Rotary Valves Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432882 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Rotary Valves Market Size

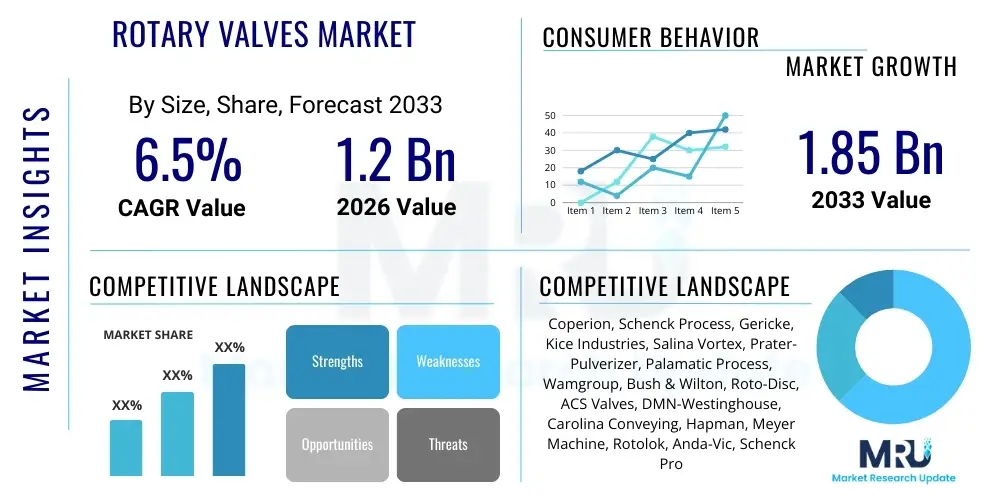

The Rotary Valves Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 1.85 Billion by the end of the forecast period in 2033. This consistent growth trajectory is primarily attributed to the accelerating adoption of automated bulk material handling systems across diverse processing industries, coupled with stringent regulatory standards concerning dust emissions and hygiene, particularly in pharmaceutical and food processing sectors. The crucial function of rotary valves in ensuring precise material dosing and acting as airtight seals drives sustained demand globally.

The valuation reflects the increasing investment in facility upgrades and new industrial constructions, especially in emerging economies focusing on enhanced production efficiency and safety. While initial capital expenditure for specialized, high-performance rotary valves can be substantial, their long-term benefits concerning operational uptime, reduced material waste, and compliance effectiveness justify the expenditure. Factors such as customization for abrasive materials, high-temperature applications, and integration capabilities with Industry 4.0 infrastructure further underpin the market's robust valuation throughout the projection period.

Rotary Valves Market introduction

The Rotary Valves Market encompasses the manufacturing, distribution, and utilization of mechanical components designed primarily for the controlled discharge of bulk solid materials from hoppers, silos, or cyclones, while simultaneously maintaining an effective airlock seal between systems operating at different pressure differentials. These valves are pivotal components in pneumatic conveying systems and dust collection equipment, ensuring that material flow is precise and continuous. The product description spans various types, including drop-through rotary valves, blow-through rotary airlocks, and specialized sanitary designs, each tailored to specific material characteristics—such as particle size, abrasiveness, temperature, and required throughput.

Major applications of rotary valves span across heavy industrial sectors like cement, mining, and power generation, as well as hygiene-critical sectors such as food and beverage, pharmaceuticals, and chemicals. In food processing, for instance, rotary valves handle ingredients like flour, sugar, and spices, demanding high-grade stainless steel and easy-clean designs to prevent contamination and meet FDA standards. Benefits derived from deploying advanced rotary valves include significant improvements in processing efficiency, minimization of product degradation, prevention of cross-contamination, and crucial maintenance of environmental compliance by effectively managing dust and emissions, thereby protecting worker health and safety. These benefits are fundamental drivers of market expansion as industries globalize and standardize operational excellence.

Driving factors for this market are multi-faceted, heavily influenced by global industrialization trends, particularly the massive infrastructure and manufacturing buildup observed in the Asia Pacific region. Furthermore, the persistent push for automation across all manufacturing verticals necessitates reliable, high-precision components like rotary valves to interface between automated feeding systems and processing machinery. The shift towards sustainable manufacturing processes also favors efficient material handling solutions that minimize energy consumption and fugitive dust emissions, positioning rotary valves as indispensable equipment within modern industrial setups seeking ISO certification and environmental compliance.

Rotary Valves Market Executive Summary

The Rotary Valves Market is characterized by steady growth, driven by fundamental business trends centered on automation and regulatory compliance. Business trends emphasize the adoption of smart, sensor-equipped rotary valves capable of predictive maintenance and real-time flow adjustment, responding to the industry-wide push for operational efficiency and reduced downtime. Key manufacturers are focusing their strategies on developing materials science innovations—such as specialized coatings and hardened components—to extend valve life when handling highly abrasive materials like cement clinker or mineral ores. Furthermore, consolidation among key players is observed, aiming to integrate pneumatic conveying expertise with valve technology for providing comprehensive material handling solutions to end-users.

Regionally, Asia Pacific is projected to remain the dominant and fastest-growing market, largely due to unprecedented infrastructure development and the rapid expansion of the chemical and food processing industries, particularly in China and India. North America and Europe, while mature markets, maintain high demand for high-specification sanitary and pharmaceutical-grade rotary valves, driven by strict regulatory environments like the FDA and EMEA standards. Regional trends show a localized focus on aftermarket services and replacement parts in developed economies, whereas emerging markets prioritize capital equipment procurement for new facilities. The Middle East and Africa present nascent opportunities tied to burgeoning cement, petrochemical, and grain handling projects, necessitating robust and customized valve solutions suitable for challenging climatic conditions.

Segment trends highlight the increasing prominence of stainless steel valves due to their superior corrosion resistance and suitability for hygiene-sensitive applications, overshadowing traditional cast iron in high-value sectors. The Drop-Through valve type holds the largest market share due to its simplicity and broad applicability, but the Blow-Through segment is exhibiting rapid growth driven by the efficiency demands of dense-phase pneumatic conveying systems. Among applications, the Food & Beverage sector is a critical growth segment, fueled by global dietary shifts and the need for high-throughput production lines capable of maintaining stringent product quality standards. Technological integration of Internet of Things (IoT) sensors within the valve mechanism to monitor temperature, vibration, and flow rate represents a significant advancement across all market segments.

AI Impact Analysis on Rotary Valves Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Rotary Valves Market frequently revolve around predictive maintenance, optimization of pneumatic conveying throughput, and the integration of AI-driven diagnostics into existing plant control systems. Common concerns focus on the cost-benefit analysis of retrofitting older valves with smart technology and the cybersecurity risks associated with connecting critical bulk handling equipment to centralized AI platforms. Users are keen to understand how AI can minimize product loss during start-up/shutdown sequences and whether machine learning algorithms can dynamically adjust rotor speed and seal pressure based on real-time material characteristics (e.g., density, moisture content) to prevent jamming or undue wear. The key themes are centered on transitioning rotary valves from static mechanical components to integrated, intelligent process control units.

AI's primary influence is moving the industry towards highly efficient and autonomous operation. By analyzing historical performance data, maintenance logs, vibration patterns, and current operational parameters, AI algorithms can accurately predict the point of potential failure for bearings or seals in a rotary valve weeks in advance. This capability shifts maintenance from reactive or time-based schedules to true condition-based monitoring, dramatically reducing unplanned downtime and optimizing inventory management for critical spare parts. Furthermore, AI-driven control systems can fine-tune valve parameters (such as rotor speed, pressure equalization rates) in real-time, maximizing conveying efficiency while minimizing energy consumption, which is especially critical in large-scale cement or chemical plants.

The integration of AI also enhances quality control and process security. In pharmaceutical or food applications, AI can correlate valve performance data with batch quality data, identifying subtle deviations in material flow that might indicate contamination or dosing inaccuracy. This level of traceability and automated verification far surpasses traditional monitoring methods. While the initial investment in integrating AI interfaces and sensors is a constraint, the long-term benefits derived from reduced operational costs, extended equipment lifespan, and maximized throughput position AI as a transformative factor, driving the demand for "smart" rotary valves equipped with native IoT connectivity features, thereby redefining the competitive landscape.

- Enhanced Predictive Maintenance: AI algorithms analyze vibration and temperature data to forecast seal or bearing failure, minimizing unscheduled downtime.

- Optimized Throughput Control: Machine learning dynamically adjusts rotor speed based on real-time material properties and upstream/downstream pressure differentials.

- Energy Efficiency Gains: AI fine-tunes pneumatic conveying system parameters, reducing air consumption required to operate the airlock seal effectively.

- Automated Diagnostics: Real-time self-assessment and reporting capabilities integrated into plant control systems.

- Improved Process Traceability: Correlation of valve performance data with batch quality results, crucial for regulatory compliance in sensitive industries.

DRO & Impact Forces Of Rotary Valves Market

The Rotary Valves Market is propelled by several strong drivers, counteracted by specific restraints, while presenting significant opportunities, all shaping the overall impact forces. The primary drivers include the escalating need for automation in bulk material handling across manufacturing sectors globally, the increasingly stringent industrial safety and dust emission regulations (such as those enforced by OSHA and ATEX), and the resultant requirement for reliable airlock seals. The continuous demand for high-precision dosing and feeding in sectors like pharmaceuticals and specialized chemicals further solidifies market growth. These factors collectively push industries to invest in high-specification, reliable rotary valves capable of operating efficiently under demanding industrial conditions, ensuring consistency and safety in processing environments.

Restraints impeding market growth primarily involve the relatively high initial capital expenditure associated with purchasing high-performance or customized rotary valves, particularly those designed for high-temperature, high-pressure, or sanitary applications. Furthermore, the complexity involved in maintaining and servicing specialized valves, requiring trained technical personnel and specific spare parts, poses a challenge, particularly for Small and Medium Enterprises (SMEs). Price volatility of raw materials, particularly stainless steel and specialized alloys used in construction, also presents a periodic constraint on manufacturing costs and ultimately, the final price point for the end-user. Moreover, alternatives like slide gate valves or flap gates, while less efficient in maintaining airtight seals, sometimes serve as lower-cost substitutes in non-critical applications.

Opportunities for market expansion are abundant, centered on integrating rotary valves with Industry 4.0 technologies, including IoT sensors and centralized control systems for condition monitoring and performance optimization. Significant potential lies in the rapid industrialization of emerging economies in Southeast Asia and Latin America, where demand for efficient material handling infrastructure is booming. Additionally, the increasing focus on powder metallurgy and additive manufacturing processes requires specialized, ultra-precise rotary valves for material dispensing, opening up niche high-value segments. The increasing demand for dust-free environments and explosion protection (ATEX compliance) in facilities handling combustible dusts offers manufacturers a clear path to market advanced, certified safety-compliant products, positioning safety as a key competitive differentiator and overriding factor influencing procurement decisions across global industries.

Segmentation Analysis

The Rotary Valves Market is comprehensively segmented based on Type, Application, and Material of construction, reflecting the highly specialized nature of bulk material handling requirements. Understanding these segments is crucial as the performance characteristics of a rotary valve—such as sealing effectiveness, throughput capacity, and resistance to abrasion or corrosion—are directly linked to its design and material composition tailored for a specific industrial application. This segmentation allows manufacturers to target specific industries with optimized product lines, from heavy-duty cast iron valves for cement factories to highly polished stainless steel designs for pharmaceutical tablet presses, ensuring that efficiency and compliance standards are met across the operational spectrum.

The segmentation by type, including Drop-Through, Blow-Through, and Rotary Airlock Feeders, defines the primary function and pneumatic system compatibility, with drop-through valves dominating due to their versatility in gravity discharge. Application segmentation reveals the critical dependence of the market on major processing sectors, with the Food & Beverage and Chemical industries being key revenue drivers demanding stringent sanitary standards and robust chemical resistance, respectively. Finally, material segmentation, encompassing Cast Iron, Stainless Steel, and specialty alloys, reflects the need to match valve durability with the characteristics of the material being processed (e.g., abrasive, corrosive, or sticky powders), influencing both capital cost and long-term maintenance requirements.

Ongoing technological advancements within these segments are focused on enhancing the seals and bearings to minimize air leakage, particularly in high-pressure systems, and developing modular designs that facilitate easier cleaning and maintenance, catering specifically to the needs of the pharmaceutical sector. Furthermore, the development of specialized rotor designs, such as flexible tip rotors and adjustable rotors, addresses the challenge of handling materials that tend to smear or build up, providing customized solutions that improve efficiency and reduce product contamination across varied industrial landscapes, making the segmentation landscape highly dynamic and responsive to end-user needs.

- By Type:

- Drop-Through Rotary Valves

- Blow-Through Rotary Valves (Airlocks)

- Offset Rotary Valves

- Heavy Duty Rotary Feeders

- By Application/End-User Industry:

- Food & Beverage Processing

- Pharmaceutical & Cosmetic

- Chemical & Petrochemical

- Cement & Mineral Processing

- Plastics & Polymer

- Power Generation (Coal Handling)

- By Material:

- Cast Iron

- Stainless Steel (304, 316)

- Aluminum

- Specialty Alloys (e.g., Chromium, Nickel)

Value Chain Analysis For Rotary Valves Market

The value chain for the Rotary Valves Market begins with the Upstream Analysis, which focuses on the procurement of critical raw materials, primarily specialized steel alloys (especially stainless steel grades 304 and 316) and cast iron, along with high-performance components like bearings, seals, and advanced coatings (e.g., tungsten carbide for abrasive resistance). Key activities at this stage include sourcing high-quality, traceable materials and ensuring robust supply chain stability to mitigate the impact of volatile commodity prices. Manufacturers often maintain close relationships with specialist metal suppliers and component makers to ensure material specifications meet the rigorous demands of industrial applications, particularly those requiring ATEX compliance or sanitary certification.

The midstream stage involves the design, manufacturing, and assembly of the rotary valves. This phase is capital intensive, requiring advanced machining capabilities (CNC), precision welding, and quality control processes to ensure tight tolerances between the rotor and the housing—critical for maintaining the airlock seal integrity and minimizing air leakage. Direct sales channels involve manufacturers selling high-value, customized rotary valves directly to large Original Equipment Manufacturers (OEMs) or major industrial corporations (e.g., global cement producers) that require specialized integration into complex pneumatic conveying systems. Indirect distribution relies heavily on regional distributors, engineering procurement and construction (EPC) firms, and local systems integrators who offer installation, maintenance, and comprehensive servicing capabilities, particularly to smaller end-users seeking localized support and expertise.

Downstream analysis focuses on installation, commissioning, maintenance, and the aftermarket services, which represent a significant and highly profitable part of the overall value chain, especially in mature markets. The longevity and high maintenance requirements of rotary valves ensure consistent demand for spare parts (rotors, seals, bearings, wear plates) and specialized refurbishment services. The final end-users, such as food processors or chemical plants, rely on these channels to ensure continuous operation and regulatory compliance. Effective distribution networks, combined with strong technical support and rapid access to spare parts, are essential for maintaining customer loyalty and competitive advantage, as downtime in processing plants can lead to massive financial losses, making reliability a paramount factor throughout the entire value chain.

Rotary Valves Market Potential Customers

Potential customers for the Rotary Valves Market are fundamentally any industrial entity involved in the processing, transfer, or packaging of bulk solid materials, whether in powder, granule, pellet, or flake form, where controlled flow and pressure separation (airlocking) are required. These end-users, or buyers of the product, encompass a vast range of sectors, each purchasing valves tailored to specific operational requirements. The largest purchasing segments include large-scale manufacturers in the Food & Beverage industry, such as cereal producers, baking companies, and sugar refineries, which require high-hygiene, quick-clean sanitary valves to prevent microbial growth and cross-contamination while ensuring high throughput capacity for continuous production runs.

Another major customer segment comprises the Chemical and Petrochemical industries, which require robust, corrosion-resistant rotary valves (often made from exotic alloys) to handle hazardous, reactive, or highly corrosive materials under extreme temperatures and pressures. These buyers prioritize safety certifications, material compatibility, and leak prevention. Furthermore, the Cement, Mining, and Mineral processing sectors represent substantial buyers of heavy-duty, abrasive-resistant rotary feeders. These customers seek valves constructed from hardened materials (like Ni-Hard or coated components) designed to withstand the wear caused by abrasive materials like cement clinker, fly ash, or mineral ores, valuing longevity and minimized maintenance intervals over high capital expenditure.

Finally, the Pharmaceutical industry stands out as a highly specialized customer base. Pharmaceutical manufacturers demand valves that meet the highest standards of cleanability (CIP/SIP capable), precision dosing (critical for active pharmaceutical ingredients - APIs), and full material traceability, often governed by cGMP (current Good Manufacturing Practices). Secondary customers include Dust Collection Equipment manufacturers (OEMs) who integrate rotary valves into their systems as airlocks for filter discharge, and EPC (Engineering, Procurement, and Construction) firms contracted to build entire processing plants, purchasing valves as part of larger, integrated material handling solutions, thus broadening the direct and indirect customer base significantly.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 1.85 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Coperion, Schenck Process, Gericke, Kice Industries, Salina Vortex, Prater-Pulverizer, Palamatic Process, Wamgroup, Bush & Wilton, Roto-Disc, ACS Valves, DMN-Westinghouse, Carolina Conveying, Hapman, Meyer Machine, Rotolok, Anda-Vic, Schenck Process, FLSmidth, Buhler Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Rotary Valves Market Key Technology Landscape

The technological landscape of the Rotary Valves Market is rapidly evolving, moving beyond simple mechanical components toward sophisticated, interconnected devices essential for modern smart factories. A key area of innovation is in the development of advanced sealing technologies. Traditional flexible tip rotors are being supplemented or replaced by specialized hard chrome or ceramic coatings on the rotor and housing, significantly extending the operational life when handling highly abrasive materials, thereby reducing the total cost of ownership (TCO). Furthermore, the design of pressure equalization ports and venting mechanisms has been refined to minimize air leakage across the valve, improving the energy efficiency of the pneumatic conveying system while ensuring maximum feed accuracy, particularly crucial in demanding applications like dense-phase conveying.

The integration of digital technology, epitomized by Industry 4.0 standards, is fundamentally altering the technology landscape. Modern rotary valves are increasingly equipped with integrated sensors for vibration, temperature, and rotational speed monitoring. These IoT-enabled components transmit real-time operational data wirelessly to centralized control systems or cloud platforms, facilitating advanced diagnostics and predictive maintenance scheduling through AI analytics. This smart integration allows operators to anticipate mechanical wear and schedule interventions precisely, maximizing uptime and shifting operational focus from corrective maintenance to preemptive optimization. The focus on modularity and quick-release designs, known as "quick-clean" technologies, is also paramount, particularly in the food and pharma sectors, where reducing cleaning time between batches is critical for throughput and contamination prevention.

Furthermore, material science advancements continue to drive the market, particularly the use of specialized polymers for rotor tips and specialized nickel-based alloys for housings in extremely corrosive or high-temperature environments, such as flue gas desulfurization systems or calcination processes. Customization through computational fluid dynamics (CFD) modeling is now commonplace, allowing manufacturers to optimize the internal geometry of the valve for specific material flow characteristics (e.g., sticky, cohesive, or friable powders), minimizing shear damage and product degradation. This shift towards simulation-driven, application-specific designs highlights the industry's commitment to delivering precise, reliable, and energy-efficient material handling solutions globally.

Regional Highlights

Regional analysis indicates distinct growth drivers and market maturity levels across key geographical areas. Asia Pacific (APAC) currently dominates the Rotary Valves Market and is expected to exhibit the highest CAGR during the forecast period. This dominance is driven by massive investment in manufacturing infrastructure, rapid urbanization, and the corresponding expansion of core processing industries, including cement, chemicals, food processing, and pharmaceuticals, particularly in economic powerhouses like China, India, and Southeast Asian nations. Regulatory pressures in APAC, mirroring Western standards regarding dust control and industrial safety, are accelerating the adoption of high-quality rotary valves as critical components in new facilities, fueling sustained demand for both standard and customized high-throughput systems.

North America and Europe represent mature yet highly influential markets. Demand here is characterized not primarily by new construction, but by replacement cycles, facility upgrades, and the increasing requirement for specialized, high-specification rotary valves. European markets are heavily influenced by stringent ATEX directives governing explosion protection and strict machinery safety standards, driving the need for certified, high-end valves often integrated with sophisticated control systems. In North America, the food and pharmaceutical sectors drive consistent demand for sanitary, FDA-compliant, and easy-to-clean valves. Market players in these regions focus heavily on providing advanced IoT integration, predictive maintenance services, and specialized aftermarket support to maintain competitive advantage.

Latin America (LATAM) and the Middle East & Africa (MEA) are emerging as significant opportunity zones. LATAM’s market growth is tied to the expansion of its mining and agricultural processing industries, requiring robust and durable rotary feeders. The MEA region, particularly the Gulf Cooperation Council (GCC) states, is witnessing large-scale investment in petrochemical plants, cement manufacturing, and grain storage facilities, necessitating durable rotary valves capable of withstanding harsh, high-temperature operating conditions. The demand in MEA is often project-based, linked to large government-backed infrastructure initiatives, presenting opportunities for bulk orders of standard and heavy-duty industrial valves.

- Asia Pacific (APAC): Highest growth market, driven by industrialization, infrastructure development, and massive expansion in the chemical and food processing sectors in China and India.

- North America: Mature market focused on technology integration, upgrades, and high-specification sanitary valves catering primarily to the pharmaceutical and premium food segments.

- Europe: Dominated by regulatory compliance (ATEX, CE marking), strong demand for safety-certified, high-efficiency pneumatic system components, and robust aftermarket services.

- Latin America (LATAM): Growth spurred by expansion in the mining, agriculture, and cement industries, focusing on heavy-duty and robust valve solutions.

- Middle East & Africa (MEA): Emerging market driven by large petrochemical, cement, and grain handling projects, requiring resilient valves suitable for extreme environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Rotary Valves Market.- Coperion

- Schenck Process

- Gericke

- Kice Industries

- Salina Vortex (Part of Tomkins)

- Prater-Pulverizer (Part of Prater Industries)

- Palamatic Process

- Wamgroup

- Bush & Wilton

- Roto-Disc

- ACS Valves

- DMN-Westinghouse

- Carolina Conveying

- Hapman

- Meyer Machine

- Rotolok

- Anda-Vic (A&V)

- FLSmidth

- Buhler Group

- Mac Process (Schenck Process)

Frequently Asked Questions

Analyze common user questions about the Rotary Valves market and generate a concise list of summarized FAQs reflecting key topics and concerns.What factors determine the selection of the correct rotary valve type for an application?

Selection is primarily determined by the material characteristics (abrasiveness, particle size, flowability), the required throughput capacity, the pressure differential across the valve (pneumatic conveying or simple gravity discharge), and specific hygiene/safety regulations (e.g., ATEX or FDA compliance).

How does the Rotary Valves Market address dust explosion risks (ATEX compliance)?

Manufacturers offer specialized rotary valves certified under ATEX directives, which feature robust housing, explosion-proof components, and adequate sealing to prevent ignition sources and contain potential explosions, crucial for handling combustible dusts like flour, sugar, or fine chemicals.

What is the primary difference between drop-through and blow-through rotary valves?

Drop-through valves are used for gravity discharge and simple airlocking in low-pressure systems, where material drops directly into the rotor pockets. Blow-through valves introduce pressurized air directly into the rotor pockets after material discharge, helping to sweep material out and integrate into pneumatic conveying lines efficiently.

How is the efficiency of a rotary valve measured in industrial settings?

Efficiency is measured mainly by volumetric capacity (throughput), the consistency of material dosing accuracy (critical for formulation), and the air leakage rate (effectiveness of the airlock seal), which directly impacts the energy consumption and performance of the overall pneumatic conveying system.

What role does material of construction play in rotary valve longevity?

The material (e.g., cast iron, stainless steel, specialty alloys) dictates the valve's resistance to wear, corrosion, and high temperatures. Stainless steel is preferred for hygiene and corrosion control, while hardened alloys and specialized coatings are necessary to maximize lifespan when handling highly abrasive bulk solids like minerals or cement.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager