ROV Sonar Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436781 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

ROV Sonar Market Size

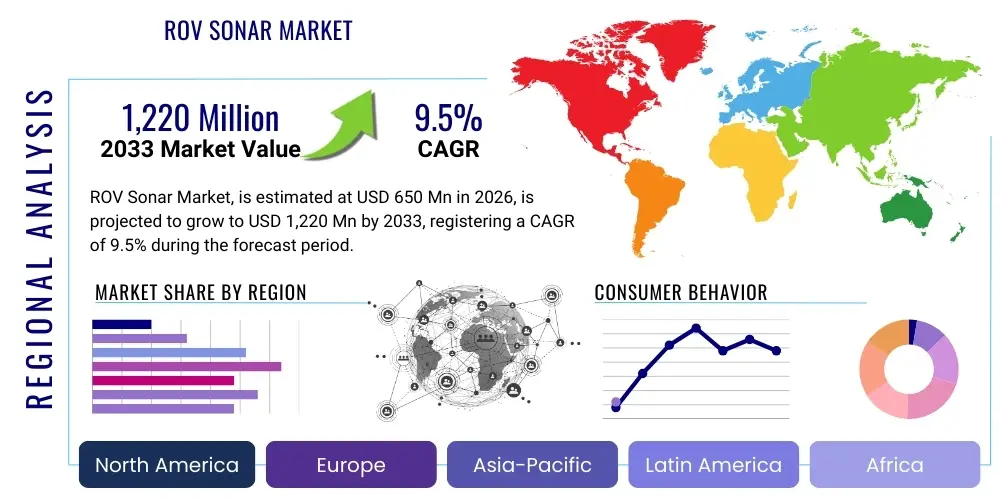

The ROV Sonar Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 650 Million in 2026 and is projected to reach USD 1,220 Million by the end of the forecast period in 2033.

ROV Sonar Market introduction

The Remotely Operated Vehicle (ROV) Sonar Market encompasses specialized acoustic systems designed for underwater mapping, navigation, and object detection when integrated with ROVs. These critical sensor packages utilize sound propagation characteristics to generate precise representations of the seabed, water column, and subsea structures, overcoming the inherent limitations of light-based vision systems in turbid or deepwater environments. ROV sonar technologies are foundational for subsea operations, enabling detailed hydrographic surveys, accurate pipeline tracking, and the safe maneuvering of vehicles in low-visibility conditions. The primary product categories include Multibeam Echosounders (MBES), Side-Scan Sonar (SSS), and Sub-Bottom Profilers (SBP), each tailored for specific data acquisition methodologies, ranging from high-resolution bathymetry to geo-hazard assessment. System performance is measured critically by factors such as operating frequency, swath coverage, resolution, and maximum depth rating, all of which must align with the demanding specifications of deep-sea commercial and defense applications.

Major applications of ROV sonar span across critical industrial and governmental sectors, establishing their indispensable role in maintaining global subsea infrastructure and security. The oil and gas industry relies heavily on these systems for life-of-field asset integrity management, including mandatory pipeline inspection, scour monitoring around platforms, and detailed rig site clearance surveys prior to decommissioning. In the defense sector, ROV sonar forms the backbone of modern naval operations, particularly in Mine Countermeasures (MCM) and rapid environmental assessment (REA) for troop deployment, ensuring the safety of strategic waterways and port entrances. Furthermore, marine science utilizes these tools extensively for habitat mapping, studying geological formations, quantifying fish populations acoustically, and conducting high-precision archaeological research on wrecks and submerged historical sites. The adoption is driven by the mandate for non-intrusive, repeatable data acquisition methods.

Driving factors underpinning market expansion are fundamentally linked to global energy transition requirements and elevated national security concerns. The substantial global push toward offshore wind farm installations, alongside complex subsea cable laying for intercontinental data transfer, mandates continuous, high-accuracy seabed characterization and post-installation monitoring, positioning ROV sonar as an indispensable component in these multibillion-dollar projects. Concurrently, heightened geopolitical tensions and the increased threat to vital subsea cables necessitate continuous naval surveillance and enhanced patrol capabilities, boosting the adoption of military-grade ROV sonar systems compatible with deep-diving platforms. Technological advancements, particularly in acoustic array design, digital signal processing, and sensor miniaturization, further propel market growth by offering higher performance, greater efficiency, and reduced size, weight, and power (SWaP) consumption levels, making advanced sonar viable for smaller, inspection-class ROVs and Autonomous Underwater Vehicles (AUVs).

ROV Sonar Market Executive Summary

The ROV Sonar Market is exhibiting robust growth characterized by high technological velocity and strategic consolidation, primarily fueled by sustained capital investment in maritime security and the transformative expansion of offshore renewable energy infrastructure. Current business trends illustrate a distinct convergence of hardware and software capabilities, where leading manufacturers are transitioning from simple sensor provision to offering holistic, data-as-a-service platforms. This involves integrating high-resolution sonar outputs with proprietary advanced data fusion, visualization, and cloud-based analytical tools, thereby significantly enhancing the end-user's ability to derive actionable intelligence rapidly. Strategic alliances and specialized acquisitions focused on enhancing Synthetic Aperture Sonar (SAS) technology and developing high-frequency, shallow-water specific solutions are defining the competitive landscape, aimed at reducing acquisition costs and improving operational throughput for commercial clients.

Geographically, market dynamics show a clear dichotomy between mature markets, where replacement cycles and technological upgrades dominate, and emerging markets, where foundational infrastructure build-out drives initial procurement. North America and Europe, representing the traditional hubs for offshore oil and gas and pioneering renewable energy, maintain leading market positions due to sophisticated regulatory environments demanding high-integrity surveys and substantial defense budgets allocated for modern underwater warfare capabilities. Conversely, the Asia Pacific (APAC) region is forecasted to achieve the most aggressive compound annual growth rate. This surge is predicated upon significant governmental investments in deep-sea port expansions, extensive deployment of regional and transcontinental fiber optic cables, and the rapid modernization of domestic naval fleets seeking enhanced seabed reconnaissance and anti-submarine capabilities, particularly around strategically contested waterways.

Analysis of market segmentation reveals distinct performance trajectories. The Multibeam Echosounders (MBES) segment maintains its commercial dominance due to unparalleled efficiency in wide-area, high-density bathymetric mapping essential for hydrography and site characterization. However, the high-resolution imaging segments, including Synthetic Aperture Sonar (SAS), are experiencing accelerated demand growth driven by specialized applications requiring minute detail, such as pipeline crack detection and Unexploded Ordnance (UXO) identification, often mandated by stricter environmental and safety regulations. In terms of application, while the Oil & Gas sector remains critical for high-end work-class ROV sonar sales, the Offshore Renewables segment is emerging as the pivotal long-term growth catalyst, projecting sustained demand through the forecast period (2026-2033) as global energy grids transition away from fossil fuels, necessitating continuous infrastructure monitoring and maintenance.

AI Impact Analysis on ROV Sonar Market

User inquiries concerning the influence of Artificial Intelligence (AI) on the ROV Sonar Market frequently highlight the transition from data acquisition challenges to data interpretation bottlenecks. Common questions probe the efficiency gains realized through automated target recognition (ATR), the capability of AI to manage and fuse multi-sensor data streams (sonar, video, inertial navigation), and the robustness of machine learning models when faced with highly variable underwater acoustic conditions and novel debris types. Users express strong interest in solutions that not only automate detection but also provide confidence scores and contextual analysis, thereby improving the reliability of autonomous inspection missions. A core expectation is that AI integration will drastically reduce the time spent in post-mission data analysis, a cost-intensive activity, and simultaneously enhance the consistency and objectivity of survey reports.

AI is fundamentally revolutionizing the core operation and utility of ROV sonar systems by facilitating true autonomy and maximizing data value. By integrating deep convolutional neural networks (CNNs) into sonar processing pipelines, manufacturers can now offer capabilities such as real-time target classification and anomaly detection directly on the platform. This transformation minimizes the reliance on human operators to scrutinize vast sonar images, allowing for immediate course correction or adaptive sampling during the mission itself. Furthermore, AI algorithms are crucial for sophisticated environmental compensation, dynamically adjusting beamforming parameters and filter settings to mitigate noise, reverberation, and changes in the water column properties, ensuring consistently high-quality data collection irrespective of challenging acoustic environments, a feat impractical with conventional manual methods.

Looking forward, the transformative potential of AI extends into predictive operations and generative modeling. Advanced ML models, trained on terabytes of historical sonar data covering diverse subsea assets and geological features, enable predictive diagnostics, forecasting scour progression, or material fatigue in offshore structures before visual confirmation is even necessary. Generative AI tools are being explored to create synthetic sonar datasets for training AUV/ROV navigation systems in hazardous scenarios without incurring expensive, high-risk operational hours. This AI-driven evolution accelerates the market shift toward smart, connected subsea assets, making the ROV sonar system less of a sensor and more of an intelligent, autonomous data generator capable of contributing to a broader, integrated digital ocean twin concept, improving decision-making across all maritime sectors.

- Automated Target Recognition (ATR): Rapid identification and classification of submerged objects, including UXO, debris, and biological targets, leveraging deep learning models for high accuracy.

- Real-Time Data Processing: Implementation of intelligent filtering algorithms to suppress acoustic noise, enhance image fidelity, and perform georeferencing instantly during data acquisition.

- Autonomous Navigation Optimization: AI-driven adaptive path planning, allowing ROVs to dynamically adjust survey lines based on terrain complexity or detected anomalies, maximizing data coverage efficiency.

- Predictive Maintenance and Diagnostics: Analyzing operational data and sonar system health metrics to anticipate hardware component failure, optimizing service intervals and reducing unscheduled downtime.

- Enhanced Data Fusion and Synthesis: AI models seamlessly integrate sonar outputs with ancillary data sources (INS, altimeters, cameras) to produce unified, three-dimensional models of the subsea environment.

- Reduction of Operational Costs: Minimizing post-processing labor and increasing the efficiency of data collection missions through higher levels of automation and reduced reliance on specialized human analysts.

- Software-Defined Sonar (SDS) Enhancement: Utilizing AI to manage and optimize the flexible configuration of digital transducers and processing pipelines based on mission objectives.

DRO & Impact Forces Of ROV Sonar Market

The ROV Sonar market's expansion is intrinsically tied to global economic trends favoring deepwater activities and stringent regulatory demands for environmental compliance and asset safety. Key drivers include the massive global investment in offshore renewable energy, necessitating meticulous site characterization and integrity monitoring of complex subsea structures (foundations, cables), and the continuous capital allocation by major economies toward modernizing naval forces and strengthening maritime domain awareness. The shift towards deeper and more remote hydrocarbon reserves also mandates the use of highly reliable, pressure-tolerant ROV sonar systems capable of operating efficiently in challenging acoustic conditions, often requiring sophisticated real-time compensation algorithms to maintain data quality in high-pressure, varying temperature regimes.

Conversely, significant market restraints impede unbridled growth. Foremost among these is the exceptionally high capital expenditure required for acquiring advanced ROV platforms and integrating premium sonar systems, such as Synthetic Aperture Sonar, limiting adoption primarily to large, established service providers and state-level entities. Furthermore, the operational complexity associated with advanced sonar data processing requires specialized hydrographic expertise, creating a talent gap that hampers rapid deployment across smaller organizations. Regulatory hurdles, particularly in sensitive marine protected areas, pertaining to the permissible acoustic intensity and frequency spectrum utilized by sonar systems, can necessitate project-specific permits and constraints, sometimes limiting survey speed or coverage, thereby increasing operational costs and timelines for commercial operators.

Opportunities for market players are converging around technological innovation and geographical expansion. The greatest technological opportunity lies in the mass integration of miniaturized, high-performance sonar units onto the rapidly proliferating fleet of small, cost-effective Autonomous Underwater Vehicles (AUVs) and inspection-class ROVs, opening up new service markets for inshore and coastal hydrography. Geographically, strategic exploration initiatives in the Arctic region, driven by resource access and the creation of new shipping lanes, represent a burgeoning frontier demanding specialized, robust sonar systems capable of operating under ice and enduring extreme cold. The proliferation of subsea fiber optic cables worldwide also represents a sustained opportunity for inspection and burial verification services, utilizing specialized sub-bottom profilers and high-frequency imagery systems integrated into work-class ROVs.

Segmentation Analysis

The ROV Sonar Market segmentation provides a granular view of demand profiles, dictated by technical requirements, end-user environment, and operational frequency. The fundamental division by Type—Multibeam Echosounders (MBES), Side-Scan Sonar (SSS), and Sub-Bottom Profilers (SBP)—reflects a spectrum of functional utility, moving from highly accurate 3D seafloor topography (MBES) to broad-area seafloor imagery (SSS) and finally, subsurface geological analysis (SBP). Manufacturers often tailor specific features within these categories, such as depth rating and operational bandwidth, to optimize performance for either shallow coastal surveys or ultra-deepwater oceanic missions, directly influencing the product's price point and target customer base.

The segmentation by Application provides vital insight into expenditure priorities across different industrial sectors. For instance, the Defense segment demands systems optimized for stealth, rapid classification, and operational reliability under demanding military specifications, often prioritizing specialized Synthetic Aperture Sonar (SAS) for high-resolution target detection. Conversely, the Marine Science segment favors multi-frequency, highly calibrated systems that can provide quantitative data for academic research purposes, such as detailed acoustic backscatter for habitat characterization. This divergence in requirement profiles dictates customized sales strategies and regulatory compliance certifications, which are particularly stringent within the defense and oil & gas sectors due to high-value asset protection requirements and national security mandates.

Furthermore, the segmentation by Frequency Range—Low, Medium, and High—directly correlates with the trade-off between range and resolution, a foundational principle of hydro-acoustics. High-frequency systems (>500 kHz) deliver exceptional resolution necessary for detailed close-range inspection (e.g., crack detection), but their effective operational range is significantly limited by absorption in the water column. Low-frequency systems (<100 kHz) offer wide-area coverage and greater penetration, making them ideal for long-range surveillance and deepwater mapping, albeit at a lower spatial resolution. This technical segmentation informs the specific ROV type a sonar system will be mounted on, typically pairing high-frequency units with small inspection-class ROVs and low-frequency units with large work-class vehicles or dedicated survey platforms.

- By Type:

- Multibeam Echosounders (MBES): Used for highly accurate 3D bathymetric mapping and charting.

- Side-Scan Sonar (SSS): Primarily used for generating detailed acoustic imagery of the seafloor texture and objects.

- Sub-Bottom Profilers (SBP): Employed for penetration surveys to analyze subsurface geological layers and sediment properties.

- Synthetic Aperture Sonar (SAS): Provides extremely high-resolution, range-independent imagery for specialized detection and classification tasks.

- Forward-Looking Sonar (FLS): Crucial for real-time ROV navigation, collision avoidance, and situational awareness in low-visibility environments.

- By Application:

- Oil & Gas (Inspection, Repair, Maintenance, and Survey): Largest traditional segment, focused on asset integrity and pipeline management.

- Defense & Security (Mine Countermeasures, Surveillance, Search & Rescue): Focuses on covert, high-reliability detection and classification of threats.

- Marine Science & Hydrography (Seabed Mapping, Habitat Assessment): Academic and governmental use for environmental data collection and charting.

- Subsea Telecommunication & Power Cable Inspection: Monitoring cable burial depth and integrity against external damage risks.

- Search and Recovery (SAR): Rapid deployment systems for locating lost assets, aircraft, or vessels in high-priority scenarios.

- By Frequency Range:

- Low Frequency (Less than 100 kHz): Maximize range and penetration, used for deepwater exploration and long-range surveillance.

- Medium Frequency (100 kHz to 500 kHz): Offers a balance between resolution and range, suitable for general survey tasks.

- High Frequency (Above 500 kHz): Delivers maximum resolution for detailed inspection and close-range target identification.

Value Chain Analysis For ROV Sonar Market

The upstream segment of the ROV Sonar value chain is fundamentally reliant on high-tech material science and specialized engineering components, defining the performance ceiling of the final product. This phase includes intensive R&D investments in hydro-acoustic sensor design, particularly the formulation and manufacturing of piezoceramic materials (PZT) essential for transducers, which convert electrical energy into acoustic energy and vice versa. Procurement involves securing specialized, high-reliability electronic components such as analog-to-digital converters (ADCs), Field-Programmable Gate Arrays (FPGAs), and high-speed digital signal processors (DSPs) optimized for massive parallel data processing. Critical expertise in this segment is highly concentrated, granting specialized component suppliers significant, though moderate, bargaining power, particularly for proprietary transducer array designs and advanced materials capable of enduring high pressure and temperature variances.

The core value creation occurs in the midstream, encompassing manufacturing, calibration, and system integration. Manufacturers assemble the physical sensor arrays, develop the complex enclosure systems (pressure housings), and integrate the proprietary beamforming and signal conditioning electronics. Crucially, the midstream phase involves developing and embedding proprietary software for data acquisition and real-time processing, which is the primary source of product differentiation. This highly technical assembly process demands specialized cleanroom environments and rigorous hydrostatic testing to ensure reliability at extreme operational depths. Effective integration onto the ROV platform itself—ensuring minimal acoustic interference from the vehicle’s thrusters and optimal sensor positioning—is a key value-added service provided by the system manufacturers or specialized integrators.

The downstream activities are crucial for market success, focusing on distribution, sales, and the provision of high-margin services. Distribution channels for large work-class sonar systems are often direct, managed through long-term contracts with major defense contractors or Tier 1 subsea service providers, guaranteeing tailored support and continuous technical upgrades. For smaller, observation-class ROV sonar units, indirect channels via global distributors and regional integrators are more prevalent, providing localized technical support. The highest growth in downstream value addition comes from post-deployment services: specialized training, maintenance contracts, and, increasingly, advanced data analytical services incorporating cloud storage and AI-powered automated report generation. This shift towards service-centric revenue models ensures ongoing customer engagement and maximizes the lifetime value derived from the initial hardware sale.

ROV Sonar Market Potential Customers

The primary customer base for high-specification ROV Sonar systems remains the global Oil and Gas sector, categorized into International Oil Companies (IOCs), National Oil Companies (NOCs), and the vast network of specialist Inspection, Repair, and Maintenance (IRM) contractors. These entities rely on ROV sonar for mission-critical tasks: detailed bathymetric surveys for new field development, regular pipeline integrity checks for corrosion or free spans, and rigorous decommissioning surveys to ensure environmental compliance. Their procurement decisions prioritize system reliability, depth rating, high data repeatability, and compatibility with standardized industry software platforms used for asset lifecycle management, often resulting in large, multi-year contracts favoring established Tier 1 suppliers.

A rapidly expanding customer cohort is found in the Government and Defense sector, encompassing national Navies, Coast Guards, and maritime law enforcement agencies across the globe. The strategic needs of these clients dictate the purchase of highly specialized, military-grade sonar systems focused on Mine Countermeasures (MCM), anti-submarine warfare (ASW) support, and hydrographic charting of strategic ports and sea lanes. These applications demand exceptional high-resolution performance, low probability of false alarm, rapid deployment capabilities, and adherence to strict military quality and communication standards. Investment cycles in this segment are often large and non-cyclical, driven by national security budgets rather than commodity price fluctuations.

The third major group includes the developers and operators within the burgeoning Offshore Renewable Energy (ORE) market, specifically those involved in offshore wind, wave, and tidal energy projects, along with the marine contractors executing the construction phase. These customers utilize ROV sonar for foundational requirements, including detailed pre-construction geological surveys to determine suitable foundation types, subsequent cable laying verification, and ongoing structural monitoring for scour and stability. Finally, specialized governmental organizations such as hydrographic offices (e.g., NOAA, UKHO) and academic research institutions represent a stable, though smaller, market segment requiring highly calibrated, research-grade sonar systems for large-scale seabed mapping, climate change studies, and complex marine biological assessments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 650 Million |

| Market Forecast in 2033 | USD 1,220 Million |

| Growth Rate | CAGR 9.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Teledyne Technologies, Kongsberg Gruppen, EdgeTech, Marine Sonic Technology, Blueprint Subsea, Tritech International, Saab AB, Fugro, ATLAS ELEKTRONIK GmbH, Sound Metrics, Hydro-Lek, MacArtney A/S, Greensea Systems, Sonardyne International, Nortek AS, Raytheon Technologies, Benthos, Innova AS, Oceaneering International, R2Sonic. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

ROV Sonar Market Key Technology Landscape

The contemporary ROV Sonar technology landscape is defined by continuous leaps in acoustic resolution, driven by advancements in array manufacturing and digital signal processing (DSP). A critical innovation is the development and widespread commercialization of high-frequency Synthetic Aperture Sonar (SAS), which processes multiple pings over a trajectory to create a synthetic acoustic array, achieving along-track resolutions significantly superior to conventional systems, often measured in centimeters regardless of operating range. This technology is becoming a standard requirement for military Mine Countermeasures (MCM) and detailed non-destructive testing (NDT) inspections in the oil and gas sector. The ability to generate near-photographic quality imagery from acoustic data is redefining the expectations for subsea imaging, pushing manufacturers to further miniaturize SAS modules for integration onto smaller, more maneuverable inspection-class ROVs and AUVs, optimizing mission efficiency and platform flexibility.

Another fundamental technological pillar is the evolution of Multibeam Echosounder (MBES) technology, incorporating advanced interferometric techniques and extremely wide swath coverage capabilities. Modern MBES systems utilize advanced phase measuring bathymetric sonar (PMBS) methods to enhance coverage rates while maintaining IHO Special Order quality data, crucial for rapid hydrographic surveys. Significant effort is being invested in transducer technology, specifically utilizing broad-band frequency techniques and Micro-machined Ultrasonic Transducers (MUTs) to allow a single sonar head to operate effectively across a wider frequency spectrum. This broadband capability improves the system's resilience to varying water column conditions and enhances the ability to differentiate between different seafloor sediment types through precise backscatter analysis, moving beyond simple depth measurements to complex seafloor characterization.

The increasing importance of software and data architecture distinguishes leading-edge products. The movement toward Software-Defined Sonar (SDS) platforms provides end-users with unprecedented flexibility, allowing real-time modification of complex operational parameters like beam steering, pulse compression schemes, and aperture configuration through simple software upgrades, decoupling hardware lifecycles from technological obsolescence. Furthermore, the integration of high-precision Inertial Navigation Systems (INS) and advanced acoustic positioning (USBL) directly within the sonar processing unit minimizes positioning errors and ensures data quality, which is paramount for meeting strict regulatory and contractual data requirements. The focus is now on generating fully georeferenced, clean data outputs that require minimal manual cleaning, effectively shifting the technological battleground from raw hardware power to intelligent, autonomous data integrity management and processing.

Regional Highlights

- North America: This region maintains its dominance due to substantial, continuous military spending focused on advanced underwater surveillance and anti-mine capabilities, particularly by the U.S. Navy. The mature Oil & Gas sector in the Gulf of Mexico drives significant demand for high-end work-class ROV sonar for aging asset integrity management and deepwater infrastructure projects. The region benefits from a high density of innovation hubs and key market leaders driving technological development in areas like AI-enhanced data processing and autonomous survey techniques.

- Europe: The European market is heavily influenced by the massive investment commitment to offshore renewable energy, particularly across the UK, Germany, and the Scandinavian countries. This drives exceptional demand for precise bathymetric and sub-bottom profiling sonar used in site selection, installation, and long-term maintenance of offshore wind farms. Furthermore, the European defense sector maintains a high demand for specialized ROV sonar systems for littoral and deepwater defense, supported by significant EU and national research funding for maritime security technologies.

- Asia Pacific (APAC): The APAC market is characterized by rapid development and high growth potential (CAGR). The primary drivers include extensive maritime infrastructure projects, encompassing major port expansions and the unprecedented installation pace of regional and transcontinental fiber optic cables, requiring constant survey and inspection. Geopolitical dynamics, particularly surrounding maritime territorial claims, spur significant investment in naval modernization and patrol capabilities, driving demand for high-resolution ROV and AUV-mounted sonar systems across key emerging economies.

- Latin America: Market growth in this region is tightly concentrated around the major oil-producing nations, specifically Brazil and Mexico, where pre-salt deepwater exploration demands highly capable and durable ROV platforms equipped with long-range Multibeam and Forward-Looking Sonar for drilling support, pipeline routing, and habitat assessment in sensitive environmental areas. Investment volatility is often linked to global oil prices, although long-term demand for infrastructure inspection remains stable.

- Middle East and Africa (MEA): The MEA market is largely dependent on the stability and performance of the hydrocarbon sector in the Arabian Gulf and West Africa. Demand focuses on reliable, rugged sonar systems for inspecting critical oil export infrastructure, security surveillance of terminals, and ensuring the safety of busy shipping lanes. While smaller than other regions, strategic governmental investments in coastal security and port modernization provide consistent, albeit moderate, growth opportunities for ROV sonar suppliers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the ROV Sonar Market.- Teledyne Technologies

- Kongsberg Gruppen

- EdgeTech

- Marine Sonic Technology

- Blueprint Subsea

- Tritech International

- Saab AB

- Fugro

- ATLAS ELEKTRONIK GmbH

- Sound Metrics

- Hydro-Lek

- MacArtney A/S

- Greensea Systems

- Sonardyne International

- Nortek AS

- Raytheon Technologies

- Benthos

- Innova AS

- Oceaneering International

- R2Sonic

Frequently Asked Questions

Analyze common user questions about the ROV Sonar market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the ROV Sonar Market?

The predominant driver is the rapid global expansion of the offshore renewable energy sector, particularly wind farm development, which mandates extensive and accurate subsea surveying and continuous monitoring using high-resolution ROV-mounted sonar systems, replacing traditional fossil fuel infrastructure inspection as the primary growth engine.

How does Synthetic Aperture Sonar (SAS) differ from traditional Side-Scan Sonar?

SAS systems significantly outperform traditional side-scan sonar by using complex signal processing to synthesize a large virtual acoustic array, achieving consistent, ultra-high resolution imagery independent of the ROV's range and platform speed. This superior along-track resolution is crucial for detailed target classification and measurement required in modern defense and inspection applications.

Which application segment holds the largest share in the ROV Sonar Market?

Historically, the Oil & Gas segment retains the largest market share, driven by mandatory inspection, repair, and maintenance (IRM) of extensive subsea pipeline networks and aging offshore platforms globally. However, the Offshore Renewables segment is poised for the fastest growth due to ongoing green energy transition initiatives worldwide.

How is AI impacting data processing in ROV Sonar systems?

AI, through machine learning and deep learning, enables Automated Target Recognition (ATR) and real-time noise reduction, drastically accelerating the interpretation of massive sonar datasets and reducing the need for extensive manual post-mission analysis, thereby delivering faster, objective, and highly actionable operational insights directly to end-users.

Which geographic region is projected to show the fastest market growth?

The Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR), fueled by significant investments in maritime security, naval modernization, and rapid development of regional subsea telecommunication and power cable infrastructure, particularly in high-growth economies such like China, India, and South Korea.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager