Round Knife Machine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435883 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Round Knife Machine Market Size

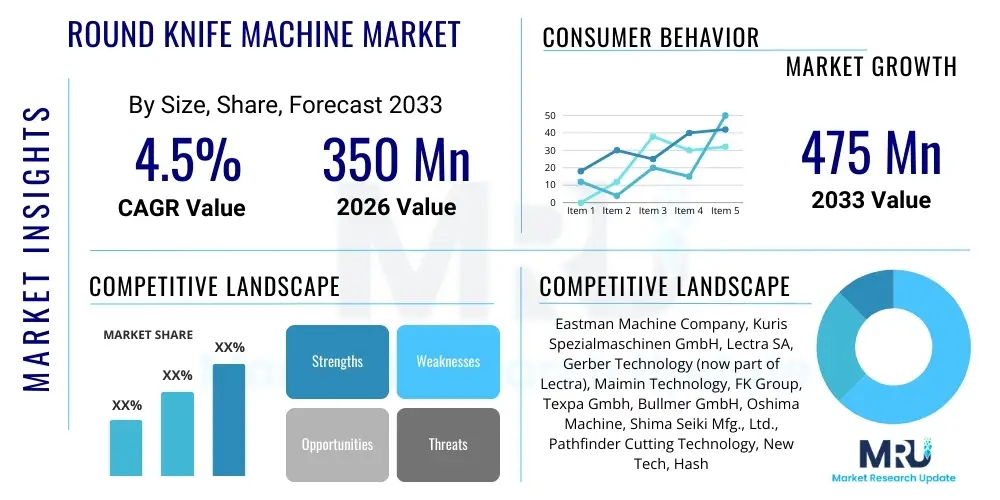

The Round Knife Machine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 350 Million in 2026 and is projected to reach USD 475 Million by the end of the forecast period in 2033. This consistent growth trajectory is primarily underpinned by the global expansion of the textile and apparel manufacturing sectors, particularly in emerging economies, coupled with the increasing demand for precision cutting tools to enhance production efficiency and reduce material wastage. The shift towards automated and semi-automated cutting solutions across various industrial applications, including automotive interiors and technical textiles, further solidifies the market's moderate yet stable expansion over the next decade.

Round Knife Machine Market introduction

The Round Knife Machine Market encompasses industrial cutting equipment utilizing a circular blade mechanism designed primarily for segmenting multiple layers of pliable materials, such as fabrics, leather, composites, and synthetic textiles. These machines, known for their versatility and high cutting capacity relative to manual methods, bridge the gap between simple handheld cutters and fully automated computer numerical control (CNC) systems, offering a cost-effective solution for small to medium batch production and intricate pattern cutting in the apparel industry. The core product provides essential functionality in preparing raw materials for downstream manufacturing processes, ensuring uniformity and efficiency in mass production environments where material throughput is critical for maintaining competitive operational costs.

Major applications of round knife machines span across the entire textile manufacturing ecosystem, including the fashion and garment industry for cutting large lays of cotton, denim, and synthetic fabrics; the automotive sector for segmenting upholstery and interior components; and the furniture industry for processing foams and coverings. The primary benefits driving their adoption include their ability to handle various fabric densities and thicknesses with high speed, resulting in improved operational throughput and labor efficiency compared to reciprocating or straight knife systems, especially for long, straight cuts or shallow curves. Furthermore, modern versions often incorporate adjustable speed settings and ergonomic designs, reducing operator fatigue and increasing the quality of the cut components.

Driving factors propelling this market include the sustained growth of global apparel demand, fueled by increasing disposable incomes and fast fashion trends requiring quicker turnaround times from design to retail, necessitating rapid and precise material preparation. Additionally, the continuous technological advancements in motor efficiency, blade materials, and integration capabilities with spreading equipment are making round knife machines more durable and adaptable to cutting increasingly sophisticated technical textiles used in protective wear and industrial filters. The push for manufacturing localization and optimization across Asia Pacific and Latin America also contributes significantly to the demand for reliable, semi-automated cutting solutions.

Round Knife Machine Market Executive Summary

The Round Knife Machine Market is characterized by steady technological evolution focusing on improving precision and integrating lighter, more energy-efficient components, positioning it as a resilient segment within the broader industrial cutting equipment landscape. Current business trends indicate a strong move toward ergonomic and safety-enhanced models, driven by stricter labor regulations and a growing emphasis on operator well-being in textile manufacturing facilities. Key manufacturers are differentiating their offerings through value-added services such as predictive maintenance packages and subscription-based software updates for computerized control units, shifting the competitive focus beyond mere hardware specifications to holistic operational support and lifecycle value generation. Moreover, there is an observable trend among mid-tier manufacturers to expand their global distribution networks to capitalize on burgeoning industrial hubs in Southeast Asia and the Middle East.

Regionally, the Asia Pacific (APAC) continues to dominate the market share, primarily due to the concentration of global textile and garment production infrastructure, particularly in countries like China, India, Vietnam, and Bangladesh. These nations represent massive captive markets where the scale of operations necessitates reliable, high-volume cutting tools, making round knife machines indispensable. Conversely, regions like North America and Europe, while representing a smaller market in terms of volume, lead in the adoption of premium, high-precision models integrated into sophisticated CAD/CAM systems, serving specialized industries such as high-performance automotive interiors and advanced technical textile fabrication where material integrity and minimal waste are paramount operational concerns. This geographical dichotomy highlights distinct demand characteristics based on prevailing labor costs, regulatory environments, and material complexity.

Segment trends reveal that the medium-to-large blade diameter segment is experiencing robust growth, driven by the requirement to cut thicker lays of fabric, addressing efficiency needs in large-scale garment factories where fabric stacking heights are maximized to reduce handling time. Application-wise, the apparel and garment segment remains the foundational revenue driver, but the technical textiles segment, including materials for aerospace, medical, and filtration industries, is demonstrating the highest CAGR, spurred by the material properties demanding specialized, precise cutting capabilities offered by advanced round knife systems. The market is also seeing a moderate shift towards semi-automatic, rail-mounted machines, which offer higher cutting accuracy and reduce physical strain compared to traditional handheld models, effectively bridging the performance gap towards fully automated cutters without the substantial capital expenditure.

AI Impact Analysis on Round Knife Machine Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Round Knife Machine Market primarily revolve around how these traditional, semi-automated tools can coexist or integrate with smart manufacturing paradigms, particularly focusing on optimization, quality control, and predictive maintenance. Common questions include whether AI can enhance material utilization beyond human capability, how digital twins could simulate optimal cutting paths for complex patterns, and the potential for AI algorithms to automatically adjust blade pressure and speed based on real-time material sensing, thus minimizing fabric distortion and maximizing blade life. The key themes summarized from user concerns point toward leveraging AI not for replacing the physical cutting mechanism itself, but for augmenting the decision-making processes surrounding the cutting operation, turning the round knife machine from a simple tool into a smart, self-optimizing component within a larger Industry 4.0 ecosystem. Expectations are high that AI will significantly reduce waste generation and enhance the repeatability of high-quality cuts.

The immediate impact of AI is manifesting through advanced sensor integration and data analytics platforms, often retrofitted onto existing high-end round knife machines. AI models are trained on historical performance data, correlating factors such as material type, blade sharpness, motor load, and ambient temperature with resulting cut quality and machine downtime. This allows for highly accurate predictive maintenance scheduling, significantly reducing unexpected operational failures and extending the lifespan of critical components like motors and bearings, thereby lowering the total cost of ownership for manufacturers. Furthermore, data collected on operator usage patterns can be analyzed by AI to develop optimized training protocols, ensuring consistent performance regardless of the specific machine operator.

Looking forward, the influence of AI will extend deeper into pattern optimization and fabric spreading control, particularly in integration with CAD/CAM nesting software. While dedicated automated cutters often handle complex nesting, AI can assist semi-automatic round knife operations by providing real-time guidance to the operator regarding the ideal path to follow to minimize drag and maximize pattern density on the lay. This intelligent assistance, delivered via augmented reality overlays or digitized guides, ensures that even a manual process achieves near-optimal material yield. The goal is to democratize sophisticated efficiency tools, making high-level optimization accessible to businesses utilizing more cost-effective round knife equipment, thereby leveling the competitive playing field against fully automated lines.

- AI-driven Predictive Maintenance: Reduces unplanned downtime by forecasting component failure based on vibration and temperature analysis.

- Optimized Cutting Parameters: Algorithms automatically suggest or adjust blade speed and pressure relative to fabric thickness and density in real-time.

- Material Utilization Enhancement: Integration with nesting software to guide manual or semi-automatic cutting paths for waste reduction.

- Quality Control Automation: Vision systems utilizing AI identify and flag cutting discrepancies or fabric defects during the cutting process.

- Operator Performance Analytics: Tracks and analyzes human-machine interaction to develop standardized, high-efficiency operating procedures and training modules.

DRO & Impact Forces Of Round Knife Machine Market

The Round Knife Machine Market is shaped by a strong combination of economic drivers rooted in global manufacturing needs, balanced against inherent operational restraints and promising technological opportunities, all governed by significant impact forces from regulatory and competitive pressures. Key drivers include the massive scale and velocity requirements of the fast fashion industry and the imperative for textile manufacturers globally to adopt semi-automated tools to improve labor efficiency and standardize product quality across diverse production sites. Conversely, the market faces restraints such as the persistent challenge of labor resistance in certain geographies where simple manual cutting is deeply entrenched, alongside the high initial capital outlay required for premium, computerized round knife systems compared to basic straight-knife alternatives. Opportunities lie predominantly in the expanding application scope within technical textiles and composite cutting, where the precision and versatility of advanced round knife designs offer a crucial edge in processing materials with specific structural demands and high raw material costs. These complex interactions define the market’s moderate growth trajectory, pushing manufacturers towards continuous innovation in ergonomics and material versatility.

The primary impact forces acting upon the market involve intensifying competition from fully automated robotic and laser cutting systems, which, despite their higher cost, are increasingly being adopted by large-scale manufacturers for flawless precision and minimal material handling. Furthermore, regulatory forces, specifically related to workplace safety and noise pollution, compel round knife manufacturers to invest heavily in developing quieter, vibration-dampened, and ergonomically safer machine designs, increasing research and development expenditure but ultimately driving product quality. Economic cycles significantly influence demand, as the purchase of industrial cutting machinery is often a large capital expenditure sensitive to interest rates and global macroeconomic stability, particularly in the volatile textile industry. Therefore, market players must constantly balance pricing strategies with the pressure to incorporate advanced safety features and smart technologies to justify the investment to end-users.

The market’s future dynamism will be defined by how effectively manufacturers capitalize on the demand for specialized, smaller-footprint cutting solutions suitable for micro-factories and localized, on-demand manufacturing models, often referred to as Mass Customization. The technical opportunity lies in leveraging advanced materials for blade construction, enhancing durability and reducing friction, thereby allowing faster cutting speeds without compromising fabric integrity or generating excessive heat. Addressing the restraint of maintenance complexity through modular design and accessible digital diagnostics will also be crucial for maintaining competitiveness, especially in developing markets where access to highly specialized technicians can be limited. Success hinges on delivering robust, efficient machines that minimize long-term operational costs and provide superior return on investment through reduced material waste and improved labor productivity.

Segmentation Analysis

The Round Knife Machine Market is systematically segmented based on criteria critical to industrial operations, primarily defined by the operational characteristics of the machine, the size of the cutting blade, and the ultimate end-use application. Understanding these segments is paramount for strategic planning, as different applications require distinct machine specifications—for instance, heavy-duty automotive upholstery demands large blade diameters and high torque, whereas delicate apparel fabrics require smaller, high-speed blades with enhanced precision controls. The segmentation framework allows market players to accurately target specific industrial niches, tailoring product development and marketing efforts to address the unique constraints and quality demands inherent in each sector, ensuring maximal market penetration and optimized resource allocation across the diverse global manufacturing landscape.

- By Operation Mode:

- Handheld/Manual Operation

- Semi-Automatic/Track-mounted Operation

- By Blade Diameter:

- Small Diameter (Under 100mm)

- Medium Diameter (100mm – 150mm)

- Large Diameter (Above 150mm)

- By Application:

- Apparel and Garments

- Home Textiles (Bedding, Curtains)

- Automotive Interiors and Upholstery

- Industrial and Technical Textiles (Filters, Composites)

- Furniture and Foams

Value Chain Analysis For Round Knife Machine Market

The value chain for the Round Knife Machine Market begins with the upstream segment involving the sourcing and processing of core raw materials and components, which include high-grade steel alloys for blades, precision electric motors, advanced polymer casings, and increasingly, complex electronic components such as microprocessors and sensors for computerized controls. Suppliers of specialized components like servo motors and proprietary blade steel often hold significant leverage, dictating quality and price points based on their technological uniqueness and material performance capabilities, which are crucial for the machine’s durability and cutting efficiency. Manufacturers in the middle segment focus on design, precision machining, assembly, quality assurance, and integration of the diverse components into the final, operational cutting machine, emphasizing modularity, standardization, and adherence to international safety standards, especially those governing electrical and mechanical stability.

The downstream analysis focuses on the distribution channels and end-user adoption patterns. Distribution primarily occurs through specialized industrial equipment distributors, agents, and often, direct sales channels for major manufacturers serving large multinational clients, particularly those with global manufacturing footprints. Direct sales allow for better customization, technical support, and comprehensive after-sales service agreements, which are highly valued in capital equipment purchases. Indirect channels, relying on regional distributors, are essential for reaching small to medium-sized enterprises (SMEs) in geographically diverse markets, providing local inventory, immediate service, and credit facilities tailored to regional economic conditions.

The role of the distribution channel is increasingly becoming consultative, moving beyond simple transactions to providing installation, operator training, and ongoing technical support, effectively acting as the front line for the original equipment manufacturer (OEM). The demand signal originates predominantly from garment manufacturers, which requires distributors to maintain deep expertise in textile processing technologies and efficiency consulting. Efficient value chain management—from securing high-quality, specialized components like Japanese or German steel for blades, through lean manufacturing processes, to providing robust, localized after-sales support—is vital for competitiveness and ensuring customer satisfaction and repeat business in a market defined by long product lifecycles and performance reliability requirements.

Round Knife Machine Market Potential Customers

The primary potential customers for round knife machines are entities engaged in high-volume production requiring accurate cutting and segmenting of flexible materials, dominated by the apparel manufacturing industry. Garment factories, ranging from large, vertically integrated textile mills to smaller contract sewing operations, rely heavily on these machines for efficiently breaking down large lays of fabric into pre-production components for various clothing items, including casual wear, uniforms, and athletic apparel. These customers prioritize machine attributes such as ergonomics for operator comfort, reliability under continuous use, and the ability to handle different fabric compositions without compromising the integrity of the lower layers of the fabric stack, which directly impacts their material yield and output quality.

A second major customer segment includes manufacturers specializing in non-apparel textile applications, prominently the automotive and furniture upholstery sectors. Automotive seating and interior component manufacturers require high-precision cutting tools to process materials like specialized leather, vinyl, and composite foams used in car seats, dashboards, and headliners, where consistency and precise edge quality are critical for safety compliance and aesthetic finishing. Similarly, furniture makers utilize round knife machines for efficiently cutting large volumes of upholstery fabric, vinyl, and cushioning materials, demanding machines with greater torque and blade diameter capacity to handle thicker, denser material stacks commonly used in commercial and residential furnishings, linking purchasing decisions closely to production throughput goals and material cost management.

The third, rapidly growing customer segment encompasses companies dealing with industrial and technical textiles, including producers of filtration media, protective gear, medical textiles, and lightweight composites. These end-users demand the highest levels of cutting precision and often require specialized machine modifications to handle abrasive, high-strength, or temperature-sensitive materials that traditional cutters might damage. For these customers, the investment decision is less price-sensitive and more focused on achieving exacting tolerances, minimizing waste of expensive technical fabrics, and integrating the cutting process smoothly into advanced manufacturing workflows. This diverse customer base necessitates that machine manufacturers offer a portfolio ranging from cost-effective manual models for high-volume apparel needs to specialized, track-mounted systems for high-value industrial applications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 350 Million |

| Market Forecast in 2033 | USD 475 Million |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Eastman Machine Company, Kuris Spezialmaschinen GmbH, Lectra SA, Gerber Technology (now part of Lectra), Maimin Technology, FK Group, Texpa Gmbh, Bullmer GmbH, Oshima Machine, Shima Seiki Mfg., Ltd., Pathfinder Cutting Technology, New Tech, Hashima, Audaces, KM Cloth Cutting Machine Co., Ltd., Juki Corporation, Pegasus Sewing Machine Mfg. Co., Ltd., Shanghai Weishi Machinery Co., Ltd., Zhejiang Jutai Precision Machinery Co., Ltd., PGM Dress Making Equipment. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Round Knife Machine Market Key Technology Landscape

The current technology landscape in the Round Knife Machine Market is undergoing a transformation driven by the integration of advanced electronics and precision engineering, moving beyond simple mechanical cutting mechanisms. The foundational technological advancement centers around the transition from traditional brushed motors to high-efficiency servo motors. Servo technology provides superior speed control, higher torque at lower speeds, and crucially, maintains blade sharpness and rotational stability with greater consistency, which is vital when cutting demanding materials or exceptionally high lays of fabric. This technological shift not only enhances cutting precision and efficiency but also significantly reduces energy consumption and machine noise, addressing key operational and environmental concerns voiced by large-scale manufacturers and regulatory bodies in mature markets like Europe and North America. The optimization of motor controls enables manufacturers to program highly specific cutting profiles tailored to material properties, maximizing both output quality and blade longevity.

Furthermore, computerized control systems and sophisticated sensors are becoming standard features in premium round knife machines, differentiating them from basic models. These integrated systems facilitate seamless interfacing with Computer-Aided Design (CAD) and Computer-Aided Manufacturing (CAM) software, allowing for digital transfer of patterns directly to the machine’s control panel, minimizing manual layout errors. Enhanced sensor technology monitors critical operational metrics in real-time, such as blade temperature, friction levels, and motor load, utilizing this data for automatic adjustment of cutting speed and pressure to prevent material fusing or distortion. The inclusion of digital diagnostics capabilities simplifies troubleshooting and allows for remote monitoring and software updates, significantly improving the serviceability and maximizing the uptime of the equipment, a major factor in high-throughput industrial settings where production continuity is paramount.

Material science innovation also plays a critical role, particularly in the development of cutting blades. Manufacturers are exploring new alloys and surface treatments, such as tungsten carbide coatings or specialized ceramic composites, to significantly increase the wear resistance and durability of the cutting edge. This reduces the frequency of sharpening and replacement, thereby lowering operational costs and maintaining higher cut quality over extended production runs. Coupled with automated sharpening mechanisms that use precise digital controls to ensure a consistent, optimal bevel angle, these technological advancements are elevating the performance ceiling of round knife machines. The overall technological direction is clear: moving towards more intelligent, sustainable, and highly integrated cutting solutions that bridge the functionality gap between semi-automated tools and fully automated CNC systems, ensuring the round knife machine remains a relevant and highly effective tool in modern manufacturing environments globally.

Regional Highlights

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market for round knife machines globally, driven by the concentration of the world’s textile and apparel manufacturing capacity, particularly in China, India, Vietnam, and Bangladesh. The region benefits from lower labor costs, massive government support for industrial development, and a high demand for high-throughput, semi-automated cutting solutions to meet global export targets. The adoption here focuses on robust, reliable machines capable of continuous operation in high-stress, multi-shift environments, catering primarily to the mass-market garment production segment.

- Europe: Europe is characterized by a mature market emphasizing quality, precision, and adherence to stringent occupational safety and environmental standards. Demand is concentrated in specialized applications, including luxury fashion, high-performance technical textiles, and advanced automotive interiors. European manufacturers favor machines integrated with sophisticated digital control systems and ergonomic designs, reflecting a preference for higher initial investment in exchange for superior material yield, minimal operational noise, and long-term compliance with worker safety regulations.

- North America: The North American market, while smaller in volume than APAC, exhibits high demand for high-end, technologically advanced round knife machines, often integrated into fully digitized micro-factory setups focused on customized and on-demand production. Key drivers include the high cost of skilled labor, necessitating automation integration, and significant domestic production in automotive, aerospace composites, and protective wear, demanding tools capable of high precision and handling complex, expensive materials with minimal waste.

- Latin America (LATAM): LATAM is a developing market showing moderate growth, particularly in countries like Brazil and Mexico, fueled by burgeoning regional garment and upholstery manufacturing industries serving local and near-shore export markets. The market structure is sensitive to economic volatility, leading to a strong demand for cost-effective, durable, and easily maintainable machines, often prioritizing value and simple functionality over advanced digital integration.

- Middle East and Africa (MEA): This region is an emerging market experiencing nascent growth, spurred by investments in new textile production hubs, notably in Turkey and Egypt, aiming to become strategic suppliers to European markets. Demand is currently fluctuating, characterized by large, intermittent capital investments in establishing modern factories that require a mix of cost-effective and high-quality cutting solutions to quickly scale production capacity.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Round Knife Machine Market.- Eastman Machine Company

- Kuris Spezialmaschinen GmbH

- Lectra SA

- Gerber Technology (now part of Lectra)

- Maimin Technology

- FK Group

- Texpa Gmbh

- Bullmer GmbH

- Oshima Machine

- Shima Seiki Mfg., Ltd.

- Pathfinder Cutting Technology

- New Tech

- Hashima

- Audaces

- KM Cloth Cutting Machine Co., Ltd.

- Juki Corporation

- Pegasus Sewing Machine Mfg. Co., Ltd.

- Shanghai Weishi Machinery Co., Ltd.

- Zhejiang Jutai Precision Machinery Co., Ltd.

- PGM Dress Making Equipment

Frequently Asked Questions

Analyze common user questions about the Round Knife Machine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the Round Knife Machine Market through 2033?

The Round Knife Machine Market is anticipated to register a CAGR of 4.5% between 2026 and 2033, driven by sustained global textile manufacturing expansion and the necessity for improved cutting efficiency in emerging markets.

How does the integration of AI affect the operational efficiency of round knife machines?

AI integration primarily enhances efficiency through predictive maintenance, reducing unexpected downtime, and optimizing cutting parameters (speed, pressure) in real-time, thereby maximizing material yield and ensuring consistent cut quality across diverse fabrics.

Which geographical region dominates the demand for round knife machines?

The Asia Pacific (APAC) region currently holds the largest market share, predominantly due to the high concentration of the global apparel and textile production base in countries like China, India, and Vietnam, where high-volume cutting solutions are essential.

What are the primary restraints impacting the adoption rate of new round knife machine technology?

The key restraints include the high initial capital investment required for advanced, semi-automated systems and intensified competition from high-precision, fully automated CNC and laser cutting technologies favored by large, premium manufacturers.

Beyond apparel, what are the fastest-growing application segments for round knife machines?

The fastest-growing application segments include the cutting of technical textiles used in industrial filtration, medical devices, and high-performance composites, where the precision and material handling capabilities of advanced round knife systems are highly valued.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager