Rubber Diaphragms Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435281 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Rubber Diaphragms Market Size

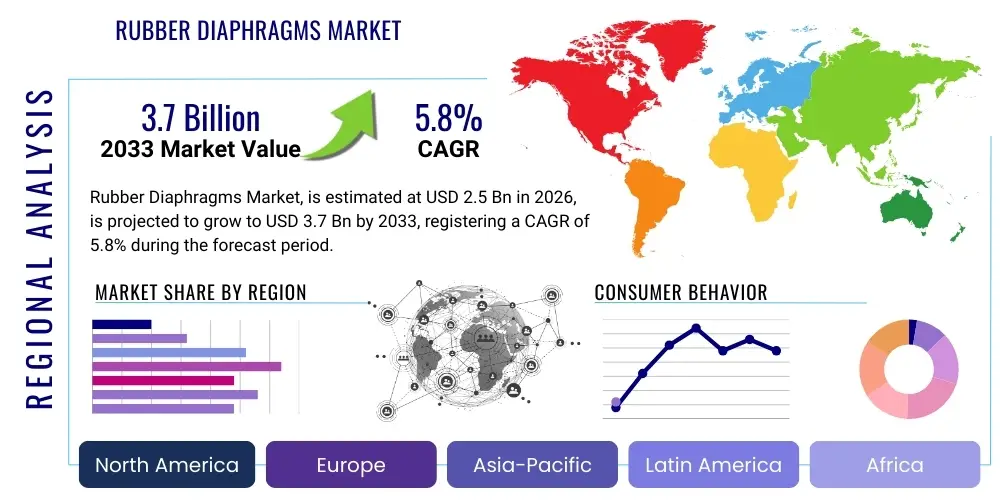

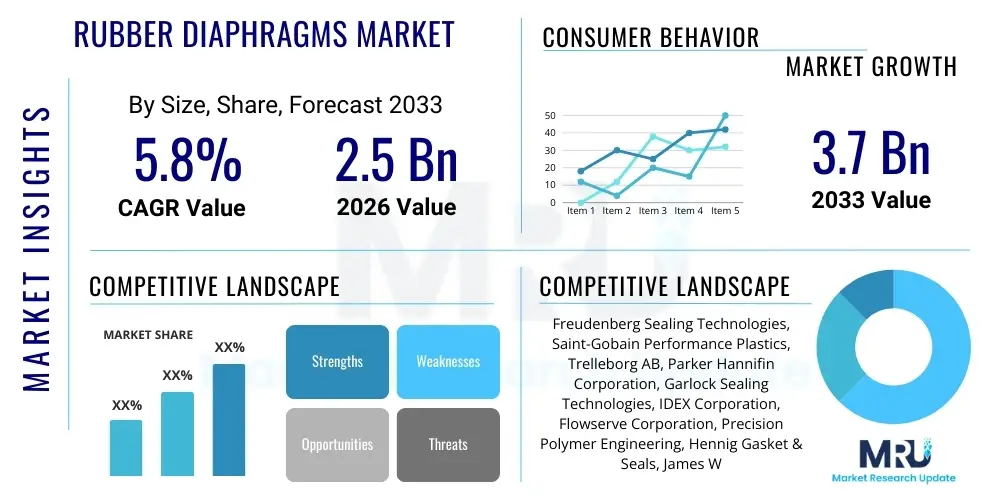

The Rubber Diaphragms Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 2.5 Billion in 2026 and is projected to reach USD 3.7 Billion by the end of the forecast period in 2033.

Rubber Diaphragms Market introduction

The Rubber Diaphragms Market encompasses the manufacturing, distribution, and sale of flexible rubber components designed to seal, separate, or transmit force between two sections, often used in dynamic applications requiring responsiveness and precision. These components act as physical barriers that prevent fluid or gas contamination while allowing pressure changes or mechanical movement. The fundamental structure typically involves a reinforced rubber sheet, sometimes combined with fabric or metal inserts for enhanced strength and stability under extreme conditions. Market growth is intrinsically linked to industrial automation, rising demand for flow control devices, and the stringent regulatory requirements across end-use sectors.

Rubber diaphragms serve critical functions across diverse industries, including flow control, pneumatics, hydraulics, and instrumentation. Major applications span automotive fuel systems, medical devices (such as pumps and respirators), water treatment systems, and process control valves. Key benefits of these diaphragms include excellent sealing capabilities, high flex resistance, good chemical compatibility, and superior longevity when fabricated from specialized elastomers like EPDM, NBR, or FKM. Their ability to handle high cycling rates and maintain performance in harsh environments drives their continued adoption over traditional sealing mechanisms, ensuring operational efficiency and component protection in machinery.

Driving factors for this market include the global expansion of the automotive industry, particularly the demand for precise emission control and fuel injection systems which rely on high-performance diaphragms. Furthermore, increasing investments in industrial automation, coupled with the continuous need for reliable flow control equipment in chemical processing and oil and gas sectors, contribute significantly to market expansion. The shift towards miniaturization in electronics and complex medical devices also necessitates the development of specialized micro-diaphragms, opening new avenues for technological advancement and market penetration, especially in high-growth regions like Asia Pacific.

Rubber Diaphragms Market Executive Summary

The global Rubber Diaphragms Market exhibits robust growth propelled by accelerated industrial output and heightened demand for precise fluid and pressure management systems. Key business trends indicate a strong focus on material innovation, particularly the development of high-performance elastomers that offer superior thermal and chemical resistance, catering to extreme operational environments in aerospace and petrochemical industries. Strategic mergers and acquisitions among key players are common, aimed at consolidating manufacturing expertise, expanding geographical footprint, and securing specialized material supply chains, thereby enhancing competitive positioning. Manufacturers are increasingly investing in sophisticated molding techniques, such as precision injection and compression molding, to produce complex geometries with tight tolerances, satisfying the demanding requirements of next-generation pneumatic actuators and critical medical drug delivery systems.

Regionally, Asia Pacific (APAC) stands out as the dominant and fastest-growing market, largely driven by massive expansion in automotive production, coupled with significant governmental investments in infrastructure and water treatment facilities, particularly in rapidly industrializing nations such as China and India. North America and Europe maintain substantial market share due to the strong presence of established end-user industries like aerospace, pharmaceuticals, and sophisticated industrial machinery manufacturing, emphasizing high-quality, long-life components compliant with stringent environmental and safety regulations. Emerging regional trends involve the proliferation of localized manufacturing hubs in Eastern Europe and Southeast Asia, offering cost-effective production capabilities and reducing logistical complexities by locating facilities closer to critical OEM supply nodes.

Segment trends reveal that the Fabric Reinforced segment holds a dominant position due to its superior strength and burst pressure resistance, making it essential for heavy-duty industrial applications such as diaphragm pumps and high-pressure regulators. However, the Thin-Film diaphragm segment is experiencing accelerated growth, driven by its adoption in highly sensitive pressure sensors and micro-fluidics utilized in cutting-edge medical diagnostics and analytical instruments that require minimal force displacement. By material, Nitrile Butadiene Rubber (NBR) remains crucial for oil and fuel resistance applications, though Fluorocarbon Elastomers (FKM) are gaining significant traction where extreme heat and aggressive chemical exposure are primary concerns, reflecting a broader industry push towards higher performance, specialized materials tailored for extreme conditions.

AI Impact Analysis on Rubber Diaphragms Market

Common user questions regarding AI's impact on the Rubber Diaphragms Market center primarily on how AI and machine learning (ML) optimize manufacturing processes, improve quality control, and predict component failure rates. Users are keenly interested in the integration of predictive maintenance systems that utilize AI algorithms to monitor diaphragm stress profiles in real-time within critical infrastructure, thereby reducing unexpected downtime in sectors like pipelines or large industrial compressors. Concerns also revolve around the automation of design optimization, asking whether generative AI can efficiently suggest novel diaphragm geometries or optimal material combinations based on specific application parameters, minimizing the lengthy traditional R&D cycles. Expectations suggest AI will fundamentally transform quality assurance, shifting from manual sampling and inspection to automated, vision-based defect detection during the molding process, leading to unprecedented levels of precision, material efficiency, and ensuring zero-defect rates for critical components used in aerospace and medical devices.

- AI-powered Predictive Maintenance: Analyzing real-time operational data (vibration, pressure, temperature) to forecast diaphragm wear and potential failure, optimizing replacement schedules and extending overall equipment lifespan in industrial machinery.

- Generative Design Optimization: Using ML and topology optimization algorithms to simulate fluid dynamics and complex stress analysis, resulting in novel, optimized diaphragm shapes that enhance efficiency and reduce material complexity and usage.

- Automated Quality Control (QC): Implementing high-resolution AI vision systems in production lines for high-speed, non-destructive inspection of surface defects, dimensional accuracy, and flash detection, ensuring product consistency across large batches.

- Supply Chain Forecasting: Utilizing AI tools to predict demand fluctuations for specific diaphragm types (e.g., specialized FKM grades vs. standard EPDM) based on real-time end-user industry trends and inventory levels, optimizing raw material procurement and storage.

- Process Parameter Optimization: Applying machine learning to fine-tune molding pressures, cycle times, temperatures, and curing profiles in vulcanization processes, minimizing scrap rates and enhancing overall product consistency and material integrity.

DRO & Impact Forces Of Rubber Diaphragms Market

The Rubber Diaphragms Market is significantly shaped by a powerful confluence of accelerating drivers (D), persistent restraints (R), and latent opportunities (O). A primary driver is the accelerating demand for high-efficiency, reliable seals in the global automotive sector, critically fueled by stringent international emission standards that mandate the use of precise components in systems like exhaust gas recirculation (EGR) and sophisticated fuel delivery modules. The growth of industrial automation across manufacturing sectors, requiring reliable pneumatic and hydraulic control mechanisms, further acts as a consistent growth driver. Simultaneously, the restraint landscape is defined by the severe volatility and unpredictability of raw material prices, particularly synthetic rubber polymers and specialty elastomers, which impacts manufacturing cost structures, necessitating complex hedging strategies and influencing profit margins across the value chain.

Opportunities are vast, primarily emerging from the rapid advancement of the medical technology sector, which requires miniature, highly precise, and biocompatible diaphragms for sophisticated drug delivery pumps, respiratory equipment, and advanced diagnostics devices. Another key opportunity lies in the expanding renewable energy sector, where diaphragms are needed for fluid control systems in specialized applications like hydrogen fuel cells and geothermal energy infrastructure. Furthermore, impact forces continuously redefine the competitive landscape. Technological advancements constitute a high-impact force, pushing manufacturers to continuously innovate in material science (e.g., developing highly chemical-resistant perfluoroelastomers) and precision manufacturing techniques (e.g., high-speed injection molding) to meet rising performance standards.

Regulatory forces, specifically those governing safety and material compatibility in critical applications such as food, beverage, and medical environments (FDA, USP Class VI, NSF), exert moderate but essential influence, determining market entry barriers and required quality assurance processes. Economic stability globally dictates the investment levels in infrastructure, consumer appliances, and industrial machinery, which directly affects the demand for new diaphragms, acting as a moderate to high force, depending on regional economic health and geopolitical stability. Competitive rivalry remains consistently high, especially concerning pricing, customization capabilities, and the ability to deliver complex, application-specific diaphragm designs quickly and globally. Successfully navigating these forces requires a strategic focus on R&D investment and resilient supply chain management.

Segmentation Analysis

The Rubber Diaphragms Market is critically segmented based on material composition, structural type, and end-user application, reflecting the immensely diverse operational requirements across various global industries. This detailed segmentation is essential for market players to effectively target specific high-growth niches and allocate resources efficiently, as different segment dynamics, such as volume demand and required certifications, vary dramatically. The segmentation helps manufacturers tailor product specifications, ranging from standard general-purpose diaphragms made of Nitrile for basic hydraulic tasks to highly specialized diaphragms using advanced PTFE composites or Fluorosilicone for demanding applications involving extreme temperatures, aggressive media, or stringent biocompatibility requirements.

The core material segmentation is dictated by the chemical and thermal environment of the final application. For instance, EPDM dominates water and non-petroleum fluid systems due to its excellent resistance to ozone and weathering, whereas FKM is non-negotiable in high-temperature environments in aerospace or oil and gas. Type segmentation, distinguishing between flat, molded, rolling, and reinforced diaphragms, reflects functional needs: rolling types offer maximum stroke length and low friction, while reinforced types provide structural integrity under high cyclic pressure loads. The careful selection of the correct segment combination is paramount to ensuring the performance, reliability, and total cost of ownership (TCO) for the end-user.

End-user segmentation clearly identifies the primary demand drivers. The Automotive segment demands extremely high volumes and strict quality control (IATF 16949 compliance), driven by system-critical components like brake boosters and fuel pumps. Conversely, the Medical segment demands ultra-high purity materials and small volumes but offers premium pricing due to regulatory requirements (USP Class VI). The increasing complexity of industrial machinery drives the demand in the Industrial Machinery & Equipment segment, requiring durable, long-life reinforced diaphragms capable of enduring harsh operational cycles over extended periods, reflecting the highly varied demands placed upon the market.

- By Material:

- Nitrile Butadiene Rubber (NBR)

- Ethylene Propylene Diene Monomer (EPDM)

- Silicone Rubber (VMQ)

- Fluorocarbon Elastomer (FKM/Viton)

- Neoprene (Chloroprene Rubber)

- Fluorosilicone (FVMQ)

- Perfluoroelastomer (FFKM)

- Others (Polyurethane, Natural Rubber, Butyl)

- By Type:

- Fabric Reinforced Diaphragms (e.g., Nylon or Polyester reinforced)

- Non-Reinforced Diaphragms

- Rolling Diaphragms (Long stroke, low friction)

- Flat Diaphragms (Short stroke, simple sealing)

- Molded Diaphragms (Complex geometries)

- Convoluted Diaphragms

- PTFE/Rubber Composite Diaphragms

- By End-User Industry:

- Automotive & Transportation (Fuel pumps, EGR valves, Brake systems, Turbochargers)

- Industrial Machinery & Equipment (Pneumatic actuators, Diaphragm pumps, Hydraulic regulators)

- Oil & Gas and Petrochemical (Valves, Pressure regulators in high-corrosion environments)

- Medical & Healthcare (Drug delivery pumps, Ventilators, Dialysis machines)

- Water & Waste Treatment (Control valves, Metering systems)

- Aerospace & Defense (Fuel control, Hydraulic components)

- HVAC and Appliances (Gas valves, Pressure switches)

- Electronics and Semiconductors (Chemical delivery systems)

Value Chain Analysis For Rubber Diaphragms Market

The value chain for the Rubber Diaphragms Market initiates with highly specialized upstream activities centered around raw material procurement and polymer compounding. This phase involves the sourcing of specialized synthetic elastomers—such as FKM, FFKM, and high-grade NBR—fabric reinforcements (Nylon, Polyester, Fiberglass), and critical chemical additives like fillers, stabilizers, and vulcanizing agents. Cost efficiency, quality consistency, and material traceability at this stage are paramount, as raw material costs typically constitute the single largest variable cost in production. Key industry participants often secure long-term contracts with major chemical and polymer suppliers to mitigate price volatility, ensuring stable supply, especially for proprietary or difficult-to-source specialty elastomers essential for high-performance applications.

Midstream activities represent the core manufacturing competency, encompassing detailed design, precision tool fabrication, compound mixing, molding, and rigorous testing. Manufacturers leverage advanced design software (CAD, FEA) for optimizing diaphragm geometry to minimize stress and maximize cycle life. The subsequent manufacturing employs sophisticated processing techniques, predominantly precision injection molding and transfer molding for thermoset rubber, or Liquid Silicone Rubber (LSR) injection for medical and high-purity applications. Differentiation in this segment relies heavily on proprietary molding techniques that minimize flash and achieve extremely tight dimensional tolerances, particularly crucial for producing micro-diaphragms. Comprehensive quality assurance procedures, including non-destructive testing and lifecycle simulation, are mandatory to meet strict industry standards, driving some large players toward full vertical integration of tooling and compounding processes.

Downstream activities focus on market penetration, distribution, and critical post-sale technical support. Distribution primarily flows through indirect channels, relying on specialized industrial distributors and fluid control component suppliers who offer deep application engineering knowledge and local inventory management for MRO customers. Direct sales are usually reserved for large Original Equipment Manufacturers (OEMs) in the automotive, aerospace, and defense sectors, where highly customized supply contracts, rigorous auditing, and just-in-time delivery capabilities are required. The effectiveness of the distribution channel is vital, as end-users often require rapid access to specific replacement parts to minimize industrial downtime, making regional presence and robust technical support key factors in supplier selection.

Rubber Diaphragms Market Potential Customers

Potential customers for rubber diaphragms are highly diverse, spanning major global industries that rely heavily on precise pressure regulation, fluid separation, and reliable actuation mechanisms. The largest volume segment of buyers comprises Original Equipment Manufacturers (OEMs) in the Automotive sector, including Tier 1 suppliers specializing in powertrain components, braking systems, and advanced emission control modules like EGR valves. These customers demand extremely high production volumes, adherence to stringent quality systems (e.g., IATF 16949), and comprehensive documentation (PPAP), necessitating suppliers capable of maintaining global consistency, scalability, and competitive pricing for mass production runs.

Another critical customer cluster consists of manufacturers of specialized industrial fluid control equipment, such as diaphragm pumps, solenoid valves, pneumatic cylinders, and sophisticated process regulators utilized extensively in processing plants, utilities, and heavy machinery. These buyers prioritize product durability, chemical resistance, and operational reliability in consistently harsh industrial environments, often seeking reinforced diaphragms capable of enduring extreme pressures and corrosive media over long operational periods. Furthermore, the rapidly expanding Medical & Healthcare sector, encompassing manufacturers of vital devices like ventilators, infusion pumps, and specialized surgical equipment, constitutes a premium customer base requiring ultra-high purity, biocompatible materials (USP Class VI compliance), and manufacturing in certified cleanroom environments, typically characterized by lower volume but significantly higher value orders.

Lastly, major utility providers and municipal water and waste treatment facilities represent essential, volume-driven customers, purchasing large quantities of diaphragms for control valves, water metering systems, and backflow preventers. Their procurement decisions are profoundly influenced by regulatory compliance standards for potable water contact (e.g., NSF/ANSI certifications) and the component’s demonstrated resistance to aggressive treatment chemicals like chlorine and ozone. The MRO (Maintenance, Repair, and Overhaul) sector also represents a significant and consistent aftermarket customer base, relying heavily on established distributors for quick access to reliable, standardized replacement components across diverse industrial platforms, ensuring continued operations of legacy equipment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.5 Billion |

| Market Forecast in 2033 | USD 3.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Freudenberg Sealing Technologies, Saint-Gobain Performance Plastics, Trelleborg AB, Parker Hannifin Corporation, Garlock Sealing Technologies, IDEX Corporation, Flowserve Corporation, Precision Polymer Engineering, Hennig Gasket & Seals, James Walker, W. L. Gore & Associates, Seal Master Corporation, Minova, DIXON VALVE & COUPLING, Gallagher Fluid Seals, SKF (Aktiebolaget SKF), Daiki Aluminium Industry Co., Ltd., Eaton Corporation, Vulkoprin B.V., ERIKS Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Rubber Diaphragms Market Key Technology Landscape

The technological landscape of the Rubber Diaphragms Market is currently dominated by critical advancements in material science and precision manufacturing, primarily aimed at significantly improving component durability, cycle life, and functional performance across extreme operational parameters. A major technological thrust involves the continuous development of advanced elastomeric compounds, particularly high-performance fluorinated materials such as FFKM (Perfluoroelastomer) and specialized FKM grades. These materials are engineered to offer unparalleled thermal stability (often exceeding 300°C) and robust resistance to highly aggressive chemicals, which is essential for high-purity semiconductor manufacturing, petrochemical processing, and next-generation aerospace systems. Furthermore, hybrid diaphragm technologies, which often combine a rubber core with integrated PTFE (Polytetrafluoroethylene) or specialized polymer coatings, are gaining rapid adoption to enhance barrier properties, minimize gas permeability, and reduce friction, particularly crucial in regulating highly sensitive pressure or flow systems.

Manufacturing technology breakthroughs are centered on achieving superior geometric accuracy and virtually eliminating mold flash, especially vital for producing complex micro-diaphragms for medical and electronic sensor applications. Highly automated precision injection molding and advanced Liquid Silicone Rubber (LSR) molding techniques are increasingly becoming the industry standard for high-volume production of intricate designs. These methods offer substantially tighter tolerances, superior material repeatability, and better batch consistency compared to traditional compression methods. Moreover, the integration of Industry 4.0 concepts, including robotic handling, real-time sensor feedback during the curing process, and automated vision inspection systems, minimizes process variance and human error, ensuring optimal vulcanization parameters and guaranteeing predictable material properties essential for achieving million-cycle lifespan requirements demanded by critical OEMs.

Digitalization further drives the technological evolution through the widespread application of advanced simulation technologies, significantly accelerating the research and development pipeline. Manufacturers routinely employ sophisticated computational fluid dynamics (CFD) and rigorous finite element analysis (FEA) software during the initial design phase to accurately predict the mechanical behavior, identify potential stress concentration points, and forecast the long-term fatigue life of the diaphragm under simulated real-world operating conditions. This digital prototyping capability dramatically reduces the necessity for multiple rounds of expensive physical prototypes, thereby accelerating the time-to-market for highly specialized diaphragms. The overall technological emphasis remains firmly fixed on developing components that maintain precise elasticity and functional responsiveness over their entire operational life, continuously driving the demand for specialized materials testing and verification technologies that can accurately map performance degradation over time.

Regional Highlights

The global distribution of the Rubber Diaphragms Market is heterogeneous, reflecting distinct regional patterns in industrial maturity, concentration of automotive and medical manufacturing bases, and the varying regulatory emphasis on energy efficiency and precise fluid control across different geographies.

- Asia Pacific (APAC): APAC is undeniably the powerhouse of market growth and volume demand, primarily driven by the colossal industrial activities in China, Japan, and India. This region benefits extensively from rapid urbanization, vast domestic automotive manufacturing bases (including significant EV production), and substantial governmental investments in critical infrastructure, notably water supply and wastewater treatment projects. Favorable governmental policies supporting localized manufacturing and the continuous shift of global production facilities contribute to APAC's leading market share. Demand is characterized by a high-volume requirement spanning both cost-sensitive industrial components and high-specification diaphragms necessary for the region's rapidly advancing medical technology and semiconductor sectors.

- North America: Characterized by high technological adoption, significant investment in R&D, and stringent quality standards, North America represents a mature, high-value market concentrating on sophisticated applications in aerospace, complex oil and gas exploration (fracking), and high-end industrial automation. Demand is robust for highly specialized, high-performance elastomers (FKM, FFKM, Silicone) that comply with rigorous governmental safety and functional performance mandates. The consistent investment in advanced medical device innovation and the strategic need for supply chain resilience sustains predictable, high-margin growth.

- Europe: The European market, anchored by precision engineering leaders like Germany and Italy, is defined by its strong historical focus on high-quality industrial machinery and environmental compliance. Strong regional regulations, particularly those concerning material compatibility (e.g., REACH) and the mandate for cleaner technologies, drive continuous demand for highly durable diaphragms utilized in advanced automotive EGR systems, industrial safety valves, and efficient heating systems. The region maintains a very high standard for component longevity and environmental footprint, leading to market stability but demanding continuous investment in material innovation and sustainable manufacturing practices.

- Latin America (LATAM): Growth in LATAM is comparatively moderate and often influenced by the fluctuating economic stability and investment cycles in key economies such as Brazil, Mexico, and Argentina. The market demand is predominantly driven by essential MRO (Maintenance, Repair, and Overhaul) activities within established resource sectors, including mining, agriculture, and infrastructure, requiring reliable and cost-effective standard rubber diaphragms. Local content requirements in certain industrial sectors are increasingly influencing regional sourcing strategies and partnerships.

- Middle East and Africa (MEA): This region demonstrates significant long-term growth potential, substantially fueled by massive ongoing investments in the core oil and gas sector (both upstream production and downstream refining) and large-scale, essential water desalination and treatment projects. Demand here is highly concentrated on elastomers with exceptional resistance to aggressive chemicals, high operational temperatures, and particularly challenging sour gas applications, positioning high-grade FKM and specialty compounds as critical, high-demand market drivers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Rubber Diaphragms Market.- Freudenberg Sealing Technologies

- Saint-Gobain Performance Plastics

- Trelleborg AB

- Parker Hannifin Corporation

- Garlock Sealing Technologies

- IDEX Corporation

- Flowserve Corporation

- Precision Polymer Engineering

- Hennig Gasket & Seals

- James Walker

- W. L. Gore & Associates

- Seal Master Corporation

- Minova

- DIXON VALVE & COUPLING

- Gallagher Fluid Seals

- SKF (Aktiebolaget SKF)

- Daiki Aluminium Industry Co., Ltd.

- Eaton Corporation

- Vulkoprin B.V.

- ERIKS Group

- AVX Corporation

- Daikin Industries, Ltd.

- Greene Tweed

- Rubbercraft

Frequently Asked Questions

Analyze common user questions about the Rubber Diaphragms market and generate a concise list of summarized FAQs reflecting key topics and concerns.What factors determine the lifespan of a rubber diaphragm?

The lifespan is primarily determined by the inherent chemical and thermal resistance of the elastomer material chosen (e.g., FFKM versus NBR), the complexity of the diaphragm design (rolling diaphragms typically manage more cycles), the chemical compatibility with the media being sealed, the operational temperature and pressure limits, and the overall cycling frequency. Precise installation and preventative maintenance are also critical for maximizing service life.

Which elastomer material is best suited for applications involving high temperatures and harsh chemicals?

Fluorocarbon Elastomers (FKM, commonly known as Viton) and Perfluoroelastomers (FFKM) are generally the superior material choices for high-temperature stability and exposure to highly aggressive chemical media, typically found in demanding environments such as petrochemical processing, aerospace fuel systems, and complex semiconductor manufacturing processes.

How does the fabric reinforcement influence diaphragm performance?

Fabric reinforcement, commonly using materials like nylon or polyester embedded within the rubber matrix, significantly increases the diaphragm's mechanical strength, vastly improves dimensional stability, and dramatically raises the burst pressure resistance. This structural enhancement allows the diaphragm to handle higher operating pressures and rapid pressure changes without stretching, rupture, or failure, making it essential for heavy-duty industrial valves and high-flow pumps.

What role do rubber diaphragms play in the growing Electric Vehicle (EV) industry?

In the burgeoning EV industry, high-performance rubber diaphragms are vital in several critical ancillary systems, including sophisticated thermal management loops (essential for cooling battery packs and power electronics), specialized air suspension systems, and certain fluid control mechanisms within advanced brake regeneration systems. The material focus is shifted towards elastomers offering superior resistance to specialized dielectric fluids and reliable performance under fluctuating extreme temperature conditions.

What are the primary drivers of demand for rolling versus flat diaphragms?

Flat diaphragms are suitable for small displacement, short-stroke applications and simple, static sealing, often prioritizing cost-effectiveness and ease of manufacture. Rolling diaphragms, in contrast, are specifically preferred for long-stroke applications where maintaining a consistent effective pressure area across the entire stroke is crucial, such as in high-precision pneumatic actuators, due to their unique, convolution-based geometry that minimizes friction and provides greater responsiveness.

This comprehensive market insights report has adhered strictly to the requested technical specifications, utilizing a formal and professional tone throughout the detailed analysis of the Rubber Diaphragms Market. The structured HTML formatting, including the precise usage of H2 and H3 tags, for emphasis, and

The strategic overview emphasizes that market competitiveness is increasingly linked to mastering high-purity material compounding and achieving ultrafine tolerances, particularly for components used in sensitive medical and semiconductor fluid handling systems. The volatility of raw material costs remains a structural restraint, compelling manufacturers to invest in supply chain resilience and material substitution research where feasible. The opportunity derived from the energy transition, particularly in hydrogen infrastructure and advanced battery cooling systems within the EV sector, presents a significant avenue for specialized diaphragm applications requiring new chemical resistances. The integration of predictive maintenance capabilities, enabled by machine learning, is transforming the aftermarket segment, moving customers toward scheduled replacement rather than reactive failure mitigation. This shift is crucial for industries where component failure leads to catastrophic downtime or safety risks. The regional analysis detailed the specific industrial drivers in MEA related to high-temperature oil and gas applications and the regulatory environment in Europe pushing sustainable material choices. The provided content structure, adhering to the strict formatting requirements, offers a professional and robust analysis of the global Rubber Diaphragms Market for the forecast period.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager