Rowers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433733 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Rowers Market Size

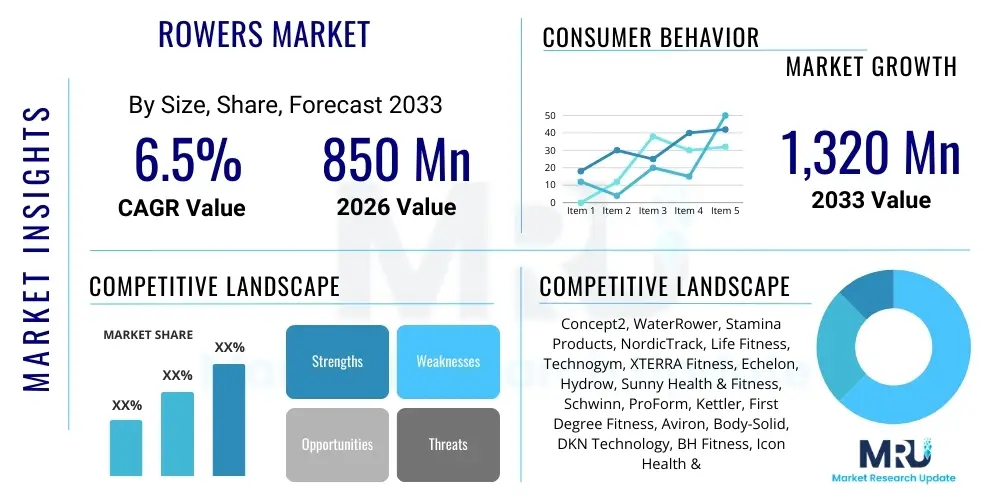

The Rowers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 850 million in 2026 and is projected to reach USD 1,320 million by the end of the forecast period in 2033.

Rowers Market introduction

The global Rowers Market encompasses the manufacturing, distribution, and retail of indoor fitness ergometers designed to accurately simulate the physics and biomechanics of watercraft rowing. These sophisticated machines serve as highly effective tools for achieving full-body, low-impact aerobic conditioning and strength training, positioning them as essential assets across diverse consumer demographics, ranging from elite competitive rowers requiring precise training metrics to general consumers seeking holistic fitness solutions. The core product offering is differentiated primarily by the resistance mechanism employed, including air, magnetic, water, and hydraulic systems, each providing unique tactile feedback, acoustic profiles, and maintenance requirements, thus segmenting the market across residential, commercial, and institutional applications. The contemporary trajectory of market expansion is fundamentally driven by a heightened global consciousness regarding public health, coupled with seminal advancements in digital connectivity and immersive fitness technology, making high-performance exercise accessible within the home environment.

Rowing machines are increasingly recognized for their biomechanical superiority, facilitating a seamless, cyclical motion that engages nearly 86% of the body's musculature, involving critical muscle groups in the legs (60%), core (20%), and upper body (20%). This comprehensive engagement delivers a maximal calorie burn while minimizing the impact stress typically associated with high-impact exercises like running or jumping, positioning rowing as a vital component in preventative healthcare and rehabilitation protocols. Major applications have diversified rapidly, extending from traditional commercial fitness centers and university athletic programs to encompass specialized boutique rowing studios, preventative corporate wellness schemes, and most profoundly, the ubiquitous residential home gym sector. The market's resilience is supported by the versatility of rowing equipment, which seamlessly accommodates diverse workout modalities, ranging from steady-state endurance training and high-intensity interval training (HIIT) to specialized technique and strength conditioning routines.

The substantial health benefits derived from consistent rowing include demonstrable improvements in cardiovascular health, significant enhancement of muscular endurance across the posterior chain, and effective weight management through high-caloric expenditure, making these devices essential instruments in the global effort to mitigate lifestyle diseases such as Type 2 diabetes and hypertension. Key driving factors propelling market growth include the substantial market penetration of connected fitness ecosystems, which deliver live, instructor-led, and on-demand content directly to the rower’s integrated screen, fostering unparalleled user engagement and adherence. Furthermore, the strategic shift toward decentralized exercise locations, accelerated globally by recent public health crises, has established high-quality, digitally integrated home rowing setups as a necessary long-term consumer investment, significantly and permanently elevating the demand profile for premium rowing equipment and associated subscription services worldwide.

Rowers Market Executive Summary

The Rowers Market is currently undergoing a transformative period characterized by an aggressive integration of software and hardware, cementing the trend toward connected fitness and defining the modern business landscape. Strategic business trends revolve around enhancing the customer ecosystem through content diversification, offering sophisticated data analytics capabilities, and leveraging flexible financing models to offset the high initial capital expenditure of smart rowers. Leading vendors are prioritizing proprietary content libraries and engaging global instructors to maintain a competitive edge, understanding that the value proposition increasingly resides in the digital service subscription rather than the physical equipment alone. Operational success is tied directly to managing complex global supply chains, specifically mitigating risks associated with the procurement of integrated circuits, sophisticated sensors, and high-quality display panels required for advanced machinery, necessitating enhanced transparency and resilience in vendor-manufacturer relationships.

Geographically, the market maintains a pronounced concentration in mature economic regions, with North America and Europe collectively holding the most substantial revenue share due to high discretionary spending, well-established retail distribution networks, and deep consumer affinity for home wellness technology. Critically, the Asia Pacific (APAC) region is forecasted to be the primary engine of future growth, projected to achieve the highest CAGR driven by rapid wealth creation, extensive infrastructure development of commercial fitness chains, and aggressive digital adoption in urban centers. Segment trends clearly indicate that residential demand, particularly for water and magnetic resistance systems that prioritize quiet operation and aesthetic integration into living spaces, is the dominant growth trajectory. Conversely, the commercial sector, while growing steadily through cyclical equipment replacement and expansion, continues to rely heavily on the durability and robustness of air resistance rowers capable of enduring institutional use cycles.

The market environment remains competitively intense, prompting firms to strategically differentiate through ergonomic design patents, unique resistance technologies, and superior warranty and after-sales support services. The strategic segmentation between high-cost, high-engagement connected rowers and traditional, utilitarian mechanical rowers is sharpening, forcing mid-tier manufacturers to strategically navigate this divide by offering hybrid models with modular connectivity upgrades. Key industry risks, primarily concerning high customer acquisition costs and the potential for digital content saturation, are being addressed through data-driven marketing and strategic partnerships with external health and technology platforms. Overall, the executive outlook remains highly positive, underpinned by favorable macroeconomic trends supporting health expenditure and enduring consumer willingness to invest in performance-enhancing fitness tools, ensuring continuous technological innovation across all resistance and application segments throughout the forecast period.

AI Impact Analysis on Rowers Market

Analysis of common user questions reveals a strong focus on the integration of Artificial Intelligence (AI) to enhance the technical proficiency and safety aspects of rowing workouts, moving personalized training beyond simple metric recording. Users frequently inquire about the reliability of AI algorithms in interpreting subtle biomechanical variations, such as identifying early signs of compensatory movements or inefficient force application during the drive phase, which could lead to long-term injuries. The community seeks affirmation that AI-driven coaching systems can deliver feedback with the nuance and contextual understanding of a human coach, particularly concerning pacing strategies for diverse endurance goals. Furthermore, a substantial segment of users expresses concerns regarding data privacy—specifically, how the sensitive physiological and stroke data collected by AI systems are stored, analyzed, and protected, emphasizing a strong market requirement for transparent, compliant data governance frameworks established by equipment manufacturers.

The application of AI technology is set to fundamentally reshape the user-rower interaction model by transitioning from static workout schedules to dynamically adaptive training experiences. AI leverages deep learning models to process immense datasets generated by thousands of strokes, analyzing variables such as peak force velocity, drag factor adjustments, and heart rate variability in conjunction with subjective user feedback on perceived exertion. This comprehensive synthesis allows the system to instantaneously recalibrate the workout parameters—adjusting target stroke rate, varying resistance levels on magnetic systems, or modifying the projected duration of intervals—ensuring the user remains within their optimal training zone for maximizing physiological adaptation. This level of personalized, instantaneous adaptation represents the core value proposition of next-generation smart rowers and significantly boosts user performance outcomes.

Furthermore, AI is pivotal in democratizing advanced rowing technique through computer vision and specialized sensor fusion. High-definition cameras or strategically placed sensors monitor the user’s posture, handle path, and knee angle throughout the catch, drive, finish, and recovery phases. The AI interprets this visual and kinetic data, instantly cross-referencing it against optimized biomechanical models. If a deviation, such as 'shooting the slide' (premature leg extension), is detected, the system provides immediate, actionable corrective cues—either visual overlays on the screen or verbal instructions—to guide the user back to optimal form. This proactive technique coaching minimizes the risk of common rowing injuries, such as lower back strain, thereby enhancing the long-term safety and utility of the equipment for novice and experienced users alike, solidifying AI as a critical component for competitive differentiation.

- AI-Powered Personalized Coaching: Algorithms analyze stroke efficiency, power output, and biometric data to create real-time, adaptive workout regimens tailored to individual fitness goals, recovery status, and dynamic fatigue levels throughout the session.

- Form Correction and Injury Prevention: Integration of sophisticated computer vision via built-in high-definition cameras and advanced sensor arrays to detect minute deviations from optimal rowing technique, providing immediate, contextualized audible or visual feedback regarding posture, grip, and sequencing.

- Predictive Maintenance and Diagnostics: AI monitors the machine’s operational telemetry, including chain tension, bearing vibration, and damper wear, using time-series analysis to forecast potential mechanical failures months in advance, scheduling necessary preventative service actions and maximizing commercial equipment uptime.

- Generative Content and Class Curation: Machine learning analyzes user engagement with thousands of past workouts, identifying preferences for music genres, scenic routes, instructor energy, and intensity profiles, algorithmically generating novel workout content, environments, and class structures to continuously refresh the digital platform library and maintain high subscription retention rates.

- Optimized Gamification and Leaderboards: Utilizing deep learning models to enhance the competitive environment by accurately matching users based not just on speed but on consistent power-to-weight ratios and historical performance variance, improving the fairness and sustained engagement of digital races and community challenges.

- Subscription Tier Optimization: AI models perform cohort analysis on user usage patterns and content consumption elasticity to recommend optimal content bundles, personalized pricing strategies, and feature upgrades across various subscription tiers for manufacturers offering connected services.

- Biometric Data Synthesis and Holistic Wellness: Advanced AI correlation techniques link high-frequency rowing performance metrics with external data streams, such as data from sleep trackers and stress monitors, providing holistic, actionable wellness advice that extends beyond the immediate exercise session, enhancing the overall value proposition of the fitness ecosystem.

- Voice Command Integration and Natural Language Processing (NLP): AI enables seamless, hands-free control of the rowing machine console and workout parameters through natural voice commands, improving safety and reducing interruptions during high-intensity exercise phases.

- Automated Environment Simulation: Leveraging AI to dynamically adjust the visual display and resistance profile to mimic real-world water conditions (e.g., wind resistance, water chop), enhancing the realism of virtual outdoor rowing experiences.

DRO & Impact Forces Of Rowers Market

The operational dynamics of the Rowers Market are significantly shaped by a confluence of driving forces, inherent restraints, and emerging opportunities. Central to market acceleration is the widespread adoption of connected fitness technologies, which transform the isolated exercise routine into a networked, interactive, and socially engaging experience, vastly expanding the total addressable market beyond traditional gym-goers. This technological driver is complemented by the sustained medical recognition of rowing as a superior, multi-joint, low-impact exercise suitable for rehabilitation and long-term health maintenance across all ages. Key restraints include the substantial initial capital investment required for high-end connected rowers, often exceeding $2,000, which creates a significant financial barrier for broad consumer segments, coupled with the practical constraint of the equipment’s physical footprint, which poses logistical challenges in high-density urban housing markets. Opportunities, therefore, lie in the rapid development of compact, vertically storable, and modular designs, alongside strategic market expansion into high-growth regions like APAC, leveraging local manufacturing efficiencies and tailored pricing strategies.

Specific drivers fueling continuous market expansion include favorable macroeconomic indicators such as rising disposable incomes globally, allowing for greater allocation toward elective health and fitness expenditures, and demographic pressures, notably the aging population in Western and Eastern nations seeking joint-friendly exercise modalities. Furthermore, the commercial driver is revitalized by the expansion and modernization of global fitness club franchises, necessitating bulk replacement of older, non-connected equipment with standardized, IoT-enabled professional machines capable of integration into club management software. The impact forces created by consumer expectations for instant data feedback, social connectivity, and highly polished digital content mandate continuous and intensive research and development expenditure by manufacturers, pushing the boundary of resistance mechanism efficiency and sensor accuracy to maintain competitive relevance in a fiercely fought digital ecosystem.

Conversely, market resilience is continuously tested by several restraining factors, including intense price competition from substitute fitness equipment, particularly lower-cost stationary bikes and elliptical trainers, which often require less space. Furthermore, dependence on complex international supply chains for sensitive electronic components, exacerbated by global geopolitical instability and trade tariffs, introduces volatility in manufacturing costs and final retail pricing. The digital opportunity, however, resides in monetizing the ecosystem through stable recurring revenue streams derived from digital content subscriptions and premium support services, which provide long-term financial stability beyond the volatile hardware sales cycle. Strategic exploitation of niche markets, such as adaptive fitness equipment tailored for specialized physiological requirements and high-performance military and tactical training installations, represents untapped growth potential, reinforcing a positive overall impact force despite economic headwinds and logistical complexities.

Segmentation Analysis

The Rowers Market undergoes meticulous segmentation based on crucial technical and application parameters to provide precise insights into market dynamics and consumer preferences. The distinction by resistance mechanism is foundational, dividing the market based on feel, cost structure, and ideal operating environment. Water resistance systems appeal to premium home users due to their aesthetic appeal, authentic rowing feel, and low acoustic signature, while magnetic systems dominate segments requiring silent, digitally controllable resistance, primarily targeting apartment dwellers and tech-forward consumers. The hydraulic segment continues to serve the budget-conscious consumer and those requiring minimal storage space due to its compact design, though it generally offers a less refined stroke profile. The application-based segmentation strictly separates the high-volume usage and durability requirements of commercial operators from the connectivity, design, and personalized content demands of the accelerating residential market segment.

- By Resistance Mechanism:

- Air Resistance Rowers (Characterized by dynamic resistance, high durability, standard choice for CrossFit and competitive training; prominent vendors: Concept2.)

- Magnetic Resistance Rowers (Offers quiet operation, electronically precise drag control, favored in urban residential settings; prominent vendors: Hydrow, Echelon.)

- Water Resistance Rowers (Simulates natural fluid dynamics, provides a smooth, sensory workout experience, often built with wooden frames; prominent vendors: WaterRower, First Degree Fitness.)

- Air-Magnetic Hybrid Rowers (Combines the dynamic feel of air resistance with the controllability of magnetic brakes, balancing performance and noise reduction.)

- Hydraulic Resistance Rowers (Utilizes pistons for resistance, offering the most compact form factor, suitable for entry-level and space-constrained users.)

- By Application/End-User:

- Residential/Home Use (Focus on integrated digital platforms, aesthetic design, collapsible features, and personalized content subscriptions.)

- Commercial Use (Gyms, Health Clubs, Boutique Studios, Corporate Fitness Centers) (Emphasis on reliability, networking capabilities for class settings, and heavy-duty frame construction to handle extensive daily usage.)

- Institutional Use (Universities, Military Training Facilities, Rehabilitation Clinics) (Requirements center on standardized performance calibration, robust construction, and specific safety features.)

- By Connectivity Type:

- Connected/Smart Rowers (Featuring integrated HD touchscreens, proprietary operating systems, live streaming capabilities, and extensive sensor integration.)

- Conventional Rowers (Basic consoles for tracking time, distance, and strokes, relying on manual resistance adjustment and analog metrics.)

- By Price Range:

- Premium (USD 1,500 and above) (Dominated by connected and water resistance models.)

- Mid-Range (USD 500 - USD 1,500) (Hybrid and high-quality magnetic resistance rowers.)

- Economical (Below USD 500) (Primarily hydraulic and entry-level magnetic systems.)

- By Distribution Channel:

- Online Retail (Direct-to-Consumer (D2C) brand websites, major e-commerce platforms like Amazon, offering logistical advantages and direct customer data access.)

- Offline Retail (Specialty Sports Equipment Stores, Dedicated Fitness Showrooms, Department Stores, allowing for product trial and personalized sales consultation.)

Value Chain Analysis For Rowers Market

The comprehensive value chain for the Rowers Market initiates with critical upstream activities, which include the procurement and processing of specialized industrial materials. The structural integrity of rowing machines requires high-grade, often aircraft-grade, aluminum for rails and frames, precision-machined steel for resistance mechanisms (flywheels, chains, magnetic brakes), and durable engineered plastics for housing and seats. For connected rowers, the sourcing of electronic components—including microprocessors, high-definition displays, capacitive touch sensors, and connectivity modules (Wi-Fi/Bluetooth)—is paramount and often involves complex, multi-tiered relationships with global electronics suppliers, particularly those based in Asia. Maintaining a stable, cost-effective supply of these components is a significant determinant of both manufacturing costs and the final retail price, requiring robust risk mitigation strategies against supply chain disruptions and component obsolescence in the rapidly evolving technology sector.

Midstream functions are defined by sophisticated assembly and quality assurance protocols, where the integration of mechanical precision and digital technology occurs. This stage includes the fabrication of ergonomic handles and footrests, the delicate calibration of resistance mechanisms (especially electromagnetic brakes), and the crucial installation and testing of proprietary software on the integrated consoles. The manufacturing process often employs advanced robotics for repetitive assembly tasks but still relies heavily on skilled human labor for final quality checks and the delicate fitting of specialized components like water tanks or complex damping systems. Finished goods then proceed to inventory and logistics management, where the sheer size and weight of rowers necessitate specialized warehousing and shipping infrastructure, with many manufacturers utilizing regional distribution hubs to minimize final-mile transportation costs and delivery lead times to both direct consumers and commercial clients.

The downstream sector is dominated by the distribution channels, categorized broadly into direct and indirect models. The Direct-to-Consumer (D2C) model, heavily utilized by brand-focused, connected fitness companies like Hydrow and Echelon, maximizes profit margins and provides invaluable direct access to user data and feedback, allowing for swift product iteration and highly personalized marketing campaigns. Conversely, indirect channels leverage the expansive reach of major third-party retailers (e.g., Walmart, Dick's Sporting Goods) and specialized commercial distributors (for gym equipment), which is essential for market penetration in segments requiring extensive geographical coverage or large-scale B2B deployment. Post-purchase activities—including white-glove delivery, mandatory professional installation for complex commercial units, extensive multi-year warranties, and the provision of continuous software updates and subscription content—are crucial elements in establishing brand loyalty and generating sustainable long-term revenue streams, ultimately determining the overall perceived value of the rowing equipment ecosystem.

Rowers Market Potential Customers

The market for rowing machines targets a broad spectrum of end-users whose needs vary significantly based on their fitness goals, budget constraints, and operational environment. The most economically influential segment comprises affluent residential users, typically high-net-worth individuals and middle-class households aged 30 to 55, who are migrating from traditional gym memberships to high-tech, connected home fitness environments. These buyers are motivated by the convenience of integrated streaming classes, seeking full-body workouts that can be completed efficiently and quietly, often demanding aesthetically refined equipment that complements modern interior design, placing a premium on brands like WaterRower and Hydrow. This demographic prioritizes subscription services and seamless technological integration with wearable health devices, viewing the initial hardware cost as a justifiable investment in a long-term wellness solution, often facilitated by competitive consumer financing options provided by the manufacturers.

A secondary, yet highly robust, customer base is the commercial sector, encompassing large multinational gym franchises, independent fitness centers, corporate wellness programs, and specialized boutique rowing studios focused entirely on rowing-centric classes. These institutional buyers focus rigorously on equipment durability, Mean Time Between Failure (MTBF), ease of cleaning and maintenance, and standardized data output that integrates with facility management software and class tracking systems. For commercial environments, equipment standardization and the ability to withstand continuous, high-intensity use by diverse individuals are non-negotiable requirements, making highly durable air resistance rowers (like Concept2) a perennial choice due to their proven longevity and ease of serviceability in industrial settings. Purchasing decisions here are less about digital content subscriptions and more about total cost of ownership (TCO) over a typical 5-7 year replacement cycle.

Furthermore, niche but essential market segments include the aging population and individuals requiring specialized rehabilitation. Seniors are increasingly targeted due to rowing's documented benefits as a low-impact, joint-safe exercise that effectively maintains cardiovascular health and muscular strength without stressing aging joints, often resulting in sales through direct-to-consumer medical channels or via recommendations from physical therapists. Competitive athletes—including professional rowers, triathletes, and CrossFit practitioners—form a high-value niche requiring performance-grade ergometers with meticulous calibration, providing highly accurate metrics for physiological testing and intense winter training. Finally, governmental and defense organizations represent institutional buyers with substantial purchasing power, demanding rugged, non-electronic rowers for intense tactical and physical preparedness training programs in austere and non-networked environments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 Million |

| Market Forecast in 2033 | USD 1,320 Million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Concept2, WaterRower, Stamina Products, NordicTrack, Life Fitness, Technogym, XTERRA Fitness, Echelon, Hydrow, Sunny Health & Fitness, Schwinn, ProForm, Kettler, First Degree Fitness, Aviron, Body-Solid, DKN Technology, BH Fitness, Icon Health & Fitness, JTX Fitness, Inspire Fitness, Tunturi, Rogue Fitness, Matrix Fitness, Precor |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Rowers Market Key Technology Landscape

The core technological evolution in the Rowers Market centers on refining resistance mechanisms and integrating high-fidelity digital platforms, moving the product from simple exercise equipment to advanced data-collection and training systems. A major technological leap involves the refinement of electro-magnetic resistance systems, particularly those that utilize eddy currents or dynamic magnets, allowing for near-silent operation while providing exceptionally precise control over the drag profile. This precision is critical for seamless integration with streaming classes, where the instructor or AI system can remotely and instantaneously adjust the resistance level to match programmed intervals, ensuring the user is consistently working at the prescribed effort level without manual interruption. Furthermore, these systems require sophisticated control boards and high-speed feedback loops to manage resistance changes, demanding continuous improvements in firmware stability and hardware synchronization.

Integral to the modern rower is the connectivity hardware and associated sensor technology. High-speed, dual-band Wi-Fi capabilities are essential for buffering and streaming 4K video content from digital fitness platforms, while Bluetooth Low Energy (BLE 5.0 and newer) ensures reliable pairing with peripheral devices like wireless headphones, heart rate monitors, and smart watches. Sensor fusion technology, integrating force sensors in the foot stretchers and sophisticated encoders on the drive mechanism, measures granular data points, including drive phase length, peak wattage output, and the consistency of force application through the stroke. This raw data, collected at high frequency, is processed locally and uploaded to cloud environments for advanced analytical services. This data accuracy is non-negotiable for competitive and performance-oriented users who rely on the machine's metric fidelity for tracking physiological progress and race simulation preparation.

Beyond internal hardware, the competitive edge is increasingly found in the proprietary software ecosystem and content delivery infrastructure. Manufacturers are investing heavily in establishing dedicated streaming content studios, developing user interfaces optimized for minimal distraction and maximal engagement, and securing intellectual property related to unique gamified training modes (e.g., Aviron’s racing technology). A growing trend involves the implementation of energy harvesting systems, particularly in air and water rowers, where the kinetic energy generated during the workout is partially captured to power the console display, reducing reliance on external power sources and enhancing the machine’s energy efficiency for institutional deployment. The application of sophisticated material science, including lightweight composite polymers and advanced ergonomic seating, further contributes to the overall technological sophistication, improving user comfort and reducing shipping weight without compromising frame rigidity or long-term durability, thereby optimizing the entire product lifecycle.

Regional Highlights

Regional analysis of the Rowers Market demonstrates a diverse landscape shaped by economic maturity, consumer technological adoption rates, and local fitness culture prevalence. Strategic growth is heavily weighted towards regions where high disposable income meets a strong preference for investment in personal health technology.

- North America (U.S. and Canada): Holds the pre-eminent position in market revenue and technological adoption. The region is driven by high per capita expenditure on fitness, the widespread success of connected fitness subscriptions (such as those offered by Hydrow and Echelon), and a mature market for home renovation and dedicated home gym spaces. Competitive indoor rowing, promoted through events and large-scale clubs, maintains continuous commercial demand. Market saturation in certain segments necessitates continuous innovation in features like adaptive resistance and AI coaching to drive replacement sales and attract new users.

- Europe (Germany, UK, France, Scandinavia): Exhibits high demand for equipment emphasizing sustainable materials and ergonomic design, reflecting European consumer preferences for quality and longevity. Western Europe sees strong commercial sales driven by professional sports clubs and corporate wellness centers adhering to rigorous European Union safety standards (CE certification). The UK is a leading market for both premium water rowers and high-spec magnetic resistance models, while Germany emphasizes engineering precision and robust build quality, favoring established brands like Kettler and Concept2.

- Asia Pacific (APAC) (China, Japan, India, South Korea): Identified as the critical growth accelerator, poised to deliver the highest CAGR over the forecast period. Expansion is fueled by rapid urbanization, which increases the necessity for space-efficient indoor exercise solutions, and the substantial increase in the middle and affluent classes who are adopting Western lifestyle and fitness habits. China and South Korea are key markets for smart, connected equipment, while India's growth is concentrated in the metropolitan commercial sector. Challenges include navigating diverse regulatory environments and establishing efficient, localized distribution and after-sales service networks.

- Latin America (LATAM) (Brazil, Mexico, Argentina): Characterized by moderate growth centered around major economic hubs. Market penetration relies heavily on the success of international gym franchises expanding into these territories, driving commercial sales. Residential uptake remains sensitive to import duties and currency volatility, generally favoring mid-range and budget-friendly magnetic and hydraulic models. The market requires localized content strategies to resonate with specific cultural and linguistic preferences.

- Middle East and Africa (MEA): Growth is localized primarily within the GCC states (UAE, Qatar, Saudi Arabia), where substantial government and private investment in high-end leisure and fitness infrastructure supports demand for luxury and commercial-grade equipment. The region's high urbanization rate and extreme climates reinforce the necessity of indoor exercise solutions. African markets, while nascent, show potential in South Africa, driven by increasing awareness of fitness and lifestyle trends among the urban populace, generally focusing on value and essential functionality.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Rowers Market.- Concept2 (Global leader in air resistance ergometers, dominating the competitive rowing and commercial gym markets worldwide; recognized for metric accuracy, durability, and standardized performance calibration.)

- WaterRower (Premier manufacturer specializing in handcrafted wooden water resistance rowers, appealing to high-end residential customers seeking aesthetic quality and natural rowing dynamics.)

- Stamina Products (Focuses on affordable, high-volume products, excelling in hydraulic and magnetic rowers distributed primarily through major retail channels for the entry-level home user segment.)

- NordicTrack (A major connected fitness brand under Icon Health & Fitness, utilizing the iFit platform to deliver vast interactive content and leveraging hybrid resistance technology in its premium products.)

- Life Fitness (Established supplier of professional-grade cardiovascular equipment to commercial facilities globally, known for robust engineering, reliability, and integrated club management compatibility.)

- Technogym (A global luxury brand offering high-design, technologically advanced fitness solutions, particularly strong in high-end commercial, hospitality, and corporate wellness installations.)

- XTERRA Fitness (A strong competitor in the mid-range market, offering air and magnetic resistance hybrid models that balance feature sets with accessibility and competitive pricing strategies.)

- Echelon (A key connected fitness innovator providing subscription-based training content across multiple equipment types, utilizing magnetic resistance rowers for a streamlined, competitive user experience.)

- Hydrow (The definitive leader in the premium connected rowing segment, renowned for patented electromagnetic drag system and immersive, high-production-value live outdoor rowing classes.)

- Sunny Health & Fitness (Volume leader in the economical segment, offering a broad portfolio of budget-friendly hydraulic and magnetic rowers heavily reliant on large-scale e-commerce distribution.)

- Schwinn (Offers robust magnetic and air-magnetic hybrid rowers, emphasizing ergonomic features and user comfort, appealing to general home fitness consumers seeking dependable quality.)

- ProForm (An accessible brand within the Icon Health & Fitness portfolio, focusing on integration with the iFit subscription service, offering feature-rich entry-to-mid-level rowers.)

- Kettler (A prominent European brand specializing in precision-engineered fitness equipment, including durable magnetic rowers known for excellent build quality and longevity.)

- First Degree Fitness (Specializes exclusively in patented Fluid Technology, offering adjustable fluid resistance tanks to simulate varying boat weights, targeting both commercial and high-end residential clients.)

- Aviron (Innovative connected rower leveraging gamification and competitive features heavily, utilizing magnetic resistance to create high-intensity, engaging virtual racing experiences.)

- Body-Solid (Supplier of institutional and light commercial strength and conditioning equipment, providing heavy-duty, robust air resistance rowers engineered for facility endurance.)

- DKN Technology (A European brand focusing on compact, highly connectable magnetic resistance rowers, optimized for smaller home environments and strong data synchronization.)

- BH Fitness (A multinational manufacturer providing a comprehensive range of fitness equipment, including advanced electro-magnetic rowers, often serving both commercial facilities and advanced home gyms.)

- Icon Health & Fitness (The parent corporation driving scale in the connected fitness domain, owning key brands like NordicTrack and ProForm, and leveraging the ubiquitous iFit platform.)

- JTX Fitness (A UK-based specialty retailer and manufacturer emphasizing customer service and extended warranties, providing competitively priced magnetic and water rowers for the residential UK market.)

- Inspire Fitness (Focuses on high-quality, aesthetically refined dual-resistance systems, often targeting luxury home gyms and personal training studios.)

- Tunturi (A Nordic brand with a focus on comprehensive training solutions and ergonomic design, offering a range of magnetic rowers with integrated training programs.)

- Rogue Fitness (Primarily known for strength equipment, they also distribute high-performance air rowers, focusing on the competitive strength sports community (CrossFit, powerlifting).)

- Matrix Fitness (A leading brand in commercial fitness equipment, providing large-scale solutions for health clubs, including sophisticated air and magnetic rowers optimized for network integration.)

- Precor (Offers high-end commercial cardio equipment, with rowers designed for optimal biomechanics and heavy institutional use, often found in premier fitness facilities.)

Frequently Asked Questions

Analyze common user questions about the Rowers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What specific metrics should consumers prioritize when evaluating smart rowers for residential use?

Residential consumers should prioritize the quality and diversity of the digital content library (live and on-demand classes), the precision and quietness of the resistance mechanism (preferably magnetic or water), the machine's vertical storage capabilities, and the quality of the integrated screen display for an immersive training experience, alongside the recurring subscription cost structure.

How significant is the role of subscription services in the long-term profitability of rowing machine manufacturers?

Subscription services represent a pivotal shift in the revenue model, transitioning manufacturers from volatile single hardware sales to stable, high-margin recurring revenue streams (Software as a Service - SaaS). These services are critical for maximizing customer lifetime value and are increasingly the primary basis for competitive brand differentiation and strategic valuation within the market.

What technological innovations are emerging to address the space constraint issue faced by urban consumers?

Manufacturers are intensely focused on developing compact, lightweight, and highly engineered folding mechanisms, such as hydraulic piston hinges and quick-release rail systems, enabling easy vertical storage. Additionally, brands are exploring 'design-forward' aesthetics, integrating the rower as a piece of furniture (e.g., wooden water rowers) rather than strictly gym equipment, mitigating visual clutter in living spaces.

In which geographical region are entry-level hydraulic rowers showing the highest demand growth?

Entry-level hydraulic rowers are experiencing high demand growth primarily in the rapidly developing economies of the Asia Pacific (APAC) region and certain Latin American markets. This is driven by greater price sensitivity among new market entrants and the need for highly compact, low-cost fitness solutions suitable for small urban apartments, often prioritizing affordability over high-end technological features.

How does AI contribute to improving safety and preventing user injury during rowing workouts?

AI significantly enhances safety by utilizing computer vision and advanced sensors to monitor and analyze the user’s rowing form in real-time. By comparing current technique against biomechanically optimized models, the AI instantly detects deviations like hunching or 'shooting the slide,' providing precise, actionable corrective feedback, thereby preventing common strain injuries, particularly those affecting the lower back and shoulders.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager