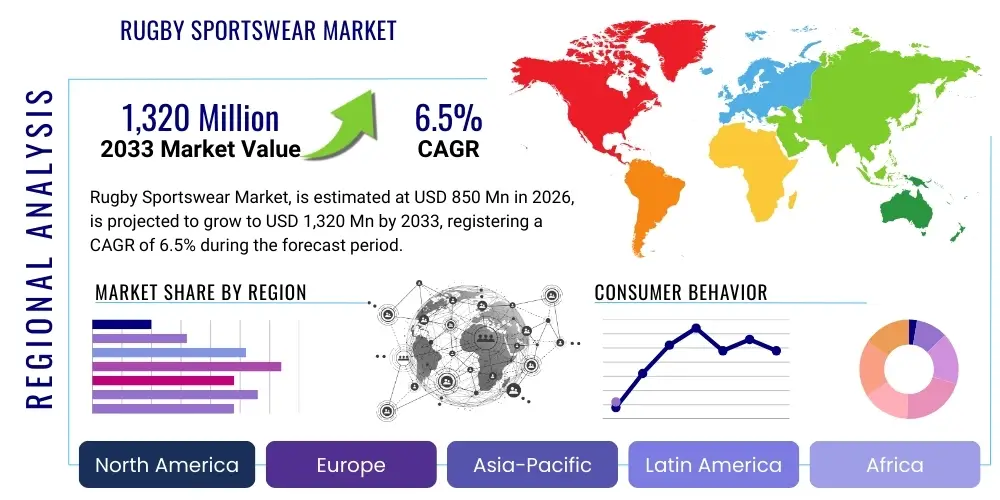

Rugby Sportswear Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434807 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Rugby Sportswear Market Size

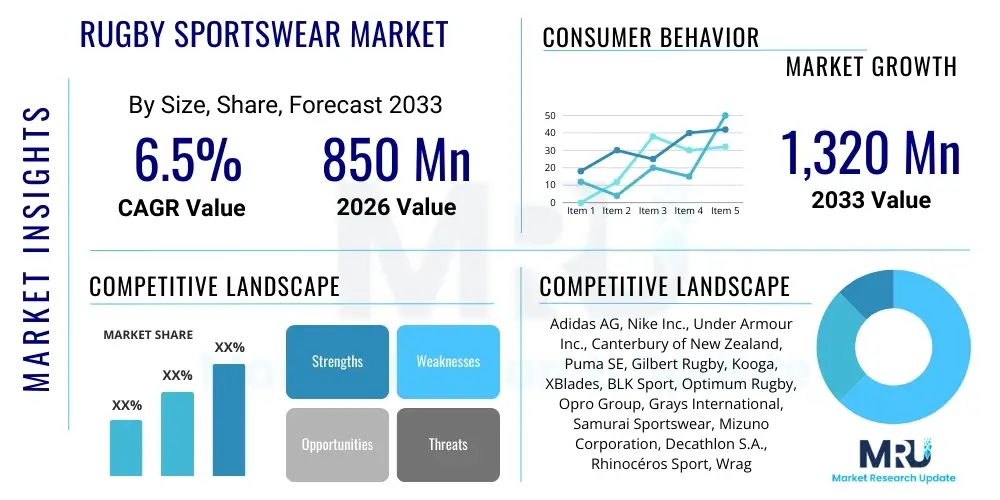

The Rugby Sportswear Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 850 Million in 2026 and is projected to reach USD 1,320 Million by the end of the forecast period in 2033.

Rugby Sportswear Market introduction

The Rugby Sportswear Market encompasses specialized apparel, footwear, and protective gear designed to meet the rigorous demands of rugby athletes across amateur, professional, and recreational levels. This specialized segment is distinct from general sports apparel due to the necessity for extreme durability, enhanced grip features, injury prevention properties, and compliance with stringent World Rugby regulations regarding safety and performance specifications. Key products include jerseys, shorts, protective headwear, shoulder pads, mouthguards, and specialized rugby boots. The primary driving forces include the global expansion of major rugby tournaments, increased participation in youth rugby programs, and continuous technological advancements in fabric engineering aimed at improving player performance and minimizing injuries.

Rugby sportswear is fundamentally differentiated by its focus on ruggedness and anatomical fit, crucial for maximizing mobility during intense scrums, tackles, and rucks. Major applications span professional club competitions such as the Premiership, Super Rugby, and the Top 14, international fixtures like the Rugby World Cup and Six Nations Championship, and extensive usage in collegiate and school-level sports. The core benefits derived from high-quality rugby apparel include improved temperature regulation through moisture-wicking materials, enhanced kinetic performance via compression technology, and increased player safety through impact absorption features. The market's structure is heavily influenced by sponsorship deals between major brands and elite teams, which significantly drive consumer adoption of replica and authentic kits, establishing product credibility and visibility.

The market environment is witnessing a crucial shift toward sustainability, with consumers increasingly demanding eco-friendly materials and ethical production processes. This trend is compelling manufacturers to integrate recycled polyester and other sustainable fabrics into their product lines, particularly in high-volume items like official team jerseys. Furthermore, the rising commercialization of rugby, especially in emerging markets like the United States and Japan, is creating substantial revenue streams through merchandising and localized product launches. Driving factors also include improvements in retail infrastructure, particularly the growth of e-commerce channels, which facilitates broader global access to specialized and customized rugby apparel, catering efficiently to niche fan bases and geographically dispersed amateur clubs while overcoming geographical barriers associated with traditional retail footprints.

Rugby Sportswear Market Executive Summary

The global Rugby Sportswear Market is currently characterized by robust expansion, fueled primarily by the increasing professionalization of the sport, rising global viewership of major events, and significant technological integration into product lines. Business trends indicate a strong focus on strategic mergers and acquisitions among established sportswear giants and smaller, niche rugby equipment manufacturers, aiming to consolidate intellectual property related to material innovation and specialized product design, ensuring a competitive edge in performance and safety features. Customization and personalization are emerging as critical competitive differentiators, especially within the direct-to-consumer (D2C) segment, allowing amateur clubs and individual players access to high-specification, tailored gear and branding options. Supply chain optimization, particularly in mitigating rising raw material costs and navigating geopolitical trade disruptions to ensure timely product delivery, remains a central management focus across the industry value chain.

Regional dynamics highlight Europe, specifically the UK and France, as the largest and most mature market, driven by deep-seated historical participation rates, established professional leagues, and high consumer spending power allocated to sports merchandise and technical gear. However, the Asia Pacific (APAC) region, spearheaded by growth in Australia, New Zealand, and strategic market development in Japan and emerging Southeast Asian nations, is anticipated to exhibit the highest Compound Annual Growth Rate (CAGR) due to successful global hosting of major tournaments and significant investment in grassroots development programs designed to increase overall participant numbers. North America represents a crucial emerging opportunity, with collegiate rugby gaining traction and professional leagues expanding their footprint, indicating a substantial future demand reservoir. Economic stability and disposable income levels correlate directly with the adoption of premium, technology-integrated apparel across these key geographical zones, influencing pricing and distribution strategies.

Segment trends underscore the dominance of the Apparel category, specifically jerseys, shorts, and protective clothing, representing the largest revenue share due to frequent replacement cycles and high volume demand from both professional and amateur teams. Within materials, synthetic fabrics like polyester and elastane continue to prevail due to their proven performance attributes regarding durability and moisture management, though sustainable alternatives incorporating recycled or bio-based polymers are rapidly gaining market share driven by corporate responsibility mandates and consumer preference. The distribution channel analysis shows that specialty retail stores, despite the e-commerce surge, retain strategic importance for fitting highly specialized items like boots and protective headgear, ensuring customer safety compliance and expert advice. While the professional athlete segment drives cutting-edge innovation, the larger amateur/recreational segment provides the necessary scale for sustained market profitability, requiring diverse product offerings and effective pricing strategies to capture varied spending capabilities across different demographic profiles.

AI Impact Analysis on Rugby Sportswear Market

Common user questions regarding AI's influence in the Rugby Sportswear Market center around personalized product recommendations, optimizing material selection for extreme stress tolerance, predictive maintenance of equipment life cycles, and enhancing fan engagement through customized merchandise design interfaces. Users frequently inquire about how AI can analyze biomechanical data captured during training or match play to recommend the optimal apparel features, such as the precise compression level required for specific muscle groups or the ideal padding placement to minimize region-specific injury risk, thereby shifting apparel from basic uniform to a functional performance tool. There is also significant user curiosity regarding AI-driven demand forecasting, which promises dramatically improved inventory management efficiency, and the deployment of personalized sizing tools delivered via augmented reality (AR) shopping interfaces, particularly valuable for geographically dispersed online customers who cannot access in-store fitting services.

The integration of artificial intelligence is fundamentally transforming the research and development (R&D) cycle in rugby sportswear. AI algorithms are adept at processing massive datasets related to fabric performance under dynamic conditions, athlete physiological responses, and impact dynamics. This capability allows manufacturers to move beyond traditional testing methods and accelerate the development of ultra-durable, lightweight, and anatomically precise gear. For instance, generative design using AI can prototype thousands of viable internal padding structures for shoulder protection or scrum caps, identifying optimal configurations that balance impact absorption and weight reduction, leading to faster, safer, and more effective product launches while maintaining compliance with stringent international regulations.

Moreover, AI extends its impact into consumer interaction and business intelligence. By analyzing purchasing patterns, social media sentiment, and demographic data, AI systems can deliver hyper-targeted marketing campaigns and product line expansions. This not only drives sales of existing products but also informs strategic decisions regarding regional expansion and partnership opportunities. The summarized expectation across the consumer and business sectors is that AI will transcend basic e-commerce applications, deeply integrating into R&D and manufacturing processes to deliver highly specialized, performance-enhancing, and sustainably produced rugby gear, ensuring the market remains aligned with modern technological capabilities and consumer demands for specialized sports equipment.

- AI-Driven Product Design: Utilizing machine learning to analyze athlete movement, impact forces, and thermal mapping to engineer jerseys and protective gear with optimal material composition, stress tolerance, and ergonomic design, resulting in performance gains.

- Personalized Sizing and Fit: Implementation of computer vision and AI algorithms via mobile apps to scan body dimensions and recommend precise sizing for boots and apparel, reducing return rates, enhancing fit satisfaction, and optimizing inventory allocation in the specialized fit category.

- Supply Chain Optimization: AI models predicting fluctuations in demand for specific team merchandise or seasonal gear, optimizing inventory levels by minimizing overstock and stockouts, and streamlining logistics from global manufacturing hubs to regional distribution centers.

- Injury Prevention Analytics: Integrating AI with wearable technology embedded in clothing to monitor physiological stress indicators, alerting players and coaches to potential overexertion or injury risk based on real-time data analysis and providing actionable insights for training load management.

- Fan Engagement and Customization: Using natural language processing (NLP) and sophisticated recommendation engines to offer highly personalized, customizable replica kit options and fan gear based on individual purchase history, browsing behavior, and social media sentiment analysis, deepening brand loyalty.

- Sustainable Material Sourcing: AI assisting in identifying and validating sustainable, high-performance material alternatives, tracking the environmental footprint of raw materials, and optimizing manufacturing processes to minimize fabric waste and energy consumption, supporting corporate sustainability goals.

DRO & Impact Forces Of Rugby Sportswear Market

The market is fundamentally driven by the escalating global popularity of rugby, marked by high-profile international competitions such as the Rugby World Cup, which significantly boost demand for licensed merchandise and professional-grade equipment, creating powerful marketing platforms. Key drivers include rigorous and continually updated enforcement of safety standards by governing bodies like World Rugby, which necessitates the continuous upgrade of protective equipment to comply with the latest regulations, forcing innovation and replacement purchases. Further acceleration comes from consumer willingness to invest in performance-enhancing apparel featuring advanced moisture management, heat regulation, and compression technologies, fueled by athletic desire for marginal gains in performance and recovery. These intertwined factors create a fertile ground for innovation and premium product differentiation, justifying higher price points for specialized gear.

Opportunities for exponential growth are concentrated in emerging rugby markets, particularly Asia and North America, where increased media coverage, strategic league development, and significant financial investment in local leagues promise future exponential consumer base expansion beyond the traditional rugby nations. Furthermore, the development of smart apparel integrating miniaturized, non-invasive sensors for performance tracking, biometric monitoring, and collision analysis offers a substantial avenue for premium product introduction and technological leadership, attracting investments from technology firms. Strategic mitigation of restraints, such as combating pervasive counterfeiting through advanced RFID or NFC authentication technology and securing long-term, stable contracts with key material suppliers to manage price volatility, is essential for achieving and sustaining profitable growth in a competitive environment. Addressing consumer price sensitivity in amateur segments through effective value engineering is also vital for broad market capture.

The impact forces influencing the Rugby Sportswear Market are multidimensional, encompassing intense brand competition leading to aggressive pricing strategies, rapid technological changes necessitating continuous research and development investment to remain relevant, and evolving regulatory environments concerning player safety and equipment specifications, demanding strict quality control. Supplier bargaining power is moderate but critical, particularly for the few specialized high-tech textile and polymer manufacturers, whose proprietary materials give them leverage. Conversely, buyer power remains high due to the availability of numerous established brands and viable substitution options for general sportswear in the training category. The threat of new entrants is moderate, as establishing the necessary brand credibility, securing mandatory technical certifications, and obtaining high-profile team sponsorships requires significant capital and time, but niche innovators can disrupt specific, high-tech segments like protective wear through proprietary impact-absorption technology. Overall, the competitive dynamics currently favor established global sportswear players and specialized rugby brands capable of leveraging deep R&D capabilities, extensive global distribution networks, and powerful brand recognition built through successful team partnerships.

Segmentation Analysis

The Rugby Sportswear Market segmentation provides a granular view of consumer preferences and operational focus areas, primarily categorized by Product Type, Material Composition, Application Level, End User Demographic, and preferred Distribution Channel. This detailed categorization is absolutely crucial for market participants to tailor their marketing efforts, product development strategies, inventory management, and pricing structures effectively to maximize market penetration across diverse consumer groups. Product segmentation, separating high-volume, frequently replaced items (jerseys, shorts) from high-value specialty items (protective gear, boots), highlights varied margin profiles and inherent differences in consumer purchasing behavior and product replacement cycles. This differentiation guides production planning and resource allocation across the manufacturing base.

Analyzing material segmentation provides crucial insight into the industry's directional shift, tracking the transition from traditional, highly durable synthetics (like heavy-gauge polyester) toward performance-integrated, lighter, and increasingly sustainable textiles (recycled nylon, bio-based fibers). This trend is significant as it influences strategic decisions regarding sourcing, R&D budgets allocated to material science, and compliance with ethical and environmental standards demanded by modern consumers and corporate stakeholders. Furthermore, application segmentation (Professional vs. Amateur/Recreational) informs product specification; professional gear requires extreme optimization and durability for elite performance, while amateur gear often prioritizes cost-effectiveness and broader size availability.

- By Product Type:

- Apparel (Jerseys, Shorts, Training Wear, Base Layers, Performance Outerwear)

- Footwear (Specialized Rugby Boots, Training Shoes)

- Protective Gear (Headguards, Shoulder Pads, Scrum Caps, Mouthguards, Taping and Strapping Accessories)

- Accessories (Bags, Balls, Training Aids)

- By Material:

- Synthetic Fabrics (Polyester, Nylon, Elastane, Polypropylene)

- Natural Fibers (Cotton Blends, Specialized Wool for Base Layers)

- Sustainable/Recycled Materials (Recycled Polyester, Organic Cotton)

- Advanced Impact Polymers and Foams (EVA, XRD Technology)

- By Application:

- Professional (International Teams, Elite Clubs)

- Amateur/Recreational (University, School, Local Clubs, Casual Players)

- By End User:

- Men (Dominant revenue share)

- Women (Fastest-growing segment due to increasing female participation)

- Children (Key market for brand building and entry-level products)

- By Distribution Channel:

- Online Retail (E-commerce Websites, Company-owned Portals, Third-Party Marketplaces)

- Offline Retail (Specialty Sports Stores, Hypermarkets/Supermarkets, Team-specific Retail Outlets)

Value Chain Analysis For Rugby Sportswear Market

The value chain for the Rugby Sportswear Market initiates with upstream activities centered on meticulous raw material procurement, dominated by the sourcing of specialized high-performance synthetic fibers, advanced polymers for durable protective gear, and specialized rubber compounds optimized for high-traction rugby boot soles. The complexity in this stage stems from managing relationships with specialized textile manufacturers capable of delivering specific performance features like four-way mechanical stretch, advanced moisture-wicking properties, anti-abrasion coatings, and extreme tear resistance necessary for rugby’s physically demanding environment. Efficient, ethical sourcing and rigorous quality control at this initial stage are critically paramount, as the integrity, performance, and mandated safety features of the final product are inextricably linked to the quality and specification of the initial raw materials, driving significant investment into material testing laboratories.

The midstream segment involves design, manufacturing, and quality assurance. Manufacturing processes utilize sophisticated computer-aided design (CAD) for pattern creation, precision cutting, specialized high-durability stitching (often reinforced flatlock stitching for comfort and longevity), high-resolution printing (sublimation printing for complex team logos and sponsors), and complex assembly of protective gear components. Branding and aggressive marketing, particularly through high-profile team and player endorsement deals, create significant perceived value and drive massive consumer demand for replica kits and associated performance gear. This segment demands high labor skill and advanced machinery to maintain both durability standards and ergonomic comfort.

The downstream segment encompasses distribution, retail, and post-sale services. The distribution channel is strategically bifurcated into direct and indirect routes. Direct distribution leverages company-owned e-commerce platforms and flagship retail stores, offering maximum control over pricing, brand messaging, and valuable customer data collection, facilitating personalized marketing. Indirect channels utilize established third-party specialty sporting goods retailers, large chain stores, and online marketplaces, which are essential for achieving broad market penetration globally and offering specialized fitting services. Specialty sports retail remains a critical channel, especially for items requiring expert consultation and fitting, such as boots and customized protective headgear, where in-person assurance significantly boosts consumer confidence and reduces safety liabilities. Logistics management must be highly responsive to significant seasonal peaks in demand, particularly leading up to major tournaments like the Rugby World Cup or Six Nations, requiring sophisticated inventory planning and agile fulfillment strategies to minimize the risk of inventory obsolescence.

Rugby Sportswear Market Potential Customers

The primary end-users and buyers in the Rugby Sportswear Market are diverse, ranging significantly from large institutional purchasers governing the sport to individual consumers purchasing retail items. Professional and amateur rugby clubs constitute a major institutional customer base, requiring substantial, recurring bulk orders of customized apparel (playing jerseys, training kits) and standardized protective equipment. These sales are often secured through lucrative, multi-year supply contracts that ensure consistent, high-volume revenue streams for manufacturers, making club relationships critically important strategic assets. National rugby federations and governing bodies also act as significant high-profile buyers, procuring equipment and high-specification apparel for national teams, development squads, and administrative staff, simultaneously influencing market technical standards through their supplier selection and regulatory requirements.

Individual consumers represent the largest volume segment of the market and can be broadly segmented into performance-driven athletes and devoted merchandise fans. Performance athletes prioritize the latest technological innovations in compression wear, specialized technical training gear, and high-performance boots that promise marginal gains in speed, agility, and injury protection, showing high price inelasticity for advanced features. Devoted fans, conversely, drive the crucial high-margin replica and licensed merchandise segment, demonstrating demand that is highly sensitive to team performance and season-specific designs, with sales peaking significantly around major international events, emphasizing the importance of brand licensing agreements and rapid production cycles for event-specific gear.

A rapidly growing customer segment includes youth leagues, scholastic teams, and educational institutions, driven by increasing localized efforts to promote rugby globally through structured school and community programs. Parents, acting as the purchasing decision-makers, seek entry-level equipment and apparel for their children, focusing intensely on core aspects like durability, value, and regulatory safety compliance, which creates an essential pipeline for building future brand loyalty and expanding the general participant base. Furthermore, the emerging segment of fitness enthusiasts engaging in rigorous high-intensity training or multi-sport activities often seeks out rugby-specific protective gear and robust base layers due to their superior durability, anatomical support, and proven ability to withstand extreme stress, effectively expanding the market application beyond strictly traditional rugby game play into general high-impact training wear.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 Million |

| Market Forecast in 2033 | USD 1,320 Million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Adidas AG, Nike Inc., Under Armour Inc., Canterbury of New Zealand, Puma SE, Gilbert Rugby, Kooga, XBlades, BLK Sport, Optimum Rugby, Opro Group, Grays International, Samurai Sportswear, Mizuno Corporation, Decathlon S.A., Rhinocéros Sport, Wragby Sportswear, Kukri Sports, Castore, Joma Sport. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Rugby Sportswear Market Key Technology Landscape

The technological evolution within the Rugby Sportswear Market is primarily centered on advanced material science, digital integration, and biomechanical engineering, all strategically aimed at enhancing player performance metrics, improving apparel durability, and maximizing crucial safety standards compliance. Advanced fabric technology constitutes the core of innovation, featuring materials designed with superior, rapid moisture management capabilities (hydrophilic treatments), integrated anti-microbial properties crucial for hygiene management, and highly advanced rip-stop and anti-abrasion weaves (often utilizing high-performance blends like Kevlar or reinforced high-denier polyester) specifically engineered to withstand the extreme tearing, friction, and pulling forces inherent in rugby scrums, tackles, and rucks without compromising flexibility. Furthermore, sophisticated compression technology is crucial, utilizing graduated pressure application in base layers to improve peripheral blood circulation, stabilize muscles, and accelerate essential post-exertion recovery, thereby minimizing athlete fatigue during high-intensity periods of play and training.

Digital technologies are rapidly transforming both the product development life cycle and direct consumer interaction. Cutting-edge 3D knitting and full body mapping techniques are extensively utilized to create apparel patterns that contour precisely and anatomically to the athlete’s unique body shape, optimizing freedom of movement, reducing chafing risk, and ensuring targeted structural support exactly where it is needed most. Furthermore, the pioneering integration of smart textiles embedded with flexible, durable micro-sensors represents a significant technological leap forward. These integrated sensors capture real-time, granular biometric and performance data—such as athlete heart rate variability, peak collision impact force measurements, running gait analysis, and muscular activity metrics—providing immediately valuable, actionable insights for coaches, medical staff, and product developers tasked with improving player safety and performance through clothing modifications.

Footwear technology continues its rapid advancement, focusing intently on designs that are simultaneously lightweight for speed yet offer high stability and energy return. Modern, high-specification rugby boots utilize specialized, hybrid stud configurations (often interchangeable metal or molded synthetic components) that are precisely tailored for optimal ground grip, lateral stability, and rotational control on various common playing surfaces, fundamentally reducing the substantial risk of ankle, knee, and lower limb injuries common in high-impact sports. The manufacturing of protective gear, such as compliant headguards and specialized shoulder pads, increasingly relies on sophisticated materials science, incorporating advanced, multi-density impact-resistant foams (e.g., specific high-density EVA or proprietary XRD Technology) that are proven to dissipate impact energy highly effectively upon collision while simultaneously maintaining minimal physical bulk and weight, ensuring strict adherence to World Rugby’s continually evolving safety and dimensional regulations. Sustainability technology, including chemical and mechanical recycling processes for fabric waste and the accelerated development of high-performance bio-based polymers, is also rapidly becoming a non-negotiable and strategically important part of the R&D pipeline for all leading sportswear brands, driving both material innovation and corporate responsibility initiatives.

Regional Highlights

The global distribution of the Rugby Sportswear Market revenue highlights distinct growth trajectories, varying market maturity levels, and unique consumer preferences across key geographical areas. Europe, encompassing the Western European nations including the United Kingdom, France, Ireland, and Italy, currently dominates the overall market landscape in terms of absolute revenue and historical market depth. This strong dominance is attributable to the long-standing, deeply entrenched cultural significance of rugby, highly professionalized and financially lucrative league structures (e.g., Six Nations, Premiership Rugby, Top 14), and relatively high average disposable incomes that consistently facilitate premium apparel and equipment consumption. Consequently, the regional demand is exceptionally strong for both officially licensed authentic team kits and high-performance, technically integrated training gear, supporting substantial, albeit generally mature, market growth.

The Asia Pacific (APAC) region is strategically positioned and widely anticipated to be the fastest-growing market segment throughout the entire forecast period, presenting the most significant opportunity for aggressive market entry. This rapid expansion is substantially influenced by Japan's successful hosting of the Rugby World Cup, which generated immense, lasting public interest and spurred crucial investment in local infrastructure, coaching standards, and grassroots participation programs across the region. Furthermore, Australia and New Zealand (Oceania), with their deeply rooted, high-performance rugby cultures (Super Rugby, consistent international dominance), remain critical hubs for technological innovation, product testing, and high-end product consumption, dictating global performance trends. Key emerging Asian economies, notably China and specific areas of Southeast Asia, represent substantial untapped potential, driven by recent government initiatives promoting physical fitness, school sports participation, and professional sports development, gradually but exponentially expanding the general consumer base beyond traditional, core rugby nations.

North America (NA) is emerging rapidly as a strategic growth frontier for rugby sportswear manufacturers. While traditionally dominated by American football and basketball, rugby’s profile is consistently rising, supported by the increasing visibility and professionalization of local leagues (e.g., Major League Rugby) and burgeoning collegiate participation in both the US and Canada, attracting new demographic segments. Market penetration success here fundamentally requires tailored marketing strategies that effectively emphasize the superior durability, technological performance features, and injury protection benefits of specialized rugby gear to competitive multi-sport athletes. Latin America and the Middle East & Africa (MEA) currently hold smaller market shares in comparison but are exhibiting promising initial growth, particularly in historically dominant rugby nations like South Africa and specific areas of South America (Argentina, Uruguay), driven by intense national pride, successful international team performance, and rapidly increasing media exposure of the sport on global platforms.

- Europe: Established market leader; high professional league presence; dominant and steady demand for officially licensed merchandise and advanced high-tech protective gear; strong cultural consumer focus on brand heritage, premium quality, and safety compliance.

- Asia Pacific (APAC): Highest expected CAGR; growth is powerfully driven by Japan's significant post-World Cup legacy, strong cultural presence and high-performance output in Oceania (Australia, NZ), and increasing government investment in regional sports development initiatives.

- North America: Crucial emerging market with high long-term growth potential; expansion is driven by increasing collegiate and professional league development; market strategy focuses heavily on performance features appealing directly to multi-sport and high-intensity athletes.

- Latin America & MEA: Moderate but promising initial growth driven by major rugby nations (South Africa, Argentina); strategic focus on products balancing affordability, necessary functional durability, and rapid accessibility in apparel and essential protective gear.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Rugby Sportswear Market.- Adidas AG

- Nike Inc.

- Under Armour Inc.

- Canterbury of New Zealand

- Puma SE

- Gilbert Rugby

- Kooga

- XBlades

- BLK Sport

- Optimum Rugby

- Opro Group

- Grays International

- Samurai Sportswear

- Mizuno Corporation

- Decathlon S.A.

- Rhinocéros Sport

- Wragby Sportswear

- Kukri Sports

- Castore

- Joma Sport

Frequently Asked Questions

Analyze common user questions about the Rugby Sportswear market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Rugby Sportswear Market?

The Rugby Sportswear Market is projected to experience a robust Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033, driven significantly by increasing global participation, particularly the high growth observed in emerging markets, and continuous innovation in material science focused squarely on maximizing player safety and enhancing athletic performance.

Which product segment holds the largest revenue share in the Rugby Sportswear Market?

The Apparel segment, which encompasses specialized team jerseys, durable shorts, and high-tech base layers, consistently holds the largest revenue share. Demand is sustained by high volume requirements from both professional teams needing official kits and amateur players needing durable, performance-enhancing training and match wear requiring frequent replacement.

How does AI technology specifically influence the design and manufacturing of rugby apparel?

AI significantly influences manufacturing by optimizing advanced product design through detailed biomechanical data analysis, enabling the provision of highly personalized and precise sizing recommendations (which substantially reduces common fit errors), streamlining complex supply chain logistics, and accelerating the identification and validation of sustainable, high-performance textile alternatives for mass production.

Which geographical region is expected to show the fastest market growth rate throughout the forecast period?

The Asia Pacific (APAC) region is strategically forecasted to exhibit the highest Compound Annual Growth Rate, fueled by substantial government investments in localized rugby development, increasing commercialization efforts, and the rising global profile of the sport following successful major international tournaments hosted within the region, notably in Japan and Oceania.

What are the primary commercial factors currently restraining sustainable growth in the rugby sportswear sector?

Key restraining factors include the relatively high manufacturing and subsequent retail costs associated with producing specialized, highly durable rugby materials and protective gear, the intense cyclical nature of market demand which spikes acutely around major international events, and the lower global participation rates when compared to globally dominant sports like football (soccer) or basketball, limiting mass market scale.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager