shelves equipped with rollers or wheels, enabling automated product movement from the loading side to the picking face (First-In, First-Out or FIFO principle). They are fundamentally optimized for high-volume, quick-turnover goods, streamlining restocking processes and significantly reducing labor time associated with shelf maintenance and rotation.

The primary applications of roller shelf systems span across supermarkets, hypermarkets, convenience stores, and specialized retail outlets, particularly for refrigerated and fast-moving consumer goods (FMCG) like beverages, dairy, and pre-packaged foods. Product benefits include improved product visibility, consistent shelf presentation, reduced out-of-stock situations, and better space utilization compared to conventional static shelving. Furthermore, the inherent FIFO functionality ensures effective expiration date management, a crucial factor in the grocery and pharmaceutical sectors, thereby minimizing waste and increasing profitability for retailers.

Driving factors for market expansion are primarily centered on the increasing global push for retail efficiency and the necessity for superior supply chain integration. The rapid growth of omnichannel retail, demanding seamless integration between in-store inventory and fulfillment centers, further necessitates advanced shelving solutions. The systems support planogram compliance automatically, offering a competitive edge to retailers focused on optimizing the customer experience and operational throughput in increasingly competitive urban markets. Investment in store automation and renovation cycles is directly fueling the adoption of these sophisticated roller mechanisms.

Roller Shelf System Market Executive Summary

The Roller Shelf System Market is experiencing robust expansion driven by global trends toward retail automation and enhanced supply chain resilience. Key business trends include the strong adoption of modular and customizable roller systems that integrate easily with existing refrigerated and dry shelving units, alongside a growing focus on sustainable materials in manufacturing. There is a palpable shift towards intelligent roller systems incorporating sensors for real-time inventory tracking and dynamic pricing updates, aligning with broader IoT deployments within the retail infrastructure. Strategic partnerships between shelving manufacturers and specialized logistics automation providers are becoming common to offer comprehensive, end-to-end solutions.

Regionally, North America and Europe remain dominant in terms of market value due to high retail operational maturity and substantial capital investment in store modernization, particularly in large format grocery chains. However, the Asia Pacific (APAC) region is demonstrating the highest growth trajectory, fueled by rapid urbanization, the proliferation of modern retail formats (hypermarkets and large convenience chains), and increasing labor costs, which drive demand for automated shelf management solutions. Emerging economies within APAC and Latin America are prioritizing scalable and cost-effective roller systems to handle their surging consumer packaged goods (CPG) volumes.

Segment-wise, the market is primarily categorized by Material Type (Plastic, Metal, Hybrid), Application (Beverages, Dairy, Packaged Foods, Pharmaceuticals), and Channel Type (Supermarkets, Convenience Stores). The plastic segment, particularly those utilizing high-durability polymers, is gaining traction due to lightweight design and lower operational noise. Beverages and packaged foods represent the largest application segments, given the high throughput and strict FIFO requirements for these categories. The market is consolidating around key players who offer integrated services, including installation, maintenance, and software integration for inventory control.

AI Impact Analysis on Roller Shelf System Market

Common user inquiries regarding AI's influence on the Roller Shelf System Market primarily focus on how predictive analytics can optimize shelf replenishment schedules, the integration of vision AI for detecting out-of-stock events, and the role of machine learning in demand forecasting to minimize labor requirements. Users are concerned about the cost-effectiveness of integrating sophisticated sensors and AI algorithms into existing, physical shelving infrastructure and the potential ROI derived from dynamic planogram management. Key expectations revolve around using AI to transform passive roller systems into active, data-generating assets that enable proactive inventory decision-making and enhance operational efficiency across vast retail networks, moving beyond simple gravity flow mechanics to intelligent shelf management platforms.

- AI-driven Predictive Replenishment: Machine learning algorithms analyze historical sales data, promotional cycles, and weather patterns to predict stock-outs, automatically triggering replenishment tasks for warehouse management systems that feed the roller shelves.

- Vision AI for Shelf Monitoring: Cameras and sensors integrated into the roller shelves use computer vision to continuously monitor product facings, confirm FIFO compliance, and instantly identify misaligned or depleted items, reducing manual auditing time.

- Dynamic Planogram Optimization: AI determines the optimal tilt angle, roller tension, and position of products on the roller shelves based on real-time sales velocity and consumer behavior data, maximizing product visibility and access.

- Automated Labor Scheduling: Data generated by the smart roller systems (e.g., time taken for restocking, peak picking hours) feeds into labor management software, optimizing staffing levels specifically for shelf maintenance and minimizing non-productive labor time.

- Enhanced Waste Reduction: AI systems leverage shelf life data, cross-referenced with picking rates recorded by the smart roller system, to issue precise alerts on items nearing expiration, significantly reducing food waste in perishable categories.

DRO & Impact Forces Of Roller Shelf System Market

The dynamics of the Roller Shelf System Market are fundamentally shaped by the confluence of retail operational efficiency demands (Drivers), high initial capital outlay (Restraints), the trend towards micro-fulfillment centers (Opportunities), and the competitive pressure to adopt automation (Impact Forces). The market benefits significantly from the pervasive drive among retailers to optimize floor space, reduce labor dependency for shelf management, and strictly enforce the First-In, First-Out (FIFO) principle, especially for high-turnover and temperature-sensitive goods. This shift toward operational excellence is strongly motivating investment in gravity-fed and flow-through solutions that promise a demonstrable return on investment through inventory control improvements and reduced product shrinkage.

However, the market faces significant restraints, primarily associated with the substantial upfront investment required to replace traditional static shelving with roller systems, particularly for established retailers with expansive physical footprints. Furthermore, the complexity involved in retrofitting existing chilled and frozen cases with durable roller mechanisms, which must withstand extreme temperature fluctuations and heavy loads, presents a technical challenge. The compatibility of various roller system designs with different product packaging shapes and sizes also poses a limiting factor, requiring highly customized solutions that increase complexity and cost for manufacturers and end-users.

Opportunities are abundant in the burgeoning e-commerce and omnichannel fulfillment sectors. Roller shelf systems are ideally suited for automated or semi-automated micro-fulfillment centers (MFCs) and dark stores, where speed and density are paramount. The development of lighter, more durable, and standardized plastic roller systems is creating new opportunities in emerging markets seeking lower-cost, highly effective solutions. The increasing integration of IoT sensors and RFID technology into the roller tracks offers significant potential for vendors to transition from merely selling equipment to providing comprehensive inventory intelligence platforms, thereby establishing new revenue streams based on data services.

The impact forces driving market change include intense competition among major shelving manufacturers to offer modular and standardized systems that minimize installation time and total cost of ownership (TCO). Regulatory pressures related to food safety and waste reduction (mandating effective FIFO adherence) are compelling retailers to adopt roller systems. Furthermore, rising consumer expectations for consistent product availability and the need for retailers to differentiate their in-store experience through pristine shelf presentation are acting as key market accelerators, making roller systems an essential investment rather than an optional upgrade.

Segmentation Analysis

The Roller Shelf System Market is segmented based on material, configuration, application, and distribution channel, providing a granular view of market dynamics and adoption patterns across the global retail landscape. Analyzing these segments is crucial for understanding specific demands, technological requirements, and investment priorities within the consumer goods sector. The inherent functional differences between gravity flow, push-back, and carton flow roller systems determine their suitability for various types of inventory, from lightweight packaged goods to heavy beverage crates, directly influencing purchasing decisions by end-users.

The configuration segment (e.g., depth, width, tilt angle) is increasingly being tailored to specific product dimensions and retail environments, moving away from standardized models. While metal roller systems (steel and aluminum) still dominate the heavy-duty and ambient storage categories due to their load-bearing capacity and longevity, high-impact plastic (polypropylene and nylon) systems are rapidly gaining market share in refrigerated and convenience store settings due to their anti-corrosion properties, lighter weight, and operational silence, addressing the aesthetic and functional needs of modern retail spaces. This material transition is a key point of competitive differentiation.

Furthermore, the application segmentation highlights distinct growth drivers; the beverage segment (dominated by high-volume, uniform packaging) heavily utilizes robust roller tracks, while the pharmaceutical and healthcare sector demands smaller, highly precise roller systems for regulatory compliance and batch control. The ongoing segmentation complexity underscores the need for manufacturers to offer highly modular and flexible product lines capable of adapting to diverse operational constraints and inventory characteristics encountered across various retail and warehousing formats globally, reinforcing the specialization of offerings within the market.

- By Material Type:

- Plastic (Polypropylene, High-Density Polyethylene)

- Metal (Steel, Aluminum)

- Hybrid Systems (Metal frame with plastic rollers)

- By Configuration:

- Gravity Flow Shelving (Standard FIFO)

- Carton Flow Racks (Suitable for diverse SKUs)

- Deep Lane Roller Systems (High density storage)

- By Application:

- Beverages (Sodas, Juices, Beer)

- Dairy and Perishables

- Packaged Foods (Snacks, Canned Goods)

- Pharmaceutical and Healthcare Products

- Cosmetics and Personal Care

- By End-User/Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Wholesale Clubs

- Drugstores and Pharmacies

- Dark Stores and Micro-Fulfillment Centers (MFCs)

Value Chain Analysis For Roller Shelf System Market

The value chain for the Roller Shelf System Market begins with upstream activities involving the sourcing of raw materials, primarily steel, aluminum, and advanced polymers (plastics), which demand rigorous quality control to ensure roller durability, load capacity, and anti-corrosion resistance, particularly for refrigerated applications. Key upstream suppliers include metal manufacturers and specialized plastic extrusion companies. Efficient raw material procurement and processing—focusing on lightweight, high-strength composites—are crucial for maintaining competitive manufacturing costs and adhering to sustainability standards increasingly mandated by large retailers.

Midstream activities encompass the manufacturing, assembly, and testing of the roller shelf components and complete systems. This stage involves precision engineering for the roller tracks, rail systems, and frames, ensuring smooth gravity flow and easy installation. Manufacturers increasingly leverage automation and robotics in their fabrication processes to achieve economies of scale and maintain precision across modular components. Distribution channels play a critical role, involving direct sales teams targeting large multinational retailers, and indirect channels relying on logistics equipment distributors, material handling specialists, and integrated retail solutions providers who often bundle roller systems with other store fixtures and warehousing technology.

Downstream analysis focuses on installation, integration, and post-sales maintenance. Direct distribution channels are typically employed for major supermarket chains requiring customized, large-scale deployments, facilitating direct communication between the retailer and the manufacturer for design modifications and quick deployment. Indirect distribution, leveraging local system integrators, is vital for reaching smaller retailers and independent convenience stores. The service segment, including warranty management, repair, and potential integration with retailer WMS (Warehouse Management Systems) for smart shelving functionality, represents a growing and high-margin part of the downstream value chain, ensuring long-term customer retention and product lifecycle support.

Roller Shelf System Market Potential Customers

The primary end-users and buyers of roller shelf systems are entities operating in high-volume retail environments where efficient inventory rotation, shelf presentation, and minimized manual intervention are critical operational objectives. Supermarkets and hypermarkets constitute the largest customer base globally, driven by their extensive requirements for managing thousands of SKUs across multiple temperature zones, from fresh produce and dairy to ambient packaged goods. Their focus on reducing restocking time and optimizing labor expenditure makes roller systems an indispensable investment for maintaining profitability in low-margin sectors.

Convenience stores and petrol station marts represent a rapidly growing customer segment, seeking smaller, highly durable roller units tailored for high-frequency impulse purchases like beverages and snacks. In these environments, maximizing shelf density and ensuring rapid product rotation directly impacts sales velocity, justifying the adoption of these systems. Furthermore, the rise of specialized retailers, such as dedicated beverage stores and cosmetic outlets, which prioritize aesthetic presentation and FIFO control for date-sensitive products, are also significant targets for customized roller shelf solutions that enhance both brand image and operational logistics.

Beyond traditional retail, the burgeoning sector of dark stores and dedicated micro-fulfillment centers (MFCs), supporting online grocery delivery and click-and-collect services, is becoming a crucial market segment. These centers require ultra-high-density storage solutions optimized for rapid automated or manual picking, where roller flow racks are essential for organizing thousands of SKUs in a confined space. Pharmaceutical warehouses and large drugstores also serve as key potential customers, utilizing roller systems to manage large inventories of medications where strict batch control, visibility, and expiration date adherence are regulatory mandates and crucial for patient safety.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.25 Billion USD |

| Market Forecast in 2033 | $2.15 Billion USD |

| Growth Rate | CAGR 7.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Mecalux, Schaefer Systems International (SSI Schaefer), Interroll Group, Hallowell, BITO Storage Systems, Trion Manufacturing, Madix, Lozier Corporation, Epta Group, Apton Partitioning, Artco Corp., PTM, LUKAS, EZ-Glide, Nestain |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Roller Shelf System Market Key Technology Landscape

The technology landscape of the Roller Shelf System Market is evolving beyond simple mechanical gravity assistance toward integrated, smart shelving solutions utilizing digital technologies. Traditional roller systems rely on highly engineered slopes and low-friction materials to ensure smooth product flow; advancements here focus on improved materials science, such as incorporating high-impact, self-lubricating polymers for rollers, which reduce maintenance requirements and operational noise, a critical factor in customer-facing retail environments. Designing modular components that allow quick installation and reconfiguration using tools-free mounting systems represents a major technological improvement in adaptability and total cost of ownership (TCO).

The most transformative technologies involve the integration of Internet of Things (IoT) devices and advanced sensor technology. Smart roller systems are increasingly equipped with pressure sensors, load cells, or photoelectric sensors placed along the roller tracks to provide real-time data on stock levels and picking activities. This sensor data, transmitted wirelessly, allows retailers to monitor product movement, track depletion rates, and identify immediate stock-out situations, effectively closing the loop between the physical shelf and the digital inventory system. RFID technology embedded in the shelving or utilized alongside product tags is also gaining traction for highly accurate inventory reconciliation and loss prevention.

Furthermore, technology development is focused on enhancing the connectivity and analytical capabilities of these systems. Integration with Retail Execution Software (RES) and Warehouse Management Systems (WMS) allows for automated alerts and optimized planogram management based on real-time shelf performance data. The future technology trajectory involves advanced AI integration, using edge computing capabilities within the shelving unit itself to process sensor data locally, predict optimal replenishment timing, and even communicate dynamic pricing information via small e-ink displays integrated into the shelf lip, transforming the roller shelf from static hardware into a dynamic, data-generating platform.

Regional Highlights

- North America: This region holds a significant market share, driven by the presence of major grocery chains (supermarkets and hypermarkets) with substantial capital budgets for store modernization. The demand is concentrated on highly durable, load-bearing roller systems for large volumes of beverages and packaged goods. Regulatory mandates concerning food traceability and waste reduction further accelerate the adoption of systems ensuring strict FIFO adherence. The US market is characterized by early adoption of IoT-enabled smart shelving integration.

- Europe: Characterized by diverse retail formats, including discounters and small city-center stores, Europe demands highly flexible and space-efficient roller systems. Western European countries, particularly Germany, the UK, and France, are mature markets prioritizing high-quality plastic and hybrid solutions for refrigerated cases. Sustainability and energy efficiency mandates drive the preference for lightweight, long-lasting materials. Eastern Europe is showing rapid growth as modern retail formats replace traditional distribution.

- Asia Pacific (APAC): APAC is the fastest-growing market, primarily fueled by rapid expansion of the organized retail sector, high urbanization rates, and rising labor costs in developing economies like China, India, and Southeast Asia. The demand here is highly price-sensitive, focusing on cost-effective, easily scalable plastic and metal hybrid systems for bulk grocery management. South Korea and Japan, with their advanced convenience store networks, are leading the integration of compact roller systems for quick-service retail.

- Latin America: The market is gradually expanding, driven by foreign direct investment in large-format retail and the need to improve inventory control standards. Adoption is concentrated in major urban centers of Brazil and Mexico. The focus is on robust, low-maintenance systems that can withstand varying climatic conditions and operational intensity typical of rapidly growing supply chains.

- Middle East and Africa (MEA): Growth is steady, primarily driven by large infrastructure projects, development of modern malls and hypermarkets in the UAE and Saudi Arabia, and the expansion of international retail chains into emerging African markets. High-specification roller systems are adopted to manage high volumes of imported goods and maintain premium shelf aesthetics.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Roller Shelf System Market.- Mecalux

- Schaefer Systems International (SSI Schaefer)

- Interroll Group

- Hallowell

- BITO Storage Systems

- Trion Manufacturing

- Madix

- Lozier Corporation

- Epta Group

- Apton Partitioning

- Artco Corp.

- PTM

- LUKAS

- EZ-Glide

- Nestain

- Speedrail Systems

- Storflex

- Tecno Display

- Crown Equipment Corporation

- Penco Products Inc.

Frequently Asked Questions

Analyze common user questions about the Roller Shelf System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary benefit of roller shelf systems for grocery retailers?

The primary benefit is guaranteeing strict First-In, First-Out (FIFO) inventory rotation, which is essential for managing product expiration dates and reducing waste, especially in perishable categories like dairy and prepared foods. This automation also significantly reduces the labor time required for manual shelf rotation and restocking.

How are roller shelf systems differentiated from traditional static shelving?

Roller shelf systems utilize gravity-fed, inclined tracks to automatically move products to the front picking face, unlike static shelving where restocking and product rotation must be performed manually by staff. This mechanism optimizes product visibility, accessibility, and ensures continuous shelf presentation without staff intervention.

What are the technical challenges associated with implementing roller systems in refrigerated environments?

The primary technical challenges include ensuring the durability and low-friction performance of the rollers in extreme, fluctuating temperatures, preventing condensation and icing from hindering the gravity flow mechanism, and utilizing materials that are highly resistant to corrosion and thermal stress while maintaining load-bearing capacity.

Which application segment holds the largest market share in the Roller Shelf System Market?

The beverages segment, specifically non-alcoholic and alcoholic packaged drinks, currently holds the largest market share due to the high volume, weight, and uniform packaging size of these products, which are ideally suited for robust gravity flow systems and require high-speed replenishment in retail settings.

How does the integration of IoT technology enhance roller shelf performance?

IoT technology, through integrated sensors and connectivity, transforms roller systems into smart shelves by providing real-time data on stock levels, depletion rates, and picking patterns. This data feeds into WMS/RES systems, enabling proactive, AI-driven replenishment alerts and dynamic planogram adjustments, thereby optimizing operational efficiency.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager