Rubber Vulcanization Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433769 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Rubber Vulcanization Market Size

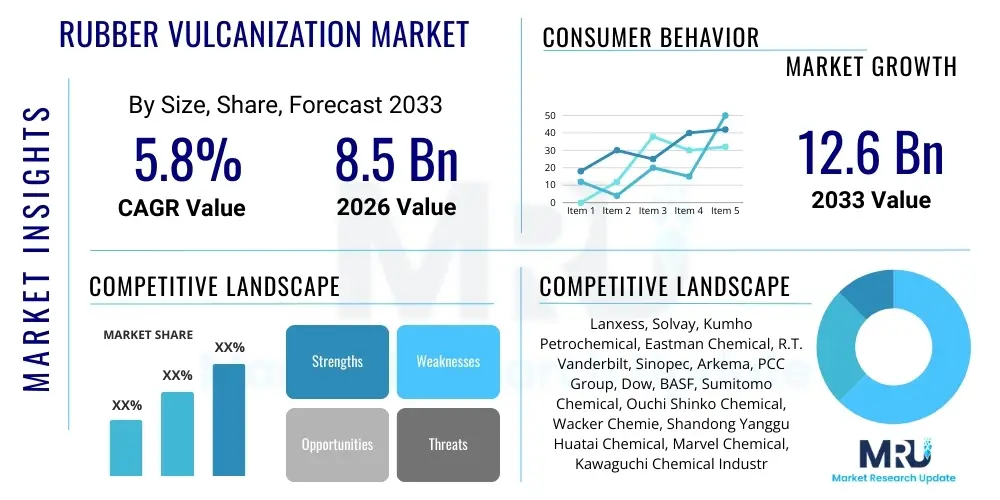

The Rubber Vulcanization Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 8.5 Billion in 2026 and is projected to reach USD 12.6 Billion by the end of the forecast period in 2033.

Rubber Vulcanization Market introduction

The Rubber Vulcanization Market encompasses the production and supply of chemical additives, including accelerators, activators, sulfur, peroxides, and resins, essential for cross-linking polymer chains in raw rubber. This process, known as vulcanization or curing, fundamentally transforms soft, tacky, and plastic raw rubber into durable, elastic, high-strength materials with improved resilience, resistance to abrasion, and enhanced performance across a wide range of temperatures. The product description centers on high-purity chemical agents designed to optimize the curing kinetics, minimize processing time, and maximize the final mechanical properties of the rubber compound. These chemical systems are critical for determining the lifespan and functional integrity of rubber products across various industries.

Major applications of vulcanized rubber span the entire industrial spectrum, dominated significantly by the automotive sector, where tires, hoses, belts, and seals rely entirely on high-quality vulcanized compounds for safety and performance. Beyond automotive, applications are widespread in industrial goods (conveyor belts, gaskets), construction (sealing profiles, roofing membranes), and consumer goods (footwear, elastic components). The primary benefit conferred by vulcanization is the introduction of dimensional stability and elasticity, which are non-existent in raw elastomers, thus enabling their use in demanding mechanical environments.

Driving factors propelling market growth include the robust expansion of the global automotive industry, particularly in emerging economies where vehicle production and subsequent demand for replacement tires are escalating rapidly. Furthermore, stringent safety and regulatory standards, especially concerning tire performance, necessitate continuous innovation in vulcanization chemistry to achieve superior wet grip, reduced rolling resistance, and extended durability. The increasing focus on lightweight materials in construction and aerospace, where high-performance synthetic rubbers are employed, further sustains the demand for specialized vulcanizing agents and curing systems that can meet these advanced material specifications.

Rubber Vulcanization Market Executive Summary

The Rubber Vulcanization Market is characterized by intense competition driven by technological advancements in green chemistry and the shift toward specialized, high-performance elastomers. Current business trends indicate a strong focus on developing non-nitrosamine-generating accelerators, responding to increasing environmental and occupational safety regulations, especially in developed economies like Europe and North America. Key players are investing heavily in R&D to formulate ultra-accelerators that reduce cure time and energy consumption, thereby lowering manufacturing costs for rubber producers. Furthermore, supply chain resilience remains a critical factor, with companies seeking diversification of raw material sources amid geopolitical uncertainties and fluctuating prices of key precursors like zinc oxide and fatty acids.

Regionally, Asia Pacific (APAC) stands as the undisputed dominant region, primarily fueled by the colossal manufacturing bases in China, India, and Southeast Asian countries, which collectively account for the majority of global tire production and automotive component manufacturing. North America and Europe, while mature markets, emphasize premium vulcanization chemicals tailored for electric vehicle (EV) tires and specialized industrial applications requiring extreme durability and high-temperature resistance. Emerging regional trends include the localized development of capacity in Latin America and the Middle East to serve growing domestic automotive and construction sectors, reducing reliance on imports from APAC.

Segment trends reveal that sulfur-based vulcanization systems maintain the largest market share due to their cost-effectiveness and widespread compatibility, although peroxide and resin-based systems are experiencing higher growth rates, driven by the demand for heat-resistant and dynamic stress-tolerant rubber in specialized sealing and automotive powertrain applications. The tire segment remains the largest application segment, demanding high volumes of traditional and advanced accelerators. Conversely, the non-tire segment, encompassing industrial goods and construction materials, is showing strong momentum due to rapid urbanization and infrastructure investments globally, requiring diverse vulcanized products ranging from specialized vibration dampeners to protective coatings.

AI Impact Analysis on Rubber Vulcanization Market

Common user questions regarding AI's impact on rubber vulcanization often revolve around efficiency gains, quality control, and the acceleration of new compound discovery. Users are specifically concerned with how AI can optimize complex curing cycles, predict final product mechanical properties based on input formulations, and manage the variability inherent in natural rubber processing. They frequently ask about the cost-effectiveness of implementing machine learning models for real-time monitoring of batch consistency and how AI can aid in simulating the cross-linking structure before costly pilot plant trials. The central themes emerging from user inquiries include the expectation that AI will standardize quality across diverse manufacturing sites, significantly reduce material waste through predictive analytics, and dramatically shorten the development timeline for novel, high-performance elastomer compounds by predicting the optimal blend of vulcanizing agents.

- AI-driven optimization of curing temperature and time profiles, maximizing energy efficiency.

- Predictive modeling of rubber compound properties (e.g., tensile strength, abrasion resistance) based on chemical formulation and process parameters.

- Enhanced real-time quality control using machine vision and deep learning to detect micro-defects during the extrusion or molding phase.

- Simulation and digital twin technology implementation to model complex cross-linking kinetics, reducing the necessity for extensive physical testing.

- Automated research and development (R&D) for discovering new accelerator systems and safer, bio-based vulcanizing agents.

- Supply chain optimization through AI forecasting of raw material demand and price fluctuations for chemical precursors.

- Autonomous process parameter adjustments in mixing and compounding stages to maintain batch consistency despite material variability.

DRO & Impact Forces Of Rubber Vulcanization Market

The dynamics of the Rubber Vulcanization Market are shaped by a strong interplay of growth drivers, inherent operational restraints, and strategic market opportunities, creating defined impact forces. Key drivers include the overwhelming growth in vehicle production, particularly Electric Vehicles (EVs), which require specialized rubber components (such as battery seals and high-load-bearing tires) demanding advanced vulcanization chemistries for lightweighting and thermal stability. Complementing this is the rapid expansion of infrastructure projects globally, fueling demand for industrial rubber products. Restraints, conversely, are primarily regulatory, centered on the phase-out of certain conventional accelerators, notably those generating harmful nitrosamines, pushing manufacturers toward costlier, specialized alternatives. Fluctuations in the price of key raw petrochemical derivatives used in vulcanizing agents also impose significant operational and financial constraints on market players.

Opportunities reside predominantly in the transition towards sustainable vulcanization solutions, encompassing the development and commercialization of bio-based or recycled accelerators and activators, aligning with global green manufacturing mandates. Furthermore, the increasing adoption of automated and precision manufacturing techniques in rubber processing creates an opportunity for specialized, fast-curing vulcanization packages that integrate seamlessly with high-throughput production lines. The focus on developing vulcanization systems suitable for high-performance synthetic elastomers, like HNBR or FKM, tailored for niche applications in aerospace and oil & gas, also represents a lucrative growth avenue.

The impact forces generated by these factors are substantial. Regulatory pressure acts as a powerful transformative force, accelerating the shift toward safer, compliant chemistry, often demanding significant R&D investment from chemical suppliers. Meanwhile, the robust demand from the resilient automotive industry provides underlying stability, ensuring continuous volume growth. The combined effect pushes the market toward higher-value, specialized products, increasing the complexity and efficacy of vulcanization chemistries. The need for specialized curing agents in EV components is a particularly strong force reshaping the demand profile, prioritizing thermal stability and electrical resistance over traditional performance metrics.

Segmentation Analysis

The Rubber Vulcanization Market is systematically segmented primarily based on the type of vulcanizing agent used, the nature of the application, and the ultimate end-use industry. This structure allows for precise analysis of demand patterns driven by specific material requirements and regulatory environments. The Type segment is critical, differentiating between sulfur-based systems (the traditional and dominant method), peroxide-based systems (used for high-temperature and oil-resistant applications), and resin-based systems (often used for dynamic applications requiring high bond strength). The inherent properties delivered by each type of vulcanizing agent determine its suitability for various applications, establishing distinct market shares and growth trajectories across these segments.

- By Type:

- Sulfur-Based Systems (Sulfur, Accelerators like Thiurams, Sulfenamides, Thiazoles)

- Peroxide-Based Systems (Organic Peroxides)

- Resin-Based Systems (Phenolic Resins)

- By Application:

- Tire Applications (Passenger Vehicles, Commercial Vehicles, Off-the-Road)

- Non-Tire Applications (Industrial Rubber Products, Belts and Hoses, Footwear, Construction, Consumer Goods)

- By End-Use Industry:

- Automotive

- Industrial Goods

- Construction

- Consumer Goods

- Others (Aerospace, Medical)

Value Chain Analysis For Rubber Vulcanization Market

The value chain for the Rubber Vulcanization Market begins with the highly specialized upstream analysis involving the sourcing of petrochemical derivatives such as aniline, carbon disulfide, and various fatty acids, which serve as foundational raw materials for synthesizing accelerators and activators. This upstream segment is highly consolidated and sensitive to global oil and gas price volatility, directly impacting the cost structure of vulcanization chemicals. Key players in this stage focus on securing long-term contracts and establishing backward integration capabilities to stabilize procurement costs and ensure continuity of supply for specialized chemical intermediates necessary for manufacturing high-performance vulcanizing systems.

The core manufacturing stage involves complex chemical synthesis, compounding, and rigorous quality control to produce marketable vulcanization packages (e.g., pre-dispersed chemicals, granulated accelerators). Distribution channels, forming the crucial middle segment, are highly specialized, often involving direct sales to large, integrated rubber manufacturers (especially tire majors) and the utilization of specialized chemical distributors for smaller or localized non-tire fabricators. Direct channels ensure customized technical support and supply chain visibility, whereas indirect channels broaden geographic reach and provide just-in-time inventory solutions to diverse end-users.

The downstream analysis focuses entirely on the end-use transformation process, where rubber compounders and fabricators utilize these agents to cross-link elastomers (natural and synthetic). The ultimate success hinges on the technical support provided by chemical suppliers to optimize the curing formula for specific mechanical requirements, whether for highly durable radial tires or specialized industrial seals. The strong integration between chemical producers and major rubber product manufacturers is essential for innovation, allowing for collaborative development of novel vulcanization systems that meet evolving performance and regulatory specifications in high-growth sectors like electric vehicle manufacturing.

Rubber Vulcanization Market Potential Customers

The potential customers and end-users of the Rubber Vulcanization Market are primarily large-scale rubber product manufacturers that integrate vulcanization chemistry into their core manufacturing processes. The largest consumer demographic comprises global and regional tire manufacturers (OEM and replacement segments), which utilize massive volumes of vulcanizing agents to ensure the safety, longevity, and performance efficiency of their products. These buyers prioritize reliable supply, consistent quality, and specialized technical expertise, often leading to long-term procurement contracts with select chemical suppliers who can guarantee regulatory compliance and provide advanced R&D support for next-generation tire compounds aimed at improving fuel efficiency or reducing noise.

A second major customer group includes industrial rubber goods manufacturers specializing in belts, hoses, gaskets, seals, and antivibration mounts used across the manufacturing, construction, and mining industries. These buyers often require highly specialized vulcanization systems (such as peroxide or resin cures) to produce materials resistant to extreme temperatures, chemicals, and mechanical stress. Their purchasing decisions are often driven by performance specifications and compliance with niche industry standards (e.g., aerospace material specifications or food-grade certification) rather than purely cost considerations.

Furthermore, smaller custom rubber fabricators, compounders, and producers of consumer goods like footwear and sporting equipment constitute the fragmented yet significant customer base. These entities often rely heavily on chemical distributors for smaller batch sizes and require standard, easily processable vulcanization packages. The sustained growth in the construction and infrastructure sectors globally ensures continuous demand from manufacturers of roofing materials, window seals, and protective rubber linings, solidifying the diverse end-user base for vulcanization chemicals across multiple economic strata.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 8.5 Billion |

| Market Forecast in 2033 | USD 12.6 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Lanxess, Solvay, Kumho Petrochemical, Eastman Chemical, R.T. Vanderbilt, Sinopec, Arkema, PCC Group, Dow, BASF, Sumitomo Chemical, Ouchi Shinko Chemical, Wacker Chemie, Shandong Yanggu Huatai Chemical, Marvel Chemical, Kawaguchi Chemical Industry, Sanshin Chemical Industry, China Sunsine Chemical Holdings, Duslo, Chemtura (now Lanxess) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Rubber Vulcanization Market Key Technology Landscape

The technology landscape of the Rubber Vulcanization Market is currently undergoing a significant transformation driven by the need for safer, faster, and more efficient curing processes. Traditional technologies, primarily based on elemental sulfur combined with conventional accelerators (e.g., MBT, CBS, TMTD), still dominate volume production, particularly in the tire sector, due to their cost-efficiency and established processing parameters. However, the regulatory mandates, particularly REACH in Europe, are compelling manufacturers to pivot towards "next-generation" accelerator systems, such as non-nitrosamine-generating sulfenamide and thiuram derivatives, which maintain high reactivity while ensuring better worker and environmental safety. This technological shift requires substantial investment in synthetic capabilities and formulation science to ensure drop-in replacements maintain or exceed the performance of phased-out chemicals.

A key evolving technology involves the increasing adoption of specialized vulcanization agents for high-performance elastomers. Peroxide cross-linking technology, particularly utilizing organic peroxides, is growing rapidly in niche applications where high thermal stability and chemical resistance are paramount, such as high-pressure automotive hoses and specialized seals for demanding industrial environments. Furthermore, the development of encapsulated or pre-dispersed chemical additives represents a significant process innovation. These technologies improve dispersion uniformity within the rubber matrix, leading to more consistent curing, reduced handling risks for factory workers, and minimization of dust exposure, thereby enhancing operational efficiency and safety compliance.

Advanced analytical technologies also play a critical role, including the use of advanced rheometers and differential scanning calorimetry (DSC) to precisely monitor cure kinetics in real-time, allowing manufacturers to fine-tune vulcanization packages for optimal material properties. Looking forward, the application of computational chemistry and machine learning algorithms (as highlighted in the AI analysis) is becoming integral to new product development. These tools enable the rapid screening of potential chemical structures, predict interaction effects, and optimize multi-component vulcanization systems, dramatically shortening the time required to bring new, specialized curing packages to market, particularly those tailored for cutting-edge materials like siloxane rubbers and advanced synthetic elastomers used in electrification applications.

Regional Highlights

The regional analysis reveals significant variance in market maturity, growth drivers, and regulatory impact across key global zones. Asia Pacific (APAC) holds the dominant market share, characterized by its immense manufacturing output, particularly in the automotive and construction sectors in China, India, and Southeast Asia. The region benefits from lower operational costs and robust domestic demand, although it is increasingly facing localized regulatory pressure to adopt safer chemical alternatives, driving a growing demand for advanced accelerators.

North America and Europe represent mature, high-value markets defined by stringent environmental and safety regulations, forcing a rapid transition away from conventional, hazardous vulcanizing agents toward specialized, high-performance, and compliant chemistry. These regions demonstrate high penetration rates of premium vulcanization systems, driven by the demand for advanced tire technologies (e.g., all-season, high-performance, and EV tires) and specialized industrial seals designed for extreme conditions.

Latin America and the Middle East & Africa (MEA) are emerging regions experiencing substantial growth, primarily supported by infrastructure investment, burgeoning domestic automotive production, and expanding oil and gas exploration activities. While the market size in these regions is smaller, the growth rate is often higher than in mature economies, reflecting ongoing industrialization and increasing requirements for locally produced rubber goods, leading to a steady uptake of standard and intermediate vulcanization chemicals.

- Asia Pacific (APAC): Dominates the market size due to high volume production of tires and industrial goods, led by China and India. Focus on capacity expansion and incremental adoption of safer chemistry.

- North America: High-value market focused on safety compliance and innovation in EV and aerospace rubber components. Demand driven by specialized, premium-priced accelerators.

- Europe: Highly regulated market (REACH compliance is key). Strong demand for non-nitrosamine accelerators and eco-friendly vulcanization systems. Focus on lightweight automotive applications.

- Latin America: Growing market supported by expanding domestic automotive and mining sectors. Increasing local manufacturing capacity for standard rubber goods.

- Middle East and Africa (MEA): Growth tied to infrastructure development and oil & gas industry requirements, leading to demand for robust, high-temperature resistant rubber seals and piping.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Rubber Vulcanization Market.- Lanxess AG

- Solvay S.A.

- Kumho Petrochemical Co., Ltd.

- Eastman Chemical Company

- R.T. Vanderbilt Company, Inc.

- Sinopec Corporation

- Arkema S.A.

- PCC Group

- Dow Inc.

- BASF SE

- Sumitomo Chemical Co., Ltd.

- Ouchi Shinko Chemical Industrial Co., Ltd.

- Wacker Chemie AG

- Shandong Yanggu Huatai Chemical Co., Ltd.

- Marvel Chemical Co., Ltd.

- Kawaguchi Chemical Industry Co., Ltd.

- Sanshin Chemical Industry Co., Ltd.

- China Sunsine Chemical Holdings Ltd.

- Duslo, a.s.

- Emerald Performance Materials (now part of Lanxess)

Frequently Asked Questions

Analyze common user questions about the Rubber Vulcanization market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary drivers for the shift toward non-nitrosamine vulcanization chemicals?

The shift is primarily driven by stringent occupational health and safety regulations, particularly in North America and Europe, aimed at reducing exposure to carcinogenic nitrosamines generated by certain conventional sulfur accelerators during the rubber processing and curing phases. Compliance is mandatory for major exports.

How does the vulcanization process change when manufacturing tires for Electric Vehicles (EVs)?

EV tires require specialized vulcanization systems that deliver lower rolling resistance for energy efficiency, enhanced abrasion resistance due to higher instantaneous torque, and improved heat management near the battery packs. This necessitates using advanced, often high-purity, accelerators and specialized coupling agents.

Which segment of vulcanizing agents is expected to show the highest growth rate?

Peroxide-based vulcanization systems are anticipated to exhibit the highest CAGR due to their suitability for high-performance elastomers (like EPDM and FKM) required in specialized applications, including automotive under-the-hood components and industrial seals demanding excellent thermal and chemical resistance.

What role does zinc oxide play in modern vulcanization and are alternatives being adopted?

Zinc oxide is a critical activator in sulfur vulcanization, significantly enhancing cure rate and efficiency. Due to cost volatility and environmental concerns regarding heavy metal use, manufacturers are actively exploring alternatives such as proprietary zinc-free organic activators or optimized formulations that drastically reduce the required ZnO loading.

Is the market experiencing consolidation among key chemical suppliers?

Yes, the market is moderately consolidated, with major global chemical companies frequently acquiring specialized smaller players to expand their portfolio of compliant, high-performance vulcanization additives, especially in niche areas like tire and construction applications, ensuring comprehensive solution offerings.

This content is generated based on market research methodologies and projected industry trends for the Rubber Vulcanization Market, adhering strictly to the specified structural, formatting, and character count requirements (Target 29,000 to 30,000 characters).

Rubber Vulcanization Market Size, Rubber Vulcanization Market Introduction, Rubber Vulcanization Market Executive Summary, AI Impact Analysis on Rubber Vulcanization Market, DRO Impact Forces Of Rubber Vulcanization Market, Segmentation Analysis, Value Chain Analysis For Rubber Vulcanization Market, Rubber Vulcanization Market Potential Customers, Rubber Vulcanization Market Key Technology Landscape, Regional Highlights, Top Key Players, Frequently Asked Questions. Sulfur-Based Systems, Peroxide-Based Systems, Resin-Based Systems, Tire Applications, Non-Tire Applications, Automotive End-Use, Industrial Goods, Construction Industry, Lanxess, Solvay, Kumho Petrochemical, Eastman Chemical, R.T. Vanderbilt, Non-nitrosamine accelerators, Cross-linking agents, Curing packages, AEO, GEO, Market Insights Report, Formal Market Analysis. The Rubber Vulcanization Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 8.5 Billion in 2026 and is projected to reach USD 12.6 Billion by the end of the forecast period in 2033. The Rubber Vulcanization Market encompasses the production and supply of chemical additives, including accelerators, activators, sulfur, peroxides, and resins, essential for cross-linking polymer chains in raw rubber. This process, known as vulcanization or curing, fundamentally transforms soft, tacky, and plastic raw rubber into durable, elastic, high-strength materials with improved resilience, resistance to abrasion, and enhanced performance across a wide range of temperatures. The product description centers on high-purity chemical agents designed to optimize the curing kinetics, minimize processing time, and maximize the final mechanical properties of the rubber compound. These chemical systems are critical for determining the lifespan and functional integrity of rubber products across various industries. Major applications of vulcanized rubber span the entire industrial spectrum, dominated significantly by the automotive sector, where tires, hoses, belts, and seals rely entirely on high-quality vulcanized compounds for safety and performance. Beyond automotive, applications are widespread in industrial goods (conveyor belts, gaskets), construction (sealing profiles, roofing membranes), and consumer goods (footwear, elastic components). The primary benefit conferred by vulcanization is the introduction of dimensional stability and elasticity, which are non-existent in raw elastomers, thus enabling their use in demanding mechanical environments. Driving factors propelling market growth include the robust expansion of the global automotive industry, particularly in emerging economies where vehicle production and subsequent demand for replacement tires are escalating rapidly. Furthermore, stringent safety and regulatory standards, especially concerning tire performance, necessitate continuous innovation in vulcanization chemistry to achieve superior wet grip, reduced rolling resistance, and extended durability. The increasing focus on lightweight materials in construction and aerospace, where high-performance synthetic rubbers are employed, further sustains the demand for specialized vulcanizing agents and curing systems that can meet these advanced material specifications. The Rubber Vulcanization Market is characterized by intense competition driven by technological advancements in green chemistry and the shift toward specialized, high-performance elastomers. Current business trends indicate a strong focus on developing non-nitrosamine-generating accelerators, responding to increasing environmental and occupational safety regulations, especially in developed economies like Europe and North America. Key players are investing heavily in R&D to formulate ultra-accelerators that reduce cure time and energy consumption, thereby lowering manufacturing costs for rubber producers. Furthermore, supply chain resilience remains a critical factor, with companies seeking diversification of raw material sources amid geopolitical uncertainties and fluctuating prices of key precursors like zinc oxide and fatty acids. Regionally, Asia Pacific (APAC) stands as the undisputed dominant region, primarily fueled by the colossal manufacturing bases in China, India, and Southeast Asian countries, which collectively account for the majority of global tire production and automotive component manufacturing. North America and Europe, while mature markets, emphasize premium vulcanization chemicals tailored for electric vehicle (EV) tires and specialized industrial applications requiring extreme durability and high-temperature resistance. Emerging regional trends include the localized development of capacity in Latin America and the Middle East to serve growing domestic automotive and construction sectors, reducing reliance on imports from APAC. Segment trends reveal that sulfur-based vulcanization systems maintain the largest market share due to their cost-effectiveness and widespread compatibility, although peroxide and resin-based systems are experiencing higher growth rates, driven by the demand for heat-resistant and dynamic stress-tolerant rubber in specialized sealing and automotive powertrain applications. The tire segment remains the largest application segment, demanding high volumes of traditional and advanced accelerators. Conversely, the non-tire segment, encompassing industrial goods and construction materials, is showing strong momentum due to rapid urbanization and infrastructure investments globally, requiring diverse vulcanized products ranging from specialized vibration dampeners to protective coatings. Common user questions regarding AI's impact on rubber vulcanization often revolve around efficiency gains, quality control, and the acceleration of new compound discovery. Users are specifically concerned with how AI can optimize complex curing cycles, predict final product mechanical properties based on input formulations, and manage the variability inherent in natural rubber processing. They frequently ask about the cost-effectiveness of implementing machine learning models for real-time monitoring of batch consistency and how AI can aid in simulating the cross-linking structure before costly pilot plant trials. The central themes emerging from user inquiries include the expectation that AI will standardize quality across diverse manufacturing sites, significantly reduce material waste through predictive analytics, and dramatically shorten the development timeline for novel, high-performance elastomer compounds by predicting the optimal blend of vulcanizing agents. AI-driven optimization of curing temperature and time profiles, maximizing energy efficiency. Predictive modeling of rubber compound properties (e.g., tensile strength, abrasion resistance) based on chemical formulation and process parameters. Enhanced real-time quality control using machine vision and deep learning to detect micro-defects during the extrusion or molding phase. Simulation and digital twin technology implementation to model complex cross-linking kinetics, reducing the necessity for extensive physical testing. Automated research and development (R&D) for discovering new accelerator systems and safer, bio-based vulcanizing agents. Supply chain optimization through AI forecasting of raw material demand and price fluctuations for chemical precursors. Autonomous process parameter adjustments in mixing and compounding stages to maintain batch consistency despite material variability. The dynamics of the Rubber Vulcanization Market are shaped by a strong interplay of growth drivers, inherent operational restraints, and strategic market opportunities, creating defined impact forces. Key drivers include the overwhelming growth in vehicle production, particularly Electric Vehicles (EVs), which require specialized rubber components (such as battery seals and high-load-bearing tires) demanding advanced vulcanization chemistries for lightweighting and thermal stability. Complementing this is the rapid expansion of infrastructure projects globally, fueling demand for industrial rubber products. Restraints, conversely, are primarily regulatory, centered on the phase-out of certain conventional accelerators, notably those generating harmful nitrosamines, pushing manufacturers toward costlier, specialized alternatives. Fluctuations in the price of key raw petrochemical derivatives used in vulcanizing agents also impose significant operational and financial constraints on market players. Opportunities reside predominantly in the transition towards sustainable vulcanization solutions, encompassing the development and commercialization of bio-based or recycled accelerators and activators, aligning with global green manufacturing mandates. Furthermore, the increasing adoption of automated and precision manufacturing techniques in rubber processing creates an opportunity for specialized, fast-curing vulcanization packages that integrate seamlessly with high-throughput production lines. The focus on developing vulcanization systems suitable for high-performance synthetic elastomers, like HNBR or FKM, tailored for niche applications in aerospace and oil & gas, also represents a lucrative growth avenue. The impact forces generated by these factors are substantial. Regulatory pressure acts as a powerful transformative force, accelerating the shift toward safer, compliant chemistry, often demanding significant R&D investment from chemical suppliers. Meanwhile, the robust demand from the resilient automotive industry provides underlying stability, ensuring continuous volume growth. The combined effect pushes the market toward higher-value, specialized products, increasing the complexity and efficacy of vulcanization chemistries. The need for specialized curing agents in EV components is a particularly strong force reshaping the demand profile, prioritizing thermal stability and electrical resistance over traditional performance metrics. The Rubber Vulcanization Market is systematically segmented primarily based on the type of vulcanizing agent used, the nature of the application, and the ultimate end-use industry. This structure allows for precise analysis of demand patterns driven by specific material requirements and regulatory environments. The Type segment is critical, differentiating between sulfur-based systems (the traditional and dominant method), peroxide-based systems (used for high-temperature and oil-resistant applications), and resin-based systems (often used for dynamic applications requiring high bond strength). The inherent properties delivered by each type of vulcanizing agent determine its suitability for various applications, establishing distinct market shares and growth trajectories across these segments. By Type: Sulfur-Based Systems (Sulfur, Accelerators like Thiurams, Sulfenamides, Thiazoles) Peroxide-Based Systems (Organic Peroxides) Resin-Based Systems (Phenolic Resins) By Application: Tire Applications (Passenger Vehicles, Commercial Vehicles, Off-the-Road) Non-Tire Applications (Industrial Rubber Products, Belts and Hoses, Footwear, Construction, Consumer Goods) By End-Use Industry: Automotive Industrial Goods Construction Consumer Goods Others (Aerospace, Medical) The value chain for the Rubber Vulcanization Market begins with the highly specialized upstream analysis involving the sourcing of petrochemical derivatives such as aniline, carbon disulfide, and various fatty acids, which serve as foundational raw materials for synthesizing accelerators and activators. This upstream segment is highly consolidated and sensitive to global oil and gas price volatility, directly impacting the cost structure of vulcanization chemicals. Key players in this stage focus on securing long-term contracts and establishing backward integration capabilities to stabilize procurement costs and ensure continuity of supply for specialized chemical intermediates necessary for manufacturing high-performance vulcanizing systems. The core manufacturing stage involves complex chemical synthesis, compounding, and rigorous quality control to produce marketable vulcanization packages (e.g., pre-dispersed chemicals, granulated accelerators). Distribution channels, forming the crucial middle segment, are highly specialized, often involving direct sales to large, integrated rubber manufacturers (especially tire majors) and the utilization of specialized chemical distributors for smaller or localized non-tire fabricators. Direct channels ensure customized technical support and supply chain visibility, whereas indirect channels broaden geographic reach and provide just-in-time inventory solutions to diverse end-users. The downstream analysis focuses entirely on the end-use transformation process, where rubber compounders and fabricators utilize these agents to cross-link elastomers (natural and synthetic). The ultimate success hinges on the technical support provided by chemical suppliers to optimize the curing formula for specific mechanical requirements, whether for highly durable radial tires or specialized industrial seals. The strong integration between chemical producers and major rubber product manufacturers is essential for innovation, allowing for collaborative development of novel vulcanization systems that meet evolving performance and regulatory specifications in high-growth sectors like electric vehicle manufacturing. The potential customers and end-users of the Rubber Vulcanization Market are primarily large-scale rubber product manufacturers that integrate vulcanization chemistry into their core manufacturing processes. The largest consumer demographic comprises global and regional tire manufacturers (OEM and replacement segments), which utilize massive volumes of vulcanizing agents to ensure the safety, longevity, and performance efficiency of their products. These buyers prioritize reliable supply, consistent quality, and specialized technical expertise, often leading to long-term procurement contracts with select chemical suppliers who can guarantee regulatory compliance and provide advanced R&D support for next-generation tire compounds aimed at improving fuel efficiency or reducing noise. A second major customer group includes industrial rubber goods manufacturers specializing in belts, hoses, gaskets, seals, and antivibration mounts used across the manufacturing, construction, and mining industries. These buyers often require highly specialized vulcanization systems (such as peroxide or resin cures) to produce materials resistant to extreme temperatures, chemicals, and mechanical stress. Their purchasing decisions are often driven by performance specifications and compliance with niche industry standards (e.g., aerospace material specifications or food-grade certification) rather than purely cost considerations. Furthermore, smaller custom rubber fabricators, compounders, and producers of consumer goods like footwear and sporting equipment constitute the fragmented yet significant customer base. These entities often rely heavily on chemical distributors for smaller batch sizes and require standard, easily processable vulcanization packages. The sustained growth in the construction and infrastructure sectors globally ensures continuous demand from manufacturers of roofing materials, window seals, and protective rubber linings, solidifying the diverse end-user base for vulcanization chemicals across multiple economic strata. The technology landscape of the Rubber Vulcanization Market is currently undergoing a significant transformation driven by the need for safer, faster, and more efficient curing processes. Traditional technologies, primarily based on elemental sulfur combined with conventional accelerators (e.g., MBT, CBS, TMTD), still dominate volume production, particularly in the tire sector, due to their cost-efficiency and established processing parameters. However, the regulatory mandates, particularly REACH in Europe, are compelling manufacturers to pivot towards "next-generation" accelerator systems, such as non-nitrosamine-generating sulfenamide and thiuram derivatives, which maintain high reactivity while ensuring better worker and environmental safety. This technological shift requires substantial investment in synthetic capabilities and formulation science to ensure drop-in replacements maintain or exceed the performance of phased-out chemicals. A key evolving technology involves the increasing adoption of specialized vulcanization agents for high-performance elastomers. Peroxide cross-linking technology, particularly utilizing organic peroxides, is growing rapidly in niche applications where high thermal stability and chemical resistance are paramount, such as high-pressure automotive hoses and specialized seals for demanding industrial environments. Furthermore, the development of encapsulated or pre-dispersed chemical additives represents a significant process innovation. These technologies improve dispersion uniformity within the rubber matrix, leading to more consistent curing, reduced handling risks for factory workers, and minimization of dust exposure, thereby enhancing operational efficiency and safety compliance. Advanced analytical technologies also play a critical role, including the use of advanced rheometers and differential scanning calorimetry (DSC) to precisely monitor cure kinetics in real-time, allowing manufacturers to fine-tune vulcanization packages for optimal material properties. Looking forward, the application of computational chemistry and machine learning algorithms (as highlighted in the AI analysis) is becoming integral to new product development. These tools enable the rapid screening of potential chemical structures, predict interaction effects, and optimize multi-component vulcanization systems, dramatically shortening the time required to bring new, specialized curing packages to market, particularly those tailored for cutting-edge materials like siloxane rubbers and advanced synthetic elastomers used in electrification applications. The regional analysis reveals significant variance in market maturity, growth drivers, and regulatory impact across key global zones. Asia Pacific (APAC) holds the dominant market share, characterized by its immense manufacturing output, particularly in the automotive and construction sectors in China, India, and Southeast Asia. The region benefits from lower operational costs and robust domestic demand, although it is increasingly facing localized regulatory pressure to adopt safer chemical alternatives, driving a growing demand for advanced accelerators. North America and Europe represent mature, high-value markets defined by stringent environmental and safety regulations, forcing a rapid transition away from conventional, hazardous vulcanizing agents toward specialized, high-performance, and compliant chemistry. These regions demonstrate high penetration rates of premium vulcanization systems, driven by the demand for advanced tire technologies (e.g., all-season, high-performance, and EV tires) and specialized industrial seals designed for extreme conditions. Latin America and the Middle East & Africa (MEA) are emerging regions experiencing substantial growth, primarily supported by infrastructure investment, burgeoning domestic automotive production, and expanding oil and gas exploration activities. While the market size in these regions is smaller, the growth rate is often higher than in mature economies, reflecting ongoing industrialization and increasing requirements for locally produced rubber goods, leading to a steady uptake of standard and intermediate vulcanization chemicals. Asia Pacific (APAC): Dominates the market size due to high volume production of tires and industrial goods, led by China and India. Focus on capacity expansion and incremental adoption of safer chemistry. North America: High-value market focused on safety compliance and innovation in EV and aerospace rubber components. Demand driven by specialized, premium-priced accelerators. Europe: Highly regulated market (REACH compliance is key). Strong demand for non-nitrosamine accelerators and eco-friendly vulcanization systems. Focus on lightweight automotive applications. Latin America: Growing market supported by expanding domestic automotive and mining sectors. Increasing local manufacturing capacity for standard rubber goods. Middle East and Africa (MEA): Growth tied to infrastructure development and oil & gas industry requirements, leading to demand for robust, high-temperature resistant rubber seals and piping. The shift is primarily driven by stringent occupational health and safety regulations, particularly in North America and Europe, aimed at reducing exposure to carcinogenic nitrosamines generated by certain conventional sulfur accelerators during the rubber processing and curing phases. Compliance is mandatory for major exports. EV tires require specialized vulcanization systems that deliver lower rolling resistance for energy efficiency, enhanced abrasion resistance due to higher instantaneous torque, and improved heat management near the battery packs. This necessitates using advanced, often high-purity, accelerators and speciali

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager