Rubber Accelerator Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437563 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Rubber Accelerator Market Size

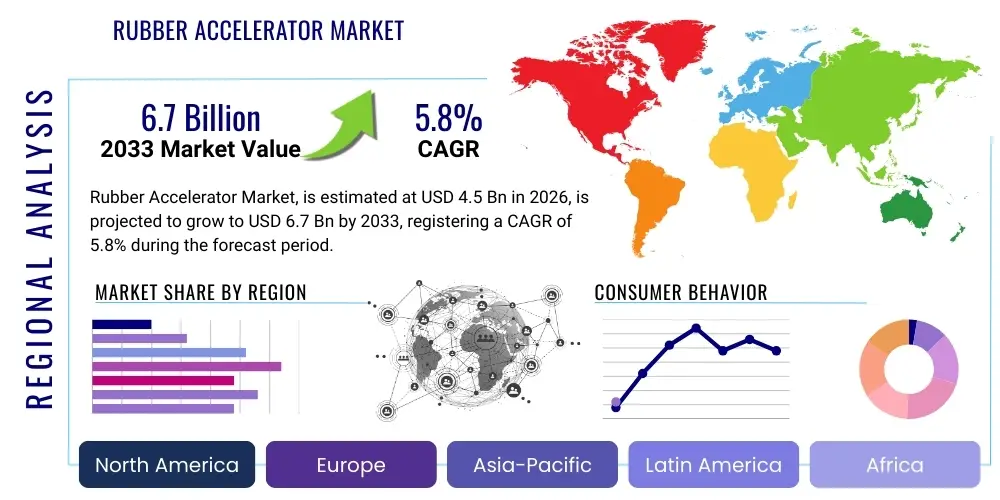

The Rubber Accelerator Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.5 billion in 2026 and is projected to reach USD 6.7 billion by the end of the forecast period in 2033. This consistent growth trajectory is primarily driven by the robust expansion of the global automotive industry, coupled with escalating demand for high-performance and durable rubber products across construction, manufacturing, and consumer goods sectors. Market maturation in developed economies is offset by intense growth opportunities within emerging Asian economies, particularly China and India, which are rapidly expanding their tire manufacturing and infrastructure development capabilities.

Rubber Accelerator Market introduction

The Rubber Accelerator Market encompasses specialized chemical compounds crucial for the vulcanization process, where they significantly reduce the time required for curing rubber while simultaneously improving its physical properties such as tensile strength, elongation, abrasion resistance, and durability. These organic chemicals, including sulfenamides, thiazoles, thiurams, and guanidines, act as catalysts, enabling the cross-linking of polymer chains in both natural and synthetic rubber. The fundamental product description centers on their ability to control the reaction kinetics during heating, ensuring uniform vulcanization and optimal performance of the final rubber article. Without accelerators, the curing process would be inefficient, resulting in substandard products lacking the necessary resilience and longevity required for industrial applications.

Major applications of rubber accelerators span across key industrial domains, with the tire industry consuming the largest share due due to strict safety and performance standards requiring precise vulcanization profiles. Beyond tires, these compounds are vital in manufacturing industrial rubber goods (like conveyor belts, hoses, and gaskets), footwear, medical devices (such as gloves and stoppers), and specialized construction components. The core benefit derived from using rubber accelerators is the maximization of production efficiency through rapid curing cycles and the enhancement of rubber product quality, which translates directly into superior operational performance and extended service life, critical factors in sectors like automotive and heavy machinery.

The market is primarily driven by global automotive production volume, especially in Asia Pacific, where electric vehicle (EV) manufacturing is further stimulating demand for specialized, high-quality tire formulations requiring advanced accelerator systems. Regulatory shifts towards greener chemistry, particularly the phasing out of traditional accelerators that generate harmful nitrosamines, are driving innovation towards eco-friendly, non-nitrosamine-generating alternatives. This need for sustainable and safer curing solutions is compelling key manufacturers to invest heavily in R&D, ensuring compliance with stringent environmental and health standards while maintaining optimal curing speeds and product characteristics necessary for demanding end-use applications.

Rubber Accelerator Market Executive Summary

The Rubber Accelerator Market is characterized by robust commercial activity dominated by the sulfenamide class of accelerators, which offer the optimal balance of processing safety, rapid cure rates, and superior physical properties in the final product. Key business trends indicate a definitive shift toward sustainable and non-toxic accelerator alternatives, driven by regulatory pressures, particularly in Europe and North America, focusing on minimizing VOC emissions and eliminating hazardous substances like thiurams and certain dithiocarbamates. Supply chain dynamics are currently optimizing around increased raw material costs and logistical challenges, pushing manufacturers toward vertical integration and long-term supply agreements to ensure stability and cost efficiency in production, especially for complex precursor chemicals like aniline and carbon disulfide.

Regionally, the Asia Pacific (APAC) market maintains its dominance, spurred by massive investments in automotive production, particularly in China, India, and Southeast Asian nations, positioning the region as both the largest producer and consumer of rubber accelerators globally. North America and Europe, while slower growing, remain critical markets characterized by high demand for specialty accelerators used in high-performance rubber goods and medical applications, where premium pricing is achievable due to stringent quality requirements and application-specific demands. Segment trends highlight the growing importance of the non-tire sector, driven by infrastructure development (requiring durable seals, bridges bearings, and construction materials) and the resurgence of the manufacturing base post-pandemic, ensuring diversified demand channels beyond the cyclical automotive industry.

In terms of technological advancements, the market is actively exploring hybrid accelerator systems, combining elements of multiple chemical classes to achieve precise control over scorch time and cure rate, which is essential for modern, thick rubber profiles and energy-efficient tire manufacturing. This executive outlook underscores a market in transition: simultaneously managing the persistent demand from core applications while strategically adapting to severe regulatory compliance mandates and capitalizing on innovation opportunities presented by sustainable chemistry and advanced material requirements in the electric mobility sector. Competitive strategies involve targeted acquisitions to secure niche technologies and strengthening distributor networks, especially within fast-growing emerging economies to capture market share effectively.

AI Impact Analysis on Rubber Accelerator Market

Common user inquiries regarding AI's influence in the Rubber Accelerator Market frequently revolve around optimizing formulation complexity, predicting material failure, and enhancing sustainable manufacturing processes. Users are concerned about how AI can rapidly screen thousands of potential accelerator combinations to identify the optimal curing system that meets stringent performance, safety, and regulatory compliance targets simultaneously, thereby drastically reducing traditional R&D cycles. Furthermore, significant interest lies in using machine learning models to analyze real-time data from mixing and vulcanization processes to predict and prevent batch variations, ensuring consistent product quality across different manufacturing sites. The key theme summarized by user questions is the expectation that AI will transition the market from empirical, trial-and-error chemistry to precise, data-driven material science, significantly accelerating the adoption of new, greener accelerator chemistries.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) platforms is poised to revolutionize the R&D and manufacturing phases within the rubber accelerator sector. AI algorithms can process vast datasets of chemical structures, reaction kinetics, and physical performance test results, accelerating the discovery of novel compounds that offer superior efficiency and lower toxicity compared to existing solutions. This capability is paramount as the industry searches for effective replacements for legacy chemicals restricted by regulations, allowing companies to respond proactively to evolving environmental health and safety standards. Furthermore, predictive modeling enables manufacturers to simulate the long-term aging and degradation of rubber products under various operational conditions, providing critical performance guarantees and potentially reducing the reliance on lengthy, costly physical testing protocols before product commercialization.

In manufacturing operations, AI drives substantial improvements in process control and yield optimization. Sophisticated monitoring systems linked to ML models analyze parameters like temperature, pressure, and mixing time during the compounding process. If deviations occur, the AI system can issue real-time adjustments or alerts, minimizing scrap rates and ensuring homogeneity in the accelerator dispersion, which is vital for uniform vulcanization. Beyond process optimization, AI is also impacting supply chain resilience by forecasting raw material demand fluctuations with greater accuracy, especially for volatile petrochemical precursors, allowing procurement teams to negotiate better contracts and avoid costly delays associated with material shortages.

- AI-driven formulation screening accelerates the discovery of non-nitrosamine-generating accelerators.

- Machine learning optimizes vulcanization process parameters (temperature, time, pressure) in real-time.

- Predictive maintenance analytics extend the lifespan of mixing equipment and production lines.

- Enhanced supply chain visibility and demand forecasting for key raw materials (e.g., Aniline, Mercaptobenzothiazole).

- Data synthesis facilitates faster regulatory compliance assessment for new chemical formulations.

- Computational chemistry simulations predict final rubber product properties and longevity without extensive physical testing.

DRO & Impact Forces Of Rubber Accelerator Market

The dynamics of the Rubber Accelerator Market are governed by a critical interplay of strong industry drivers, necessary regulatory restraints, and inherent opportunities for technological advancement, all collectively defining the market's impact forces. The primary driver is the relentless global expansion of the automotive and transportation sectors, particularly in emerging markets, necessitating high volumes of tires and other essential rubber components with superior performance characteristics. This demand is intrinsically linked to rising urbanization and infrastructure development worldwide, which fuels the need for industrial rubber goods like belts, seals, and hoses, thereby securing a steady consumption base for accelerators. However, the market faces significant restraints, chiefly regulatory mandates restricting the use of certain accelerator types (like certain thiurams and dithiocarbamates) due to their potential to form carcinogenic nitrosamines, requiring substantial investment in R&D for compliant alternatives.

Significant opportunities exist in the shift towards specialized accelerators required for high-performance applications, such as those used in Electric Vehicle (EV) tires, which require reduced rolling resistance and enhanced durability to maximize battery range and withstand higher instantaneous torque. Furthermore, the growing focus on sustainable manufacturing presents opportunities for green accelerators derived from renewable sources or those utilizing closed-loop chemistry, attracting premium pricing and favorable regulatory treatment. The critical impact forces shaping this market include the highly concentrated nature of key raw material supply (leading to price volatility) and the technical barrier to entry for developing complex, multi-functional accelerator systems. These forces necessitate strategic partnerships and robust supply chain management to maintain operational competitiveness and innovation cycles.

Moreover, the intensifying global focus on product longevity and warranty periods across all rubber-consuming sectors necessitates the use of robust curing agents that guarantee predictable and long-lasting physical properties, amplifying the demand for high-quality, specialty accelerators. The restraint posed by intellectual property disputes surrounding patented low-nitrosamine chemistries also influences market entry and competitive positioning. Ultimately, the market trajectory is defined by the industry’s ability to balance cost-effective mass production required by the tire industry with the rapid development of sophisticated, safe, and environmentally sound curing systems mandated by evolving global health and environmental regulations, ensuring innovation remains the central strategic imperative.

Segmentation Analysis

The Rubber Accelerator Market is systematically segmented based on chemical type, application, and form, providing a granular view of market dynamics and consumption patterns. The chemical type segmentation, including sulfenamides, thiazoles, thiurams, and others (e.g., dithiocarbamates, guanidines), dictates curing characteristics such as scorch time, cure rate, and the final mechanical properties of the rubber. Sulfenamide accelerators, known for their delayed action and superior processing safety, currently dominate the market, primarily due to their extensive use in the high-volume tire manufacturing sector. Understanding these segments is crucial for manufacturers to tailor production capabilities and marketing efforts towards specific end-user needs and regulatory environments.

The application segment is dominated by the tire industry, which accounts for the vast majority of consumption globally, reflecting the non-discretionary nature of automotive replacement and original equipment demand. However, the industrial rubber goods segment, encompassing hoses, belts, seals, cables, and gaskets, represents a significant and steadily growing consumer base, driven by expansion in the manufacturing, mining, and oil & gas sectors. The form of the accelerator (powder, pellets, or oil-treated granules) is also a critical segmentation factor, affecting handling safety, dispersion quality, and metering accuracy during the compounding phase; the industry is trending towards dust-free, granular forms to improve occupational health and efficiency on the factory floor.

This detailed segmentation allows market players to identify high-growth potential niches, such as specialty accelerators for EPDM rubber used in automotive weather stripping or nitrile rubber used in oil-resistant seals. The regulatory differences between regions further influence segment adoption; for example, the stricter European regulations accelerate the substitution of thiuram-based accelerators with safer, sulfenamide or thiazole alternatives. Therefore, segmentation analysis serves as the foundation for strategic decision-making, guiding product development pipelines and investment allocation in research and manufacturing capacity worldwide.

- By Chemical Type:

- Sulfenamides (CBS, TBBS, NOBS)

- Thiazoles (MBT, MBTS, ZMBT)

- Thiurams (TMTD, TMTM, TETD)

- Guanidines (DPG, DOTG)

- Others (Dithiocarbamates, Xanthates)

- By Application:

- Tire Industry (Passenger vehicles, Commercial vehicles, Aircraft)

- Industrial Rubber Goods (Hoses, Belts, Seals, Gaskets)

- Footwear

- Latex Products

- Others (Medical, Construction, Adhesives)

- By Form:

- Powder

- Oil-Treated Granules/Pellets

Value Chain Analysis For Rubber Accelerator Market

The value chain for the Rubber Accelerator Market begins with the upstream sourcing of crucial petrochemical raw materials, primarily aniline, carbon disulfide, and various amines, which are synthesized into intermediate products like MBT (Mercaptobenzothiazole), the backbone for many accelerator classes. This upstream segment is characterized by high capital intensity and reliance on the global chemical and petroleum industries, meaning fluctuations in crude oil prices and specific chemical precursor availability directly influence the final cost of accelerators. Specialized chemical companies execute the complex synthesis steps, ensuring high purity and consistent quality, which is critical as impurities can drastically affect the vulcanization process and the final rubber performance. Efficient management of these precursors, particularly minimizing dependence on single-source suppliers, is a key strategic imperative for accelerator manufacturers.

The midstream phase involves the primary manufacturing and formulation of accelerators, where intermediate chemicals are processed into the final market-ready forms (e.g., sulfenamides, often derived from MBT). This stage involves precise chemical reactions, milling, granulation, and sometimes encapsulation to enhance dispersion, improve handling safety (dust reduction), and control scorch delay. Distribution channels are highly varied, encompassing both direct sales to major multinational tire manufacturers and reliance on specialized chemical distributors who service smaller rubber goods manufacturers globally. Direct sales relationships are crucial for large-volume, highly technical products, allowing for close technical collaboration and customized product development tailored to specific tire lines or industrial applications.

Downstream analysis focuses on the end-users, predominantly compounders and rubber product manufacturers. The primary application, the tire industry, demands large, consistent volumes directly from manufacturers, utilizing rigorous quality control standards and demanding just-in-time delivery. Indirect channels typically involve local distributors or agents who manage smaller volumes for fragmented end-use markets like specialized footwear or niche industrial seals. The efficiency of the distribution network, particularly in emerging markets like Southeast Asia and Latin America, dictates market penetration and competitive reach. The increasing complexity of regulatory compliance, especially concerning product traceability and hazard information (Safety Data Sheets), adds administrative overhead throughout the entire value chain, requiring robust quality assurance systems at every stage.

Rubber Accelerator Market Potential Customers

Potential customers for the Rubber Accelerator Market primarily consist of industrial entities involved in the compounding, molding, and finishing of both natural and synthetic rubber products. The largest segment of end-users are multinational tire manufacturing giants, including companies like Michelin, Bridgestone, Goodyear, and Continental, who require massive, highly consistent volumes of accelerators like CBS and TBBS to ensure the performance and safety standards of billions of tires produced annually. These large buyers often dictate specific performance criteria, engage in long-term supply agreements, and may even require bespoke accelerator blends optimized for their unique rubber formulations and manufacturing processes, making them the most critical revenue source for accelerator producers.

The secondary, but highly diversified, customer base includes manufacturers of Industrial Rubber Goods (IRG). This segment encompasses companies specializing in automotive components (non-tire applications like engine mounts, hoses, and weather stripping), conveyor belt manufacturers serving mining and logistics industries, and producers of critical infrastructure components such as bridge bearing pads and expansion joints. These buyers require a broader range of specialty accelerators, often emphasizing properties like heat resistance, oil resistance, and low compression set, compelling accelerator suppliers to maintain a versatile product portfolio covering thiazoles, dithiocarbamates, and specific sulfenamide derivatives suitable for various polymer types (NR, SBR, EPDM, NBR).

Furthermore, specialty segments such as the medical device industry (requiring ultra-pure, non-leaching accelerators for stoppers and gloves) and the adhesive/sealant industry also represent significant potential customers, often purchasing smaller volumes but commanding higher price points due to stringent regulatory and purity requirements. The procurement decisions across all these customer segments are driven by a complex calculation involving product performance metrics (scorch delay, cure speed, final hardness), cost-in-use, consistency of supply, and critically, compliance with regional health and safety regulations regarding nitrosamine formation and overall toxicity profiles, making supplier qualification a lengthy and rigorous process.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 billion |

| Market Forecast in 2033 | USD 6.7 billion |

| Growth Rate | CAGR 5.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sichuan Huitai Chemical, Eastman Chemical Company, Lanxess AG, Sunsine Chemical Holdings Ltd., Arkema SA, Kumho Petrochemical Co. Ltd., Shandong Yanggu Huatai Chemical Co. Ltd., Ningbo Actmix Chemical Industry Co. Ltd., Ouchi Shinko Chemical Industrial Co. Ltd., Agrocel Industries Pvt. Ltd., Struktol Company, R. T. Vanderbilt Company Inc., AkzoNobel (Nouryon), China Sunsine Chemical Holdings Limited, Wuxi Huahong Chemical. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Rubber Accelerator Market Key Technology Landscape

The technological landscape of the Rubber Accelerator Market is dynamically evolving, driven primarily by the twin objectives of achieving enhanced product performance and meeting stringent environmental and health standards. A foundational technology dominating the landscape is the continuous improvement in synthesis processes for major accelerator classes, particularly Sulfenamides (like N-tert-butyl-2-benzothiazolesulfenamide, TBBS, and N-cyclohexyl-2-benzothiazolesulfenamide, CBS). Manufacturers are leveraging advanced catalytic chemistry and optimized reaction pathways to improve yield, reduce energy consumption, and minimize the formation of hazardous byproducts during synthesis, enhancing overall manufacturing sustainability and cost efficiency, particularly in competitive APAC manufacturing hubs.

A second critical area of innovation lies in the development of pre-dispersed and encapsulated accelerator technologies. Traditional powder accelerators pose safety risks (dust inhalation) and dispersion challenges within the rubber matrix, leading to non-uniform cure profiles. Pre-dispersed systems, typically accelerators mixed with polymer binders or oil carriers into granular or pellet form, ensure superior homogeneity, faster mixing times, improved metering accuracy, and significantly reduced occupational exposure to dust. This technology is becoming a standard requirement for high-specification rubber goods and tire production, driving the adoption of specialized pelletizing and granulation equipment across the industry.

Furthermore, there is a focused technological effort on developing next-generation, non-nitrosamine-generating (NNG) accelerators. This involves substituting traditional thiuram and dithiocarbamate systems with inherently safer chemistries or designing specialty booster systems that enhance the activity of safer thiazoles or sulfenamides without compromising scorch safety or final cure properties. Computational chemistry and AI-driven materials science are playing an increasingly important role here, allowing chemists to model and predict the kinetic behavior of novel accelerator molecules before costly laboratory synthesis, dramatically shortening the R&D cycle for compliant and high-performance curing systems that are future-proofed against anticipated global regulatory changes.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing regional market, primarily propelled by its dominant position in global automotive manufacturing, especially the massive tire production base in China, India, and ASEAN nations. Robust infrastructure spending and the concentration of major global rubber processing companies in the region ensure continuous high demand. The market dynamics here are heavily influenced by local capacity expansion and the dual demand for both cost-effective commodity accelerators and sophisticated, regulatory-compliant specialty products for export-grade tires.

- North America: This region is characterized by mature, high-value end-user segments demanding premium and specialty accelerators. Consumption is driven less by volume growth and more by the need for high-performance compounds used in aircraft tires, advanced industrial seals, and the rapidly growing Electric Vehicle (EV) segment, which requires superior material properties. Strict adherence to health and safety regulations accelerates the adoption of NNG and pre-dispersed forms, commanding higher prices compared to generic products.

- Europe: Europe exhibits the most stringent regulatory environment globally, particularly concerning nitrosamines (REACH regulations), which significantly influences product choice and innovation. The market strongly favors sustainable, low-toxicity accelerators. While volume growth is steady, it is focused on specialized applications in the automotive (OEM and replacement) and highly specialized industrial rubber sectors, driving manufacturers to invest heavily in technological compliance and eco-friendly alternatives to maintain market access.

- Latin America (LATAM): Growth in LATAM is closely linked to domestic automotive production hubs in Brazil and Mexico and infrastructure investment. The market shows a high reliance on imported accelerators, though local manufacturing capacity is slowly expanding. Price sensitivity is higher here compared to North America and Europe, leading to a focus on cost-efficient, standard accelerator classes, while regulatory adoption tends to lag behind the global leaders.

- Middle East and Africa (MEA): This region represents a nascent but expanding market, particularly in the UAE, Saudi Arabia, and South Africa, fueled by investments in oil & gas infrastructure (requiring specialized high-temperature resistant rubber components) and local manufacturing expansion. Demand for accelerators supports local tire manufacturing and a growing construction sector, but the market often relies on established, cost-effective technologies and imported chemical products due to limited local production of precursors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Rubber Accelerator Market.- Sichuan Huitai Chemical Co., Ltd.

- Eastman Chemical Company

- Lanxess AG

- Sunsine Chemical Holdings Ltd.

- Arkema SA

- Kumho Petrochemical Co. Ltd.

- Shandong Yanggu Huatai Chemical Co. Ltd.

- Ningbo Actmix Chemical Industry Co. Ltd.

- Ouchi Shinko Chemical Industrial Co. Ltd.

- Agrocel Industries Pvt. Ltd.

- Struktol Company

- R. T. Vanderbilt Company Inc.

- AkzoNobel (Nouryon)

- China Sunsine Chemical Holdings Limited

- Wuxi Huahong Chemical Co., Ltd.

- Jingdong Chemical Co., Ltd.

- Puyang Jida Chemical Co., Ltd.

- Double Bond Chemical Ind. Co., Ltd.

- King Industries, Inc.

- Eutec Chemical Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Rubber Accelerator market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of rubber accelerators in the manufacturing process?

Rubber accelerators are chemical compounds used to significantly speed up the vulcanization (curing) process of rubber, reducing curing time from hours to minutes while enhancing critical physical properties such as tensile strength, elasticity, abrasion resistance, and overall durability of the final product.

Which chemical type dominates the rubber accelerator market?

Sulfenamide accelerators, such as CBS (N-Cyclohexyl-2-benzothiazolesulfenamide) and TBBS (N-tert-butyl-2-benzothiazolesulfenamide), currently dominate the market due to their excellent balance of delayed action (scorch safety) and high cure speed, making them ideal for high-volume applications like tire manufacturing.

How do global regulations impact the future growth of the rubber accelerator market?

Strict global regulations, particularly in Europe (REACH) and North America, mandate the reduction or elimination of accelerators that generate carcinogenic nitrosamines. This drives strong market growth for non-nitrosamine-generating (NNG) alternatives, leading to increased R&D and higher costs for compliant, specialty chemical systems.

What role does the Asia Pacific region play in the rubber accelerator market?

Asia Pacific is the largest consumer and producer market globally, primarily driven by massive domestic automotive and tire production capacity, especially in China and India. The region's rapid industrialization and infrastructure development ensure it remains the key growth engine for global demand.

Why is pre-dispersed rubber accelerator technology gaining prominence?

Pre-dispersed accelerators, typically in granular or pellet form, are gaining prominence because they improve worker safety by eliminating dust, ensure superior dispersion uniformity within the rubber compound, and enhance manufacturing efficiency through better metering and reduced scrap rates compared to traditional powder forms.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager