Roof Truss Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438709 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Roof Truss Market Size

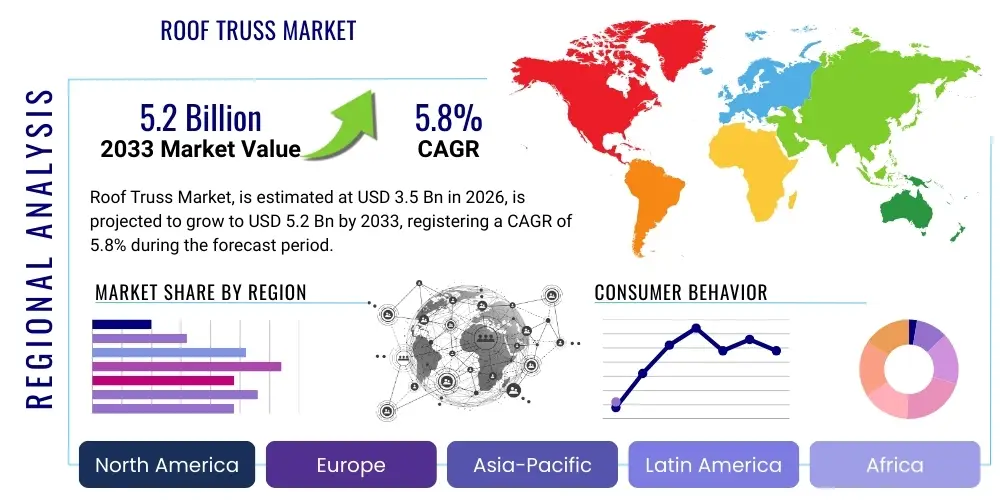

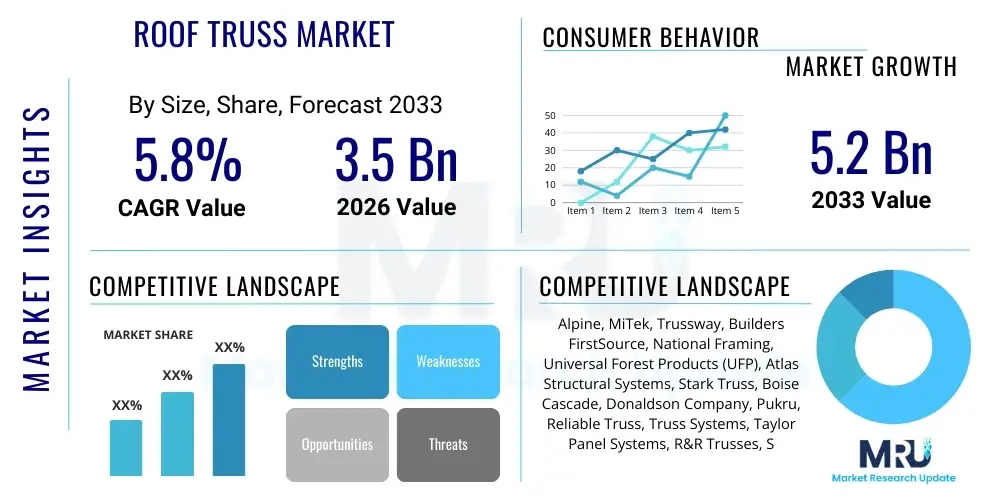

The Roof Truss Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 5.2 Billion by the end of the forecast period in 2033.

Roof Truss Market introduction

The Roof Truss Market encompasses the design, manufacture, and distribution of engineered structural frameworks, primarily made of wood or steel, used to support roofs in residential, commercial, and industrial construction. These pre-fabricated components are designed to efficiently span long distances, transferring the roof load to the exterior walls and ensuring structural integrity. Roof trusses offer significant advantages over traditional stick framing, including speed of construction, reduced material waste, and guaranteed structural precision, driven by sophisticated CAD software and automated assembly processes. The efficiency and reliability of modern roof trusses make them indispensable components in rapid housing development and large-scale infrastructure projects worldwide.

Product descriptions within this market vary based on design geometry, such as King Post, Queen Post, Fink, and Gable end trusses, each serving specific architectural and loading requirements. The primary material used remains treated lumber, leveraging its strength-to-weight ratio and cost-effectiveness, although the utilization of light gauge steel trusses is increasing, particularly in regions prone to fire or seismic activity, and in large commercial structures demanding wider clear spans. Furthermore, the market is characterized by a high degree of customization, as each truss design must be precisely tailored to the specific dimensions and load conditions of the building project.

Major applications of roof trusses span the entire construction ecosystem, ranging from single-family homes and multi-story residential complexes to retail outlets, warehouses, agricultural buildings, and institutional facilities like schools and hospitals. Key benefits driving market adoption include substantial labor savings on-site, minimization of construction timelines, improved worker safety, and consistency in quality control achieved through factory production. Driving factors for market expansion include sustained global population growth requiring new housing infrastructure, government investments in public works, and the increasing preference among contractors for prefabricated, engineered components that comply rigorously with international building codes and standards.

Roof Truss Market Executive Summary

The Roof Truss Market is experiencing robust growth fueled by consistent demand from the global residential construction sector and significant uptake in prefabricated building methodologies. Business trends highlight a strong focus on automation and integration of design software (such as specialized CAD/CAM systems) to enhance production efficiency and reduce lead times. Companies are increasingly investing in sophisticated robotic assembly lines to handle the precise cutting and fastening of components, thereby reducing reliance on manual labor and improving the dimensional accuracy of the final product. Furthermore, sustainability is becoming a major competitive differentiator, with manufacturers exploring certified lumber sources and optimizing material usage to minimize waste, aligning with broader green building initiatives.

Regional trends indicate that North America and Europe maintain maturity in terms of established manufacturing infrastructure and strict building codes, driving consistent demand for high-quality, certified trusses. However, the Asia Pacific (APAC) region, led by rapidly developing economies like China and India, is emerging as the fastest-growing market due to massive urbanization, burgeoning middle-class housing projects, and infrastructural expansion. In APAC, the adoption rate of prefabricated truss systems is accelerating as conventional construction methods struggle to keep pace with demand and standardization improves. Challenges, however, persist globally, notably the volatility in raw material prices, particularly lumber, which necessitates sophisticated supply chain management and forward contracting strategies.

Segment trends confirm that the wood truss segment retains market dominance due to its favorable cost structure and ease of handling, especially in low-rise residential applications. Concurrently, the steel truss segment is gaining traction in the commercial and industrial sectors where fire resistance, durability, and expansive clear span requirements are critical specifications. Residential end-use remains the primary demand driver, but the commercial segment is witnessing strong growth driven by the construction of logistics centers, data centers, and large retail parks. Segment optimization is centered on developing hybrid truss solutions and exploring new connection technologies that allow for quicker assembly and higher load-bearing capacities, further cementing the pre-fabricated truss system's advantage over traditional methods.

AI Impact Analysis on Roof Truss Market

User queries regarding AI's impact on the Roof Truss Market frequently revolve around optimizing design complexity, predicting material demands amid fluctuating prices, and automating factory floor operations. Users are keen to understand how AI can improve the efficiency of structural design software (FEA and CAD integration) to ensure structural stability under complex load conditions while minimizing material input. Concerns often address the initial capital expenditure required for implementing AI-driven manufacturing systems and the potential displacement of skilled labor involved in design consultation and manual assembly processes. Expectations are high regarding AI's ability to create generative designs that are both cost-effective and structurally optimized, drastically cutting down the iterative design cycle time. Furthermore, users anticipate AI playing a crucial role in preventative maintenance of specialized machinery used in truss production, thereby maximizing operational uptime.

The integration of Artificial Intelligence primarily revolutionizes the pre-construction phase of the roof truss manufacturing process. AI algorithms can rapidly analyze thousands of design permutations based on inputs such as architectural plans, local building codes, stress factors, and material costs. This capability allows manufacturers to select the most structurally sound and economically efficient truss geometry instantly, minimizing the over-engineering often associated with traditional design methods. Furthermore, predictive modeling powered by AI assists in managing complex supply chains by forecasting material needs, especially for volatile commodities like lumber and steel, enabling procurement teams to secure materials at optimal pricing points and mitigate risk associated with sudden market fluctuations.

On the production side, machine learning algorithms are utilized for quality control and process automation. AI-enabled vision systems can scrutinize raw materials for defects (e.g., knots or inconsistent density in lumber) with higher precision than human inspectors, ensuring only high-grade materials proceed to assembly. Similarly, AI drives robotic cutting and component placement machinery, optimizing cutting patterns to reduce waste and ensuring tolerances are met within microns, a critical factor for structural integrity and ease of on-site installation. This automation not only accelerates production output but significantly enhances the reliability and consistency of the manufactured trusses, ensuring strict compliance with engineering specifications.

- AI-driven generative design optimizes truss geometry for maximum strength and minimum material use.

- Machine Learning (ML) algorithms enable accurate prediction of lumber and steel price volatility, aiding strategic procurement.

- AI vision systems enhance quality control by identifying material defects in raw lumber and ensuring precise component assembly.

- Predictive maintenance schedules for truss manufacturing equipment are optimized using AI to minimize costly downtime.

- Enhanced project scheduling and logistics management through AI-driven modeling improve delivery timelines to construction sites.

DRO & Impact Forces Of Roof Truss Market

The dynamics of the Roof Truss Market are dictated by a confluence of driving forces stemming from global urbanization and construction innovation, tempered by specific restraints related to material costs and industry competition, creating opportunities through technological advancement and sustainable practices. Key drivers include the global push towards off-site construction methods, which favor engineered products like trusses due to their precision and rapid installation time, significantly reducing overall project durations. Furthermore, the increasing complexity of architectural designs necessitates engineered solutions capable of handling irregular shapes and larger spans, which trusses are uniquely positioned to address. Restraints primarily center on the persistent volatility of raw material costs, particularly the lumber market, which directly impacts manufacturing margins and the final cost to the builder. Additionally, the fragmented nature of the construction industry in certain developing regions presents a barrier to the widespread adoption of standardized truss systems.

Opportunities for market expansion are abundant, particularly through geographical diversification into emerging markets in Asia and Africa, where construction activity is booming and modern building practices are being adopted rapidly. Product innovation, focusing on moisture-resistant coatings, fire-retardant treatments, and hybrid steel-wood configurations, presents avenues for higher value offerings. The development of specialized truss systems tailored for modular construction and high-density multi-family housing also opens new high-growth verticals. Impact forces governing the market include stringent regulatory requirements regarding structural safety and seismic resistance, which favor certified engineered components, and the intense competitive rivalry among key manufacturers who continually strive to optimize pricing and expand their distribution networks, putting pressure on smaller, regional players.

The long-term trajectory of the market is strongly influenced by demographic shifts and governmental policies. Population centralization in urban centers necessitates vertical and dense construction, requiring robust and standardized structural components. Furthermore, environmental impact forces, such as the push for sustainable forestry and certified wood products, are increasingly shaping procurement decisions and manufacturing standards. Companies that successfully integrate sustainable sourcing practices and leverage automation to mitigate rising labor costs while ensuring compliance with evolving building codes will be best positioned to capitalize on the sustained demand for efficient, reliable roof support systems throughout the forecast period.

Segmentation Analysis

The Roof Truss Market is comprehensively segmented based on material type, design geometry (type), and end-use application, providing a detailed view of market demand across various construction sectors. The segmentation highlights the market's preference for traditional wood-based solutions in residential construction due to cost efficiency, while indicating a growing migration toward steel and engineered wood options in larger commercial and demanding industrial projects where specific load-bearing and fire safety attributes are paramount. Analyzing these segments is crucial for understanding regional demand patterns, manufacturing specialization, and the competitive landscape, allowing stakeholders to tailor their product offerings and strategic investments accordingly.

By design type, common trusses such as King Post, Queen Post, and Fink trusses dominate the volume, reflecting their utility in standard residential roofs and pitched roof structures. However, specialized designs like Attic trusses, which incorporate usable living space, command a higher price point and are seeing increased adoption in suburban housing developments looking to maximize floor area without significant foundation changes. The end-use segmentation clearly identifies residential construction as the foundational pillar of market demand, but growth rates in commercial and industrial applications, driven by warehousing, logistics infrastructure, and large retail development, are consistently outpacing the residential segment in developed economies, emphasizing diversification opportunities.

Further granularity in segmentation often includes parameters such as the manufacturing process (manual versus automated production) and geographical distribution channels (direct sales to builders vs. supply through lumberyards/distributors). The trend towards modular and prefabricated construction methodologies is a strong cross-segmental driver, demanding manufacturers focus on achieving tight tolerances and standardizing component interfaces. The resilience of the construction sector, even amidst economic slowdowns, suggests sustained demand across all major segments, with material innovation being the key differentiator in achieving competitive advantage and regulatory compliance in different operational environments.

- By Type:

- Parallel Chord Truss

- King Post Truss

- Queen Post Truss

- Fink Truss

- Attic Truss

- Scissor Truss

- Gable Truss

- By Material:

- Wood Truss (Dimensional Lumber, Laminated Veneer Lumber - LVL)

- Steel Truss (Light Gauge Steel - LGS)

- Hybrid Truss

- By End-Use Application:

- Residential Construction (Single-Family, Multi-Family)

- Commercial Construction (Retail, Office, Hospitality)

- Industrial & Institutional Construction (Warehousing, Schools, Healthcare)

- By Application Area:

- Roofs

- Floors (Floor Trusses)

Value Chain Analysis For Roof Truss Market

The value chain for the Roof Truss Market begins with the rigorous procurement of raw materials, primarily high-quality lumber or light gauge steel coils, which represents the upstream segment. Upstream analysis highlights the critical role of material sourcing, where strategic relationships with certified sawmills and steel suppliers are essential to ensure consistent quality, stable pricing, and adherence to sustainability standards (such as FSC certification for wood). The effectiveness of raw material storage, inventory management, and initial processing (e.g., kiln drying for lumber) directly impacts the quality and cost structure of the final product. Volatility in commodity markets, particularly for southern yellow pine and SPF lumber, introduces significant risk, requiring manufacturers to employ sophisticated hedging and procurement strategies to maintain cost competitiveness.

The manufacturing process forms the core of the value chain, involving design engineering (using specialized software like MiTek or Alpine systems), precise component cutting (often automated with CNC equipment), and assembly using metal connector plates and high-tonnage hydraulic presses. This segment demands substantial capital investment in machinery, advanced software licenses, and skilled technical personnel for system operation and quality assurance. Efficiency gains in this stage, often achieved through lean manufacturing principles and robotic automation, are the main source of competitive advantage. Post-production activities include quality checks, protective treatment (e.g., preservative or fire-retardant application), and bundling for transportation, requiring specialized logistical planning due to the bulky and often non-stackable nature of the trusses.

Downstream analysis focuses on distribution channels and end-user engagement. Trusses are typically distributed through direct sales (large manufacturers selling directly to major homebuilders or commercial contractors) or indirectly through specialized building material distributors, lumberyards, and retail chains like Builders FirstSource. The shift toward prefabricated components requires robust logistics capabilities for timely delivery and organized installation sequencing on the job site. Direct interaction with builders and engineers is critical for providing technical support, installation guidance, and ensuring that the final product adheres perfectly to the site-specific requirements. The success of the downstream segment relies heavily on maintaining strong relationships with influential general contractors and leveraging digital tools for seamless order management and project tracking.

Roof Truss Market Potential Customers

The primary customers for the Roof Truss Market are entities engaged in the physical construction of residential, commercial, and industrial facilities requiring structured roof support systems. These encompass a broad spectrum of buyers, dominated numerically by the residential segment. Specifically, large-scale production homebuilders, who rely on standardized, repeatable designs and rapid construction timelines, represent the single largest volume purchaser. These customers prioritize consistency, reliable supply chains, and standardized pricing to maintain high output rates and schedule adherence. Medium-sized custom home builders and residential remodelers also constitute a significant customer base, often requiring more specialized or complex custom truss designs tailored to unique architectural specifications.

In the commercial sector, key potential customers include general contractors specializing in retail (strip malls, big-box stores), hospitality (hotels, resorts), and mid-rise office buildings. These customers typically demand longer spans, higher load ratings, and specific certifications for fire resistance, often driving demand toward steel or hybrid truss systems. For industrial applications, logistics companies, warehouse developers, and manufacturers building large production facilities are core buyers. Their requirements prioritize maximum clear span capabilities, high durability, and specialized truss geometries to accommodate heavy roof equipment, such as HVAC units or solar panel arrays.

Furthermore, government and institutional buyers, including developers of schools, hospitals, military bases, and affordable housing projects, represent stable, high-volume customers. These public sector buyers often operate under strict regulatory and budgetary constraints, favoring standardized, cost-effective solutions that meet rigorous safety and durability standards. Ultimately, the end-user customer profile demands a product that minimizes on-site labor costs, guarantees structural integrity as per engineering plans, and ensures long-term operational performance of the building envelope.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.2 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Alpine, MiTek, Trussway, Builders FirstSource, National Framing, Universal Forest Products (UFP), Atlas Structural Systems, Stark Truss, Boise Cascade, Donaldson Company, Pukru, Reliable Truss, Truss Systems, Taylor Panel Systems, R&R Trusses, Shelter Systems Limited, A-1 Roof Trusses, Southern Components, G&T Truss, Apex Structural |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Roof Truss Market Key Technology Landscape

The Roof Truss Market relies heavily on sophisticated technological integration across design, fabrication, and quality assurance processes to achieve the precision required for engineered wood products. The foundational technology is the advanced use of specialized Computer-Aided Design and Manufacturing (CAD/CAM) software, such as those provided by industry leaders like MiTek and Alpine. These systems enable structural engineers to perform complex load calculations, determine optimal web member arrangements, and generate precise cutting files for automated machinery. This digital integration ensures that truss designs are structurally sound, compliant with local codes, and optimized for minimal material usage, significantly differentiating modern truss manufacturing from traditional site-built framing methods.

The manufacturing floor is dominated by high-precision automated machinery. Computer Numerically Controlled (CNC) saws are standard, capable of cutting lumber at multiple angles simultaneously with extreme accuracy, reducing waste and increasing throughput speed. Following cutting, the process utilizes high-capacity hydraulic presses, essential for embedding the galvanized steel connector plates (gussets) into the wood members under high pressure. Technological advancement here focuses on increasing the speed and efficiency of the pressing stage, often integrating automated jigging systems that rapidly set up the truss layout based on digital plans, minimizing changeover time between different truss designs and maximizing the capacity for mass customization.

Emerging technologies also play a crucial role in maintaining quality and efficiency. Laser projection systems are increasingly used on assembly tables to guide workers or robotic arms in the precise placement of wood members before pressing. Furthermore, sophisticated inventory and material tracking systems, often leveraging RFID or barcode scanning, ensure that the right materials are used for the correct job and facilitate real-time monitoring of production flow. The adoption of robotics for material handling, component loading, and automated quality inspection is defining the advanced technological landscape, pushing the industry toward a higher level of precision and operational scalability, directly supporting the increasing demand for prefabricated structural elements.

Regional Highlights

Geographic analysis of the Roof Truss Market reveals distinct maturity levels and growth trajectories across major global regions, influenced by localized construction practices, economic development, and regulatory environments. North America, encompassing the United States and Canada, represents a mature and technologically advanced market. It is characterized by high rates of residential and commercial construction, strict adherence to engineered wood product standards, and widespread adoption of automated manufacturing techniques. The region benefits from established supply chains and a high acceptance rate among contractors for off-site manufactured components, driven by ongoing labor shortages that necessitate faster, less labor-intensive building solutions.

Europe demonstrates sustained demand, particularly in the UK, Germany, and Nordic countries, where energy efficiency and sustainable construction standards are paramount. European growth is often linked to renovation projects and the construction of high-quality, dense multi-family housing. The regulatory environment strongly favors highly certified and tested structural components. While growth is steady, innovation focuses heavily on wood preservation techniques, fire protection, and optimizing truss design to maximize internal usable space within roof structures.

The Asia Pacific (APAC) region stands out as the primary growth engine for the global roof truss market, driven by rapid urbanization and infrastructure investments in emerging economies such as China, India, and Southeast Asia. The transition from traditional, manual construction methods to standardized, prefabricated systems is accelerating in APAC, creating enormous opportunities for international truss manufacturers to introduce advanced production technologies and design methodologies. This region's immense volume potential is attractive, though it requires navigating complex regulatory landscapes and establishing localized supply networks.

- North America: Market leader due to large-scale residential construction, strong regulatory framework (ICC/IBC), and high adoption of automation technology, particularly in the US.

- Europe: Stable market growth driven by renovation, strong sustainability mandates, and robust demand for timber frame and engineered wood solutions in residential and light commercial sectors.

- Asia Pacific (APAC): Highest projected growth rate fueled by rapid urbanization, massive infrastructure projects (e.g., affordable housing), and the gradual shift away from traditional building methods toward prefabrication, particularly in China and India.

- Latin America (LATAM): Developing market characterized by varying adoption rates; growth tied to commercial and institutional building projects, with slow, steady growth in residential sectors contingent on economic stability.

- Middle East & Africa (MEA): Market growth concentrated in GCC countries due to large-scale urban development and tourism projects, with a preference for steel trusses in the Middle East due to extreme climate conditions and fire safety concerns.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Roof Truss Market.- Alpine (Subsidiary of ITW)

- MiTek Industries Inc. (Subsidiary of Berkshire Hathaway)

- Trussway Ltd.

- Builders FirstSource, Inc.

- National Framing Inc.

- Universal Forest Products (UFP) Industries, Inc.

- Atlas Structural Systems

- Stark Truss Company, Inc.

- Boise Cascade Company

- Donaldson Company, Inc.

- Pukru Construction (Pty) Ltd.

- Reliable Truss Company

- Truss Systems, LLC

- Taylor Panel Systems Ltd.

- R&R Trusses, Inc.

- Shelter Systems Limited

- A-1 Roof Trusses

- Southern Components, Inc.

- G&T Truss

- Apex Structural Systems

Frequently Asked Questions

Analyze common user questions about the Roof Truss market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for pre-fabricated roof trusses?

The primary factor is the increasing global trend toward off-site construction and prefabrication, driven by the need for faster construction timelines, reduced on-site labor costs, and guaranteed structural precision that exceeds the consistency achievable with traditional stick-framing methods.

How does the volatility of lumber prices affect the Roof Truss Market?

Lumber price volatility significantly impacts manufacturing margins and the final cost of wood trusses. Manufacturers mitigate this risk through strategic forward procurement contracts, optimized cutting technology to minimize waste, and by offering alternative materials like light gauge steel trusses.

Which segment of the Roof Truss Market is expected to show the highest growth rate?

The Asia Pacific (APAC) region, particularly the residential end-use application segment, is expected to exhibit the highest growth rate due to rapid urbanization, massive housing shortages, and the increasing adoption of efficient, standardized construction practices across major economies like China and India.

What role does technology play in modern roof truss manufacturing?

Technology is critical; it includes advanced CAD/CAM software for optimized structural design, CNC machinery for precision cutting, robotic assembly for high-volume production, and high-tonnage hydraulic presses for securely embedding metal connector plates, ensuring structural integrity and efficiency.

Are steel trusses replacing wood trusses in the construction industry?

While wood trusses dominate residential construction due to cost and ease of use, light gauge steel (LGS) trusses are increasingly replacing wood in large commercial, industrial, and multi-family high-rise projects due to their superior fire resistance, durability, and ability to handle wider clear spans, particularly in seismic zones.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager