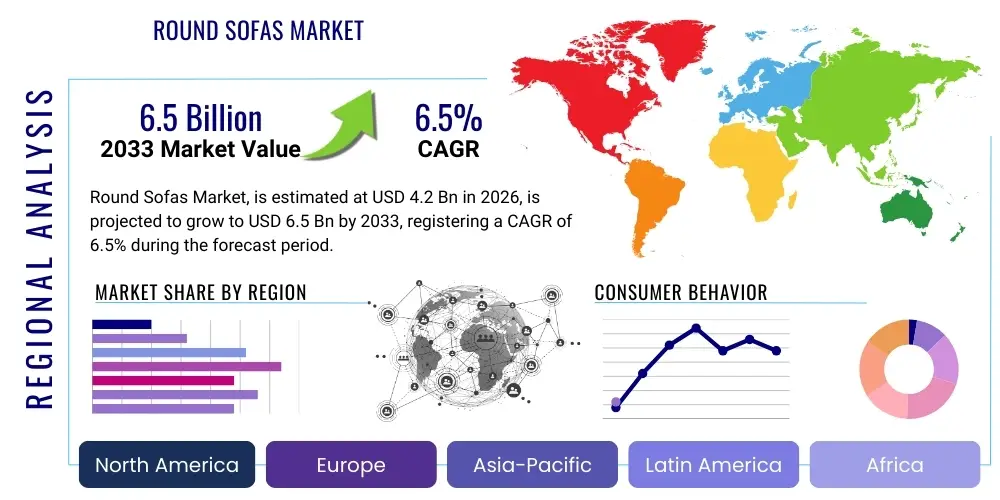

Round Sofas Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436367 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Round Sofas Market Size

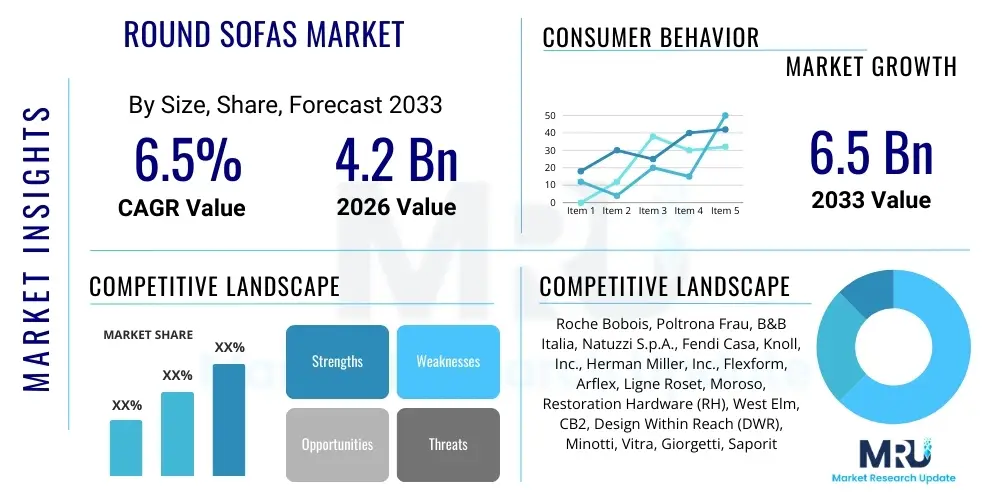

The Round Sofas Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at $4.2 billion in 2026 and is projected to reach $6.5 billion by the end of the forecast period in 2033. This robust growth trajectory is primarily fueled by increasing consumer preference for aesthetically pleasing and space-optimizing furniture designs, particularly in the premium and luxury residential sectors, coupled with expanding application in high-end commercial spaces such as boutique hotels and executive lounges. The intrinsic design flexibility of round sofas, which facilitates organic traffic flow and encourages social interaction, positions them as a key element in modern interior design concepts globally.

Round Sofas Market introduction

The Round Sofas Market encompasses the manufacturing, distribution, and sale of seating units characterized by curvilinear forms, deviating from traditional straight-line configurations. These products range from semi-circular settees and curved sectionals to fully circular conversation pits, serving both aesthetic and functional purposes in contemporary living environments. The core product description emphasizes sophisticated design, often featuring modular capabilities, high-density foam filling, and premium upholstery materials such as performance velvet, Italian leather, or sustainable woven fabrics. Major applications span residential settings, including luxury apartments and family homes, and burgeoning commercial sectors suchises, luxury hospitality (hotels and resorts), corporate waiting areas, and high-end retail environments.

The primary benefits associated with round sofas include enhanced spatial fluidity, a high degree of comfort, and the creation of intimate, collaborative seating arrangements that break the rigidity of conventional layouts. Key driving factors propelling market expansion include the global surge in disposable income, leading to higher spending on interior décor and home renovations. Furthermore, the strong influence of social media and interior design trends, which frequently showcase curvilinear and organic furniture forms, stimulates consumer demand. Architectural trends prioritizing open-plan living and soft, biophilic design elements further solidify the market's positive outlook, making the round sofa a focal point in design-forward spaces.

Round Sofas Market Executive Summary

The global Round Sofas Market is characterized by accelerating business trends driven by customization and digital retail transformation. Manufacturers are increasingly leveraging digital visualization tools and augmented reality (AR) applications to allow consumers to customize materials, dimensions, and configurations before purchase, enhancing consumer engagement and reducing inventory risks. The shift towards sustainable sourcing, particularly the use of recycled materials and ethically produced fabrics, represents a critical competitive differentiator, aligning with increasing environmental consciousness among affluent consumers. Business models are evolving, focusing heavily on direct-to-consumer (DTC) channels, which offer higher margins and direct feedback loops, contrasting with the traditional reliance on large furniture retail chains.

Regional trends indicate North America and Europe maintaining dominance due to high discretionary spending, established interior design cultures, and a strong presence of luxury furniture brands. However, the Asia Pacific (APAC) region is demonstrating the highest growth velocity, attributed to rapid urbanization, the proliferation of high-density housing requiring optimized furniture solutions, and the escalating demand from the burgeoning middle and upper classes in countries like China and India. In these regions, round sofas are viewed as status symbols representing modern, international luxury, driving significant investment in commercial projects such as premium office spaces and high-end residential towers.

Segmentation trends highlight the Fabric and Velvet sub-segments leading in material choice due to their versatility, comfort, and vast range of available textures and colors, catering effectively to modern residential aesthetics. Conversely, the high-end Leather segment commands the highest average selling prices (ASPs), particularly in commercial installations that prioritize durability and a timeless, executive look. The Distribution segment sees Online retail growing exponentially, benefiting from improved logistics for bulky items and sophisticated e-commerce platforms, while Brick-and-Mortar stores remain crucial for experiential purchasing, where customers prefer to test comfort and assess material quality firsthand before committing to a high-value purchase like a round sofa.

AI Impact Analysis on Round Sofas Market

Common user questions regarding AI's impact on the Round Sofas Market center on themes of personalization, supply chain efficiency, and future design trends. Users frequently inquire about how AI can recommend the ideal sofa configuration based on room dimensions and existing decor (personalization). They also ask if AI can reduce the long lead times associated with custom furniture production (supply chain). Furthermore, there is strong interest in how generative AI might be used to create novel, commercially viable, and ergonomic round sofa designs that human designers might overlook. The underlying concern is whether technology will enhance the artisan quality of furniture or simply commoditize the design process.

The analysis reveals that AI is fundamentally transforming the market from a design-centric perspective to an experience-centric one. Generative AI tools are now being utilized to iterate rapidly through millions of design possibilities, optimizing dimensions for comfort and material usage for sustainability. This capability accelerates the product development lifecycle significantly. In the manufacturing phase, predictive maintenance algorithms minimize equipment downtime, ensuring smoother production flows for complex, curved frames. Most importantly, AI-powered customer relationship management (CRM) systems and recommendation engines are fine-tuning the consumer journey, offering highly tailored product suggestions, thereby improving conversion rates and overall customer satisfaction in the often complex custom furniture buying process.

Furthermore, AI is instrumental in streamlining the supply chain for bulky furniture. Demand forecasting models, leveraging machine learning, analyze historical sales data, seasonal variations, and external macroeconomic indicators to predict future needs with high accuracy. This precise forecasting minimizes overstocking or understocking of expensive raw materials (such as imported leather or specialized foam), leading to operational cost reductions and more reliable delivery schedules for the end-consumer. The synergy between AI-driven design iteration and predictive logistics constitutes the most profound technological shift currently experienced in the high-end furniture segment.

- AI-driven personalized recommendations based on room size, style matching, and user feedback data.

- Generative design tools creating optimized, ergonomic, and novel curvilinear sofa forms.

- Predictive maintenance reducing manufacturing downtime for specialized wood and metal fabrication equipment.

- Machine learning algorithms optimizing inventory management for high-value upholstery materials.

- Augmented Reality (AR) applications, powered by AI spatial mapping, allowing virtual product placement for enhanced customer visualization.

- Automated quality control systems using computer vision to detect minor imperfections in stitching and upholstery finishing.

DRO & Impact Forces Of Round Sofas Market

The market dynamics are defined by a complex interplay of Drivers, Restraints, and Opportunities, which collectively form the Impact Forces shaping the trajectory of the Round Sofas Market. Drivers primarily revolve around the aesthetic appeal and functionality offered by circular designs, which align seamlessly with modern, open-plan architectural trends and the growing cultural emphasis on social and comfortable interior spaces. Restraints are chiefly associated with the high cost of production due to complex manufacturing processes involving curved frames and specialized upholstery application, coupled with significant logistical challenges related to shipping large, non-standard shaped furniture. Opportunities emerge from technological advancements in materials (e.g., performance fabrics resistant to staining and fading) and the untapped potential of emerging economies in APAC and MEA experiencing rapid luxury infrastructure development.

Key drivers include the global expansion of the luxury residential and hospitality sectors. High-end hotels, resorts, and corporate headquarters increasingly utilize round sofas to create distinctive, luxurious, and inviting common areas that foster collaboration and relaxation. This commercial application provides a significant, stable revenue stream for premium manufacturers. Moreover, the increasing influence of interior design media and celebrity designers promotes curvilinear furniture, making round sofas a highly desirable centerpiece for wealthy homeowners undertaking significant renovation projects. This shift from purely functional furniture to statement pieces significantly boosts average transaction values and drives innovation in aesthetics and material choice.

However, the market faces structural restraints concerning pricing and distribution. The specialized tooling and high labor intensity required to craft perfectly curved frames and apply complex upholstery patterns result in a substantially higher price point compared to standard rectangular sofas, limiting affordability for mass-market consumers. Furthermore, the volume and non-standard shape of round sofas complicate storage and international shipping, leading to higher freight costs and longer lead times, which can deter potential buyers seeking immediate gratification. Overcoming these logistical hurdles through efficient supply chain optimization and advanced flat-pack design remains a crucial market challenge.

- Drivers: Growing adoption in the luxury hospitality sector; increasing global disposable income fueling expenditure on high-end decor; strong preference for aesthetically unique, statement furniture pieces; urbanization driving demand for efficient, flexible seating solutions in large open spaces.

- Restraints: High manufacturing complexity and production costs leading to premium pricing; significant logistical challenges related to shipping large, bulky, and non-stackable units; longer custom lead times compared to standard furniture.

- Opportunity: Expansion into high-growth emerging markets (APAC, MEA); technological advancements in sustainable and durable performance materials; leveraging e-commerce and AR visualization tools for personalized customization and reduced physical showroom reliance.

- Impact Forces: The high initial cost (Restraint) is currently being partially mitigated by increased demand from the luxury commercial segment (Driver), but market expansion hinges on the successful integration of digital platforms (Opportunity) to streamline customization and purchasing experience.

Segmentation Analysis

The Round Sofas Market is comprehensively segmented based on material, application, and distribution channel, providing a granular view of market dynamics and consumer preferences across different tiers. Segmentation by material reveals a consumer focus on aesthetics and durability, with natural leather dominating the high-end commercial sector and sophisticated fabrics, including performance velvet and textured synthetics, being preferred in residential settings for their warmth and customization potential. Application segmentation clearly delineates the demand profiles of residential consumers (seeking comfort and style) versus commercial clients (prioritizing longevity, ease of cleaning, and high-traffic performance), directly influencing material choices and structural requirements.

The most significant differentiation in market behavior occurs in the distribution channel segment. The traditional reliance on physical, brick-and-mortar stores is steadily shifting, particularly in established markets, towards online retail channels. E-commerce platforms are increasingly adept at handling high-value furniture, offering sophisticated services like white-glove delivery, assembly, and enhanced return policies, making the purchase of large, complex items more accessible. However, offline channels retain their critical importance, especially for luxury and ultra-premium buyers who insist on physically experiencing the comfort and assessing the material quality and craftsmanship of the sofa before finalizing a substantial investment.

Understanding these segmentations allows manufacturers to strategically allocate resources, optimize product lines, and tailor marketing efforts. For instance, companies targeting the residential segment will invest heavily in material innovation concerning sustainability and tactile comfort, whereas those focusing on the commercial segment will emphasize structural integrity, fire-retardant materials, and large-scale order fulfillment capabilities. The trend of modularity, which crosses all segments, allows manufacturers to offer hybrid products that can be configured to suit both residential living rooms and expansive hotel lobbies, maximizing the product’s addressable market.

- By Material:

- Leather (Full-grain, Top-grain, Bonded)

- Fabric (Velvet, Linen, Cotton, Performance Polyester)

- Synthetic/Others (Vegan Leather, Specialized Acoustic Fabrics)

- By Application:

- Residential (Apartments, Villas, Standalone Homes)

- Commercial (Hotels, Corporate Offices, Lounges, Retail Spaces)

- By Distribution Channel:

- Online Retail (E-commerce Websites, Company-Owned Sites)

- Offline Retail (Furniture Stores, Designer Showrooms, Specialty Boutiques)

Value Chain Analysis For Round Sofas Market

The value chain for the Round Sofas Market begins with upstream activities focused on raw material sourcing, which is highly specialized. This includes procuring high-quality timber (often sustainably certified hardwoods like oak or walnut for curved frames), specialized metal components (for modular connectors and bases), high-density polyurethane foam, and premium upholstery materials. Due to the luxury positioning of many round sofas, manufacturers often source fabrics and leathers from specialized global suppliers known for their quality and ethical practices. The efficiency of the upstream segment is critical, as fluctuations in global commodity prices for wood and chemicals directly impact the final product cost and manufacturing margin. Strong supplier relationships and rigorous quality control protocols at this stage are essential for maintaining the high standards expected in the luxury furniture market.

The core manufacturing stage involves complex processes, including frame construction using specialized bending techniques, precise cutting of foam components, and highly skilled artisanal upholstery application to ensure a seamless curve and perfect fit. Midstream activities also encompass branding, quality assurance, and inventory management. Finished products then move into the downstream segment, dominated by distribution channels. The distribution network is bifurcated into direct channels, where manufacturers sell directly to consumers or interior designers, and indirect channels, involving third-party retailers, department stores, or specialized furniture franchises. Direct sales offer higher control over pricing and customer experience but require significant investment in logistics and dedicated fulfillment centers capable of handling bulky items.

In the downstream flow, direct distribution, especially through manufacturer-owned flagship stores and specialized e-commerce sites, is gaining traction as brands seek to build deeper relationships with their clientele. Indirect channels, while offering broader market reach, often lead to reduced margins for the manufacturer. The choice of channel significantly impacts brand perception; high-end, limited-edition round sofas are often distributed exclusively through designer showrooms (indirect specialized channel), whereas mass-market or modular versions may utilize high-volume online retailers. The success of the downstream segment is highly dependent on last-mile logistics proficiency, including white-glove delivery services, which are non-negotiable for ensuring customer satisfaction with a high-value, fragile furniture piece.

Round Sofas Market Potential Customers

Potential customers for the Round Sofas Market fall predominantly into two primary categories: high-net-worth individuals (HNWIs) and institutions within the premium commercial sector. HNWIs are typically end-users seeking statement pieces for large living spaces, customized home theaters, or bespoke residential projects. These buyers prioritize craftsmanship, brand pedigree, exclusive materials, and the ability to customize the piece to integrate seamlessly into a personalized, luxurious interior design scheme. Their purchasing decisions are often influenced by recommendations from interior architects and design consultants, who value the design impact and quality assurance offered by established luxury brands.

The second major consumer segment comprises professional buyers across the hospitality, corporate, and real estate development industries. Hotel procurement managers seek durable, stylish, and comfortable seating solutions for lobbies, executive suites, and lounge areas, where the curved form enhances the welcoming atmosphere and optimizes traffic flow. Similarly, high-end corporate clients purchasing for executive offices or collaborative zones view round sofas as investments that reflect a modern, approachable corporate culture. For these institutional buyers, factors like fire safety compliance, material resilience (stain resistance, heavy-duty stitching), and the ability to fulfill large-volume orders on a defined timeline are paramount, often overriding pure aesthetic preference.

A rapidly growing customer sub-segment includes younger, design-conscious urban professionals. While perhaps not HNWIs, this group places high value on stylish, modular, and space-saving curved sofas that fit into smaller luxury apartments. They are typically early adopters of e-commerce platforms and are willing to pay a premium for design novelty and sustainability credentials. This demographic is driving the demand for performance fabrics and environmentally friendly materials, compelling manufacturers to broaden their product lines beyond traditional luxury leather offerings to capture this dynamic, digitally engaged customer base.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $4.2 billion |

| Market Forecast in 2033 | $6.5 billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Roche Bobois, Poltrona Frau, B&B Italia, Natuzzi S.p.A., Fendi Casa, Knoll, Inc., Herman Miller, Inc., Flexform, Arflex, Ligne Roset, Moroso, Restoration Hardware (RH), West Elm, CB2, Design Within Reach (DWR), Minotti, Vitra, Giorgetti, Saporiti Italia, Kettal |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Round Sofas Market Key Technology Landscape

The production of round sofas requires a specific set of advanced technologies focused on precision, material integrity, and customization. A crucial technology involves Computer Numerically Controlled (CNC) routing machines, which are essential for cutting complex, curved wooden or metal frame components with millimeter accuracy. Traditional manufacturing often struggled with consistency in curvilinear structures, but CNC technology ensures repeatability and structural soundness, which is paramount for high-end furniture designed for longevity. This precision machining minimizes material waste and allows for highly complex, asymmetrical designs that are increasingly popular in the luxury segment. Furthermore, specialized wood bending and molding techniques, sometimes involving steam or radio frequency technology, are utilized to create durable, seamless curves without compromising the strength of the timber.

Beyond frame manufacturing, digital visualization technologies are rapidly defining the retail and design experience. Augmented Reality (AR) applications allow consumers to place a virtual 3D model of a customized round sofa directly into their living space via a smartphone or tablet, providing an immediate sense of scale and aesthetic fit. This technological advancement significantly reduces buyer remorse and increases consumer confidence, particularly for online sales where the inability to physically interact with the product is a major barrier. Alongside AR, sophisticated 3D modeling software is used by interior designers and manufacturers to generate precise renderings and engineering blueprints, ensuring perfect alignment of modular components and accurate depiction of upholstery drape and texture.

Material technology forms another critical pillar. The integration of high-performance fabrics, often engineered with nanotechnology, provides features such as advanced stain repellency, microbial resistance, and UV protection, greatly enhancing the longevity and maintenance ease, especially crucial for commercial applications. Smart upholstery technology, though nascent, is emerging, incorporating features like integrated charging ports or subtle environmental sensors. Lastly, advanced ERP (Enterprise Resource Planning) systems integrated with manufacturing execution systems (MES) manage the complex supply chain and production scheduling required for bespoke, high-cost items, optimizing inventory flow from raw material input to final white-glove delivery.

Regional Highlights

- North America (U.S., Canada, Mexico): North America represents a mature and dominant market, characterized by high consumer spending power and a strong culture of interior design consulting. The U.S. leads regional demand, driven by robust activity in luxury housing construction and significant refurbishment cycles in the high-end hospitality sector (e.g., luxury resorts in Florida, California, and Nevada). Demand is strongly concentrated in the Fabric and Modular segments, emphasizing comfort and adaptability in large residential spaces. Manufacturers focus heavily on customization and prompt delivery, leveraging established distribution channels and sophisticated digital retail tools. The market is highly competitive, featuring both global luxury imports and strong domestic artisanal brands.

- Europe (Germany, U.K., France, Italy): Europe is the historical epicenter of luxury furniture design, with Italy, France, and Germany driving innovation and quality standards. This region places immense emphasis on heritage, craftsmanship, and sustainable sourcing. Demand for round sofas is highly concentrated in designer showrooms and specialty boutiques, where craftsmanship certification (Made in Italy) acts as a powerful selling point. The U.K. market is characterized by strong online penetration, while Central European markets prioritize minimalist, durable designs. The commercial segment, particularly premium office furniture and high-design hotels, remains a robust consumer base, focusing heavily on leather and high-grade, durable fabrics that reflect timeless European aesthetics.

- Asia Pacific (APAC) (China, India, Japan, South Korea): APAC is projected to be the fastest-growing region, fueled by unprecedented rates of urbanization and the rapid expansion of the affluent class, particularly in China and India. The demand profile in APAC is dual-natured: in major metropolitan areas, there is a strong preference for contemporary, space-optimizing modular round sofas suitable for high-rise living, often influenced by Western luxury trends. Simultaneously, the hospitality sector boom in Southeast Asia drives substantial procurement of durable, visually impactful pieces for new resort openings. Price sensitivity is higher than in Europe, yet a strong willingness exists to pay a premium for internationally recognized luxury brands, leading to significant investment in expanding local manufacturing and distribution capabilities by multinational firms.

- Latin America (Brazil, Argentina, Rest of LATAM): Latin America presents a fragmented but promising market, heavily influenced by local interior design traditions that favor bold shapes and rich textures. Brazil stands out as a key market due to its established furniture design industry and relatively stable economy supporting luxury consumption. Demand is primarily driven by high-end residential projects and boutique commercial spaces. Market growth is often volatile, tied closely to macroeconomic stability and currency fluctuations, making local sourcing of materials and manufacturing preferred to mitigate import risks and costs.

- Middle East and Africa (MEA) (UAE, Saudi Arabia, South Africa): The MEA region is characterized by exceptionally high luxury spending, particularly in the Gulf Cooperation Council (GCC) countries like the UAE and Saudi Arabia. Demand for round sofas here is tied to large-scale infrastructure projects, including ultra-luxury hotel developments (e.g., NEOM in Saudi Arabia) and expansive royal palaces or high-end residential compounds. Customers prioritize opulence, size, and bespoke customization, often demanding exotic materials, intricate detailing, and the largest available sectional configurations. The market is almost entirely focused on the ultra-premium end, necessitating specialized, high-security logistics and white-glove installation services.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Round Sofas Market.- Roche Bobois

- Poltrona Frau

- B&B Italia

- Natuzzi S.p.A.

- Fendi Casa

- Knoll, Inc.

- Herman Miller, Inc.

- Flexform

- Arflex

- Ligne Roset

- Moroso

- Restoration Hardware (RH)

- West Elm

- CB2

- Design Within Reach (DWR)

- Minotti

- Vitra

- Giorgetti

- Saporiti Italia

- Kettal

- Kartell

- Fritz Hansen

- Cassina

- De Sede

- Moooi

Frequently Asked Questions

Analyze common user questions about the Round Sofas market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the current demand for round and curved sofas?

The primary drivers are contemporary interior design trends favoring soft, organic, and biophilic shapes, coupled with the increasing need for social and flexible seating arrangements in open-plan residential and luxury commercial spaces. Round designs facilitate conversation and break up the rigidity of traditional room layouts, making them preferred statement pieces.

How does the high cost of a round sofa compare to a standard rectangular sofa?

Round sofas typically command a significant price premium due to the complexity of manufacturing. They require specialized CNC tooling, highly skilled labor for frame bending, and more intricate upholstery application processes compared to the straightforward construction of conventional straight-line furniture, resulting in higher production costs.

What materials are most popular for high-end residential round sofas?

High-end residential consumers overwhelmingly prefer luxurious and tactile materials such as high-grade performance velvet, which offers a rich texture and durability, and premium, soft-touch fabrics (like linen blends). Full-grain aniline leather remains popular for its longevity and classic appeal, particularly in high-traffic or executive settings.

Which geographical region exhibits the fastest growth rate in the Round Sofas Market?

The Asia Pacific (APAC) region, specifically emerging economies like China and India, is projected to show the highest Compound Annual Growth Rate (CAGR). This acceleration is driven by rapid expansion of the luxury real estate sector, increasing consumer wealth, and the adoption of Westernized high-end interior design aesthetics in metropolitan areas.

How is technology influencing the purchase experience for customized round sofas?

Technology, particularly Augmented Reality (AR) applications and 3D visualization tools, is revolutionizing the purchase experience. These tools enable customers to virtually place and customize the sofa configuration in their home environment before committing to the purchase, mitigating risk and enhancing personalization, especially in online sales channels.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager