Rotary Pulverizers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431729 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Rotary Pulverizers Market Size

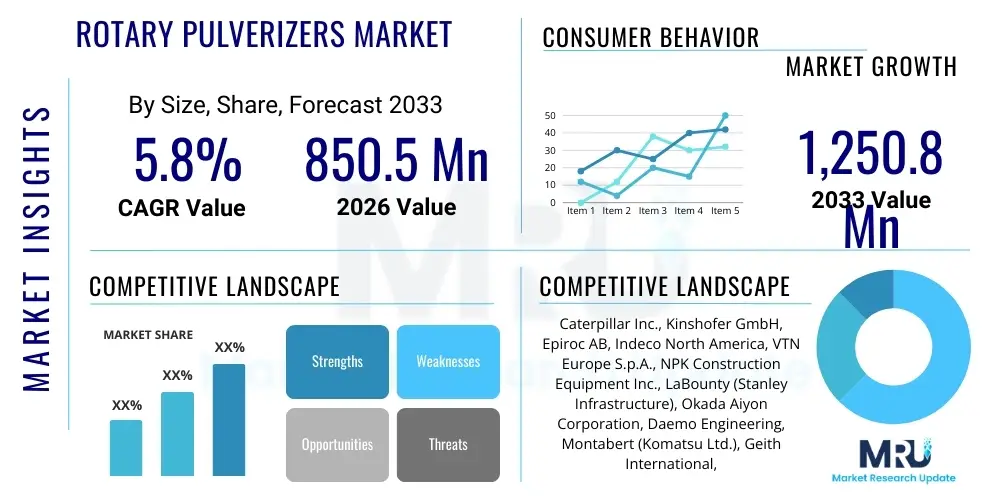

The Rotary Pulverizers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $850.5 Million in 2026 and is projected to reach $1,250.8 Million by the end of the forecast period in 2033.

Rotary Pulverizers Market introduction

The Rotary Pulverizers Market encompasses the global trade and utilization of heavy-duty hydraulic attachments designed for excavators, specialized in the secondary demolition and processing of concrete and masonry structures. These attachments, often featuring 360-degree rotation capabilities, are essential tools in construction waste recycling, enabling operators to efficiently separate reinforcing steel (rebar) from concrete debris, thereby preparing materials for subsequent crushing and processing. The design optimization focuses on high crushing force, rapid jaw cycles, and enhanced durability to withstand abrasive materials found in demanding demolition environments, ensuring optimal throughput and reduced downtime in large-scale projects.

Rotary pulverizers are characterized by their robust construction, typically utilizing high-strength, wear-resistant steel alloys in the jaw structure. Their mechanical advantage lies in the integration of specialized hydraulic cylinders that generate immense crushing power, crucial for breaking down thick concrete sections after primary demolition has occurred. Major applications span across urban renewal projects, bridge dismantling, industrial plant decommissioning, and infrastructure repair where material separation and volume reduction are critical factors for logistical and environmental compliance. The growing emphasis on sustainable construction and the circular economy further cements the market position of these specialized attachments.

The core benefits of employing rotary pulverizers include significant noise reduction compared to traditional impact breakers, increased operational precision, and superior material purity essential for high-quality recycling streams. Key driving factors include stringent environmental regulations mandating construction and demolition (C&D) waste diversion from landfills, rapid urbanization necessitating complex demolition procedures, and technological advancements leading to lighter yet more powerful attachment designs. Furthermore, the increasing complexity of reinforced concrete structures in modern architecture necessitates specialized tools that can handle high volumes of densely packed rebar efficiently and safely, propelling demand across developed and developing economies.

Rotary Pulverizers Market Executive Summary

The Rotary Pulverizers Market is experiencing robust growth driven primarily by escalating global demand for efficient C&D waste management and infrastructure renewal projects, especially in North America and Western Europe where regulatory frameworks incentivize recycling. Business trends indicate a strong move toward hydraulic attachments featuring modular designs, enhanced connectivity for telematics and predictive maintenance, and materials engineered for extended operational lifecycles, reducing the total cost of ownership (TCO). Manufacturers are increasingly focusing on optimizing power-to-weight ratios to enable use on smaller, more versatile excavators, broadening the potential customer base beyond traditional heavy demolition contractors.

Regionally, the Asia Pacific (APAC) region is projected to exhibit the highest growth trajectory, fueled by large-scale infrastructure development in countries like China and India, coupled with significant urban redevelopment initiatives generating substantial volumes of demolition waste. While North America and Europe remain key mature markets, characterized by high adoption rates of advanced, specialized rotating models, Latin America and the Middle East & Africa (MEA) are emerging as high-potential markets dueating to burgeoning construction sectors and increasing investment in localized recycling facilities. Regulatory shifts towards mandated recycling quotas are universally supporting market expansion across these diverse geographical regions.

Segment trends reveal that the rotating pulverizer segment dominates the market due to its superior versatility and maneuverability, allowing precise material handling and positioning critical for secondary reduction tasks. Application-wise, the recycling and material processing segment is demonstrating accelerated growth, outpacing traditional primary demolition uses, reflecting the industry's focus on maximizing valuable material recovery. Furthermore, there is a pronounced trend toward attachments suitable for medium to large excavators (20-40 tons), which offer the optimal balance between power output, reach, and operational efficiency for standard demolition sites and high-volume processing yards.

AI Impact Analysis on Rotary Pulverizers Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Rotary Pulverizers Market primarily revolve around operational efficiency, safety improvements, and predictive maintenance capabilities. Users frequently ask if AI can optimize pulverizer usage patterns, how machine learning algorithms improve the accuracy of material identification during processing, and whether AI-driven diagnostics can significantly reduce unscheduled downtime. These concerns highlight a collective expectation that AI integration will transform reactive maintenance into proactive asset management and enhance material recovery rates, driving a new wave of efficiency gains in demolition and recycling operations.

- AI-driven Predictive Maintenance: Utilizing sensor data and machine learning to forecast component failure (e.g., jaw wear, hydraulic seals) before operational failure occurs, maximizing uptime.

- Automated Cycle Optimization: AI algorithms analyzing material density and structural resistance to automatically adjust hydraulic pressure and jaw closing speed, ensuring maximum crushing efficiency.

- Enhanced Safety Monitoring: Real-time analysis of operating angles, load stress, and proximity to hazards, providing immediate alerts and limiting dangerous operation modes.

- Material Sorting Assistance: Integrating computer vision and AI recognition systems with pulverizer operations, particularly in recycling centers, to identify and separate different grades of concrete and rebar for higher purity yields.

- Digital Twin Simulation: Creating virtual models of pulverizers and demolition sites to simulate wear, optimize attachment design, and plan complex demolition sequences, reducing physical prototyping costs.

- Autonomous Operation Potential: Preliminary research into fully autonomous excavator-pulverizer systems for high-risk or repetitive operational environments, improving operator safety and consistency.

DRO & Impact Forces Of Rotary Pulverizers Market

The Rotary Pulverizers Market is currently subjected to several interconnected dynamics, summarized by the synergistic influence of strong regulatory drivers and technological advancements, occasionally constrained by high initial investment costs and complex maintenance requirements. Market expansion is propelled by global infrastructure spending and the crucial necessity for environmentally responsible handling of C&D waste. The stringent implementation of landfill taxes and recycling mandates acts as a significant external driving force, making the use of efficient processing equipment like rotary pulverizers economically compelling for contractors. These drivers are balanced by the restraining factors such as the specialized training required for operators, the substantial capital outlay required for high-capacity attachments, and volatility in raw material costs (e.g., specialized steel alloys) which affect manufacturing costs and final pricing.

Opportunities for market growth lie predominantly in developing smart attachments, incorporating IoT and sensor technology to provide real-time performance diagnostics and improve operational intelligence. Furthermore, the expansion into niche applications, such as specialized processing within nuclear decommissioning or highly specific quarrying operations, presents avenues for specialized product development. The increasing popularity of rental fleets for heavy equipment also lowers the barrier to entry for smaller contractors, expanding the potential user base and stabilizing demand across various economic cycles. Strategic partnerships between attachment manufacturers and original equipment manufacturers (OEMs) of excavators are crucial for developing fully integrated systems optimized for maximum hydraulic output.

The primary impact forces shaping the competitive landscape include intensified regulatory scrutiny regarding material purity in recycled aggregates, driving demand for more precise separation capabilities. Technological disruption, particularly the adoption of advanced materials engineering to enhance jaw lifespan and reduce weight, constantly pressures manufacturers to innovate. Economic cycles influencing infrastructure spending globally represent a major external impact, directly correlating with the volume of demolition and construction activities. Finally, the shift toward electrification and hybrid machinery in heavy equipment is beginning to influence the design requirements for hydraulic attachments, demanding efficiency optimization tailored to new power sources, ensuring the long-term sustainability and performance viability of rotary pulverizers in a rapidly evolving equipment market.

Segmentation Analysis

The Rotary Pulverizers Market segmentation is strategically based on the distinct technical characteristics of the attachments and their primary deployment environments, ensuring comprehensive market coverage. Segmentation by product type differentiates between the versatility and fixed force application, while segmentation by application focuses on the ultimate end-use of the attachment—whether breaking down concrete in a demolition scenario, preparing material for recycling, or processing rock in a quarry. The crucial element of tonnage capacity, categorized by the size of the carrier excavator, determines the maximum material handling capability and is vital for contractor selection based on project scale and structural specifications, driving the distribution and pricing strategies across the market.

- By Product Type:

- Rotating Pulverizers (360-degree rotation)

- Fixed Pulverizers (Non-rotating)

- By Application:

- Demolition (Primary and Secondary)

- Recycling and Material Processing

- Quarrying and Mining

- Infrastructure Development

- By Excavator Tonnage Capacity:

- Below 15 Tons (Mini and Small Excavators)

- 15 to 30 Tons (Medium Excavators)

- Above 30 Tons (Large and Heavy Excavators)

- By Sales Channel:

- OEM (Original Equipment Manufacturer)

- Aftermarket (Dealers and Distributors)

Value Chain Analysis For Rotary Pulverizers Market

The value chain for the Rotary Pulverizers Market begins with the upstream procurement of specialized raw materials, primarily high-tensile, abrasion-resistant steel alloys and complex hydraulic components (cylinders, seals, valves). Success at this stage relies heavily on forging long-term supplier relationships to ensure material quality, stability of supply, and cost control, crucial given the performance demands placed on these heavy-duty attachments. Manufacturers then engage in intricate design, engineering, and precision fabrication processes, focusing on optimizing the geometric structure of the jaws, the efficiency of the hydraulic circuit, and the overall longevity of the wear parts, ensuring compliance with international safety and performance standards.

The downstream activities involve strategic distribution channels that bridge the gap between production and end-users. Distribution is multifaceted, involving both direct sales by manufacturers, particularly to large corporate contractors or global rental companies, and indirect sales through extensive networks of specialized equipment dealers and regional distributors. These intermediaries provide critical services such as localized technical support, spare parts inventory management, and maintenance services, which are essential factors influencing purchase decisions and customer loyalty within the heavy equipment sector. Effective logistics management is paramount due to the large size and weight of the pulverizers, requiring specialized freight handling and installation expertise.

Direct distribution often facilitates customization and specialized order fulfillment, catering to unique project requirements or integration demands with specific excavator models. Conversely, indirect distribution ensures broader market penetration, particularly in geographically dispersed or emerging markets where localized presence and trusted dealership relationships are critical for sales success. Furthermore, the aftermarket segment—focused on wear parts replacement, repairs, and scheduled maintenance services—forms a significant and high-margin component of the value chain, extending the operational life of the product and securing ongoing revenue streams for the market participants.

Rotary Pulverizers Market Potential Customers

The primary consumers and end-users of rotary pulverizers are professional entities engaged in large-scale structural dismantling and material processing, requiring robust tools for secondary concrete reduction and rebar separation. Major segments include specialized demolition contractors who require precision tools for complex urban environments and industrial site dismantling, where safety and noise constraints are paramount. Additionally, construction material recycling yards represent a significant customer base, relying on pulverizers to process incoming C&D waste streams, separating valuable aggregates from ferrous metals to create marketable products and maximize waste diversion efficiency.

Infrastructure development authorities and large civil engineering firms also constitute vital potential customers, utilizing these attachments for bridge removal, road rehabilitation, and large-scale public works projects where high throughput is mandatory. Mining and quarrying operations occasionally use specialized heavy-duty pulverizers for secondary rock breaking and processing in environmentally sensitive areas where traditional blasting is restricted or uneconomical. Furthermore, equipment rental companies serve as key intermediaries, purchasing large fleets of standard models to cater to short-term project demands from smaller or intermittent contractors, thus expanding the accessibility of the technology.

The purchasing criteria for these end-users are highly technical, prioritizing the attachment's weight-to-power ratio, the durability of wear components (e.g., replaceable teeth and cutters), operational flexibility provided by 360-degree rotation, and seamless integration with their existing excavator fleet. Decision-makers assess the total cost of ownership, factoring in fuel efficiency impacts, maintenance frequency, and the anticipated lifespan of the product under heavy use. Therefore, successful market penetration requires manufacturers to demonstrate superior performance metrics, reliability, and comprehensive post-sales service and parts availability.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $850.5 Million |

| Market Forecast in 2033 | $1,250.8 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Caterpillar Inc., Kinshofer GmbH, Epiroc AB, Indeco North America, VTN Europe S.p.A., NPK Construction Equipment Inc., LaBounty (Stanley Infrastructure), Okada Aiyon Corporation, Daemo Engineering, Montabert (Komatsu Ltd.), Geith International, Hammer SRL, OSA Demolition Equipment, Allied Construction Products, Trevi Benne S.p.A., Rammer (Sandvik), Genesis Attachments, Xcentric Ripper International, Mantovanibenne S.p.A., ECY Haulmark Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Rotary Pulverizers Market Key Technology Landscape

The technological landscape of the Rotary Pulverizers Market is defined by continuous innovation focused on enhancing material durability, hydraulic efficiency, and operational intelligence. A central technological development is the shift towards advanced proprietary steel alloys, such as HARDOX or equivalent high-tensile steels, which significantly extend the lifespan of the jaw plates and cutting blades, reducing the frequency of costly replacements and maintenance downtime. Furthermore, sophisticated hydraulic regeneration circuits are increasingly integrated into newer models, which capture and reuse hydraulic fluid energy during the jaw opening cycle. This technical advancement lowers overall fuel consumption of the carrier excavator and increases the speed and consistency of the pulverizing operation, enhancing productivity on site.

Another crucial technological element is the refinement of the 360-degree rotation mechanisms, often utilizing robust slew bearings and powerful hydraulic motors to provide precise positioning control. This rotational capability is vital for complex demolition tasks, allowing operators to attack structural components from optimal angles and manage material placement effectively, thereby improving site safety and reducing manual handling requirements. Manufacturers are also implementing bolt-on, interchangeable wear parts (e.g., teeth and blades) that simplify field maintenance and minimize the specialized tooling required for routine servicing, making the equipment more user-friendly and reliable across diverse operational environments globally.

The integration of digital technology is rapidly gaining traction. Modern rotary pulverizers are often equipped with mounting points for telematics sensors, facilitating the monitoring of key performance indicators (KPIs) such as operational hours, hydraulic pressure peaks, and component stress levels. This data allows for condition-based monitoring, transitioning the industry toward predictive maintenance models. Furthermore, innovations in quick coupler systems allow faster, safer changes between different attachments, maximizing the versatility and utilization rate of the carrier excavator on multi-faceted projects. These technological integrations underscore the industry’s commitment to safety, efficiency, and long-term asset value preservation.

Regional Highlights

- North America (U.S. and Canada): This region holds a significant market share characterized by the high adoption of large, specialized rotating pulverizers. Demand is fueled by extensive infrastructure revitalization programs, particularly bridge decommissioning and urban renewal, alongside strict waste disposal regulations that strongly favor on-site concrete processing and recycling. The market is mature, emphasizing high-performance, robust attachments and sophisticated telematics integration.

- Europe (Germany, UK, France, Italy): Europe is a leading market driven by stringent C&D waste recycling directives (Waste Framework Directive) and a mature construction industry focused on sustainability and noise reduction in urban demolition. Central and Western Europe exhibit strong demand for mid-range (15-30 ton) specialized pulverizers used for precision secondary demolition and high-purity material recovery in densely populated areas. Innovation often focuses on quieter operation and minimal vibration.

- Asia Pacific (APAC) (China, Japan, India, South Korea): APAC is the fastest-growing market globally, propelled by massive urbanization, infrastructure investment, and industrial expansion. While cost-sensitivity remains a factor, the sheer volume of construction and demolition waste generated, especially in China and India, is driving exponential demand for high-capacity pulverizers for both primary demolition and large-scale recycling yards. Japan and South Korea lead in adopting advanced, high-technology models.

- Latin America (Brazil, Mexico): This region represents an emerging market with moderate growth, primarily driven by investments in mining infrastructure and urban development projects. Market adoption is gradually increasing as contractors recognize the long-term economic benefits of efficient material processing, moving away from less specialized equipment. Price competitiveness and robust local support networks are key competitive factors.

- Middle East and Africa (MEA) (GCC Countries, South Africa): Growth in MEA is concentrated in the Gulf Cooperation Council (GCC) countries, supported by large-scale mega-projects and oil and gas infrastructure decommissioning. Demand is cyclical, linked closely to large government construction mandates. South Africa shows steady demand driven by mining and quarrying applications where durable, high-impact attachments are essential for rock processing.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Rotary Pulverizers Market.- Caterpillar Inc.

- Kinshofer GmbH

- Epiroc AB

- Indeco North America

- VTN Europe S.p.A.

- NPK Construction Equipment Inc.

- LaBounty (Stanley Infrastructure)

- Okada Aiyon Corporation

- Daemo Engineering

- Montabert (Komatsu Ltd.)

- Geith International

- Hammer SRL

- OSA Demolition Equipment

- Allied Construction Products

- Trevi Benne S.p.A.

- Rammer (Sandvik)

- Genesis Attachments

- Xcentric Ripper International

- Mantovanibenne S.p.A.

- ECY Haulmark Ltd.

Frequently Asked Questions

Analyze common user questions about the Rotary Pulverizers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of using a rotating pulverizer over a fixed model?

Rotating pulverizers offer 360-degree positioning, dramatically increasing versatility and precision in secondary demolition. This capability allows operators to approach structures from any angle, maximizing efficiency, especially when separating rebar from concrete or working in confined urban spaces.

How do global recycling mandates impact the market demand for rotary pulverizers?

Stringent global mandates, particularly in Europe and North America, require high diversion rates for construction and demolition (C&D) waste. Pulverizers are essential for this process as they efficiently reduce concrete volume and separate materials, enabling compliance and making recycled aggregates commercially viable.

What is the key technological focus for manufacturers in the Rotary Pulverizers Market?

The key technological focus is on enhancing the durability of wear parts through advanced steel alloys, improving hydraulic efficiency via regeneration circuits for better fuel economy, and integrating telematics for predictive maintenance and real-time performance monitoring.

Which geographical region is anticipated to show the highest growth rate for rotary pulverizers?

The Asia Pacific (APAC) region, particularly driven by massive urbanization and large-scale infrastructure projects in countries like China and India, is anticipated to exhibit the highest Compound Annual Growth Rate (CAGR) due to the immense volume of concrete demolition and recycling activity.

What size excavator is typically required to operate a high-capacity rotary pulverizer effectively?

High-capacity rotary pulverizers are most effectively operated on heavy excavators, generally those with an operating weight of Above 30 Tons, ensuring sufficient hydraulic flow, stability, and lifting capacity to handle large concrete structures safely and efficiently.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager