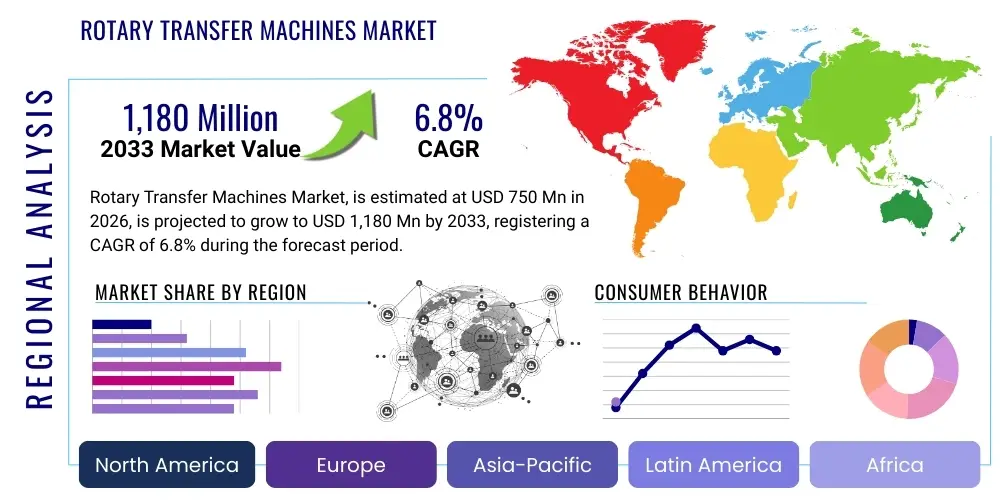

Rotary Transfer Machines Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437964 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Rotary Transfer Machines Market Size

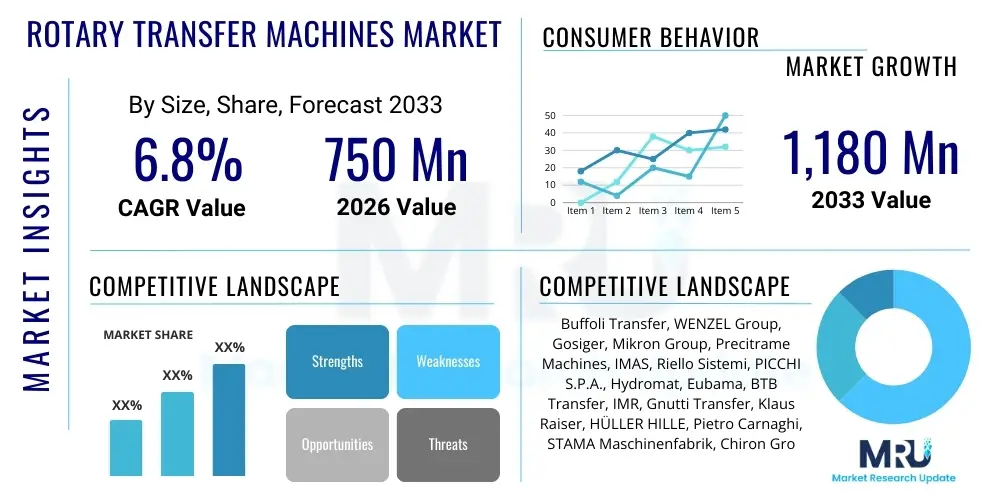

The Rotary Transfer Machines Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $750 Million in 2026 and is projected to reach $1,180 Million by the end of the forecast period in 2033.

Rotary Transfer Machines Market introduction

Rotary transfer machines are highly specialized, multi-station machining centers designed for the rapid and simultaneous processing of complex components. These machines operate by rotating a central pallet or table, which indexes workpieces sequentially through various fixed tooling stations. Unlike traditional sequential machining, rotary transfer technology allows for operations such as drilling, tapping, milling, threading, and turning to occur concurrently, significantly reducing cycle times and optimizing mass production efficiency. This capability makes them indispensable in industries requiring high volumes of precision parts, such as the automotive, hydraulics, and fluid power sectors.

The core product offering includes machines categorized by the number of stations—ranging typically from 3 to 12 or more—and the type of actuation system utilized, predominantly hydraulic, pneumatic, or advanced servo-electric systems. Servo-electric models are gaining prominence due to their superior energy efficiency, higher precision control, and simplified maintenance compared to their hydraulic counterparts. Major applications span the manufacturing of fittings, valves, brake components, injectors, and sophisticated medical device parts. The demand for these machines is intrinsically linked to the global expansion of high-precision manufacturing and the continuous necessity for faster, more accurate production methods in automotive electrification and aerospace component fabrication.

Key benefits driving market adoption include unmatched production throughput, exceptional repeatability, and the capability to consolidate multiple manufacturing processes onto a single platform, thereby minimizing handling risks and floor space requirements. The convergence of Industry 4.0 principles, integrating IoT sensors, real-time data monitoring, and predictive maintenance capabilities, is further enhancing the appeal of modern rotary transfer systems. Driving factors specifically revolve around the stringent quality standards in end-use industries, the rising complexity of component geometries, and the persistent global pressure on manufacturers to achieve cost-competitive production cycles while maintaining zero-defect output.

Rotary Transfer Machines Market Executive Summary

The Rotary Transfer Machines Market exhibits robust business trends driven by global manufacturing digitalization and the shift towards complex component production. A primary business trend involves the increased adoption of modular and flexible rotary transfer systems, allowing manufacturers to adapt quickly to evolving product designs without extensive retooling or investment in entirely new machinery. Furthermore, strategic partnerships between machine tool builders and automation providers are common, focusing on offering turnkey solutions that integrate loading, unloading, quality inspection (e.g., in-process gauging), and post-processing capabilities. This trend underscores a market requirement for holistic, automated manufacturing cells rather than standalone machining units, positioning advanced servo-driven machines as the preferred choice due to their flexibility and digital connectivity.

Regionally, the Asia Pacific (APAC) area remains the epicenter of growth, fueled by massive investments in automotive manufacturing (especially electric vehicles) and electronics production across China, India, and Southeast Asia. Europe, particularly Germany and Italy, maintains a strong foothold due to its historical expertise in high-precision machine tool manufacturing and a high demand from the premium hydraulics and aerospace sectors. North America shows stable growth, concentrating on modernization efforts and leveraging these machines for specialized applications in the energy and medical device industries, where ultra-high precision is paramount. Competitive dynamics are intensified by regional players offering cost-effective alternatives, pushing established global leaders to innovate constantly in terms of speed and operational uptime.

Segment trends reveal that the Multi-Station segment, particularly machines featuring six or more stations, is experiencing accelerated growth, reflecting the manufacturing necessity to complete highly complex parts, requiring numerous sequential operations, in a single setup. By operation type, servo-electric rotary transfer machines are projected to dominate the market share throughout the forecast period due to their superior control, reduced environmental impact, and seamless integration with Industrial Internet of Things (IIoT) frameworks. Application-wise, the automotive sector, driven by the shift from traditional combustion engine parts to electric vehicle components (e.g., cooling components, battery housing parts, charging connectors), remains the single largest end-user, ensuring sustained high demand for customized, high-volume machining solutions.

AI Impact Analysis on Rotary Transfer Machines Market

Common user questions regarding AI's impact on the Rotary Transfer Machines Market center on several key themes: how AI can improve machine uptime and predictive maintenance schedules, whether AI algorithms can optimize complex tooling paths and setup times for multi-station machines, and the role of machine learning in ensuring zero-defect production through enhanced quality control. Users are keen to understand if AI can effectively manage the massive data streams generated by servo-electric systems to preemptively identify potential component failures or drift in machining tolerances. The consensus expectation is that AI integration will primarily shift the operational model from reactive maintenance and quality control to proactive, self-optimizing manufacturing processes, fundamentally enhancing overall equipment effectiveness (OEE).

Based on this analysis, the introduction of Artificial Intelligence is revolutionizing the operational paradigm of rotary transfer technology, moving beyond simple automation into true intelligent manufacturing. AI and machine learning algorithms are being applied to analyze vibration data, temperature fluctuations, power consumption metrics, and tool wear rates in real-time. This sophisticated analysis enables highly accurate predictive maintenance models, dramatically reducing unplanned downtime—a critical factor given the high throughput and specialized nature of these machines. Furthermore, AI is utilized in optimizing cycle parameters, allowing the machine control system to dynamically adjust feed rates and spindle speeds based on real-time material condition variations, ensuring consistent part quality even across long production runs.

- AI-driven Predictive Maintenance: Analyzing sensor data for early fault detection in spindles, indexing tables, and transfer mechanisms, minimizing catastrophic failure risk.

- Cycle Time Optimization: Machine learning algorithms dynamically adjust machining parameters (feeds, speeds) to maximize throughput while adhering strictly to tolerance limits.

- Adaptive Quality Control: Utilizing computer vision and AI for in-process inspection and anomaly detection, ensuring immediate flagging of non-conforming parts.

- Setup and Changeover Reduction: AI assists operators by providing optimized setup routines and tooling recommendations based on historical performance data for similar parts, reducing manual intervention time.

- Energy Efficiency Management: Optimizing machine operation schedules and power consumption patterns to reduce utility costs without sacrificing production output.

DRO & Impact Forces Of Rotary Transfer Machines Market

The dynamics of the Rotary Transfer Machines Market are defined by significant drivers, inherent restraints, promising opportunities, and prevailing impact forces that dictate investment decisions and technological innovation. The primary driver is the accelerating global demand for high-precision, customized components, particularly within the automotive industry's transition towards electric mobility, which requires mass production of complex, lightweight, and tightly toleranced parts. This demand is coupled with the pressure to reduce manufacturing costs per unit and achieve unprecedented levels of dimensional accuracy, making the high-speed, parallel processing capability of rotary transfer machines highly attractive. The adoption of Industry 4.0 standards further drives integration, as manufacturers seek connected, data-rich machining solutions that enhance transparency and control over global operations.

Conversely, several restraints impede market expansion. Foremost among these is the exceptionally high initial capital investment required for these specialized machines, which typically limits their adoption primarily to large-scale manufacturers and specialized contract machining shops. Furthermore, the specialized skill set required for operating, programming, and maintaining these multi-station systems presents a significant barrier, leading to labor shortages in industrialized regions. The market also faces the restraint of relatively low flexibility compared to modular CNC machining centers; while rotary transfer machines excel in dedicated high-volume production, they struggle with frequent, low-volume changeovers, although new modular designs are attempting to mitigate this challenge.

Opportunities in the market center on geographical expansion into emerging economies where infrastructure development and industrialization are accelerating, such as parts of Southeast Asia and Latin America. Technological opportunities exist in the further hybridization of manufacturing processes, such as integrating laser processing or advanced additive manufacturing steps directly into the rotary transfer sequence. Impact forces primarily include the stringent regulatory standards in the medical and aerospace sectors, demanding validated and traceable production processes, which mandates the use of highly reliable and digitally monitored rotary transfer systems. Geopolitical factors affecting global supply chains also impact machine tool procurement decisions, often favoring regional suppliers or multi-regional manufacturing footprints to enhance resilience against external shocks.

Segmentation Analysis

The Rotary Transfer Machines Market is segmented based on critical operational and structural characteristics, including the type of machine configuration, the operational mechanism utilized for actuation, and the primary application sector. Understanding these segments is crucial for manufacturers to tailor their product offerings and for end-users to select the appropriate equipment for specific volume requirements and component complexities. The machine type segmentation reflects the complexity of the part, where multi-station systems are reserved for parts requiring numerous sequential operations, offering the highest level of consolidation.

The dominance of servo-electric systems in the operation segmentation highlights the market's trajectory toward digitalization, energy efficiency, and high control resolution, replacing older hydraulic and pneumatic systems in new installations. Application analysis demonstrates the market's dependence on durable goods manufacturing, particularly the automotive industry, which dictates massive volume requirements. The increasing prominence of the medical and aerospace sectors, however, emphasizes the simultaneous market demand for extreme precision and robust traceability features in machining processes.

- By Type:

- 3-Way Rotary Transfer Machines

- 4-Way Rotary Transfer Machines

- Multi-Station Rotary Transfer Machines (5 stations and above)

- By Operation:

- Hydraulic Rotary Transfer Machines

- Pneumatic Rotary Transfer Machines

- Servo-Electric Rotary Transfer Machines

- By Spindle Orientation:

- Horizontal Rotary Transfer Machines

- Vertical Rotary Transfer Machines

- By Application:

- Automotive & Transportation Components

- Hydraulics & Fluid Power

- Medical Devices & Instruments

- Electrical & Electronics

- Aerospace & Defense

- General Engineering & Consumer Goods

- By End-User Industry:

- Tier 1 & Tier 2 Automotive Suppliers

- Specialized Contract Machining Shops

- Original Equipment Manufacturers (OEMs)

- Precision Component Manufacturers

Value Chain Analysis For Rotary Transfer Machines Market

The value chain for the Rotary Transfer Machines Market begins with the upstream suppliers of specialized raw materials and critical components. This includes high-grade tool steel and structural metals for the machine frame, sophisticated precision bearings, and advanced control systems (CNCs, servo motors, drives). Upstream risks often involve volatility in raw material prices and dependency on a few key global suppliers for high-performance CNC technology and servo-mechanisms. Strong relationships with suppliers specializing in high-stiffness components and integrated automation modules are crucial for machine builders to ensure the quality, precision, and longevity of the final product.

Midstream activities involve the core machine tool manufacturers (OEMs) responsible for design, engineering, assembly, customization, and rigorous testing of the rotary transfer systems. Due to the high degree of customization required for each machine based on the customer's specific component geometry and production volume, engineering and system integration constitute a major portion of the value added. The distribution channel is often bifurcated: direct sales channels are typically used for large, strategic customers requiring extensive consultation and customized integration support, ensuring direct communication between the end-user and the OEM's technical staff. Indirect sales utilize specialized local distributors or agents, particularly in regions where the OEM lacks a substantial physical presence, allowing for localized service and faster response times.

The downstream segment encompasses the end-users across various manufacturing sectors—primarily automotive, medical, and hydraulics. This stage also includes aftermarket services, such as installation, commissioning, specialized training, spare parts supply, preventative maintenance contracts, and retooling/reconfiguring services. The provision of robust, responsive downstream support is a key competitive differentiator, as machine uptime is paramount for high-volume production facilities. The shift towards connected machines allows OEMs to offer predictive maintenance services remotely, integrating the downstream phase closer to the manufacturing cycle and maximizing the value realization for the customer throughout the machine’s operational lifespan.

Rotary Transfer Machines Market Potential Customers

The primary potential customers for rotary transfer machines are large-scale manufacturers and specialized precision component suppliers focused on high-volume, repetitive production of intricate metallic parts. These machines are most economically justifiable when component run lengths are extremely long, justifying the high initial setup and specialized tooling costs. End-users in the automotive industry, particularly Tier 1 and Tier 2 suppliers producing engine components, transmission parts, brake systems, and fluid connectors, represent the largest customer base. The current transition to electric vehicle manufacturing has created a new segment of customers seeking solutions for battery contacts, cooling plate components, and high-pressure charging parts.

Beyond the automotive sector, high-demand customers include manufacturers in the hydraulics and fluid power sectors who require flawless machining of complex valve bodies, fittings, and manifolds. These components demand tight tolerances and zero leakage, which rotary transfer machines are uniquely positioned to deliver consistently and quickly. Furthermore, the medical device industry, specifically manufacturers of surgical instruments, orthopedic implants, and complex connectors, relies heavily on these machines for their precision, repeatability, and capacity to handle small, high-value components efficiently. Customers prioritize vendors who can demonstrate expertise in process validation and compliance with strict industry standards such as ISO 13485.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $750 Million |

| Market Forecast in 2033 | $1,180 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Buffoli Transfer, WENZEL Group, Gosiger, Mikron Group, Precitrame Machines, IMAS, Riello Sistemi, PICCHI S.P.A., Hydromat, Eubama, BTB Transfer, IMR, Gnutti Transfer, Klaus Raiser, HÜLLER HILLE, Pietro Carnaghi, STAMA Maschinenfabrik, Chiron Group, Famar, Index-Werke. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Rotary Transfer Machines Market Key Technology Landscape

The technology landscape of rotary transfer machines is characterized by a relentless drive toward enhanced integration, speed, and precision, largely mediated by sophisticated Computer Numerical Control (CNC) systems. Modern rotary transfer centers leverage multi-axis CNC controllers capable of managing up to 10 or more axes simultaneously, essential for complex interpolation and simultaneous machining operations across different stations. The shift from hydraulic to advanced servo-electric actuation is the most defining technological trend. Servo technology provides superior control over indexing speed, positioning accuracy, and tool movement, contributing directly to higher process capability indices (CpK) and minimizing thermal deformation issues associated with hydraulic fluids.

Advanced sensor technology and the integration of IIoT are fundamental components of the contemporary rotary transfer machine. These systems are now equipped with an array of sensors—including acoustic emission, vibration monitoring, temperature probes, and current consumption sensors—to collect vast amounts of operational data. This data is critical for implementing condition monitoring and predictive maintenance strategies. Furthermore, quick-change tooling systems and automatic pallet changers are becoming standard features, drastically reducing setup and changeover times, thereby mitigating one of the primary historical limitations of rotary transfer technology and improving machine flexibility for smaller batch sizes.

Another crucial technological development involves the incorporation of non-traditional machining processes onto the rotary platform. This includes integration of specialized processes like laser etching for marking, automated part cleaning stations (e.g., ultrasonic washing), and in-situ metrology using high-resolution probes or vision systems. This hybridization allows manufacturers to perform near-complete component finishing within the confines of the rotary cell, eliminating the need for separate transport and processing stages. Furthermore, sophisticated collision detection software and simulation tools are used extensively during the programming phase to ensure optimal process sequencing and tool paths, minimizing the risk of expensive machine damage and lengthy commissioning periods.

Regional Highlights

- Asia Pacific (APAC): APAC is the fastest-growing region, driven by its massive automotive manufacturing base, particularly the rapid proliferation of EV production in China, South Korea, and Japan. The region benefits from substantial government investments aimed at modernizing manufacturing infrastructure and increasing localized production capabilities for high-precision components. Countries like India and Vietnam are increasingly adopting advanced rotary transfer technology to compete globally in general engineering and consumer electronics component production, positioning APAC as the dominant consumption and manufacturing hub.

- Europe: Europe represents a mature but highly innovative market, characterized by demand for ultra-high precision machines primarily from the German, Swiss, and Italian machine tool industries. The European market focuses heavily on niche, high-value applications in aerospace, complex fluid power components, and specialized medical instruments. Growth here is steady, driven by replacement cycles, continuous quality improvement initiatives, and strict adherence to environmental and efficiency standards, favoring advanced servo-electric models.

- North America: The North American market is characterized by strong demand for specialized, custom-engineered solutions, particularly within the defense, aerospace, and high-end medical device sectors. Investment is concentrated on enhancing manufacturing resiliency and reducing reliance on overseas supply chains. The region sees continuous modernization of aging equipment and a strong uptake of IIoT-enabled machines, often integrated with complex robotic loading systems to maximize operational efficiency and manage high labor costs.

- Latin America: This region presents emerging opportunities, primarily concentrated in the automotive manufacturing centers of Mexico and Brazil. Market growth is more sensitive to macroeconomic stability and foreign direct investment. Demand is typically focused on cost-effective, robust solutions for components required by multinational automotive OEMs operating within the region.

- Middle East and Africa (MEA): The MEA market is relatively small but shows potential, particularly in industrializing nations like Saudi Arabia and the UAE, driven by diversification efforts away from oil and gas into specialized manufacturing sectors. Procurement tends to be project-specific, focusing on infrastructure, defense, and localized energy equipment production.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Rotary Transfer Machines Market.- Buffoli Transfer S.p.A.

- WENZEL Group GmbH & Co. KG

- Gosiger, Inc.

- Mikron Group

- Precitrame Machines SA

- IMAS S.R.L.

- Riello Sistemi S.p.A.

- PICCHI S.P.A.

- Hydromat, Inc.

- Eubama GmbH & Co. KG

- BTB Transfer S.r.l.

- IMR International Machining & Research

- Gnutti Transfer S.p.A.

- Klaus Raiser GmbH & Co. KG

- HÜLLER HILLE Werkzeugmaschinen GmbH

- Pietro Carnaghi S.p.A.

- STAMA Maschinenfabrik GmbH

- Chiron Group SE

- Famar s.r.l.

- Index-Werke GmbH & Co. KG

Frequently Asked Questions

Analyze common user questions about the Rotary Transfer Machines market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of a rotary transfer machine over a standard CNC machining center?

The primary advantage is vastly superior throughput and reduced cycle time. Rotary transfer machines allow for simultaneous, parallel operations across multiple stations on a single workpiece, consolidating complex production into one highly efficient cell, whereas standard CNC centers perform operations sequentially.

Which application segment holds the largest share in the Rotary Transfer Machines Market?

The Automotive and Transportation Components segment holds the largest market share. This dominance is driven by the need for high-volume, precise manufacturing of critical components such as engine parts, brake system elements, and, increasingly, components for electric vehicle transmissions and cooling systems.

How is Industry 4.0 influencing the design and adoption of new rotary transfer machines?

Industry 4.0 necessitates integrating IIoT sensors and advanced CNC controllers, enabling real-time data collection, remote monitoring, and AI-driven predictive maintenance. This connectivity enhances machine uptime, optimizes operational parameters, and ensures high quality control traceability across global manufacturing networks.

What are the key differences between hydraulic and servo-electric rotary transfer systems?

Servo-electric systems offer higher precision, faster indexing speeds, better energy efficiency, and superior flexibility in programming and axis control compared to traditional hydraulic systems. Servo models align better with modern digitalization requirements and typically require less maintenance.

What is the main barrier to entry for smaller manufacturers in adopting rotary transfer technology?

The main barrier is the exceptionally high initial capital investment and the significant cost associated with custom tooling and specialized setup. This makes rotary transfer machines economically viable primarily for manufacturers capable of guaranteeing extremely high-volume production runs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager