Rolling Stock Wheel Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434757 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Rolling Stock Wheel Market Size

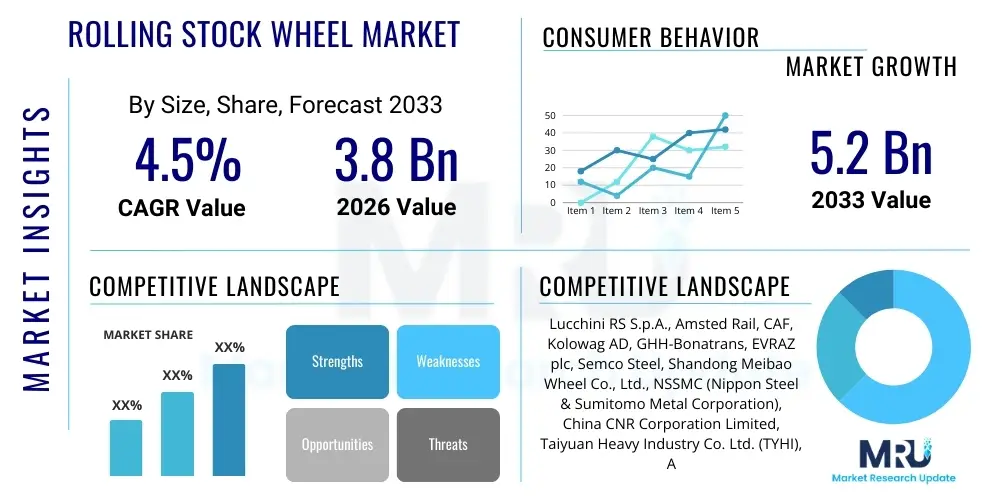

The Rolling Stock Wheel Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 3.8 billion in 2026 and is projected to reach USD 5.2 billion by the end of the forecast period in 2033. This robust expansion is primarily driven by massive global investments in high-speed rail networks, particularly across the Asia Pacific region, coupled with the mandatory replacement cycles and stringent safety regulations governing railway infrastructure worldwide. The focus on enhancing freight efficiency and expanding metropolitan rail systems, such as metros and trams, further solidifies the market's growth trajectory, requiring durable, high-performance wheelsets compliant with international standards like EN 13262 and AAR specifications.

Rolling Stock Wheel Market introduction

The Rolling Stock Wheel Market encompasses the design, manufacture, and distribution of specialized wheels essential for railway vehicles, including locomotives, passenger coaches, freight wagons, and urban transit systems. These wheels, typically manufactured from high-quality forged or cast steel alloys, are critical components responsible for ensuring safe, efficient, and smooth operation of rail transport by maintaining contact between the rolling stock and the rails. Their performance parameters, such as hardness, fatigue resistance, and dimensional accuracy, are paramount for high-speed operation and heavy-duty freight haulage. Major applications span across mainline railways, industrial railways, and rapid transit systems, providing the foundation for global logistics and passenger mobility networks.

The key benefits derived from high-quality rolling stock wheels include enhanced energy efficiency through minimized rolling resistance, extended service life of both the wheels and the rail infrastructure, and crucially, improved safety margins against derailment and catastrophic failure. Innovations in manufacturing processes, such as vacuum degassing and advanced heat treatment, contribute to superior material integrity capable of withstanding extreme thermal and mechanical stresses inherent in modern rail operations. The market is fundamentally driven by government policies supporting railway modernization, the necessity of replacing aging fleets, and the increasing demand for sustainable and high-capacity transport solutions, particularly in rapidly urbanizing economies.

Rolling Stock Wheel Market Executive Summary

The Rolling Stock Wheel Market exhibits strong growth, underpinned by significant business trends centered on material innovation and lifecycle cost reduction. Key industry players are focusing on developing lightweight yet durable alloys, such as specialized aluminum-steel hybrids for urban transit, to reduce vehicle mass and energy consumption. Furthermore, the trend toward predictive maintenance strategies, integrating sensor technology directly into wheelsets (smart wheels), is transforming operational expenditure models. Regionally, Asia Pacific leads the growth curve, propelled by extensive high-speed rail projects in China and India, while Europe and North America maintain mature markets characterized by strict regulatory compliance and high demand for specialized components for heavy haul freight operations. Segment-wise, the high-speed passenger rail segment is experiencing the fastest acceleration due to continuous expansion efforts globally, though the freight segment remains the largest volume consumer, demanding highly resilient forged steel wheels designed for extreme load bearing capacity and long-distance endurance.

AI Impact Analysis on Rolling Stock Wheel Market

User queries regarding AI's influence predominantly revolve around three areas: how AI can minimize catastrophic failures through advanced predictive analytics; the role of AI in optimizing wheel design and material selection for extreme conditions; and the potential for autonomous inspection systems to reduce human error and inspection time. Users are particularly concerned with the transition cost associated with embedding intelligent sensors and the compatibility of AI platforms with legacy rail infrastructure maintenance systems. The consensus highlights that AI offers unprecedented opportunities for shifting from time-based maintenance to condition-based maintenance, thereby maximizing wheel lifespan, minimizing operational downtime, and achieving substantial savings in maintenance, repair, and overhaul (MRO) activities. AI-driven models analyzing acoustic signatures, vibration patterns, and temperature data are becoming indispensable tools for detecting early stage defects, such as shelling, spalling, or thermal cracks, long before they become safety hazards, fundamentally redefining the maintenance paradigm within the railway industry.

- AI-powered Predictive Maintenance: Utilization of machine learning algorithms to analyze real-time sensor data (vibration, temperature, acoustic emissions) collected from wheelsets to forecast potential failure points and schedule maintenance precisely, maximizing asset availability.

- Automated Visual Inspection: Deployment of high-speed cameras and AI vision systems at rail depots to automatically inspect wheel profiles, detecting minute surface imperfections and wear deviations with greater accuracy and speed than human inspectors.

- Optimized Manufacturing Processes: Applying AI and generative design tools to simulate millions of load scenarios, leading to optimized wheel geometry and material composition, reducing material usage while enhancing fatigue strength and durability.

- Inventory and Supply Chain Optimization: Using AI to predict demand fluctuations for replacement wheelsets based on track usage, environmental conditions, and specific rolling stock fleet requirements, streamlining inventory management for OEMs and maintenance providers.

- Enhanced Safety Protocols: AI algorithms providing real-time risk assessment by integrating wheel condition data with operational parameters (speed, load, track geometry), offering proactive warnings to prevent incidents related to wheel failure or gauge deviation.

DRO & Impact Forces Of Rolling Stock Wheel Market

The Rolling Stock Wheel Market is significantly influenced by a delicate balance of driving factors, constraints, and emerging opportunities. Key drivers include massive infrastructure spending on rail expansion globally, particularly driven by urbanization and the shift toward sustainable transport modes, necessitating higher volumes of durable wheelsets. Restraints largely stem from the extremely high cost and complexity involved in manufacturing wheels that meet rigorous international safety certifications, coupled with long replacement cycles that moderate replacement demand in mature markets. However, the market presents substantial opportunities through the adoption of lightweight materials, the integration of smart sensor technologies for condition monitoring, and the growing demand for specialized, high-performance wheels for high-speed and heavy-haul applications. These forces collectively shape competitive dynamics, compelling manufacturers to invest heavily in advanced metallurgy, process control, and digital integration to meet evolving regulatory and operational demands globally.

Drivers: Global expansion of railway networks, particularly in developing economies, is the primary driver. The establishment of high-speed corridors in Asia, the Middle East, and Europe demands sophisticated, resilient wheel designs capable of handling speeds exceeding 250 km/h, requiring specialized heat treatment and precision manufacturing. Additionally, the increasing focus on intermodal freight transport and the resultant demand for high axle load wagons necessitates extremely robust wheels, driving innovation in material strength and fatigue resistance. Governments worldwide view rail as a critical component of decarbonization strategies, further fueling investment in both passenger and freight rolling stock, consequently increasing the total accessible market for wheels.

Restraints: The market faces significant restraints related to stringent certification requirements and high capital investment. Regulatory bodies impose severe quality checks (e.g., ultrasonic testing, magnetic particle inspection), leading to long lead times and high production costs. Furthermore, the specialized nature of wheel manufacturing requires substantial investment in advanced forging equipment, precise CNC machining centers, and comprehensive testing facilities, creating high barriers to entry. Economic downturns or political instability impacting major infrastructure projects can also temporarily restrict market growth, as the demand for new wheels is highly correlated with capital expenditure on new rolling stock purchases rather than immediate maintenance needs.

Opportunities: Future opportunities lie in technological advancements focused on reducing lifecycle costs and improving performance. The development and commercialization of composite and hybrid wheel solutions promise weight reduction without compromising strength, which is vital for electric multiple units (EMUs) and urban rail systems seeking energy efficiency. The integration of IoT sensors into wheelsets for real-time monitoring of temperature, stress, and vibration offers a high-value opportunity to transition maintenance practices, generating a lucrative aftermarket for smart wheel components and associated data analysis services. Furthermore, modernization projects focusing on replacing older, less efficient wheels with new generation components compliant with advanced noise reduction standards (e.g., TSI Noise) present steady replacement demand.

Segmentation Analysis

The Rolling Stock Wheel Market is highly fragmented and analyzed across several critical dimensions, including the type of product, the specific rolling stock application, and the material composition used in manufacturing. Understanding these segmentations is vital for market players as it dictates manufacturing complexity, regulatory compliance requirements, and pricing strategies. The choice between forged and cast wheels, for instance, significantly impacts the wheel's durability and suitability for high-speed or heavy-haul operations. Similarly, market demand varies drastically between the high-volume, standardized requirements of the freight sector and the highly customized, high-performance needs of the high-speed passenger rail segment, driving differentiated R&D investments among key manufacturers.

The inherent diversity in railway operating environments—ranging from the extreme cold of Siberian routes to the high-humidity, high-heat conditions of Southeast Asia—necessitates specialization within each segmentation, particularly concerning material science and surface treatments to prevent corrosion and wear. The evolution of urban transit systems, including metros and trams, further complicates the segmentation landscape, requiring lighter, quieter wheels designed for frequent stopping and starting and smaller track radii. This complexity ensures that market players must maintain flexible manufacturing capabilities and robust metallurgical expertise to serve the varied global demands across all defined segments effectively.

- By Product:

- Forged Wheels (Dominant segment due to superior strength and fatigue resistance)

- Cast Wheels (Used in specific low-speed or industrial applications)

- By Rolling Stock Type:

- Freight Wagons (Largest volume consumer, focused on durability and load capacity)

- Passenger Coaches (High focus on smoothness, noise reduction, and safety)

- Locomotives (Requires extremely high strength and resistance to traction forces)

- High-Speed Rail (HSR) (Requires precision balance, low residual stress, and advanced metallurgy)

- Urban Transit (Metro, Tram, Light Rail) (Focus on low noise, light weight, and frequent braking resistance)

- By Material:

- Steel Wheels (Standard Carbon Steel, High-Carbon Steel, Alloyed Steel)

- Aluminum Alloy Wheels (Primarily for lightweight urban rail applications)

- Composite Materials (Emerging segment for specific high-performance requirements)

Value Chain Analysis For Rolling Stock Wheel Market

The value chain for the Rolling Stock Wheel Market begins with complex upstream activities centered on raw material sourcing and primary manufacturing. Upstream activities involve the procurement of high-grade steel scrap and alloying elements necessary for producing specialized rail steel billets. Key manufacturers maintain stringent control over steel refining processes, including vacuum degassing and electric arc furnace operations, to ensure minimal impurities and optimal chemical composition, crucial prerequisites for wheel durability. These specialized steel producers often operate captive rolling and forging facilities to maintain quality control over the entire production process, transforming raw billets into near-net shape wheel blanks through powerful hydraulic presses, a critical, energy-intensive step.

Midstream processing involves advanced heat treatment, crucial for conferring the required mechanical properties, followed by precision CNC machining to achieve exact profiles and tolerances stipulated by international standards (e.g., AAR M-107/M-208 and EN 13262). Quality assurance, including sophisticated non-destructive testing (NDT) such as ultrasonic and magnetic particle inspection, forms a vital part of the midstream process, adding significant cost and value. The distribution channel is often bifurcated: direct distribution is common for major OEMs (Original Equipment Manufacturers) supplying new rolling stock projects, requiring specialized logistics for heavy, high-value components. Indirect distribution, leveraging authorized distributors and aftermarket service providers, is prevalent for MRO and replacement market sales, offering localized inventory and quick turnaround times for specialized wheelsets.

Downstream analysis focuses on installation, maintenance, and end-of-life management. End-users, comprising national railway operators and private freight companies, engage in sophisticated wheelset assembly and mounting procedures, often requiring specialized presses and tooling to secure wheels onto axles. The aftermarket segment is robust, driven by periodic wear and replacement, along with reprofiling and repair services necessary to extend asset life. Given the safety-critical nature of the product, adherence to strict maintenance schedules and the use of certified repair shops defines the downstream value proposition, ensuring that even replacement components maintain the integrity required for high-speed and heavy-haul operations globally.

Rolling Stock Wheel Market Potential Customers

The potential customers and end-users of rolling stock wheels are highly concentrated and fall into distinct categories defined by the scale and nature of their railway operations. The primary buyers are Rolling Stock Original Equipment Manufacturers (OEMs), such as CRRC, Siemens Mobility, Alstom, and Bombardier (now acquired by Alstom), who integrate the wheels into new train sets destined for global railway projects. These OEMs demand high volumes, stringent quality controls, and tailored specifications based on the end-operator's specific network conditions and regulatory environment, often signing long-term supply contracts with wheel manufacturers to ensure continuity and quality standardization.

The second major group consists of National and Private Railway Operators, including entities like Deutsche Bahn, Union Pacific, Indian Railways, and China Railways. These organizations are pivotal for the aftermarket segment, as they manage vast operational fleets requiring continuous maintenance, repair, and overhaul (MRO). Their purchasing decisions are driven by total cost of ownership (TCO), wheel longevity, and maintenance cycle optimization. Specialized fleet maintenance companies and large industrial corporations operating their own rail lines (e.g., mining companies, port authorities) also represent a crucial subset of end-users, requiring specific heavy-duty or industrial-grade wheels capable of withstanding unique operational stresses.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.8 Billion |

| Market Forecast in 2033 | USD 5.2 Billion |

| Growth Rate | CAGR 4.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Lucchini RS S.p.A., Amsted Rail, CAF, Kolowag AD, GHH-Bonatrans, EVRAZ plc, Semco Steel, Shandong Meibao Wheel Co., Ltd., NSSMC (Nippon Steel & Sumitomo Metal Corporation), China CNR Corporation Limited, Taiyuan Heavy Industry Co. Ltd. (TYHI), ArcelorMittal, Midas Rail International, Siemens Mobility, Alstom, CRRC Corporation Limited. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Rolling Stock Wheel Market Key Technology Landscape

The technological landscape of the Rolling Stock Wheel Market is defined by continuous advancements in metallurgy, manufacturing precision, and digital integration aimed at maximizing wheel performance and longevity under increasingly demanding operational criteria. A core technological focus is on advanced materials science, specifically developing specialized high-carbon alloyed steels that offer superior tensile strength and hardness profiles while maintaining sufficient ductility to resist brittle fracture. Technologies such as vacuum-arc remelting (VAR) and electroslag remelting (ESR) are employed to minimize inclusions and microstructural defects within the steel, crucial for high-speed and heavy-haul wheel integrity, directly improving fatigue life and resistance to thermal stress cracking induced by braking.

Precision manufacturing techniques represent another critical technological pillar. This includes the use of highly accurate robotic forging lines that ensure consistent shape and grain flow, followed by state-of-the-art CNC grinding and turning machines capable of achieving sub-micron tolerances on the wheel tread and flange profile. Furthermore, differentiated heat treatment processes, such as localized rim quenching and tempering, are utilized to tailor the mechanical properties across the wheel body—creating a hard, wear-resistant tread surface while maintaining a tough, shock-absorbent wheel plate and hub. These advanced processing methods are non-negotiable for manufacturers aiming to meet the demanding specifications of global railway operators, particularly concerning safety-critical dimensions and surface finishing requirements.

The emerging technological frontier is the integration of ‘Smart Wheel’ systems, leveraging Internet of Things (IoT) sensors and wireless telemetry. This involves embedding or attaching specialized sensors (e.g., fiber optic strain gauges, temperature sensors, acoustic emission transducers) directly onto the wheel or axle box. This technology enables continuous, real-time monitoring of critical parameters like wheel stress, temperature buildup, and track interaction forces. The data collected feeds into cloud-based AI systems, facilitating advanced condition monitoring and predictive maintenance. This shift represents a significant technological leap from conventional inspection methods, optimizing maintenance cycles and dramatically reducing the likelihood of unexpected operational failures, driving the digital transformation of railway maintenance practices globally.

Regional Highlights

The global Rolling Stock Wheel market demonstrates significant regional variations driven by differing infrastructure priorities, regulatory environments, and the maturity of rail networks. Asia Pacific (APAC) is currently the dominant and fastest-growing region, fueled overwhelmingly by state-led investment in extensive high-speed rail networks in China and ambitious metro and rail modernization projects in India, Southeast Asia, and Australia. The sheer scale of rolling stock procurement in China alone dictates global production capacity and demand, focusing on high-volume production of both standard freight and specialized high-speed wheelsets. The necessity for local manufacturing and technology transfer in countries like India further shapes the competitive landscape in this dynamic region.

Europe represents a mature but highly complex market characterized by stringent cross-border regulatory harmonization (TSI regulations) and a strong emphasis on reducing noise pollution (Silent Wheels technology). Demand is sustained by continuous modernization of conventional passenger and freight fleets, coupled with stable growth in high-speed connectivity across the continent. Key manufacturers in this region are often vertically integrated and focus heavily on R&D for lightweight materials and advanced noise-dampening designs, catering to operators seeking maximum operational efficiency and environmental compliance. Furthermore, the European aftermarket for wheel maintenance and reprofiling services is robust due to the high utilization rates of existing rolling stock.

North America, particularly the United States and Canada, is dominated by the heavy-haul freight segment. The market demands extremely durable, high-axle load wheels (up to 40 tonnes per axle) designed for long distance, severe operating conditions, adhering primarily to AAR standards. Investment cycles are closely tied to the commodity market performance (coal, grain, intermodal traffic). Latin America and the Middle East & Africa (MEA) present emerging opportunities, with significant planned urban rail developments and new cross-country freight lines. However, market growth in these regions can be volatile, highly dependent on favorable government financing and stable geopolitical conditions for project execution.

- Asia Pacific (APAC): Dominant market share and fastest growth driven by massive state investment in HSR (China, South Korea) and high-volume urban transit expansion (India, Southeast Asia). Emphasis on mass production and specialized metro wheels.

- Europe: Mature market focused on technological sophistication, regulatory compliance (TSI), noise reduction technology, and high-performance components for international rail corridors. Strong replacement demand for passenger fleets.

- North America: Focuses heavily on the demanding heavy-haul freight sector, requiring AAR-compliant wheels with maximum load-bearing capacity and fatigue resistance. Replacement cycles are critical due to intense usage.

- Latin America (LATAM): Emerging market potential driven by metro expansion in major cities (Brazil, Mexico) and mining railway projects, demanding specialized industrial and heavy-duty wheels.

- Middle East & Africa (MEA): Growth fueled by new infrastructure projects connecting economic hubs (e.g., Gulf Rail network), requiring components suited for high temperatures and desert environments, often reliant on foreign expertise and high-quality imports.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Rolling Stock Wheel Market, characterizing their strategic positioning, product portfolios, and recent market developments. These companies are crucial in setting industry standards for material science, manufacturing quality, and technological integration.- Lucchini RS S.p.A.

- Amsted Rail

- GHH-Bonatrans

- EVRAZ plc

- Kolowag AD

- NSSMC (Nippon Steel & Sumitomo Metal Corporation)

- CAF (Construcciones y Auxiliar de Ferrocarriles)

- Taiyuan Heavy Industry Co. Ltd. (TYHI)

- CRRC Corporation Limited

- Semco Steel

- Shandong Meibao Wheel Co., Ltd.

- ArcelorMittal

- Bharat Forge

- Midas Rail International

- Siemens Mobility

- Alstom

Frequently Asked Questions

Analyze common user questions about the Rolling Stock Wheel market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected CAGR for the Rolling Stock Wheel Market through 2033?

The Rolling Stock Wheel Market is projected to experience a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033, driven by global railway network expansion, high-speed rail development, and mandatory fleet modernization programs worldwide.

How does the type of rolling stock (freight vs. high-speed) affect wheel manufacturing requirements?

Freight wheels prioritize durability, extremely high axle load capacity, and resistance to wear over long distances (AAR standards). High-speed wheels require superior material cleanliness, precise dynamic balance, specialized heat treatments for thermal resistance, and adherence to extremely tight geometric tolerances (TSI standards).

What role does AI technology play in enhancing the life cycle and safety of rolling stock wheels?

AI significantly enhances wheel safety and longevity by enabling predictive maintenance. AI systems analyze real-time sensor data (vibration, acoustics) to detect micro-defects early, allowing for condition-based servicing which minimizes unscheduled downtime and maximizes the wheel's operational lifespan beyond traditional time-based maintenance schedules.

Which geographical region is the primary growth engine for the Rolling Stock Wheel market?

The Asia Pacific (APAC) region, particularly driven by massive investments in high-speed rail projects in China and rapid urbanization requiring new metro and light rail systems in India and Southeast Asia, is identified as the dominant market and the key growth engine.

What is the significance of forging technology compared to casting in modern wheel production?

Forging is the standard, preferred technology for high-performance rolling stock wheels (especially high-speed and heavy-haul) because the forging process imparts superior mechanical properties, including enhanced grain structure, higher fatigue strength, and reduced risk of internal defects compared to casting, ensuring the safety and reliability required for rail operations.

What is the primary material used in rolling stock wheel manufacturing and why?

Specialized high-carbon alloyed steel is the primary material used globally due to its optimized balance of hardness for wear resistance, tensile strength for load bearing, and fracture toughness. These metallurgical properties are achieved through controlled alloying and specific heat treatment processes, ensuring the wheel can withstand high dynamic stresses and thermal loads generated during braking.

How are environmental regulations influencing the design of rolling stock wheels?

Environmental regulations, particularly in Europe, are driving demand for "Silent Wheels" or noise-dampening wheel designs. Manufacturers employ technologies such as resilient wheel inserts, rubber damping elements, or tuned absorbers within the wheel structure to reduce the noise generated from wheel-rail interaction, meeting strict urban noise standards (e.g., TSI Noise).

Define the "Smart Wheel" concept and its market opportunity.

A Smart Wheel integrates IoT sensor technology (monitoring temperature, strain, vibration) directly into the wheelset. The market opportunity lies in transitioning the high-value aftermarket MRO sector towards data-driven predictive models, offering rail operators enhanced safety, efficiency, and significant reductions in maintenance expenditures.

What are the main regulatory standards governing the quality and production of railway wheels?

The main regulatory standards are the Association of American Railroads (AAR M-107/M-208) for North America and the European Standards (EN 13262) governed by Technical Specifications for Interoperability (TSI) for Europe. Compliance with these standards is mandatory for market entry and operation, defining everything from material composition to ultrasonic testing protocols.

In the value chain, which segment adds the most significant non-material value?

The midstream processing segment, which encompasses advanced heat treatment, precision CNC machining, and comprehensive non-destructive testing (NDT), adds the most significant non-material value. These processes transform the raw steel billet into a safety-critical component compliant with micron-level tolerances and specific mechanical properties.

What are the key differences between a passenger coach wheel and a locomotive wheel?

Locomotive wheels require superior resistance to high traction forces, demanding extremely robust designs and specialized steel to handle greater torque transmission. Passenger coach wheels focus more on lightweight design, noise reduction, and maintaining smoothness at high velocities, often prioritizing comfort and efficiency over sheer tractive effort.

How is the lifespan of a rolling stock wheel primarily determined?

The lifespan is primarily determined by the rate of wear on the tread and flange, which is influenced by factors such as axle load, track geometry, operational speed, and the frequency of reprofiling. Advances in steel metallurgy and surface treatments are continually extending the permissible wear limits and overall life cycle of modern wheels.

What impact does urbanization have on the demand for specific wheel types?

Urbanization directly increases demand for Urban Transit wheels (Metro, Tram, Light Rail). These wheels must be lighter, operate quietly due to proximity to residential areas, and possess high thermal stability to withstand frequent, intense braking cycles associated with dense metropolitan networks.

How do lightweight materials like aluminum alloys fit into the rolling stock wheel market?

Aluminum alloy wheels are a niche, high-value segment primarily used in high-speed trains and urban transit systems where reducing unsprung mass is critical for energy efficiency, reduced track wear, and dynamic performance. They are often used in conjunction with a steel hoop for the critical rolling surface contact.

What technological advancements are crucial for mitigating thermal cracking in wheels?

Crucial technological advancements include specialized rim quenching during the heat treatment process, which creates a highly homogeneous, tempered microstructure resistant to thermal fatigue. Furthermore, the use of advanced ceramic braking systems (where applicable) helps minimize the transfer of heat into the wheel rim, reducing thermal stress concentration.

Explain the significance of wheel reprofiling services in the aftermarket segment.

Wheel reprofiling (turning the wheel tread back to its optimal profile) is a critical aftermarket service that extends the wheel's operational life multiple times before final scrapping. It is essential for maintaining safe wheel-rail interaction, preventing excessive wear, and correcting defects caused by uneven running, thereby offering substantial cost savings to railway operators.

What are the primary challenges related to high barriers to entry for new market players?

High barriers to entry include the immense capital requirement for specialized forging, heat treatment, and precision machining facilities, combined with the several years necessary to achieve rigorous international safety certifications (AAR, EN) and gain approval from major global railway operators and OEMs.

How do global steel price fluctuations affect the Rolling Stock Wheel Market?

Global steel price fluctuations significantly impact the market, as high-grade alloy steel constitutes a major component of the manufacturing cost. Volatility necessitates robust hedging strategies for manufacturers and can lead to cost pass-through to railway operators, influencing overall procurement budgets for new rolling stock.

What specific testing methodologies ensure the quality of rolling stock wheels?

Key testing methodologies include non-destructive testing (NDT), such as ultrasonic testing to detect internal defects, magnetic particle inspection for surface cracks, and sophisticated dynamic testing (rolling road tests) to assess fatigue resistance, along with dimensional and metallurgical checks to verify compliance with specification standards.

What is the expected long-term impact of autonomous freight trains on wheel design?

Autonomous freight operations will increase the demand for "smarter" wheels capable of transmitting detailed condition data autonomously. Design emphasis will shift towards extreme reliability, minimal maintenance intervention, and integration of sensors for continuous self-assessment to ensure long periods of unattended operation.

Which component is typically considered the most difficult to produce in the wheelset assembly?

The wheel itself is the most complex component due to the need for precise metallurgical properties achieved through controlled forging and heat treatment, coupled with extremely stringent dimensional tolerances necessary to ensure safe wheel-rail contact and dynamic stability at high speeds.

What is driving the market shift towards high-carbon alloyed steels?

The demand for high-carbon alloyed steels is driven by the need for increased wear resistance and longer service life under higher operational speeds and heavier axle loads. These specialized alloys provide the necessary hardness without sacrificing the fracture toughness required to maintain safety under extreme stress conditions.

How does track geometry degradation impact rolling stock wheel wear rates?

Poor track geometry (e.g., tight curves, misaligned rails, or uneven track surfaces) significantly accelerates wheel wear, especially flange wear, and can induce abnormal stresses leading to rolling contact fatigue defects (RCF). This necessitates more frequent wheel reprofiling and increases MRO costs for operators.

What distinguishes a monoblock wheel from a wheel assembled with a separate tire?

A monoblock wheel is forged from a single piece of steel, offering superior structural integrity and suitability for high-speed applications where reliability is paramount. Wheels with separate tires involve shrink-fitting a specialized steel tire onto a cast or forged wheel center, typically used for older designs or specialized tram applications, allowing easier replacement of the worn surface.

Why is non-destructive testing (NDT) essential in the wheel manufacturing process?

NDT, particularly ultrasonic inspection, is essential because rolling stock wheels are safety-critical components. NDT ensures that the finished product contains no internal defects (like voids or inclusions) or surface cracks that could propagate under stress and lead to catastrophic failure during high-speed or heavy-load operation.

What opportunities exist in the market related to wheel noise reduction?

Opportunities exist in the development and patenting of advanced noise reduction technologies, including composite materials, optimized wheel profile designs (low-noise profiles), and integrated damping elements (resilient wheels), particularly lucrative in markets with strict urban noise regulations like the EU and Japan.

How does the total cost of ownership (TCO) factor into purchasing decisions for rolling stock wheels?

TCO is critical; railway operators often select wheels based not only on initial purchase price but primarily on expected lifespan, resistance to wear (reducing reprofiling frequency), and reliability (minimizing costly failures). Higher-quality, more durable wheels generally offer a lower TCO despite a higher upfront cost.

Which segment, new rolling stock or aftermarket MRO, contributes more significantly to market revenue?

While new rolling stock projects generate large, cyclical revenues, the aftermarket Maintenance, Repair, and Overhaul (MRO) segment, driven by mandatory periodic replacement and reprofiling, consistently contributes a substantial and stable portion of the total market revenue over the long term, often slightly exceeding the new build market share.

What impact does globalization and standardization have on wheel design and procurement?

Globalization drives the need for standardization (e.g., adherence to both AAR and EN standards for export), forcing manufacturers to invest in highly flexible production lines capable of meeting diverse, region-specific requirements. This standardization simplifies procurement for international railway operators but increases the complexity of certification for producers.

What are the primary factors restraining rapid market growth despite high rail expansion?

The main restraints are the extremely long service life of high-quality wheels, which naturally limits replacement demand, coupled with the rigorous regulatory approval processes that slow down the adoption of innovative, new products and add significant time and expense to manufacturing compliance.

How are new rail electrification projects influencing the wheel market?

Electrification projects lead to a higher demand for electric multiple units (EMUs) and high-speed trains, shifting the focus of manufacturers toward lighter wheel designs, optimized for high speeds and high traction effort, often demanding specialized thermal and fatigue properties for efficient electric braking and propulsion.

What is the role of metallurgical purity in wheel performance?

Metallurgical purity (low sulfur, phosphorus, and non-metallic inclusions) is vital, especially for high-speed wheels. High purity reduces the risk of internal stress concentrators and microstructural defects, directly increasing the wheel's resistance to fatigue cracking and brittle failure, crucial for safety and extending asset life.

Explain the concept of an 'Integrated Wheelset' and its future market relevance.

An Integrated Wheelset is a complete assembly (wheels, axle, axle boxes, bearings, and sometimes integrated sensors) supplied as a single unit. Its relevance is growing because it simplifies procurement, guarantees compatibility across components, and facilitates the integration of smart monitoring technologies directly during the assembly phase, appealing to major OEMs.

What impact do extreme climate conditions (e.g., severe cold) have on wheel material selection?

Extreme cold requires wheel steel with high fracture toughness and low-temperature impact resistance to prevent brittle fracture. Specialized alloys and heat treatments are mandatory to ensure the wheels maintain their mechanical integrity and ductility even at sub-zero operational temperatures common in regions like Siberia or Northern Canada.

What is the typical replacement cycle duration for a heavy-haul freight wagon wheel?

While the actual mileage varies significantly, a heavy-haul freight wheel can often operate for 5 to 10 years before requiring full replacement, undergoing several intermediate reprofiling procedures during its service life to maintain optimal profile and safety compliance.

How do maintenance organizations utilize acoustic monitoring in relation to wheel condition?

Acoustic monitoring systems placed alongside the track listen for specific sound signatures associated with wheel defects, such as shelling or spalling. AI analyzes these sounds to identify damaged wheels needing immediate attention, enabling proactive intervention and preventing potential derailments before visual defects are evident.

What are the competitive advantages of vertically integrated wheel manufacturers?

Vertically integrated manufacturers (controlling steel production to final machining) maintain superior quality control over raw materials and the entire production chain. This results in highly consistent product quality, reduced production costs, shorter lead times, and quicker incorporation of R&D innovations, granting a significant competitive edge in large contracts.

How are new entrants attempting to disrupt the established Rolling Stock Wheel Market?

New entrants, often from emerging economies, compete aggressively on cost for standard freight or lower-speed applications. They are also investing heavily in R&D focusing on advanced digital integration (Smart Wheel systems) to differentiate their offering from legacy manufacturers who dominate traditional forged steel production.

What is the relationship between railway operating speed and the required precision of the wheel profile?

As operating speed increases, the required precision of the wheel profile and dynamic balance increases exponentially. Minute imbalances or deviations in profile at 300 km/h generate significant vibrations, leading to rapid wear, safety risks, and discomfort, necessitating higher manufacturing tolerances for high-speed rail.

What are the future market implications of the shift towards modular rolling stock design?

Modular design will favor standardized, easily replaceable wheelsets that can be quickly swapped out, promoting the demand for complete, integrated wheelset assemblies supplied by manufacturers, rather than just individual wheels, streamlining maintenance logistics for global operators.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager