Rotary Screener Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432469 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Rotary Screener Market Size

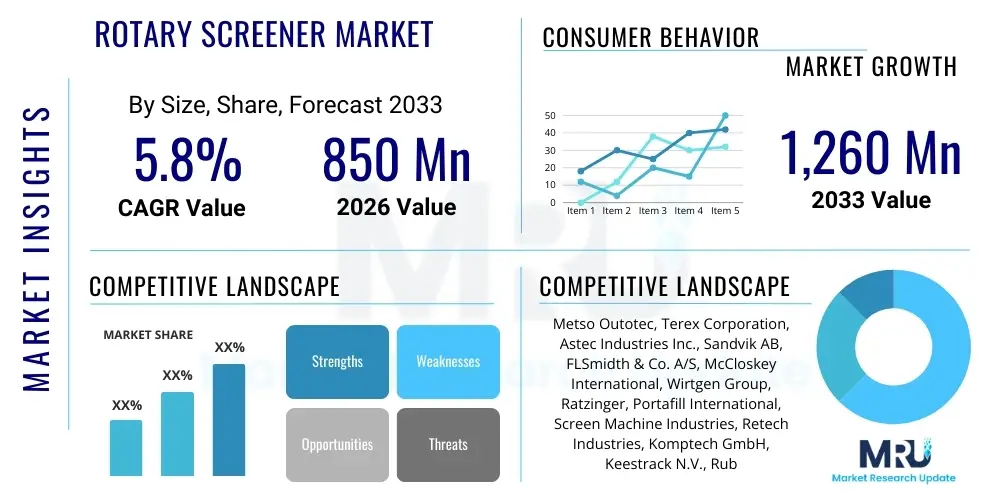

The Rotary Screener Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 850 Million in 2026 and is projected to reach USD 1,260 Million by the end of the forecast period in 2033. This consistent expansion is primarily driven by the escalating global demand for efficient material separation across heavy industries, particularly in construction, mining, and municipal waste management sectors. The necessity for precise classification of materials, coupled with increasing regulatory pressure to recycle construction and demolition (C&D) waste, provides substantial momentum to the market’s trajectory. Furthermore, advancements in modular design and integration of smart diagnostics are enhancing the overall adoption rate of modern rotary screening solutions globally.

Rotary Screener Market introduction

The Rotary Screener Market encompasses machinery designed for the volumetric separation and classification of bulk materials based on particle size. These robust industrial systems, often known as trommel screens, employ a rotating cylindrical drum, equipped with various aperture sizes, to efficiently process aggregates, waste, compost, biomass, and other raw materials. The mechanical action of the rotating drum tumbles the material, allowing undersized particles to fall through the screen openings while oversized materials are retained and discharged separately. This process is fundamental in optimizing material quality and preparing input streams for subsequent processing stages, significantly impacting operational efficiency and end-product purity in numerous heavy industries. The technology is valued for its high throughput, effectiveness in handling wet or sticky materials, and relatively low maintenance requirements compared to certain vibrating screen alternatives.

Major applications of rotary screeners span critical infrastructure and resource management sectors. In the mining industry, they are indispensable for primary size reduction and pre-sorting of ore, aggregates, and coal, ensuring optimized feed for crushers and grinders. For construction and demolition (C&D) waste recycling, rotary screeners are crucial for separating concrete, wood, soil, and plastics, facilitating compliance with waste diversion mandates and reducing landfill volumes. Additionally, the compost and agriculture sectors rely heavily on rotary screens for refining organic materials, producing marketable soil amendments, and managing large volumes of vegetative waste. The versatility of rotary screeners, allowing for interchangeable screen panels and adjustable rotation speeds, makes them highly adaptable to diverse operational requirements and material characteristics.

The principal driving factors fueling market growth include rapid global urbanization, which necessitates immense infrastructural development, and the subsequent surge in demand for quarried aggregates and construction materials. Simultaneously, stringent environmental regulations in developed economies are accelerating the adoption of C&D waste recycling technologies, positioning rotary screeners as essential equipment in waste processing facilities. The core benefit these machines provide—high efficiency in separating complex, high-moisture content feedstock—directly translates into reduced material handling costs and enhanced profitability for operators. Technological innovations focused on incorporating features like self-cleaning brushes, improved dust suppression systems, and integrated real-time monitoring further solidify the market's growth potential by offering improved operational reliability and environmental compliance.

Rotary Screener Market Executive Summary

The global Rotary Screener Market is characterized by robust growth, underpinned by sustained capital expenditure in mining exploration and resource recovery, coupled with the global shift towards circular economy models emphasizing waste processing and recycling. Business trends indicate a strong move toward modular, highly mobile screening units, which offer enhanced flexibility and reduced commissioning time for contractors operating across multiple sites or in remote locations. Key market participants are focusing their strategic efforts on geographical expansion, particularly within high-growth Asia Pacific economies, and the integration of digital solutions for remote monitoring and predictive maintenance. This competitive landscape is driving innovation in material science for screen media, focusing on durability and non-blinding characteristics, thereby maximizing uptime and overall operational efficiency across demanding environments.

Regional trends reveal Asia Pacific (APAC) as the dominant and fastest-growing region, fueled by massive infrastructure projects in nations like China, India, and Southeast Asian countries, requiring vast quantities of classified aggregates and construction materials. North America and Europe, while mature, demonstrate stable demand, driven primarily by replacement cycles, regulatory mandates for advanced environmental controls (such as stringent dust emissions standards), and the need for sophisticated municipal solid waste (MSW) sorting technologies. The European market, in particular, showcases a high adoption rate of electric-powered mobile screeners, aligning with ambitious decarbonization goals and noise reduction policies within urban operational areas. Latin America and the Middle East and Africa (MEA) are emerging markets, with growth linked to nascent mining projects and burgeoning waste management infrastructure development.

Segment trends highlight the continued dominance of the Trommel screen type segment due to its unparalleled ability to handle wet, sticky, and heterogeneous materials found commonly in composting and waste streams. However, the Vibrating Screen segment, though less effective with highly cohesive materials, is gaining traction in specific mining and quarrying applications where high frequency and precise, fine particle separation are paramount. Application-wise, the Waste Management sector is poised to witness the highest CAGR, propelled by global commitments to divert waste from landfills and the rising complexity of material recovery facility (MRF) operations. Segmentation by capacity also shows a growing demand for high-capacity, heavy-duty machines capable of handling volumes exceeding 500 tons per hour (TPH), reflecting the scale of modern industrial operations.

AI Impact Analysis on Rotary Screener Market

User queries regarding the impact of Artificial Intelligence (AI) on the Rotary Screener Market frequently revolve around optimizing operational parameters, predicting component failure, and enhancing material quality control. Users often ask: "Can AI automatically adjust the trommel rotation speed based on real-time material moisture?" and "How can machine learning reduce the blinding rate of screen media?" The consensus among users is an expectation that AI and associated data analytics will transform the traditionally mechanical process of screening into a more adaptive and self-regulating system. Key themes emerging from these discussions include the desire for automated feedstock analysis, minimizing human intervention in optimizing separation efficiency, and leveraging predictive diagnostics to extend the lifespan of expensive wear parts. Concerns often center on the complexity and cost associated with integrating sophisticated sensors and AI platforms into existing, often legacy, rotary screener fleets, alongside ensuring data security and system reliability in harsh operating environments.

The integration of AI technologies is fundamentally shifting the maintenance and operational strategies within the Rotary Screener Market. By utilizing Machine Learning (ML) algorithms, manufacturers can process vast datasets collected from integrated sensors—monitoring vibration, sound, motor load, temperature, and material flow rates—to establish accurate baseline operational models. This data-driven approach allows the system to instantaneously detect anomalies that signify the onset of mechanical failure, such as bearing degradation or structural fatigue, long before traditional vibration analysis or visual inspection would identify the issue. This pivot towards true predictive maintenance (PdM) dramatically reduces unplanned downtime, optimizing scheduling for component replacement during pre-planned service intervals, thereby achieving significant reductions in operational expenditure (OPEX) and enhancing machine availability, which is critical in high-throughput environments.

Beyond maintenance, AI algorithms are also revolutionizing process control and material flow optimization. Advanced vision systems, combined with deep learning models, can analyze the composition and particle size distribution of the incoming feedstock in real-time. This allows the rotary screener’s control system to dynamically adjust key operating variables, such as drum angle, rotational velocity, and feeder speed, to maintain optimal separation efficiency even when the material characteristics change rapidly (e.g., shifts in moisture content or bulk density). This level of autonomous adaptation ensures maximum throughput and consistent product quality, especially vital in complex sorting applications like mixed waste processing or highly regulated aggregate production. The cumulative impact is the evolution of the rotary screener from a passive mechanical tool into an active, intelligent material processing node within the broader industrial ecosystem, driving higher rates of resource recovery and energy efficiency.

- AI-driven Predictive Maintenance (PdM) utilizing sensor data to forecast component failure and schedule proactive repairs, minimizing expensive unplanned downtime.

- Real-time autonomous optimization of drum rotational speed, angle, and feed rate based on ML analysis of feedstock characteristics (moisture, density).

- Enhanced quality control through computer vision systems that analyze and adjust separation processes to meet stringent particle size specifications.

- Development of digital twins for simulating operational scenarios, training operators, and optimizing machine design for specific application profiles.

- Improved energy efficiency through AI algorithms that regulate motor power consumption based on real-time load requirements, avoiding unnecessary energy spikes.

- Automation of complex cleaning cycles and anti-blinding protocols based on sensor feedback regarding screen aperture blockage, enhancing throughput consistency.

DRO & Impact Forces Of Rotary Screener Market

The dynamics of the Rotary Screener Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively define the Impact Forces influencing market adoption and growth trajectory. Key drivers include the overwhelming global demand for construction aggregates driven by urbanization and state-funded infrastructure projects, alongside mandatory regulatory frameworks pushing for efficient waste recycling and resource recovery. Conversely, significant restraints involve the high initial capital expenditure (CAPEX) required for sophisticated screening units, coupled with the specialized maintenance requirements and substantial operating costs, particularly in remote regions. The primary opportunities lie in the rapidly increasing adoption of mobile, modular screening solutions and the integration of Internet of Things (IoT) sensors and data analytics to enhance operational transparency and efficiency, offering compelling value propositions to end-users focusing on total cost of ownership (TCO). These factors combine to exert significant impact forces, compelling manufacturers to innovate in areas of energy efficiency, portability, and automation to overcome market inertia and capture emerging demand.

Impact forces stemming from global economic trends, environmental policy, and technological maturity exert pressure on the market. Economic impact forces relate directly to commodity prices and infrastructure spending cycles; a boom in mining or construction activity immediately boosts demand for screening equipment. Environmental impact forces, driven by increasing public awareness and governmental mandates (e.g., carbon reduction targets and zero-waste policies), necessitate the use of high-efficiency, low-emission screeners, favoring electric models and those with superior dust suppression technology. These environmental pressures act as powerful drivers, forcing industries to invest in new, compliant equipment. Furthermore, the rising cost and scarcity of skilled labor are creating a technology pull force, increasing the demand for highly automated and remotely operable screeners that minimize reliance on onsite personnel and enhance site safety, effectively transforming labor complexity into an opportunity for technological differentiation.

Specific restraints, such as the inherent challenges of processing highly cohesive or extremely abrasive materials which lead to premature wear and screen blinding, act as barriers to full market penetration, particularly in applications dealing with clay-rich soils or specific industrial residues. Addressing these restraints requires manufacturers to invest heavily in material science for screen media (e.g., high-density polyurethane or specialized rubber) and incorporate physical mechanisms like self-cleaning systems, mitigating the operational risks associated with sticky feedstock. The overall impact forces suggest a market moving towards premiumization, where initial cost barriers are gradually overcome by the long-term economic advantages derived from high uptime, superior sorting precision, and reduced lifecycle maintenance costs offered by technologically advanced rotary screening systems.

Segmentation Analysis

The Rotary Screener Market is comprehensively segmented based on Type, Application, End-Use Capacity, and Mobility, providing a granular view of market dynamics and catering to the diverse needs of the global industry. The core segmentation by Type differentiates between the primary operating mechanisms, namely Trommel Screens, Vibrating Screens, and Gyratory Screens, each optimized for different material characteristics and throughput requirements. Trommel screens typically dominate segments involving large-scale processing of organic matter and waste due to their superior handling of wet and sticky materials, while high-frequency vibrating screens are preferred for fine classification of dry aggregates. Analyzing these segments is crucial for understanding technological preferences and investment allocation across different industrial verticals, such as mining versus recycling.

Segmentation by Application is critical, as it directly correlates equipment demand with specific industrial cycles. Key applications include Mining and Quarrying (focused on large, heavy-duty machines), Construction and Infrastructure (demanding mobility and high throughput for C&D waste), Waste Management and Recycling (requiring versatility for heterogeneous waste streams), and Agriculture and Composting (focusing on purity and gentle material handling). The divergent growth rates across these applications—with Waste Management often exhibiting the highest CAGR due to regulatory impetus—highlight where future investment and innovation are likely to be concentrated. Furthermore, the segmentation by End-Use Capacity distinguishes between equipment catering to small-scale independent contractors requiring low throughput (under 50 TPH) and industrial giants needing ultra-high capacity solutions (over 500 TPH), reflecting differences in capital investment capabilities and operational scale.

A crucial segmentation for modern market tracking is Mobility, separating stationary (fixed-plant) screeners from mobile (tracked or wheeled) screeners. The proliferation of mobile units, driven by contractors seeking flexibility and reduced transportation logistics across multiple sites, represents a significant growth vector. Stationary units, while requiring higher initial installation, remain essential for large, long-term processing facilities like major mines or centralized municipal recycling centers where continuous, high-volume operations are the standard. The geographical distribution and material handling characteristics dictate the preferred mobility segment, with mobile screeners capturing increasing market share, particularly in developed economies with high labor costs and stringent site time limitations.

- By Type:

- Trommel Screens (Dominant in waste and compost)

- Vibrating Screens (Key for aggregates and mining)

- Gyratory Screeners (Specialized fine screening)

- By Application:

- Mining and Quarrying

- Construction and Infrastructure

- Waste Management and Recycling (C&D, MSW)

- Agriculture and Forestry

- Compost and Soil Amendment Production

- By End-Use Capacity (Tons Per Hour - TPH):

- Low Capacity (Up to 50 TPH)

- Medium Capacity (50 TPH – 250 TPH)

- High Capacity (Above 250 TPH)

- By Mobility:

- Stationary/Fixed Plant

- Mobile (Tracked and Wheeled)

Value Chain Analysis For Rotary Screener Market

The value chain for the Rotary Screener Market begins with the upstream supply of critical raw materials, primarily high-grade steel alloys and specialized wear-resistant components (such as rubber or polyurethane liners and screen media). Upstream efficiency is fundamentally linked to global steel price volatility and the reliable sourcing of specialized materials essential for ensuring the longevity and durability of the screening drum and chassis. Manufacturers rely on robust supplier relationships to mitigate commodity price risks and ensure the timely delivery of precision-engineered components, including sophisticated gearboxes, bearings, hydraulic systems, and increasingly, specialized electronic sensors and automation components necessary for modern smart screeners. Maintaining quality control at this initial stage is paramount, as component failure in harsh operating environments can lead to costly operational shutdowns, heavily influencing the final product's reputation and total cost of ownership.

The manufacturing stage involves high-precision fabrication, machining, and assembly, often demanding significant capital investment in advanced welding robots and CNC machinery to ensure tight tolerances for the rotating drum mechanism. Key activities include the design and engineering of modular components, integration of complex drive systems (variable speed drives), and testing the assembled unit under simulated load conditions. Downstream activities focus heavily on establishing effective distribution channels. The market relies predominantly on a hybrid model comprising direct sales for large, customized stationary plants and an extensive network of independent, authorized dealers and distributors for mobile and standard-model screeners. These dealer networks are crucial as they provide localized sales support, equipment financing options, and, most importantly, critical after-sales services, including parts replacement, technical support, and preventative maintenance contracts, which constitute a significant revenue stream for manufacturers.

The final stage of the value chain involves end-user operation and servicing. End-users (e.g., mining firms, construction contractors, recycling operators) assess the equipment based on metrics like throughput stability, energy consumption per ton processed, and overall reliability. Indirect channels, represented by rental and leasing companies, play an increasingly important role, especially for small and medium-sized enterprises (SMEs) that prefer flexible operational expenditure (OPEX) over large capital outlay. The trend towards integrating IoT and telematics enhances the downstream value proposition by allowing manufacturers and dealers to offer proactive service monitoring and predictive analytics. This integrated service model strengthens the link between the OEM and the customer, extending the economic life of the equipment and reinforcing brand loyalty within a highly competitive industrial machinery landscape.

Rotary Screener Market Potential Customers

Potential customers for rotary screeners span a wide spectrum of heavy industries fundamentally involved in bulk material handling, separation, and purification. The primary end-users can be broadly categorized into mining and quarrying corporations, large civil engineering and construction firms, municipal and private waste management operators, and agricultural enterprises focusing on composting and soil production. Mining companies, often characterized by high capital budgets and continuous, demanding operations, seek high-capacity, durable stationary units capable of operating reliably in harsh environments for primary material sizing. Their procurement decisions are heavily influenced by equipment uptime guarantees, maintenance cost profiles, and throughput consistency, prioritizing ruggedness over mere initial cost.

Construction contractors and demolition specialists represent another major customer segment, particularly driving the demand for mobile and easily relocatable rotary screeners. These buyers require versatile equipment that can process mixed construction and demolition (C&D) waste efficiently on site, reducing transportation costs and accelerating material recycling efforts to comply with local building regulations. For this segment, ease of maintenance, rapid deployment, and the machine's ability to handle highly heterogeneous and often abrasive feedstock are key purchasing criteria. The shift toward sustainable building practices mandates higher material recovery rates, making rotary screeners an essential asset in modern construction project planning and execution.

Furthermore, waste management authorities and commercial composting facilities constitute a rapidly expanding customer base. These entities require screeners optimized for separating organic waste, municipal solid waste (MSW) fractions, and sludge into marketable or reusable derivatives. Efficiency in handling high-moisture, sticky materials—a characteristic where trommel screens excel—is paramount for these end-users. Their procurement typically focuses on machines with superior self-cleaning capabilities, robust anti-blinding features, and compliance with stringent public health and environmental standards regarding noise and odor control. The purchasing decision for all customer groups is increasingly becoming risk-averse, favoring suppliers who offer comprehensive service packages, proven fuel efficiency, and technological integration (IoT) to ensure optimal long-term operational performance.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 Million |

| Market Forecast in 2033 | USD 1,260 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Metso Outotec, Terex Corporation, Astec Industries Inc., Sandvik AB, FLSmidth & Co. A/S, McCloskey International, Wirtgen Group, Ratzinger, Portafill International, Screen Machine Industries, Retech Industries, Komptech GmbH, Keestrack N.V., Rubble Master HMH GmbH, Edge Innovate, General Kinematics, Minyu Machinery Corp., Superior Industries, Haver & Boecker Niagara, MMD Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Rotary Screener Market Key Technology Landscape

The technological landscape of the Rotary Screener Market is rapidly evolving beyond basic mechanical rotation, driven by demands for increased efficiency, reduced environmental impact, and seamless operational integration. A critical development is the widespread adoption of variable frequency drive (VFD) technology, which allows operators precise control over the drum's rotational speed. This adaptability is essential for optimizing screening performance when handling diverse and changing feedstock materials, such as shifting from dry aggregates to high-moisture organic waste. VFDs not only maximize separation efficiency but also contribute significantly to energy savings by ensuring the motor operates at the optimal power level required for the load, minimizing unnecessary energy consumption compared to fixed-speed systems. Furthermore, modern screeners increasingly feature modular designs, enabling quicker assembly and dismantling, which is pivotal for mobile operations and reducing logistical complexity across various job sites.

Another dominant technological trend involves the sophisticated integration of sensor technology and telematics. Modern rotary screeners are equipped with a network of sensors monitoring vibration analysis, bearing temperature, oil condition, and material flow through the drum. This connectivity facilitates real-time data transmission to centralized operational dashboards via IoT platforms. The collected data is crucial for implementing advanced AI-driven predictive maintenance programs, allowing operators to transition from reactive repairs to proactive servicing, drastically improving equipment uptime and overall reliability. Furthermore, the integration of global positioning systems (GPS) and geofencing capabilities in mobile screeners enhances fleet management, improves asset security, and aids in optimizing machine allocation across large-scale projects, leading to higher asset utilization rates for leasing and contracting companies.

Environmental compliance and dust control are also major technological focus areas. Innovations include advanced dust suppression systems, often utilizing high-pressure water misting nozzles or integrated vacuum systems that capture fine particulate matter at transfer points, ensuring adherence to stringent air quality regulations, particularly in urban construction and quarrying sites. Screen media technology is continually advancing, moving toward specialized polyurethane and rubber components that offer superior wear resistance and non-blinding properties when processing sticky materials like clay or high-moisture compost, thereby maintaining consistent throughput without frequent manual intervention. These continuous innovations collectively contribute to lower operational costs, improved workplace safety, and a reduced environmental footprint, cementing technology as a primary differentiator in the competitive rotary screener market.

Regional Highlights

The Asia Pacific (APAC) region is currently the dominant market for rotary screeners and is forecasted to maintain the highest growth trajectory throughout the forecast period. This acceleration is overwhelmingly driven by unprecedented government investments in large-scale infrastructure and urbanization projects, particularly in rapidly industrializing economies like India, China, and Southeast Asian nations (Indonesia, Vietnam). These projects necessitate massive volumes of aggregates, crushed stone, and recycled construction materials, directly fueling demand for high-capacity, heavy-duty screening equipment. Furthermore, escalating environmental concerns and new government mandates related to municipal solid waste (MSW) and C&D waste recycling in major APAC cities are creating robust secondary markets for trommel screens and specialized recycling equipment. Local manufacturers are increasingly adopting modular and mobile designs to cater to the logistical challenges and demanding schedules inherent in major regional construction efforts.

North America and Europe represent mature markets characterized by replacement cycles, regulatory adherence, and a strong preference for technological sophistication. In North America, demand is heavily influenced by the revitalized focus on domestic infrastructure modernization (roads, bridges, utilities) and the highly developed mining sector, which prioritizes large, stationary plants offering high levels of automation and integration with IoT systems for efficiency. European market growth, conversely, is profoundly shaped by stringent environmental protection legislation, particularly concerning carbon emissions and noise pollution. This regulatory environment drives a strong demand for low-emission, energy-efficient electric-powered mobile screeners and specialized separation technology required for complex waste streams, aligning with the EU’s circular economy mandates. Manufacturers targeting these regions must comply with strict safety standards and offer superior telematics packages and high-precision screening capabilities.

The emerging markets of Latin America (LATAM) and the Middle East and Africa (MEA) offer significant, albeit more volatile, growth potential. Growth in LATAM is intrinsically linked to commodity price cycles, particularly the extraction of copper, iron ore, and precious metals, driving demand for heavy screening equipment in primary resource processing. However, political instability and foreign exchange fluctuations can pose restraints. In the MEA region, substantial investment in large-scale urban development projects (e.g., in the UAE and Saudi Arabia) and the development of new mining frontiers across Africa are stimulating demand. These regions often favor robust, easy-to-maintain equipment that can handle extreme temperatures and abrasive desert conditions. The challenge in MEA often lies in developing robust distribution and servicing networks due to the vast geographical distances and infrastructure limitations, making the availability of reliable, locally supported maintenance services a crucial competitive advantage.

- Asia Pacific (APAC): Leading market size and growth rate, driven by urbanization, infrastructure mega-projects, and mandated waste recycling initiatives in China and India.

- North America: Stable demand fueled by infrastructure revitalization, established mining sectors, and high adoption rates of AI/IoT-enabled predictive maintenance systems.

- Europe: Focus on high-efficiency, low-emission (electric/hybrid) mobile screeners, propelled by rigorous EU environmental and noise pollution regulations.

- Latin America (LATAM): Growth tied to cyclical demand from key resource extraction industries, especially iron ore and copper mining.

- Middle East and Africa (MEA): Emerging growth due to large-scale construction development and new mining investments, requiring rugged, high-capacity equipment suitable for harsh climates.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Rotary Screener Market.- Metso Outotec

- Terex Corporation

- Astec Industries Inc.

- Sandvik AB

- FLSmidth & Co. A/S

- McCloskey International

- Wirtgen Group (John Deere)

- Komptech GmbH

- Keestrack N.V.

- Rubble Master HMH GmbH

- Edge Innovate

- General Kinematics

- Portafill International

- Screen Machine Industries

- Minyu Machinery Corp.

- Superior Industries

- Haver & Boecker Niagara

- MMD Group

- Retech Industries

- Pronar Sp. z o.o.

Frequently Asked Questions

Analyze common user questions about the Rotary Screener market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a rotary screener (trommel) and a vibrating screen?

The primary difference lies in the mechanism and suitability of material. Rotary screeners use a slow, tumbling rotation of a cylindrical drum, making them superior for handling wet, sticky, or heterogeneous materials (like compost or MSW) and for high throughput. Vibrating screens use high-frequency oscillation, making them ideal for precise separation of dry, granular materials (like fine aggregates) and high-volume mining applications where high efficiency is required.

How is the adoption of AI and IoT affecting the operational costs of rotary screeners?

AI and IoT integration significantly lower operational costs by enabling predictive maintenance (PdM). By monitoring vibration and performance data in real-time, systems can predict component failures, minimizing unplanned downtime, reducing labor costs associated with reactive repairs, and ensuring maximum asset utilization, leading to a reduced total cost of ownership (TCO).

Which application segment is driving the highest growth rate in the Rotary Screener Market?

The Waste Management and Recycling segment is projected to exhibit the highest Compound Annual Growth Rate (CAGR). This growth is driven by increasing global regulatory pressure to divert construction and demolition (C&D) waste and municipal solid waste (MSW) from landfills, necessitating investments in robust, high-efficiency trommel screening technology for material recovery facilities (MRFs).

What are the key environmental benefits associated with modern rotary screeners?

Modern rotary screeners offer significant environmental benefits, primarily through enhanced resource recovery, which reduces landfill waste volume and the need for virgin material extraction. Additionally, new models feature integrated, high-efficiency dust suppression systems and increasingly utilize electric or hybrid power systems, substantially lowering carbon emissions and reducing noise pollution on job sites, aiding compliance with urban environmental mandates.

What factor is most critical for choosing between a mobile and a stationary rotary screener?

The most critical factor is the required operational flexibility and permanence of the processing site. Mobile screeners (tracked or wheeled) are essential for contract work across multiple locations or short-term projects, emphasizing quick setup and transport. Stationary screeners are chosen for large, long-term facilities (major quarries, centralized recycling plants) that require maximum throughput, durability, and deep integration into a fixed processing circuit.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager