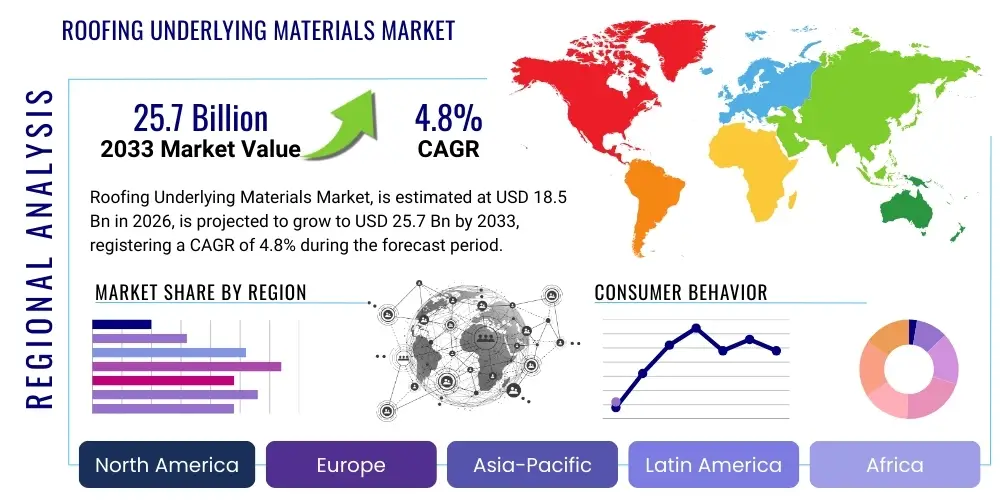

Roofing Underlying Materials Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436838 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Roofing Underlying Materials Market Size

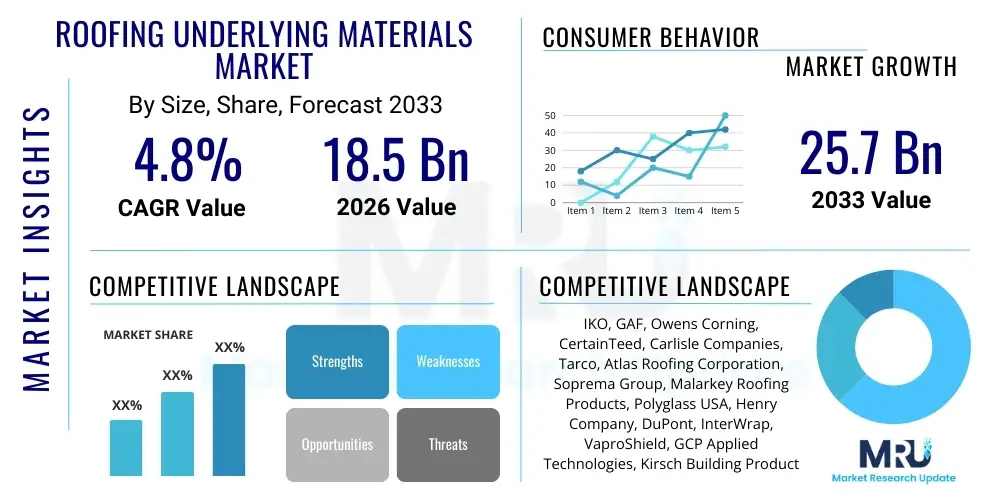

The Roofing Underlying Materials Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at $18.5 Billion in 2026 and is projected to reach $25.7 Billion by the end of the forecast period in 2033. This growth is primarily driven by increasing global construction activities, particularly in emerging economies, coupled with stricter building codes mandating enhanced weather resistance and durability in roofing systems. The shift towards high-performance synthetic underlayments, replacing traditional felt products, significantly contributes to the rising market valuation.

Roofing Underlying Materials Market introduction

The Roofing Underlying Materials Market encompasses essential components installed beneath the primary roofing cover (such as shingles, tiles, or metal) to provide a crucial layer of protection against moisture penetration, wind uplift, and subsequent structural damage. These materials, commonly known as underlayment, serve as a secondary weather barrier, ensuring integrity even if the primary roofing material is compromised. Products range from traditional asphalt-saturated felt to modern high-performance synthetic materials and specialized rubberized asphalt membranes. Major applications span residential structures, commercial buildings, and industrial facilities, driven by global infrastructure development and the mandatory replacement of aged roofing systems. The primary benefits include superior water resistance, enhanced roof deck protection, improved energy efficiency (especially with reflective underlayments), and compliance with contemporary building standards. Key driving factors include increasing extreme weather events necessitating robust roofing solutions, accelerated urbanization, and technological advancements leading to lighter, more durable, and easier-to-install synthetic variants.

Roofing Underlying Materials Market Executive Summary

The Roofing Underlying Materials Market is characterized by a significant transition from conventional organic felt underlayment towards high-performance synthetic and self-adhering membranes. This shift is fueling market expansion, with synthetic underlayments dominating new installations due to their superior tear resistance, UV stability, and reduced installation weight, aligning perfectly with evolving construction methodologies that prioritize speed and efficiency. Geographically, the Asia Pacific (APAC) region is projected to exhibit the highest growth rate, propelled by massive residential and commercial infrastructure projects in China, India, and Southeast Asian nations, coupled with increasing adoption of international building standards. Concurrently, North America and Europe remain mature but vital markets, characterized by stringent regulatory frameworks promoting energy-efficient and highly durable roofing solutions, favoring specialized products like self-adhering rubberized asphalt for low-slope applications.

Major business trends include intensified mergers and acquisitions among leading material producers aimed at consolidating market share and expanding geographical reach, alongside substantial investment in sustainable product development, such as recyclable polymer-based underlayments. Segment trends indicate that while the residential sector remains the largest consumer base, the commercial segment shows accelerating demand, particularly for high-quality, fire-resistant underlayment required in large-scale flat roof construction. Overall, the market trajectory is strongly upward, supported by robust repair and replacement cycles in established markets and explosive new construction demands in developing regions, mandating strategic focus on supply chain resilience and material innovation to capitalize on future growth opportunities.

AI Impact Analysis on Roofing Underlying Materials Market

User queries regarding the impact of Artificial Intelligence (AI) on the Roofing Underlying Materials Market frequently center on themes of supply chain optimization, predictive maintenance of manufacturing assets, and enhanced quality control during production. Consumers and industry professionals are keen to understand how AI algorithms can predict demand fluctuations for specific materials (like polymer films or asphalt) based on regional weather forecasts and real-time construction activity, thereby minimizing inventory costs and ensuring timely delivery of underlayment products to job sites. Another core area of concern relates to using computer vision and machine learning for automated inspection of underlayment integrity, both during manufacturing to detect microscopic defects and post-installation to assess durability and flag potential failure points, leading to significant reductions in material waste and warranty claims.

The implementation of AI-driven systems promises transformative changes across the value chain, moving beyond simple automation to sophisticated data analysis. In material science, AI accelerates the discovery and formulation of new underlayment compounds with optimized properties, such as enhanced UV resistance or superior adhesion capabilities, reducing the traditional trial-and-error cycle. Furthermore, for large-scale commercial roofing projects, AI tools can optimize the material layout and cutting patterns to minimize waste, a critical factor given the rising costs of raw polymers and elastomers. This technological integration is expected not only to streamline operations and enhance product quality but also to facilitate the creation of highly customized, performance-based underlayment solutions tailored to specific climatic and structural requirements, solidifying AI's role as a key competitive differentiator in the specialized construction materials sector.

- AI optimizes global logistics and inventory management for raw materials and finished underlayment products based on predictive demand modeling.

- Machine learning algorithms enhance quality control in manufacturing by identifying defects in synthetic and felt underlayments at high speed.

- Predictive maintenance schedules for underlayment production machinery maximize uptime and reduce operational bottlenecks.

- AI-enabled drone inspections assess existing roof underlayment integrity and provide precise damage mapping for replacement planning.

- Generative design AI assists in developing novel, high-performance polymer blends for next-generation synthetic underlayments.

- Data analytics driven by AI provide granular insights into regional product performance, guiding strategic market deployment and product specifications.

DRO & Impact Forces Of Roofing Underlying Materials Market

The Roofing Underlying Materials Market is primarily driven by global governmental investments in infrastructure and rising construction output, particularly in rapidly urbanizing nations, alongside the necessity for high-performance roofing systems resilient to increasing instances of severe weather conditions such as hurricanes and heavy snowfall. Restraints include the volatility of raw material prices, specifically petrochemical-derived polymers and asphalt, which directly impact manufacturing costs and product affordability, and the existence of a mature, often price-sensitive, traditional felt underlayment market that slows the transition to higher-priced, advanced synthetic alternatives. Opportunities lie prominently in the development of sustainable, green underlayment solutions and the expansion into niche applications like solar roof integration, which require specialized fire-resistant and heat-reflective barriers. These market dynamics create strong impact forces; the increasing global standardization of stringent building codes acts as a major accelerating force for premium product adoption, while cyclical downturns in the housing market occasionally exert deflationary pressure on demand, requiring manufacturers to maintain lean, flexible supply chains to mitigate risk.

Segmentation Analysis

The Roofing Underlying Materials Market is fundamentally segmented based on the material type, product form, application, and end-user sector, each exhibiting distinct growth dynamics and technological adoption patterns. Material segmentation, which includes traditional felt, high-performance synthetic polymers, and specialized rubberized asphalt, is critical as it dictates performance characteristics such as water resistance, breathability, and lifespan, directly influencing its suitability for different climatic conditions and roof types. Product form segmentation distinguishes between traditional roll goods and advanced self-adhering membranes, reflecting installer preference for faster, less labor-intensive application methods. The residential segment typically dominates consumption volume, while the commercial sector drives demand for technical specifications and premium, fire-rated materials. Understanding these segments is vital for manufacturers to tailor their product lines, marketing efforts, and distribution strategies effectively, focusing development on areas promising high long-term returns, such as durable, UV-resistant synthetic membranes for sustainable construction projects.

- By Material Type:

- Asphalt Saturated Felt

- Synthetic Underlayment (Polypropylene, Polyethylene)

- Rubberized Asphalt (Self-Adhered Membranes)

- By Product Form:

- Non-Adhering Underlayment (Mechanically Fastened)

- Self-Adhering Underlayment

- By Application/Slope:

- Steep-Slope Roofing (Residential, Light Commercial)

- Low-Slope/Flat Roofing (Large Commercial, Industrial)

- By End-User:

- Residential Construction

- Commercial Construction

- Industrial Construction

- By Distribution Channel:

- Direct Sales (to large contractors)

- Distributors and Wholesalers

- Retail Channels (Home Improvement Stores)

Value Chain Analysis For Roofing Underlying Materials Market

The value chain for the Roofing Underlying Materials Market begins intensely with upstream analysis, focusing on the sourcing of key raw materials. For synthetic underlayments, this involves securing refined polymers like polypropylene and polyethylene from petrochemical suppliers. For asphalt-based products, reliable access to high-quality asphalt and specialized reinforcements (like fiberglass mats or organic felts) is paramount. Price volatility and geopolitical stability in oil and gas producing regions significantly influence the cost structure at this initial stage. Efficient procurement, leveraging long-term supply contracts and robust inventory management, is crucial for manufacturers to maintain competitive pricing and stable production cycles. Furthermore, significant investment is channeled into R&D at this phase to develop materials that meet evolving environmental regulations and technical performance criteria, such as enhanced fire resistance or improved vapor permeability, which translates directly into product differentiation in the highly competitive downstream market segments.

Manufacturing and processing constitute the midstream segment, where raw materials are transformed into finished underlayment rolls through processes such as extrusion, saturation, or coating. Operational efficiency, quality control, and adherence to varying international standards (e.g., ASTM, CSA, CE) are critical aspects of this stage. Companies that possess proprietary coating formulas or advanced lamination techniques for synthetic products gain a distinct advantage in terms of product performance and manufacturing cost efficiency. The downstream analysis focuses on the distribution channels, which are heavily fragmented but essential for market penetration. Distribution typically involves a mix of direct sales to large volume residential builders or commercial contractors, and indirect sales through specialized roofing wholesalers, general building materials distributors, and large-format retail home improvement centers. The choice of channel strategy is often dictated by regional market maturity and product specialization.

The final phase involves installation and end-use, emphasizing the role of professional roofing contractors who are the primary purchasers and specifiers of these materials. Product training, technical support, and ease of installation—particularly the adoption of self-adhering products—are vital factors influencing purchasing decisions at this level. Direct relationships with leading contractors allow manufacturers to gather crucial feedback for product innovation and refinement. Effective management of the distribution network, ensuring product availability and timely delivery, directly impacts project schedules and contractor loyalty. Ultimately, the efficiency and transparency across the entire value chain, from polymer sourcing to final installation support, determine the market success and overall profitability within the fiercely competitive roofing materials sector.

Roofing Underlying Materials Market Potential Customers

The primary customer base for roofing underlying materials is diverse, encompassing professional entities and individuals involved in new construction, renovation, and repair activities across residential, commercial, and industrial sectors. Professional roofing contractors and construction firms represent the largest and most influential buyer segment, as they are responsible for selecting, purchasing, and installing high volumes of material based on project specifications, local building codes, and performance requirements mandated by architects and engineers. These professional users prioritize product attributes such as reliability, ease of application, warranty coverage, and availability through established distribution channels, often leading to strong brand loyalty once a material proves its effectiveness in diverse environmental settings. Furthermore, large national home builders and developers operate as key institutional buyers, often negotiating volume discounts directly with manufacturers, demanding consistency in quality and supply chain logistics to maintain their rigorous construction timelines.

A second crucial segment includes specialized wholesalers and distributors who act as intermediaries, bridging the gap between large-scale manufacturers and smaller, local contractors or retailers. These potential customers stock a comprehensive range of felt, synthetic, and specialty membranes, playing a vital role in regional market supply and providing essential technical advice. Their purchasing behavior is driven by inventory turnover, margin potential, and the breadth of product lines offered by manufacturers. Lastly, the Do-It-Yourself (DIY) sector, although smaller in terms of overall volume for full roof installations, remains a significant customer base, especially for localized repair and small-scale renovation projects. DIY customers typically procure materials through retail channels like home centers, favoring products that are marketed for ease of installation, are clearly compliant with basic safety standards, and offer readily accessible installation instructions, often favoring lighter synthetic options over heavy asphalt felt.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $18.5 Billion |

| Market Forecast in 2033 | $25.7 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | IKO, GAF, Owens Corning, CertainTeed, Carlisle Companies, Tarco, Atlas Roofing Corporation, Soprema Group, Malarkey Roofing Products, Polyglass USA, Henry Company, DuPont, InterWrap, VaproShield, GCP Applied Technologies, Kirsch Building Products, MFM Building Products, Decra Roofing Systems, Tamko Building Products, Allied Building Products. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Roofing Underlying Materials Market Key Technology Landscape

The technological landscape of the Roofing Underlying Materials Market is rapidly advancing, moving far beyond traditional organic felt to focus on engineered solutions that enhance durability, ease of installation, and building envelope performance. A primary area of innovation is in the formulation and processing of synthetic underlayments, which predominantly utilize advanced polypropylene and polyethylene films. Key technological features include slip-resistant coatings, designed to improve installer safety on steep-slope roofs, and UV-stabilizers that allow the material to withstand extended exposure to sunlight during construction delays without compromising its protective properties. Furthermore, breathability technology, which permits water vapor to escape from the building structure while preventing liquid water intrusion, is becoming standard in high-end synthetic products, mitigating the risk of mold and structural decay beneath the roof covering, thereby fulfilling stringent modern construction specifications.

Another significant technological advancement is the proliferation of self-adhering membranes, particularly those based on rubberized asphalt or specialized polymeric blends. These products utilize proprietary adhesive layers protected by release films, offering superior waterproofing capabilities, especially around complex areas like valleys, eaves, and penetrations. Innovations in this segment focus on developing adhesives that maintain their performance across a wider temperature range (low-temperature flexibility for cold climates and high-temperature resistance to prevent melt-off in hot regions) and ensuring compatibility with various roof deck materials. The integration of advanced polymer modification techniques, such as the use of Styrene-Butadiene-Styrene (SBS) or Styrene-Ethylene-Butylene-Styrene (SEBS) in rubberized asphalt, provides exceptional elasticity and self-sealing characteristics, making them indispensable for critical waterproofing applications and low-slope roofing systems where moisture defense is paramount.

Sustainable technology also forms a critical part of the current landscape, driven by growing environmental consciousness and regulatory pressures for green building certifications. Manufacturers are investing in technologies that minimize volatile organic compounds (VOCs) in adhesives and coatings and exploring the use of recycled or bio-based content in underlayment construction. Additionally, reflective underlayments, designed with highly reflective surfaces, are gaining traction. These materials aid in reducing solar heat gain during the construction phase and contribute marginally to overall roof system reflectivity, helping buildings meet increasingly strict energy efficiency codes. The overarching trend is towards multi-functional products that not only protect the structure from water but also contribute positively to overall energy performance, fire safety, and installer efficiency.

Regional Highlights

- North America (NA): The North American market, comprising the United States and Canada, is highly mature and characterized by stringent building codes and a strong focus on high-performance materials. Demand is robust, driven equally by new residential construction and a consistently large repair and replacement market, particularly in regions prone to extreme weather (hurricanes in the Southeast, heavy snow loads in the Northeast and Midwest). Synthetic underlayments dominate the steep-slope segment due to installer preference for lightweight, durable, and highly compliant materials. Regulatory requirements, such as those imposed by Florida Building Code and state-level energy codes, accelerate the adoption of premium products like self-adhering membranes for ice and water shield applications, ensuring continuous high-value sales volumes in the region.

- Europe: The European market displays varied regional dynamics, with Germany, France, and the UK leading in terms of material consumption and technological adoption. The region is heavily influenced by energy efficiency mandates and sustainability goals, driving demand for vapor-permeable and environmentally certified underlayments. Historically, bituminous felt holds a strong position, but synthetic alternatives are gaining market share rapidly, particularly for pitched roofs. Standardization efforts under organizations like CEN and national green building programs significantly influence purchasing decisions, compelling manufacturers to offer highly specified products that cater to diverse architectural styles and strict environmental performance standards.

- Asia Pacific (APAC): APAC represents the fastest-growing region globally for roofing underlying materials, underpinned by explosive urbanization, rapid industrialization, and massive governmental investments in infrastructure across countries like China, India, and Indonesia. While the market remains competitive on price, there is a swift transition from low-quality traditional materials to durable synthetic and self-adhered products, especially in rapidly developing urban centers where international quality standards are being adopted. Increasing affluence and awareness regarding long-term structural protection drive higher material consumption, making APAC a primary target for global manufacturers expanding production capacity and strategic distribution networks.

- Latin America (LATAM): The LATAM region experiences moderate but stable growth, highly dependent on local economic conditions and fluctuating commodity prices. Brazil and Mexico are the largest markets, driven by residential and light commercial construction activities. The market often favors cost-effective solutions, leading to higher consumption of traditional felt underlayment, though premium self-adhering membranes are increasingly used in upscale projects and areas susceptible to heavy rainfall and humidity. Market growth relies heavily on macroeconomic stability and increased foreign investment in construction projects.

- Middle East and Africa (MEA): Growth in MEA is concentrated in the Gulf Cooperation Council (GCC) states, propelled by megaprojects and commercial infrastructure development. In the hot climate of the Middle East, materials must demonstrate exceptional heat resistance and UV stability. Demand for highly specialized, heat-reflective, and high-performance synthetic or specialized self-adhering membranes is substantial to combat high ambient temperatures. The African market is highly varied, with growth concentrated in South Africa and North African nations, where construction demands are linked to addressing rapid population growth and infrastructure deficits.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Roofing Underlying Materials Market.- IKO

- GAF

- Owens Corning

- CertainTeed

- Carlisle Companies

- Tarco

- Atlas Roofing Corporation

- Soprema Group

- Malarkey Roofing Products

- Polyglass USA

- Henry Company

- DuPont

- InterWrap

- VaproShield

- GCP Applied Technologies

- Kirsch Building Products

- MFM Building Products

- Decra Roofing Systems

- Tamko Building Products

- Allied Building Products

Frequently Asked Questions

Analyze common user questions about the Roofing Underlying Materials market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between synthetic and felt roofing underlayments?

Synthetic underlayments are lightweight, tear-resistant, water-resistant, and offer superior UV exposure tolerance, typically made from polyolefin materials. Felt underlayments, derived from organic or fiberglass mats saturated with asphalt, are heavier, prone to tearing, and generally provide lower performance in terms of moisture management and durability compared to modern synthetic options.

How do self-adhering membranes improve roof longevity and water protection?

Self-adhering membranes, often rubberized asphalt, create a watertight seal around fasteners and roofing nails through their viscous composition, preventing water intrusion that mechanical fasteners might allow. They are crucial for 'ice and water shield' applications in prone areas like eaves, valleys, and protrusions, significantly enhancing the primary roof system's lifespan and waterproofing capabilities.

Which material segment holds the largest market share in the roofing underlayment industry?

The Synthetic Underlayment segment is rapidly capturing the largest market share due to its excellent cost-to-performance ratio, ease of installation, and compliance with modern building codes requiring robust secondary weather barriers. This material type is replacing traditional felt across many residential and steep-slope commercial applications globally.

What impact do stringent building codes have on the roofing underlying materials market?

Stringent building codes, especially those governing wind uplift, fire rating, and moisture protection (like ASTM and regional standards), directly mandate the use of higher-quality, often premium-priced, advanced underlayments. This regulatory environment accelerates innovation and drives market growth towards durable, certified synthetic and self-adhering products, particularly in regions affected by severe weather events.

Is there a noticeable trend towards sustainable or green underlayment materials?

Yes, sustainability is a key trend, driven by green building initiatives (LEED, BREEAM). Manufacturers are focusing on reducing VOC content, incorporating recycled polymers into their synthetic products, and developing highly reflective materials that contribute to improved building energy efficiency and reduced environmental footprint throughout the material lifecycle.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager