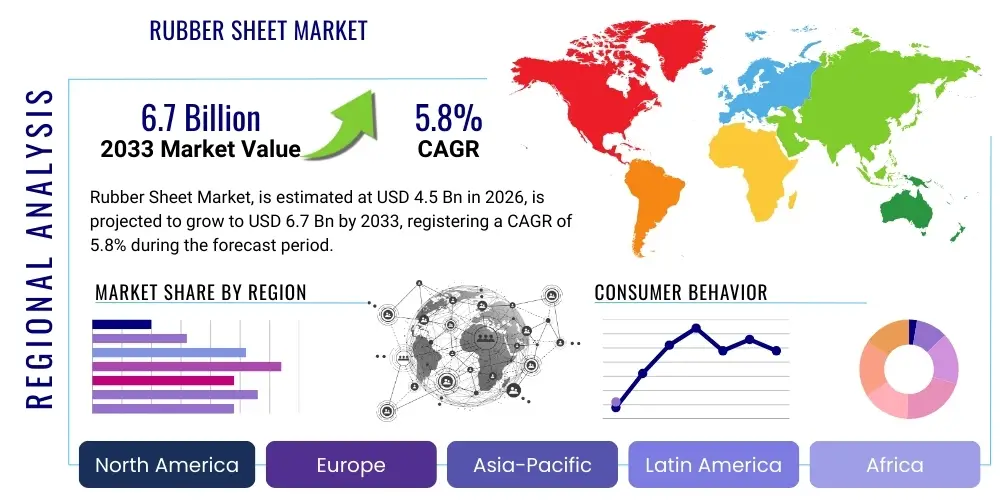

Rubber Sheet Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436274 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Rubber Sheet Market Size

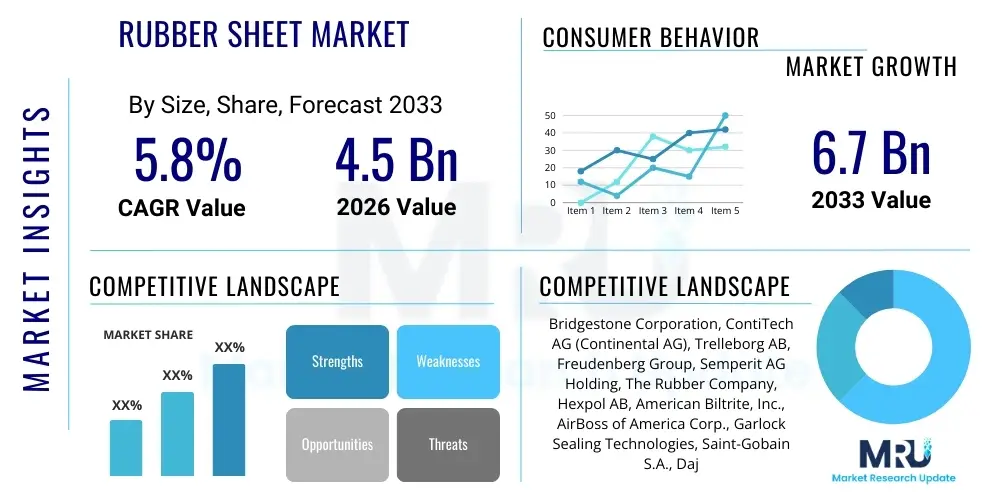

The Rubber Sheet Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 6.7 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally supported by robust demand across essential industrial sectors, particularly automotive manufacturing, construction, and specialized industrial equipment production, where rubber sheets serve critical functions such as sealing, vibration dampening, and insulation. The inherent versatility and superior mechanical properties of various elastomer compounds, including SBR, EPDM, and Nitrile, ensure their continuous integration into new and evolving engineering applications globally.

Rubber Sheet Market introduction

The Rubber Sheet Market encompasses the manufacturing, distribution, and application of flat, flexible materials derived primarily from natural rubber (NR) and various synthetic elastomers such as Styrene-Butadiene Rubber (SBR), Ethylene Propylene Diene Monomer (EPDM), Neoprene (CR), and Nitrile Butadiene Rubber (NBR). These sheets are produced through processes like calendering or extrusion and subsequent vulcanization, resulting in materials optimized for specific environments and performance criteria, including resistance to abrasion, chemicals, extreme temperatures, and weathering. The intrinsic value proposition of rubber sheets lies in their dual capability to provide effective sealing solutions—preventing leaks and ingress in pressurized systems—and outstanding shock absorption and sound insulation in dynamic mechanical assemblies. The market's complexity stems from the need to tailor material composition precisely to end-user requirements, balancing factors like Shore hardness, tensile strength, and elongation capabilities.

Product description highlights the essential function of rubber sheets as resilient barriers and mechanical components. They are categorized based on their thickness, width, length, and, most importantly, the type of polymer used, which dictates their suitability for harsh environments. Major applications span structural engineering, transportation infrastructure, fluid handling systems, and consumer goods manufacturing. In infrastructure, they are vital for bridge bearings and expansion joints; in automotive, they form crucial gaskets and vibration mounts; and in process industries, they are indispensable for lining tanks and hoppers. The inherent flexibility and customizable resistance profile of rubber sheets ensure they remain preferred materials over rigid plastics or metals in applications demanding pliability and dynamic performance.

Key driving factors include accelerated urbanization, which boosts construction activity demanding sealing and sound insulation products, and the ongoing expansion of the global automotive industry, particularly the transition towards electric vehicles (EVs), which require high-performance, lightweight rubber components for battery pack sealing and thermal management. Furthermore, stringent regulatory standards concerning workplace safety and environmental protection necessitate the use of specialized rubber sheets (e.g., fire-retardant or anti-static grades) in mining, oil and gas, and manufacturing facilities. The sustained focus on minimizing energy loss and maximizing operational efficiency across industries solidifies the demand for high-quality insulation and sealing materials provided by advanced rubber sheeting solutions.

- Market Intro: Global supply and demand of flexible elastomer products for industrial sealing, protection, and vibration control.

- Product Description: Vulcanized natural or synthetic elastomer materials (rolls or cut sheets) characterized by thickness, polymer type (SBR, EPDM, NBR), and specific resistance properties (chemical, thermal, abrasion).

- Major Applications: Gaskets and Seals, Conveyor Belting, Vibration Dampening Pads, Flooring and Matting, Tank Liners, and specialized automotive components.

- Benefits: Excellent sealing capability, superior elasticity and resilience, noise and vibration absorption, and resistance to diverse environmental factors (UV, ozone, acids).

- Driving factors: Growth in automotive manufacturing (especially EVs), rapid infrastructure development, and increasing industrial focus on equipment longevity and maintenance efficiency.

Rubber Sheet Market Executive Summary

The Rubber Sheet Market demonstrates resilience fueled by persistent industrialization in emerging economies and critical technological shifts in developed markets, particularly within the transportation and energy sectors. Business trends indicate a strong move toward specialization, where manufacturers are increasingly developing proprietary elastomer formulations offering enhanced characteristics, such as extremely low compression set, superior flame retardancy, or specialized oil resistance for aerospace and high-performance industrial applications. This shift drives higher Average Selling Prices (ASPs) for premium grades and encourages investments in advanced compounding and calendering machinery capable of producing precision sheets with tighter dimensional tolerances. Furthermore, sustainability is becoming a key business metric, leading to increased research into bio-based synthetic rubber alternatives and efficient recycling processes for end-of-life rubber products, impacting the competitive landscape and supply chain sourcing strategies.

Regionally, Asia Pacific (APAC) remains the undisputed dominant market, primarily due to the concentration of global manufacturing hubs in China, India, and Southeast Asian nations, generating immense demand from the automotive, machinery, and construction industries. North America and Europe, while representing mature markets, exhibit strong growth in high-specification rubber sheets driven by rigorous regulatory requirements and the need for durable materials in specialized sectors like aviation and renewable energy infrastructure (wind turbines, solar farms). The Middle East and Africa (MEA) are seeing escalating demand linked to large-scale infrastructure projects and sustained investment in oil and gas exploration and processing, requiring high-temperature and chemical-resistant sheeting solutions. Localized production is increasing in Latin America to mitigate long supply chains and cater more directly to the specific technical standards of regional heavy industries.

Segment trends reveal that the Synthetic Rubber segment, especially EPDM and NBR, holds a superior market share due to their engineered performance consistency and tailored resistance capabilities compared to Natural Rubber. Application-wise, the Gaskets and Seals segment is perpetually dominant, driven by the critical necessity of zero-leak systems across all machinery. However, the Conveyor Belting and Industrial Matting segments are also experiencing significant volume growth corresponding to the expansion of mining, logistics, and material handling operations globally. The sheet grade categorization shows increasing preference for commercial and industrial grades, which offer a balance between cost and performance, though high-performance grades targeting extreme temperatures or specialized chemical exposures are expanding rapidly due to niche, high-value industrial requirements.

AI Impact Analysis on Rubber Sheet Market

User inquiries regarding AI's influence in the Rubber Sheet Market primarily focus on three core areas: how AI can optimize complex material compounding processes, its role in predictive maintenance applications using integrated sensors and rubber components, and the potential for AI-driven automation in quality control and manufacturing. Users are particularly concerned about leveraging machine learning (ML) algorithms to manage the highly variable nature of raw material inputs (both natural and synthetic polymers) and predict the resultant mechanical properties of the final vulcanized sheet with greater accuracy than traditional laboratory testing. There is significant interest in transitioning from manual or subjective visual inspection of finished rubber sheets to automated, high-speed defect detection systems utilizing computer vision and deep learning models, thereby ensuring compliance with stringent industry standards, especially in aerospace and medical device components.

The implementation of AI and related smart manufacturing technologies is poised to revolutionize the operational efficiency of rubber sheet production facilities. By analyzing real-time data streams from mixers, extruders, and calenders—including temperature, pressure, and cure time profiles—AI systems can dynamically adjust parameters to maintain consistent product quality and minimize scrap rates. This level of optimization reduces material waste and energy consumption, leading to significant cost savings and improved sustainability metrics. Furthermore, predictive modeling enables manufacturers to anticipate equipment failure (e.g., wear on calendering rollers or mixing blades) before critical breakdowns occur, shifting maintenance strategies from reactive to proactive, thereby maximizing uptime and overall production throughput.

Beyond the manufacturing floor, AI algorithms are being applied in supply chain logistics for raw material procurement, optimizing inventory levels based on fluctuating polymer costs and expected market demand forecasts. This allows rubber sheet companies to hedge against price volatility and ensure a stable supply of necessary compounds. In product development, generative design techniques assisted by AI are explored to design complex rubber profiles and composite structures (like multi-layered dampening mats) that exhibit enhanced performance characteristics while minimizing material usage, fulfilling the industry's continuous push for lightweight yet durable solutions. The adoption, however, is gradual, concentrated among large multinational corporations due to the high initial investment required for sensor integration and data infrastructure development.

- AI-driven optimization of rubber compounding recipes for precise property control (e.g., hardness, tensile strength).

- Enhanced quality control through computer vision systems detecting microscopic surface defects and dimensional inconsistencies in real time.

- Predictive maintenance schedules for high-capital equipment (calenders, mixers) based on operational data analysis, minimizing unplanned downtime.

- Optimization of energy consumption during the vulcanization process using ML models to refine heating cycles.

- Improved supply chain resilience and cost management by forecasting polymer price fluctuations and managing inventory dynamically.

- Simulated performance testing of new rubber sheet designs under varying stress and environmental conditions, accelerating product validation.

DRO & Impact Forces Of Rubber Sheet Market

The dynamics of the Rubber Sheet Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities. Key drivers include the exponential growth in the global automotive sector, particularly the rapid adoption of electric vehicles, which require specialized fire-resistant and thermally stable rubber components for battery casings and sealing. Coupled with this is the continuous global investment in infrastructure renewal and expansion, necessitating large volumes of high-durability rubber sheeting for applications like bridge joints, railway pads, and tunnel linings. Opportunities are largely concentrated around material innovation, specifically the development of sustainable, bio-based elastomers and composite rubber sheets offering multi-functional characteristics (e.g., anti-microbial, anti-static, highly oil-resistant grades), allowing penetration into specialized markets like healthcare and high-tech electronics manufacturing. Geographical expansion into rapidly industrializing regions of Africa and Southeast Asia also represents a significant growth vector for established market players.

However, the market faces significant restraints that dampen growth potential. The most critical restraint is the high volatility and unpredictable fluctuation in the prices of key raw materials, including crude oil derivatives (for synthetic rubbers like NBR and EPDM) and natural rubber latex. These price swings directly impact manufacturing costs and margins, complicating long-term planning and pricing strategies. Furthermore, the market faces increasing regulatory pressure, particularly in Europe and North America, regarding the use of certain chemical additives (like phthalates and specific curing agents) deemed environmentally harmful, forcing manufacturers to incur significant costs associated with reformulating and re-certifying their product lines. Competition from alternative materials, such as specialized engineered plastics and thermoplastic elastomers (TPEs), which offer lower processing costs in certain applications, also poses a constraint, especially in mid-range industrial uses.

Impact forces indicate that technological advancement is a pivotal force, driving the need for higher performance specifications, which, in turn, favors specialized manufacturers capable of advanced compounding. Economic cycles directly correlate with demand, as the rubber sheet market is intrinsically linked to construction and automotive production—sectors highly sensitive to GDP fluctuations and interest rates. Environmental regulations act as a powerful external force, compelling the industry toward 'green' production methodologies and sustainable sourcing, fundamentally altering the competitive dynamics by favoring companies with robust environmental, social, and governance (ESG) frameworks. The cumulative impact assessment suggests that despite raw material volatility, the essential nature of rubber sheets in industrial infrastructure ensures sustained long-term demand, with growth concentrated in high-value, specialized segments.

- Drivers:

- Surging demand from Electric Vehicle (EV) and high-performance automotive segments.

- Increased global infrastructure and construction spending.

- Technological advancements leading to high-performance, specialized rubber grades.

- Restraints:

- Volatile pricing and supply chain instability of key raw materials (synthetic polymers and natural latex).

- Strict environmental regulations concerning compounding chemicals and manufacturing effluent.

- Intense cost competition from generic commodity grades and substitution by TPEs.

- Opportunities:

- Development and commercialization of bio-based and recyclable elastomers.

- Penetration into niche high-tech sectors requiring ultra-clean or specialty conductive rubber sheets.

- Adoption of Industry 4.0 technologies (AI, IoT) in manufacturing processes for efficiency gains.

- Impact forces:

- Technological Differentiation (High).

- Economic Fluctuations (Medium to High).

- Regulatory Compliance (High).

Segmentation Analysis

The Rubber Sheet Market is extensively segmented based on material type, product type, end-use industry, and geography, reflecting the highly customized nature of its applications. Segmentation by material is crucial as it dictates the functional performance characteristics, cost structure, and intended environment of use. Synthetic rubbers, comprising polymers like EPDM, NBR, and SBR, collectively dominate the market due to their tailored resistance profiles to oil, heat, and chemicals, essential in rigorous industrial settings. Natural rubber, valued for its superior tensile strength and resilience, maintains a significant share in applications requiring high elasticity and abrasion resistance, particularly in mining and certain construction components.

Product type segmentation distinguishes between general-purpose industrial sheets (e.g., sheeting for shop flooring, basic weather stripping) and high-performance application-specific sheets, such as diaphragms, specialized conductive mats, and highly engineered gasket materials. End-use industry analysis reveals the paramount role of the Automotive and Transportation sector, followed closely by the Construction and Infrastructure sector. The former utilizes rubber sheets for sealing, dampening, and interior components, while the latter relies on them for waterproofing, expansion joints, and vibration isolation in large structures. Other significant applications include those in the oil and gas industry, demanding chemical and heat resistance, and the pharmaceutical sector, requiring non-toxic, cleanroom-compatible grades.

Understanding these segments is vital for strategic market entry and product positioning. Manufacturers often specialize in a limited range of polymer types or specific end-use applications (e.g., exclusively producing fire-retardant sheeting for mass transit systems) to leverage proprietary technological advantages and meet specific regulatory burdens. The growth rate within each segment varies significantly; for instance, the demand for specialized EPDM sheets for HVAC and roofing applications is growing rapidly due to regulatory shifts towards energy-efficient building materials, whereas commodity SBR usage aligns more directly with overall macroeconomic cycles and generalized industrial output.

- By Material Type:

- Natural Rubber (NR)

- Synthetic Rubber (SR)

- Styrene-Butadiene Rubber (SBR)

- Ethylene Propylene Diene Monomer (EPDM)

- Nitrile Butadiene Rubber (NBR)

- Neoprene (Chloroprene Rubber - CR)

- Silicone and Fluoroelastomers (FKM/Viton)

- By Product Type/Grade:

- Commercial/General Purpose Grade

- Industrial Grade

- High-Performance/Specialty Grade

- Fabric Reinforced Sheets

- By Thickness:

- < 3 mm

- 3 mm - 6 mm

- > 6 mm

- By End-Use Industry:

- Automotive and Transportation

- Construction and Infrastructure

- Oil and Gas/Chemical Processing

- Mining and Material Handling

- Electronics and Electrical

- Medical and Pharmaceutical

- General Manufacturing

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Rubber Sheet Market

The value chain for the Rubber Sheet Market begins with the upstream sourcing of raw materials, which is highly complex due to the dependency on two distinct primary inputs: natural rubber latex (primarily sourced from Southeast Asia) and petrochemical derivatives, which form the building blocks for synthetic rubbers (like butadiene and styrene). This upstream stage involves significant capital investment in polymerization plants for synthetic rubbers and large-scale agricultural operations for natural rubber. Fluctuation in oil prices and geopolitical stability in NR producing regions directly impacts the cost base for the entire downstream chain. Manufacturers mitigate this risk through strategic long-term contracts and maintaining diversified sourcing portfolios. The quality and consistency of these inputs are paramount, as they directly influence the final mechanical properties of the rubber sheet.

The core manufacturing and processing stage involves the crucial steps of compounding, mixing, calendering (shaping), and vulcanization (curing). Compounding involves mixing the base polymer with essential additives such as fillers (carbon black, silica), plasticizers, accelerators, and anti-degradants, defining the sheet’s final characteristics. Calendering machinery then shapes the material into precise thicknesses and widths. This midstream activity is highly technology-intensive, requiring advanced quality control systems to ensure uniformity. Direct sales channels are often employed for large industrial clients (e.g., major automotive OEMs or construction companies) seeking specialized, high-volume orders, allowing for direct technical collaboration and reduced distribution costs.

The downstream distribution process is characterized by a mix of direct and indirect channels. Indirect channels utilize specialized industrial distributors and wholesalers who maintain large inventories of standard-grade rubber sheets and provide cutting, slitting, and kitting services to smaller end-users. These distributors are critical in reaching fragmented markets, such as local workshops and small-scale infrastructure projects. Direct distribution is favored for large, complex projects or specialized products like custom-engineered gaskets, where technical support and quality traceability from the manufacturer are non-negotiable. The value chain concludes with the end-users—ranging from original equipment manufacturers (OEMs) integrating rubber components into final products to maintenance, repair, and overhaul (MRO) operations that consume replacement sheeting and seals.

Rubber Sheet Market Potential Customers

Potential customers for rubber sheet products span virtually every segment of the heavy and light manufacturing economies, primarily centered around entities that require durable sealing, material protection, or vibration isolation. Original Equipment Manufacturers (OEMs) in the automotive industry represent one of the most significant customer bases, utilizing rubber sheets for engine gaskets, chassis components, interior noise reduction, and weather sealing systems. With the shift to EVs, demand is expanding for specialized flame-retardant and high-dielectric strength silicone or EPDM sheets used in battery enclosures and cable insulation. These customers demand highly specific material certifications and high-volume consistency, often entering into multi-year supply agreements with manufacturers.

Another crucial segment comprises construction companies and infrastructure developers. These customers procure high-grade neoprene or SBR sheeting for expansion joints in bridges and roads, waterproof membranes for roofing and foundations, and specialized anti-vibration mats for railway tracks and machinery foundations. Their purchasing decisions are heavily influenced by regulatory standards, material longevity, and resistance to environmental degradation (UV, ozone, water). Furthermore, the Maintenance, Repair, and Overhaul (MRO) departments across various sectors, including oil and gas refineries, chemical plants, mining operations, and large processing facilities, form a constant, stable customer base, requiring replacement sheets for worn gaskets, conveyor belts, and protective tank linings, prioritizing quick availability and chemical compatibility.

Beyond traditional industrial applications, emerging customer segments include manufacturers in the renewable energy sector, suchately wind and solar farms, which require durable, weather-resistant seals and vibration dampeners for long-term outdoor operation. Additionally, the medical and pharmaceutical equipment manufacturing industry seeks ultra-pure, non-toxic, and FDA-compliant silicone and specialized synthetic rubber sheets for diaphragms, seals, and fluid transfer tubing. Targeting these high-value, highly regulated industries necessitates significant investment in clean manufacturing facilities and rigorous documentation of compliance, offering higher margins but demanding specialized expertise from the rubber sheet producer.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 6.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bridgestone Corporation, ContiTech AG (Continental AG), Trelleborg AB, Freudenberg Group, Semperit AG Holding, The Rubber Company, Hexpol AB, American Biltrite, Inc., AirBoss of America Corp., Garlock Sealing Technologies, Saint-Gobain S.A., Dajac Inc., Biltrite Industries, WARCO BILTRITE, Gates Corporation, Precision Rubber Industries Pvt. Ltd., Hebei Junda Rubber Sheet Co., Ltd., Atlantic Gasket Corporation, Rubber King, Kuraray Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Rubber Sheet Market Key Technology Landscape

The core technology landscape in the Rubber Sheet Market revolves around enhancing material compounding precision and improving the efficiency and quality control of manufacturing processes. Key technological advancements center on Continuous Vulcanization (CV) systems, particularly UHF (Ultra-High Frequency) and hot air vulcanization lines, which allow for rapid, continuous curing of extruded or calendered sheets, significantly improving production throughput compared to traditional batch press curing. Further technological focus is placed on advanced internal mixers and twin-screw extruders used in the compounding stage. These machines ensure a homogenous dispersion of fillers and chemical agents within the polymer matrix, which is crucial for achieving consistent physical properties and reducing material variability, especially when processing highly viscous or specialty elastomer compounds like FKM or HNBR.

In the domain of material science, significant research and development efforts are directed toward creating multi-functional composite rubber sheets. This involves integrating specialized materials, such as conductive carbon nanotubes or metal fibers, within the elastomer structure to produce sheets that are not only sealing agents but also function as EMI shielding or heat dissipators—critical for modern electronics and high-tech automotive applications. Furthermore, the development of sustainable compounding agents, moving away from traditional petroleum-based plasticizers to bio-oils and renewable fillers (like highly purified natural fibers), is a critical technological trend driven by environmental and consumer pressure. This requires substantial reformulation expertise and adaptation of curing chemistry to maintain performance standards while reducing the ecological footprint.

Automation and digitalization represent a growing technological force within rubber sheet production. The integration of IoT sensors and advanced process control systems allows for real-time monitoring of critical parameters (temperature profiles, tension, sheet thickness) throughout the calendering and curing stages, minimizing human error and facilitating precise dimensional control. Laser and ultrasonic cutting technologies are also becoming standard practice for high-precision fabrication of custom gaskets and seals from the base sheet material, replacing less accurate die-cutting methods. These technologies ensure waste reduction and enable quick turnaround times for custom, on-demand orders, positioning manufacturers who adopt them competitively ahead of those relying on legacy machinery.

- Continuous Vulcanization (CV) Technology: Utilizing UHF and salt bath curing for high-speed, continuous processing of rubber sheets and profiles.

- Advanced Compounding Systems: High-shear internal mixers (e.g., Banbury) and twin-screw extruders for superior filler dispersion and homogeneity in complex recipes.

- Precision Calendering: Multi-roll calenders with highly accurate gap control and temperature uniformity to produce sheets with tight dimensional tolerances.

- Automation and IoT Integration: Real-time monitoring and control systems for temperature, pressure, and thickness during production, feeding into predictive quality algorithms.

- Material Innovation: Development of high-performance composite sheets (e.g., electrically conductive, EMI shielding, thermally conductive) and substitution of traditional additives with sustainable, bio-based alternatives.

- Precision Fabrication: Implementation of CNC, laser, and waterjet cutting technologies for accurate custom gasket and seal creation from stock sheeting.

Regional Highlights

The global demand for rubber sheets demonstrates significant regional disparities driven by differential rates of industrialization, regulatory landscapes, and automotive production capacity. Asia Pacific (APAC) holds the largest market share globally, dominated by mass production hubs in China, India, and ASEAN countries. This dominance is attributed to robust manufacturing sectors—particularly in electronics assembly, general machinery, and, crucially, the world's largest automotive manufacturing output. Furthermore, massive ongoing infrastructure investments, including high-speed rail and urban development projects in India and Southeast Asia, create sustained, high-volume demand for commercial and industrial-grade sheeting for sealing, dampening, and protective purposes. Manufacturers in APAC benefit from lower operational costs, though they face increasing pressure to adopt Western quality standards and environmental compliance measures.

North America and Europe represent mature markets characterized by steady, moderate growth, primarily concentrated in high-value, specialized segments. Demand here is driven not by volume but by stringent regulatory requirements in aerospace, medical, and specialized industrial manufacturing (oil and gas, chemical processing), necessitating certified, high-performance materials like FKM, silicone, and specialized NBR compounds. These regions exhibit a strong focus on technical innovation, demanding materials that offer resistance to extreme temperatures, specific chemicals, and low flammability. The automotive sector's transition to electric vehicles in both regions is significantly boosting demand for specialized thermal and fire-protection rubber sheets, particularly in Germany, the US, and the UK. Pricing in these regions is significantly higher due to advanced R&D costs and strict compliance mandates.

Latin America and the Middle East and Africa (MEA) are emerging growth markets, driven primarily by raw material extraction industries and infrastructure development. LATAM demand is strongly tied to mining, construction, and limited automotive assembly in countries like Brazil and Mexico, prioritizing durable, abrasion-resistant sheets for conveyor belts and heavy machinery protection. The MEA region, heavily influenced by petrochemical and oil and gas industries, exhibits a high demand for robust, chemical and heat-resistant elastomer sheets for piping, gaskets, and sealing applications in refineries and upstream facilities. Government-backed mega-projects, especially in the Gulf Cooperation Council (GCC) countries, are accelerating demand for high-specification rubber components in transportation and urban development projects, although political and economic instability can occasionally hinder growth in certain sub-regions of Africa.

- Asia Pacific (APAC): Market leader due to high volume manufacturing (Automotive, Electronics, Construction); key countries are China, India, and Japan. Focus on both commodity and high-volume industrial grades.

- North America: Strong demand for high-performance and specialty rubbers (Silicone, FKM) driven by aerospace, medical, and EV manufacturing; strict safety and environmental standards dictate product quality.

- Europe: Growth concentrated in premium, environmentally compliant elastomers; robust demand from German automotive OEMs and stringent standards for building energy efficiency (EPDM for roofing/HVAC).

- Middle East and Africa (MEA): Growth tied to oil and gas exploration, refinery operations, and large-scale infrastructure projects; demand focused on high-temperature and chemical-resistant sheeting.

- Latin America (LATAM): Market driven by mining operations and construction; demand for heavy-duty, abrasion-resistant rubber products, especially in Brazil and Mexico.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Rubber Sheet Market.- Bridgestone Corporation

- ContiTech AG (Continental AG)

- Trelleborg AB

- Freudenberg Group

- Semperit AG Holding

- The Rubber Company

- Hexpol AB

- American Biltrite, Inc.

- AirBoss of America Corp.

- Garlock Sealing Technologies

- Saint-Gobain S.A.

- Dajac Inc.

- Biltrite Industries

- WARCO BILTRITE

- Gates Corporation

- Precision Rubber Industries Pvt. Ltd.

- Hebei Junda Rubber Sheet Co., Ltd.

- Atlantic Gasket Corporation

- Rubber King

- Kuraray Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Rubber Sheet market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Synthetic Rubber Sheet segment?

The primary growth factors are the stringent requirements of modern industries, specifically automotive and oil and gas, for engineered resistance properties that Natural Rubber cannot consistently offer. Synthetic rubbers like NBR and EPDM provide superior resistance to oil, chemicals, high temperatures, and ozone degradation, coupled with greater production consistency and tailored performance characteristics essential for precision applications.

How does the shift towards Electric Vehicles (EVs) specifically impact rubber sheet demand?

The EV shift increases demand for specialized, high-performance rubber sheets, particularly Silicone and fire-retardant EPDM. These materials are crucial for sealing high-voltage battery enclosures, providing thermal management insulation, and ensuring safety through flame resistance and electrical isolation, shifting the market focus toward specialty elastomers rather than traditional general-purpose grades.

Which geographical region dominates the global Rubber Sheet Market in terms of consumption volume?

The Asia Pacific (APAC) region dominates the market volume due to its concentration of global manufacturing centers, rapid infrastructure development, and high output from the automotive and electronics industries in countries like China and India, generating extensive demand for both commodity and industrial-grade sheeting.

What are the key technological advancements influencing the quality and efficiency of rubber sheet manufacturing?

Key technological advancements include the widespread adoption of Continuous Vulcanization (CV) systems for faster curing, implementation of sophisticated multi-roll calenders for dimensional precision, and integration of IoT-based process controls and AI-driven quality inspection systems to ensure material consistency and reduce scrap rates.

What is the most significant restraint challenging profitability in the Rubber Sheet Market?

The most significant restraint is the extreme volatility in the pricing of core raw materials, encompassing both petrochemical derivatives (for synthetic rubber inputs) and natural rubber latex. These unpredictable price fluctuations directly impact manufacturing costs, complicate inventory management, and necessitate frequent adjustments to product pricing strategies across the value chain.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager