Ruby Earrings Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435730 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Ruby Earrings Market Size

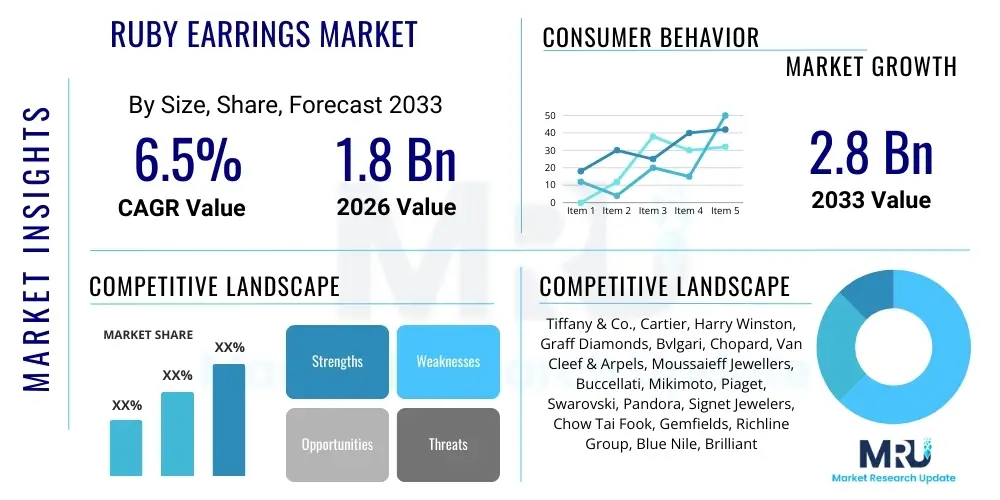

The Ruby Earrings Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 1.8 Billion in 2026 and is projected to reach USD 2.8 Billion by the end of the forecast period in 2033. This consistent growth trajectory is primarily fueled by the increasing disposable income among the affluent consumer base globally, coupled with the rising cultural significance of colored gemstones, particularly rubies, as investments and heirloom pieces. The market's valuation reflects a strong demand across both established luxury segments and rapidly expanding emerging economies in Asia Pacific.

The valuation reflects the high price point associated with natural, high-quality rubies and the premium placed on skilled craftsmanship and branded jewelry. Factors such as traceability, ethical sourcing, and certification (e.g., GIA, Gubelin) are becoming paramount, driving up the perceived and actual value of authenticated ruby earrings. Furthermore, technological advancements in cutting and setting techniques, particularly micro-pave and invisible settings, allow designers to create intricate and highly desirable pieces, further bolstering market value and consumer interest in bespoke and limited-edition collections.

Geographically, while North America and Europe remain foundational markets due to established luxury consumption patterns, the APAC region is exhibiting the most rapid expansion. This surge is attributed to wealth creation, shifting demographic preferences toward opulent jewelry for occasions like weddings and festivals, and the successful penetration of international luxury brands through omnichannel distribution strategies. The introduction of lab-grown rubies at competitive price points also expands the total addressable market, catering to environmentally conscious consumers and those seeking high aesthetic value without the corresponding premium of natural stones, contributing significantly to the overall market size projection.

Ruby Earrings Market introduction

The Ruby Earrings Market encompasses the design, manufacturing, distribution, and sale of ear jewelry featuring natural or lab-created ruby gemstones set in precious metals such as gold, platinum, or silver. Rubies, revered for their deep red color and exceptional hardness (9 on the Mohs scale), symbolize passion, prosperity, and status, making them highly sought after in the luxury jewelry sector. These pieces range from simple stud designs suitable for daily wear to elaborate chandelier or drop earrings reserved for high-end ceremonial occasions. The intrinsic value of the ruby, determined by its color saturation (pigeon's blood being the most prized), clarity, cut, and carat weight, defines the product segment and target consumer.

Major applications for ruby earrings span personal adornment, gifts for significant life milestones (such as anniversaries, birthdays, and graduations), and inclusion in bridal and high-fashion collections. The primary benefits driving market demand include the gemstone’s durability, timeless elegance, investment potential, and emotional symbolism. Unlike certain fashion jewelry trends, ruby earrings maintain their classic appeal, ensuring longevity in consumer preference. The association of rubies with luxury brands and heritage further enhances their market desirability, making them staple items in high-net-worth individual portfolios.

Key driving factors include global economic stability improving consumer confidence in luxury spending, effective digital marketing strategies emphasizing gemstone narrative and provenance, and the increasing influence of celebrities and social media on luxury jewelry trends. Furthermore, evolving fashion cycles are incorporating more vibrant colors, positioning the ruby as a central component in modern jewelry design. The diversification of the market through high-quality synthetic rubies is also a significant driver, allowing a wider demographic access to large, visually striking stones, thereby stimulating overall volume growth while maintaining the premium segment's integrity.

Ruby Earrings Market Executive Summary

The Ruby Earrings Market is characterized by robust resilience and steady innovation, with market growth underpinned by strong business trends focusing on sustainability and personalized experiences. Business trends highlight a significant shift towards omni-channel retail, where traditional brick-and-mortar stores are integrated seamlessly with sophisticated e-commerce platforms offering virtual try-ons and detailed digital certification. Leading luxury houses are investing heavily in supply chain transparency, ensuring ethical sourcing of rubies from established origins like Mozambique and Myanmar (Burma), responding directly to consumer demand for responsible luxury. Investment in advanced manufacturing technologies, such as 3D printing for wax molds, is accelerating design prototyping and customization capabilities, reducing time-to-market for new collections and driving operational efficiencies across the industry value chain.

Regionally, the market maintains its highest revenue concentration in North America and Western Europe, attributed to mature consumer markets with established traditions of purchasing high-carat jewelry. However, the Asia Pacific region, particularly Greater China and India, represents the fastest-growing market segment. This explosive regional trend is driven by massive generational wealth transfer, urbanization, and a cultural affinity for red gemstones which symbolize good fortune and prosperity. Latin America and the Middle East also demonstrate potential, fueled by high-net-worth individuals who view ruby jewelry as a critical asset class and status symbol, prompting luxury retailers to expand their presence in major regional hubs like Dubai and São Paulo through exclusive partnerships and flagship boutiques.

Segment trends indicate that the Type segmentation, particularly Drop and Dangle earrings, is experiencing accelerated growth, driven by fashion trends emphasizing statement jewelry for evening wear and social events. Within the Material segment, 18K Gold remains the dominant choice, although Platinum settings are gaining traction among ultra-luxury buyers seeking maximum durability and hypo-allergenic properties. The distribution landscape is witnessing the highest proportionate growth in the Online Retail segment, facilitated by enhanced security protocols for high-value shipping and the introduction of advanced augmented reality tools that bridge the sensory gap of online jewelry purchasing. Personalized and custom-designed ruby earrings, often commissioned through specialized artisan jewelers, also represent a high-value niche segment demonstrating above-average profit margins.

AI Impact Analysis on Ruby Earrings Market

User queries regarding the impact of Artificial Intelligence (AI) on the Ruby Earrings Market center primarily on personalized shopping experiences, ethical sourcing traceability, and accelerated design innovation. Consumers frequently ask how AI can guarantee the authenticity and origin of their stones, predict future jewelry trends, and offer hyper-personalized recommendations based on their style profile and past purchases. Key concerns revolve around the potential for AI to devalue artisan skills or dilute the emotional resonance of traditional jewelry selection. Overall, the expectation is that AI will streamline the procurement-to-purchase process, enhance transparency, and enable mass customization, fundamentally changing how consumers interact with and acquire high-end gemstone jewelry while optimizing the highly complex global supply chain associated with rubies.

- AI-driven trend forecasting for predicting color preferences and popular setting styles, optimizing inventory management for retailers.

- Enhanced supply chain traceability systems utilizing blockchain technology powered by AI to verify ruby provenance and ethical sourcing standards.

- AI integration in virtual try-on applications (Augmented Reality) offering real-time visualization of how different ruby earring cuts and settings look on the customer.

- Automated grading assistance tools that use image recognition to assess ruby color saturation, clarity, and cut parameters with higher consistency than manual inspection.

- Personalized marketing engines generating bespoke product recommendations and advertising creatives tailored to individual consumer taste and purchase history, maximizing conversion rates.

- Optimized manufacturing processes, including AI algorithms for precise laser cutting of rubies and efficient material usage in casting precious metals, minimizing waste.

DRO & Impact Forces Of Ruby Earrings Market

The dynamics of the Ruby Earrings Market are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively shape the competitive landscape and growth trajectory. Key drivers include the cultural significance and investment appeal of natural rubies, sustained growth in global high-net-worth populations, and increasing social media influence positioning ruby jewelry as a luxury lifestyle essential. These forces create a consistently high demand floor for premium products. However, the market faces significant restraints, notably the high cost and scarcity of high-quality natural rubies, which restricts accessibility and limits mass-market penetration. Furthermore, geopolitical instability in key sourcing regions (e.g., Africa, Southeast Asia) and stringent import/export regulations can disrupt the supply chain, impacting pricing and availability. The threat of sophisticated counterfeit products also necessitates continuous investment in security and authentication technologies, adding to operational costs.

Opportunities for market expansion are abundant, particularly through the introduction and aggressive marketing of high-quality lab-grown (synthetic) rubies. This alternative offers consumers ethical assurances, superior clarity, and accessibility at lower price points, broadening the consumer base beyond traditional luxury limits. Furthermore, digital transformation provides opportunities for direct-to-consumer (DTC) models, minimizing intermediary costs and allowing brands to offer enhanced customer education and transparent pricing. Developing innovative, modular, or convertible earring designs that offer multiple wearing styles also presents a strong opportunity to appeal to modern consumers seeking versatility and value in their luxury purchases, ensuring ongoing engagement with evolving fashion tastes.

The primary impact forces acting on this market include the global regulatory environment concerning conflict minerals and ethical sourcing, which forces companies to adopt comprehensive due diligence protocols. Economic shifts, such as inflation or recessionary pressures, immediately impact discretionary luxury spending, causing temporary volatility in demand. Conversely, the rising influence of conscious consumerism acts as a positive force, rewarding brands that prioritize environmental, social, and governance (ESG) factors in their operations. Technological innovation in gemstone production (e.g., specialized heat treatment to enhance color) and retail experience (e.g., virtual shopping appointments) serve as powerful internal forces determining competitive advantage among market players, compelling continuous investment in R&D and digital infrastructure to maintain market leadership.

Segmentation Analysis

The Ruby Earrings Market is comprehensively segmented based on various critical attributes, including the type of earring, the material of the setting, the origin of the ruby, the cut of the gemstone, and the distribution channel used for sales. Understanding these segmentations is vital for manufacturers and retailers to tailor their product offerings and marketing strategies effectively. For instance, the distinction between natural and lab-created rubies determines both the price point and the target demographic, with natural rubies dominating the high-value segment and lab-created stones appealing to the affordability and sustainability-conscious consumer. Distribution segmentation is becoming increasingly blurred, necessitating hybrid models that cater to both the desire for tactile, in-person luxury purchasing and the convenience of secure, high-quality online transactions, especially for bespoke items.

The differentiation across earring types—Stud, Drop, Hoop, and Chandelier—reflects varying consumer preferences based on occasion and style. Stud earrings remain the perennial classic, driving high volume due to their versatility and suitability for everyday wear, whereas Drop and Chandelier earrings command higher average selling prices (ASPs) as statement pieces for formal events. The metal used in the setting (Gold, Platinum, Silver) directly correlates with the perceived luxury and price. Gold, particularly 18K white and yellow gold, holds the largest market share due to its balance of durability, aesthetic appeal, and widespread cultural acceptance, while platinum caters to the ultra-premium niche seeking superior metal purity and durability.

Analyzing these segments provides strategic insights. For example, focusing on specific cuts like Oval or Cushion cuts for larger stones allows brands to maximize brilliance and appeal to traditional luxury buyers. Conversely, promoting Princess or Asscher cuts in smaller, pave-set designs can attract a younger, more design-forward audience. Geographical segmentation is equally important, as cultural preferences heavily influence demand; Asian markets often prefer warmer 22K or 24K yellow gold settings paired with high-saturation "pigeon's blood" rubies, whereas Western markets show a greater preference for 18K white gold or platinum settings with slightly lighter red tones.

- By Type:

- Stud Earrings

- Drop & Dangle Earrings

- Hoop Earrings

- Chandelier Earrings

- By Material:

- Gold (18K, 14K, 10K)

- Platinum

- Silver

- Other Alloys

- By Ruby Origin:

- Natural Rubies

- Lab-Created Rubies (Synthetic)

- By Cut:

- Round Cut

- Oval Cut

- Pear Cut

- Cushion Cut

- Emerald/Asscher Cut

- By Distribution Channel:

- Offline Retail (Exclusive Brand Stores, Specialty Jewelry Stores, Departmental Stores)

- Online Retail (E-commerce Websites, Company-Owned Portals)

Value Chain Analysis For Ruby Earrings Market

The value chain of the Ruby Earrings Market is intricate, beginning with resource extraction and culminating in final consumer sales. The upstream segment involves the mining and sourcing of corundum (ruby ore), primarily from geographic clusters in Southeast Asia and Africa. This stage is highly regulated and capital-intensive, requiring substantial investment in exploration, extraction technology, and adhering to strict ethical mining standards. Once extracted, the rough stones move through specialized cutters and polishers. The quality of the cutting process is critical, as it significantly influences the stone's final brilliance, color presentation, and subsequent market value. Ethical sourcing assurance is a major constraint and value-add activity at this initial stage, providing vital competitive differentiation for luxury brands.

Midstream activities involve the design, precious metal procurement, manufacturing, and setting of the ruby into the earring mount. Designers translate market trends and consumer insights into physical models, often utilizing advanced CAD/CAM software and 3D printing for precision prototyping. The manufacturing process includes casting the metal setting (gold, platinum), ensuring high-quality surface finish, and the meticulous process of stone setting, which requires highly skilled labor to secure the valuable rubies without damage. Quality assurance and certification by independent gemological laboratories (e.g., GIA, AGS) are critical midstream steps, providing the essential trust factor required for high-value transactions. Brands must manage inventory efficiently, balancing the high carrying costs of precious metals and gemstones against fluctuating demand.

The downstream analysis focuses on distribution and retail. Distribution channels are bifurcated into direct and indirect routes. Direct channels include brand-owned flagship stores and dedicated e-commerce platforms, offering the highest level of brand control over the customer experience and profit margins. Indirect channels involve authorized specialty jewelry stores, high-end department stores, and multi-brand luxury retailers. The shift toward robust online retail necessitates significant investment in secure logistics, insurance, and high-fidelity digital presentation (including 360-degree views and AR features). Effective post-sale service, including warranties, maintenance, and buy-back guarantees, completes the value cycle, ensuring customer loyalty and maximizing the lifetime value of the consumer.

Ruby Earrings Market Potential Customers

Potential customers for the Ruby Earrings Market are highly segmented, primarily encompassing high-net-worth individuals (HNWIs) and ultra-high-net-worth individuals (UHNWIs) seeking investment-grade, natural ruby jewelry for personal collection or generational transfer. This demographic prioritizes provenance, carat weight, superior clarity, and association with established heritage luxury brands known for exceptional craftsmanship and authenticated certification. Purchases within this segment are often driven by major life events, status signaling, and the desire to acquire unique, bespoke pieces, often through private appointments or exclusive pre-release showings, necessitating a highly personalized sales approach.

A secondary, rapidly expanding customer base includes the aspirational middle and upper-middle classes, particularly in emerging markets like China, India, and Southeast Asia. These buyers are typically purchasing ruby earrings for ceremonial purposes, such as weddings, festivals, and gifts. While they still value aesthetic quality and brand reputation, this segment is more price-sensitive and is increasingly open to high-quality, lab-created ruby options or pieces utilizing smaller, yet well-cut, natural rubies set in 14K gold. Retailers targeting this group must focus on accessible price points, promotional financing options, and strong marketing campaigns highlighting the emotional and cultural significance of the ruby.

Furthermore, contemporary consumers, including millennials and Gen Z, represent an emerging segment. This group values sustainability, ethical sourcing, and unique, contemporary designs over traditional high-carat extravagance. They often prefer versatile, modern settings (like platinum or minimal bezel settings) and are strong patrons of direct-to-consumer (DTC) brands that offer transparent sourcing narratives. This segment is highly active online, utilizing social media and digital channels for research and purchase, pushing brands to innovate not only in product design but also in digital engagement and sustainability reporting, driving the demand for conflict-free and environmentally responsible gemstone jewelry.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 2.8 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Tiffany & Co., Cartier, Harry Winston, Graff Diamonds, Bvlgari, Chopard, Van Cleef & Arpels, Moussaieff Jewellers, Buccellati, Mikimoto, Piaget, Swarovski, Pandora, Signet Jewelers, Chow Tai Fook, Gemfields, Richline Group, Blue Nile, Brilliant Earth, David Yurman |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ruby Earrings Market Key Technology Landscape

The Ruby Earrings Market is increasingly leveraging advanced technologies across its value chain to enhance product quality, ensure authenticity, and optimize consumer experience. A key technological advancement is the widespread adoption of Computer-Aided Design (CAD) and Computer-Aided Manufacturing (CAM) software. These tools enable jewelers to design intricate, highly precise settings, maximizing the light performance of the ruby and ensuring perfect alignment and fit. Coupled with high-resolution 3D printing, especially for rapid prototyping in wax or resin, brands can drastically reduce the time taken from initial concept to mold casting, facilitating faster response times to evolving fashion trends and accelerating personalized custom orders.

In the area of material science and production, technologies related to both natural and synthetic rubies are crucial. For natural rubies, advanced heat treatment processes, conducted under controlled atmospheric conditions, are used to optimize and stabilize color saturation, a critical determinant of value. For the burgeoning lab-created segment, technologies like the Verneuil, Czochralski, and Flux methods allow for the production of chemically and structurally identical rubies with exceptional clarity and size consistency, often preferred by consumers prioritizing perfection and ethical sourcing. These synthetic methods allow for reliable mass production, addressing the scarcity concerns associated with high-quality natural stones.

Furthermore, digital technologies are redefining the retail and security landscape. Blockchain technology is emerging as a standard for transparent supply chain management, offering immutable records of a ruby’s journey from mine to market, thereby combating fraud and certifying ethical provenance—a vital tool for AEO in addressing consumer trust questions. Retail experiences are being transformed by Augmented Reality (AR) and Virtual Reality (VR) applications that allow consumers to virtually try on high-value items before purchase, significantly lowering the barrier for high-value online transactions and offering a superior, engaging digital shopping experience. Specialized laser inscription and micro-tagging are also utilized for permanent, invisible identification of high-carat stones, enhancing security and facilitating future authentication.

Regional Highlights

Regional dynamics within the Ruby Earrings Market are stratified, reflecting variations in wealth accumulation, cultural preferences, and market maturity, necessitating tailored strategies for growth and penetration.

- North America (U.S. and Canada): This is a mature, high-spending market characterized by strong consumer demand for high-end designer brands and certified, investment-grade jewelry. The region leads in e-commerce adoption for luxury goods, and consumers place a high value on sustainable practices and detailed provenance tracking.

- Europe (UK, Germany, France, Italy): Europe is defined by its deep-rooted luxury heritage, with a strong emphasis on classic, timeless designs and artisanal craftsmanship. France and Italy, in particular, serve as global centers for jewelry design and manufacturing. The European market exhibits strong demand for 18K gold and platinum settings, favoring subtle elegance over overt statement pieces, although regional variations exist.

- Asia Pacific (APAC - China, India, Japan, Southeast Asia): APAC is the engine of future market growth, fueled by rapid wealth creation and deep cultural significance attached to red gemstones (symbolizing luck, prosperity, and power). India and China drive enormous demand for high-carat jewelry, particularly for weddings and traditional festivals. The market is increasingly adopting omni-channel retail, and the younger generation is driving the acceptance of high-quality lab-grown rubies.

- Middle East and Africa (MEA): This region is characterized by ultra-high-net-worth consumers who view high-carat ruby jewelry as an essential store of wealth and status symbol. Demand is concentrated in major wealth hubs like the UAE and Saudi Arabia, favoring opulent, elaborate designs, often involving large, unheated natural rubies.

- Latin America: This is an emerging market showing cautious but steady growth. Demand is centered among urban affluent populations, driven by local designers and the gradual penetration of international luxury brands. Economic volatility often steers demand towards pieces that retain investment value, maintaining a focus on high quality despite macroeconomic pressures.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ruby Earrings Market.- Tiffany & Co.

- Cartier

- Harry Winston

- Graff Diamonds

- Bvlgari

- Chopard

- Van Cleef & Arpels

- Moussaieff Jewellers

- Buccellati

- Mikimoto

- Piaget

- Swarovski

- Pandora

- Signet Jewelers (Kays, Zales)

- Chow Tai Fook

- Gemfields

- Richline Group (Berkshire Hathaway)

- Blue Nile

- Brilliant Earth

- David Yurman

- Kering (Boucheron, Pomellato)

- LVMH (Chaumet, Fred)

- De Beers Forevermark

- Tanishq (Tata Group)

Frequently Asked Questions

Analyze common user questions about the Ruby Earrings market and generate a concise list of summarized FAQs reflecting key topics and concerns.What factors determine the value of a ruby earring?

The value is determined by the Four Cs: Color (saturation, hue, tone—with "pigeon's blood" being the most prized), Clarity (lack of inclusions), Cut (proportions and symmetry), and Carat weight. Origin, treatment (heated vs. unheated), and certification status also significantly impact the final price. Provenance and ethical sourcing are growing value determinants.

Are lab-created rubies considered genuine alternatives to natural rubies?

Lab-created rubies are chemically, physically, and optically identical to natural rubies, offering superior clarity and color consistency at a lower cost. While they hold less investment value than high-quality natural stones, they are a genuine, ethically sourced alternative for consumers prioritizing aesthetics, affordability, and sustainability, driving substantial growth in the accessible luxury segment.

How is the ethical sourcing of rubies guaranteed in the current market?

Ethical sourcing is increasingly guaranteed through rigorous due diligence, third-party certification (e.g., RJC membership), and the use of technology like blockchain for transparent, traceable supply chain tracking from the mine to the point of sale. Major luxury brands adhere to strict internal protocols to ensure their rubies are conflict-free and extracted responsibly, addressing key AEO consumer concerns about provenance.

What are the current key trends influencing ruby earring design?

Current design trends emphasize versatility, modularity (convertible pieces), and a return to bolder, statement designs like chandelier and elongated drop earrings. Modern consumers favor personalized jewelry, often combining rubies with other contrasting gemstones. Minimalist settings (bezel or tension settings) in white metals are popular among younger buyers, while classic yellow gold remains dominant in Asian markets.

Which distribution channels are experiencing the fastest growth for luxury ruby earrings?

The Online Retail channel is experiencing the fastest proportional growth, driven by enhanced secure logistics, sophisticated e-commerce platforms featuring AR try-ons, and brand-owned direct-to-consumer websites offering transparency and exclusive collections. However, Offline Retail, specifically flagship brand boutiques, remains crucial for high-value sales, serving as experience centers for personalized consultations and authentication services.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager