Rotogravure Printing Machine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437250 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Rotogravure Printing Machine Market Size

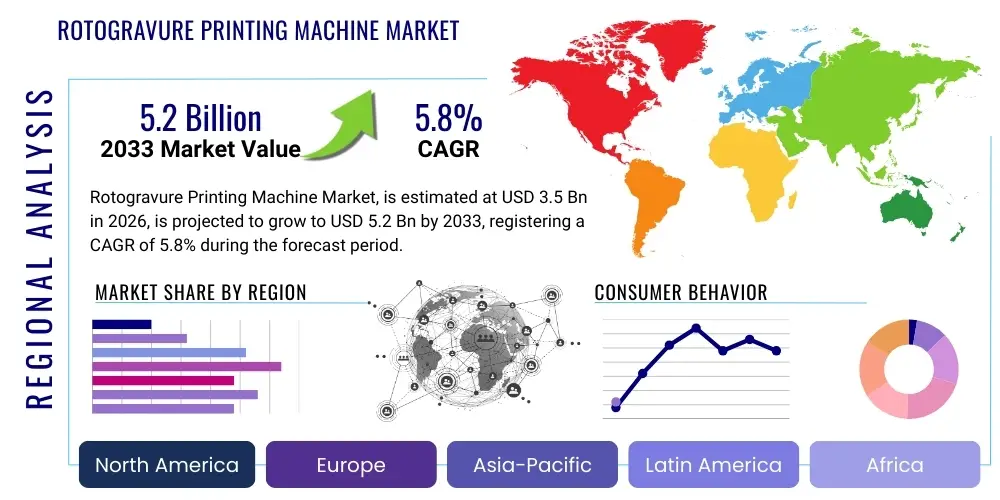

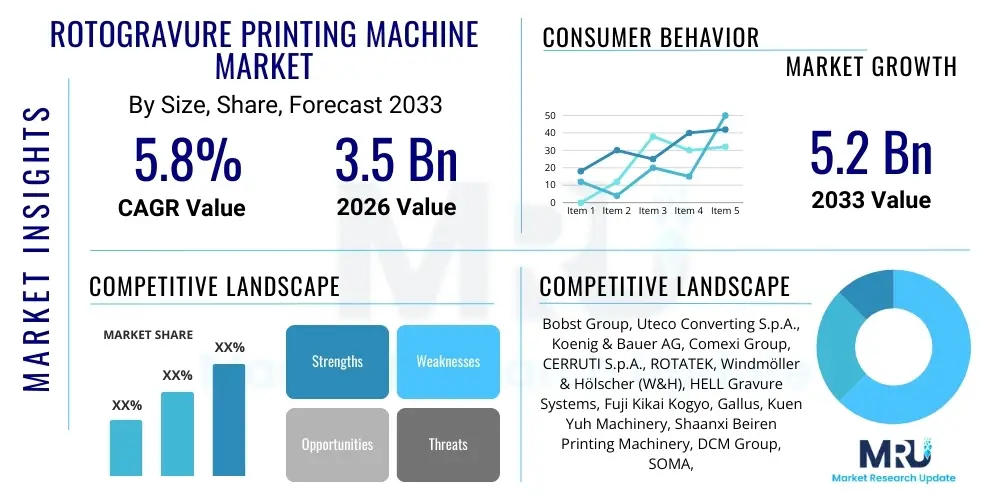

The Rotogravure Printing Machine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 5.2 Billion by the end of the forecast period in 2033.

Rotogravure Printing Machine Market introduction

The Rotogravure Printing Machine Market encompasses equipment used primarily for high-volume, long-run printing applications, characterized by the use of engraved cylinders to transfer ink directly onto substrates. This technology is highly valued for its ability to produce sharp, detailed, high-quality images with excellent consistency and repeatability, making it indispensable in sectors requiring vibrant and sophisticated aesthetics. Key substrates processed include films, foils, papers, and laminates, which are crucial for the rapid expansion of the flexible packaging industry globally. The robust nature of rotogravure technology allows for high-speed operation and superior ink laydown, which translates into lower operational costs for massive production runs, solidifying its position as a preferred printing method despite the rising prominence of digital alternatives in short-run environments. Furthermore, advancements in electronically engraved cylinders and sophisticated tension control systems are continuously improving the efficiency and reducing the waste associated with rotogravure processes.

Major applications of rotogravure printing machines span across two primary sectors: flexible packaging and publication printing. In flexible packaging, rotogravure is critical for printing food wrappers, pouches, labels, and shrink sleeves, where high-definition graphics and brand consistency are paramount for consumer appeal. The ability to handle complex multi-layer substrates and specialty inks (including metallic and matte finishes) provides a competitive edge over other printing techniques. In publication, while facing competition from digital media, rotogravure remains essential for high-quality magazines, catalogs, and security printing due to its reliable color reproduction and durability. The inherent quality benefits, combined with the economies of scale achieved in large orders, position the market for steady, quality-driven growth. The increasing complexity of modern packaging designs and the global focus on enhancing product aesthetics directly fuel the demand for advanced rotogravure machinery.

Driving factors for this market include the unprecedented global expansion of the processed food and consumer goods industries, particularly in Asia Pacific and Latin America, necessitating vast quantities of high-quality flexible packaging. Furthermore, technological benefits such as superior consistency across millions of prints, effective handling of wide web widths, and excellent solvent recovery systems that enhance sustainability contribute significantly to market adoption. The continuous development of automation features, including automated cylinder handling and register control, minimizes downtime and operational complexity, making modern rotogravure presses more attractive to large-scale converters. Despite challenges related to high initial investment and cylinder preparation time, the long-term cost-efficiency and quality output drive sustained investment in this specialized capital equipment sector.

Rotogravure Printing Machine Market Executive Summary

The Rotogravure Printing Machine Market is characterized by robust investment driven primarily by the escalating demand for high-quality, high-volume flexible packaging solutions across emerging economies. Business trends indicate a strong move toward highly automated, shaftless gravure presses integrated with advanced inspection and defect detection systems to minimize waste and ensure quality consistency. Environmentally conscious manufacturing is shaping the market, with key players focusing heavily on developing water-based ink systems and more efficient solvent recovery units to meet stringent global sustainability regulations. Furthermore, the convergence of traditional gravure printing with digital pre-press workflows, including Computer-to-Engrave (CtE) technologies, is enhancing setup speed and reducing lead times, thereby addressing the traditional limitations of gravure technology and making it more competitive against flexography and digital printing, especially for mid-to-long runs. Strategic collaborations between machinery manufacturers and specialized ink suppliers are becoming critical to optimize the printing process for novel, eco-friendly substrates and high-barrier films.

Regional trends highlight Asia Pacific (APAC) as the undisputed dominant growth center, fueled by massive industrialization, population growth, and the corresponding surge in packaged consumer goods (FMCG) and food products in countries like China, India, and Southeast Asia. These regions prioritize investment in high-speed machinery to meet massive domestic demand. North America and Europe, conversely, exhibit moderate, value-driven growth, emphasizing machinery upgrades focused on Industry 4.0 integration, energy efficiency, and sustainability compliance, rather than sheer capacity expansion. Latin America shows promising growth, particularly in Brazil and Mexico, linked to expanding retail chains and the modernization of local packaging converters. The Middle East and Africa are emerging regions, where infrastructure development and increasing urbanization are slowly but surely increasing the adoption of packaged goods, opening new market opportunities for established rotogravure manufacturers looking to penetrate niche local markets.

Segment trends underscore the dominance of the flexible packaging application segment, which continues to command the largest market share due to the global shift away from rigid containers. Within machinery type, shaftless rotogravure presses are gaining significant traction over traditional shafted models, attributed to their superior operational flexibility, reduced setup time, faster job changeovers, and enhanced registration accuracy, which are critical in a market demanding shorter cycles. Furthermore, the shift from solvent-based inks, while still dominant in specific quality-critical applications, towards water-based ink systems represents a key trend, particularly in response to regulatory pressures in Europe and North America focusing on volatile organic compound (VOC) reduction. The continuous development of specialized presses designed for wide web applications (above 1300 mm) further solidifies rotogravure's role in industrial-scale printing for industrial films and architectural surfaces.

AI Impact Analysis on Rotogravure Printing Machine Market

User queries regarding the impact of Artificial Intelligence (AI) on rotogravure printing frequently revolve around how AI can mitigate the complexity and variability inherent in the traditional gravure process. Common themes include the integration of predictive maintenance systems to minimize unplanned downtime, the use of machine learning algorithms for real-time color and register control, and the potential for AI-driven automation in cylinder engraving and preparation, a typically labor-intensive step. Users are particularly concerned about ensuring consistent quality across high-speed, long runs and reducing the significant material waste associated with initial setup and defect correction. They anticipate AI transforming rotogravure from a skilled-operator-dependent process into a fully optimized, self-correcting manufacturing operation, thereby improving overall equipment effectiveness (OEE) and justifying the high capital expenditure required for modern presses.

- AI-Powered Predictive Maintenance: Utilizing sensor data and machine learning to forecast component failures, scheduling preventative interventions, and dramatically reducing unplanned production stoppages.

- Real-time Color Management: AI algorithms automatically adjusting ink viscosity, drying parameters, and color densities in milliseconds to maintain precise color matching throughout the entire run, minimizing human error.

- Automated Registration Control: Implementing deep learning models to predict and compensate for substrate stretch and movement at extremely high speeds, ensuring perfect image overlay (register accuracy).

- Quality Assurance and Defect Detection: Advanced computer vision systems powered by AI identifying subtle print defects (e.g., skips, streaks, missing dots) and classifying them instantly, enabling immediate process adjustments.

- Optimized Job Setup and Cylinder Engraving: AI modeling historical data to recommend optimal engraving patterns, cell structures, and start-up parameters, drastically shortening make-ready times and reducing material waste.

- Energy Consumption Optimization: Intelligent algorithms managing press speed, drying tunnel temperatures, and ventilation systems to minimize energy usage while maintaining required drying and curing conditions.

- Workflow Integration: AI facilitating seamless data flow between Enterprise Resource Planning (ERP) systems, prepress software, and the physical printing press, creating a highly efficient, integrated manufacturing environment.

DRO & Impact Forces Of Rotogravure Printing Machine Market

The dynamics of the Rotogravure Printing Machine Market are shaped by a powerful interplay of drivers, restraints, and opportunities, culminating in significant impact forces that dictate investment decisions and technological focus. Key drivers include the massive surge in global flexible packaging consumption, driven by changing consumer habits, particularly the preference for convenience and single-serve packaging formats, which heavily rely on gravure for visual appeal and barrier properties. Concurrently, technological advancements in automation, such as electronic shaft control and improved drying technology, significantly boost the efficiency and throughput of modern rotogravure presses. However, the market faces significant restraints, chiefly the extremely high initial capital investment required for purchasing and installing the machinery, coupled with the expensive and time-consuming process of cylinder engraving and preparation, which makes short-run jobs economically unviable. Additionally, increasing environmental regulations targeting VOC emissions from solvent-based inks pose a persistent challenge, forcing manufacturers to invest heavily in alternative ink chemistries and advanced recovery systems.

Opportunities for growth are concentrated in the transition towards sustainable printing practices, specifically the development of presses optimized for water-based and energy-curable (UV/EB) inks, minimizing environmental impact while maintaining quality. The emerging demand for highly specialized security printing applications (e.g., currency, tax stamps, high-security documents) also provides a niche high-value opportunity, leveraging gravure's unique ability to deliver precise, intricate details that are difficult to counterfeit. The primary impact forces currently driving the market include the "Packaging Proliferation Imperative," where the need for aesthetically superior and functional packaging is non-negotiable for brand differentiation, forcing converters to invest in gravure quality. Simultaneously, the "Regulatory Compliance Pressure" forces continuous innovation in solvent recovery and ink formulation, acting as a catalyst for machine upgrades and technological differentiation among vendors who can offer sustainable solutions.

Segmentation Analysis

The Rotogravure Printing Machine Market is segmented based on operation type, application, and ink type, allowing for a detailed understanding of varying technological adoption patterns and end-user demands. The segmentation by operation type differentiates between traditional shafted presses and modern shaftless (electronic line shaft) presses, reflecting the industry's shift towards greater automation and quicker changeovers. Application segmentation highlights the crucial role of rotogravure in consumer goods, with flexible packaging dominating the market landscape, followed by publication and specialty printing. Segmentation by ink type, distinguishing between solvent-based and water-based inks, reveals the ongoing technological transition necessitated by global environmental standards and regulations.

- By Operation Type

- Shaftless Rotogravure Printing Machines

- Shafted Rotogravure Printing Machines

- By Application

- Flexible Packaging (Food & Beverages, Personal Care, Pharmaceutical)

- Publication Printing (Magazines, Catalogs, Books)

- Decorative Printing (Wallpaper, Vinyl Flooring)

- Security and Specialty Printing

- Others (Industrial Films, Heat Transfer Printing)

- By Ink Type

- Solvent-Based Inks

- Water-Based Inks

- UV/EB Curing Inks

- By Web Width

- Narrow Web (Below 800 mm)

- Medium Web (800 mm to 1300 mm)

- Wide Web (Above 1300 mm)

Value Chain Analysis For Rotogravure Printing Machine Market

The value chain of the Rotogravure Printing Machine Market begins with the upstream suppliers of raw materials and specialized components, transitioning through the core manufacturing and integration process, and concluding with downstream distribution and end-user conversion. Upstream analysis involves key suppliers providing high-precision engineering materials such as specialized steel alloys for machine frames, advanced polymers for rollers, and complex electronic components, including servo drives, sophisticated PLCs, and high-resolution inspection cameras essential for shaftless operations and quality control. The cost and quality of these highly specialized components, particularly the engraving technology (lasers and electromechanical engravers), significantly influence the final machine price and performance capabilities. Strong relationships and reliable sourcing from specialized electronic and mechanical suppliers are vital for maintaining the competitive edge and technological superiority of the equipment manufacturers.

The core of the value chain is the manufacturing process, involving intricate design, assembly, and rigorous testing of the complex press lines. Manufacturers integrate mechanical structures with advanced control systems (HMI, PLC, register control) and specialized units like drying tunnels and solvent recovery systems. Downstream analysis focuses on the distribution channels and end-users. Distribution is primarily handled through direct sales teams for major, high-cost press lines, supplemented by specialized regional agents or distributors who provide local sales, installation, and critical after-sales services, including spare parts supply and technical support. The end-users, predominantly flexible packaging converters, integrate these machines into high-volume production lines, utilizing them to convert films and substrates into finished packaging products for the FMCG, food, and pharmaceutical industries.

The distribution channel structure differentiates between direct and indirect sales strategies. For flagship, high-value, and customized rotogravure presses, manufacturers rely on direct engagement with large, multinational packaging conglomerates, ensuring bespoke specifications are met and long-term service contracts are established. This direct channel fosters deep technical partnership. Conversely, indirect channels involving regional distributors are crucial for penetrating smaller, localized markets, offering standardized models, and providing faster response times for maintenance and operational training. The efficiency of the distribution network, particularly the availability of highly skilled service technicians capable of installing and troubleshooting complex gravure systems, is a critical factor influencing customer purchasing decisions and long-term market penetration. Ensuring a robust global service network minimizes downtime, which is a significant cost factor for end-users operating high-speed equipment.

Rotogravure Printing Machine Market Potential Customers

Potential customers for Rotogravure Printing Machines are overwhelmingly large-scale industrial entities whose business models are predicated on producing vast quantities of standardized, high-quality printed materials requiring superior aesthetics and durability. The primary end-users are flexible packaging converters who supply pouches, wrappers, and laminates to multinational consumer goods companies (FMCG), food and beverage processors, and pharmaceutical manufacturers. These converters require the consistency, speed, and versatility of gravure to print millions of units across various barrier films, foil, and paper substrates. The high quality and long-run efficiency offered by rotogravure are non-negotiable for these customers, who seek to maximize throughput while minimizing the per-unit cost of complex packaging designs. Furthermore, the specialized nature of gravure printing, allowing for superior ink laydown and handling of opaque white and metallic inks, makes it the preferred choice for premium and high-visibility consumer products.

Secondary potential customers include specialized publication houses focusing on high-volume, high-quality magazines and catalogs, where exceptional color depth and image clarity are essential for advertising revenue and subscriber satisfaction. While this segment has faced pressure from digital media, the requirement for high-fidelity commercial printing remains relevant for major advertisers. Additionally, manufacturers of decorative materials, such as vinyl flooring, laminates, and sophisticated wall coverings, are significant buyers, utilizing rotogravure's capacity for wide-format, repetitive, and durable pattern application on heavy industrial substrates. Security printing operations, including governmental agencies and certified security printers, also represent a high-value customer base, relying on gravure technology for banknotes, official documents, and high-security labels due to its unparalleled consistency and difficulty to replicate, leveraging features like micro-engraving.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.2 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bobst Group, Uteco Converting S.p.A., Koenig & Bauer AG, Comexi Group, CERRUTI S.p.A., ROTATEK, Windmöller & Hölscher (W&H), HELL Gravure Systems, Fuji Kikai Kogyo, Gallus, Kuen Yuh Machinery, Shaanxi Beiren Printing Machinery, DCM Group, SOMA, Nordmeccanica Group, Jiangsu Zhongke, Qifeng Machinery, Zhejiang Jinbao, Lohia Corp Limited, Taiyo Kikai Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Rotogravure Printing Machine Market Key Technology Landscape

The technological landscape of the Rotogravure Printing Machine Market is defined by a continuous pursuit of enhanced automation, superior registration accuracy, and environmental sustainability. A foundational technology driving modern press design is the Electronic Line Shaft (ELS) or shaftless system, which replaces mechanical gear trains with individual servo motors for each printing unit. This innovation significantly improves speed, reduces mechanical complexity, minimizes vibration, and drastically shortens make-ready and changeover times by facilitating precise, electronic register control and remote adjustment. Furthermore, advanced gravure cylinder preparation technologies, specifically laser engraving and high-speed electromechanical engraving, are crucial; these systems allow for rapid production of precise cell structures necessary for high-definition graphics and specialty security features, integrating seamlessly with digital prepress workflows to achieve Computer-to-Engrave (CtE) efficiency.

Another significant technology focus is on enhancing efficiency and safety through sophisticated drying and ventilation systems. Modern presses utilize high-efficiency drying tunnels with integrated solvent recovery units (SRUs). SRUs employ activated carbon adsorption or condensation techniques to capture and recycle volatile organic compounds (VOCs) emitted from solvent-based inks, enabling compliance with strict air quality standards while offering economic benefits through solvent reuse. This technology is becoming mandatory in highly regulated markets such as Europe. Additionally, regenerative thermal oxidizers (RTOs) are often deployed to safely combust remaining low concentrations of solvents, ensuring minimal environmental leakage. The efficacy and energy consumption of these recovery systems are key differentiators among machinery manufacturers, catering directly to the environmental compliance needs of large converters.

Finally, the integration of Industry 4.0 principles is fundamentally transforming operations. This includes sophisticated Human-Machine Interfaces (HMIs) providing real-time operational diagnostics and performance metrics (OEE monitoring). Inline quality inspection systems, utilizing high-resolution cameras and pattern matching software, detect microscopic defects and automatically adjust parameters without operator intervention, thereby maintaining print quality at speeds exceeding 600 meters per minute. Furthermore, data analytics and machine learning are increasingly used for predictive maintenance, analyzing vibration, temperature, and current draw data from motors and bearings to anticipate potential failures, thereby ensuring near-zero unplanned downtime. These technological advancements collectively reduce waste, improve operational uptime, and reduce the reliance on highly specialized manual labor, positioning rotogravure as a high-tech manufacturing solution.

Regional Highlights

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market for rotogravure printing machines globally. This dominance is driven by high population density, rapid industrialization, and explosive growth in the FMCG sector, especially in China, India, and Southeast Asian nations. The region’s converters prioritize high-speed, wide-web presses to meet the massive demand for flexible food and consumer packaging. Government policies supporting manufacturing and the availability of cheaper labor, despite high automation requirements, further contribute to large-scale investment in new rotogravure capacity. The market here focuses on cost-efficient operations and capacity expansion, often adopting newer, highly automated shaftless presses to handle complex film structures required by international brands operating locally. The competitive landscape is intense, with both established global players and strong regional manufacturers vying for dominance.

- Europe: The European market is characterized by maturity, stringent quality requirements, and a strong focus on sustainability. Growth in this region is primarily driven by replacement demand and technological upgrades aimed at complying with environmental regulations, particularly those concerning VOC emissions. European converters seek highly energy-efficient machines equipped with state-of-the-art solvent recovery and water-based ink capabilities. Key markets such as Germany, Italy, and the UK prioritize presses with high levels of automation (Industry 4.0 integration, advanced quality control) to ensure efficiency and maintain competitiveness despite higher operational costs. The demand for specialty printing, including high-security and decorative applications, remains robust, pushing innovation in specialized gravure technology.

- North America: North America exhibits stable, moderate growth, largely influenced by the premiumization trend in packaging and the adoption of cutting-edge technology. The market here demands high-performance rotogravure presses capable of handling complex graphic requirements for branding and consumer engagement. While flexible packaging demand is strong, the focus is less on sheer volume expansion and more on technological integration, such as integrating digital print heads for variable data elements directly onto the gravure line (Hybrid printing). Investment is concentrated among large packaging groups seeking to consolidate operations and achieve higher overall equipment effectiveness (OEE) through AI-driven maintenance and advanced automation features. Environmental compliance and worker safety standards are significant purchasing criteria.

- Latin America (LATAM): LATAM is an emerging market with high potential, particularly in Brazil and Mexico, driven by increasing urbanization, rising disposable incomes, and the modernization of the retail sector. Local converters are gradually replacing older equipment with modern, high-speed rotogravure presses to cater to international brands expanding their presence in the region. Economic volatility can sometimes restrain large capital investments, but the underlying demand for domestically produced flexible packaging remains strong. The market is often cost-sensitive, leading to a balance between quality output and initial machinery cost, favoring reliable, durable equipment capable of handling diverse job requirements.

- Middle East and Africa (MEA): The MEA region is at an nascent stage of rotogravure adoption, with investment concentrated in packaging hubs like the UAE, Saudi Arabia, and South Africa. Growth is tied to infrastructure development, food security initiatives, and the establishment of local manufacturing bases for consumer goods. The demand is often project-based, linked to large industrial or food processing investments. While smaller in scale compared to APAC, the region offers significant long-term opportunities as local printing capabilities expand to reduce reliance on imported packaging materials.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Rotogravure Printing Machine Market.- Bobst Group

- Uteco Converting S.p.A.

- Koenig & Bauer AG (KBA)

- Comexi Group

- CERRUTI S.p.A.

- ROTATEK S.A.

- Windmöller & Hölscher (W&H)

- HELL Gravure Systems GmbH

- Fuji Kikai Kogyo Co., Ltd.

- Gallus Ferd. Rüesch AG (A Heidelberg Company)

- Kuen Yuh Machinery Co., Ltd.

- Shaanxi Beiren Printing Machinery Co., Ltd.

- DCM Group (Decim Machinery)

- SOMA Engineering

- Nordmeccanica Group

- Jiangsu Zhongke Group

- Qifeng Machinery Co., Ltd.

- Zhejiang Jinbao Machinery Co., Ltd.

- Lohia Corp Limited

- Taiyo Kikai Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Rotogravure Printing Machine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for Rotogravure Printing Machines globally?

The primary driver is the exponential growth of the global flexible packaging industry, particularly within the food, beverage, and personal care sectors across emerging economies in Asia Pacific. Rotogravure offers the superior print quality, durability, and high-speed efficiency required for long-run packaging production that is essential for brand consistency and consumer appeal.

How do shaftless rotogravure presses compare to traditional shafted presses, and which is dominating the market?

Shaftless (Electronic Line Shaft) presses are dominating new installations due to their superior performance characteristics. They replace mechanical linkages with individual servo motors, offering significantly faster job changeovers, enhanced registration precision, reduced mechanical wear, and greater operational flexibility compared to older, less efficient shafted models.

What are the key sustainability challenges facing the rotogravure market?

The main sustainability challenge is the high emission of volatile organic compounds (VOCs) associated with traditional solvent-based inks. Market players are actively addressing this by investing heavily in advanced solvent recovery systems (SRUs) and developing high-performance water-based and UV/EB ink technologies suitable for high-speed gravure applications to ensure regulatory compliance and reduce environmental footprint.

What role does automation, particularly Industry 4.0 technology, play in modern rotogravure printing?

Automation is crucial for improving Overall Equipment Effectiveness (OEE). Modern rotogravure presses integrate Industry 4.0 technologies such as AI-driven predictive maintenance, automated register and color control, and inline defect detection systems. These features minimize waste, reduce reliance on manual intervention, accelerate setup times, and ensure consistent print quality across extremely long production runs.

Despite the rise of digital printing, why does rotogravure remain the preferred choice for certain applications?

Rotogravure remains preferred for extremely high-volume, long-run jobs requiring the highest quality, consistency, and durability. Its ability to handle wide web widths, apply thick ink films (ideal for metallic or opaque white inks), and deliver high-definition, repetitive patterns (e.g., decorative printing, security features) provides unmatched quality and lower long-term per-unit cost efficiency compared to current digital technologies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager