Rolling Chassis Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431555 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Rolling Chassis Market Size

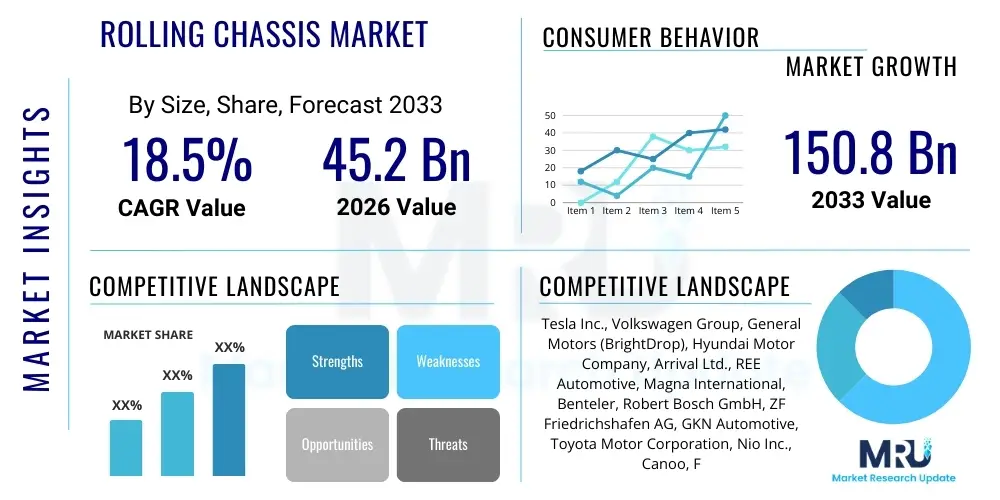

The Rolling Chassis Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 45.2 Billion in 2026 and is projected to reach USD 150.8 Billion by the end of the forecast period in 2033. This substantial growth is fundamentally driven by the accelerated global transition toward electrified mobility and the adoption of standardized platform architectures by major automotive original equipment manufacturers (OEMs). The high projected CAGR reflects the ongoing strategic shift away from dedicated, model-specific vehicle construction towards scalable, modular 'skateboard' platforms that efficiently integrate battery packs and high-voltage electronics. Market valuation is rapidly increasing as chassis components transition from purely mechanical assemblies into highly complex, software-defined systems that encompass the critical elements of vehicle intelligence and safety.

The financial valuation of the market is increasingly tied to the intellectual property and technological complexity embedded within the chassis structure rather than just the raw materials and assembly costs. Key factors contributing to the rising market size include the increasing average selling price (ASP) of advanced rolling chassis equipped with sophisticated electronic control units (ECUs), thermal management systems (TMS), and integrated hardware necessary for Level 4 and Level 5 autonomous driving functionalities. Furthermore, the commercial vehicle sector, especially heavy-duty electric trucks and last-mile delivery vans, presents a major revenue stream. These vehicles require specialized, highly durable, and robust rolling chassis capable of accommodating large battery capacities and sustained operational cycles, commanding higher price points compared to standard passenger vehicle platforms, thereby significantly inflating the overall market forecast by 2033.

Geographically, market expansion is heterogeneous, with Asia Pacific contributing the largest share of volume growth, while North America and Europe drive innovation and high-value product penetration. The market forecast assumes sustained high investment in battery manufacturing capacity and continued government support across key regions to push electric vehicle adoption. The competitive landscape is also evolving, with traditional Tier 1 suppliers increasingly challenging OEMs by offering complete, ready-to-use rolling chassis platforms to third-party manufacturers and mobility startups, further fragmenting and boosting the market value through externalized platform services and specialized engineering solutions, ensuring that the foundational structure remains the highest value component in future mobility solutions.

Rolling Chassis Market introduction

The Rolling Chassis Market defines the integrated structural foundation of a modern vehicle, encompassing all mobility-critical components excluding the outer body and interior trim. This foundational unit includes the frame structure, axles, wheels, brakes, suspension, steering system, and, critically in the modern context, the integrated high-voltage electric powertrain and battery architecture. Historically, chassis were purely mechanical structures; however, the ongoing mobility revolution has transformed them into sophisticated electromechanical platforms, now frequently referred to as 'skateboard platforms,' optimized specifically for battery electric vehicles (BEVs) and autonomous functionality. These architectures are designed for modularity, enabling diverse vehicle types—from compact urban cars to large commercial trucks—to be built atop a single, standardized base, which is a profound strategic advantage for mass production and rapid product diversification.

Major applications of rolling chassis technology span the entire mobility spectrum, with the greatest concentration currently observed in the mass-market production of electric passenger vehicles (SUVs and crossovers). Beyond passenger transport, rolling chassis are vital for the burgeoning commercial vehicle segment, underpinning electric buses, medium-duty delivery vans, and heavy-duty long-haul electric trucks, where durability, high-payload capacity, and efficient energy management are paramount. Furthermore, specialized applications include dedicated platforms for autonomous shuttles, robotics, and industrial vehicles, often requiring unique structural adaptations and integration of highly redundant electronic safety systems. The core benefit derived from utilizing a rolling chassis is the significant reduction in time-to-market for new models, alongside substantial savings in research and development expenses through shared engineering assets and standardized component procurement across diverse product portfolios.

The market is primarily driven by three interconnected factors: the global push for zero-emission vehicles, necessitating specialized EV architectures compatible with high-density battery arrays and advanced thermal management; the economic benefits of platform standardization and sharing among OEMs, providing unprecedented economies of scale that surpass the limitations of internal combustion engine-era platforms; and the inherent advantages these modular structures offer for integrating complex Advanced Driver-Assistance Systems (ADAS) and autonomous driving hardware seamlessly. A well-designed rolling chassis enhances vehicle safety by providing superior battery protection and managing crash forces effectively. It also dramatically improves vehicle dynamics due to the low center of gravity afforded by underfloor battery placement. The growing availability of third-party rolling chassis suppliers also lowers the barrier to entry for new automotive players, fueling competition and accelerating technological advancement across the entire automotive value chain.

Rolling Chassis Market Executive Summary

The global Rolling Chassis Market is undergoing transformative growth fueled by aggressive platform consolidation and the strategic shift toward software-defined vehicles (SDVs). Business trends are dominated by strategic alliances and co-development agreements among major global OEMs, such as the partnerships focused on standardized EV platforms (e.g., Volkswagen’s MEB or partnerships between established players and specialized platform suppliers). These alliances are crucial for amortizing the billions invested in new-generation EV architectures and securing robust, specialized component supply chains, reducing inherent risks associated with EV platform development. Furthermore, the rise of ‘Chassis-as-a-Service’ (CaaS), where specialized firms license or sell complete, validated rolling chassis platforms to diverse end-users, is rapidly decentralizing vehicle manufacturing, offering speed and flexibility, which is highly attractive to mobility startups and low-volume specialty manufacturers seeking rapid market entry.

Regionally, trends clearly delineate centers of manufacturing scale versus technological innovation. Asia Pacific maintains its lead in volume and affordability, driven by state support and large consumer bases, focusing on fast mass production of cost-optimized rolling chassis for urban and mass-market EVs. This region benefits from integrated domestic supply chains for battery and electronic components. In contrast, North America and Europe are driving the complexity curve, prioritizing features such as advanced structural battery integration, extreme-fast charging capability built into the platform, and the readiness to host highly complex computing hardware for autonomous operations. Regulatory bodies in these regions, specifically the EU and US NHTSA, heavily influence design parameters related to crashworthiness and integrated safety systems, ensuring that regional development focuses on premium, high-value platforms incorporating sophisticated active and passive safety architecture.

Segment trends emphasize the overwhelming dominance of the Battery Electric Vehicle (BEV) propulsion segment, overshadowing diminishing demand for traditional ICE and hybrid chassis platforms. Within the component segment, the greatest value accretion is observed in the electrical and electronic systems embedded in the chassis, reflecting the increasing importance of integrated thermal management systems for battery packs and centralized domain controllers that manage complex vehicle dynamics and sensor data for autonomous operations. The commercial vehicle sub-segment, particularly medium and heavy-duty electric trucks, is poised for explosive growth as large logistics companies begin fleet electrification, demanding rolling chassis that emphasize payload, reliability, and extreme duty cycles. This requires specialized heavy-duty componentry, reinforced structural frames, and advanced material science to ensure extended operational lifespans and superior durability under high stress conditions.

AI Impact Analysis on Rolling Chassis Market

User inquiries frequently explore how Artificial Intelligence is transforming the fundamental design, structural integrity, and operational lifespan of the rolling chassis. A major focus area is the application of generative AI in designing complex, multi-functional chassis components. Users are asking how AI can create structures that are lighter yet stronger, effectively balancing the need for reduced vehicle weight (crucial for EV range) with the increased rigidity required to house and protect large, heavy battery packs. Concerns also revolve around the complexity of integrating AI hardware (such as specialized neural network processors) directly into the chassis platform, requiring sophisticated cooling solutions and redundant power supplies to ensure reliable autonomous operation across varying climates and road conditions, demanding an intelligent, proactive thermal management infrastructure capable of rapid, localized adjustments.

During the design phase, AI-powered topology optimization tools analyze millions of design iterations based on multi-objective parameters such as stress, strain, weight, manufacturing feasibility, and resonant frequencies. This rapid simulation capability allows manufacturers to develop highly optimized frame geometries that utilize material only where strictly necessary, minimizing waste and maximizing performance—a process unattainable through traditional engineering methods. This has led to innovations such as asymmetrical chassis designs that better manage kinetic energy during specific crash scenarios. Furthermore, AI is critical in the manufacturing process, where sophisticated machine learning algorithms monitor real-time assembly data from robotic welders and fastener systems, ensuring micro-level quality control and predictive adjustment, guaranteeing the structural integrity essential for high-speed EV operations and demanding autonomous functionalities, significantly reducing human error and boosting production efficiency.

Operationally, the AI embedded within the rolling chassis enables advanced features that enhance user experience and maintain asset value. Predictive analytics monitor vibrational patterns, thermal gradients, and electrical load spikes across the battery, suspension, and braking systems using extensive datasets collected over the vehicle's lifespan. By analyzing this complex, high-velocity data, AI can accurately forecast component fatigue and failure, advising maintenance schedules long before mechanical failure occurs, thereby minimizing critical vehicle downtime for commercial fleets—a massive economic benefit. This capability transforms the rolling chassis from a passive structure into an intelligent system capable of continuous learning and self-improvement, dynamically adjusting suspension dampening and steering responses based on learned driver behavior and immediate environmental data, directly contributing to superior vehicle dynamics, safety, and operational longevity.

- AI-driven topology optimization reduces chassis weight and enhances material efficiency by determining optimal load-bearing structures for EV platforms.

- Predictive maintenance algorithms analyze sensor data from suspension, brakes, and electrical systems to forecast component longevity and schedule proactive servicing, maximizing fleet uptime.

- Machine learning optimizes real-time thermal management for high-voltage battery systems integrated into the chassis, preventing performance degradation and extending battery life, especially during fast charging.

- AI facilitates enhanced sensor fusion and data processing required for Level 4/5 autonomous driving perception systems embedded within the platform’s centralized control units.

- Generative design accelerates the iterative process of developing modular, scalable chassis architectures by rapidly validating thousands of potential multi-material designs.

- Automated quality inspection systems using computer vision and acoustic monitoring ensure micro-level precision in complex component assembly and welding processes, guaranteeing structural integrity.

- AI enables dynamic, real-time adjustments of active suspension systems based on predictive road condition analysis and optimal vehicle load distribution.

- Embedded machine learning models improve energy consumption by optimizing the powertrain's torque vectoring and regenerative braking strategies within the rolling chassis electronics.

- AI aids in supply chain resiliency by predicting demand spikes and potential bottlenecks for specialized rolling chassis components like high-density integrated circuit boards and power semiconductors.

- Advanced robotics, guided by AI, perform complex multi-material joining techniques required for modern lightweight aluminum and composite chassis structures with high accuracy and speed.

DRO & Impact Forces Of Rolling Chassis Market

The market is predominantly driven by the economic and technological necessity of platform standardization, particularly in the EV sector. The concept of the rolling chassis allows OEMs to drastically reduce the complexity and capital outlay associated with vehicle development by standardizing the most expensive and technically challenging components—the battery, powertrain, and electronic backbone. This platform sharing strategy is a powerful impact force, accelerating the speed at which diversified models can be introduced to market, thereby meeting intense consumer demand for new electric vehicles across various price points and segments. Furthermore, environmental regulations, such as stringent European Union CO2 targets and national zero-emission vehicle mandates, serve as non-negotiable external drivers compelling the industry to adopt these specialized EV platforms, which are inherently superior to structurally adapted ICE architectures due to integrated battery management and superior crash protection.

Significant restraints center on the colossal initial investment required to pivot existing, decades-old manufacturing infrastructures toward rolling chassis production, demanding new facilities optimized for high-voltage battery handling, multi-material joining, and precise robotic assembly. This high barrier to entry restricts smaller players and creates temporary liquidity pressures even for established OEMs. Moreover, the reliance on a few global suppliers for critical components, especially advanced semiconductors, thermal management system elements, and high-energy-density battery cells, creates chronic supply chain vulnerabilities. Any disruption in these specialized upstream channels can severely impede the global production of complete rolling chassis units, impacting final vehicle delivery schedules. Another restraint is the technical challenge of ensuring the rolling chassis remains compatible with rapidly evolving battery technologies and future autonomous hardware iterations (such as new Lidar units), necessitating continuous and expensive re-engineering cycles to maintain platform relevance.

Opportunities are abundant in the high-growth commercial and specialized vehicle segments. The demand for robust, purpose-built electric rolling chassis for autonomous delivery vans, heavy-duty construction vehicles, and specialized vocational trucks is currently significantly undersupplied, representing a major revenue gap. Furthermore, the development of ‘Smart’ rolling chassis, fully integrated with cloud-based diagnostics and over-the-air (OTA) update capabilities, creates lucrative new revenue streams related to software licensing and servicing, shifting the core business model from a single hardware sale to recurring digital services throughout the vehicle’s lifespan. The strategic opportunity also lies in perfecting the 'structural battery' concept, where the battery casing acts as the primary load-bearing structure, dramatically enhancing vehicle efficiency, simplifying manufacturing, and ultimately lowering the total cost of the advanced rolling chassis platform while increasing its structural integrity and safety profile.

Segmentation Analysis

Market segmentation provides a crucial framework for understanding the diverse applications and underlying technologies within the Rolling Chassis domain. The segmentation by Propulsion Type, particularly the Battery Electric Vehicle (BEV) category, is the most dynamically growing segment, commanding the highest R&D expenditure and demonstrating the strongest forecast growth. This segment requires a unique rolling chassis design characterized by specialized thermal management loops, integrated cooling systems for high-performance motors and inverters, and complex multi-layered battery protection structures, setting it distinctly apart from simpler ICE platform requirements. The rise of Fuel Cell Electric Vehicles (FCEV) platforms also represents a niche but high-potential segment, primarily focused on heavy-duty trucking, demanding specialized high-pressure hydrogen tank integration and unique weight distribution considerations within the chassis structure for safety and stability.

The segmentation by Vehicle Type clearly dictates the structural requirements and complexity of the platform. Passenger Vehicle rolling chassis prioritize comfort, advanced safety features, and modularity for various body styles (e.g., SUVs, crossovers), emphasizing lightweight construction using advanced aluminum and composite materials to maximize range. Conversely, Commercial Vehicle rolling chassis require exceptional durability, high axle load capacity, and robust integration of pneumatic and hydraulic systems, especially in the Medium & Heavy Commercial Vehicle categories, where chassis must endure extreme weight and continuous operation cycles. The increasing adoption of LCV rolling chassis for electric last-mile delivery fleets is a major volume driver, demanding platforms optimized for frequent stop-start cycles and high mileage accumulation coupled with integrated telematics capability.

Component segmentation highlights the transformation of traditional mechanical systems into intelligent, electronically controlled modules. The Powertrain segment is now overwhelmingly focused on optimizing electric drive units (EDU) and axle design for maximum torque efficiency and compact packaging. More crucially, the Electrical & Electronic Systems segment—including the central ECUs, high-voltage distribution units, and integrated sensor arrays—is the fastest-growing component segment by value. The necessity of incorporating sophisticated steer-by-wire and brake-by-wire systems, which are integral to Level 4 autonomy and offer superior vehicle control, further increases the complexity and market value derived from these electronic components integrated directly within the rolling chassis platform, positioning it as the technological nucleus of the vehicle.

- By Propulsion Type:

- Internal Combustion Engine (ICE) (Phasing out, niche applications remaining)

- Battery Electric Vehicle (BEV) (Dominant market segment, highest projected growth rate)

- Plug-in Hybrid Electric Vehicle (PHEV) (Transitional segment, steady decline expected post-2030)

- Fuel Cell Electric Vehicle (FCEV) (Emerging, focused on heavy-duty and long-haul commercial applications requiring dense energy storage)

- By Vehicle Type:

- Passenger Vehicles (Sedan, SUV, Hatchback, Premium Crossover)

- Commercial Vehicles (Light Commercial Vehicle, Medium & Heavy Commercial Vehicle, Specialized Utility Platforms)

- By Component:

- Powertrain & Drivetrain Components (Electric Motors, Inverters, Single-Speed Transmissions, e-Axles)

- Braking Systems (Brake-by-Wire, Regenerative Braking Modules, Integrated Hydraulic Systems with redundancy)

- Suspension Systems (Air, Coil, Semi-Active/Active Suspension Modules, Continuous Damping Control)

- Steering Systems (Steer-by-Wire Modules, Electronic Power Steering, Redundancy systems)

- Electrical & Electronic Systems (High-Voltage Wiring, Centralized Domain Controllers, Thermal Management ECUs, Integrated Sensor/Lidar Housing)

- Structural Frame & Integrated Battery Housing (High-strength Steel, Aluminum Alloys, Structural Composites, crash-optimized designs)

- By Sales Channel:

- Original Equipment Manufacturer (OEM) (In-house developed or Joint Venture platforms)

- Third-Party Supplier/Platform Licensing (Specialized engineering firms selling validated platforms to new entrants and startups)

- Aftermarket (Limited component replacement, primarily for high-wear suspension and braking components)

- By Autonomy Level:

- Non-Autonomous (Standard vehicle platforms)

- Semi-Autonomous (L1-L3 Ready Platforms with pre-integrated ADAS sensors and electronic redundancy built into the chassis control systems)

- Fully Autonomous (L4-L5 Ready Platform requiring fail-operational architecture, specialized cooling, and high-performance computing unit integration)

Value Chain Analysis For Rolling Chassis Market

The upstream segment of the rolling chassis value chain is heavily concentrated on securing high-quality, strategically important materials and specialized components, marking a point of high risk and potential bottleneck. This involves sourcing advanced lightweight materials—primarily specialized grades of aluminum alloys and high-tensile, low-weight steel—necessary to construct the robust yet energy-efficient frame. Critical component suppliers include manufacturers of high-performance electric motors (permanent magnet synchronous motors), high-voltage batteries (lithium-ion cell providers, often subject to global supply constraints), and complex electronic systems (semiconductor and sensor manufacturers). Price volatility and geopolitical factors affecting raw material sourcing (such as nickel, cobalt, and lithium) pose significant risks at this foundational stage, making long-term supply agreements and strategic vertical integration increasingly vital for chassis manufacturers to ensure cost stability, continuous production, and adherence to sustainability standards.

The midstream stage is defined by advanced manufacturing and precise systems integration. Chassis fabricators receive structural materials and sub-components and perform complex assembly processes, including high-precision robotic welding, automated riveting, and multi-material bonding techniques crucial for achieving superior crash safety and structural integrity. For BEV platforms, this stage includes the meticulous, safety-critical integration of the heavy battery pack and complex thermal management hardware into the frame, requiring clean-room conditions and high levels of automation. Distribution channels are bifurcated: Direct distribution is standard when the rolling chassis division operates within a large OEM, delivering platforms internally to various global final assembly plants to meet production schedules. Indirect distribution involves specialized tier-one suppliers or platform providers (like REE Automotive or Benteler) selling complete, validated rolling chassis assemblies directly to third-party mobility startups or specialized vehicle builders, fulfilling the ‘Chassis-as-a-Service’ model. This indirect channel is rapidly expanding, offering diversified revenue streams and accelerated market penetration for new mobility concepts.

The downstream activities involve final vehicle completion, retail, and fleet operations. Once the body and interior are married to the rolling chassis, the final vehicle undergoes rigorous dynamic testing, regulatory certification, and essential software flashing to activate critical systems. For passenger vehicles, the value chain concludes with sales through dealerships and subsequent consumer use, where durability and integrated diagnostics (provided by the smart chassis) directly affect long-term customer satisfaction and warranty costs. For commercial vehicles and MaaS fleets, the downstream focus shifts entirely to Total Cost of Ownership (TCO), operational reliability, and maximizing uptime. The advanced diagnostics embedded in the rolling chassis allow fleet managers to monitor the health of high-wear components (suspension, battery degradation) remotely and accurately, ensuring predictive maintenance and maximizing asset lifespan, representing significant value capture through optimized operational efficiency for the high-volume end-user.

Rolling Chassis Market Potential Customers

The traditional core clientele for rolling chassis are established global automotive OEMs (Original Equipment Manufacturers) such as General Motors, Volkswagen Group, and Toyota. These major players utilize proprietary or co-developed rolling chassis platforms to create scale across their vast product lines, recognizing the chassis as the crucial, repeatable element of vehicle architecture that generates immense savings. These customers demand highly reliable, rigorously tested platforms that meet global regulatory standards for safety and emissions, prioritizing flexibility to accommodate varying wheelbases, battery sizes, and vehicle segments while maintaining component commonality to minimize long-term servicing complexity and inventory management burdens across their extensive global manufacturing networks.

A rapidly expanding and highly strategic customer segment consists of emerging Electric Vehicle startups and specialized niche manufacturers. Companies like Canoo, Arrival, and numerous regional EV makers depend heavily on readily available, validated third-party rolling chassis platforms due to the prohibitive cost and time required for proprietary platform development. Lacking the multi-billion dollar engineering budgets of legacy OEMs, these customers leverage external chassis solutions to dramatically compress their product development timelines, allowing them to focus resources solely on brand identity, advanced software development, and unique customer experience features. Their key requirements are standardized interfaces, high flexibility for customized 'top-hat' designs, and immediate assurance of regulatory compliance and high safety ratings, making specialized platform providers highly valuable partners in this disruptive space.

Furthermore, major logistics and delivery companies (e.g., Amazon, FedEx, DHL) and urban Mobility-as-a-Service (MaaS) operators constitute a significant potential customer base for commercial vehicle rolling chassis. These entities increasingly seek to purchase the electric platform directly, often in collaboration with specialized body-builders, to create purpose-built delivery vans, autonomous pods, or electric utility vehicles optimized for fleet deployment and highly specific operational needs. Their purchasing criteria are heavily skewed towards extreme durability, maximized payload capacity, low maintenance frequency facilitated by the integrated digital components of the chassis, and robust telematics integration to manage large, continuously operating vehicle pools effectively. This B2B segment demands industrial-grade chassis designed for continuous, high-stress operation and a predictable 10–15 year operational lifespan, ensuring maximum return on capital investment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 45.2 Billion |

| Market Forecast in 2033 | USD 150.8 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Tesla Inc., Volkswagen Group, General Motors (BrightDrop), Hyundai Motor Company, Arrival Ltd., REE Automotive, Magna International, Benteler, Robert Bosch GmbH, ZF Friedrichshafen AG, GKN Automotive, Toyota Motor Corporation, Nio Inc., Canoo, Foxconn Technology Group, Dana Incorporated, Proterra Inc., VDL Groep, Foton Motor Group, BYD Company Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Rolling Chassis Market Key Technology Landscape

The technological evolution of the rolling chassis is fundamentally tied to electrification and autonomy, demanding platforms that are highly integrated, digitally controllable, and optimized for energy storage. The cornerstone technology is the 'Skateboard Platform Architecture,' a modular, low-profile design that houses the battery pack and all powertrain components entirely beneath the passenger or cargo floor. This architecture maximizes energy density and structural integrity. Technical advancements include the aggressive move towards structural battery integration (often termed Cell-to-Chassis technology), where the battery enclosure itself contributes to the vehicle’s torsional stiffness and crash management capabilities, reducing reliance on conventional body-in-white structures and significantly improving the platform's energy efficiency by reducing overall vehicle mass and centralizing weight distribution.

Electrification drives the necessity for sophisticated thermal management systems (TMS) embedded directly within the rolling chassis, managing the temperature of high-voltage components, electric motors, power electronics, and, most critically, the battery cells. These systems employ intricate liquid cooling circuits and highly efficient heat pumps, relying on integrated ECUs and AI algorithms to maintain optimal operational temperatures, which directly impacts charging speed, battery lifespan, and overall vehicle range. Additionally, the shift towards software-defined control is profoundly evident in the adoption of Brake-by-Wire and Steer-by-Wire (SbW) systems. SbW eliminates the traditional mechanical linkage between the steering wheel and the road wheels, offering greater flexibility in design, superior control responsiveness, and, crucially, enabling the fail-operational redundancy necessary for safe Level 4 and Level 5 autonomous driving, which must be fully supported by the chassis's resilient electrical and mechanical structure.

The enablement of autonomy requires significant hardware integration into the rolling chassis, positioning it as the ultimate host for vehicle intelligence. This includes robust mounting points and precisely calibrated positioning for critical perception sensors (Lidar, high-resolution radar, cameras) and high-performance computing (HPC) platforms, often centrally located within the chassis to minimize cabling length and shield sensitive electronics from environmental elements. The platform requires high-speed, high-throughput vehicle networks, such as Automotive Gigabit Ethernet or specialized data buses, to handle the massive volumes of sensor data generated and processed in real-time. Future technology trends will focus on chassis platforms with distributed, smart actuation systems that allow for 'all-wheel steering' and highly granular control over individual wheel torque (torque vectoring) and braking force, further blurring the lines between the mechanical frame and the intelligent digital control system that monitors and operates the vehicle in dynamic environments.

Regional Highlights

Asia Pacific (APAC) stands as the undisputed market leader, responsible for the highest volume production of rolling chassis, largely due to China's dominant position as the world's largest manufacturer and consumer of electric vehicles. Governments across the region, particularly in China and South Korea, have implemented supportive policies, including massive subsidies, tax breaks, and regulatory mandates, which have dramatically accelerated the adoption of localized EV platforms. APAC manufacturers excel in achieving cost efficiencies through strategic vertical integration, controlling both battery supply and chassis manufacturing. While technological complexity is increasing, the regional focus remains on scaling affordable, reliable BEV platforms for urban mobility and mass-market consumer segments, with substantial investments in domestic supply chains aimed at regional self-sufficiency and robust export capacity to neighboring markets.

Europe represents the second-largest market and is characterized by a strong emphasis on premiumization, sustainability, and rapid technological adoption driven by stringent regulatory frameworks. The aggressive European Union emissions regulations necessitate an immediate and irreversible shift towards integrated BEV chassis designs. European OEMs (like Volkswagen, Mercedes-Benz, and BMW) are investing heavily in new-generation modular platforms (e.g., SSP, PPE) that feature advanced materials, integrated active air suspension systems, and full technological readiness for L3 autonomy. The high concentration of specialized Tier 1 suppliers in Germany and France drives innovation in components like high-precision brake-by-wire and sophisticated steer-by-wire systems. The European market demands rolling chassis that offer superior driving dynamics, world-class safety features, and a seamless digital experience integrated into the platform's core architecture, justifying higher ASPs.

North America is emerging as a high-value growth market, driven particularly by the rapidly electrifying commercial sector (last-mile delivery fleets, heavy trucking) and significant government investment through programs like the Bipartisan Infrastructure Law, which supports charging infrastructure development. Leading US automakers and EV specialists are focusing on robust, highly durable rolling chassis designed for large electric pickup trucks and heavy-duty vehicles, prioritizing battery longevity, high towing capacity, and extreme fast-charging compatibility across diverse climatic conditions. The region is also the global center for L4/L5 autonomous vehicle testing and large-scale deployment. Consequently, North American rolling chassis platforms must incorporate advanced, redundant electronic architectures and power delivery systems capable of supporting the high computational demands of self-driving technology in demanding operational environments, making technological sophistication a core purchasing criterion.

- Asia Pacific (APAC): Dominant in volume, driven by China’s mass-market EV production and favorable policies. Focus on cost optimization, vertical integration, and high scalability of standardized BEV platforms for regional and global export markets.

- Europe: High-value segment driven by strict environmental regulations and consumer demand for premium EVs. Emphasis on advanced active suspension, integrated L3 autonomy readiness, and utilization of next-generation lightweight structural materials in complex platforms.

- North America: Rapid growth in the commercial vehicle segment (e-trucks, vans) and strong technological push for L4/L5 autonomous rolling chassis. Focus on ruggedization, high power architecture (800V systems), and integration of sophisticated high-performance computing units.

- Latin America: Emerging market with growth concentrated in public transport electrification (e-buses) and light commercial vehicles in major urban centers. Market development is heavily reliant on foreign investment and strategic localized assembly partnerships to mitigate import costs.

- Middle East and Africa (MEA): Niche but strategic market growth linked to major smart city projects (e.g., NEOM, Dubai). Demand is centered on specialized autonomous shuttle platforms and electric utility vehicles, requiring highly durable materials and resilient thermal management systems for extreme climate operation.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Rolling Chassis Market.- Tesla Inc. (Pioneering structural battery integration and large-scale, vertically integrated platform architecture)

- Volkswagen Group (Major platform developer with MEB and future SSP architectures driving standardization)

- General Motors (Developing Ultium platform and specialized BrightDrop commercial chassis for logistics)

- Hyundai Motor Company (Leading with E-GMP platform strategy known for 800V charging capability)

- Arrival Ltd. (Specialized in lightweight, micro-factory modular commercial vehicle platforms)

- REE Automotive (Provider of modular, independent wheel-based electric platform technology)

- Magna International (Major Tier 1 supplier offering integrated platform solutions and contract manufacturing)

- Benteler (Specialized engineering firm offering global third-party rolling chassis and system integration)

- Robert Bosch GmbH (Key supplier of electronic control units, steering, and advanced braking systems integrated into the chassis)

- ZF Friedrichshafen AG (Leading supplier of e-axles, active suspension, and chassis control systems)

- GKN Automotive (Specialist in e-driveline systems and advanced torque vectoring components)

- Toyota Motor Corporation (Developing specialized platforms for its global EV transition, focused on solid-state battery integration)

- Nio Inc. (Advanced platform architecture focusing on integrated battery swap functionality and vehicle intelligence)

- Canoo (Designing highly modular, multi-purpose B2B and B2C electric platforms)

- Foxconn Technology Group (New entrant offering the MIH open platform for third-party vehicle manufacturing)

- Dana Incorporated (Focusing on advanced e-propulsion systems, thermal management, and drivetrain components)

- Proterra Inc. (Leading supplier of heavy-duty electric bus and commercial vehicle platforms)

- VDL Groep (European specialist in electric bus and modular commercial vehicle chassis assembly)

- Foton Motor Group (Major Chinese commercial vehicle chassis manufacturer focusing on heavy-duty electric applications)

- BYD Company Ltd. (Vertically integrated producer of standardized BEV platforms and blade battery technology)

Frequently Asked Questions

Analyze common user questions about the Rolling Chassis market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a traditional chassis and an electric rolling chassis (skateboard platform)?

The key difference is integration and layout. A traditional chassis supports the internal combustion engine and mechanical components separately, whereas the electric rolling chassis (skateboard) structurally integrates the battery pack, centralized powertrain components, and high-voltage electronics directly into a flat, robust floor structure, optimizing weight distribution, maximizing interior space, and improving crash safety characteristics.

How does modular rolling chassis architecture contribute to vehicle manufacturing cost reduction?

Modular rolling chassis reduce manufacturing costs primarily by achieving massive economies of scale. They enable OEMs to share the complex, expensive, and non-differentiating engineering components—powertrain, steering, suspension, and battery architecture—across numerous vehicle models and diverse brands, dramatically shortening the product development cycle and minimizing R&D investment per specific model variant.

Which geographical region dominates the global Rolling Chassis Market and why?

The Asia Pacific (APAC) region currently dominates the global Rolling Chassis Market due to the immense scale of Electric Vehicle (EV) production, particularly in China. This dominance is driven by substantial governmental support, rapid consumer adoption, and a focused strategy on high-volume, cost-effective manufacturing of standardized BEV rolling chassis platforms for both domestic and international markets.

What is 'Structural Battery Integration' and how does it impact the rolling chassis?

Structural battery integration (e.g., Cell-to-Chassis) is a technological advancement where the battery enclosure and cells become active, primary load-bearing components of the rolling chassis frame. This approach dramatically improves the platform’s torsional rigidity, enhances overall vehicle safety, and significantly reduces the total weight and complexity of the vehicle structure, boosting energy efficiency.

Are rolling chassis platforms ready for fully autonomous vehicles (Level 4 and 5)?

Yes, modern high-end rolling chassis are specifically engineered to be 'L4/L5 Ready.' They incorporate necessary features such as redundant, fail-operational electronic control systems (steer-by-wire/brake-by-wire), stable mounting points for Lidar and radar, integrated cooling systems, and high-speed data architecture to support the intense computational and electrical requirements of fully autonomous driving systems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager