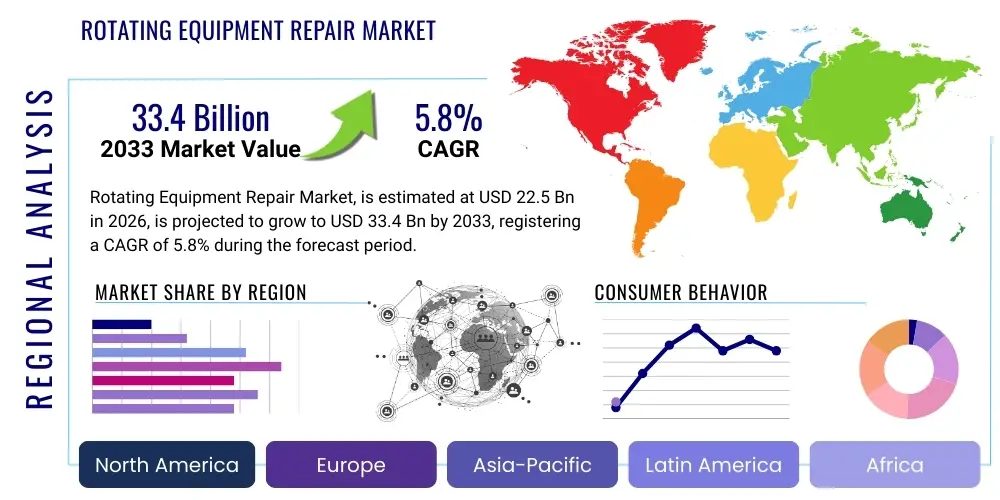

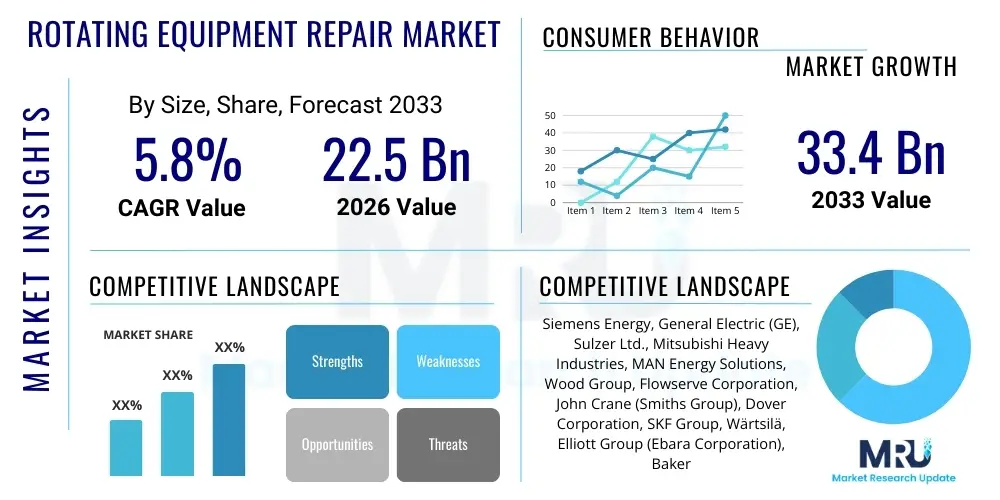

Rotating Equipment Repair Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437292 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Rotating Equipment Repair Market Size

The Rotating Equipment Repair Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $22.5 Billion in 2026 and is projected to reach $33.4 Billion by the end of the forecast period in 2033.

Rotating Equipment Repair Market introduction

The Rotating Equipment Repair Market encompasses the maintenance, overhaul, inspection, and replacement services required for machinery that utilizes rotational motion to perform its function. This equipment, crucial across heavy industries, includes turbines (gas, steam, hydro), pumps (centrifugal, positive displacement), compressors (axial, centrifugal, reciprocating), and motors/generators. These assets are the operational backbone of sectors like oil and gas, power generation, chemical processing, and manufacturing, where equipment failure can lead to catastrophic operational shutdowns and significant financial losses. The demand for reliable repair services is fundamentally driven by the need to maximize asset uptime, extend equipment lifecycle, and ensure regulatory compliance, particularly in environments involving high pressure, extreme temperatures, or hazardous materials.

The core service offerings within this market range from scheduled preventative maintenance (PM) and predictive maintenance (PdM) based on condition monitoring, to emergency breakdown repairs and comprehensive overhauls. As industrial infrastructure ages globally, the complexity of repairs increases, requiring specialized expertise, advanced diagnostic tools, and precision manufacturing capabilities for component restoration or replacement. Furthermore, the increasing adoption of highly efficient, complex machinery means that repair personnel must possess cutting-edge skills related to advanced metallurgy, digital control systems, and alignment precision. This dependency on specialized expertise elevates the overall value proposition of expert rotating equipment repair providers.

Driving factors for sustained market growth include stringent safety regulations mandating routine inspections, the rising integration of Industrial Internet of Things (IIoT) sensors necessitating digitally-enabled repair strategies, and the global push towards optimizing energy efficiency. Major applications span utility-scale power plants requiring steam turbine refurbishment, refineries needing high-pressure compressor maintenance, and wastewater treatment facilities depending on reliable pumping systems. The benefits derived from professional repair services include minimized total cost of ownership (TCO), improved mean time between failures (MTBF), enhanced operational safety, and increased asset longevity, collectively supporting uninterrupted industrial productivity across the globe.

Rotating Equipment Repair Market Executive Summary

The Rotating Equipment Repair Market is currently undergoing a significant transformation, marked by a decisive shift from reactive repair strategies to proactive, condition-based and predictive maintenance models. Business trends emphasize service digitalization, where market players are increasingly investing in sophisticated diagnostic tools, remote monitoring capabilities, and centralized data analytics platforms to anticipate failures rather than simply responding to them. This transition is profoundly affecting service contracts, moving away from time-and-material billing toward performance-based agreements focusing on guaranteed uptime. Furthermore, consolidation among original equipment manufacturers (OEMs) and independent service providers (ISPs) is driving competition, leading to a focus on specialized niche services such as advanced material coatings and proprietary rotor balancing techniques.

Segment trends indicate that the Oil & Gas sector remains the dominant end-user due to the criticality and high complexity of turbomachinery used in exploration, transportation, and refining processes. However, the Power Generation segment, particularly conventional thermal power plants and emerging renewable energy infrastructure (e.g., geared turbine repair in hydro and wind), is demonstrating the fastest growth potential. In terms of service type, the predictive maintenance segment, enabled by AI-driven analytics, is experiencing accelerated adoption as industries prioritize cost control through reduced unplanned downtime. Equipment-wise, compressor and turbine repair represent the highest revenue share due to the associated high capital costs and precision requirements.

Regionally, the Asia Pacific (APAC) region is forecasted to exhibit the highest growth rate, primarily fueled by massive infrastructure development, rapid industrialization, and significant investments in new power generation capacity, particularly in China and India. While North America and Europe currently hold substantial market share, driven by mature regulatory frameworks and advanced adoption of IIoT in maintenance, their growth trajectory is steadier, focusing on the refurbishment and modernization of existing, aging assets. The Middle East and Africa (MEA) region also presents robust opportunities, intrinsically linked to expansion in the petroleum and petrochemical industries, where maintaining complex rotating equipment is paramount to national economic stability.

AI Impact Analysis on Rotating Equipment Repair Market

Common user inquiries concerning AI’s influence on the Rotating Equipment Repair Market revolve around four key themes: the feasibility and accuracy of automated predictive failure detection, the expected displacement of human technicians, the required cybersecurity measures for IIoT data transfer, and the return on investment (ROI) associated with implementing AI-driven condition monitoring systems (CMS). Users are keen to understand how AI algorithms can process vast amounts of sensor data—including vibration, temperature, and pressure—in real time to pinpoint nascent equipment issues far earlier than traditional methods, thereby optimizing repair schedules. There is a palpable expectation that AI will transition repair from a costly reactive process into an efficient, predictable operational function, raising questions about the necessary capital expenditure and integration complexity, particularly for legacy machinery.

The immediate practical impact of artificial intelligence is the optimization of diagnostics and scheduling. AI excels at pattern recognition in complex data streams, allowing for the creation of precise digital twin models that simulate equipment degradation under various operational loads. This capability dramatically reduces diagnostic time and ensures that repair teams arrive onsite with the exact tools and replacement parts needed, minimizing mean time to repair (MTTR). Although AI streamlines many tasks, concerns regarding the necessary upskilling of maintenance personnel persist, as technicians now need to be proficient in interpreting machine learning outputs and managing sophisticated sensor networks, shifting the focus from manual labor to data-driven decision-making.

Furthermore, the integration of AI influences the entire repair value chain, from automated inventory management for spare parts to the generation of highly accurate repair recommendations. Specialized algorithms are being developed to analyze repair history alongside operational data, improving the longevity of repaired assets by identifying common failure modes and suggesting process improvements. While this offers significant efficiency gains, the initial cost and effort required to integrate AI platforms with diverse, often proprietary, legacy monitoring systems pose a notable barrier to entry, especially for smaller market participants or facilities with non-standard equipment configurations. Ultimately, AI is viewed as an indispensable tool for achieving the next level of operational efficiency and minimizing asset downtime in high-stakes industrial environments.

- AI-enabled Predictive Maintenance (PdM): Utilizes machine learning to analyze vibration, acoustic, and thermal data, forecasting equipment failure with high accuracy.

- Optimized Repair Scheduling: Algorithms determine the optimal time for equipment shutdown, balancing repair cost against risk of catastrophic failure.

- Digital Twin Diagnostics: Creation of virtual replicas to simulate component wear and test repair strategies before physical intervention.

- Automated Root Cause Analysis (RCA): AI rapidly sifts through historical repair logs and operational parameters to identify the fundamental cause of failure, enhancing repair efficacy.

- Remote Expert Guidance: Integration of AI with Augmented Reality (AR) tools to provide real-time, data-driven instructions to field technicians, improving first-time fix rates.

- Inventory Management Optimization: Machine learning models forecast necessary spare parts demand based on projected maintenance schedules, reducing carrying costs and ensuring availability.

DRO & Impact Forces Of Rotating Equipment Repair Market

The Rotating Equipment Repair Market is primarily driven by the imperative of maximizing industrial asset uptime, underpinned by the ongoing global expansion of heavy industries like petrochemicals, power generation, and manufacturing, which rely heavily on continuous equipment operation. Regulatory mandates pertaining to safety, emissions control, and operational integrity, particularly in the energy sector, enforce strict maintenance schedules, thereby sustaining demand for specialized repair services. The widespread recognition of the cost benefits associated with preventative and predictive maintenance strategies, coupled with the aging installed base of industrial machinery globally, further strengthens the market drivers. However, market expansion faces significant restraints, chiefly the scarcity of highly skilled, specialized technicians capable of servicing complex turbomachinery and advanced equipment. The high capital investment required for state-of-the-art diagnostic tools, specialized workshops, and large-scale balancing facilities also restricts the competitive landscape, alongside the challenge posed by long lead times and substantial logistical difficulties involved in procuring proprietary OEM spare parts.

Opportunities within the market largely center on technological advancements, specifically the adoption of IIoT-enabled condition monitoring and the proliferation of remote diagnostic services. The integration of advanced repair technologies such as laser welding, additive manufacturing (3D printing) for rapid prototyping of specialized components, and advanced coating techniques provides a pathway for service providers to offer enhanced reliability and performance upgrades, beyond simple restoration. Furthermore, the growing global focus on sustainable operations and energy efficiency provides opportunities for repair specialists to focus on modernization services that improve the efficiency of older rotating assets, appealing to environmental and economic mandates. Strategic partnerships between large OEMs and regional independent repair shops, aimed at expanding service reach and capability, also present substantial avenues for growth.

The core impact forces shaping this market involve a delicate balance between cost containment, technological disruption, and operational reliability. The shift toward predictive analytics significantly impacts repair cycles, transforming revenue streams from emergency call-outs to recurring maintenance contracts. Supplier power is high, particularly for OEMs holding proprietary knowledge and parts, although independent service providers are gradually increasing their leverage through advanced reverse engineering and specialized technical expertise. Buyer power is moderate; while end-users are concentrated (e.g., major utility companies), the switching costs for specialized repair services are often substantial due to the critical nature of the equipment, giving repair providers reasonable pricing power, particularly in niche high-precision segments like turbine repair. Overall, the market trajectory is guided by the continuous tension between the high cost of sophisticated maintenance and the far higher cost of unplanned downtime.

Segmentation Analysis

The Rotating Equipment Repair Market is meticulously segmented based on the type of service required, the specific equipment being serviced, and the end-use industry utilizing the machinery. This segmentation allows market participants to tailor their offerings, focusing on specialized technical capabilities and specific vertical market needs. The analysis shows that complex, large-scale equipment like gas and steam turbines demands the most intensive repair services, often involving full rotor disassembly and specialized metallurgical analysis, leading to higher average service contract values. Conversely, high-volume equipment such as standard industrial pumps and motors drives the volume side of the market, necessitating rapid turnaround times and decentralized service networks. The rise of condition monitoring as a preferred service model is blurring the traditional lines between preventative and corrective repair, favoring integrated service packages that combine sensor installation, data analytics, and hands-on maintenance.

- Service Type:

- Overhaul and Refurbishment

- Maintenance and Inspection (Preventative and Predictive)

- Repair and Replacement

- Upgrades and Modernization

- Equipment Type:

- Turbines (Gas Turbines, Steam Turbines, Hydro Turbines, Wind Turbines)

- Compressors (Centrifugal, Axial, Reciprocating)

- Pumps (Centrifugal Pumps, Positive Displacement Pumps, Vacuum Pumps)

- Motors and Generators

- Gearboxes and Transmissions

- End-Use Industry:

- Oil and Gas (Upstream, Midstream, Downstream)

- Power Generation (Thermal, Nuclear, Renewables)

- Chemicals and Petrochemicals

- Mining and Metals

- Water and Wastewater Management

- Manufacturing (Pulp & Paper, Food & Beverage)

- Service Provider:

- Original Equipment Manufacturers (OEMs)

- Independent Service Providers (ISPs)

- In-house Service Departments

Value Chain Analysis For Rotating Equipment Repair Market

The value chain for the Rotating Equipment Repair Market is highly complex, starting with the upstream supply of specialized components, materials, and technological infrastructure, extending through the technical repair process, and culminating in the delivery of a serviced asset back to the end-user. Upstream activities involve the sourcing of high-grade raw materials (e.g., specialized alloys, coatings, and seal materials), precision component manufacturing (e.g., blades, impellers, shafts), and the supply of advanced diagnostic equipment like vibration analyzers and ultrasonic testing devices. The efficiency and quality of the upstream supply chain are critical, as the metallurgical integrity of replacement parts directly determines the longevity of the repair. Dependencies on proprietary OEM parts often create bottlenecks, increasing lead times and costs, which independent service providers aim to mitigate through advanced reverse engineering and specialized manufacturing partnerships.

The midstream segment is defined by the actual service delivery, executed by specialized service centers, field service teams, and regional repair workshops. This stage involves complex logistics for transporting massive equipment, highly technical procedures such as non-destructive testing (NDT), precise rotor balancing, advanced welding, and fitting new components. Repair providers compete fiercely on turnaround time, quality certifications, and the depth of their engineering expertise. The adoption of digital tools, including Computerized Maintenance Management Systems (CMMS) and remote diagnostic platforms, is central to optimizing the midstream process, ensuring efficient scheduling of technicians and resource allocation, particularly for complex on-site repairs and maintenance turnarounds (outages).

The downstream involves the distribution channels and the direct relationship with the end-users. Services are delivered through direct contracts, long-term service agreements (LTSAs), and sometimes through specialized agents or distributors, particularly in geographically fragmented markets. Direct distribution is dominant for complex equipment repair, often necessitating high-touch technical sales and consultation. Long-term contracts, which typically include condition monitoring, regular inspections, and guaranteed parts supply, ensure a stable revenue stream for service providers while offering end-users predictable maintenance costs and guaranteed performance levels. The effectiveness of the downstream relationship is often measured by the reduction in unplanned downtime achieved for the client, emphasizing a partnership approach focused on asset performance rather than transactional repair services.

Rotating Equipment Repair Market Potential Customers

The potential customer base for the Rotating Equipment Repair Market is comprised of heavy industrial asset owners and operators across sectors where continuous operation of machinery is paramount to production and safety. The largest segment remains the Power Generation industry, including owners of thermal power stations (coal, natural gas), nuclear facilities, and large-scale renewable projects (hydro and wind farms), which require constant, reliable operation of turbines and generators. These entities prioritize service providers with established expertise in high-temperature, high-pressure environments, seeking long-term service agreements that minimize the risks associated with critical asset failure and regulatory non-compliance. Their purchasing decisions are heavily influenced by proven MTBF metrics and guaranteed performance restoration.

Another major segment includes the global Oil and Gas industry, encompassing upstream drilling and extraction facilities, midstream pipeline and storage operations, and downstream refining and petrochemical plants. Customers in this sector utilize highly specialized and robust rotating equipment, particularly large centrifugal compressors and multi-stage pumps, often operating in harsh or remote environments. Due to the high value of output and the extreme costs of unforeseen shutdowns, these buyers demand rapid response capabilities, comprehensive field services, and specialized component repair techniques for materials resistant to corrosive media. The transition toward digitalization in this sector also makes customers keen on integrating predictive analytics into their maintenance procurement strategies.

Beyond the core energy sectors, the market extends to the large-scale Manufacturing and Infrastructure industries, including entities involved in chemical processing, cement production, metals and mining, and large municipal water and wastewater treatment facilities. These buyers rely on reliable pumping systems, blowers, and general industrial motors. While the equipment complexity may sometimes be lower than turbomachinery, the sheer volume of assets and the necessity for immediate operational readiness ensure a continuous demand flow for repair, inspection, and preventative maintenance services. The purchasing criteria here often balance cost-efficiency with high availability, favoring service providers who offer modular, flexible, and scalable repair solutions adaptable to diverse equipment brands and specifications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $22.5 Billion |

| Market Forecast in 2033 | $33.4 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Siemens Energy, General Electric (GE), Sulzer Ltd., Mitsubishi Heavy Industries, MAN Energy Solutions, Wood Group, Flowserve Corporation, John Crane (Smiths Group), Dover Corporation, SKF Group, Wärtsilä, Elliott Group (Ebara Corporation), Baker Hughes, Precision Castparts Corp. (Berkshire Hathaway), WEG S.A., Timken Company, Regal Rexnord, KSB SE & Co. KGaA, Weir Group, Allied Reliability Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Rotating Equipment Repair Market Key Technology Landscape

The technology landscape in the Rotating Equipment Repair Market is rapidly evolving, driven by the need for increased precision, reduced downtime, and enhanced longevity of serviced assets. Condition Monitoring Systems (CMS) form the foundational technology, utilizing sophisticated sensors (accelerometers, proximity probes, temperature sensors) coupled with high-speed data acquisition systems to capture real-time operational signatures. Advanced vibration analysis, often integrated with acoustics and thermography, allows technicians to detect subtle mechanical defects such as bearing wear, shaft misalignment, or rotor imbalance at an extremely early stage. The efficacy of CMS is paramount for enabling predictive maintenance schedules, thereby transforming traditional time-based repair intervals into optimized, condition-based interventions, which significantly reduces maintenance expenditure and the risk of catastrophic failure.

Furthermore, digital technologies such as the Industrial Internet of Things (IIoT) and Digital Twins are revolutionizing how repair decisions are made. IIoT provides the connectivity framework necessary to transmit vast quantities of operational data from remote or complex assets to centralized analytics hubs. Digital Twins, which are virtual replicas of physical assets, utilize this data to simulate component degradation, evaluate the impact of repair choices, and test the performance parameters of repaired equipment before it is returned to service. This capability ensures repair quality and allows for the creation of customized, asset-specific maintenance programs, moving beyond generic repair standards. These technologies are crucial for high-value assets like gas turbines, where optimal performance is linked directly to efficiency and fuel consumption.

In terms of physical repair techniques, advanced manufacturing and material science technologies are playing an increasing role. Specialized processes like High-Velocity Oxygen Fuel (HVOF) coating and advanced laser cladding are utilized to restore worn surfaces, providing superior wear resistance, corrosion protection, and thermal stability compared to original components. Precision machining, including five-axis CNC grinding and turning, ensures that repairs meet stringent geometrical tolerances critical for high-speed rotational machinery. Moreover, portable, high-precision laser alignment systems are now standard practice for ensuring proper coupling between repaired components and adjacent machinery, eliminating a major source of post-repair operational stress and vibration, directly impacting the quality and guarantee period offered by service providers.

Regional Highlights

- Asia Pacific (APAC) Market Dominance and Growth Trajectory: APAC is anticipated to be the fastest-growing region in the Rotating Equipment Repair Market, driven by unprecedented industrial expansion, robust investment in infrastructure, and the continuous development of power generation capacity, particularly in emerging economies like China, India, and Southeast Asian nations. The region is characterized by a mix of new installations requiring warranty and scheduled maintenance, alongside a rapidly growing installed base of aging equipment demanding specialized refurbishment. Governments’ focus on reliable utility services and capacity expansion in chemical and refining sectors ensures steady demand. Local service providers are rapidly improving their capabilities, often supported by joint ventures with established Western OEMs, focusing heavily on adapting predictive maintenance technologies to the region's diverse operational environments.

- North America (NA) Market Maturity and Technological Adoption: North America holds a substantial share of the global market, characterized by mature industrial infrastructure and a high concentration of technologically advanced end-users, particularly in the Oil & Gas and Power sectors. Market growth here is less driven by new infrastructure builds and more by the imperative to upgrade and extend the operational life of existing assets, which often includes complex steam turbines and large refinery compressors. The region is a leader in adopting AI, IIoT, and advanced remote diagnostic services, enabling sophisticated, condition-based maintenance contracts. Regulatory environments, particularly environmental and safety standards, mandate high precision in repair and maintenance, sustaining high service quality demands and premium pricing for specialized expertise.

- European Market Focus on Efficiency and Modernization: Europe presents a highly competitive and mature market. The region’s trajectory is strongly influenced by energy transition policies, leading to increased repair and refurbishment needs for conventional power assets undergoing flexible operation regimes, and substantial growth in specialized service demand for wind and hydro turbines. European service providers emphasize advanced repair techniques, metallurgical expertise, and integrated performance optimization services aimed at enhancing energy efficiency. Strict adherence to ISO quality standards and environmental regulations means customers prioritize service providers who can demonstrate low-emission repair processes and component upgrades that improve overall asset efficiency.

- Middle East and Africa (MEA) Investment in Energy Infrastructure Maintenance: The MEA region’s market demand is overwhelmingly tied to the massive installed base of rotating equipment in the upstream, midstream, and downstream Oil & Gas industries, particularly in the GCC nations. Given the centrality of these assets to national economies, maintenance spending is typically robust and prioritized. The market is characterized by a strong presence of international OEMs and service providers due to the need for highly specialized repair capabilities for very large, high-value assets (e.g., LNG compressors and large gas turbines). Opportunities are concentrated in localized service delivery expansion and training programs designed to develop regional technical expertise, mitigating logistical challenges associated with overseas repairs.

- Latin America (LA) Market Dynamics and Resource Sector Dependence: Latin America's rotating equipment repair market is highly cyclical and intrinsically linked to the performance of its dominant resource sectors, including mining, petroleum, and utilities. Countries like Brazil and Mexico drive the majority of the regional demand. While preventative maintenance adoption is growing, the market still features a high degree of reactive repair due to economic fluctuations and less stringent maintenance budgets in certain segments. The logistical complexity of servicing equipment across vast geographic distances and the reliance on imported specialized parts often increase repair lead times and costs, presenting opportunities for service providers who can establish strong local fabrication and technical support capabilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Rotating Equipment Repair Market.- Siemens Energy

- General Electric (GE)

- Sulzer Ltd.

- Mitsubishi Heavy Industries

- MAN Energy Solutions

- Wood Group

- Flowserve Corporation

- John Crane (Smiths Group)

- Dover Corporation

- SKF Group

- Wärtsilä

- Elliott Group (Ebara Corporation)

- Baker Hughes

- Precision Castparts Corp. (Berkshire Hathaway)

- WEG S.A.

- Timken Company

- Regal Rexnord

- KSB SE & Co. KGaA

- Weir Group

- Allied Reliability Group

Frequently Asked Questions

Analyze common user questions about the Rotating Equipment Repair market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand in the Rotating Equipment Repair Market?

The foremost driver is the critical need to maximize asset uptime and prevent costly unplanned downtime in heavy industries. This necessity is compounded by the globally aging installed base of industrial machinery, requiring complex refurbishment and life extension services, alongside regulatory mandates for continuous operational integrity.

How are predictive maintenance technologies impacting traditional repair models?

Predictive maintenance (PdM), enabled by IIoT sensors and AI analytics, is shifting repair models from reactive failure response to proactive, condition-based interventions. This minimizes catastrophic failures, optimizes resource allocation, and allows service providers to offer long-term performance-based contracts rather than transactional repairs.

Which segment holds the largest market share by equipment type?

The Turbine and Compressor segment holds the largest market share. This is due to the extreme complexity, high capital value, and stringent operational requirements of these assets, especially in the Oil & Gas and Power Generation sectors, leading to high-value, specialized repair contracts.

What are the main challenges faced by Independent Service Providers (ISPs) in this market?

ISPs primarily face challenges related to accessing proprietary intellectual property, specialized tooling, and genuine spare parts controlled by Original Equipment Manufacturers (OEMs). They must also continuously invest in advanced diagnostics and highly skilled technical labor to compete effectively with OEM service networks.

Which geographical region is expected to demonstrate the highest growth rate?

The Asia Pacific (APAC) region is projected to show the highest growth rate, driven by extensive industrialization, large-scale infrastructure projects, and significant ongoing expansion in power generation and petrochemical capacities across countries such as China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager