Roof Windows Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434383 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Roof Windows Market Size

The Roof Windows Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 5.6 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the rising global focus on sustainable building practices, increased demand for natural lighting solutions in residential and commercial architecture, and the proliferation of attic conversion and home renovation projects across developed economies. The increasing awareness regarding the health benefits associated with natural daylight and enhanced ventilation further fuels consumer investment in high-quality roof window systems.

Market valuation growth reflects not only volume increases but also a shift towards higher-value, technology-integrated products. Modern roof windows often incorporate advanced features such as automated operation, high-efficiency triple glazing, and integrated sensors for climate control, thereby boosting the average selling price and overall market revenue. Furthermore, regulatory mandates concerning building energy performance in regions like Europe necessitate the replacement of older, less efficient roof structures, creating a strong, recurring demand for energy-efficient roof window replacements. The integration of roof windows into prefabricated housing solutions and modular construction also provides novel avenues for market penetration, ensuring sustained growth through 2033.

Roof Windows Market introduction

The Roof Windows Market encompasses the manufacturing, distribution, and installation of windows specifically designed for installation on sloped roofs, primarily to introduce natural light, enhance ventilation, and improve the aesthetic appeal of converted attic spaces or upper floors. These specialized windows, distinct from standard vertical wall windows, are essential components in optimizing passive solar gain and ensuring habitable attic environments. Products range from simple fixed glazing units to complex, electronically operated pivoting or top-hung windows that integrate seamlessly with modern smart home ecosystems. Key applications span residential attic conversions, extensions, and commercial buildings seeking to utilize natural illumination to reduce energy costs and improve occupant well-being. The market is propelled by increasing urbanization, stringent energy efficiency standards, and a sustained global trend towards maximizing usable living space within existing residential footprints.

Product description highlights focus on robust frame materials such as treated wood, PVC, and aluminum, coupled with high-performance glazing technologies, including low-emissivity (Low-E) coatings and laminated safety glass. The primary benefits derived from roof window installation include significant reductions in reliance on artificial lighting during daylight hours, effective cross-ventilation capabilities that improve indoor air quality, and the creation of brighter, more inviting interior spaces. Major applications are concentrated within the residential sector, particularly in mature markets where roof conversions are standard practice, but also extend into non-residential areas such as schools, hospitals, and light industrial facilities utilizing daylighting strategies. The overall market trajectory is highly sensitive to residential construction cycles and consumer disposable income allocated towards home improvements and energy efficiency upgrades.

Roof Windows Market Executive Summary

The global Roof Windows Market is undergoing rapid transformation characterized by increasing digitization and a strong focus on sustainable materials and energy performance. Business trends indicate a clear pivot toward premiumization, where manufacturers are differentiating their offerings through automation capabilities, superior thermal insulation (U-value optimization), and aesthetically integrated designs. Key vendors are expanding their e-commerce presence and strengthening partnerships with professional installers and architect networks to secure project-based sales. Furthermore, the rising cost of energy is making the long-term investment in high-efficiency roof windows highly appealing to consumers, driving corporate strategies toward innovation in glazing technology and remote operation systems. Mergers and acquisitions are frequent among component suppliers and system integrators aiming to achieve scale and consolidate technological expertise.

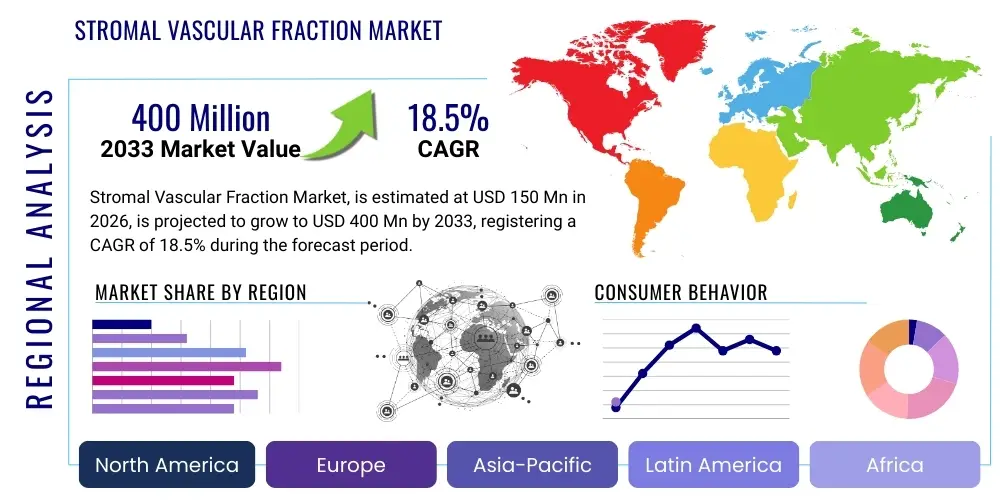

Regional trends reveal Europe maintaining its dominance, largely due to the stringent EU Energy Performance of Buildings Directive (EPBD) and extensive government-backed renovation initiatives aimed at decarbonizing the building stock. North America exhibits strong growth, particularly in the custom home building and high-end remodeling segments, favoring durable materials and connectivity features. Meanwhile, the Asia Pacific region is emerging as a significant growth engine, fueled by rapid urbanization, increasing middle-class disposable income, and the adoption of modern, international building standards in populous nations like China and India. However, regional market segmentation also highlights varied preferences in material—wood still dominates in certain European niches, while PVC and aluminum gain traction in Asia and parts of North America due to low maintenance requirements.

Segment trends underscore the strong demand for automated and remote-controlled roof windows (Electric/Solar powered segment) as users prioritize convenience and integration into smart home systems. The residential application segment remains the largest revenue contributor, intrinsically linked to housing starts and renovation activity. Material-wise, high-performance wood and engineered wood products are seeing renewed interest due to sustainability credentials, while advancements in composite materials offer structural integrity and superior thermal performance without the maintenance concerns associated with traditional materials. Glazing trends show a notable shift from double to triple glazing, reflecting the market’s response to heightened energy efficiency requirements and consumer demand for superior noise reduction and climate control capabilities.

AI Impact Analysis on Roof Windows Market

User queries regarding the impact of Artificial Intelligence (AI) on the Roof Windows Market overwhelmingly center on themes of automation, predictive maintenance, and energy optimization within the context of smart buildings. Users frequently inquire about how AI algorithms can manage opening and closing schedules based on real-time weather forecasts, internal humidity levels, and occupancy patterns to maximize energy savings and occupant comfort. There is keen interest in the potential for AI to personalize light and ventilation settings dynamically. Furthermore, manufacturing stakeholders are exploring how AI can optimize production lines, detect defects in glazing or framing materials instantly, and manage complex supply chains, leading to expectations of reduced waste and faster product customization cycles within the industry.

AI's influence is transforming roof windows from passive structural elements into dynamic, responsive building systems. In the B2C segment, AI facilitates seamless integration with broader smart home environments, allowing windows to autonomously regulate indoor climate and reduce HVAC load by strategically using natural ventilation. In the manufacturing sector, AI-driven analysis of sales data and consumer preferences enables highly accurate demand forecasting, allowing manufacturers to optimize inventory and accelerate the introduction of new, highly customized product variants. This technological infusion is expected to raise the competitive barrier, rewarding companies that invest early in digital and cognitive technologies to enhance product intelligence and operational efficiency.

Concerns often revolve around the security and privacy implications of interconnected window systems and the complexity of installation and maintenance for highly sophisticated, sensor-laden products. However, the overarching expectation is that AI will be the key differentiator driving the next generation of building envelope solutions, ensuring that roof windows contribute optimally to zero-energy or passive house standards. This integration allows the roof window system to evolve beyond a simple aperture, becoming a critical node in the building's environmental management network, constantly learning and adjusting to occupant needs and external conditions.

- AI-driven optimization of ventilation and daylighting schedules based on internal air quality and external weather data.

- Enhanced predictive maintenance using sensor data to anticipate material failure or operational issues in automated mechanisms.

- Streamlining manufacturing processes through AI-powered quality control and robotic assembly precision.

- Personalized user experiences via machine learning algorithms that adjust settings based on historical user behavior and light preferences.

- Improved energy modeling and simulation during the architectural design phase, utilizing AI to determine optimal roof window placement and size.

DRO & Impact Forces Of Roof Windows Market

The Roof Windows Market is characterized by robust growth drivers, yet tempered by notable restraints, while simultaneously benefiting from significant structural opportunities. Key drivers include the global push for energy-efficient buildings, mandates supporting the increase in natural lighting in living spaces, and demographic shifts leading to increased home renovation and attic conversion activities, especially in densely populated urban centers. These forces compel manufacturers to innovate continuously, focusing on thermal performance and integrated automation. Conversely, significant restraints involve the typically high upfront costs associated with premium, high-efficiency roof window installations, which can deter budget-conscious consumers, alongside complex and time-consuming installation processes that require specialized labor and regulatory compliance checks related to roof integrity and structure.

Opportunities in the market center on the expanding scope of IoT integration, allowing roof windows to become fully connected smart devices controllable via smartphone applications and voice commands, thus enhancing user convenience and security features. Furthermore, the developing markets in Asia Pacific present vast untapped potential as modern construction techniques are adopted and regulatory frameworks around light and ventilation standards improve. The adoption of solar-powered operation systems also presents a crucial opportunity, reducing reliance on grid electricity and simplifying installation where electrical wiring access is challenging. These forces collectively shape the competitive landscape, emphasizing innovation in both product design (aesthetics) and core functionality (energy performance).

The dominant impact forces influencing the market trajectory include technological advancements in glazing (e.g., electrochromic glass or self-cleaning coatings) and the increasing severity of climate change regulations, particularly in Europe, which necessitate high insulation values. Economic conditions, specifically housing market stability and interest rate environments that influence consumer renovation spending, exert a direct short-term impact. Long-term growth remains underpinned by demographic demands for flexible, optimized living spaces and the continued architectural preference for contemporary designs that maximize daylight ingress, making roof windows an indispensable feature in modern, sustainable construction.

Segmentation Analysis

Segmentation analysis provides a critical lens through which to understand the varied demands and structural components of the Roof Windows Market. The market is primarily segmented based on the mechanism of operation (Type), the material used for the frame (Material), the nature of the glazing (Glazing Type), and the end-use application (Application). Understanding these segments is crucial for strategic market entry and product development, as consumer preferences vary significantly across different geographical regions and construction styles. For instance, the demand for manual operation units remains strong in budget-conscious segments, while high-income markets increasingly favor automated, sensor-driven systems.

The major revenue streams are generated through the residential application segment, driven by new housing developments and the robust global trend of attic and loft conversions aimed at maximizing habitable space. Within the product type segmentation, top-hung and pivoting windows dominate due to their superior functionality in offering excellent views and comprehensive ventilation control. Furthermore, the material segment is witnessing a transition, with traditional wood frames remaining popular for aesthetic reasons, while high-performance PVC and aluminum frames gain significant market share due to their longevity, minimal maintenance requirements, and superior resistance to varying weather conditions, particularly in coastal or high-humidity environments.

Glazing technology segmentation highlights the shift towards multi-layered, energy-efficient solutions. Double glazing currently holds the largest volume share, but triple and quadruple glazing systems are rapidly growing in adoption, especially in Nordic countries and regions with severe climate demands, driven by strict insulation standards. This technological evolution indicates a market maturity where energy savings and environmental performance are becoming primary purchasing criteria over initial capital expenditure, thus influencing manufacturer R&D investment towards next-generation thermal break technologies and advanced low-emissivity coatings to meet these increasingly rigorous performance benchmarks.

- By Type:

- Top-Hung Windows

- Pivoting Windows (Center Pivot)

- Fixed Windows

- Balcony/Terrace Windows (Cabrio Systems)

- Egress Windows

- By Material:

- Wood/Timber

- PVC/Vinyl

- Aluminum

- Composite Materials

- By Glazing Type:

- Double Glazing

- Triple Glazing

- Others (Quadruple, Self-Cleaning, Electrochromic)

- By Operation:

- Manual

- Electric/Solar Powered (Automated)

- By Application:

- Residential

- Non-Residential (Commercial, Institutional)

Value Chain Analysis For Roof Windows Market

The Value Chain for the Roof Windows Market begins with the Upstream Analysis, which involves the sourcing and processing of core raw materials—high-quality timber (often laminated or treated), specialized glass for glazing units (including Low-E coatings and inert gas filling), and metals or polymers for framing and operational hardware (hinges, motors, flashing). Raw material costs and availability significantly impact final product pricing and manufacturing lead times. Manufacturers focus intensely on securing long-term contracts with specialized glass producers and maintaining efficient timber processing facilities to ensure consistent quality and compliance with environmental sustainability certifications, such as FSC for wood products. Quality control at this initial stage is paramount, as defects in glazing units can compromise the entire window's thermal integrity.

Midstream activities encompass the precise manufacturing and assembly of the roof window systems. This stage involves complex processes including frame fabrication (cutting, jointing, treating), assembly of the insulated glass units (IGUs), integration of operational mechanisms (manual hinges or electric actuators), and the packaging of the complete unit, often including specialized flashing kits necessary for watertight installation. Direct distribution channels are often favored by major international players, utilizing dedicated distribution centers and direct sales forces targeting large-scale construction projects and professional dealer networks. Indirect channels involve partnerships with large retailers, home improvement stores, and regional distributors who manage local inventory and small-to-medium contractor sales, ensuring broader market reach and decentralized logistics.

The Downstream Analysis focuses on the sale, installation, and post-sale services. Installation is a highly critical step, typically carried out by certified installers or professional contractors due to the technical requirements concerning roof structure, weatherproofing, and regulatory compliance. The installer acts as a vital link, influencing customer satisfaction and brand loyalty. Post-sale services, including warranties and maintenance (especially for automated units), constitute an essential component of the value proposition, extending the product lifecycle and ensuring long-term performance. The efficiency of the distribution channel—whether direct-to-contractor or via retail—determines the speed of delivery and the final cost to the end-user, highlighting the importance of optimized logistics management throughout the value chain.

Roof Windows Market Potential Customers

The primary target demographic for the Roof Windows Market comprises residential homeowners engaged in large-scale renovation, expansion, or conversion projects, specifically those undertaking attic or loft conversions to create functional living spaces. These end-users are characterized by a strong desire to maximize the usability and value of their properties, often driven by the need for additional bedrooms, home offices, or leisure areas. Purchasing decisions for this segment are highly influenced by aesthetic appeal, energy efficiency ratings, ease of operation, and brand reputation for durability and watertightness. This customer group often relies heavily on the recommendations of architects, general contractors, and specialized roofers, making B2B engagement with these professional advisors crucial for market penetration.

A secondary, yet significant, customer segment includes professional builders and residential developers involved in new construction projects, particularly those focusing on townhouses, apartment complexes, or custom single-family homes designed with energy performance and natural light maximization as core features. These B2B customers prioritize bulk pricing, ease of installation, regulatory compliance (e.g., meeting fire egress requirements), and guaranteed supply chain reliability. For developers, the selection of roof windows is often a cost-benefit analysis where the improved appeal and potentially higher resale value generated by superior lighting outweigh the marginal increase in material cost compared to standard roofing.

Furthermore, the non-residential sector represents a growing segment, encompassing commercial property owners, institutional facility managers (schools, universities, hospitals), and light industrial operators seeking to improve the working environment and reduce operational energy expenditure. For this segment, the focus shifts towards large-format roof window solutions, often integrated into flat roof systems, prioritizing robust performance, industrial durability, and centralized, remote-management capabilities for multiple units across large spans. Regulatory compliance concerning workplace health and safety standards, which often mandates certain levels of natural illumination and ventilation, drives procurement decisions in this non-residential customer base.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.6 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | VELUX, FAKRO, Roto Frank, Keylite Roof Windows, Altaterra (Dakea), Lamilux, LUXXE, AHRDO, Skylight International, Pella Corporation, Marvin Windows and Doors, VZLUX, HWACHEON MACHINERY, Jinmao Group, Sunoptics, CertainTeed, Anderson Corporation, RoofLITE+, The View Window Company, ESSMANN GROUP |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Roof Windows Market Key Technology Landscape

The technological landscape of the Roof Windows Market is rapidly evolving, driven primarily by the need for superior energy efficiency, automation, and seamless building integration. A key area of innovation is Glazing Technology, where the shift from standard double-glazing to high-performance triple or even quadruple-glazing units is becoming prevalent. These advanced systems incorporate specialized Low-Emissivity (Low-E) coatings and are filled with inert gases like Argon or Krypton to minimize heat transfer, drastically improving the window’s overall U-value and contributing significantly to passive house standards. Furthermore, advancements in specialized glass, such as self-cleaning coatings (activated by UV light) and electrochromic glass (which changes opacity electronically), are providing added value and functionality, appealing to premium segments seeking low-maintenance and dynamic solar control.

Another dominant technological trend is the integration of Smart Operation Systems and Internet of Things (IoT) connectivity. Modern roof windows are increasingly equipped with integrated motors (electric or solar-powered) connected to sophisticated sensor arrays that monitor temperature, humidity, and rainfall. These smart systems allow for automated operation, enabling the windows to close instantly upon detecting rain or to adjust ventilation settings based on indoor air quality, managed entirely through smartphone apps or integrated smart home hubs. This shift from manual to connected operation is enhancing user convenience, security, and the optimization of indoor climate control, making the roof window a proactive component of the building envelope system and aligning with the broader trend of digitized architecture.

Material Science and Manufacturing Precision also form crucial aspects of the technological landscape. Innovations in frame materials focus on improving thermal breaks in aluminum frames and developing highly durable, engineered wood products that resist moisture and warping while offering excellent insulation properties. Precision manufacturing techniques, often utilizing CNC machinery and advanced robotics, ensure extremely tight tolerances for seals and fittings, which are essential for guaranteeing long-term watertightness and air tightness, two primary consumer concerns for roof-installed products. Continuous investment in developing lighter, yet stronger, flashing systems that integrate seamlessly with various roofing materials (tiles, slate, metal) remains a critical area of focus for maintaining installation flexibility and reducing potential points of failure, thereby increasing overall product reliability and longevity in diverse environmental conditions.

Regional Highlights

- Europe: Dominance and Sustainability Focus

Europe holds the largest market share in the Roof Windows Market, driven by high population density, long-established practices of utilizing attic spaces, and the stringent requirements imposed by the European Union's energy performance directives (EPBD). Countries like Germany, the UK, France, and the Nordic nations are leaders in adopting high-efficiency, triple-glazed, and smart roof window systems. The strong emphasis on renovation and retrofitting programs, often subsidized by governments to meet climate neutrality targets, ensures consistent and high demand for replacements and upgrades. Europe is the primary proving ground for smart, automated, and sustainably sourced (FSC-certified wood) roof window products, setting global trends in design and efficiency.

- North America: Growth in Custom Builds and High-End Renovation

The North American market, comprising the U.S. and Canada, exhibits robust growth fueled by strong residential construction activity and an increasing consumer preference for luxury, daylight-filled living spaces. While less dense than Europe, the market favors large, durable roof windows, often opting for PVC or aluminum-clad wood frames due to extreme climate variations. Egress roof windows, which meet safety codes for emergency exit, are a particularly strong segment here. The market is increasingly influenced by energy conservation codes (like those established by the International Energy Conservation Code - IECC), pushing demand toward Low-E coatings and superior insulation ratings, particularly in the high-value custom home segment.

- Asia Pacific (APAC): Rapid Urbanization and Emerging Demand

APAC represents the fastest-growing market, primarily spurred by rapid urbanization, significant infrastructure development, and increasing adoption of Western architectural styles in developing economies such as China, India, and Southeast Asia. The introduction of standardized building codes and a rising middle class with greater disposable income are accelerating the demand for modern, installed solutions over traditional light fixtures. While the market here is more price-sensitive, demand is quickly shifting towards maintenance-free materials like PVC and aluminum. Major opportunities lie in large-scale residential projects and institutional buildings seeking cost-effective daylighting solutions.

- Latin America (LATAM) and Middle East & Africa (MEA): Untapped Potential

The LATAM and MEA regions currently hold smaller market shares but offer long-term potential. Growth in LATAM is tied to fluctuating economic conditions but shows promise in upscale residential developments in urban centers. In MEA, the demand is primarily concentrated in the Gulf Cooperation Council (GCC) countries, driven by high-profile commercial and residential projects that require high-performance glazing solutions to mitigate extreme solar heat gain while maximizing natural light, favoring triple-glazing with specialized solar control features.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Roof Windows Market.- VELUX

- FAKRO

- Roto Frank

- Keylite Roof Windows

- Altaterra (Dakea)

- Lamilux

- LUXXE

- AHRDO

- Skylight International

- Pella Corporation

- Marvin Windows and Doors

- VZLUX

- HWACHEON MACHINERY

- Jinmao Group

- Sunoptics

- CertainTeed

- Anderson Corporation

- RoofLITE+

- The View Window Company

- ESSMANN GROUP

Frequently Asked Questions

Analyze common user questions about the Roof Windows market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Roof Windows Market?

The primary drivers are the global emphasis on achieving energy efficiency in buildings, increased natural lighting requirements in architecture, and the rising consumer trend of renovating and converting attic spaces into habitable areas. Regulatory mandates, particularly in Europe, compelling the use of highly insulated building components, significantly boost market demand.

How is smart technology impacting modern roof window design?

Smart technology integration, utilizing IoT sensors and motorized mechanisms, allows roof windows to automatically manage ventilation, open/close based on weather conditions (rain sensors), and integrate with smart home systems for climate control. This increases user convenience, security, and optimizes energy consumption within the structure.

Which regions demonstrate the highest demand for roof windows?

Europe currently holds the highest market share due to established renovation markets and strict energy performance standards. However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth rate, driven by urbanization and increasing residential construction adhering to modern international standards.

What are the key material trends influencing the frame segment?

While wood remains popular for its aesthetic appeal, there is a substantial shift towards low-maintenance, high-performance materials such as PVC and aluminum/composite frames. These materials offer superior durability, better thermal break capabilities, and resistance to environmental degradation, catering to both residential and non-residential applications.

What is the Compound Annual Growth Rate (CAGR) expected for the Roof Windows Market through 2033?

The Roof Windows Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033, reflecting robust demand across renovation, new construction, and the adoption of high-value, automated window solutions globally.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager