Rotogravure Printing Presses Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434749 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Rotogravure Printing Presses Market Size

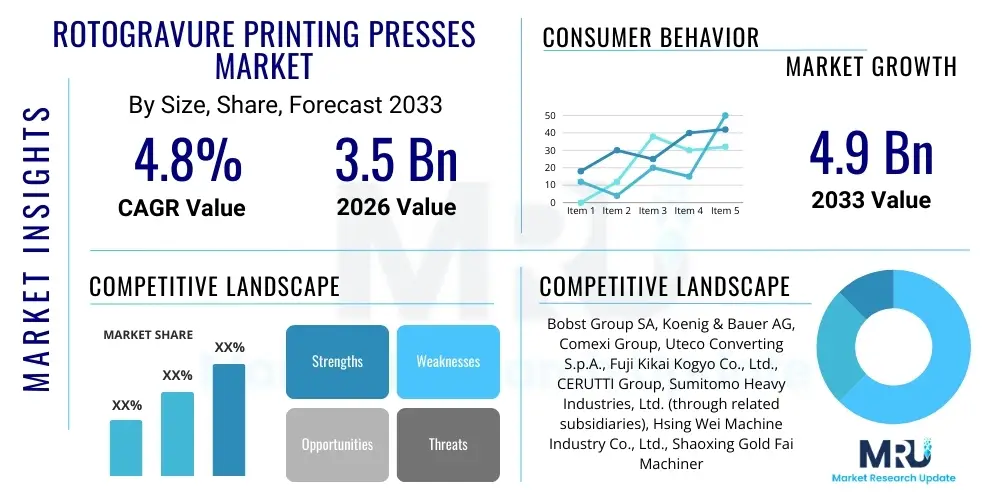

The Rotogravure Printing Presses Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 4.9 Billion by the end of the forecast period in 2033. This consistent growth trajectory is primarily driven by the expanding packaging industry, particularly in flexible packaging for food, beverages, and pharmaceuticals, where high-quality, large-volume printing is essential for brand consistency and consumer appeal.

Rotogravure Printing Presses Market introduction

The Rotogravure Printing Presses Market encompasses the design, manufacturing, sale, and servicing of high-speed printing machinery utilizing the gravure printing technique, which involves engraving the image onto a copper-plated cylinder. This method is highly favored in sectors demanding exceptional print quality, vibrant color reproduction, and long run lengths, specifically within the converting and packaging industries. Rotogravure presses are engineered for high throughput and consistency, making them indispensable for complex designs on diverse substrates, including thin films, foils, and specialty papers.

Key products within this market include shafted and shaftless presses, electronic line shaft (ELS) systems, and specialized presses tailored for security printing or decorative applications. Major applications span flexible packaging (snack bags, pouches), labeling, publication printing (magazines, catalogs), and decorative laminates (flooring, furniture surfaces). The inherent benefits of rotogravure, such as superior ink laydown, durability of the printing cylinders for repeat jobs, and high-speed operational efficiency, solidify its position despite competition from flexography and digital printing technologies.

The market expansion is fundamentally driven by the rising global demand for consumer packaged goods (CPG), especially in emerging economies. Furthermore, technological advancements focusing on automation, quick changeovers, and reduced solvent emissions (VOCs) are enhancing the viability and environmental compliance of these presses. The need for distinctive, premium packaging that differentiates products on crowded retail shelves continues to spur investment in sophisticated rotogravure technology capable of handling intricate graphics and demanding specifications.

Rotogravure Printing Presses Market Executive Summary

The Rotogravure Printing Presses Market is characterized by robust investment in high-automation equipment, addressing labor costs and efficiency requirements. Business trends indicate a strong move toward sustainable printing solutions, prompting manufacturers to integrate energy recovery systems and use water-based or electron beam (EB) curable inks, although solvent-based inks still dominate high-performance flexible packaging. The consolidation of large converting companies is driving demand for high-capacity, standardized press models capable of supporting global supply chains. Key regional trends show the Asia Pacific (APAC) region as the primary growth engine, fueled by rapid industrialization, massive population growth, and burgeoning middle-class consumerism driving packaging consumption in countries like China, India, and Southeast Asia. North America and Europe, while mature, focus on replacement cycles and integrating smart factory (Industry 4.0) capabilities into their existing infrastructure, prioritizing press connectivity and predictive maintenance features. Segmentation trends highlight the Shaftless category dominating the market due to superior register control and reduced setup times, while the Flexible Packaging segment remains the largest end-user application, consistently demanding wider web widths and faster operating speeds to meet scaling production needs.

AI Impact Analysis on Rotogravure Printing Presses Market

Common user inquiries regarding AI in the rotogravure sector center on how automation and machine learning can enhance operational efficiency, minimize waste, and predict equipment failure. Users frequently ask about the role of AI in color matching consistency across different runs and substrates, as well as its ability to optimize the doctor blade setting and pressure adjustments in real-time, which are traditionally dependent on operator skill. The core concern is whether AI integration will require substantial capital expenditure and retraining, potentially disrupting established production flows. However, expectations are high for AI to streamline complex setup processes, reduce changeover downtime (a major bottleneck in gravure printing), and improve predictive maintenance schedules, transitioning the industry from reactive repairs to proactive, data-driven management. Users anticipate AI will democratize high-level operational performance, making expert precision achievable even with less experienced staff. These themes summarize the key influence of AI as a tool for precision, prediction, and enhanced operational autonomy.

- AI-driven Predictive Maintenance: Analyzing sensor data from cylinders, doctor blades, and dryers to forecast equipment failure, minimizing unplanned downtime.

- Real-time Color and Register Control: Utilizing machine vision and deep learning algorithms to monitor print quality and automatically adjust ink viscosity and cylinder alignment with micro-level precision.

- Optimized Job Setup: AI algorithms processing historical job data to recommend optimal printing parameters (speed, tension, drying temperature) for specific substrates, drastically reducing setup time and material waste.

- Waste Reduction Analytics: Identifying patterns in production rejects and process anomalies, allowing operators to intervene before large batches of material are ruined.

- Supply Chain Integration: Using AI to forecast ink and solvent requirements based on production schedules, optimizing inventory levels and reducing carrying costs.

- Energy Efficiency Optimization: Machine learning controlling dryer temperatures and ventilation rates based on current production speed and ink coverage, resulting in significant energy savings.

DRO & Impact Forces Of Rotogravure Printing Presses Market

The Rotogravure Printing Presses Market is shaped by powerful forces, driven primarily by the escalating global demand for high-quality flexible packaging, particularly in the food and pharmaceutical sectors where visual branding is paramount. Restraints include the high initial capital investment required for gravure presses and the industry's reliance on solvent-based inks, which faces increasing regulatory scrutiny concerning volatile organic compound (VOC) emissions. Opportunities are abundant in the transition toward sustainable ink systems, such as water-based or UV/EB curing technologies adapted for high-speed gravure. Furthermore, expanding geographical markets in Africa and Latin America, coupled with the need for security printing and specialized decorative applications, present significant untapped potential. The key impact forces revolve around technological innovation driving automation and efficiency, stringent environmental regulations pushing for cleaner operations, and market dynamics favoring highly consolidated, quality-focused converting operations that require the consistent, reliable output of gravure technology.

Drivers include the continuous demand for elaborate, multi-layered packaging that only gravure can consistently produce at speed, the durability of gravure cylinders for extremely long print runs (often exceeding millions of impressions), and the superior ability of gravure to handle large-area solid colors and fine vignettes. The growth in specialized consumer goods, requiring premium finishes and tactile effects, further necessitates the use of gravure. Additionally, the proliferation of private labels and store brands globally encourages investments in presses that ensure visual consistency across vast product lines.

However, the restraints are significant. The lengthy and costly cylinder preparation process, which involves engraving and chrome plating, increases lead times compared to digital or flexographic platemaking. This makes gravure less viable for short-run, fast-turnaround jobs. Furthermore, the specialized skillset required to operate and maintain these complex, high-precision machines constitutes a recurring constraint, particularly in developing markets. The inherent environmental challenge posed by the widespread use of toluene and other solvents remains a significant regulatory hurdle globally, compelling manufacturers to invest heavily in solvent recovery systems, which adds to the operating cost.

Opportunities lie in developing hybrid printing systems that combine gravure with digital or flexography for variable data printing and enhanced customization. The push towards sustainable substrates, such as bio-plastics and compostable films, necessitates the development of new cylinder configurations and ink systems optimized for these materials. Expanding the application scope beyond traditional packaging into high-value functional printing, such as printed electronics and specialized security features on official documents, provides lucrative new market avenues. Manufacturers that can effectively integrate Industry 4.0 principles, offering remote diagnostics and cloud-based performance monitoring, will gain a competitive edge by minimizing total cost of ownership (TCO) for end-users.

Segmentation Analysis

The Rotogravure Printing Presses Market is comprehensively segmented based on technology, operation type, application, and web width. Understanding these segments provides clarity on market dynamics and investment pockets. Technology segmentation often differentiates between traditional mechanical line shaft presses and modern Electronic Line Shaft (ELS) or Shaftless systems, with the latter commanding higher adoption due to superior precision and control. Operation type is typically categorized into fully automatic, semi-automatic, and manual systems, reflecting the varied levels of automation required by different converters. The primary driver remains the application segment, dominated by flexible packaging, which includes materials for food, pharmaceutical, and personal care products. This segment dictates the required web width, leading to segmentation into narrow, medium, and wide web presses, catering to everything from labels to large-format decorative foils.

- By Technology:

- Electronic Line Shaft (ELS) Presses

- Shaftless Presses

- Mechanical Line Shaft Presses

- By Operation Type:

- Automatic Rotogravure Printing Presses

- Semi-Automatic Rotogravure Printing Presses

- By Application:

- Flexible Packaging

- Publication Printing (Magazines, Catalogs)

- Decorative Printing (Laminates, Wallpapers)

- Labeling

- Security Printing

- By Web Width:

- Narrow Web (Up to 600 mm)

- Medium Web (600 mm to 1200 mm)

- Wide Web (Above 1200 mm)

- By Ink Type:

- Solvent-Based Inks

- Water-Based Inks

- UV/EB Curable Inks

Value Chain Analysis For Rotogravure Printing Presses Market

The value chain for the Rotogravure Printing Presses Market begins with upstream suppliers providing critical raw materials and components, including specialized high-tolerance steel, precision motors, sophisticated electronic components, and advanced automation software systems. These components are integral to the press manufacturers, who engage in complex design, engineering, and assembly processes. Downstream activities involve the distribution channel, which utilizes both direct sales teams specializing in large industrial machinery and authorized regional distributors who handle installation, commissioning, and localized support. The final users are printing and converting houses, which transform raw packaging materials (films, foils) into finished products for major consumer packaged goods (CPG) companies and publishers. The effectiveness of the value chain relies heavily on the quality and reliability of after-sales service, including spare parts supply and technical consultation, which often determines the long-term profitability of the press investment for the end-user.

Rotogravure Printing Presses Market Potential Customers

The primary customers for rotogravure printing presses are large-scale printing and converting companies specializing in producing vast quantities of standardized, high-quality printed materials. These customers require presses capable of high-speed, continuous operation with minimal variability in color and register control. Key target sectors include the food and beverage packaging industry, where high-barrier films and sophisticated branding demand gravure quality, and the pharmaceutical industry, which requires tamper-evident packaging with intricate security features. Additionally, manufacturers of decorative surfaces, such as those producing laminated flooring, furniture foils, and high-end wallpapers, are crucial customers, leveraging gravure's ability to deposit heavy ink weights for realistic texture and pattern reproduction. Lastly, major publication houses focused on long-run catalogs and high-gloss magazines, though a diminishing segment, still represent a significant niche requiring gravure's cost-effectiveness at massive volumes. These customers prioritize machine longevity, operational speed, and low waste generation metrics.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 4.9 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bobst Group SA, Koenig & Bauer AG, Comexi Group, Uteco Converting S.p.A., Fuji Kikai Kogyo Co., Ltd., CERUTTI Group, Sumitomo Heavy Industries, Ltd. (through related subsidiaries), Hsing Wei Machine Industry Co., Ltd., Shaoxing Gold Fai Machinery Co., Ltd., Shantou Guanghua Printing Machinery Co., Ltd., Nordmeccanica SpA, Shaanxi Beiren Printing Machinery Co., Ltd., Rotomec SpA (part of Bobst), Manugraph India Limited, KAMA GmbH, Windmoeller & Hoelscher Corporation, HolwegWeber (part of W&H), Landa Digital Printing (indirect impact on segment), HP Inc. (digital hybrid integration), Totani Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Rotogravure Printing Presses Market Key Technology Landscape

The Rotogravure Printing Presses market is undergoing significant technological evolution, moving away from conventional mechanical systems towards highly digitized and automated platforms. A pivotal development is the widespread adoption of Electronic Line Shaft (ELS) and fully Shaftless technologies. ELS systems utilize independent servo drives for each printing unit, replacing the cumbersome mechanical drive chains. This advancement offers superior precision in registration control, drastically reduces vibrations, and simplifies maintenance, leading to faster setup and reduced substrate waste during changeovers. These presses are often integrated with sophisticated register control cameras and automatic viscosity measurement systems, ensuring color consistency throughout extended print runs, a critical factor for flexible packaging converters serving demanding global brands.

Another major technological focus is directed at improving drying efficiency and energy consumption. Traditional gravure printing requires extensive drying capacity due to the high volume of volatile solvents used in the ink. Modern presses feature advanced drying tunnels with highly efficient air recirculation and solvent recovery units (SRUs) to meet stricter environmental regulations and reduce operating costs. Furthermore, the integration of automation tools, often leveraging Artificial Intelligence and Machine Learning, is transforming operational control. These tools manage complex variables such as web tension, doctor blade pressure, and ink flow dynamically, minimizing the reliance on manual adjustments and enhancing overall productivity. This smart integration is key to achieving Industry 4.0 compliance within converting facilities.

Finally, the development of new inking and coating technologies is essential. While solvent-based inks remain prevalent, there is increasing commercial viability for water-based gravure inks for specific applications, particularly in less demanding packaging structures and decorative printing, driven by sustainability mandates in Europe and North America. Furthermore, high-speed electron beam (EB) and ultraviolet (UV) curing systems are being adapted for gravure to enable immediate drying, eliminating the need for extensive thermal drying tunnels and allowing for the processing of sensitive substrates that cannot withstand high heat. This technological diversification ensures the gravure process remains competitive against rapidly evolving flexographic and digital printing alternatives, particularly for high-fidelity decorative and functional printing requirements.

Regional Highlights

The Rotogravure Printing Presses market exhibits significant regional variations in terms of growth rates, technological adoption, and application focus. Asia Pacific (APAC) currently dominates the market both in volume and growth trajectory. This dominance is attributed to robust economic growth, massive industrial expansion, and the rapidly increasing consumer base in countries such as China, India, and Indonesia. These nations are witnessing explosive growth in the food, beverage, and personal care sectors, driving exponential demand for flexible packaging printed using high-speed, cost-effective gravure technology. Furthermore, APAC serves as a major manufacturing hub, necessitating continuous investment in new press installations to meet export demands and domestic consumption patterns. The region often prioritizes presses that offer high throughput and durability, suitable for continuous mass production environments.

Europe and North America represent mature markets characterized by replacement cycles and high-value applications. Press manufacturers in these regions focus heavily on integrating advanced automation, sustainability features (such as sophisticated VOC abatement and energy recovery), and specialized capabilities like short-run gravure adaptation. The European market, driven by stringent EU regulations (e.g., REACH), is a leader in adopting water-based and solvent-free printing technologies, often prioritizing press flexibility and reduced environmental footprint over sheer volume capacity. North America emphasizes high-fidelity printing for premium brands and sophisticated security printing applications, utilizing advanced ELS systems to ensure ultra-precise registration required by brand owners.

Latin America and the Middle East & Africa (MEA) are emerging regions offering substantial growth potential. Economic recovery and urbanization are accelerating the shift from traditional unbranded goods to packaged consumer products, stimulating initial investment in gravure presses for local converting houses. In MEA, particularly the GCC nations and South Africa, there is increasing demand for decorative laminates and high-quality flexible packaging. These regions often import mid-range to high-end presses, seeking reliable machinery that can handle challenging climatic conditions and diverse substrate types, representing strong opportunities for refurbished machinery or technologically robust, mid-sized press models from international vendors.

- Asia Pacific (APAC): Highest growth market driven by expanding CPG industry, flexible packaging boom in China and India, and rising demand for wide-web presses for high volume production.

- Europe: Focus on replacement cycles, sustainability mandates (water-based inks, solvent recovery), and high-precision gravure for decorative and luxury goods printing.

- North America: Market stability driven by demand for high-security printing, sophisticated food packaging, and investment in smart factory technologies (Industry 4.0 integration) to optimize TCO.

- Latin America (LATAM): Emerging market characterized by increasing urbanization, rising middle-class consumer spending, and steady adoption of medium-web presses for regional packaging needs.

- Middle East & Africa (MEA): Growth centered around decorative applications (laminates) and expansion of food packaging industries in key economic centers like UAE, Saudi Arabia, and South Africa.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Rotogravure Printing Presses Market.- Bobst Group SA

- Koenig & Bauer AG

- Comexi Group

- Uteco Converting S.p.A.

- Fuji Kikai Kogyo Co., Ltd.

- CERUTTI Group (Specializing in high-end gravure solutions)

- Sumitomo Heavy Industries, Ltd. (Active in specialized printing machinery)

- Hsing Wei Machine Industry Co., Ltd. (Prominent Asian manufacturer)

- Shaoxing Gold Fai Machinery Co., Ltd.

- Shantou Guanghua Printing Machinery Co., Ltd.

- Nordmeccanica SpA (Often integrated with gravure lines)

- Shaanxi Beiren Printing Machinery Co., Ltd.

- Rotomec SpA (Subsidiary of Bobst Group, focusing on gravure)

- Manugraph India Limited

- KAMA GmbH (Known for specialized finishing solutions integrated with gravure)

- Windmoeller & Hoelscher Corporation (Primarily flexo, but offering integrated solutions)

- HolwegWeber (Focus on bag and converting machinery, adjacent to gravure)

- Nipko Machines Private Limited

- Heidelberger Druckmaschinen AG (Indirectly through packaging segment focus)

- Toshin Kogyo Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Rotogravure Printing Presses market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the demand for new rotogravure printing presses globally?

The primary driving factors are the exponential growth in the global flexible packaging sector, particularly for high-quality food and pharmaceutical products, requiring consistent, high-fidelity printing over long production runs. Additionally, the need for enhanced brand visibility, coupled with superior handling of specialized substrates like thin films and metallized materials, solidifies rotogravure's market position. Technological replacement cycles in mature markets and mass urbanization in developing regions further stimulate demand for efficient, modern ELS-based equipment to replace older mechanical presses and increase throughput.

How are environmental regulations impacting the adoption and technological design of rotogravure presses?

Environmental regulations, specifically concerning the reduction of Volatile Organic Compounds (VOCs) emitted by solvent-based inks, are profoundly impacting press design. Manufacturers are responding by integrating advanced, highly efficient solvent recovery and abatement systems, or by actively developing presses optimized for sustainable alternatives such as water-based inks and UV/EB curing systems. This regulatory pressure accelerates the adoption of closed-loop systems and drives R&D towards cleaner, more energy-efficient drying technologies, increasing the capital cost but reducing the long-term operational environmental footprint and compliance risk for end-users.

What is the key difference between Electronic Line Shaft (ELS) and conventional mechanical rotogravure presses?

The key difference lies in the driving mechanism and precision control. Mechanical presses rely on gears and drive chains connected to a central shaft, leading to mechanical wear, vibration, and register inconsistencies at high speeds. ELS (Shaftless) presses utilize individual, synchronized servo motors for each printing station, eliminating mechanical linkages. This results in far superior registration accuracy, faster and more repeatable changeovers, reduced maintenance, and significantly higher operational speeds, making ELS technology the industry standard for modern, high-performance flexible packaging applications and crucial for waste reduction.

Which application segment currently holds the largest market share in the rotogravure printing presses industry?

The Flexible Packaging segment consistently holds the largest market share. This includes various materials used for packaging consumer goods such as snacks, beverages, detergents, and pharmaceuticals. Rotogravure technology is favored here due to its ability to print highly complex graphics consistently onto non-absorbent, flexible substrates like polyethylene, polypropylene, and various composite films. The demand is particularly concentrated in high-volume, multi-color jobs where the durability and print quality of gravure cylinders provide a significant competitive advantage over other printing methods.

What role does automation and Industry 4.0 play in the future growth of the rotogravure market?

Automation and Industry 4.0 integration are critical for future market growth, addressing labor skill gaps and enhancing competitiveness against digital printing. Future rotogravure presses are being designed with integrated sensors, AI-driven predictive maintenance systems, automated registration and color matching adjustments, and remote diagnostics capabilities. This allows converters to achieve higher Overall Equipment Effectiveness (OEE), minimize human intervention errors, streamline data logging for regulatory compliance, and facilitate shorter run capabilities by dramatically reducing non-productive setup and changeover times, thereby lowering the total cost of ownership (TCO).

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager