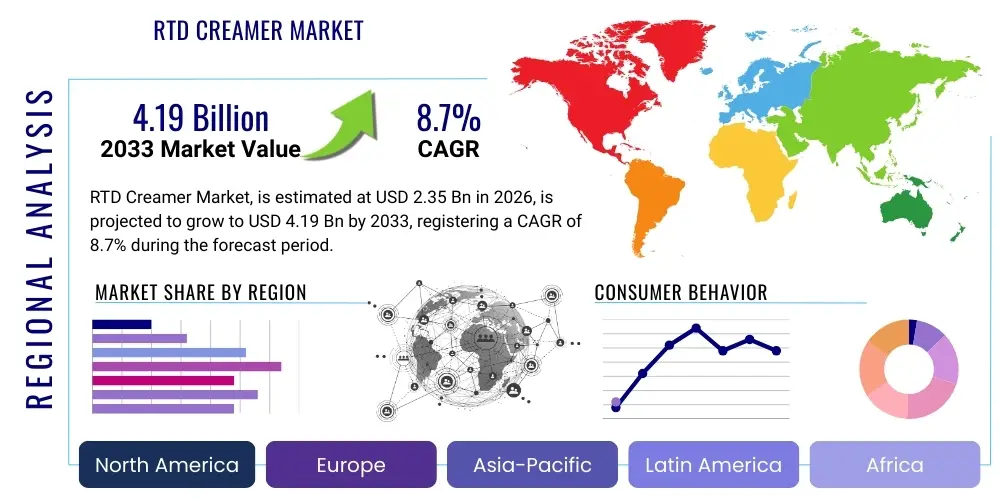

RTD Creamer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435927 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

RTD Creamer Market Size

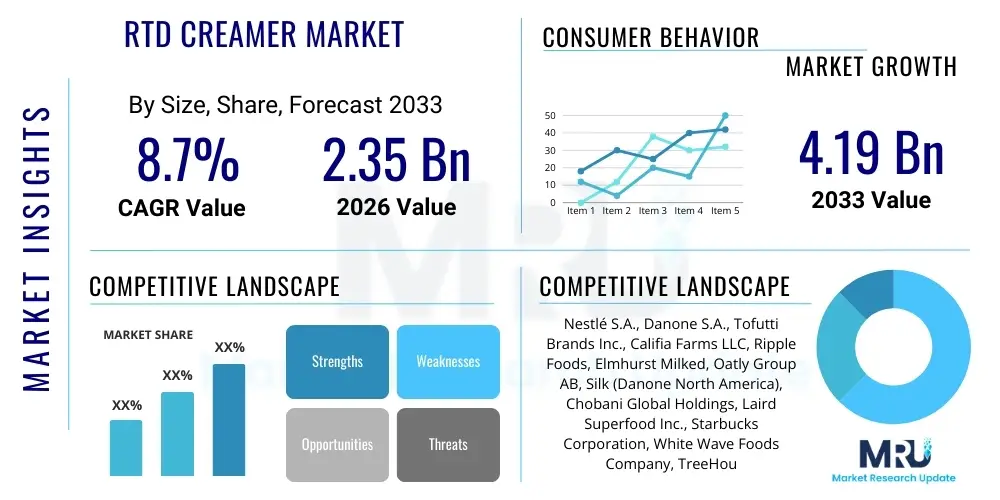

The RTD Creamer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.7% between 2026 and 2033. The market is estimated at USD 2.35 Billion in 2026 and is projected to reach USD 4.19 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by shifting consumer preferences towards convenient, single-serve beverage solutions and the increasing demand for diverse flavor profiles and healthier, plant-based alternatives to traditional dairy creamers.

RTD Creamer Market introduction

The Ready-to-Drink (RTD) Creamer Market encompasses various liquid or powdered formulations specifically designed to enhance coffee, tea, and other hot beverages, packaged for immediate use without requiring mixing or preparation, diverging from traditional large-format liquid creamers or complex powdered alternatives. These products offer superior convenience and portability, aligning perfectly with the fast-paced modern lifestyle of working professionals and students seeking quick, portion-controlled solutions. The primary applications span across home use, office environments, and travel, significantly contributing to the expansion of the out-of-home coffee culture by providing customizable beverage experiences.

Product descriptions within this segment typically highlight attributes such as non-dairy sourcing (almond, oat, soy, coconut), zero sugar or low-calorie content, and the integration of functional ingredients like collagen or MCT oils, transforming the creamer from a simple additive into a functional dietary supplement. Major applications include direct integration into brewed coffee and specialty drinks, where the RTD format ensures consistent flavor and texture. The benefits are multifaceted, encompassing extended shelf life compared to fresh dairy, ease of use, and adaptability to various dietary restrictions, particularly for lactose-intolerant or vegan consumers who require reliable, ready-mixed solutions.

The market is predominantly driven by powerful socio-economic factors, including urbanization, rising disposable incomes in emerging economies, and the relentless marketing efforts by major food and beverage corporations promoting specialty coffee consumption at home. Furthermore, the relentless pace of product innovation focused on clean label ingredients and exotic, dessert-inspired flavors sustains consumer interest and encourages premiumization within the category, moving RTD creamers beyond basic functionality into a realm of luxury and personalization.

RTD Creamer Market Executive Summary

The RTD Creamer market is undergoing a transformative period characterized by rapid innovation in ingredient sourcing and sustainability initiatives, particularly concerning non-dairy alternatives. Business trends indicate a robust shift towards mergers and acquisitions focused on smaller, niche brands specializing in high-growth areas like oat-based and coconut-based creamers, enabling larger corporations to rapidly capture market share in the premium and specialty segments. Strategic partnerships between creamer manufacturers and coffee shop chains are also emerging, designed to co-develop products that transition the specialty coffee experience into the retail environment, thereby stabilizing revenue streams against volatile commodity pricing and increasing brand visibility.

Regionally, the market dynamics are heavily skewed towards North America, which remains the primary revenue generator due to high per capita consumption of coffee and established consumer acceptance of non-dairy alternatives. However, Asia Pacific is registering the fastest growth, propelled by the Westernization of diets, the rapid expansion of organized retail, and the growing demand for convenient breakfast and beverage options, particularly in populous countries like China and India. European growth, while steady, is primarily focused on organic and environmentally certified products, reflecting stringent consumer expectations regarding sustainable sourcing and minimized environmental impact across the supply chain.

Segment trends confirm the dominance of the plant-based category, with oat creamer experiencing exponential growth, often surpassing almond and soy due to its superior mouthfeel and neutral flavor profile, which mimics traditional dairy characteristics more closely. In terms of formulation, liquid RTD creamers hold the majority share owing to convenience and textural superiority, yet the powder segment maintains a crucial role in applications demanding extended shelf stability and reduced shipping costs. Flavor innovation continues to drive volume, with classic vanilla and seasonal pumpkin spice dominating sales, while functional benefits such as added vitamins, proteins, or immunity boosters are increasingly influencing purchasing decisions among health-conscious demographics.

AI Impact Analysis on RTD Creamer Market

User inquiries regarding AI's influence on the RTD Creamer market frequently center on three critical areas: supply chain optimization, predictive flavor development, and personalized marketing efforts. Consumers and industry professionals are keenly interested in how Artificial Intelligence can streamline the cold chain logistics necessary for preserving the quality of liquid dairy and plant-based RTD products, ensuring freshness and minimizing spoilage. A significant concern revolves around the ethical use of AI in predicting consumer trends, specifically how algorithms can identify untapped flavor combinations or functional ingredients that might offer a competitive edge. Furthermore, there is substantial user interest in how AI-driven analytics can facilitate highly personalized product recommendations and targeted digital advertising, optimizing return on marketing investment while catering to highly fragmented consumer dietary preferences, thereby enhancing customer lifetime value.

- AI-driven Predictive Analytics: Utilization in forecasting consumer demand for specific seasonal or functional flavors, significantly reducing R&D cycle times for new product launches.

- Optimized Supply Chain Management: AI algorithms deployed to manage inventory, temperature control (cold chain), and route optimization, minimizing waste and ensuring product freshness across vast distribution networks.

- Automated Quality Control: Deployment of AI-powered vision systems in manufacturing facilities to detect minute variations in viscosity, color, and packaging defects, ensuring consistent product quality standards.

- Personalized Nutrition Recommendations: AI platforms analyzing user-generated health data and purchase history to suggest customized RTD creamer formulations that meet specific dietary goals (e.g., keto-friendly, high protein).

- Targeted Marketing and Ad Campaigns: Machine Learning models segmenting consumer bases with precision, delivering highly relevant promotional content and increasing conversion rates for new or premium RTD creamer lines.

DRO & Impact Forces Of RTD Creamer Market

The dynamics of the RTD Creamer market are dictated by a balanced interplay of accelerating drivers related to convenience and health consciousness, notable restraints involving logistical complexity and regulatory hurdles, and substantial opportunities emerging from untapped consumer segments and technological advancements. The immediate impact forces currently favor market expansion, largely due to post-pandemic consumer habits prioritizing ready-to-use food and beverage items, coupled with sustained investment in non-dairy technology. However, the reliance on stable supply chains for raw materials like oats, almonds, and coconuts introduces inherent volatility, which acts as a pivotal restraint requiring robust mitigation strategies across key manufacturing jurisdictions.

Primary drivers fueling growth include the rising popularity of the ‘coffee shop at home’ trend, where consumers seek specialty ingredients to replicate café-style beverages without leaving their houses, placing a premium on quality and diverse flavoring options. The demand for functional and transparently labeled products, free from artificial preservatives and excessive sugars, further stimulates innovation, forcing manufacturers to reformulate existing lines. Conversely, significant restraints involve the high cost associated with cold chain logistics, especially for large-format liquid RTD creamers, which limits market penetration in regions with underdeveloped distribution infrastructure. Additionally, regulatory scrutiny concerning the nutritional claims (e.g., 'natural' or 'clean label') can pose challenges, requiring precise and costly adherence to complex labeling standards across different geographies.

Opportunities are abundant in emerging markets across Asia and Latin America, where coffee consumption is steadily increasing but RTD creamer penetration remains low, offering significant first-mover advantage for international brands. Technological advancement presents an opportunity to develop shelf-stable, aseptic packaging solutions that reduce the dependency on refrigerated transport while maintaining product integrity and nutritional value. The primary impact forces currently exerting the strongest influence are intensified competitive rivalry and evolving consumer health awareness. These forces compel continuous product differentiation through functional fortification (e.g., adaptogens, probiotics) and sustainable packaging commitments, shaping the competitive landscape and demanding continuous adaptation from market leaders.

Segmentation Analysis

The RTD Creamer market is intricately segmented based on source, flavor, distribution channel, and formulation, providing manufacturers with crucial insights for targeted product development and market entry strategies. Analysis of these segments reveals that consumer choices are increasingly driven by dietary restrictions and flavor adventurousness, rather than solely by price. The dominance of the plant-based segment underscores a permanent behavioral shift away from traditional dairy, necessitated by both health concerns (lactose intolerance) and ethical considerations (sustainability and animal welfare). Understanding the nuances within each segment, such as the rapid growth acceleration of oat milk-based products over established almond options, is vital for forecasting future investment priorities.

Detailed evaluation of distribution channels highlights the pivotal role of online retail, which provides consumers with unparalleled access to niche and international brands that may not be available in conventional brick-and-mortar stores. This shift empowers smaller, innovative companies specializing in unique flavor profiles or highly specific dietary categories (e.g., paleo or keto) to reach their target audience effectively. Furthermore, the formulation analysis indicates that while liquid creamers maintain market leadership due to convenience and ease of blending, powdered formulations are increasingly positioned for travel, bulk purchase, and applications demanding zero refrigeration, offering distinct advantages for food service operators and long-distance logistics.

- Source:

- Dairy-Based

- Plant-Based

- Almond

- Oat

- Soy

- Coconut

- Hemp/Cashew Blends

- Flavor:

- Original/Unflavored

- Vanilla

- Hazelnut

- Caramel

- Seasonal & Specialty (e.g., Pumpkin Spice, Peppermint Mocha)

- Distribution Channel:

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Retail

- Specialty Coffee Shops & Food Service

- Formulation:

- Liquid (Refrigerated)

- Liquid (Shelf-Stable/Aseptic)

- Powdered

Value Chain Analysis For RTD Creamer Market

The value chain for the RTD Creamer market begins with rigorous upstream activities focused on the sourcing and processing of core raw materials, predominantly dairy derivatives or specialized plant ingredients such as oats, almonds, and coconuts. Upstream analysis reveals significant reliance on agricultural sustainability and climate resilience, as fluctuations in crop yields directly impact ingredient costs and supply stability. Manufacturers are increasingly focused on vertical integration or long-term partnership agreements with certified sustainable suppliers to secure high-quality, traceable inputs, which is critical for supporting clean label positioning and meeting demanding consumer expectations regarding ethical sourcing.

The midstream phase involves complex manufacturing, formulation, and aseptic packaging processes. This stage is capital-intensive, requiring advanced blending equipment, homogenization technology, and stringent quality control protocols to ensure both microbiological safety and consistent product texture, particularly for non-dairy emulsions which are inherently less stable than traditional dairy. Distribution is a crucial element, necessitating robust cold chain infrastructure for refrigerated liquid products. Distribution channels are bifurcated into direct sales to large retailers and food service operators, and indirect channels relying on third-party logistics (3PL) providers and e-commerce platforms, with the latter rapidly gaining traction for niche and subscription-based sales models.

Downstream analysis focuses on retail presentation, marketing, and final consumer acquisition. Direct channels, primarily large supermarket chains and hypermarkets, offer high volume and broad visibility, relying on strategic shelf placement and promotional activities. Indirect channels, particularly online retail and specialty stores, focus on targeted marketing campaigns utilizing data analytics to reach specific demographic groups such as vegans, keto dieters, or consumers seeking specific functional benefits. The efficiency of the distribution system, particularly in minimizing transit time and maintaining temperature control, directly impacts profitability and reduces product spoilage, reinforcing the importance of digitized inventory management throughout the value chain.

RTD Creamer Market Potential Customers

The primary consumers (End-Users/Buyers) of RTD creamers encompass a wide demographic spectrum, but key segments include Millennials and Generation Z consumers who prioritize convenience, functional benefits, and adherence to specific dietary regimes. These consumers are actively seeking products that enhance their daily routines, viewing coffee consumption not just as a necessity but as a personalized ritual. They are highly responsive to innovative flavors and products that explicitly address health concerns, such as low sugar content or the inclusion of adaptogens, making them the target demographic for premium, specialty RTD creamer brands.

Another significant customer segment comprises individuals with recognized dietary restrictions, specifically lactose-intolerant individuals and the growing population adopting vegan or plant-based lifestyles. For this group, RTD creamers offer a convenient, ready-mixed, and reliable way to enjoy coffee without compromise. Furthermore, the food service industry, including quick-service restaurants (QSRs) and institutional catering services (hotels, offices), represent substantial B2B buyers who require bulk, portion-controlled, and highly stable creamer solutions to standardize beverage offerings and minimize preparation time and spoilage risks.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.35 Billion |

| Market Forecast in 2033 | USD 4.19 Billion |

| Growth Rate | 8.7% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nestlé S.A., Danone S.A., Tofutti Brands Inc., Califia Farms LLC, Ripple Foods, Elmhurst Milked, Oatly Group AB, Silk (Danone North America), Chobani Global Holdings, Laird Superfood Inc., Starbucks Corporation, White Wave Foods Company, TreeHouse Foods Inc., Kerry Group plc, Blue Diamond Growers, SunOpta Inc., Forager Project, International Delight (Danone), Coffee mate (Nestlé), Nutpods. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

RTD Creamer Market Key Technology Landscape

The technology landscape governing the RTD Creamer market is primarily focused on enhancing product stability, improving nutritional profiles, and maximizing operational efficiency within high-volume manufacturing environments. A critical technology is Ultra-High Temperature (UHT) processing and aseptic packaging, which allows for the creation of shelf-stable liquid creamers, significantly reducing the dependence on the cold chain while preserving flavor and nutritional integrity for extended periods. This aseptic technology involves rapidly heating the product to sterilize it, followed by packaging in sterile, multi-layered cartons or pouches, enabling manufacturers to reach geographically distant markets previously inaccessible due to refrigeration limitations.

Another crucial technological area involves advanced emulsification and homogenization techniques, particularly vital for plant-based creamers. Non-dairy liquids often require complex stabilization systems to prevent separation, sediment formation, or 'curdling' when mixed with hot, acidic coffee. Manufacturers utilize high-pressure homogenization and specialized hydrocolloids (stabilizing agents) to create smooth, consistent, and heat-stable emulsions that mimic the textural quality of traditional dairy fat. Furthermore, ingredient technology is constantly evolving, with techniques like microbial fermentation being used to create highly functional, animal-free proteins and fats that offer superior sensory characteristics and reduced environmental impact compared to conventional sourcing methods.

Regional Highlights

- North America: Market Dominance and Innovation Hub

North America, particularly the United States, represents the largest and most mature market for RTD Creamers, characterized by high consumer awareness, widespread distribution, and a culture centered around convenient coffee consumption. The region is the primary innovation hub, seeing rapid market introductions of functional ingredients (MCTs, collagen, prebiotics) and diverse flavor profiles, often influenced by seasonal trends and social media virality. The competitive landscape is intense, dominated by both established food and beverage giants and agile startup brands focusing exclusively on niche dietary segments (e.g., keto, zero sugar). The robust infrastructure for refrigerated and ambient distribution supports high sales volumes, though manufacturers face continuous pressure to justify premium pricing through superior quality and sustainable sourcing claims.

The U.S. consumer is increasingly demanding transparency, driving the popularity of clean label RTD creamers free from artificial colors, sweeteners, and high-fructose corn syrup. Canada follows similar trends but often adopts innovative products slightly later, focusing more heavily on certified organic and locally sourced ingredients. Growth is sustained by the constant cycling of limited-time offer (LTO) flavors and the successful cross-promotion of RTD creamers alongside single-serve coffee pods, reinforcing the concept of a complete, customized home beverage solution.

- Europe: Focus on Sustainability and Organic Certification

The European RTD Creamer market, while smaller than North America, demonstrates high value growth driven by stringent consumer demand for ethical sourcing and organic certification. Northern and Western European countries, notably the UK, Germany, and the Nordic regions, are leaders in plant-based consumption, favoring oat and soy alternatives, often mandated by strong local sustainability policies. The market penetration is heavily influenced by supermarket chains that champion private label brands emphasizing low environmental footprint and reduced packaging waste, often favoring shelf-stable aseptic packaging over chilled options to minimize energy consumption in the supply chain.

Regulatory alignment across the European Union imposes high standards for labeling and nutritional claims, necessitating careful formulation and marketing strategies. The resistance to highly processed or artificially flavored products is pronounced, leading manufacturers to invest heavily in natural extract technology and clean sugar alternatives. Eastern Europe shows emerging potential, but growth is hampered by slower adoption of non-dairy trends and a stronger historical preference for traditional liquid milk additives, though urbanization and increased globalization are slowly shifting these preferences towards convenience RTD formats.

- Asia Pacific (APAC): Rapid Growth and Urbanization

APAC is projected to be the fastest-growing region, benefiting significantly from rapidly changing consumer lifestyles fueled by economic growth and extensive urbanization. Countries like China, Japan, and South Korea are witnessing a surge in specialty coffee culture, and RTD creamers are increasingly seen as a convenient and modern accompaniment. The market here is unique due to the diverse local beverage preferences; while coffee consumption drives demand in urban centers, traditional tea consumption also presents an opportunity for tea-specific creamer formulations.

Infrastructure challenges, particularly concerning cold chain capabilities in secondary cities and rural areas, mean that shelf-stable powdered and aseptic liquid formulations hold a competitive edge. Flavor profiles are often customized to local palates, sometimes incorporating less intense sweetness levels or traditional ingredients. International brands are actively investing in local manufacturing facilities and adapting packaging sizes to cater to the smaller household unit sizes prevalent in many Asian countries, utilizing both online platforms and expanding convenience store networks for distribution.

- Latin America (LATAM): Emerging Market Dynamics

The Latin American market is characterized by strong regional preferences and varying economic stability. Brazil and Mexico are the primary markets, driven by large populations and established coffee cultures. However, the adoption of specialized RTD creamers, particularly the high-end plant-based varieties, is limited primarily to affluent urban populations. Affordability remains a critical factor, often pushing mainstream consumers towards less expensive, traditional powdered creamers or fluid milk.

Opportunities exist in developing products that utilize locally sourced ingredients, which can offer cost advantages and cater to regional tastes. As organized retail expands and international influence increases, the demand for convenient, ready-to-use liquid formulations is expected to grow. Manufacturers entering this region must navigate complex local regulatory environments and manage volatile exchange rates while focusing marketing efforts on the clear benefits of convenience and extended shelf life.

- Middle East and Africa (MEA): Untapped Potential and Premiumization

The MEA region presents a market with significant untapped potential, particularly within the Gulf Cooperation Council (GCC) countries, where high disposable income supports the premiumization trend. The hot climate makes the convenience of RTD, shelf-stable options highly appealing, provided they can withstand environmental stress during transit. Demand is currently concentrated among expatriate populations and younger, globally connected consumers in major metropolitan areas such as Dubai, Riyadh, and Johannesburg.

Halal certification is a mandatory requirement for market entry across most of the Middle East, influencing ingredient sourcing and manufacturing processes. Plant-based options are growing, often preferred due to dietary sensitivities or religious considerations regarding dairy handling. The African market, while representing high volume potential, faces significant hurdles related to logistics infrastructure and affordability, meaning powdered formats often dominate outside of major South African cities, where modern retail is more developed.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the RTD Creamer Market.- Nestlé S.A.

- Danone S.A.

- Tofutti Brands Inc.

- Califia Farms LLC

- Ripple Foods

- Elmhurst Milked

- Oatly Group AB

- Silk (Danone North America)

- Chobani Global Holdings

- Laird Superfood Inc.

- Starbucks Corporation

- White Wave Foods Company

- TreeHouse Foods Inc.

- Kerry Group plc

- Blue Diamond Growers

- SunOpta Inc.

- Forager Project

- International Delight (Danone)

- Coffee mate (Nestlé)

- Nutpods

Frequently Asked Questions

Analyze common user questions about the RTD Creamer market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the shift from traditional creamers to RTD creamer formats?

The shift is primarily driven by superior consumer convenience, portability, the growing demand for single-serve, portion-controlled packaging, and the continuous innovation in plant-based, dairy-free alternatives that appeal to health-conscious consumers and those with dietary restrictions.

Which plant-based ingredient is currently dominating the RTD creamer market?

Oat milk-based creamers are experiencing the fastest market growth and are highly dominant. This is due to their neutral flavor profile and textural characteristics that closely mimic traditional dairy, offering excellent emulsification and a desirable mouthfeel in hot beverages.

How do cold chain logistics impact the pricing and availability of liquid RTD creamers?

Cold chain logistics significantly increase operational costs due to the necessity of constant refrigeration during storage and transit. This added complexity and expense often results in higher retail prices and limits the distribution of chilled liquid RTD creamers in regions with underdeveloped distribution infrastructure.

What role does functional ingredient integration play in current RTD creamer product development?

Functional ingredients such as MCT oil, collagen peptides, adaptogens (like Ashwagandha), and probiotics are vital for differentiation. They allow manufacturers to position RTD creamers as health-and-wellness products, appealing to consumers seeking added nutritional benefits beyond basic flavor enhancement.

Which geographical region is anticipated to demonstrate the highest growth rate for RTD creamers?

The Asia Pacific (APAC) region is forecasted to achieve the highest Compound Annual Growth Rate (CAGR). This expansion is largely attributed to increasing disposable incomes, rapid urbanization, and the widespread adoption of Western-style coffee culture and convenient food and beverage solutions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager