Rugged Devices Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437286 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Rugged Devices Market Size

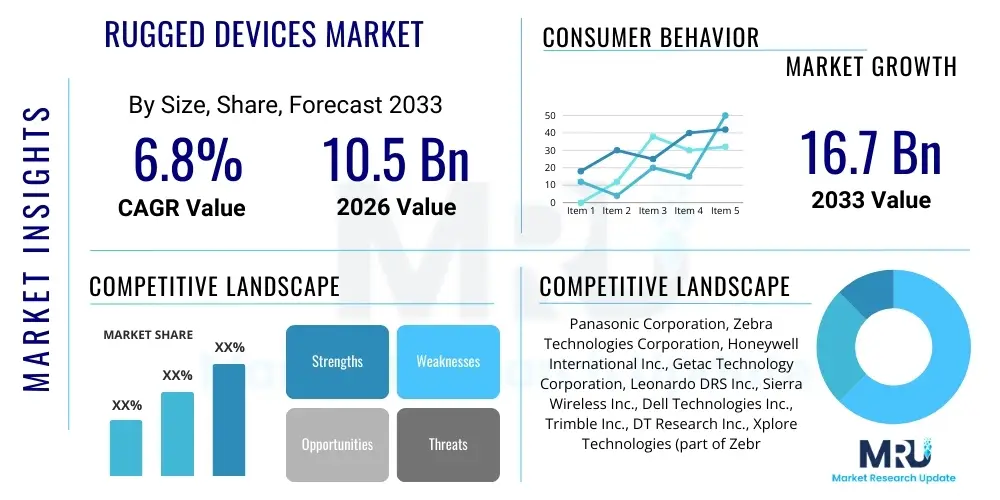

The Rugged Devices Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 10.5 Billion in 2026 and is projected to reach USD 16.7 Billion by the end of the forecast period in 2033. This consistent growth trajectory is primarily driven by the increasing demand for durable, reliable computing solutions across high-stress environments such as industrial automation, defense, and field services. The mandatory requirement for devices capable of withstanding extreme temperatures, vibrations, drops, and ingress of dust or water, stipulated by stringent industry regulations, cements the market’s inherent stability and expansion potential over the next decade.

Rugged Devices Market introduction

The Rugged Devices Market encompasses a diverse range of electronic equipment, including rugged handheld devices, laptops, tablets, and specialized vehicular mounted computers, all designed to operate reliably in harsh operating conditions, surpassing the durability offered by consumer-grade electronics. These devices adhere to rigorous standards, most notably the Ingress Protection (IP) rating system and the U.S. Military Standard (MIL-STD-810H), ensuring resilience against environmental stressors such as thermal shock, excessive moisture, high altitude, and prolonged vibration. The primary product differentiation lies in their protective features, including reinforced casings, solid-state drives (SSDs), specialized touchscreens operable with gloves, and enhanced battery life, catering specifically to sectors where equipment failure results in significant operational downtime or safety hazards.

Major applications of rugged devices span critical infrastructure management, including energy and utilities, public safety, logistics and warehousing, and heavy construction, where conventional technology quickly degrades or fails. For instance, in logistics, rugged handheld scanners and tablets streamline inventory management and delivery tracking in extreme cold or dusty warehouse environments. In the defense sector, rugged laptops and communications gear are indispensable for mission-critical operations, providing secure and reliable communication capabilities under combat conditions. The inherent benefit these devices provide is significantly reduced Total Cost of Ownership (TCO) compared to standard devices, which require frequent replacement or specialized protective enclosures, making them a strategic investment for enterprise mobility initiatives.

Driving factors propelling market growth include the global trend toward digitalization and the implementation of Industry 4.0 initiatives across manufacturing and industrial sectors. As organizations increasingly adopt the Industrial Internet of Things (IIoT), the need for robust edge computing devices capable of processing and transmitting large volumes of sensor data in real-time becomes paramount. Furthermore, substantial governmental and defense spending on modernization programs, particularly in North America and Asia Pacific, necessitates the procurement of advanced, ruggedized communication and computing platforms. The rapid deployment of 5G networks in industrial zones also creates a significant push, enabling faster, more reliable data transfer that maximizes the efficiency potential of high-performance rugged devices in complex field operations.

Rugged Devices Market Executive Summary

The global Rugged Devices Market is characterized by robust business trends centered on convergence, customization, and connectivity. Key industry players are focusing heavily on developing modular designs, allowing end-users to tailor peripherals such as barcode scanners, RFID readers, and advanced cameras to specific workflow requirements without compromising the device’s rugged integrity. This move towards standardization of specialized components enhances interoperability and reduces logistical complexity for large enterprises. Furthermore, the market exhibits a strong trend towards integrating advanced features like enhanced security protocols (e.g., biometric authentication) and ultra-long-life batteries, addressing critical enterprise concerns regarding data integrity and operational continuity during extended shifts in remote locations.

Regionally, North America remains the dominant revenue generator, primarily due to high military expenditures, early adoption of advanced industrial automation technologies, and a well-established infrastructure for field service management in sectors like oil and gas. However, the Asia Pacific (APAC) region is projected to register the fastest growth rate, fueled by rapid industrialization, massive infrastructure development projects, and the expansion of e-commerce logistics chains in countries like China, India, and Japan. European markets demonstrate steady growth, driven by stringent workplace safety regulations that mandate the use of durable equipment in construction and utility sectors, alongside significant investments in modernizing public safety networks.

Segment trends indicate that the rugged tablet segment is experiencing the most rapid adoption, replacing traditional rugged laptops due to enhanced portability and ease of use in highly mobile environments. While the Military and Defense segment remains the largest end-user category, the Industrial and Commercial sectors, particularly Transportation and Logistics, are rapidly increasing their market share. This shift is accelerating the demand for rugged devices that support vehicle mounting, telematics integration, and specialized mobile software applications. Technology-wise, there is a clear migration towards devices supporting 5G connectivity and incorporating advanced processing capabilities necessary for edge computing applications and sophisticated data analytics directly in the field.

AI Impact Analysis on Rugged Devices Market

Users frequently inquire about how Artificial Intelligence (AI) and Machine Learning (ML) integration will redefine the functional scope and operational efficiency of rugged devices, often asking: "Can AI enhance the predictive maintenance capabilities of my field equipment?" or "How will AI processors embedded in rugged tablets handle complex real-time data analysis at the network edge?" The key user concerns revolve around leveraging AI to maximize operational uptime, optimize resource allocation, and enhance security without compromising the fundamental rugged attributes—durability and battery life. There is a clear expectation that future rugged devices will transition from being mere data capture tools to intelligent platforms capable of autonomous decision-making in adverse conditions.

The integration of AI directly into rugged devices focuses on two core areas: enhancing operational efficiency and improving device resilience. For operational efficiency, embedded AI enables sophisticated real-time data processing for tasks like visual inspection (identifying component defects in manufacturing floors or surveying infrastructure damage using integrated cameras) and optimized route planning for logistics personnel. This edge AI processing minimizes latency and reduces reliance on intermittent cloud connectivity, which is often unreliable in remote or industrial environments. Furthermore, AI algorithms are crucial for sophisticated sensor fusion, allowing rugged devices to contextualize input from multiple sensors (temperature, pressure, vibration) more accurately than traditional programming methods.

Regarding device resilience, AI is increasingly utilized for predictive maintenance of the device itself. By constantly monitoring internal metrics such as battery health cycles, temperature fluctuation impact, and sensor performance, AI algorithms can predict component failure before it occurs, prompting preventative maintenance alerts for IT teams. This drastically extends the service life of expensive rugged equipment. Moreover, AI-driven power management systems optimize energy consumption based on usage patterns and environmental load, ensuring that devices remain functional for critical mission durations, directly addressing user demands for greater operational continuity in extreme environments.

- AI-enabled predictive maintenance forecasting component degradation and failure.

- Real-time edge processing for computer vision and anomaly detection in industrial settings.

- Optimized power management via ML algorithms extending battery operational life.

- Enhanced security through AI-driven anomaly detection and biometric authentication integration.

- Facilitation of autonomous operational control and coordination in logistics and defense applications.

DRO & Impact Forces Of Rugged Devices Market

The Rugged Devices Market dynamic is fundamentally shaped by a powerful confluence of drivers and constraints, moderated by compelling market opportunities. The primary driver is the pervasive spread of the Industrial Internet of Things (IIoT) across manufacturing, oil and gas, and utilities sectors, necessitating reliable data input/output devices that can withstand harsh factory floors or outdoor pipeline inspection routes. The increasing adoption of mobile computing solutions by governmental and public safety agencies globally, driven by mandates for real-time situational awareness and secure data exchange, further fuels demand. However, the market faces significant restraints, chiefly the high initial acquisition cost of rugged hardware compared to rapidly evolving, lower-priced consumer devices. Additionally, maintaining rugged certification while integrating fast-evolving internal technologies (e.g., processors, memory modules) presents a complex design challenge, leading to slower technological refresh cycles compared to consumer electronics.

Opportunities for market expansion are strongly rooted in technological advancements, particularly the widespread integration of 5G connectivity, which promises ultra-low latency and high bandwidth critical for complex field applications like remote diagnostics and augmented reality (AR) assistance on rugged tablets. The trend towards modularity and customization offers OEMs a significant competitive advantage, allowing them to provide niche solutions that integrate specific sensor arrays (e.g., thermal imaging, gas detection) relevant to specialized industries such as mining or pharmaceuticals. Furthermore, emerging economies are rapidly increasing their investment in infrastructure and defense modernization, opening large, untapped markets for rugged technology deployment, shifting the geographical focus beyond traditionally dominant regions.

The key impact forces dictating market evolution include the regulatory environment, particularly MIL-STD and IP rating mandates that standardize product quality and reliability, acting as a high barrier to entry for new competitors. Technological innovation, specifically miniaturization and improved battery technology, exerts a continuous force, pressuring manufacturers to deliver lighter, more powerful devices without sacrificing durability. Economic forces, especially fluctuating commodity prices for specialized materials used in rugged casing, also influence production costs and final device pricing. Ultimately, the interplay between the mandatory durability requirements and the demand for cutting-edge connectivity and processing power forms the core tension guiding future product development and market strategy.

Segmentation Analysis

The Rugged Devices Market is systematically segmented based on the device type, the level of ruggedization required, the operating system used, and the specific end-user industry, enabling targeted marketing and product development strategies. Device type segmentation, which includes Laptops, Tablets, and Handhelds, is crucial as each category addresses distinct workflow requirements—for instance, rugged handhelds dominate inventory management, while rugged laptops are preferred for complex diagnostics and administrative tasks in field offices. The level of ruggedization is essential, distinguishing between semi-rugged, fully rugged, and ultra-rugged, reflecting the varying operational environments from mildly challenging warehouse settings to extreme military deployment zones, directly impacting material choice and design cost.

- By Type:

- Rugged Handheld Devices/Mobile Computers (e.g., Scanners, PDAs)

- Rugged Tablets

- Rugged Laptops/Notebooks

- Rugged Vehicle-Mounted Computers

- By Level of Ruggedization:

- Fully Rugged

- Semi-Rugged

- Ultra-Rugged

- By Operating System:

- Windows

- Android

- iOS

- Others (Linux, proprietary OS)

- By End-Use Industry:

- Military and Defense

- Government and Public Safety (Police, Fire, EMS)

- Industrial (Manufacturing, Mining, Oil & Gas)

- Transportation and Logistics (Warehousing, Fleet Management)

- Utilities and Energy

- Healthcare

- Retail and Field Services

Value Chain Analysis For Rugged Devices Market

The value chain for the Rugged Devices Market begins with upstream activities, focusing heavily on the sourcing and manufacturing of high-reliability components. This stage is dominated by specialized suppliers providing industrial-grade processors, robust display technologies (often specialized hardened glass), high-capacity batteries, and unique casing materials such as magnesium alloys and reinforced polymers. Crucially, upstream component providers must comply with the rigorous quality standards required for rugged certification (e.g., tolerance for extreme temperatures and shock resistance), leading to higher component costs and fewer standard commercial suppliers compared to the consumer electronics sector. Strategic partnerships between rugged device manufacturers and specialized semiconductor producers are vital to ensure the long-term supply and integration of next-generation chipsets while maintaining the required durability profile.

Midstream activities involve the core manufacturing and assembly processes undertaken by Original Equipment Manufacturers (OEMs). This includes specialized rugged design engineering—a critical step where durability specifications (IP rating, drop resistance) are integrated with functional requirements (ports, modular expansion slots, thermal management). Quality control and mandatory certification testing, such as MIL-STD-810H and specific explosion-proof certifications (e.g., ATEX/IECEx for Oil & Gas), consume a significant portion of the cost and time in this segment. Customization capabilities, allowing for tailored input/output configurations or specialized software pre-loading, are often the key competitive differentiators at the manufacturing stage, catering to the bespoke needs of large enterprise clients.

Downstream distribution channels are bifurcated into direct sales and indirect channels. Direct sales are common for large government and military contracts, often involving highly specialized configurations and managed service agreements directly with the OEM. Indirect distribution, however, relies heavily on a network of specialized Value-Added Resellers (VARs) and system integrators who possess expert knowledge of specific vertical markets (e.g., utility field maintenance or logistics software integration). These VARs play a crucial role in providing implementation services, configuration, and post-sales technical support, bridging the gap between the OEM and the complex needs of the end-user environment. Effective downstream support is essential as rugged devices often operate in mission-critical applications where downtime must be minimized.

Rugged Devices Market Potential Customers

Potential customers for rugged devices are defined primarily by their operational environment and the critical nature of their workflows, which necessitate equipment resilience far beyond standard commercial offerings. The largest and most demanding customer base resides within the Military and Defense sectors, encompassing army, navy, air force, and various national security agencies. These buyers require ultra-rugged, highly secure devices for tactical communications, battlefield situational awareness, and vehicle-mounted applications, where compliance with MIL-STD standards is non-negotiable. Procurement cycles in this segment are typically long, involving rigorous testing and large, multi-year contracts, making it a highly stable but competitive market segment.

A rapidly expanding segment of potential customers includes industrial and logistics operators. This encompasses large manufacturing facilities adopting Industry 4.0 automation, mining companies operating in hazardous environments, and global transportation and warehousing firms managing complex supply chains. These customers primarily seek rugged handhelds and tablets for applications such as asset tracking, quality control inspections, preventive maintenance scheduling, and real-time inventory updates. Their purchasing criteria often balance rugged durability with integration capabilities, demanding seamless compatibility with existing enterprise resource planning (ERP) systems and industrial control systems, prioritizing Android-based platforms for ease of app deployment and familiarity.

Furthermore, government and public safety organizations—including police forces, fire departments, and emergency medical services (EMS)—represent a continuously vital customer base. These entities require semi-rugged or fully rugged mobile data terminals (MDTs) and tablets mounted in vehicles or carried by field officers for accessing critical databases, real-time dispatch information, and electronic reporting. Utilities and energy companies, specifically those managing remote infrastructure like power grids and pipelines, also represent core customers. Their need for devices capable of prolonged outdoor exposure, especially with specialized certifications like ATEX for explosive atmospheres, makes them dedicated buyers of high-end, purpose-built rugged computing solutions essential for infrastructure management and compliance inspections.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 10.5 Billion |

| Market Forecast in 2033 | USD 16.7 Billion |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Panasonic Corporation, Zebra Technologies Corporation, Honeywell International Inc., Getac Technology Corporation, Leonardo DRS Inc., Sierra Wireless Inc., Dell Technologies Inc., Trimble Inc., DT Research Inc., Xplore Technologies (part of Zebra), Samsung Electronics Co., Ltd. (via specialized division), Advantech Co., Ltd., Kontron AG, NEXCOM International Co., Ltd., AAEON Technology Inc., Handheld Group AB, Miltope Corporation, Durabook (Twinhead International Corp.), CipherLab Co., Ltd., MobileDemand |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Rugged Devices Market Key Technology Landscape

The core technology landscape of the Rugged Devices Market is undergoing a rapid transition driven by consumerization and the need for enhanced field connectivity and processing power, all while maintaining uncompromising durability. A critical technological focus is the evolution of screen technology, moving toward brighter, highly responsive displays (often utilizing specialized protective glass like Corning Gorilla Glass or proprietary hardened solutions) that remain legible under direct sunlight and are operable via gloved hands or when wet. Furthermore, the reliance on traditional hard disk drives (HDDs) has been almost entirely superseded by Solid State Drives (SSDs) due to their superior resistance to shock, vibration, and extreme temperature variations, fundamentally enhancing the reliability profile of the entire device in harsh mobile environments. Power management systems are also becoming increasingly sophisticated, incorporating advanced battery chemistry (e.g., extended life lithium polymer cells) and hot-swappable battery designs to maximize operational longevity without requiring a full system shutdown, which is crucial for continuous field operations.

Connectivity standards represent another pivotal area of technological advancement. The rollout of 5G is significantly impacting rugged device design, necessitating the integration of new modem architectures and antenna designs capable of maximizing bandwidth and reliability in challenging geographical terrains, essential for real-time remote diagnostics and large file transfers. Beyond cellular connectivity, the adoption of advanced location services, utilizing high-precision GPS, GLONASS, and Galileo systems, is critical for public safety and military applications requiring highly accurate mapping and tracking capabilities. Furthermore, many rugged devices are now incorporating specialized ports and connectors (e.g., MIL-SPEC circular connectors) designed to resist water, dust, and vibration while ensuring reliable power and data transfer to external peripherals such as specialized sensors, vehicle docks, and thermal cameras.

The emergence of modular and standardized computing platforms is also reshaping the technology landscape. Manufacturers are increasingly utilizing common internal chassis and motherboard designs across various form factors (tablets, laptops) to streamline production and simplify component sourcing. This modularity extends to peripheral integration, employing standardized docking systems and accessory interfaces that allow users to quickly swap out specialized tools—such as industrial barcode scanners, magnetic stripe readers, or secure biometric sensors—based on the task at hand. Finally, the shift in operating systems towards secure, enterprise-optimized versions of Android and Windows 10/11 ensures compatibility with modern security standards and mobile device management (MDM) platforms, facilitating easier deployment and maintenance within complex IT infrastructures.

Regional Highlights

The global demand for rugged devices exhibits strong regional variations based on industrial maturity, defense spending patterns, and technological adoption rates. North America consistently holds the dominant market share, driven primarily by the stringent requirements of its vast military and defense complex, which is a key procurer of high-specification, custom-built rugged computing and communication gear. Furthermore, the region’s mature utility, oil and gas, and transportation sectors, characterized by extensive geographical coverage and reliance on rigorous field service protocols, mandate the use of durable mobile solutions. Regulatory compliance and the rapid embrace of new technologies, particularly in integrating drones and advanced robotics with rugged control devices, solidify North America's leadership position in innovation and market value.

Asia Pacific (APAC) is projected to be the fastest-growing region, presenting substantial untapped market potential. This rapid expansion is fundamentally linked to accelerated industrialization, large-scale infrastructure projects (roads, ports, and smart cities), and the booming e-commerce and logistics sector across economies like China, India, and Southeast Asia. As these countries invest heavily in automating manufacturing facilities and modernizing their public safety and military apparatus, the requirement for robust, affordable, and customizable rugged devices multiplies. While price sensitivity remains a factor, the increasing adoption of local manufacturing and assembly capabilities is enabling competitive pricing and faster market penetration for both international and regional rugged device vendors.

Europe represents a stable and mature market, characterized by a strong emphasis on industrial compliance, occupational health and safety (OHS) standards, and sophisticated public sector technology integration. Key drivers include the modernization of police and emergency services across the European Union, the continued investment in high-tech manufacturing (e.g., automotive and aerospace), and the extensive digitalization of European utilities infrastructure. The demand in Europe is often skewed towards devices that offer specific environmental certifications and conform to regional security standards, fostering a market focused on high-quality, long-lifecycle products, particularly in Western and Nordic countries.

- North America: Dominance in defense and military procurement; high adoption rate in oil, gas, and utilities; strong focus on R&D and implementation of advanced robotics interfaces.

- Asia Pacific (APAC): Fastest projected growth due to rapid infrastructure development and expansion of e-commerce logistics; increasing domestic manufacturing capacity in countries like China and India.

- Europe: Stable demand driven by stringent occupational safety regulations and public safety modernization; significant market presence in high-tech industrial manufacturing and utilities management.

- Latin America (LATAM): Growing demand fueled by mining, resource exploration, and developing public safety digitalization initiatives, though often constrained by fluctuating economic conditions.

- Middle East and Africa (MEA): Market growth concentrated in high-spending Gulf Cooperation Council (GCC) countries driven by large oil & gas projects, infrastructure development, and substantial homeland security investments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Rugged Devices Market.- Panasonic Corporation

- Zebra Technologies Corporation

- Honeywell International Inc.

- Getac Technology Corporation

- Dell Technologies Inc.

- Trimble Inc.

- DT Research Inc.

- Xplore Technologies (part of Zebra)

- Samsung Electronics Co., Ltd. (via specialized divisions)

- Advantech Co., Ltd.

- Kontron AG

- NEXCOM International Co., Ltd.

- AAEON Technology Inc.

- Handheld Group AB

- Miltope Corporation

- Durabook (Twinhead International Corp.)

- CipherLab Co., Ltd.

- MobileDemand

- Bluebird Inc.

- JLT Mobile Computers AB

Frequently Asked Questions

Analyze common user questions about the Rugged Devices market and generate a concise list of summarized FAQs reflecting key topics and concerns.What criteria define a fully rugged device versus a semi-rugged device?

A fully rugged device is designed and tested to withstand extreme environmental stresses, typically conforming to military standards (MIL-STD-810H) and possessing high Ingress Protection (IP) ratings (e.g., IP65 or higher) for complete protection against dust and jets of water. Semi-rugged devices offer enhanced durability over consumer products, featuring some reinforced components and moderate IP ratings, suitable for environments like factory floors or construction sites where exposure is less severe.

How is 5G connectivity transforming the operational utility of rugged tablets and handhelds?

5G connectivity provides the ultra-low latency and high bandwidth essential for mission-critical applications, enabling real-time remote diagnostics, seamless integration of augmented reality (AR) guidance for field technicians, and rapid transmission of large, high-resolution data files (such as 3D scans or detailed photographic inspections) from remote locations, significantly improving operational efficiency and decision-making speed.

Which end-user industries are currently driving the most substantial growth in the rugged devices market?

The most substantial growth is currently driven by the Transportation and Logistics sector, propelled by the global surge in e-commerce and the need for reliable, mobile data capture and fleet management solutions. The Industrial sector, particularly manufacturing adapting to Industry 4.0, is also a critical growth driver, requiring robust devices for automated monitoring and control on demanding factory floors.

What impact does the Total Cost of Ownership (TCO) have on the purchasing decision for rugged devices?

TCO is a paramount factor. While the initial acquisition cost of a rugged device is significantly higher than a consumer-grade device, its longer operational lifespan, superior durability, and reduced failure rates drastically minimize repair, replacement, and lost productivity costs over a typical five-year service life, making the rugged option a more financially viable long-term investment for enterprise operations.

Are rugged devices moving away from Windows operating systems towards Android, and why?

Yes, there is a notable shift, particularly in the rugged handheld and tablet segments, towards enterprise-optimized Android platforms. This migration is driven by Android's inherent flexibility, ease of application development for specialized workflows, lower licensing costs, and familiarity for field workers, although Windows maintains dominance in high-performance rugged laptop applications and specific defense contracts.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager