Rubber Stamps Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436925 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Rubber Stamps Market Size

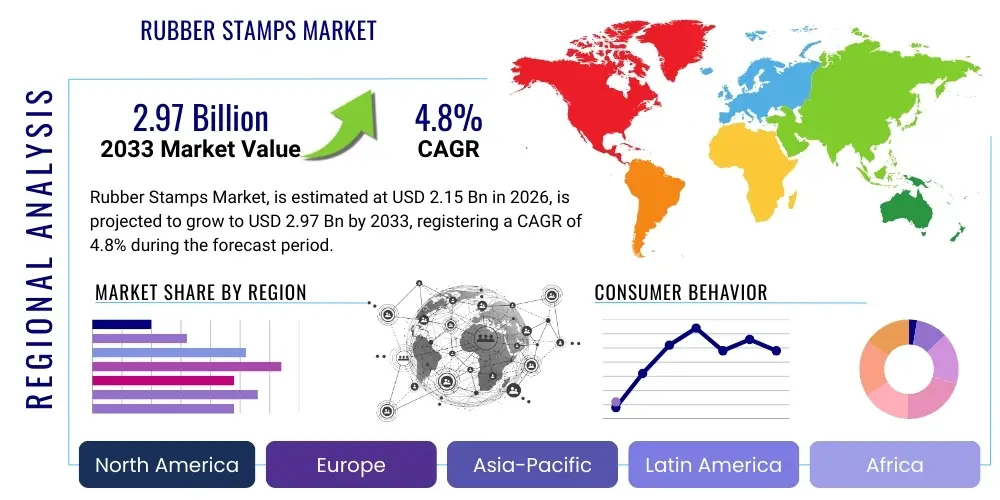

The Rubber Stamps Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at $2.15 Billion in 2026 and is projected to reach $2.97 Billion by the end of the forecast period in 2033.

Rubber Stamps Market introduction

The Rubber Stamps Market encompasses the manufacturing, distribution, and sale of manual and automated devices used for applying inked images, text, or patterns onto surfaces, predominantly paper or packaging materials. Historically a tool for administrative efficiency and official documentation, the market has evolved significantly, incorporating advanced materials, ergonomic designs, and sophisticated inking technologies. Products range from basic hand stamps utilizing traditional stamp pads to modern, highly efficient self-inking and pre-inked mechanisms, catering to diverse sectors including corporate administration, government agencies, logistics, retail, and the burgeoning creative and crafting industries. The fundamental value proposition remains the rapid, repeatable, and consistent application of critical information, logos, or personalized designs.

The product portfolio within this market is segmented primarily based on mechanism and intended application. Self-inking stamps, which contain an internal, rotating ink pad, and pre-inked stamps, where the ink is impregnated into the stamp itself, represent the highest growth segments due to their convenience, clean operation, and durability, largely replacing traditional rubber stamps in professional environments. Key applications span across logistics (date stamping, tracking codes), financial services (endorsements, approvals), education, and personalized crafting. The rise of small and medium-sized enterprises (SMEs) and the increasing complexity of international logistics requiring verifiable physical markings continue to underpin steady demand, even amidst increasing digitalization.

Driving factors for sustained market growth include the global expansion of e-commerce, which necessitates efficient and traceable physical marking solutions for warehousing and package handling, and the growing demand for personalized products in the consumer segment. The benefits derived from rubber stamps—cost-effectiveness, reliability, lack of dependence on electronic systems, and immediate physical verification—make them indispensable tools in many operational environments. Furthermore, manufacturers are increasingly focusing on sustainability, developing eco-friendly rubber and recycled plastic casings, which appeals to environmentally conscious corporate buyers and consumers, thereby securing the product's relevance in modern operational ecosystems.

Rubber Stamps Market Executive Summary

The global Rubber Stamps Market is characterized by a moderate, stable growth trajectory, underpinned by the ongoing necessity for physical verification and identification across various commercial and governmental sectors. Current business trends indicate a strong shift towards highly convenient and efficient product types, specifically self-inking and pre-inked stamps, driven by demands for clean handling, rapid deployment, and longevity. Consolidation among major manufacturers is leading to improved supply chain efficiencies and accelerated product innovation, particularly in customization and digital integration capabilities, such as incorporating QR codes or variable data printing elements into stamp designs. Regional analysis reveals that Asia Pacific is the fastest-growing market, propelled by rapid industrialization, expansion of manufacturing bases, and increasing governmental standardization requirements across emerging economies, while North America and Europe maintain dominance in terms of technological adoption and premium product usage, driven by high corporate expenditure on branding and security marking solutions.

Segment trends highlight the significant dominance of the self-inking stamp category due to its superior user experience and suitability for high-volume use cases in professional settings. However, the personalized and customized segment, which includes intricate laser-engraved designs used by crafters and boutique businesses, is exhibiting the highest CAGR, reflecting a broader consumer movement towards unique branding and DIY creative projects. Materially, the focus is increasingly on durable polymers and high-quality, oil-based inks that offer enhanced longevity and clear imprints. Strategically, market players are leveraging multi-channel distribution, emphasizing both traditional office supply vendors and sophisticated online platforms that facilitate easy design and ordering of bespoke stamps, optimizing reach across B2B and B2C segments simultaneously.

In summary, the market is resilient, adapting to digital challenges by emphasizing high-utility, specialized, and personalized applications where physical presence is non-negotiable, such as legal documentation, proprietary product marking, and secure packaging seals. Key industry participants are investing in automated production processes, ensuring competitive pricing, and focusing on niche markets like industrial stamping (e.g., metal, plastic, textile marking), which utilize specialized rubber compounds and inks. The stable demand from governmental bodies and the consistent growth of e-commerce logistics ensure that the Rubber Stamps Market remains a reliable and predictable sector within the broader office supplies and consumables industry.

AI Impact Analysis on Rubber Stamps Market

Analysis of user inquiries concerning the integration of Artificial Intelligence (AI) within the Rubber Stamps Market reveals two primary themes: operational optimization and displacement risk. Users are frequently questioning how AI tools, particularly computer vision and predictive analytics, can streamline the custom stamp ordering process, focusing on automated design proofing, error reduction, and faster production scheduling. Simultaneously, a significant concern revolves around the potential for complete digital document management systems, often enhanced by AI-driven validation and blockchain technology, to render physical stamps obsolete for official purposes. Key expectations center on AI improving supply chain efficiency, enabling mass personalization through automated template generation based on user requirements, and enhancing security features of physical stamps by integrating traceable digital identifiers or sophisticated anti-counterfeiting markings that are easier for automated systems to detect and authenticate. However, the general consensus acknowledges that for physical goods and non-digital legal documentation, the physical stamp maintains an irreplaceable function, with AI potentially serving as an enhancement tool rather than a replacement.

- AI-driven optimization of personalized stamp design and proofing workflows, reducing human error.

- Predictive maintenance schedules for automated stamping machinery used in high-volume industrial applications.

- Enhanced security features for official stamps using AI-verifiable micro-text or integrated digital tracking elements.

- Potential slight decrease in administrative stamp usage due to AI-enabled digital signing and validation platforms.

- AI-powered market segmentation and demand forecasting to optimize inventory management for diverse stamp types and sizes.

- Integration of Computer Vision systems to verify stamp quality and imprint consistency during the manufacturing process.

DRO & Impact Forces Of Rubber Stamps Market

The Rubber Stamps Market is influenced by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO), which collectively shape the competitive landscape and growth trajectory. Key drivers include the persistent global reliance on physical documentation for legal, financial, and governmental transactions, the rapid growth of e-commerce demanding standardized physical markings for logistics and traceability, and the burgeoning consumer interest in customized and personalized crafting and branding solutions. These factors create consistent demand across B2B, B2C, and Governmental sectors. However, restraints primarily involve the global shift towards digitalization and paperless office policies, particularly in highly developed economies, and the competitive threat posed by digital signature technologies and electronic document management systems, which reduce the need for physical authentication stamps.

Impact forces govern the market’s response to these factors. High bargaining power of raw material suppliers (especially specialized rubber compounds and advanced polymers) slightly constrains profit margins, while the moderate bargaining power of buyers (large corporations and government bodies) forces manufacturers to maintain competitive pricing and high quality. The threat of substitutes, largely digital validation methods, remains high, necessitating continuous product innovation, particularly in convenience and efficiency. Competitive rivalry is fragmented but intense, focusing on product reliability, durability, and time-to-market for custom orders. Opportunities for market expansion reside in targeting emerging economies with low digital penetration, specializing in eco-friendly and sustainable product lines, and developing hybrid solutions that combine physical stamping with digital verification links (e.g., QR codes stamped onto documents).

Overall, the market is strategically positioned to mitigate the digital threat by focusing on specialized, high-security applications where a physical imprint is legally or operationally mandated. The convergence of physical marking needs in logistics and personalized branding demands from SMEs ensures that, while traditional administrative stamp usage may decline, growth in specialized segments—such as industrial coding, tamper-proof seals, and custom packaging markers—will sustain overall market expansion. Manufacturers succeeding in this environment are those who prioritize efficient production processes, high customization capabilities, and strategic partnership development across key distribution channels.

Segmentation Analysis

The Rubber Stamps Market is comprehensively segmented based on product type, material, application, end-use industry, and distribution channel, providing a granular view of demand patterns and growth pockets. Product type segmentation distinguishes between traditional manual stamps, which require external ink pads, and the more popular self-inking and pre-inked stamps, driven by user preference for speed and cleanliness. Material segmentation focuses on the composition of the stamp itself (natural vs. synthetic rubber, photopolymer, engraved metal) and the casing (plastic vs. metal). Application analysis differentiates between functional use (date stamps, corporate seals, address stamps) and decorative use (crafts, personalized items). End-use industries range from professional offices and government to industrial manufacturing and personal consumer use, each demanding unique features and durability levels.

- By Product Type:

- Traditional (Manual) Stamps

- Self-inking Stamps

- Pre-inked Stamps (Flash Stamps)

- Daters and Numberers

- Industrial Marking Stamps

- By Material:

- Natural Rubber

- Synthetic Rubber (Nitrile, Silicone)

- Photopolymer

- Wood Mount

- Metal Mount/Casing

- By Application:

- Administrative and Office Use (Address, Signature, Official Seal)

- Legal and Financial Documentation

- Logistics and Inventory Marking (Date, Tracking Codes)

- Personalization and Crafting (DIY, Branding)

- Industrial Coding and Marking

- By End-Use Industry:

- Commercial Offices and Corporate Sector

- Government and Public Administration

- Financial Services and Banking

- Education

- Retail and E-commerce

- Industrial Manufacturing

- By Distribution Channel:

- Online Retail (E-commerce Platforms)

- Offline Retail (Stationery Stores, Office Supply Chains)

- Direct Sales (B2B Contracts)

- By Region:

- North America (USA, Canada, Mexico)

- Europe (Germany, UK, France, Italy, Spain, Rest of Europe)

- Asia Pacific (China, Japan, India, South Korea, Rest of APAC)

- Latin America (Brazil, Argentina, Rest of LATAM)

- Middle East and Africa (UAE, Saudi Arabia, South Africa, Rest of MEA)

Value Chain Analysis For Rubber Stamps Market

The Value Chain for the Rubber Stamps Market begins with upstream activities focused on raw material procurement, encompassing the sourcing of specialized rubber compounds (natural or synthetic), polymers, ink formulations, and casing materials (plastics or metals). Manufacturers must secure high-quality rubber sheets and reliable, non-toxic, fast-drying inks that meet regulatory standards. Upstream efficiency significantly impacts final product cost and quality. Key suppliers in this stage are chemical companies, polymer producers, and specialized dye manufacturers. Manufacturers then engage in core transformation processes such as laser engraving, photopolymer plate creation, injection molding for casings, and precise assembly, particularly for complex mechanisms like self-inking models, where precision engineering is critical to prevent leakage and ensure consistent stamping action.

Downstream activities involve distribution and sales. The distribution channel is bifurcated into direct and indirect methods. Direct distribution typically involves large B2B contracts with major corporations, government bodies, or industrial clients requiring customized, high-volume orders. This channel often necessitates specialized consultation and production capabilities. Indirect distribution is managed through wholesale partners, large office supply retailers (both physical and online), and specialized e-commerce platforms that facilitate user-friendly design customization. Online platforms have become increasingly vital, enabling smaller manufacturers and custom stamp makers to reach a global B2C market effectively, managing order fulfillment and personalization digitally before the physical product is shipped. Successful downstream strategy requires seamless integration between physical inventory and digital ordering systems.

The market heavily relies on efficient logistics and inventory management, given the high degree of product customization. Value is added at the personalization stage, where specialized laser technology allows for intricate designs, logos, and variable data elements to be incorporated rapidly. Service elements, such as warranty, after-sales ink refill availability, and custom design support, also contribute significantly to perceived customer value and brand loyalty. The shift towards sustainable sourcing and manufacturing processes is an emerging value-added factor, appealing strongly to corporate clients committed to environmental social governance (ESG) standards, thereby completing a circular value chain that emphasizes raw material quality and ethical production.

Rubber Stamps Market Potential Customers

The potential customer base for the Rubber Stamps Market is highly diverse, spanning both professional and consumer segments, reflecting the utility of physical marking across numerous operational contexts. End-users can be broadly categorized into commercial entities requiring official documentation and branding tools, governmental and regulatory bodies needing security and authentication marks, and individual consumers or small businesses demanding personalization and crafting supplies. Commercial entities, including large multinational corporations, law firms, accounting practices, and financial institutions, frequently purchase stamps for signatures, endorsements, date tracking, and internal document processing, valuing durability and high-volume consistency. The logistical sector, driven by e-commerce, represents a crucial segment, utilizing stamps for quick package marking, quality control verification, and inventory management in warehouses and shipping depots.

Government agencies at all levels—federal, state, and local—are vital end-users, relying on rubber stamps for official seals, notary public endorsements, authorized signatures, and document validity assurance, particularly in countries where physical paperwork maintains high legal standing. This segment prioritizes security features and strict adherence to dimensional and design standards. Furthermore, the small to medium-sized enterprise (SME) sector is a high-growth customer segment, utilizing custom rubber stamps for cost-effective branding on packaging, business cards, and marketing materials, reflecting the growing trend of personalized consumer interaction.

Finally, the consumer market, driven by the crafting, scrapbooking, and hobbyist communities, forms a specialized, high-margin niche, demanding artistic, intricate, and unique stamp designs. Educational institutions also remain consistent buyers for grading, administrative purposes, and classroom activities. Targeting potential customers requires understanding their primary need: high-volume efficiency (corporate), security and legality (government), or personalization and aesthetic quality (SMEs/consumers). Manufacturers must align their distribution strategies and product offerings—from heavy-duty industrial daters to finely detailed photopolymer stamps—to meet the distinct requirements of these varied buyer groups.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $2.15 Billion |

| Market Forecast in 2033 | $2.97 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Trodat GmbH, Colop Stempelerzeugung GmbH, Shachihata Inc., Brother Industries, Limited, R. A. Dykman Industries, LLC, Trelleborg AB, Stamp-Ever Co., Ltd., Cosco Industries, Inc., S.R. Industries, RubberStamps.net, ExcelMark, Ideal Stamp, Stamper's Anonymous, Xstamper (Shachihata subsidiary), Shiny Stamp, MaxStamp, The Stampmaker, Justrite Manufacturing Company, Corpse Carver Stamps, A-1 Stamp & Engraving. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Rubber Stamps Market Key Technology Landscape

The manufacturing process of rubber stamps relies on several critical technologies that ensure precision, durability, and customization capability. The transition from traditional vulcanized rubber stamping plates to modern polymer and laser engraving systems represents the most significant technological evolution. Laser engraving technology, particularly CO2 lasers, allows manufacturers to etch intricate, high-resolution designs onto rubber sheets or synthetic polymer materials with exceptional speed and accuracy. This capability is crucial for meeting the increasing demand for detailed corporate logos, specialized seals, and fine-text documentation stamps. Furthermore, Flash technology, utilized in pre-inked stamps, involves exposing a light-sensitive polymer to intense light through a printed mask, creating micro-porous cells that hold and dispense ink uniformly, significantly extending the stamp's life and reducing the need for constant re-inking, providing a key competitive advantage in the high-end market segment.

Beyond the physical stamping material, significant technological advancements are centered on the mechanism and ink delivery systems. Self-inking technology relies on precise spring mechanisms and rotating components housed within a durable casing to automatically re-ink the stamp die between impressions, optimizing consistency and minimizing mess. Manufacturers are consistently improving these internal components, utilizing lightweight, high-grade polymers to enhance ergonomics and longevity, which directly impacts user satisfaction in corporate environments where stamps are used frequently. Ink technology itself is evolving, moving towards quick-drying, archival-quality, and solvent-resistant formulations tailored for specific non-paper surfaces (e.g., metal, plastic, glossy packaging), expanding the market into industrial marking applications where traditional oil-based inks are inadequate.

Finally, the integration of digital technology into the ordering and design process is transforming the supply chain. Advanced Computer-Aided Design (CAD) software and web-to-print solutions allow end-users to upload, edit, and proof their stamp designs instantaneously. This automation, often utilizing vector graphics and automated template checks, streamlines the custom production workflow, significantly reducing lead times and ensuring precise replication of customer specifications. The adoption of enterprise resource planning (ERP) systems linked to laser engraving machines facilitates highly efficient mass customization, making small-batch and individualized orders economically viable. These digital technologies are crucial for competing effectively in a market increasingly focused on speed, personalization, and high-fidelity output.

Regional Highlights

Geographic analysis reveals distinct consumption patterns and growth drivers across major global regions, reflecting variations in administrative practices, industrialization rates, and digital adoption levels.

- Asia Pacific (APAC): APAC is projected to exhibit the highest growth rate, driven by rapid industrial expansion, increasing standardization requirements in manufacturing, and high population density necessitating efficient administrative marking systems in developing nations like India and China. The expansion of regional e-commerce giants relies heavily on physical package tracking and marking solutions.

- North America: North America holds a substantial market share, primarily driven by high corporate demand for professional, high-quality, self-inking stamps for legal, financial, and logistical verification. The region focuses heavily on technological sophistication, using stamps integrated with high-security features and premium durable materials.

- Europe: Europe maintains a mature and stable market, characterized by strict regulatory requirements for official seals and notary stamps, particularly in continental countries like Germany and France. Emphasis is placed on environmental sustainability, driving demand for eco-friendly, recycled, and bio-based material stamps.

- Latin America (LATAM): The LATAM market is growing moderately, supported by strong bureaucratic reliance on physical documentation and increasing industrial investment, though often preferring traditional, cost-effective rubber stamps over higher-priced self-inking mechanisms.

- Middle East and Africa (MEA): Growth in MEA is concentrated in the governmental and energy sectors, requiring robust, industrial-grade stamps for certifications and official approvals. Market expansion is correlated with infrastructure projects and increasing corporate formalization, driving demand for reliable marking solutions in harsh environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Rubber Stamps Market.- Trodat GmbH

- Colop Stempelerzeugung GmbH

- Shachihata Inc.

- Brother Industries, Limited

- R. A. Dykman Industries, LLC

- Trelleborg AB

- Stamp-Ever Co., Ltd.

- Cosco Industries, Inc.

- S.R. Industries

- RubberStamps.net

- ExcelMark

- Ideal Stamp

- Stamper's Anonymous

- Xstamper (Shachihata subsidiary)

- Shiny Stamp

- MaxStamp

- The Stampmaker

- Justrite Manufacturing Company

- Corpse Carver Stamps

- A-1 Stamp & Engraving

Frequently Asked Questions

Analyze common user questions about the Rubber Stamps market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between self-inking and pre-inked rubber stamps?

Self-inking stamps contain a removable, rotating internal ink pad that flips and replenishes the rubber die after each impression. Pre-inked stamps, utilizing Flash technology, hold the ink directly within the die itself, requiring no internal movement or separate pad, generally offering a quieter action and a sharper image for a longer duration before needing re-inking.

How is the growth of e-commerce influencing demand in the Rubber Stamps Market?

E-commerce expansion significantly drives demand, particularly in the logistics and packaging sectors, necessitating efficient physical marking for inventory management, quality control verification, tracking codes, and internal process stamps in fulfillment centers and warehouses globally. Personalized branding stamps for small online businesses also represent a major growth niche.

Which geographical region shows the most potential for growth in the market?

The Asia Pacific (APAC) region is forecasted to exhibit the highest Compound Annual Growth Rate (CAGR) due to rapid industrialization, increasing volumes of cross-border trade, and persistent reliance on physical documentation in large, rapidly developing economies such as China and India.

Are traditional rubber stamps being replaced entirely by digital signature technology?

While digital signatures have reduced the use of administrative stamps in some sectors, they have not fully replaced physical stamps. Rubber stamps remain essential for critical applications requiring physical, tangible marking on goods, secure packaging seals, international trade documents, and legal paperwork where a wet or dry physical impression is mandated by law or operational protocol.

What are the key technological advancements shaping the manufacturing of custom stamps?

Key advancements include high-precision CO2 laser engraving systems for intricate designs, the use of advanced photopolymer and Flash technologies for long-lasting pre-inked products, and the integration of web-to-print software to automate and streamline the custom design and ordering process for personalized consumer and corporate stamps.

What are the main restraints hindering growth in the rubber stamps industry?

The primary restraints include the aggressive global adoption of paperless policies and digital documentation systems, especially within large multinational corporations and developed governmental agencies. Furthermore, the availability of low-cost digital alternatives for internal document processing and verification poses a competitive challenge.

How are environmental concerns addressed by rubber stamp manufacturers?

Manufacturers are addressing environmental concerns by increasing the use of sustainable and eco-friendly materials, including bio-based polymers, recycled plastics for casings, and natural or non-toxic ink formulations. Some companies offer carbon-neutral or reduced-footprint stamp products, aligning with corporate sustainability goals.

What role do specialized industrial marking stamps play in the overall market?

Specialized industrial marking stamps use robust materials and unique, highly durable inks (e.g., solvent-based or quick-drying) designed to adhere to non-porous surfaces like metal, plastic, and textiles. These stamps are critical for quality control, permanent asset identification, and batch coding in harsh manufacturing and automotive environments, representing a high-value niche segment.

What is the significance of the photopolymer segment within the stamp market?

Photopolymer materials are crucial for custom stamp production, as they allow for exceptional detail and flexibility in design creation through a light exposure process. This material is highly favored by the crafting industry and businesses requiring complex logo replication due to its high resolution and lower production cost compared to traditional engraved rubber.

How important is the customization feature for maintaining market relevance?

Customization is paramount for market relevance, transforming rubber stamps from generic office tools into personalized branding and functional instruments. The ability to rapidly produce unique text, graphics, and specialized codes (like QR codes or sequential numbering) drives demand across SMEs, personal use, and niche industrial applications, offering significant differentiation from generic mass-produced items.

Which end-use industry is the largest consumer of rubber stamps?

The Commercial Offices and Corporate Sector, encompassing large administrative entities, law firms, and financial institutions, historically represents the largest consumer segment. These entities rely on stamps for high-volume, repetitive tasks such as endorsement, approval, signature replication, and document dating, prioritizing speed, consistency, and durability.

What is the expected average lifespan of a modern self-inking stamp?

A modern, high-quality self-inking stamp is typically rated for approximately 2,000 to 5,000 crisp impressions before the internal pad requires re-inking or replacement. The stamp mechanism itself, if properly maintained, can last for many years, offering excellent return on investment for high-frequency users.

How does the quality of ink impact the overall rubber stamp market?

Ink quality is a critical factor influencing user satisfaction and application breadth. High-quality, fast-drying, and archival inks ensure clear, non-smudging impressions that are resistant to fading, which is essential for legal and governmental documents. The development of specialized inks for different materials expands the market into industrial and textile marking.

What strategic role does online distribution play for rubber stamp manufacturers?

Online distribution, through dedicated e-commerce sites and major marketplaces, is strategically vital as it facilitates easy access to B2C consumers and SMEs, enabling seamless design customization and immediate ordering. This channel dramatically reduces turnaround time for personalized products and allows manufacturers to gather crucial customer data on design preferences.

What is a dater or numberer stamp and where is it predominantly used?

Dater or numberer stamps are specialized mechanical stamps featuring adjustable bands that allow users to quickly change dates, sequential numbers, or alphanumeric combinations. They are predominantly used in logistics, warehousing, banking, and administrative environments where documents or packages require standardized chronological or numerical tracking.

How does government use of seals and stamps contribute to market stability?

Governmental use provides foundational market stability as official seals, notary stamps, and authorized marks are mandatory for legal and administrative processes in most jurisdictions. These requirements are less susceptible to short-term economic fluctuations or immediate technological disruptions, ensuring consistent baseline demand for high-security, durable stamp products.

What distinguishes synthetic rubber from natural rubber in stamp production?

Synthetic rubber, often in the form of specialized polymers, offers superior resistance to oil-based or industrial inks, preventing degradation and swelling, which is crucial for chemical resistance and long-term durability, especially in manufacturing environments. Natural rubber is often chosen for its softer impression and lower initial cost.

What are the key drivers for growth in the personalization and crafting segment?

The personalization and crafting segment is driven by the rise of DIY culture, the desire for unique small business branding on packaging, and the increasing consumer interest in customized artistic expression. Manufacturers cater to this segment by offering detailed photopolymer stamps and user-friendly online design tools.

How do manufacturers ensure quality and consistency in mass-produced self-inking stamps?

Quality assurance is maintained through automated manufacturing processes, rigorous stress testing of internal components (springs and rotating mechanisms), and integration of Computer Vision systems during assembly to check alignment tolerances, ensuring smooth, leak-free operation and consistent, high-fidelity impressions across the product line.

What market opportunities exist in developing hybrid physical-digital marking solutions?

Hybrid solutions, such as stamps that include unique, scannable QR codes linking to digital documents or verification databases, represent a significant opportunity. This blend leverages the immediate authority of a physical stamp with the security and traceability benefits of digital technology, addressing concerns about counterfeit documentation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager