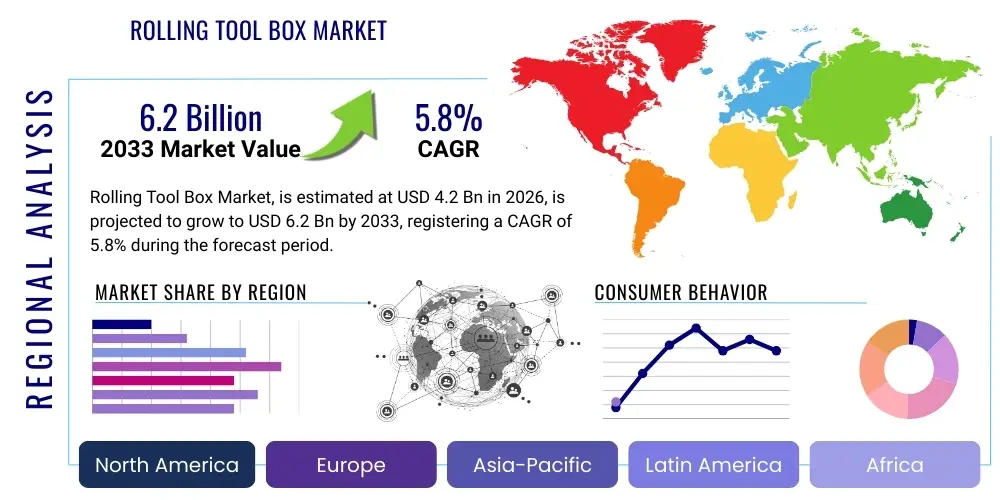

Rolling Tool Box Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438436 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Rolling Tool Box Market Size

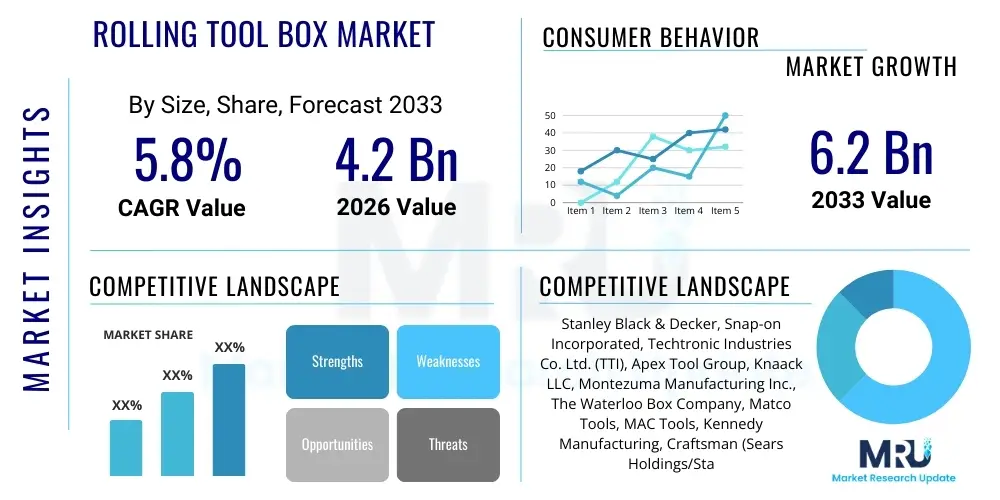

The Rolling Tool Box Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.2 Billion in 2026 and is projected to reach USD 6.2 Billion by the end of the forecast period in 2033.

Rolling Tool Box Market introduction

The Rolling Tool Box Market encompasses the manufacturing, distribution, and sale of storage units equipped with wheels and handles, designed for the portable organization and transportation of tools and equipment. These products serve a critical function across numerous professional and consumer sectors, offering enhanced mobility, robust protection, and optimized organization for essential instruments. The versatility of rolling tool boxes, ranging from heavy-duty industrial models constructed from reinforced steel to lightweight, durable plastic variants for general household use, positions them as indispensable assets in environments requiring frequent relocation of tools, such such as construction sites, automotive repair facilities, and large industrial maintenance operations. The market landscape is characterized by constant innovation in material science, ergonomic design, and security features, aiming to improve longevity and user experience, thus driving steady demand from both professional tradesmen and DIY enthusiasts globally. The increasing complexity of modern tools and the necessity for organized, secure storage further solidify the market’s foundational stability and growth potential.

Product description highlights the key characteristics that define rolling tool boxes, primarily their incorporation of integrated wheels, telescoping handles, and multi-tier storage systems (including drawers, trays, and bulk compartments). Materials utilized are primarily heavy-gauge steel for maximum durability and security, high-impact polypropylene or specialized engineered plastics for corrosion resistance and lightweight mobility, and occasionally aluminum for a balance of weight and strength. Major applications span industrial maintenance, automotive repair and body shops, plumbing and electrical contracting, construction, and general consumer use in garages or workshops. The inherent benefits of these products include significant time savings through efficient organization, reduced risk of tool damage or loss, enhanced safety by reducing manual lifting strain, and increased productivity due to tools being readily accessible exactly where they are needed. These benefits are fundamental drivers supporting continuous adoption across diverse professional environments where efficiency is paramount.

Driving factors stimulating the growth of the Rolling Tool Box Market are closely linked to global economic trends, specifically the persistent expansion of the construction sector, particularly in emerging economies, and the robust growth observed in the automotive aftermarket and repair services industry. Furthermore, the rising adoption of specialized technical training programs and the growing population of professional tradespeople (plumbers, electricians, HVAC technicians) who require high-quality, reliable mobile storage solutions, substantially contribute to market expansion. Consumer segment growth is driven by the increasing popularity of DIY projects and home renovation activities, encouraging individuals to invest in better home workshop organization. Technological advancements focused on integrated smart features, such as Bluetooth tracking and centralized locking mechanisms, also act as key differentiators and market accelerators, appealing to security-conscious professionals and advanced industrial users seeking sophisticated inventory management capabilities within their storage systems.

Rolling Tool Box Market Executive Summary

The global Rolling Tool Box Market is experiencing dynamic shifts, primarily fueled by significant business trends centered on material innovation and enhanced modularity, which directly address the diverse needs of both industrial and consumer users. Manufacturers are heavily investing in lighter, yet stronger materials like reinforced composites and specialized engineered plastics, alongside developing fully customizable modular systems that allow end-users to tailor storage configurations precisely to their specific tool sets and workflow requirements. Concurrently, the integration of advanced security features, including biometric locks and IoT connectivity for inventory tracking, is emerging as a critical competitive edge, particularly in high-value professional sectors where tool security and accountability are crucial. These business adaptations are streamlining supply chains and accelerating the shift towards premium, specialized products, moving the market away from generic, basic storage options and emphasizing long-term value and operational efficiency for the professional end-user, thereby sustaining robust revenue growth across the professional-grade segment.

Regional trends indicate that North America and Europe remain the foundational markets, characterized by high adoption rates driven by established industrial bases, stringent safety regulations, and high labor costs necessitating optimal organization and efficiency on job sites. However, the Asia Pacific (APAC) region is projected to register the fastest growth rate throughout the forecast period, primarily propelled by massive investments in infrastructure development, rapid industrialization, and the consequential expansion of the construction and manufacturing sectors, especially in key economies like China, India, and Southeast Asian nations. This rapid infrastructural growth is creating substantial, sustained demand for mobile storage solutions across numerous burgeoning industrial centers. The Middle East and Africa (MEA) are also showing promising acceleration, linked to large-scale urban development projects and increasing oil and gas sector maintenance activities, driving regional market penetration, although these markets still present significant logistical and distribution challenges compared to established Western markets.

Segmentation trends reveal strong growth in the professional segment, particularly within the heavy-duty and industrial-grade tool boxes made predominantly of steel, due to their superior longevity and load-bearing capacity required in harsh working environments like mining, aerospace maintenance, and large-scale construction. By material, high-density plastic tool boxes are witnessing surging demand in the DIY and consumer segments, valued for their corrosion resistance, light weight, and affordability, which makes them ideal for general garage and home workshop use. Furthermore, the distribution channel segment is observing a notable shift towards e-commerce platforms, driven by factors such as enhanced product comparison tools, detailed customer reviews, and the convenience of direct delivery, allowing smaller, specialized manufacturers to compete effectively against established brick-and-mortar retailers and broadening the geographical reach of premium, niche product offerings within the global market.

AI Impact Analysis on Rolling Tool Box Market

Analysis of common user questions regarding the impact of Artificial Intelligence (AI) on the Rolling Tool Box Market reveals a core set of themes revolving around smart organization, predictive maintenance integration, and supply chain optimization. Users frequently inquire if AI can lead to "smart toolboxes" capable of automatic inventory checks, identifying missing tools immediately, and even placing reorder notifications autonomously. Concerns also center on how AI-driven analytics could improve the durability and design of future tool boxes by predicting failure points based on usage data, or optimizing ergonomic designs based on biomechanical usage patterns collected from professional environments. Furthermore, a significant segment of queries focuses on the application of AI in manufacturing processes—specifically optimizing material cutting, robotic assembly, and quality control during production to reduce costs and enhance consistency, leading to more durable and affordable end products. The summary of user expectations suggests a strong desire for AI to transform the tool box from a passive storage unit into an active, intelligent asset management system that minimizes downtime and maximizes operational efficiency.

The direct application of AI technology, while perhaps not embedded within the physical structure of basic rolling tool boxes themselves, exerts a powerful influence on their ecosystem, design, and manufacturing efficiency. Generative design tools driven by AI are currently being leveraged by leading manufacturers to optimize the structural geometry of plastic and metal components, ensuring maximum strength-to-weight ratio while simultaneously reducing material waste during fabrication. This results in lighter, more durable products that are also more cost-effective to produce. Additionally, AI algorithms are playing a crucial role in optimizing the global supply chain, forecasting regional demand with high accuracy, managing inventory across multiple distribution centers, and ensuring that specific, highly specialized rolling tool box models are available in the correct geographical markets precisely when required by major industrial clients or rapidly expanding construction projects.

Looking forward, the concept of "smart organization" driven by computer vision and machine learning represents a major potential breakthrough. Imagine toolboxes integrated with small, ruggedized sensors and cameras that use AI object recognition to instantly identify the presence or absence of every stored tool. This capability moves beyond simple RFID tagging, offering immediate, contextualized feedback to the user or their centralized asset management system. Such integration directly addresses key user pain points related to lost tools, inventory management compliance, and time wasted searching for equipment on large job sites. This convergence of physical storage and digital intelligence is poised to redefine the premium segment of the market, transforming the rolling tool box into an integral part of modern, highly efficient, and data-driven workflow management systems across high-value industries like aerospace and specialized energy infrastructure maintenance, thereby elevating the overall perceived value of the product.

- AI-driven generative design optimizes structural integrity and material efficiency.

- Predictive maintenance analytics can be integrated into high-end models to monitor tool usage and condition.

- Computer vision and machine learning enable automated, instantaneous tool inventory checking within the box.

- AI optimizes global supply chain logistics, improving demand forecasting and regional stocking strategies.

- Robotics and AI-enhanced quality control streamline manufacturing processes, ensuring product consistency and durability.

- Integration with centralized Asset Management Systems (AMS) transforms tool boxes into traceable, active assets.

- AI-based ergonomics analysis guides handle placement and wheel design for enhanced user comfort and safety.

DRO & Impact Forces Of Rolling Tool Box Market

The Rolling Tool Box Market is significantly shaped by a confluence of powerful drivers (D), constraining factors (R), and compelling opportunities (O), which collectively dictate market trajectory and competitive intensity. The primary market drivers include the consistent global growth in construction and infrastructure development, which necessitates high-volume, mobile tool storage solutions, and the professionalization of various trades requiring robust, organized equipment. Restraints mainly revolve around the inherent limitations of high-cost, premium materials (like industrial-grade steel) leading to pricing sensitivity among small contractors or DIY consumers, and the competition posed by fixed storage solutions or alternative, non-wheeled organizational systems that may suffice for sedentary workshops. Opportunities are strongly linked to material science innovations (e.g., advanced composite plastics offering high strength at low weight) and the burgeoning trend towards smart, connected tool storage features, which allow manufacturers to introduce high-margin, differentiated products catering to modern industrial needs, offering significant potential for market expansion and revenue diversification beyond traditional segments.

Impact forces within this market segment are currently high, primarily driven by competitive rivalry and the strong bargaining power of end-users, particularly large industrial purchasers who demand customized solutions and substantial volume discounts. The threat of new entrants remains moderate; while manufacturing tool boxes is not proprietary, establishing the required brand reputation for durability and security, especially in the professional segment, demands significant upfront investment in quality control and specialized distribution networks. However, the bargaining power of suppliers, particularly those providing specialized, high-grade steel alloys or advanced locking mechanisms, can occasionally be moderate to high, especially during periods of volatile raw material pricing, placing pressure on manufacturer profit margins. The impact of substitutes, such as standardized fixed cabinetry or simple handheld carriers, is moderated by the unique value proposition of mobility offered by rolling tool boxes, which is a non-negotiable requirement for field-based professionals, ensuring that the rolling variants maintain a distinct market niche and enduring relevance.

Furthermore, external macro-environmental factors significantly impact the market dynamics. Regulatory adherence related to workplace safety and material standards, particularly in North America and Europe, acts as both a driver for quality improvements and a restraint due to the increased costs of compliance. The lifecycle of a rolling tool box, often extending well over a decade for high-quality professional models, poses a cyclical restraint, as replacement cycles are slow unless driven by technological obsolescence (e.g., the introduction of significantly lighter or smarter models) or physical damage. To mitigate these restraints, market players are focused on emphasizing the Total Cost of Ownership (TCO) benefits, promoting the value of long-term durability and organizational efficiency over the initial purchase price, and continuously innovating the product features (such as enhanced water resistance or rapid modular customization) to accelerate the upgrade cycle and capture new revenue streams from existing user bases, thereby sustaining market momentum effectively against prevailing economic headwinds.

Segmentation Analysis

The Rolling Tool Box Market is strategically segmented across several critical dimensions, including material composition, application area, distribution channel, and product capacity, all of which are essential for understanding consumer behavior and tailored product development. Material segmentation—primarily steel, plastic (polypropylene/HDPE), and aluminum—is fundamental, directly influencing product durability, weight, cost, and suitability for specific environments, with steel dominating industrial use and plastic leading the consumer sector. Application segmentation differentiates between highly demanding professional settings (automotive, construction, industrial) and less rigorous consumer or DIY applications, allowing manufacturers to optimize features such as lock mechanisms, wheel size, and drawer slide quality. Analysis of these segments is vital for businesses seeking to prioritize investment in manufacturing processes, align marketing efforts with specific end-user needs, and develop targeted channel strategies to maximize global market penetration effectively.

Distribution channel analysis reveals a critical bifurcation between traditional offline sales—comprising specialized tool retailers, large home improvement centers (Big Box stores), and industrial distributors—and the rapidly expanding online retail segment, including dedicated e-commerce platforms and manufacturer direct-to-consumer sales. The online channel is gaining prominence due to its ability to offer a wider selection of specialized, heavy-duty models and transparent price comparison, appealing particularly to niche professional buyers and digitally native consumers. Capacity segmentation, ranging from small, portable rolling carts to large, multi-cabinet workshop systems, reflects the varied requirements for tool storage volume, correlating directly with the user’s profession (e.g., a field technician needing a compact setup versus a mechanic needing a massive stationary system that is occasionally wheeled for reorganization). Understanding these segments allows companies to forecast demand accurately across different product lines and maintain appropriate inventory levels.

Furthermore, segmentation by end-user type, distinguishing between professional tradespeople, industrial organizations, and general consumers, provides deep insights into purchasing power, brand loyalty, and quality expectations. Professional users prioritize reliability, heavy load capacity, and robust security, often justifying higher price points, leading to a strong focus on lifetime warranty and industrial-grade construction. In contrast, the consumer segment is more price-sensitive and prioritizes convenience, aesthetic design, and ease of use in non-commercial settings. The strategic identification and targeting of these diverse segments enable market players to allocate research and development resources toward specialized features, such as enhanced weatherproofing for construction models or anti-tip safety mechanisms for multi-drawer systems, ensuring that product development remains highly relevant and competitive in the respective target markets, driving sustainable, segmented market share gains.

- Material Type:

- Steel (Heavy-duty, Professional, Industrial)

- Plastic (Polypropylene, HDPE - Lightweight, Consumer, DIY)

- Aluminum (Balanced strength and weight, specialized applications)

- Application:

- Automotive (Repair Shops, Body Works)

- Construction and Infrastructure

- Industrial Maintenance and Repair Operations (MRO)

- Home Use and DIY

- Aerospace and Defense

- Distribution Channel:

- Offline Retail (Specialty Tool Stores, Big Box Retailers, Industrial Distributors)

- Online Sales (E-commerce Platforms, Manufacturer Websites)

- Capacity/Size:

- Small (Portable Carts/Chest Combos)

- Medium (Standard Single-Stack Systems)

- Large (Multi-Cabinet, Modular Workshop Systems)

Value Chain Analysis For Rolling Tool Box Market

The value chain for the Rolling Tool Box Market is structured linearly, beginning with raw material sourcing and culminating in final product delivery and aftermarket support, with each stage adding substantial value and requiring specialized operational focus. The upstream activities involve the procurement of critical raw materials, primarily steel (often cold-rolled or stainless variants), various grades of high-impact plastics, aluminum sheets, and specialized components like caster wheels, drawer slides, and locking mechanisms. Efficiency in upstream management is highly dependent on managing volatile commodity prices and securing reliable, high-quality supplies to ensure product durability meets industrial standards. Manufacturers gain significant competitive advantage here through strategic long-term contracts with specialized steel mills and plastic compound suppliers, ensuring cost stability and material consistency, which is paramount for maintaining product quality reputation within the professional user base who demand uncompromising reliability and structural integrity in their tools and storage.

Midstream activities encompass the core manufacturing and assembly processes, which involve metal stamping, welding, plastic injection molding, powder coating, and the final assembly of complex multi-drawer systems, followed by rigorous quality assurance testing. This stage is capital-intensive and highly sensitive to automation and technological investment; companies that utilize advanced robotics for welding and sophisticated computer numerical control (CNC) equipment for precision shaping achieve higher throughput and superior product quality consistency. Downstream activities focus heavily on distribution and retail. The distribution channel is bifurcated into direct channels (manufacturer sales teams handling large industrial or governmental contracts) and indirect channels (wholesalers, independent distributors, and major retailers like Lowe’s or Home Depot). The efficacy of the indirect channel relies heavily on efficient inventory management, strategic warehousing, and strong logistical partnerships capable of handling the transport of heavy, bulky goods economically and reliably to geographically dispersed markets, maximizing accessibility for both professional and consumer clientele.

Direct distribution, though less common for consumer-grade products, is vital for specialized, high-security, or custom industrial rolling cabinets, ensuring direct manufacturer oversight on installation and servicing. Indirect distribution, leveraging extensive retail networks (both physical and online), drives mass market penetration and volume sales, particularly for standardized plastic and mid-range steel units. The after-sales service and warranty provision constitute the final crucial segment of the value chain, highly critical for maintaining brand loyalty, especially in the professional market where the perceived quality of a product is heavily influenced by the manufacturer's commitment to supporting the product lifecycle through parts replacement and customer service. Streamlining the entire value chain—from procuring specialized, lightweight materials to deploying an efficient e-commerce logistics network—is essential for optimizing the margin structure, enhancing responsiveness to market demand shifts, and ultimately securing sustainable competitive advantage in the highly competitive global market for mobile tool organization solutions.

Rolling Tool Box Market Potential Customers

The potential customer base for the Rolling Tool Box Market is highly diverse and spans across key economic sectors, characterized by a fundamental need for mobile, organized, and secure storage solutions for expensive or sensitive equipment. The core segments include professional tradespeople such as mechanics, plumbers, electricians, HVAC technicians, and carpenters who require durable, easy-to-transport systems that can withstand the rigors of daily job site use, emphasizing features like heavy-duty casters, secure locking mechanisms, and high load capacities. Beyond individual tradesmen, large industrial enterprises and organizational bodies, including manufacturing facilities, utility companies, government maintenance departments, and defense contractors, constitute a crucial segment, often purchasing specialized rolling tool boxes in bulk for standardization across their operational sites or fleet maintenance depots, prioritizing industrial-grade steel construction and strict compliance with corporate safety standards.

Another major segment is the automotive sector, encompassing professional garages, collision repair centers, and high-performance racing teams. These buyers often require highly specific configurations, such as systems designed to accommodate specialized diagnostic tools or integrated workbench surfaces, and they typically represent the highest-end purchasers, favoring brands known for precision engineering and advanced feature sets like integrated power strips and superior drawer slide quality that ensure reliable, frequent access. The rapid growth of the automotive aftermarket globally continues to drive robust demand from this sector, where downtime translates directly into significant revenue losses, making efficient tool management a top priority and justifying investment in premium, specialized rolling storage solutions that maximize technician efficiency and minimize time spent searching for tools.

Finally, the large and continually expanding consumer and Do-It-Yourself (DIY) market represents a significant volume opportunity. These customers, ranging from hobbyists with dedicated home workshops to homeowners seeking improved garage organization, are generally more price-sensitive and prioritize features like aesthetics, ease of assembly, and moderate weight, leading to higher adoption rates of plastic and lighter-gauge steel tool boxes. Direct marketing efforts targeting these consumers through major retail channels and digital platforms capitalize on the increasing trend towards home improvement and organized living. The successful segmentation and targeting of these distinct customer groups—from demanding industrial maintenance crews to value-seeking DIY enthusiasts—necessitates a broad product portfolio, diversified distribution strategies, and customized marketing narratives emphasizing either robust professionalism or convenient home organization, tailored specifically to the needs and purchasing behaviors of each identified potential customer segment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.2 Billion |

| Market Forecast in 2033 | USD 6.2 Billion |

| Growth Rate | CAGR 5.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Stanley Black & Decker, Snap-on Incorporated, Techtronic Industries Co. Ltd. (TTI), Apex Tool Group, Knaack LLC, Montezuma Manufacturing Inc., The Waterloo Box Company, Matco Tools, MAC Tools, Kennedy Manufacturing, Craftsman (Sears Holdings/Stanley Black & Decker), Beta Utensili S.p.A., Harbor Freight Tools (US General), Lista International Corporation, Huot Manufacturing, Toter (by Wastequip), DURHAND, DEWALT, Husky (The Home Depot), Kobalt (Lowe's Companies) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Rolling Tool Box Market Key Technology Landscape

The Rolling Tool Box Market is continuously evolving through the integration of specialized manufacturing techniques and advanced material science, alongside emerging digital technologies aimed at enhancing functionality and security. A primary technological focus remains on material innovation; manufacturers are increasingly utilizing high-density, impact-resistant engineered polymers (plastics) and specialized lightweight aluminum alloys to reduce the overall weight of the units without compromising structural integrity or load-bearing capacity, which is crucial for maximizing portability and meeting stringent transportation standards. Furthermore, advanced metal forming processes, such as laser cutting, sophisticated bending techniques, and automated robotic welding, ensure superior precision and durability for steel tool cabinets, allowing for tighter tolerances and enhanced structural rigidity, extending the service life of industrial-grade products significantly in harsh operating environments.

Beyond material and manufacturing improvements, the adoption of specialized component technologies significantly elevates product utility. Key areas include the engineering of robust, oversized caster wheels utilizing non-marking polyurethane or high-load rubber, designed to navigate uneven industrial floors or construction sites smoothly while distributing heavy loads effectively, thereby improving maneuverability and reducing user strain. Advanced drawer slide technology, particularly heavy-duty ball-bearing slides with smooth operation and 100% full-extension capabilities, is standard in premium models, ensuring easy access to heavy tools and preventing drawer binding, a critical feature valued by professional mechanics and industrial maintenance personnel. Furthermore, innovative locking mechanisms, ranging from centralized one-touch key locks to electronic keypads and emerging biometric systems, are being implemented to maximize tool security and accountability, addressing the high costs associated with tool loss or theft on job sites and enhancing overall asset protection strategies for corporate clients.

The most forward-looking technological trend involves the nascent integration of smart features, leveraging the Internet of Things (IoT) infrastructure. While still primarily reserved for high-end industrial and specialized maintenance applications, this technology includes embedded sensors for internal temperature and humidity monitoring (crucial for sensitive electronic tools), GPS tracking capabilities for asset location and anti-theft measures, and Bluetooth connectivity allowing for remote locking/unlocking and digital inventory management through mobile applications. These smart features transform the rolling tool box from a simple passive storage unit into an active, connected asset within a larger operational system, allowing for data-driven decisions regarding tool usage, maintenance schedules, and inventory optimization. This strategic use of digital technology, although increasing product complexity and cost, provides unparalleled value in terms of operational efficiency and security compliance, particularly for enterprise clients managing thousands of tools across multiple field locations globally, thus positioning connected tool boxes as a key future differentiator in the premium segment of the market.

Regional Highlights

- North America: This region dominates the Rolling Tool Box Market, driven by high labor costs necessitating efficient, organized workflows, and a strong culture of DIY projects and home workshops. The market is mature, characterized by high demand for premium, heavy-duty steel and specialized composite plastic models, especially within the established automotive aftermarket and large-scale residential and commercial construction sectors. Major manufacturers and robust distribution networks ensure high product availability and competitive pricing, maintaining North America's position as a critical revenue generator and innovation hub.

- Europe: Europe represents a highly significant market, emphasizing quality, ergonomic design, and strict adherence to workplace safety standards. Germany, the UK, and France are key contributors, with demand predominantly arising from the advanced manufacturing, specialized trade services, and automotive sectors. There is a strong preference for high-quality, long-lasting products, leading to high adoption of specialized brands focused on precise engineering and compliance with European Union regulations regarding material use and environmental standards.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region due to explosive infrastructure spending, rapid industrialization, and the massive expansion of the construction and manufacturing industries, particularly in China, India, and Southeast Asia. While the market initially favors cost-effective plastic and lighter-gauge steel models, increasing industrial sophistication is driving burgeoning demand for higher-quality professional and industrial-grade rolling cabinets to support expanding maintenance and MRO operations across newly established factory floors and large construction sites.

- Latin America (LATAM): The LATAM market is growing steadily, propelled by increasing urbanization and corresponding construction activities, particularly in Brazil and Mexico. Economic volatility often dictates consumer choice, leading to a strong demand for durable, mid-range priced tool boxes that offer excellent value. The informal economy and smaller, independent contractors often rely on versatile, reliable, and affordable mobile storage solutions, presenting specific challenges and opportunities for scaled distribution and local manufacturing adaptations.

- Middle East & Africa (MEA): Growth in the MEA region is closely linked to large government-funded projects in the energy sector (oil & gas maintenance) and massive infrastructural development (e.g., in the UAE and Saudi Arabia). Demand is highly concentrated on heavy-duty, corrosion-resistant tool boxes capable of withstanding extreme environmental conditions (heat, sand, humidity). Imports dominate the supply, with a focus on high-security features necessary for expensive tools used in specialized industrial applications within challenging operational climates.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Rolling Tool Box Market.- Stanley Black & Decker (including Craftsman and DEWALT brands)

- Snap-on Incorporated (including Snap-on, Matco Tools, and Williams)

- Techtronic Industries Co. Ltd. (TTI) (including Milwaukee Tool and Husky - license partner)

- Apex Tool Group, LLC

- Knaack LLC

- Montezuma Manufacturing Inc.

- The Waterloo Box Company

- Kennedy Manufacturing

- Lista International Corporation

- MAC Tools (A division of Stanley Black & Decker)

- Beta Utensili S.p.A.

- Huot Manufacturing

- Toter (by Wastequip)

- DURHAND

- Kobalt (Lowe's Companies private brand)

- Harbor Freight Tools (US General brand)

- Proto (A division of Stanley Black & Decker)

- Gerrard Tool Company

- Sunex Tools

- Custom Tool Boxes Inc.

Frequently Asked Questions

Analyze common user questions about the Rolling Tool Box market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between plastic and steel rolling tool boxes?

Steel rolling tool boxes offer superior durability, load capacity, and security, making them ideal for heavy industrial and automotive professional use. Plastic (polypropylene/HDPE) versions are significantly lighter, corrosion-resistant, and more affordable, catering primarily to DIY enthusiasts and field service technicians needing maximum portability and weather resistance.

Which geographic region currently dominates the Rolling Tool Box Market?

North America currently holds the largest market share, driven by strong demand from established construction and automotive sectors, high consumer spending on DIY equipment, and a preference for premium, high-capacity mobile storage systems required by professional tradespeople across the United States and Canada.

What are the key technological advancements affecting rolling tool box design?

Key technological advancements include the integration of IoT features such as GPS tracking and remote locking for asset management, the use of advanced ball-bearing drawer slides for high load stability, and the incorporation of specialized lightweight composite materials to enhance portability without sacrificing strength and structural integrity.

How is the growth of e-commerce impacting the distribution of rolling tool boxes?

E-commerce is significantly expanding the market reach, allowing consumers and specialized professionals to access a wider range of niche, heavy-duty, and customizable models often unavailable in physical retail stores. Online channels offer detailed specifications and customer reviews, driving competitive pricing and direct-to-consumer sales for numerous specialized manufacturers.

What is the projected Compound Annual Growth Rate (CAGR) for the Rolling Tool Box Market?

The Rolling Tool Box Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033, primarily fueled by infrastructural development in emerging economies and the continuous need for optimized tool organization in professional industrial settings globally.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager