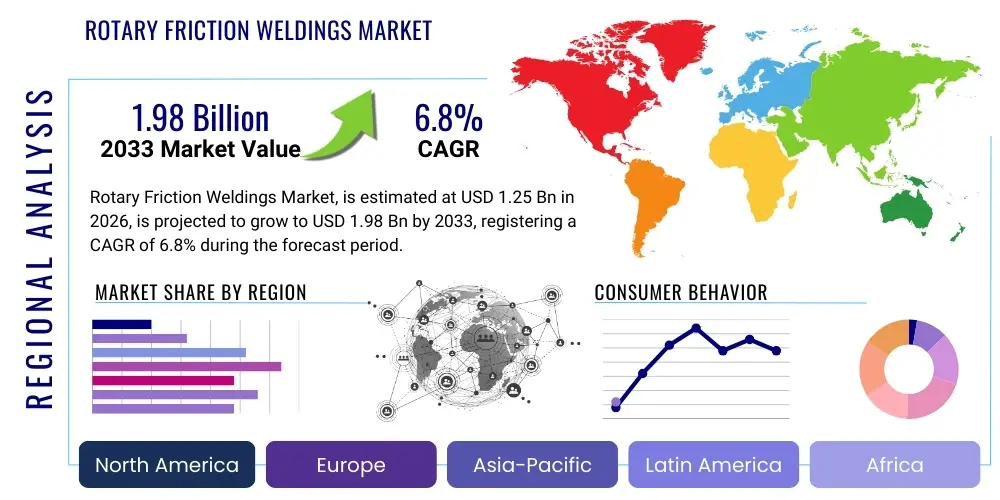

Rotary Friction Weldings Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438653 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Rotary Friction Weldings Market Size

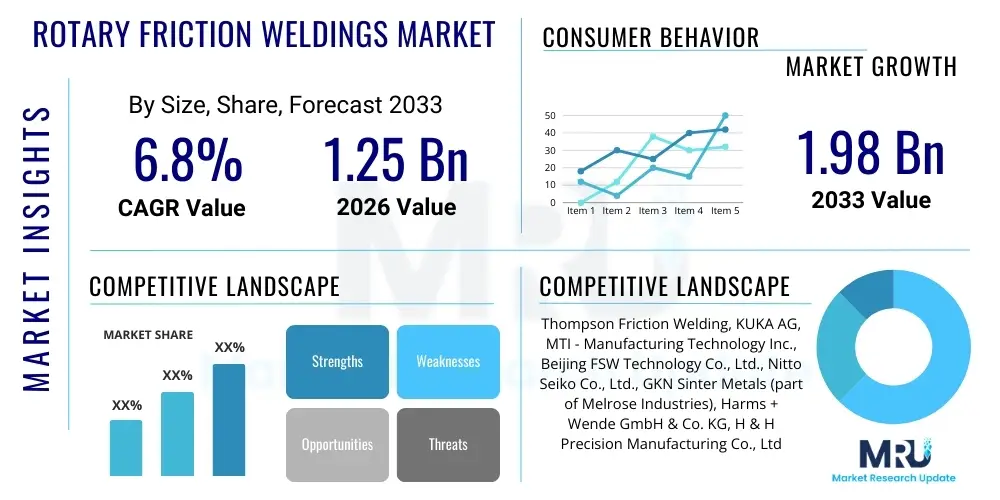

The Rotary Friction Weldings Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.25 Billion in 2026 and is projected to reach USD 1.98 Billion by the end of the forecast period in 2033.

Rotary Friction Weldings Market introduction

The Rotary Friction Weldings Market encompasses advanced solid-state joining technologies utilized across highly demanding industrial sectors, particularly automotive, aerospace, defense, and oil and gas. Rotary friction welding is a process that generates heat through mechanical friction between a rotating component and a stationary component pressed together under axial force. This method results in a high-quality, full-penetration bond characterized by fine grain structure, minimal heat-affected zones (HAZ), and superior mechanical properties compared to conventional fusion welding techniques. The primary products within this market include specialized direct drive friction welding machines, inertia friction welding machines, and hybrid systems designed for joining dissimilar materials such as aluminum to steel or various advanced composite structures.

Major applications for rotary friction welding are concentrated in high-volume, mission-critical component manufacturing. In the automotive industry, this technology is vital for producing turbocharger shafts, engine valves, drive axles, and piston rods, where reliability and fatigue strength are paramount. The aerospace sector utilizes friction welding for jet engine components, landing gear systems, and structural airframe parts due to the necessity of maintaining material integrity at high stress and temperature thresholds. Furthermore, the oil and gas sector relies on friction welding for drilling tools, pipeline components, and specialized downhole equipment, benefiting from the strong, hermetically sealed joints that withstand extreme operational environments.

The key benefits driving market adoption include enhanced joint strength, reduced material waste, superior energy efficiency compared to traditional welding methods, and the capacity to join previously incompatible material combinations, which is increasingly critical in lightweighting initiatives. The driving factors accelerating market expansion are largely tied to stringent regulatory demands for fuel efficiency and reduced emissions, prompting the development of lighter, multi-material vehicle and aircraft components. Continuous innovation in machine control systems, automation integration, and the rising demand for electric vehicle (EV) battery components requiring specialized dissimilar material joining further solidify the market’s positive trajectory. Global capital expenditure in advanced manufacturing facilities, especially in emerging economies, represents a significant growth impetus.

Rotary Friction Weldings Market Executive Summary

The Rotary Friction Weldings Market is exhibiting robust growth, propelled by the persistent global shift toward lightweight, high-performance materials in critical infrastructure and transportation sectors. Business trends indicate a strong focus on developing highly automated, modular friction welding solutions that can be seamlessly integrated into Industry 4.0 manufacturing lines. Leading vendors are investing heavily in advanced monitoring systems, utilizing sensors and data analytics to ensure process repeatability and quality control, thereby minimizing defect rates and maximizing operational uptime. Furthermore, the market is characterized by strategic collaborations between welding equipment manufacturers and specialized material providers to address complex joining challenges posed by next-generation superalloys and ceramic matrix composites, particularly those used in aerospace propulsion systems and nuclear applications.

Regional trends reveal that Asia Pacific (APAC) continues to dominate the consumption landscape, primarily driven by massive investments in automotive manufacturing, particularly in China and India, and expanding industrial infrastructure development. North America and Europe, however, lead in technological innovation, focusing on precision-engineered friction welding systems for high-value applications in defense and specialized medical devices. The competitive environment is intensifying, with companies leveraging proprietary machine designs and specialized tooling to capture niche applications. There is a notable movement toward providing comprehensive lifecycle support, including predictive maintenance services and remote diagnostics, enhancing the overall value proposition for end-users seeking maximal return on capital investment.

Segment trends underscore the rising prominence of Direct Drive Friction Welding (DDFW) systems due to their superior precision, faster cycle times, and reduced energy consumption compared to traditional inertia systems. While inertia welding remains critical for large-diameter components requiring high kinetic energy input, DDFW is gaining traction in mid-to-small part fabrication across the automotive and general industrial sectors. Application-wise, the automotive segment accounts for the largest market share, though the aerospace segment demonstrates the highest anticipated growth rate, driven by long-term aircraft order backlogs and the continuous overhaul cycle requiring stringent material quality assurance. The increasing necessity for joining battery components in the rapidly expanding EV market also positions friction welding, particularly linear friction welding variants, as a crucial enabling technology, although rotary friction welding dominates cylindrical component fabrication.

AI Impact Analysis on Rotary Friction Weldings Market

Common user questions regarding AI’s impact on the Rotary Friction Weldings Market revolve around how machine learning can enhance process reliability, predict weld quality variations in real-time, and optimize complex machine parameters for dissimilar material joining. Users seek confirmation on AI's ability to reduce the dependency on highly specialized operators and automate the decision-making processes regarding tool wear compensation and fault detection. Key concerns center on data privacy, the cost of implementing sophisticated sensor arrays required for effective AI training, and the integration challenges with legacy welding machinery. Overall, there is high expectation that AI will revolutionize quality assurance, moving the industry from post-weld inspection to proactive, real-time process control and parametric optimization, critical for achieving zero-defect manufacturing in highly regulated industries like aerospace.

- Real-Time Quality Prediction: AI algorithms analyze sensor data (torque, force, displacement, temperature) instantly to predict joint strength and microstructure quality, minimizing destructive testing requirements.

- Parametric Optimization: Machine learning optimizes weld parameters (rotational speed, axial force, deceleration time) for new or variable material combinations, significantly reducing pre-production development time.

- Predictive Maintenance: AI monitors machine performance, vibration patterns, and component wear, forecasting potential equipment failures and scheduling maintenance proactively to maximize uptime.

- Automated Fault Detection: Computer vision and advanced data analysis rapidly identify subtle deviations in the weld flash or material flow, signaling process inconsistencies immediately.

- Operator Assistance: AI provides guided workflows and complex troubleshooting support, reducing the necessary skill level required for consistent high-quality output.

- Process Repeatability Enhancement: Machine learning ensures consistent execution across multiple machines and locations by standardizing parameter settings based on historical high-quality weld data.

DRO & Impact Forces Of Rotary Friction Weldings Market

The market dynamics are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), significantly influencing the adoption rate of rotary friction welding technologies. A primary driver is the pervasive demand for high-integrity joints in safety-critical components across aerospace and defense, where the solid-state nature of friction welding ensures welds free from typical fusion defects such as porosity or solidification cracking. The ability of friction welding to efficiently join dissimilar materials, such as lightweight alloys to high-strength steels, directly supports global industrial strategies focused on mass reduction and enhanced performance, particularly crucial in the burgeoning electric vehicle sector for motor shafts and battery component assemblies. Furthermore, the inherent environmental advantages, including reduced energy consumption and the elimination of hazardous welding fumes and shielding gases, align with increasingly strict environmental, social, and governance (ESG) standards, making the technology economically and ecologically appealing.

Despite strong drivers, the market faces several restraining factors that limit broader adoption. The most significant restraint is the high initial capital investment required for purchasing and installing sophisticated friction welding machinery, often placing it out of reach for small and medium-sized enterprises (SMEs) without specialized financing. Furthermore, the process is inherently limited to components with circular or near-circular cross-sections, unlike linear friction welding which addresses flat or non-circular geometries, thus restricting its applicability in certain manufacturing scenarios. Technical complexities related to precise component alignment and material preparation, coupled with the necessity for highly skilled operators and maintenance personnel, also contribute to market friction, particularly in regions with developing industrial labor pools. Competition from alternative advanced joining techniques, such as laser welding and brazing, remains a constant challenge, forcing friction welding suppliers to continuously demonstrate superior joint quality and cost-effectiveness.

Significant opportunities exist in expanding the application scope into new high-growth areas, particularly in the additive manufacturing (AM) post-processing segment, where friction welding can be used to join AM-produced components to wrought components, thus mitigating cost and complexity. The development of portable or smaller-footprint friction welding machines tailored for repair and maintenance operations in the oil and gas field offers a lucrative avenue for growth. Moreover, the integration of advanced monitoring and control systems, including AI and machine learning for closed-loop parameter control, provides a critical opportunity to overcome operational complexities and enhance repeatability, thus lowering the barriers to entry for new users. Technological advancements focusing on hybrid friction welding techniques that combine friction with other energy sources (e.g., induction heating) to improve weld efficiency and broaden the range of feasible materials present substantial future market expansion potential, particularly in handling temperature-sensitive alloys.

Segmentation Analysis

The Rotary Friction Weldings Market is comprehensively segmented based on machine type, component material, end-use industry, and geographic region, reflecting the diverse applications and technological requirements of various industrial users. Understanding these segments is crucial for strategic market planning, as each segment exhibits unique growth drivers and competitive dynamics. The differentiation by machine type, namely Direct Drive versus Inertia, reflects the trade-off between precision control and kinetic energy capacity needed for different component sizes and material properties. The end-use segmentation is essential as it directly correlates market demand with global manufacturing trends in aerospace, automotive, and general machinery, allowing vendors to tailor their product offerings and specialized tooling to specific industry compliance standards and production volumes.

- By Machine Type:

- Direct Drive Friction Welding (DDFW) Machines

- Inertia Friction Welding Machines

- Hybrid Friction Welding Systems

- By Welding Material:

- Steel to Steel

- Aluminum Alloys

- Dissimilar Materials (e.g., Aluminum to Steel, Copper to Aluminum)

- Nickel and Titanium Alloys (Superalloys)

- By Application/Component:

- Axles and Drive Shafts

- Engine Valves

- Turbocharger Rotors and Shafts

- Drill Pipes and Tool Joints

- Piston Rods and Hydraulic Cylinders

- Battery Components (Electrode Tabs, Busbars)

- By End-Use Industry:

- Automotive

- Aerospace and Defense

- Oil and Gas

- Industrial Machinery and Heavy Equipment

- Electrical and Power Generation

- Medical

Value Chain Analysis For Rotary Friction Weldings Market

The value chain for the Rotary Friction Weldings Market begins with the upstream suppliers responsible for raw materials, sophisticated electronic components, and high-precision mechanical subsystems necessary for machine construction. This upstream segment includes specialized manufacturers of high-power hydraulic components, electrical drives, customized bearings, and advanced control electronics, particularly Programmable Logic Controllers (PLCs) and Human-Machine Interface (HMI) systems. The quality and availability of these core components directly influence the performance, reliability, and cost structure of the final welding machine. Furthermore, specialized tooling suppliers, who produce custom weld dies and fixtures designed to hold complex component geometries accurately under high axial load, play a crucial enabling role in optimizing the welding process for specific industrial applications.

The midstream segment is dominated by the Original Equipment Manufacturers (OEMs) of friction welding machines. These manufacturers focus on complex system integration, ensuring high force capacity, rotational speed accuracy, and thermal control. Key activities include advanced machine design, assembly, rigorous calibration, and the integration of proprietary software for process monitoring and data logging. These OEMs often provide customized machine solutions tailored to the production volume and material handling needs of large-scale industrial customers, moving beyond standardized catalog products. The competitive advantage at this stage is derived from machine rigidity, dynamic performance, and the ability to integrate automation features such as robotic loading and unloading, enhancing overall system throughput and operational efficiency.

Downstream activities involve distribution channels, installation, commissioning, and post-sales support that directly impact end-user satisfaction and operational continuity. Distribution can be classified into direct sales channels, typically used for large, specialized capital equipment sold directly to major Tier 1 suppliers and aerospace primes, and indirect channels utilizing regional distributors or agents for smaller industrial machinery sales. The critical importance of continuous service, including specialized operator training, provision of spare parts, and timely technical assistance, cannot be overstated, as machine downtime in high-volume production environments is extremely costly. Successful OEMs prioritize offering comprehensive maintenance contracts and technical consultancy services, thereby fostering long-term relationships and securing recurrent revenue streams from supporting the installed machine base throughout its lifecycle.

Rotary Friction Weldings Market Potential Customers

The primary potential customers and end-users of rotary friction welding technology are global manufacturers engaged in producing high-reliability components where joint integrity is non-negotiable and where high volumes necessitate rapid, repeatable processes. The automotive industry represents the largest customer base, consisting of major vehicle manufacturers and their Tier 1 suppliers who utilize the technology for critical powertrain components, steering shafts, and specialized transmission parts. As the industry transitions to electric vehicles, component manufacturers supplying motor shafts, differential components, and especially those working on integrating dissimilar materials for battery trays and cooling systems, form a rapidly expanding customer segment, valuing the technology's ability to achieve robust metallurgical bonds between traditionally incompatible metals like copper and aluminum.

Another crucial segment comprises the aerospace and defense sectors, including airframe manufacturers, jet engine component suppliers, and armament producers. These customers demand the highest level of material integrity and minimal thermal damage, making friction welding ideal for fabricating turbine shafts, landing gear struts, and complex engine discs from superalloys like Inconel and titanium. The necessity for stringent quality compliance (e.g., AS9100, NADCAP) means that these buyers prioritize machines offering advanced data logging, precise control, and detailed traceability features. The defense segment often utilizes the technology for ordnance components and specialized vehicle parts where extreme shock resistance and material homogeneity are mandatory characteristics.

Beyond transportation, the heavy machinery and oil and gas industries form substantial customer bases. Oil and gas companies and their equipment suppliers (e.g., manufacturers of drill pipes, downhole tools, and riser connections) require extremely strong, fatigue-resistant joints capable of withstanding high pressure, high temperature (HPHT) environments. The industrial machinery sector, including manufacturers of hydraulic cylinders, construction equipment, and textile machinery components, also frequently employs rotary friction welding for components requiring rapid, cost-effective assembly of robust shaft-like structures. In the medical device sphere, smaller, specialized friction welding systems are used by manufacturers for surgical instruments and implantable devices, capitalizing on the process’s clean, precise nature and ability to join bio-compatible materials.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.25 Billion |

| Market Forecast in 2033 | USD 1.98 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Thompson Friction Welding, KUKA AG, MTI - Manufacturing Technology Inc., Beijing FSW Technology Co., Ltd., Nitto Seiko Co., Ltd., GKN Sinter Metals (part of Melrose Industries), Harms + Wende GmbH & Co. KG, H & H Precision Manufacturing Co., Ltd., J-TEQ Friction Welding, Superior Joining Technologies, Inc., ETA, Ltd., Haimer GmbH, ESAB Corporation, General Kinematics Corporation, Trumpf Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Rotary Friction Weldings Market Key Technology Landscape

The Rotary Friction Weldings Market is characterized by three fundamental technological approaches: Direct Drive Friction Welding (DDFW), Inertia Friction Welding (IFW), and advanced Hybrid Systems. DDFW represents the state-of-the-art in precision control, where the rotational speed is maintained by an electric motor throughout the welding cycle and abruptly stopped using a braking system, typically pneumatic or hydraulic, allowing for highly controlled thermal input and precise axial displacement measurement. This technology is preferred for smaller, intricate components and materials that are sensitive to excessive heat input, such as aluminum alloys and complex superalloys used in aviation. Continuous innovation in DDFW focuses on high-speed motor technology, improving braking repeatability, and integrating sophisticated closed-loop force control systems to achieve micro-level displacement accuracy, essential for maintaining tight tolerances.

Inertia Friction Welding (IFW), conversely, relies on storing kinetic energy in a flywheel before contact. The flywheel is accelerated to a predetermined speed, the drive system is disengaged, and the stored kinetic energy is then entirely dissipated through friction at the interface, followed by the application of forging force. IFW is typically deployed for larger diameter components and materials requiring a higher, rapid energy input to achieve sufficient plastic deformation and material upset, commonly seen in drilling tool joints and large engine valves. Technological advancements in IFW are centered on optimizing flywheel design, improving the instantaneous application of high forging forces, and enhancing non-destructive testing (NDT) capabilities integrated within the machine structure to verify the integrity of the bulkier weld zones immediately after the process concludes, reducing reliance on external inspection stages.

The emerging landscape includes Hybrid Friction Welding systems and advanced monitoring technologies. Hybrid systems often incorporate supplementary heating sources, such as induction or laser pre-heating, to soften materials prior to friction application, which significantly reduces the necessary axial force and expands the range of materials that can be successfully joined, including ceramics and complex metal matrix composites. Furthermore, the convergence of friction welding with Industry 4.0 principles is paramount. This involves the widespread use of high-frequency sensors, digital twin modeling for virtual process optimization, and AI-driven monitoring systems that analyze process signatures (force/torque/speed curves) against established baselines. These technologies are crucial for assuring weld quality in real-time, automating parameter adjustments for material variability, and providing comprehensive digital documentation necessary for regulatory compliance, especially in aerospace and medical sectors.

Regional Highlights

- Asia Pacific (APAC): Dominates the global rotary friction welding market share, propelled by exponential growth in the regional automotive industry, especially in China, India, and Southeast Asian nations. APAC serves as the global manufacturing hub for high-volume component production, necessitating efficient, repeatable joining technologies. The rapid infrastructure development and expansion of regional defense and heavy equipment manufacturing sectors further solidify the demand for friction welding machines tailored for robust and reliable construction components.

- North America: Characterized by high technological adoption and a strong focus on high-value, low-volume production, predominantly driven by the stringent quality requirements of the aerospace, defense, and oil & gas sectors. The US market emphasizes advanced DDFW and hybrid systems for joining complex superalloys and managing R&D projects related to next-generation engine designs and space exploration hardware. Investment in advanced manufacturing centers and the reshoring of critical component production are key regional drivers.

- Europe: A mature market defined by strong demand from the automotive premium segment and sophisticated industrial machinery manufacturers (Germany, Italy, France). European manufacturers prioritize precision, automation, and compliance with strict environmental standards. There is significant R&D focus on integrating friction welding into automated production cells (Industry 4.0 integration) and applying the technology for lightweight vehicle components to meet EU carbon emission targets, specifically targeting electric vehicle battery housing and motor components.

- Middle East and Africa (MEA): Growth is primarily concentrated in the Oil and Gas sector, particularly for joining drill pipes, casing, and specialized pipeline components required for deep-sea and challenging onshore extraction projects. The demand is cyclical, tied directly to global energy prices and capital expenditure in exploration and production (E&P) activities, favoring large-scale, robust Inertia Friction Welding machines capable of handling heavy-duty materials.

- Latin America: Represents a developing market with growth linked to the recovery and expansion of regional automotive production (Brazil, Mexico) and local industrial machinery needs. Adoption rates are currently lower than in major industrialized regions, but rising foreign direct investment (FDI) in manufacturing is expected to stimulate demand for cost-effective and reliable friction welding solutions over the forecast period.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Rotary Friction Weldings Market.- Thompson Friction Welding

- KUKA AG

- MTI - Manufacturing Technology Inc.

- Beijing FSW Technology Co., Ltd.

- Nitto Seiko Co., Ltd.

- GKN Sinter Metals (part of Melrose Industries)

- Harms + Wende GmbH & Co. KG

- H & H Precision Manufacturing Co., Ltd.

- J-TEQ Friction Welding

- Superior Joining Technologies, Inc.

- ETA, Ltd.

- Haimer GmbH

- ESAB Corporation

- General Kinematics Corporation

- Trumpf Group

- FRIMA Funke & Rösel GmbH

- A.M.E. s.r.l.

- VS Welders

- Stirweld SAS

- Robomatix Industries

Frequently Asked Questions

Analyze common user questions about the Rotary Friction Weldings market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the key advantage of rotary friction welding over traditional arc welding?

The primary advantage is that rotary friction welding is a solid-state process, meaning the materials are joined below their melting point. This eliminates fusion defects like porosity, spatter, and solidification cracking, resulting in superior mechanical properties, minimal heat-affected zones, and higher fatigue strength, essential for critical components in aerospace and automotive applications.

Which end-use industry is driving the highest demand for rotary friction welding equipment?

The Automotive industry currently accounts for the largest market share, driven by the high-volume production of engine valves, turbocharger shafts, and drive axles. However, the Aerospace and Defense sector is projected to exhibit the highest growth rate due to the increasing need to join dissimilar superalloys for next-generation jet engine components and airframe structures.

Can rotary friction welding effectively join dissimilar metals, such as steel and aluminum?

Yes, rotary friction welding is exceptionally effective at joining many dissimilar metals that are challenging or impossible to join using conventional fusion welding methods. This capability is a core driver for its adoption in lightweighting initiatives across the automotive and electric vehicle manufacturing sectors, specifically for joining ferrous metals to light alloys like aluminum and copper.

What are the main types of rotary friction welding machines available in the market?

The market primarily features two main types: Direct Drive Friction Welding (DDFW) machines, which offer precise process control and are suitable for smaller, sensitive parts; and Inertia Friction Welding (IFW) machines, which rely on stored kinetic energy in a flywheel and are preferred for larger components requiring substantial forging force and heat input.

How is AI impacting the quality control and efficiency of the friction welding process?

AI impacts quality control by enabling real-time monitoring and prediction of weld integrity based on analysis of process variables (force, torque, speed, displacement). This minimizes post-weld inspection, optimizes machine parameters automatically for consistency, and enhances overall efficiency by forecasting maintenance needs, aligning the technology with Industry 4.0 smart manufacturing principles.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager