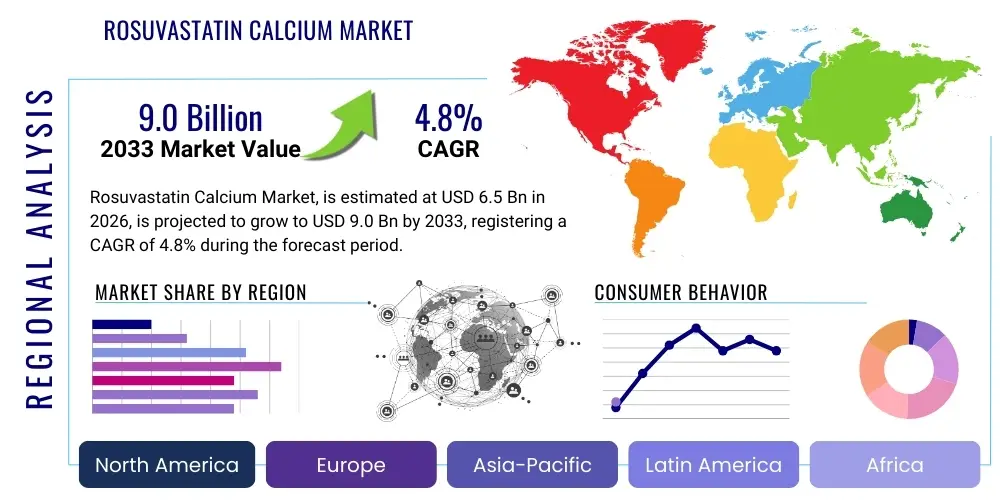

Rosuvastatin Calcium Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437384 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Rosuvastatin Calcium Market Size

The Rosuvastatin Calcium Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 6.5 Billion in 2026 and is projected to reach USD 9.0 Billion by the end of the forecast period in 2033.

Rosuvastatin Calcium Market introduction

Rosuvastatin calcium is recognized globally as a highly efficacious synthetic inhibitor of 3-hydroxy-3-methylglutaryl coenzyme A (HMG-CoA) reductase, positioning it firmly within the class of drugs commonly known as statins. Its primary therapeutic purpose is the management of primary hypercholesterolemia, mixed dyslipidemia, and homozygous familial hypercholesterolemia. By selectively inhibiting the rate-limiting enzyme in cholesterol biosynthesis within the liver, Rosuvastatin dramatically reduces levels of low-density lipoprotein cholesterol (LDL-C), often referred to as 'bad cholesterol,' which is a crucial risk factor in the pathogenesis of atherosclerotic cardiovascular disease (ASCVD). Furthermore, clinical trials have demonstrated its capability to elevate high-density lipoprotein cholesterol (HDL-C) and modestly reduce triglycerides, thereby offering a comprehensive improvement in overall lipid profiles critical for cardiac health.

The clinical relevance of Rosuvastatin Calcium extends significantly into the realm of preventive cardiology. It is widely prescribed for the primary prevention of major cardiovascular events, such as myocardial infarction and stroke, in individuals who possess multiple ASCVD risk factors but may not yet present with overt coronary artery disease. This application reflects a broader shift in global clinical practice toward aggressive, early intervention to mitigate long-term cardiovascular burden, particularly in high-risk populations including those with Type 2 diabetes mellitus or established peripheral artery disease. The drug’s powerful LDL-C reduction capabilities, which often surpass those of older-generation statins like Simvastatin and Pravastatin, ensure its designation as a preferred therapeutic agent when intensive lipid lowering is required, cementing its role as a fundamental medicine on essential drug lists worldwide. The benefits of Rosuvastatin, encompassing LDL-C lowering, plaque stabilization, and proven long-term safety, underpin its status as a cornerstone in CVD management protocols.

The market dynamics are fundamentally driven by several powerful and interconnected factors. Firstly, the escalating global epidemic of lifestyle-related diseases, including obesity, hypertension, and sedentary habits, directly feeds the increasing prevalence of dyslipidemia, requiring sustained pharmacological intervention. Secondly, the widespread patent expiration of the original branded product (Crestor) has facilitated the entry of numerous generic manufacturers. This genericization has drastically lowered the cost of therapy, making high-efficacy treatment accessible to large populations across diverse socioeconomic settings, particularly supporting volume growth in emerging markets. Finally, ongoing research continues to reinforce the pleiotropic effects of Rosuvastatin—its anti-inflammatory and plaque-stabilizing properties—which provide therapeutic benefits beyond mere cholesterol reduction, ensuring continued confidence among prescribers despite the introduction of newer drug classes. The synthesis of high-quality, cost-effective API remains a central competitive element for generic companies seeking profitability in this mature yet high-volume pharmaceutical segment, driven by persistent global health needs.

Rosuvastatin Calcium Market Executive Summary

The Rosuvastatin Calcium market analysis reveals a mature generic landscape characterized by high prescription volumes but highly competitive pricing dynamics. Business trends are dominated by aggressive cost optimization strategies employed by major pharmaceutical players to maintain thin margins in the face of widespread commoditization. Companies are increasingly focused on vertical integration, managing the entire supply chain from API synthesis to final formulation, thereby reducing reliance on third-party suppliers and safeguarding quality consistency across their global operations. A critical emerging business trend is the strategic pivot towards fixed-dose combination (FDC) products, which blend Rosuvastatin with antihypertensive, anti-diabetic, or anti-platelet agents. This innovation offers a crucial avenue for value-added differentiation and enhanced patient adherence, offering a modest premium over standard single-entity generic tablets, vital for long-term revenue stability in saturated developed markets.

Regional trends indicate a distinct bifurcation in market performance. Developed markets, encompassing North America and Western Europe, maintain high market volume stability, but exhibit minimal revenue growth due to peak generic penetration and stringent reimbursement policies enforced by national health services and private payers. These regions are focused on optimized utilization within established clinical pathways and tend to favor the lowest-cost generic options. Conversely, the high-growth potential is concentrated in the Asia Pacific (APAC) region, propelled by countries such as China, India, and Southeast Asian nations, which collectively represent the primary engine of volume expansion. This acceleration is linked to demographic transitions, rapidly expanding urbanization leading to a higher burden of non-communicable diseases, and significant investments in public health infrastructure which facilitates wider distribution and prescription of essential medicines. Local manufacturers in APAC are strategically capitalizing on government support for domestic production and large public tender opportunities.

Segmentation insights emphasize the overwhelming dominance of the oral tablet formulation, reflecting its universal acceptance and cost profile, and the primary application in addressing established hypercholesterolemia. However, the fastest-growing sub-segment is the utilization of Rosuvastatin for the primary prevention of ASCVD in intermediate-risk groups, reflecting global clinical guideline shifts towards earlier, aggressive intervention. Distribution channels remain heavily reliant on retail pharmacies and large drug store chains, underscoring the nature of Rosuvastatin as a chronic, outpatient therapy. The competitive environment is intensely oligopolistic among global generic giants who compete fiercely on price and large-scale tender acquisitions. The key strategic imperative for success remains volume maximization through efficient, low-cost API sourcing, regulatory proficiency, and robust supply chain resilience across multiple international jurisdictions.

AI Impact Analysis on Rosuvastatin Calcium Market

In analyzing user queries regarding AI’s influence on the Rosuvastatin Calcium market, a recurring interest centers on how machine learning can enhance pharmacovigilance and quality control for generic formulations. With hundreds of generic versions available globally following patent expiry, users and regulators seek assurances regarding bioequivalence, efficacy consistency, and safety profiling across diverse product sources. AI algorithms are highly effective in processing and analyzing vast datasets of real-world patient data (RWD) and electronic health records (EHRs) to detect subtle variations in therapeutic outcomes or adverse event reporting (specifically statin-associated muscle symptoms - SAMS) across different generic manufacturers. This real-time, large-scale surveillance capability helps regulatory bodies and healthcare providers rapidly identify any deviations in quality or performance, ensuring that the mass market adoption of generic Rosuvastatin Calcium remains safe and reliable, which is crucial for maintaining clinical trust in the treatment class and managing public health outcomes effectively.

Furthermore, AI plays an increasingly vital role in optimizing the utilization and prescribing patterns of Rosuvastatin by moving the therapeutic model towards precision medicine. By integrating complex data inputs including patient characteristics, genomic markers (e.g., polymorphisms in SLCO1B1), metabolic profiles, and existing medication adherence data, AI models can predict a patient’s likely response to standard Rosuvastatin dosing, identifying potential non-responders or those susceptible to muscle-related side effects. This ability allows for the precision adjustment of dosage, initiation of alternative therapies, or tailored risk counseling, thus maximizing the efficacy and safety profile for each patient. This application of AI refines the drug's usage, maximizing its therapeutic window and enhancing patient compliance, thereby reinforcing Rosuvastatin's perceived value in the face of costly, newer non-statin competitors that rely on highly targeted patient selection. AI thus stabilizes Rosuvastatin’s demand by ensuring its appropriate and optimized deployment.

Operationally, within the highly optimized generic manufacturing sector, AI is instrumental in streamlining production logistics and improving quality management. Complex predictive maintenance systems monitor sophisticated API manufacturing equipment, minimizing unexpected shutdowns and maximizing throughput, which directly impacts the ability of generic companies to maintain competitive pricing by increasing operational efficiency. Supply chain optimization, leveraging AI to predict fluctuations in regional demand (e.g., seasonal variations or large government tender awards) and adjusting inventory levels accordingly, reduces carrying costs and prevents costly stockouts. Ultimately, AI transforms Rosuvastatin Calcium from a simple chemical compound into a component within a digitally managed therapeutic ecosystem, enhancing efficiency across its entire lifecycle, from synthesis through to patient adherence monitoring, thereby sustaining its position as the workhorse of cardiovascular prevention.

- AI-driven optimization of personalized Rosuvastatin dosing based on genomic and phenotypic data to minimize adverse effects (e.g., SAMS) and maximize therapeutic efficacy.

- Enhanced supply chain efficiency and predictive demand forecasting for generic API stability and inventory management, minimizing stockouts and maintaining cost efficiency crucial for profitability.

- Acceleration of research into novel lipid-lowering targets using machine learning models, although Rosuvastatin remains the cost-effective first-line foundation therapy.

- Improvement in clinical trial design and large-scale real-world evidence generation for post-market surveillance and stringent bioequivalence monitoring of generic formulations.

- Risk stratification using AI to identify patients requiring aggressive Rosuvastatin therapy versus those suitable for lifestyle modification alone, supporting comprehensive primary prevention efforts.

- AI algorithms utilized for advanced quality control, anomaly detection, and deviation management in mass-scale generic API and finished product manufacturing processes, ensuring batch consistency.

DRO & Impact Forces Of Rosuvastatin Calcium Market

The Rosuvastatin Calcium market’s trajectory is dictated by a compelling set of market dynamics, where entrenched drivers meet significant restraining forces. The key market driver is the inexorable expansion of the global population afflicted by chronic metabolic disorders, including type 2 diabetes, obesity, and hypercholesterolemia, all of which mandate long-term statin therapy to prevent catastrophic cardiovascular outcomes. This sustained epidemiological pressure is buttressed by clear, globally accepted clinical guidelines that consistently mandate the use of high-intensity statins, such as Rosuvastatin, as the first line of defense. The drug's transition to an affordable generic status acts as an additional powerful driver, enabling mass procurement by public health systems in both mature and emerging markets, significantly increasing total addressable patient volume and consumption units annually.

Conversely, the primary and most acute restraint is the aggressive and sustained price deflation across all major markets following patent expiration. This "race to the bottom" severely erodes revenue per unit, forcing manufacturers to operate on minimal margins and constantly seek greater cost efficiencies, which limits investment in non-essential areas such as new formulation innovation or extensive marketing. Furthermore, the increasing emergence of novel, high-cost non-statin therapies, such as PCSK9 inhibitors and siRNA-based drugs (e.g., inclisiran), poses a moderate long-term threat. While these alternatives currently target niche patient populations (e.g., those with familial hypercholesterolemia or statin intolerance), their expanding indications and potential for less frequent dosing (e.g., bi-annual injections) could eventually chip away at the premium end of the Rosuvastatin market, though they are unlikely to replace it as the foundation therapy due to cost disparities.

Opportunities for sustaining profitability lie predominantly in strategic market maneuvers, specifically focusing on complex fixed-dose combinations (FDCs) and penetrating underdeveloped regions with growing healthcare needs. FDCs offer a mechanism to revitalize perceived product value by improving patient adherence and outcomes, allowing manufacturers to charge a slight premium over standard generics, thus sidestepping pure price competition. Geographically, expanding market penetration across high-population, high-growth rate emerging economies, particularly in Southeast Asia, the Middle East, and parts of Africa, represents a critical growth pathway. These regions are experiencing rapid expansion of private healthcare and government focus on chronic disease management, providing substantial tender opportunities for cost-effective, established cardiovascular treatments like Rosuvastatin. Successfully navigating the complex regulatory filing requirements and establishing robust local supply chains in these diverse jurisdictions is essential for seizing these expansion opportunities and maintaining market relevance.

Segmentation Analysis

The Rosuvastatin Calcium market is fundamentally segmented based on factors related to product type, therapeutic application, and distribution channel, reflecting the varied needs of both patients and institutional healthcare purchasers globally. The analysis of these segments is crucial for identifying pockets of resilience and future growth within this mature generic space. The formulation segment reveals that conventional oral tablets overwhelmingly dominate volume consumption due to their cost-effectiveness, ease of administration, and standardized clinical dosing protocols. However, a significant growth avenue lies within the Fixed-Dose Combinations (FDCs) segment, which addresses the pervasive issue of patient non-adherence by simplifying complex multi-drug regimens, thereby adding value beyond the basic generic product.

Application segmentation clearly demonstrates that the largest revenue share is derived from treating established hypercholesterolemia and mixed dyslipidemia, where the drug has proven indispensable in achieving strict LDL-C goals. Nevertheless, future growth momentum is anticipated to shift increasingly towards the primary prevention segment. As global health organizations and insurance payers recognize the long-term cost benefits of preventing initial cardiovascular events, clinical guidelines are becoming more aggressive in recommending statin initiation for individuals identified at intermediate risk, based on factors such as age, diabetes status, and elevated inflammatory markers. This focus on prevention significantly broadens the target patient pool. Furthermore, segmentation by dosage strength—from 5 mg up to 40 mg—is critical for market analysis, with 10 mg and 20 mg doses typically accounting for the bulk of prescriptions for maintenance therapy, accurately reflecting standard clinical practice necessary to meet LDL-C goals.

- By Formulation:

- Conventional Oral Tablets (Dominant Segment due to cost efficiency)

- Capsules and Oral Suspensions (Niche markets for pediatric use or patients with dysphagia)

- Fixed-Dose Combinations (FDCs) (Strategic Growth Segment combining Rosuvastatin with other agents)

- By Application:

- Hypercholesterolemia and Mixed Dyslipidemia (Core Therapeutic Application and Largest Revenue Share)

- Primary Prevention of Atherosclerotic Cardiovascular Disease (ASCVD) (Highest Growth Potential due to guideline shifts)

- Secondary Prevention Post-Acute Coronary Syndrome (Mandatory high-intensity treatment)

- Treatment of Hypertriglyceridemia (Adjunct and combined therapy use)

- By Dosage Strength:

- 5 mg (Low-Intensity Initial Dosing and sensitivity patients)

- 10 mg (Standard Maintenance Dosing and moderate reduction target)

- 20 mg (Standard Maintenance/High-Intensity Dosing for aggressive targets)

- 40 mg (Maximum High-Intensity Dosing, primarily for severe familial or refractory cases)

- By Distribution Channel:

- Retail Pharmacies and Drug Stores (Volume Leader for chronic outpatient prescriptions)

- Hospital Pharmacies (Institutional Supply for inpatient initiation and discharge scripts)

- Online Pharmacies and E-Commerce Platforms (Fastest Growing Channel due to price competitiveness and convenience)

- Government Tenders and Bulk Procurement Agencies (High-volume, low-margin institutional sales)

Value Chain Analysis For Rosuvastatin Calcium Market

The value chain for Rosuvastatin Calcium commences with the rigorous, capital-intensive manufacturing of the active pharmaceutical ingredient (API). This upstream phase is crucial and is heavily concentrated among a few large, globally recognized API producers, predominantly based in South Asia (India) and China, leveraging geographical cost advantages and advanced chemical synthesis technologies. The process requires complex, multi-step chemical synthesis and purification, adhering strictly to global regulatory standards (e.g., US FDA, EMA GMP). Upstream analysis highlights that competitive success in this phase is defined by process chemistry innovation aimed at increasing yield, optimizing reaction conditions, and ensuring the absolute purity and consistent crystalline polymorphism of the Rosuvastatin calcium salt. This fierce upstream competition sets the baseline cost for the entire market, making strategic API procurement or efficient in-house production a defining competitive feature for generic companies seeking sustainable profitability.

Mid-stream activities focus on formulation and finished product manufacturing (FDF). This phase involves transforming the API into various dosage forms, primarily oral tablets, and ensuring the product meets stability, bioequivalence, and regulatory compliance requirements across diverse international markets. The formulation process requires sophisticated technological processes, especially for moisture-sensitive Rosuvastatin or complex FDCs requiring specialized drug layering and protective coating. Quality control and exhaustive stability testing are non-negotiable requirements here, demanding significant investment in analytical technology. Downstream activities revolve around product distribution and ensuring broad market access. The distribution model is predominantly indirect, utilizing global wholesalers and national distributors who manage vast logistics networks to efficiently move product from manufacturing plants to retail pharmacies and hospital procurement centers across multiple territories. This network management is critical due to the high volume and low-margin nature of the product, necessitating optimized inventory control and fast turnover.

Direct distribution, utilized mainly for securing large government contracts or bulk sales to managed care organizations, simplifies the supply chain and provides manufacturers with better control over realized pricing and delivery schedules, often yielding favorable terms by eliminating intermediary costs. However, indirect channels remain indispensable for maximizing retail market penetration into fragmented global landscapes. The end-users—patients, prescribers, and institutional buyers—exert powerful influence on the value chain. Pharmacy Benefit Managers (PBMs) and national healthcare systems, acting as centralized buyers in developed markets, leverage Rosuvastatin's generic status to dictate pricing and inclusion on essential medicine lists, profoundly impacting the realized profitability at the manufacturer level. Consequently, sustained generic market success depends less on novel drug development and more on vertical integration, superior regulatory expertise for rapid multi-jurisdiction filing, and sheer logistical prowess to dominate high-volume supply tenders globally, ensuring product accessibility and cost minimization across the entire chain.

Rosuvastatin Calcium Market Potential Customers

The Rosuvastatin Calcium market is characterized by a high volume of potential customers spanning both clinical and institutional segments. The primary consumer is the patient population, specifically adults over the age of 45, globally, who have been diagnosed with primary hypercholesterolemia, mixed dyslipidemia, or established cardiovascular disease. This demographic typically requires lifelong, chronic therapy, ensuring stable, sustained demand for maintenance doses. A secondary, yet increasingly critical patient cohort includes individuals who are asymptomatic but identified through risk screening (e.g., high Framingham risk scores or elevated C-reactive protein) as candidates for primary prevention of major cardiac events. As preventative medicine gains traction globally, this cohort represents significant future growth in prescription volume, particularly in regions where health screening is becoming more prevalent.

Beyond the individual patient, critical institutional buyers significantly influence market procurement and pricing. These include Government Health Systems and national public health agencies (such as those in Europe, India, and China), which engage in massive annual procurement tenders, purchasing bulk volumes of generic Rosuvastatin based almost exclusively on the lowest achievable cost per unit and proven regulatory compliance. Similarly, Pharmacy Benefit Managers (PBMs) in the US and large regional managed care organizations act as powerful, consolidated customers. They control formulary inclusion and reimbursement status, effectively acting as gatekeepers to the mass market. These institutional customers prioritize robust supply assurance, impeccable regulatory history, and maximal cost savings, viewing Rosuvastatin as a cost-effective commodity essential for managing population health, thus dictating the intense competition among generic suppliers focused on delivering value and volume efficiency.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 6.5 Billion |

| Market Forecast in 2033 | USD 9.0 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Teva Pharmaceutical Industries, Mylan (Viatris), Sun Pharmaceutical Industries, Hikma Pharmaceuticals, Aurobindo Pharma, Dr. Reddy's Laboratories, Pfizer Inc., AstraZeneca PLC (Generic/API involvement), Cipla Ltd., Lupin Ltd., Sandoz (Novartis), Apotex Inc., Zydus Cadila, Alkem Laboratories,Torrent Pharmaceuticals, Amneal Pharmaceuticals, Glenmark Pharmaceuticals, Intas Pharmaceuticals, Cadila Pharmaceuticals, Daiichi Sankyo Company, Limited, Hetero Drugs Ltd., Granules India Ltd., Unichem Laboratories, Natco Pharma Limited, Shandong Xinhua Pharmaceutical Co., Ltd., Hubei Tianrui Chemical Co., Ltd., Changzhou Pharmaceutical Factory. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Rosuvastatin Calcium Market Key Technology Landscape

The technological landscape surrounding the Rosuvastatin Calcium market is predominantly focused on advanced pharmaceutical engineering and digitalization aimed at maximizing efficiency and product stability in a hyper-competitive generic environment, rather than molecular drug innovation. A critical area of technological focus is the deployment of highly sophisticated continuous manufacturing processes for API synthesis. This technology moves beyond traditional batch processing, allowing for uninterrupted production, reduced cycle times, and enhanced quality monitoring through sophisticated Process Analytical Technology (PAT) systems. The shift toward continuous flow chemistry for Rosuvastatin production grants leading manufacturers significant cost advantages by reducing labor, minimizing waste, and accelerating throughput, essential competitive edges when selling a high-volume, low-margin generic product into global markets. Furthermore, precise control over crystallization technology is paramount to ensure consistent crystalline structure (polymorphism) and guaranteed bioequivalence across all generic batches, a non-negotiable regulatory standard.

In terms of dosage formulation, specialized coating and tablet-pressing technologies are crucial. Rosuvastatin is inherently sensitive to moisture and light, necessitating the use of advanced polymer film coatings and optimized excipient blends to maintain chemical stability and prolong shelf life, particularly for products destined for high-humidity regions in APAC and LATAM. Furthermore, the development and regulatory filing of Fixed-Dose Combinations (FDCs) utilize complex multi-layer tablet technology or specialized matrix systems. These require sophisticated pharmaceutical engineering to ensure that chemically incompatible drugs (like Rosuvastatin and certain anti-hypertensives) can be combined into one unit dose while maintaining precise release kinetics, stability, and therapeutic efficacy for all combined compounds, effectively improving complex patient management.

Indirect technological influences include the integration of digital health and supply chain management systems utilizing big data analytics and artificial intelligence. Digital twin technology is increasingly adopted in pharmaceutical operations, allowing engineers to simulate and optimize complex manufacturing parameters—such as material flow and temperature control—without physical disruption, thereby drastically reducing production variability and time-to-market. Additionally, the adoption of smart packaging and adherence monitoring systems tracks whether patients are taking their Rosuvastatin as prescribed. This data integration into telehealth platforms and Electronic Health Records (EHRs) ensures consistent adherence, maximizes the real-world therapeutic effect, and further reinforces the stability of prescription volumes, ensuring that Rosuvastatin remains a highly utilized chronic medication managed through advanced digital platforms.

Regional Highlights

Market consumption and growth patterns for Rosuvastatin Calcium demonstrate high sensitivity to regional healthcare policies, economic development, and epidemiological profiles, creating varied market dynamics across the globe.

- North America (NA): Represents a high-volume, established market, primarily driven by the United States and Canada. Growth in revenue is highly restricted due to massive generic saturation and severe price control exerted by major Pharmacy Benefit Managers (PBMs) and governmental payers like Medicare. The region's stability is maintained by the high prevalence of cardiovascular disease and robust clinical guidelines mandating statin use, leading to extremely high, yet cost-compressed, prescription volumes. Operational focus is on efficient, large-scale supply chain management.

- Europe: Western Europe demonstrates stable, mature demand, anchored by robust national healthcare systems (e.g., NHS, sickness funds) that mandate the use of cost-effective generic alternatives. Central and Eastern Europe offer a faster, though smaller, growth trajectory as healthcare infrastructure modernizes and diagnosis rates for dyslipidemia increase. The region is characterized by fragmented national regulatory and reimbursement mechanisms, requiring generic companies to possess significant regulatory agility across the EU and surrounding countries.

- Asia Pacific (APAC): Positioned as the leading growth vector globally, driven by massive, untapped patient populations in emerging economies such as China, India, and Indonesia. This growth is fueled by increasing affluence, rapid urbanization leading to higher rates of metabolic syndrome, and significant government investment in public health infrastructure. Local manufacturers are critically important here, often gaining market dominance through large-scale government procurement tenders focused on providing affordable, essential medicines.

- Latin America (LATAM): Offers significant potential, benefiting from expanding health insurance coverage and increasing awareness of cardiovascular risk factors across the population. Regulatory fragmentation, particularly concerning bioequivalence requirements, and macroeconomic volatility in countries like Brazil and Argentina temper explosive growth, but the sustained epidemiological need for CVD treatment ensures a consistent, moderately expanding market, focused on generic affordability and accessible distribution networks.

- Middle East and Africa (MEA): This is a highly heterogeneous market segment. The Gulf Cooperation Council (GCC) countries show strong demand supported by substantial healthcare budgets addressing high rates of lifestyle diseases (diabetes, obesity). Sub-Saharan Africa remains primarily an essential medicines market, driven by international aid and slowly improving primary healthcare access, with market size constrained by systemic affordability issues and developing distribution infrastructure, necessitating strong partnerships for market penetration.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Rosuvastatin Calcium Market.- Teva Pharmaceutical Industries

- Mylan (Viatris)

- Sun Pharmaceutical Industries

- Hikma Pharmaceuticals

- Aurobindo Pharma

- Dr. Reddy's Laboratories

- Pfizer Inc.

- AstraZeneca PLC (Generic/API involvement)

- Cipla Ltd.

- Lupin Ltd.

- Sandoz (Novartis)

- Apotex Inc.

- Zydus Cadila

- Alkem Laboratories

- Torrent Pharmaceuticals

- Amneal Pharmaceuticals

- Glenmark Pharmaceuticals

- Intas Pharmaceuticals

- Cadila Pharmaceuticals

- Daiichi Sankyo Company, Limited

- Hetero Drugs Ltd.

- Granules India Ltd.

- Unichem Laboratories

- Natco Pharma Limited

- Shandong Xinhua Pharmaceutical Co., Ltd.

- Hubei Tianrui Chemical Co., Ltd.

- Changzhou Pharmaceutical Factory

- Macleods Pharmaceuticals Ltd.

Frequently Asked Questions

Analyze common user questions about the Rosuvastatin Calcium market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the continued demand for Rosuvastatin Calcium?

The primary factor driving demand is the escalating global prevalence of cardiovascular diseases (CVD), hypercholesterolemia, and related metabolic syndromes, coupled with the established efficacy and cost-effectiveness of generic Rosuvastatin as a first-line treatment in clinical guidelines worldwide. Its inclusion in essential medicine lists ensures high utilization.

How has the generic availability of Rosuvastatin Calcium impacted market revenue?

Generic availability has severely constrained overall market revenue growth due to intense price erosion and margin compression. However, it has dramatically increased prescription volume and patient accessibility, shifting market dynamics from branded revenue to generic volume maximization and efficient supply chain operation.

Which geographical region is projected to experience the fastest growth in the Rosuvastatin Calcium market?

The Asia Pacific (APAC) region, specifically emerging economies like China and India, is projected to experience the fastest market growth. This is driven by rapid increases in disease incidence linked to urbanization, improving healthcare infrastructure, and expanding public health initiatives promoting essential chronic disease medications.

Are fixed-dose combination (FDC) therapies containing Rosuvastatin a significant market trend?

Yes, FDCs are a key strategic trend. They offer enhanced patient adherence and therapeutic convenience by combining Rosuvastatin with other cardiovascular drugs (e.g., anti-hypertensives). This strategy allows manufacturers to revitalize product value and achieve differentiation in the highly commoditized core generic market.

What major restraints are impacting the profitability of Rosuvastatin Calcium manufacturers?

The main restraints are intense price competition among generic manufacturers, high bargaining power of institutional buyers (PBMs, governments) who negotiate massive volume discounts, and the moderate, long-term threat posed by newer, high-cost non-statin lipid-lowering therapies.

How does AI contribute to optimizing the use of Rosuvastatin in clinical practice?

AI contributes by enabling precision medicine, utilizing machine learning algorithms to analyze genetic and clinical patient data to predict optimal Rosuvastatin dosing, thereby improving efficacy, minimizing adverse effects, and supporting healthcare providers in adhering to personalized treatment protocols.

What role does upstream API manufacturing technology play in market competition?

Upstream API technology is critical for competitive advantage. The adoption of advanced chemical engineering and continuous manufacturing processes allows leading companies to maximize production yield, ensure high purity, and significantly reduce the cost of goods sold, which is essential for winning large generic volume tenders.

What technological advancements are crucial for Rosuvastatin formulation?

Advanced formulation requires specialized coating technologies to protect the moisture-sensitive Rosuvastatin molecule and enhance stability, alongside complex multi-layer tablet technology essential for developing stable and effective fixed-dose combination products.

Which segment of the Rosuvastatin market is expected to drive future volume growth?

The application segment dedicated to the primary prevention of atherosclerotic cardiovascular disease (ASCVD) in intermediate-risk patients is expected to drive future volume growth, following increasingly aggressive clinical guidelines recommending early statin initiation.

How do Pharmacy Benefit Managers (PBMs) influence the US Rosuvastatin market?

PBMs exert significant control by managing formularies and negotiating prices on behalf of health plans. They leverage the abundant generic supply to demand deep discounts, often favoring the lowest-cost manufacturer to ensure Rosuvastatin remains affordable and accessible within their covered drug lists, pressuring manufacturer margins.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Rosuvastatin Calcium Market Size Report By Type (Purity 98.0%, Purity 99.0%, Other), By Application (Tablet (including dispersible tablet and general tablet), Capsule, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Rosuvastatin Calcium Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Purity 99.0%, Purity 98.0%, Others), By Application (Capsule, Tablet (including dispersible tablet and general tablet), Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager