Rowing Shoes Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432155 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Rowing Shoes Market Size

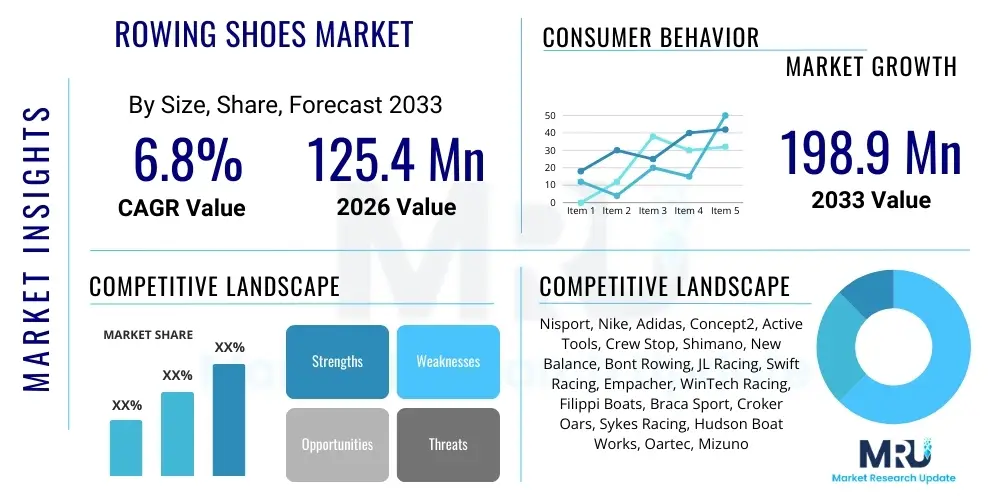

The Rowing Shoes Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 125.4 Million in 2026 and is projected to reach USD 198.9 Million by the end of the forecast period in 2033.

Rowing Shoes Market introduction

The Rowing Shoes Market encompasses specialized footwear designed exclusively for competitive and recreational rowing, primarily for use in fixed-stretcher boats or indoor rowing machines (ergometers). These shoes are engineered to provide maximum power transfer, stability, and secure foot containment, featuring stiff soles, robust heel cups, and specialized lacing systems or quick-release mechanisms compatible with standardized foot stretchers in rowing shells. The core product design prioritizes biomechanical efficiency, ensuring the athlete can exert force consistently throughout the drive phase without energy loss due to foot movement or compression.

Major applications of rowing shoes span professional athletic training, Olympic and world championship competitions, university-level collegiate rowing programs, and widespread use by amateur rowing clubs globally. The market growth is inherently linked to the increasing popularity of rowing as a fitness activity, coupled with significant investment in advanced sports technology and equipment by governing bodies such as the World Rowing Federation (FISA). Manufacturers continually innovate materials, focusing on lightweight, water-resistant, and high-traction components, primarily utilizing carbon fiber composites and high-grade synthetic polymers to enhance performance and durability.

The primary benefits driving market expansion include enhanced performance metrics, reduced risk of common rowing-related injuries (such as Achilles tendon strain or heel slippage), and improved comfort during long training sessions. Furthermore, the mandatory requirements for specialized footwear in competitive settings, ensuring standardized footplate interfaces, necessitate specific product adoption. Driving factors encompass rising disposable income leading to higher participation in niche sports, technological advancements in material science (e.g., highly breathable yet water-repellent fabrics), and aggressive marketing by leading athletic brands entering or expanding their footprint in the niche rowing equipment sector.

Rowing Shoes Market Executive Summary

The Rowing Shoes Market exhibits strong growth momentum driven by the professionalization of competitive rowing and increased global participation in recreational and indoor rowing activities. Current business trends indicate a significant shift towards premium, customized footwear, where technological differentiation—such as micro-adjustable fit systems and ultra-stiff carbon fiber soles—commands higher price points and drives revenue growth in developed markets like North America and Europe. Strategic partnerships between manufacturers and elite rowing teams or national federations are key market penetration strategies, ensuring product visibility and rapid feedback loops for innovation, while supply chain resilience remains a critical factor due to dependence on specialized composite materials.

Regionally, North America maintains market leadership, fueled by robust collegiate sports funding and a strong culture of water sports participation, closely followed by Europe, which benefits from established competitive rowing histories in countries like the UK, Germany, and Italy. The Asia Pacific region is forecast to demonstrate the highest CAGR, primarily due to the rising adoption of rowing in emerging economies such as China and India, coupled with substantial government investment in athletic infrastructure ahead of major international sporting events. Market maturity is highest in established Western markets, where replacement cycles and high-performance segmentation dominate sales, contrasting with APAC's focus on introductory and mid-range equipment for new participants.

Segment trends highlight the dominance of the Professional Application segment in terms of revenue per unit, although the Amateur/Recreational segment drives volume sales, particularly through the indoor rowing machine market. Material segmentation is leaning heavily towards advanced synthetics offering superior moisture management and weight reduction compared to traditional materials. Furthermore, the E-commerce distribution channel is rapidly gaining prominence, offering broader access to niche brands and specialized fitting guides, challenging the traditional dominance of specialized sporting goods stores and direct-to-club sales models.

AI Impact Analysis on Rowing Shoes Market

Common user inquiries regarding AI's influence in the Rowing Shoes Market center on personalization, performance optimization, and manufacturing efficiency. Users frequently ask how AI can be used to design shoes that perfectly match an individual athlete's biomechanics, how sensor data integrated into rowing shoes can be processed by AI to offer real-time technique feedback, and whether AI can predict shoe longevity or failure points based on usage patterns. The key themes revolve around achieving true custom fit for maximum power transfer, enhancing injury prevention through predictive analytics, and streamlining supply chains using smart demand forecasting.

The consensus expectation is that AI will transform the niche market from standardized sizing toward mass customization. Users anticipate advanced algorithms will utilize 3D scanning technology and foot pressure mapping data (collected during real or simulated rowing strokes) to generate precise digital blueprints for manufacturing bespoke footwear. Furthermore, there is strong interest in AI-powered coaching tools integrated with sensor-equipped rowing shoes. These tools are expected to analyze minute variations in foot angle, pressure distribution, and connection timing during the stroke, providing highly specific, actionable feedback that surpasses traditional human coaching observations, thereby directly impacting the performance capabilities derived from the footwear.

While direct AI integration into the shoe material itself is limited, the primary impact lies in the periphery: optimizing the athlete-equipment interface and improving operational efficiency for manufacturers. Concerns often touch upon data privacy regarding sensitive biomechanical data and the cost implications of AI-driven customization, potentially making high-performance rowing shoes inaccessible to amateur rowers. However, the anticipated benefits—such as reduced design cycle time, minimized material waste through optimized cutting paths, and better inventory management via machine learning—are expected to substantially outweigh these challenges, driving efficiency across the value chain.

- AI-driven Biomechanical Customization: Utilizing 3D scans and pressure sensors to create personalized shoe molds for optimal fit and power transfer.

- Predictive Maintenance and Longevity: Analyzing usage data via embedded sensors to predict wear patterns and recommend timely replacements or repairs.

- Real-time Performance Feedback: Processing sensor data (force, angle, timing) using machine learning algorithms to provide instant feedback on rowing technique efficiency.

- Optimized Supply Chain Management: Employing AI for highly accurate demand forecasting, reducing inventory holding costs and improving fulfillment rates for specialized niche products.

- Automated Quality Control: Implementing machine vision and AI algorithms in manufacturing to detect minute defects in composite materials or structural integrity during production.

DRO & Impact Forces Of Rowing Shoes Market

The dynamics of the Rowing Shoes Market are governed by a complex interplay of drivers (D), restraints (R), opportunities (O), and potent impact forces, primarily stemming from performance demands and market structure constraints. Key drivers include the mandatory requirement for proprietary shoe-stretcher interfaces in competitive shells, consistent investment in sports technology research by global federations, and the strong correlation between specialized footwear and measurable athletic performance gains. These drivers ensure a consistent replacement cycle and demand for premium products, particularly within well-funded professional and collegiate programs. Restraints, however, pose persistent challenges, notably the niche nature of the market, which limits economies of scale in manufacturing, and high initial investment costs for cutting-edge materials like aerospace-grade carbon fiber, which can deter adoption among smaller rowing clubs or individual amateur athletes. Furthermore, the limited standardization of foot stretcher interfaces across different boat manufacturers can create market fragmentation, requiring brands to produce multiple, specific models.

Opportunities for exponential growth are primarily centered on expansion into emerging markets, particularly in Asia Pacific, where rowing participation is rapidly gaining governmental support and infrastructural development. Another significant opportunity lies in the development of highly sustainable and recycled material composites that meet performance standards, addressing growing consumer preference for eco-friendly athletic gear while potentially reducing long-term material procurement costs. Furthermore, the integration of smart technology (IoT and sensor-based tracking) offers manufacturers a pathway to product differentiation and the creation of value-added services linked to performance analysis, expanding the market beyond just physical footwear into a data-driven performance ecosystem.

Impact forces critically shaping the market include the economic power of major international sporting events, which accelerate technological adoption and innovation cycles leading up to competitions like the Olympics. Supplier bargaining power remains moderately high due to the specialized nature of high-performance composite suppliers, impacting manufacturing costs and profitability. Buyer power is moderate to high, largely exerted by national rowing teams and major university programs whose bulk purchasing decisions significantly influence brand dominance and product specification adoption. Technological innovation acts as a significant positive impact force, continually redefining performance benchmarks and rendering older models obsolete, thus sustaining the replacement market even when participation rates stabilize.

Segmentation Analysis

The Rowing Shoes Market is segmented based on critical factors including Material Type, Application (End-User), and Distribution Channel. This segmentation allows manufacturers to target specific cohorts based on performance requirements, budget constraints, and purchasing preferences. The division based on material reflects the crucial trade-off between stiffness, weight, and cost, directly affecting the shoe's efficacy in transferring power from the athlete to the boat. Application segmentation differentiates between the rigorous, high-performance demands of professional athletes and the durability and comfort requirements of amateur or recreational users, including those primarily using indoor rowing machines.

Understanding the distribution channels is vital for optimizing market reach. The market is increasingly adopting an omnichannel approach, combining the traditional expertise of specialized sports retailers and direct club sales with the efficiency and broad reach of e-commerce platforms. This detailed segmentation analysis provides a granular view of market dynamics, highlighting areas of highest growth potential and identifying underserved niche requirements, ensuring strategic resource allocation in product development and marketing efforts across different geographical regions.

Key segments are defined by their unique contribution to the overall market revenue and volume, indicating differential growth rates. For instance, while high-end carbon fiber models represent a smaller volume segment, they generate disproportionately high revenue due to premium pricing, whereas synthetic mesh models, favored by amateur clubs, drive overall unit volume. The subsequent subsections delve into the specifics of these primary segments and the strategic implications for market stakeholders seeking competitive advantages.

- By Material Type:

- Carbon Fiber Composites

- High-Grade Synthetic Mesh and Polymers

- Traditional Synthetics (Rubber/Plastics)

- By Application (End-User):

- Professional Athletes (Competitive Racing)

- Amateur/Recreational Rowers

- Indoor Rowing (Ergometer Use)

- By Distribution Channel:

- Online Retail (E-commerce Platforms)

- Offline Retail (Specialty Sporting Goods Stores, Direct Club Sales)

Value Chain Analysis For Rowing Shoes Market

The Value Chain for the Rowing Shoes Market begins with upstream activities focused heavily on the sourcing and processing of specialized materials. This phase involves R&D cooperation with chemical and composite material suppliers (e.g., carbon fiber prepreg manufacturers) to ensure the stiffness-to-weight ratio meets elite performance standards. Upstream analysis highlights that the specialized nature of these materials—often proprietary or requiring unique fabrication processes—grants significant bargaining power to material suppliers. Success at this stage relies on secure, long-term contracts and investment in raw material substitution or recycling technologies to mitigate supply chain risks and cost fluctuations.

Mid-stream activities encompass the core manufacturing processes, including the intricate molding of stiff soles, precision assembly of the upper materials, and the integration of specialized quick-release mechanisms compatible with foot stretchers. Distribution channels form the critical link to the downstream market. Direct distribution involves sales to national rowing federations, university programs, and large rowing clubs through dedicated sales teams, ensuring customized service and bulk discounts. This channel is crucial for high-volume, professional sales. Indirect distribution leverages established retail networks, including large online athletic platforms and specialized brick-and-mortar stores, which serve the dispersed amateur and indoor rowing consumer base, focusing on accessibility and visibility.

Downstream analysis focuses on marketing, sales, and post-sale support. Given the niche nature of the product, marketing efforts are highly targeted, often involving endorsements from professional athletes and sponsorship of major regattas. Customer support, especially concerning fitting and compatibility with different boat models, is paramount. The distribution strategy must balance the need for specialized advice (best served by direct and specialty retail) with the convenience and competitive pricing offered by E-commerce. Efficient logistics, especially for global shipping of relatively low-volume, high-value items, completes the value delivery system, ensuring that manufacturers capture maximum value by controlling key processes from material specification to final consumer interaction.

Rowing Shoes Market Potential Customers

Potential customers for the Rowing Shoes Market are segmented primarily based on their level of participation, funding source, and frequency of equipment usage. The most lucrative end-users are institutional buyers, specifically collegiate rowing programs and national/Olympic training centers. These entities purchase high-volume, premium-grade footwear annually due to rigorous training schedules that necessitate frequent replacement and the imperative to maximize athlete performance. Their purchasing decisions are driven by technological superiority, proven track records in competition, and contractual relationships with specific boat or equipment manufacturers.

The second major category encompasses rowing clubs and school-level teams. These buyers seek a balance between durability, standardized fit, and cost-effectiveness. While they may not require the absolute highest-end carbon fiber models for every athlete, they prioritize robust construction that can withstand intensive use in club fleet boats. Their purchasing tends to be cyclical, aligning with seasonal competitive schedules and club budget allocations. They often rely on specialized distributors or direct club sales for consolidated orders and technical support regarding fleet management and shoe compatibility.

The third and fastest-growing customer segment is the individual recreational rower and the indoor rowing enthusiast. Driven by the recent surge in popularity of fitness modalities utilizing ergometers (like concept rowers), this segment demands comfort, versatility, and ease of use, often prioritizing aesthetic design alongside functional features. These customers predominantly rely on online retail platforms for purchasing, emphasizing brand reputation, user reviews, and accessibility. Tapping into this segment requires tailored marketing focusing on fitness and health benefits rather than purely competitive performance metrics.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 125.4 Million |

| Market Forecast in 2033 | USD 198.9 Million |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nisport, Nike, Adidas, Concept2, Active Tools, Crew Stop, Shimano, New Balance, Bont Rowing, JL Racing, Swift Racing, Empacher, WinTech Racing, Filippi Boats, Braca Sport, Croker Oars, Sykes Racing, Hudson Boat Works, Oartec, Mizuno |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Rowing Shoes Market Key Technology Landscape

The technology landscape in the Rowing Shoes Market is highly concentrated on material science innovation and biomechanical engineering to maximize efficiency and connectivity. The most significant technological advancement involves the use of advanced composite materials, primarily unidirectional or woven carbon fiber, to construct the sole plate. This technology ensures extreme rigidity, minimizing energy absorption or flex during the critical drive phase of the stroke, leading to direct power transfer. Manufacturing utilizes precision molding techniques, often borrowed from the cycling shoe or aerospace industry, to achieve consistency and maintain a low overall weight, a crucial performance metric in competitive rowing.

Furthermore, technology is focused on optimizing the interface between the foot, the shoe, and the boat's foot stretcher. This involves proprietary quick-release or adjustable clamping mechanisms (e.g., heel retention systems) that allow athletes to quickly exit the boat in emergency situations while maintaining a highly secure connection during competition. This technical requirement is regulated by international standards and necessitates continuous R&D to balance security, ease of use, and compatibility with various boat hull manufacturers. The integration of hydrophobic and highly breathable synthetic upper materials (such as Kevlar-reinforced mesh or specialized TPU films) also represents a core technological focus, managing moisture and ensuring comfort in water-heavy environments without sacrificing structural integrity.

The emerging technological frontier includes the integration of Smart Shoe components. Although still nascent, several brands are experimenting with embedding micro-sensors (Inertial Measurement Units - IMUs and pressure sensors) within the shoe's sole. These sensors capture high-frequency data related to force distribution, foot angle changes, and stroke timing inconsistencies. The data collected is then wirelessly transmitted to external analytical platforms or coaching software, leveraging machine learning algorithms (as analyzed in the AI section) to provide advanced technique diagnostics, transitioning the footwear from a passive piece of equipment to an active data source for performance optimization.

Regional Highlights

- North America: This region is the largest revenue contributor to the Rowing Shoes Market, primarily driven by the extensive infrastructure of collegiate rowing (NCAA) and the high disposable income dedicated to premium sporting equipment. US and Canadian universities represent major institutional buyers, ensuring consistent demand for high-end, technologically advanced footwear. The market here is characterized by early adoption of new materials, high brand consciousness, and robust direct sales channels linked to elite training centers. The recent surge in indoor rowing fitness studios further diversifies demand, sustaining the recreational segment.

- Europe: Holding the second-largest market share, European demand is rooted in a rich historical tradition of competitive rowing, particularly in countries like the UK, Germany, and the Netherlands. The market is highly influenced by international competitive events and national federation standards. European consumers, while demanding high quality, often exhibit a stronger preference for brands with established legacies in the sport. The emphasis is on highly durable, performance-centric models tailored for diverse water conditions, with robust regulatory oversight ensuring safety standards for quick-release mechanisms.

- Asia Pacific (APAC): APAC is projected to register the fastest CAGR during the forecast period. Growth is accelerating due to substantial governmental investment in sports infrastructure, particularly in preparation for major international games hosted in countries like China, Japan, and Australia. While the professional segment is maturing rapidly, the amateur segment offers immense untapped potential as rowing gains popularity as a middle-class sport. Challenges remain in localized distribution networks and price sensitivity compared to Western markets, driving demand for value-for-money, high-durability synthetic models.

- Latin America: The market in Latin America is developing, concentrated primarily in countries such as Brazil and Argentina, where coastal and river rowing is competitive. Market growth is sporadic, heavily dependent on governmental or private sponsorship for elite athletes. The segment relies on imported premium brands, leading to higher retail prices and a focus on essential, reliable equipment rather than cutting-edge technological integration. Local manufacturing presence is minimal, relying predominantly on indirect distribution channels.

- Middle East and Africa (MEA): MEA represents the smallest market share, with demand concentrated in specific affluent urban centers or regions with dedicated sports facilities (e.g., UAE, South Africa). Market growth is slow but steady, driven by specialized athletic development programs and expatriate communities. The high costs associated with importing specialized rowing equipment and limited localized competitive infrastructure remain key limitations to widespread market penetration in this region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Rowing Shoes Market.- Nisport

- Nike

- Adidas

- Concept2 (Focus on Ergometer Shoe Interfaces)

- Active Tools

- Crew Stop

- Shimano

- New Balance

- Bont Rowing

- JL Racing

- Swift Racing

- Empacher (Boat Manufacturer with Equipment Focus)

- WinTech Racing

- Filippi Boats

- Braca Sport

- Croker Oars

- Sykes Racing

- Hudson Boat Works

- Oartec

- Mizuno

Frequently Asked Questions

Analyze common user questions about the Rowing Shoes market and generate a concise list of summarized FAQs reflecting key topics and concerns.What distinguishes specialized rowing shoes from conventional athletic footwear?

Rowing shoes feature extremely rigid, often carbon-fiber, soles for maximal power transfer and stability, preventing energy loss through flex. They also incorporate specialized quick-release mechanisms compatible with the foot stretchers standardized in rowing shells, a safety requirement unique to the sport.

Is the Carbon Fiber segment the fastest-growing in the Rowing Shoes Market?

While the Carbon Fiber segment commands the highest average selling price and high-end performance niche, the fastest growth by volume is projected in the High-Grade Synthetic Mesh and Polymers segment, driven by increasing participation in amateur and indoor rowing, particularly in Asia Pacific.

How is AI expected to influence the design and fit of future rowing shoes?

AI will revolutionize design through mass customization, utilizing algorithms that process biomechanical data (3D scans, pressure mapping) to create individualized shoe geometries, ensuring a perfect, performance-optimized fit for each athlete.

Which geographical region holds the largest market share for rowing footwear?

North America currently holds the largest market share, fueled by high levels of investment and extensive infrastructure in collegiate and professional rowing programs, leading to consistent demand for premium, technologically advanced equipment.

What are the primary factors restraining the global expansion of the Rowing Shoes Market?

The niche nature of the sport, leading to limited economies of scale, and the high procurement cost of specialized, performance-grade materials (like advanced composites) are the primary restraints limiting market size and access for budget-constrained consumers.

The Rowing Shoes Market, while niche, is strategically important for athletic performance equipment providers. The specialized requirements for stability, power transfer, and safety mechanisms mandate a high degree of technological focus, particularly in material science. The market’s future trajectory is strongly correlated with the expansion of rowing programs globally, especially the burgeoning participation rates in Asia and the continuous technological arms race within elite competitive circuits. Key manufacturers must prioritize material innovation and embrace AI-driven personalization tools to maintain competitive superiority and capture the projected growth in the forecast period. The increasing focus on indoor rowing provides a crucial, reliable volume segment that balances the high-value, low-volume nature of the professional racing segment, ensuring overall market stability and sustained investment in research and development.

The competitive landscape is characterized by a mix of specialized rowing equipment manufacturers and larger multinational athletic brands selectively entering the premium segment. Successfully navigating this market requires brands to adhere strictly to international safety and compatibility standards while differentiating products through superior fit, lightweight construction, and advanced sensor integration capabilities. Distribution strategies must effectively integrate direct-to-club models for institutional sales with robust e-commerce platforms to serve the geographically dispersed individual consumer. As global health and fitness consciousness continues to rise, especially post-pandemic, rowing, and consequently, the demand for specialized rowing shoes, is poised for consistent, moderate-to-high growth across all major regions.

Furthermore, sustainability is emerging as a non-negotiable factor. Future market leaders will be those who can successfully incorporate recycled materials or bio-based polymers without compromising the critical structural rigidity required for performance. This transition not only appeals to environmentally conscious athletes but also potentially shields manufacturers from volatile pricing in petroleum-derived materials. The overall market health is robust, defined by specialized expertise and a commitment to high-performance engineering.

In conclusion, the projected CAGR of 6.8% reflects a solid, specialized growth trajectory, underpinned by institutional demand and technological innovation. Stakeholders must carefully monitor regional expenditure trends, particularly the increasing budgets allocated to sports development in APAC, and proactively integrate digital technologies, such as advanced data analytics and AI customization, to secure long-term value and market leadership. The shift towards multi-material construction and the demand for performance feedback loops embedded within the footwear represent the defining characteristics of the next generation of rowing shoes.

The strategic emphasis on collegiate programs in North America and established competitive circuits in Europe ensures that the premium segment remains strong, driving technological trickle-down effects into the amateur market. For manufacturers, optimizing the supply chain to handle the complexities of composite materials procurement and managing intellectual property related to proprietary fastening systems are paramount operational challenges. Market resilience is demonstrated by the consistent demand regardless of broad economic cycles, due to the critical nature of the equipment for competition.

Finally, regulatory compliance regarding safety mechanisms, particularly the mandatory quick-release systems, imposes a significant barrier to entry for generic footwear providers, thereby protecting the market share of established, specialized manufacturers. This regulatory environment reinforces the value chain, placing high importance on R&D and rigorous testing protocols, further cementing the niche and high-value status of professional rowing shoes. Investment in consumer education regarding the performance benefits of optimized footwear versus generic athletic shoes will be essential to accelerating growth within the recreational segment.

The integration of digital performance tracking, as enabled by sensor technology in the shoe sole, is a game-changer. This innovation transforms the product from a passive mechanical interface into an active, data-generating tool essential for elite training. Manufacturers who successfully leverage this data utility, providing seamless integration with coaching platforms, will secure dominant positions. This push towards 'smart rowing gear' reflects a broader trend in high-performance sports, where data drives decision-making at every level of competition and training regimen.

Furthermore, macroeconomic stability in key competitive regions supports continued expenditure on high-quality equipment. Global sporting events serve as powerful showcases for new technology, compelling national teams and funded programs to constantly upgrade their gear. This event-driven replacement cycle is a key structural element supporting the moderate yet consistent CAGR observed in this highly specialized segment of the sports equipment industry.

The increasing focus on athlete comfort and injury prevention also drives demand for sophisticated, ergonomically designed footwear. Issues such as heel slippage and inadequate foot stability, which can lead to biomechanical inefficiencies and injury, are mitigated by advanced materials and precision molding. Manufacturers are increasingly utilizing pressure mapping studies during dynamic rowing movements to fine-tune sole geometry and support structures, moving beyond simple static measurements to create truly performance-enhancing gear tailored for dynamic forces exerted during the rowing stroke.

The geographical diversification, especially the expected surge in demand from the Asia Pacific region, necessitates manufacturers to adapt their supply chains and product mixes. While North America and Europe demand premium customization, APAC entry strategies often require scalable, durable, and slightly more cost-effective solutions to appeal to the mass market of new participants and growing club systems. Balancing this high-end versus high-volume requirement is critical for maximizing global profitability over the forecast period.

Lastly, the role of specialized distributors and retailers cannot be overstated. Unlike mass-market athletic shoes, rowing footwear requires specific knowledge regarding boat compatibility, foot stretcher interfaces, and maintenance in harsh, wet environments. The specialized knowledge provided by these channels adds significant value, justifying the often-higher price point compared to general sporting goods stores. Strengthening these direct and specialized sales relationships remains a cornerstone of successful market strategy.

The demand for lightweight yet robust construction continues to push the boundaries of material science in the market. Every gram saved in boat weight, including the attached equipment, contributes to competitive advantage. This constant pursuit of marginal gains ensures that manufacturers consistently invest in researching lighter, stronger polymers and composites. This technological imperative translates directly into higher unit costs but ensures sustained revenue generation from the premium market segment that prioritizes performance above all else.

Effective risk mitigation is also central to the strategic planning for key market players. Dependency on a limited number of specialized composite suppliers creates vulnerability to supply shocks or price inflation. Therefore, strategic market players are actively exploring dual-sourcing strategies and investing in vertical integration or collaborative research with material scientists to secure future supply chains and maintain cost predictability in a highly specialized manufacturing sector.

The strong coupling between the rowing shoes market and the rowing shell manufacturing industry means that product innovation is often dictated or influenced by advancements in boat design. New foot stretcher designs or hull configurations may necessitate specific adjustments to the shoe interface. This interdependence fosters co-development and long-term partnerships between specialized footwear manufacturers and leading boat builders, ensuring rapid adaptation to industry standards and maintaining compatibility across the competitive fleet.

Consumer education about the technical necessity of rowing shoes, particularly for safety and injury prevention (related to the quick-release mechanism), is vital for market penetration among novice rowers. Many new participants might initially use generic trainers, but understanding the biomechanical risks and competitive advantages inherent in specialized footwear drives eventual conversion to market products. Educational outreach and certification standards play a supporting role in driving this market transition.

The financial structure of the market, characterized by institutional purchasing cycles (universities, federations), often leads to large, predictable orders, providing stability for manufacturers. However, penetrating these established relationships requires high levels of trust, proven performance, and long-term service contracts. Manufacturers often provide leasing options or specialized maintenance services to secure these crucial institutional partnerships, moving beyond simple product sales to offering integrated equipment solutions.

In summary, the market's trajectory is positive, supported by structural demand drivers (competitive necessity, institutional funding) and enhanced by technological advancements (AI customization, sensor integration). Strategic focus on material durability, interface compatibility, and global distribution network expansion—particularly targeting the high-growth APAC region and the growing indoor rowing segment—will define market success in the 2026-2033 forecast period.

Further analysis reveals that pricing strategies are heavily tiered. Entry-level models for amateur rowers prioritize longevity and affordability, typically utilizing durable synthetics, while professional models command premium pricing based purely on material weight reduction, stiffness coefficients, and advanced ergonomic features. Managing this pricing divergence across different segments is a core component of maximizing overall revenue capture across the heterogeneous consumer base.

The shift towards bespoke manufacturing, facilitated by 3D printing and AI-driven design, presents both an opportunity for competitive differentiation and a substantial capital expenditure hurdle. Only manufacturers capable of integrating these high-tech production methods seamlessly into their operations will be able to capitalize on the increasing consumer demand for hyper-personalized equipment, positioning themselves at the cutting edge of athletic gear innovation.

The longevity and reputation of established brands, coupled with strategic endorsements from Olympic athletes and major regatta sponsorships, play an oversized role in influencing purchasing decisions, especially at the professional level. Maintaining brand visibility and associating the product with proven high performance are crucial non-technical strategies that support sales volumes and premium pricing power within the elite segment.

The robust demand from indoor rowing enthusiasts utilizing ergometers is often overlooked but provides an essential market counterweight to the seasonal nature of on-water rowing. These consumers require similar features relating to stability and power transfer but prioritize enhanced ventilation and comfort for sustained indoor use. Product lines tailored specifically for the indoor segment ensure continuous revenue flow throughout the calendar year, mitigating the seasonality inherent in the core outdoor market.

Finally, intellectual property protection, especially regarding proprietary quick-release mechanisms and unique sole constructions, is vital. Manufacturers invest heavily in securing patents to maintain technological exclusivity and deter fast followers, ensuring that the substantial R&D expenditure translates into sustained competitive advantage and strong profit margins in this performance-critical, specialized niche.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager