Rubber Molding Machines Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435322 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Rubber Molding Machines Market Size

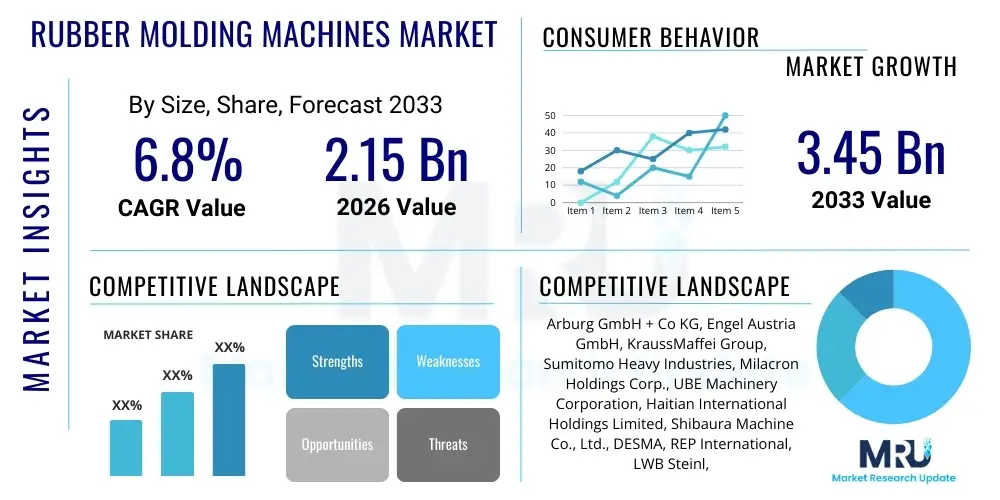

The Rubber Molding Machines Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $2.15 billion in 2026 and is projected to reach $3.45 billion by the end of the forecast period in 2033.

Rubber Molding Machines Market introduction

The Rubber Molding Machines Market encompasses highly specialized industrial equipment designed for transforming raw rubber compounds into finished products with precise shapes and characteristics. These machines—including injection molding, compression molding, and transfer molding variants—are critical to manufacturing components requiring high elasticity, durability, and resistance to environmental factors, such as seals, gaskets, O-rings, dampeners, and tires. The core function of these devices is to heat, compress, and cure rubber materials within molds under extreme pressure, ensuring consistency and minimizing material waste across high-volume production cycles.

The demand for advanced rubber molding technology is intrinsically linked to the expansion of critical end-use industries, particularly the automotive, medical device, aerospace, and consumer goods sectors. Automotive electrification is a major growth driver, necessitating high-performance rubber components for battery casings, thermal management systems, and specialized sealing applications that withstand harsh chemical environments and high voltages. Furthermore, the medical industry relies heavily on precision rubber molding for disposable components, drug delivery systems, and surgical equipment, pushing manufacturers towards machines offering superior repeatability and contamination control.

Benefits associated with modern rubber molding machines include significantly enhanced production efficiency, reduced cycle times through improved material heating and cooling systems, and heightened accuracy driven by digital control systems. Key driving factors stimulating market growth involve stringent regulatory requirements in automotive safety and medical purity, the increasing adoption of automated manufacturing processes (Industry 4.0 integration), and the ongoing shift towards advanced, high-specification synthetic and natural rubber compounds that necessitate specialized, high-pressure processing capabilities.

Rubber Molding Machines Market Executive Summary

The Rubber Molding Machines Market is experiencing robust expansion driven by global industrial automation trends and specialized requirements across high-growth sectors. Business trends indicate a strong move towards all-electric and hybrid molding machines, favoring energy efficiency, reduced operational noise, and exceptional process control precision over traditional hydraulic systems. Manufacturers are focusing heavily on integrating IoT sensors and cloud-based monitoring platforms to facilitate predictive maintenance and real-time quality assurance, optimizing uptime and material throughput. Furthermore, sustainability is becoming a key differentiator, pushing the development of machines capable of processing high-performance elastomers and specialized recycled materials with minimal scrap generation.

Regionally, Asia Pacific (APAC) maintains its dominance, primarily fueled by the massive automotive manufacturing base in China, India, and Japan, coupled with rapid industrialization and escalating domestic demand for consumer electronics and medical devices. North America and Europe, while mature markets, are leading the adoption of highly advanced, automated machinery geared towards high-precision applications like aerospace seals and complex medical components, driven by stringent quality standards and high labor costs necessitating full automation. The competitive landscape in these regions is focused on technological leadership and customization capabilities tailored to specific high-tolerance manufacturing needs.

Segment trends reveal that Injection Molding Machines hold the largest market share due to their suitability for high-volume, automated production of intricate components with tight tolerances. However, Compression Molding Machines remain vital for large components like specific tire types and heavy-duty industrial gaskets. In terms of end-use, the automotive sector remains the primary revenue generator, but the medical device segment is projected to exhibit the fastest growth CAGR, spurred by global healthcare investment and the demand for miniature, high-purity elastomer parts. The market dynamics are currently emphasizing digitalization, material traceability, and continuous process optimization.

AI Impact Analysis on Rubber Molding Machines Market

Common user questions regarding AI’s influence on the Rubber Molding Machines Market center on how artificial intelligence can optimize historically manual or empirical processes, specifically cycle time reduction, defect prediction, and material usage efficiency. Users frequently inquire about the feasibility of autonomous quality control systems replacing human inspection, the ability of AI algorithms to compensate for material variability in real-time, and the return on investment (ROI) associated with implementing complex machine learning models into legacy molding equipment. The key thematic concerns revolve around data security, the necessity for standardized data labeling in industrial settings, and the required skill upgrade for machine operators transitioning to AI-managed production environments, all summarized by the expectation that AI will transition rubber molding from a skilled craft to a data-driven science.

The introduction of AI and Machine Learning (ML) algorithms is fundamentally transforming the operational efficiency and quality control parameters within the rubber molding industry. AI models are now capable of analyzing vast streams of sensor data—including temperature fluctuations, pressure curves, and material flow rates—to predict potential defects or process anomalies seconds before they manifest. This shift from reactive troubleshooting to proactive prediction allows manufacturers to maintain optimal processing parameters consistently, reducing scrap rates significantly. Furthermore, AI-driven process optimization facilitates 'self-tuning' machinery, where algorithms automatically adjust parameters (e.g., curing time, injection speed) based on raw material batch variations or environmental changes, ensuring consistent output quality across diverse production conditions.

Beyond process control, AI is significantly impacting maintenance and design. Predictive maintenance schedules, managed by ML, analyze vibrational and thermal data to anticipate component failure (such as heaters or hydraulic pumps), maximizing machine uptime and extending the operational lifespan of expensive capital equipment. In the design phase, generative AI tools are assisting engineers in simulating mold flow dynamics and optimizing vent locations, reducing the traditional trial-and-error cycle required for new mold development. This integration ensures not only higher production quality but also faster market entry for new rubber components, aligning the industry with the speed demanded by sectors like electric vehicle manufacturing.

- AI-Powered Predictive Maintenance: Reduces unplanned downtime by forecasting equipment failure based on real-time sensor data analysis.

- Autonomous Quality Inspection: Utilizes machine vision and deep learning to identify microscopic defects, surpassing human inspection speed and accuracy.

- Real-Time Process Optimization: Machine learning algorithms dynamically adjust injection and curing parameters based on material variability and environmental conditions.

- Cycle Time Reduction: AI identifies non-critical holding or cooling times that can be safely minimized without compromising component integrity.

- Simulation and Design Optimization: Generative AI aids in rapid prototyping and mold design refinement, reducing time-to-market for new parts.

DRO & Impact Forces Of Rubber Molding Machines Market

The Rubber Molding Machines Market is powerfully shaped by significant Drivers related to industrial modernization and sector-specific demand, countered by certain structural Restraints, while offering compelling growth Opportunities, collectively defining the Impact Forces that govern market expansion. The primary driver is the accelerating shift towards electric vehicle (EV) production globally, which necessitates complex, high-performance seals, vibration dampeners, and gaskets made from highly durable elastomers, requiring precision injection molding machinery. This high-growth automotive segment places intense pressure on manufacturers to scale production capacity and improve machine repeatability, ensuring zero-defect components critical for battery safety and thermal management systems.

However, the market faces structural restraints, chiefly the extremely high capital expenditure required for acquiring advanced, fully automated injection molding machines, particularly the all-electric variants which offer superior precision but carry a premium price tag. This high barrier to entry limits the rapid modernization potential for smaller and medium-sized enterprises (SMEs). Another restraint is the inherent complexity associated with processing diverse rubber compounds, often requiring specialized training and expertise for machine operation and maintenance, contributing to operational overheads and potential production variability if expertise is lacking. Furthermore, geopolitical instability affecting global supply chains for specialized machine components and high-grade steel molds introduces cost fluctuations and lead time uncertainties.

Opportunities for sustained market expansion are abundant, particularly in the adoption of sustainable manufacturing practices and the penetration of new geographical markets. The rising industry focus on circular economy principles creates opportunities for developing machines optimized for recycling rubber or processing bio-based and sustainable elastomer compounds, meeting corporate environmental mandates. Furthermore, the burgeoning demand for miniature, high-tolerance components in the implantable medical device and micro-fluidic sectors necessitates specialized micro-molding machines, representing a lucrative niche opportunity. The combined Impact Forces underscore a market characterized by high technical innovation requirements, high initial investment costs, and significant long-term growth potential anchored in the precision manufacturing demands of future-forward industries.

Segmentation Analysis

The Rubber Molding Machines Market is segmented primarily based on Machine Type (Injection Molding, Compression Molding, Transfer Molding), Mode of Operation (Hydraulic, Electric, Hybrid), End-Use Industry (Automotive, Medical, Consumer Goods, Industrial), and geographical regions. This segmentation is crucial as different machine types cater to vastly different production scales and component complexity requirements. Injection molding dominates in sectors requiring high throughput and complex shapes, such as automotive seals and precision medical components, leveraging its speed and automation capabilities. Meanwhile, hydraulic machines, while gradually losing ground to electric and hybrid models, remain cost-effective for extremely high-tonnage applications where brute force clamping is essential, typically in heavy industrial molding.

The transition toward electric and hybrid machines reflects the industry's focus on AEO principles—specifically energy efficiency and reduced total cost of ownership (TCO). Electric machines offer granular control over injection velocity and pressure profiles, minimizing material waste and ensuring unparalleled repeatability, which is a key buying criterion for Tier 1 suppliers in regulated industries. End-use segmentation highlights the market's dependence on the automotive industry for volume, covering everything from engine mounts and tires to specialized EV seals. The fastest growth, however, is observed within the Medical and Aerospace sectors, driven by the demand for highly regulated, high-performance elastomer components that require zero defects and certified production environments.

Geographically, market segmentation reinforces the strategic importance of the APAC region due to its expansive manufacturing ecosystem. However, technological development and the concentration of high-end, precision manufacturing facilities remain focused in North America and Europe, which demand advanced, custom-engineered machinery. Analyzing these segments provides strategic insights into investment priorities, indicating a future leaning towards highly automated, energy-efficient injection molding solutions capable of handling specialized, high-performance rubber materials.

- By Machine Type:

- Injection Molding Machine

- Compression Molding Machine

- Transfer Molding Machine

- By Mode of Operation:

- Hydraulic

- All-Electric

- Hybrid

- By End-Use Industry:

- Automotive and Transportation

- Medical and Healthcare

- Consumer Goods

- Industrial Goods and Machinery

- Aerospace and Defense

- By Region:

- North America (U.S., Canada)

- Europe (Germany, UK, France, Italy)

- Asia Pacific (China, Japan, India, South Korea)

- Latin America (Brazil, Mexico)

- Middle East & Africa (MEA)

Value Chain Analysis For Rubber Molding Machines Market

The value chain for the Rubber Molding Machines Market begins with sophisticated upstream activities focused on raw material procurement and complex component manufacturing. Key upstream suppliers include specialized manufacturers of high-tonnage clamping units, precision heating elements, advanced hydraulic systems (for traditional models), and, crucially, high-performance servo motors and control electronics necessary for all-electric and hybrid machines. The quality and performance of components like controllers, pumps, and specialized steel alloys used in molding barrels significantly dictate the final machine’s precision and lifespan. A strong reliance exists on global semiconductor and automation component suppliers, making the upstream segment highly sensitive to technological obsolescence and supply chain shocks, particularly concerning digitally controlled systems.

The core of the value chain involves the Original Equipment Manufacturers (OEMs) who engage in machine design, precision assembly, and rigorous testing. This stage is characterized by significant R&D investment, focusing on thermal management, clamping force uniformity, and integrating advanced control software (HMI, process monitoring). Distribution channels represent a crucial link, often involving a mix of direct sales teams for major, highly customized installations and specialized regional distributors who provide local sales, technical support, and critical after-sales service, including maintenance contracts and spare parts supply. Indirect distribution, leveraging engineering procurement firms and specialized system integrators, is also utilized, especially for large, turnkey factory projects.

Downstream activities center on the end-users—the component manufacturers who utilize these machines to produce finished rubber parts for sectors like automotive and medical. This segment demands extensive technical support, operator training, and high-quality maintenance services to ensure continuous, precise operation. The final stage involves the component buyers (e.g., car makers, medical device companies) who dictate the stringent quality standards, thereby influencing the required sophistication of the molding machine itself. The continuous feedback loop from the downstream users regarding machine performance, energy consumption, and repeatability is vital for driving upstream innovation and technological improvements, focusing the entire chain on delivering high throughput with minimal waste.

Rubber Molding Machines Market Potential Customers

The potential customer base for Rubber Molding Machines is highly diversified but fundamentally anchored by manufacturers requiring precision elastomer components in high volumes and under strict quality controls. The largest segment comprises Tier 1 and Tier 2 suppliers within the automotive industry, who need these machines to produce sealing systems (oil seals, gaskets), anti-vibration mounts, brake components, and increasingly, specialized high-voltage seals and battery pack components for electric vehicles. These customers prioritize high repeatability, fast cycle times, and the capability to integrate machines into fully automated production cells, driving demand for all-electric and hybrid models with high tonnage capabilities.

Another rapidly expanding customer segment includes manufacturers of medical devices and pharmaceutical packaging. These buyers require machines offering superior cleanliness, minimal contamination risks, and extremely high precision for producing miniature components like stoppers, plungers, caps, and complex internal pump components. For this segment, equipment validation, material traceability systems, and sterile operational environments are paramount, making suppliers who offer specialized liquid silicone rubber (LSR) injection molding systems highly attractive. The rigorous regulatory environment governing these end-users ensures a sustained demand for certified, top-of-the-line machinery with detailed data logging capabilities.

Furthermore, major industrial manufacturers, including those in aerospace, construction, and general machinery, constitute a stable customer base. These sectors utilize molded rubber for heavy-duty gaskets, specialized seals designed to withstand extreme temperatures or chemical exposure, and large-format dampening components. These customers often utilize robust compression and transfer molding machines alongside large-tonnage hydraulic injection systems. Finally, custom rubber component job shops and molders, who serve multiple industries by manufacturing specialized, smaller-batch parts, represent consistent buyers of versatile, medium-sized machinery capable of quick mold changeovers and flexible material processing capabilities.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $2.15 billion |

| Market Forecast in 2033 | $3.45 billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Arburg GmbH + Co KG, Engel Austria GmbH, KraussMaffei Group, Sumitomo Heavy Industries, Milacron Holdings Corp., UBE Machinery Corporation, Haitian International Holdings Limited, Shibaura Machine Co., Ltd., DESMA, REP International, LWB Steinl, VMI Group, Maplan, Multitech Machinery Co., Ltd., Gomaplast Machinery, DEKUMA Rubber and Plastic Technology, Yizumi Group, Tung Yu Hydraulic Machinery Co. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Rubber Molding Machines Market Key Technology Landscape

The technology landscape of the Rubber Molding Machines Market is rapidly evolving, driven primarily by the need for superior precision, energy efficiency, and seamless integration into smart factory environments (Industry 4.0). The most significant technological shift is the acceleration in the adoption of all-electric molding machines. These machines utilize highly precise servo-motor technology for every axis of movement—clamping, injection, and ejection—offering repeatable accuracy within microns, crucial for highly regulated industries like medical and aerospace. They consume significantly less energy than traditional hydraulic systems and eliminate the risks associated with hydraulic oil contamination, addressing critical sustainability and operational cleanliness requirements increasingly demanded by advanced manufacturers globally.

Another essential technological innovation is the deployment of sophisticated cold runner block systems, particularly in injection molding for Liquid Silicone Rubber (LSR). These systems maintain the rubber compound below curing temperature until it reaches the mold cavity, minimizing material waste (flash and runner scrap) and significantly improving material utilization efficiency. This technology, coupled with advanced nozzle designs and highly controlled temperature zones, allows for the processing of increasingly viscous and sensitive elastomers with greater speed and reduced risk of premature vulcanization. Furthermore, the integration of vacuum technology, especially in compression and transfer molding, is becoming standard practice to eliminate air pockets and voids within the molded part, thereby improving mechanical integrity and reducing scrap rates.

Digitalization forms the backbone of modern machine operation. Advanced Human-Machine Interfaces (HMIs) now incorporate intuitive graphical programming and real-time process monitoring tools. Connectivity through Industrial IoT (IIoT) protocols enables machine-to-machine communication, centralized data acquisition, and remote diagnostics, facilitating predictive maintenance and overall equipment effectiveness (OEE) calculations across multiple production sites. This digital integration allows machine operators to utilize data analytics for sophisticated process adjustments, moving away from purely manual tuning towards an algorithmically guided manufacturing process, which is critical for maintaining competitiveness in global manufacturing environments.

Regional Highlights

The global Rubber Molding Machines Market exhibits distinct regional dynamics shaped by differing industrial maturity, regulatory landscapes, and manufacturing output volumes. These differences influence the type of machinery purchased and the primary growth drivers in each area.

- Asia Pacific (APAC): Dominates the market both in terms of production volume and installed base. This region is the global manufacturing hub for automotive components, consumer electronics, and general industrial goods, driven largely by China, India, and Southeast Asian economies. The growth is characterized by high volume demand for both standard hydraulic and modern, cost-effective hybrid injection machines, alongside significant investment in capacity expansion.

- North America: Characterized by high technological adoption and demand for specialized machinery. The focus here is on precision manufacturing for the aerospace, medical device, and specialized high-performance automotive (EV) sectors. Growth is heavily skewed toward high-end, all-electric machines and sophisticated LSR molding systems, driven by stringent quality standards and a higher emphasis on energy efficiency and automation to offset high labor costs.

- Europe: A mature, highly advanced market, notably led by Germany and Italy, known for manufacturing high-quality industrial machinery. The European market prioritizes sustainability, energy efficiency, and Industry 4.0 integration. Demand is strong for customized hybrid and electric molding solutions, specialized in producing high-tolerance components for the premium automotive segment, general industrial applications, and advanced packaging solutions.

- Latin America (LATAM): Represents an emerging market with moderate growth, primarily centered in Brazil and Mexico due to localized automotive assembly and consumer goods production. Market activity is generally focused on modernizing existing fleets, leading to demand for robust, reliable hydraulic and hybrid machines that offer a strong balance of performance and operational cost efficiency.

- Middle East and Africa (MEA): A nascent market with growth potential concentrated in industrial sectors, including oil & gas, infrastructure, and developing manufacturing bases. Demand is currently lower volume but focused on heavy-duty, reliable machinery (often compression or large hydraulic injection) required for sealing and industrial components that withstand harsh regional environmental conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Rubber Molding Machines Market.- Arburg GmbH + Co KG

- Engel Austria GmbH

- KraussMaffei Group

- Sumitomo Heavy Industries

- Milacron Holdings Corp.

- UBE Machinery Corporation

- Haitian International Holdings Limited

- Shibaura Machine Co., Ltd.

- DESMA

- REP International

- LWB Steinl

- VMI Group

- Maplan

- Multitech Machinery Co., Ltd.

- Gomaplast Machinery

- DEKUMA Rubber and Plastic Technology

- Yizumi Group

- Tung Yu Hydraulic Machinery Co.

Frequently Asked Questions

Analyze common user questions about the Rubber Molding Machines market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the adoption of all-electric rubber molding machines?

The primary factor is the superior precision, repeatability, and energy efficiency offered by electric machines compared to traditional hydraulic models. This precision is critical for high-tolerance applications in the medical and electric vehicle (EV) sectors, directly reducing material scrap and overall operational costs (Total Cost of Ownership).

How does the growth of the electric vehicle (EV) industry impact the Rubber Molding Machines Market?

EV growth significantly boosts demand for high-performance rubber molding machines capable of producing specialized high-voltage seals, thermal management gaskets, and battery housing components. These parts require robust, heat-resistant, and chemically stable elastomers processed using precision injection molding systems, driving market valuation.

Which geographical region dominates the Rubber Molding Machines Market in terms of volume?

The Asia Pacific (APAC) region, led by China and India, dominates the market in volume due to its extensive manufacturing base for automotive components, industrial goods, and consumer products, necessitating large-scale production capabilities.

What role does Industry 4.0 play in modern rubber molding operations?

Industry 4.0 facilitates integration of IoT sensors, data analytics, and AI/ML algorithms into machines. This enables predictive maintenance, real-time quality control, autonomous process tuning, and remote monitoring, maximizing machine uptime and overall manufacturing efficiency.

What are the main distinctions between compression molding and injection molding machines?

Compression molding is typically used for large, simple parts and lower volumes, where the material is placed directly into the heated mold cavity. Injection molding, conversely, is suitable for high-volume, complex, and intricate parts, where pre-plasticized material is forced into a closed mold cavity under high pressure, ensuring faster cycle times and consistent quality.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager