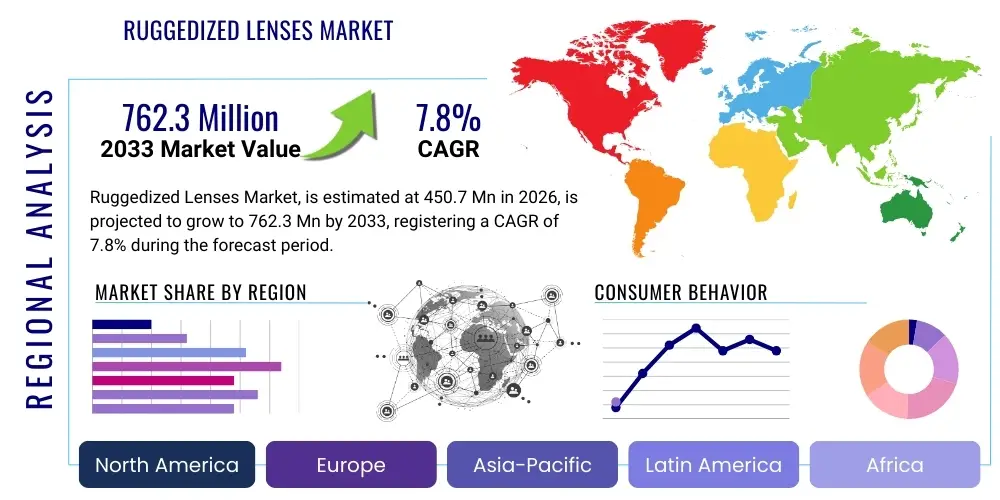

Ruggedized Lenses Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439625 | Date : Jan, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Ruggedized Lenses Market Size

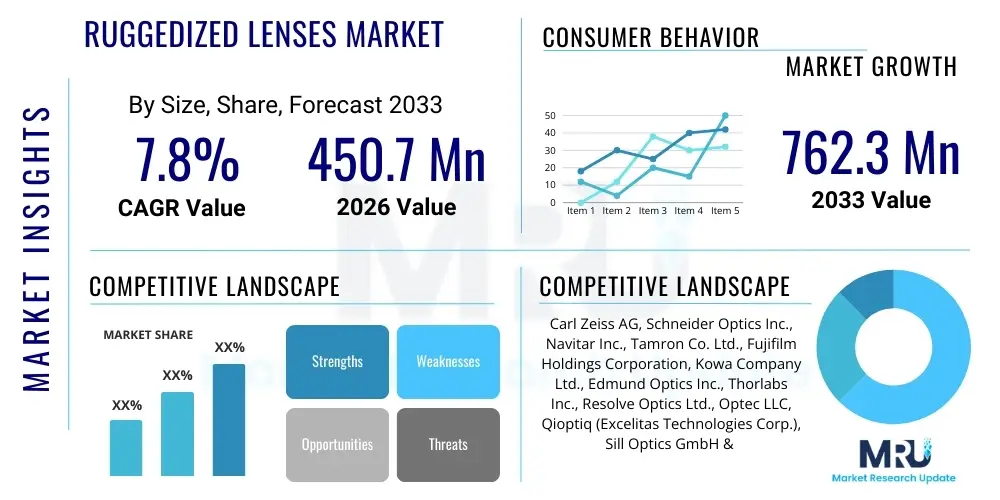

The Ruggedized Lenses Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 450.7 million in 2026 and is projected to reach USD 762.3 million by the end of the forecast period in 2033.

Ruggedized Lenses Market introduction

The Ruggedized Lenses Market encompasses optical components engineered to perform reliably and maintain optical integrity in harsh environmental conditions that would typically degrade or destroy standard lenses. These conditions include extreme temperatures, significant mechanical shock, constant vibration, high humidity, dust, corrosive chemicals, and even radiation. The products within this market are characterized by their robust mechanical construction, often featuring specialized housing materials, advanced sealing techniques, and durable optical coatings, all designed to ensure resistance against physical stress and environmental ingress. Major applications for these resilient lenses span a wide array of critical sectors, including industrial automation for machine vision in factory settings, military and defense for surveillance and target acquisition systems, aerospace for satellite and UAV imaging, and automotive vision systems for advanced driver-assistance systems (ADAS) and autonomous vehicles. They also find extensive use in medical imaging within challenging clinical environments, public safety surveillance in outdoor and exposed locations, and in scientific research conducted in extreme conditions. The primary benefits derived from using ruggedized lenses include significantly enhanced operational reliability, an extended lifespan for imaging systems, reduced maintenance and replacement costs, and consistent high-quality optical performance regardless of the environmental challenges encountered. This reliability is paramount for mission-critical applications where failure is not an option, directly contributing to safety, efficiency, and data accuracy. The market growth is fundamentally driven by the escalating global demand for industrial automation and robotics, particularly in hazardous or uncontrolled environments where precision and resilience are non-negotiable. Furthermore, continuous advancements and increased investments in defense and aerospace technologies, which inherently require robust and high-performing optical solutions, significantly contribute to market expansion. The proliferation of autonomous systems, ranging from self-driving cars to industrial drones and underwater vehicles, further fuels this demand as these platforms rely heavily on dependable vision systems to navigate and operate effectively. Additionally, the growing focus on smart infrastructure and pervasive surveillance systems, which must withstand outdoor elements, coupled with stringent industry standards for operational safety and longevity, collectively act as powerful driving factors propelling the Ruggedized Lenses Market forward, ensuring its sustained growth throughout the forecast period.

Ruggedized Lenses Market Executive Summary

The Ruggedized Lenses Market is poised for substantial growth, propelled by the relentless expansion of industrial automation and the ever-increasing sophistication of defense and security applications globally. Current business trends within this dynamic market reveal a strong inclination towards the development of highly compact and lightweight lens designs, crucial for integration into miniaturized systems such as drones, wearable technologies, and compact robotic platforms, without compromising on their inherent ruggedness or optical performance. There is a discernible shift towards offering enhanced spectral range capabilities, allowing these lenses to operate efficiently across visible, infrared, and ultraviolet spectra, thereby expanding their utility in diverse and specialized applications like hyperspectral imaging for environmental monitoring or night vision for military operations. Furthermore, the integration of smart features, such as embedded sensors for real-time environmental monitoring, self-cleaning coatings, and advanced diagnostic capabilities, is becoming increasingly prevalent, transforming passive optical components into intelligent, adaptive systems capable of optimizing their performance autonomously. These innovations are critical for reducing manual intervention and extending operational periods in remote or inaccessible locations. Geographically, North America and Europe continue to dominate the market, primarily due to their advanced manufacturing industries, extensive defense spending, and a robust ecosystem of research and development that fosters technological innovation and early adoption. However, the Asia Pacific region is rapidly emerging as a pivotal growth hub, driven by aggressive industrialization initiatives, burgeoning investments in smart city projects, and the rapid expansion of key manufacturing sectors, including automotive and consumer electronics, particularly in countries like China, India, and South Korea. These regions are witnessing a surge in demand for cost-effective yet highly durable vision solutions. From a segmentation perspective, fixed focal length lenses currently hold a significant market share, valued for their stability, optical precision, and relative cost-efficiency in a myriad of industrial machine vision applications. Nevertheless, the demand for more sophisticated zoom and telecentric lenses is steadily climbing, driven by complex inspection tasks requiring variable magnification or precise dimensional measurements independent of object distance. The military and defense sector remains a cornerstone application, alongside a burgeoning demand from the automotive industry, where ruggedized lenses are indispensable for the reliable functioning of Advanced Driver-Assistance Systems (ADAS) and the future deployment of fully autonomous vehicles, necessitating robust vision in all weather and road conditions.

AI Impact Analysis on Ruggedized Lenses Market

The burgeoning integration of artificial intelligence is fundamentally reshaping the landscape of the Ruggedized Lenses Market, moving beyond traditional optics to enable more intelligent and adaptive vision systems. Users and industry stakeholders are frequently inquiring about the multifaceted ways AI can enhance the performance, reliability, and application scope of ruggedized lenses. A primary area of interest revolves around AI's capacity to facilitate predictive maintenance for optical systems, allowing for real-time monitoring of lens health, early detection of potential degradation, and proactive scheduling of maintenance, thereby maximizing uptime and operational efficiency, especially in remote or hazardous environments. Furthermore, there is significant enthusiasm for how AI can empower advanced image processing capabilities directly at the lens or sensor level, enabling edge computing for faster and more accurate data interpretation, crucial for autonomous navigation, object recognition, and critical decision-making in real-time without reliance on centralized processing. Users are also keenly exploring the potential for AI-driven design tools and simulation platforms to revolutionize the development cycle of ruggedized lenses, accelerating the iterative process of material selection, optical configuration, and mechanical design, ultimately leading to more optimized, efficient, and cost-effective lens architectures that better balance durability with optical precision. The overarching expectation is that AI will transform ruggedized lenses from passive, static components into active, intelligent elements within a larger ecosystem, capable of dynamic self-adaptation to changing environmental conditions and providing richer, more actionable data for sophisticated AI-powered analytics and decision-making processes across various demanding applications.

- AI-driven predictive maintenance and self-diagnosis for optical components, ensuring continuous operation and reduced downtime in critical applications.

- Enhanced image processing and real-time data interpretation at the edge, leveraging AI algorithms for faster decision-making in autonomous systems.

- Optimization of ruggedized lens design, material selection, and manufacturing processes through AI-powered simulation and generative design tools.

- Facilitation of autonomous calibration, focus adjustment, and environmental compensation using AI for consistent optical performance in dynamic conditions.

- Integration of AI for advanced object detection, tracking, and pattern recognition in challenging environments (e.g., fog, low light) with ruggedized optics.

- Development of adaptive optics for dynamic environmental distortion correction, guided by AI to maintain image clarity and resolution.

- Improved data compression and intelligent data filtering for efficient transmission of high-resolution imagery from ruggedized camera systems.

DRO & Impact Forces Of Ruggedized Lenses Market

The Ruggedized Lenses Market is significantly propelled by several powerful drivers, primarily the escalating global demand for advanced automation and sophisticated machine vision systems across various industrial sectors. Industries such as manufacturing, logistics, and quality control are increasingly integrating automated processes that rely on highly precise and resilient optical components capable of operating flawlessly in harsh, factory-floor environments characterized by dust, vibrations, temperature fluctuations, and potential chemical exposure. Concurrently, the continuous and substantial investments in military and defense technologies worldwide, particularly for surveillance, reconnaissance, target acquisition, and remote sensing applications, necessitate optical solutions that can withstand extreme battlefield conditions, including shock, radiation, and wide temperature variations, thereby creating a robust and consistent demand for ruggedized lenses. The rapid proliferation of autonomous systems, ranging from self-driving vehicles to industrial robots and unmanned aerial or underwater vehicles, further acts as a critical growth driver. These systems inherently require vision capabilities that are impervious to environmental challenges to ensure safe and reliable operation in diverse and often unpredictable settings, making ruggedized lenses an indispensable component for their functionality and safety protocols. Despite these strong drivers, the market faces notable restraints, chiefly the high manufacturing costs associated with the specialized materials and precision engineering techniques required to produce lenses that meet stringent ruggedization standards. The use of exotic glasses, sapphire, and advanced coating processes, coupled with rigorous testing, contributes significantly to the overall production expense, potentially limiting adoption in cost-sensitive applications. Furthermore, the technical complexities involved in balancing superior optical performance with extreme durability often present design challenges, requiring extensive research and development efforts that can prolong product development cycles and increase initial investment. Nevertheless, the market is rich with opportunities arising from several emerging sectors. The expanding adoption of autonomous vehicles, for instance, represents a massive potential market, as every vehicle requires multiple resilient camera systems for navigation, sensing, and safety. The burgeoning market for medical imaging devices designed for challenging clinical environments, such as surgical suites or emergency response units, also presents significant growth avenues, as these require robust optics that can withstand frequent sterilization and intense use. Moreover, the increasing integration of Internet of Things (IoT) devices in outdoor, industrial, and smart city applications necessitates durable imaging capabilities for monitoring, security, and data collection in exposed environments. These drivers and opportunities are compounded by several impact forces that collectively shape the market's trajectory. Technological advancements, particularly in materials science and optical coatings, are continuously improving the performance-to-durability ratio of ruggedized lenses, making them more versatile and efficient. The widespread adoption of Industry 4.0 paradigms emphasizes smart manufacturing and automation, inherently boosting demand for resilient vision systems. Additionally, increasingly stringent environmental and safety regulations across various industries mandate higher reliability and performance standards for all components, including optics, thereby accelerating the adoption of ruggedized solutions. These intertwined factors create a powerful impetus for market growth, reinforcing the critical role of resilient optical solutions in modern technological landscapes, driving innovation and expanding their application across a multitude of demanding sectors.

Segmentation Analysis

The Ruggedized Lenses Market is characterized by a sophisticated and highly granular segmentation framework, essential for accurately dissecting its intricate dynamics, identifying specific growth pockets, and understanding the diverse technological demands across various end-user industries. This detailed approach enables market players to pinpoint niche requirements and develop tailored product offerings that address precise operational challenges, thereby optimizing market penetration and competitive positioning. Key segmentation categories meticulously delineate the market based on lens fundamental characteristics, their intended applications, the specific industries they serve, their operational spectral range, and their level of environmental protection. Such a comprehensive segmentation is vital for recognizing unique market preferences, technological adoption rates, and the varying degrees of customization sought by different client bases. As the market continues to evolve with increasing complexity in system integration and environmental demands, a granular understanding of these segments becomes paramount for strategic planning, product development roadmaps, and forecasting future growth trajectories, especially in an environment where bespoke solutions are becoming increasingly critical for highly specialized and mission-critical applications.

- By Type:

- Fixed Focal Length Lenses: Offer constant magnification and field of view, highly stable for precise, repetitive tasks in machine vision and industrial automation.

- Zoom Lenses: Provide variable focal lengths, allowing for adjustable magnification and field of view, ideal for surveillance, broadcasting, and applications requiring flexibility.

- Telecentric Lenses: Designed for high-precision measurement applications, eliminating parallax error and ensuring consistent image magnification regardless of object distance variations.

- Varifocal Lenses: Offer a range of focal lengths that can be adjusted manually, providing flexibility in setup for security and general surveillance.

- Micro Lenses: Extremely small lenses used in compact imaging systems, endoscopic devices, and miniature cameras for specific space-constrained rugged applications.

- By Application:

- Machine Vision: Industrial inspection, quality control, robot guidance, and automated assembly in harsh factory environments.

- Surveillance and Security: Outdoor security cameras, border patrol systems, critical infrastructure monitoring, and perimeter defense in exposed locations.

- Military and Defense: Airborne reconnaissance, ground vehicle optics, soldier-worn systems, targeting, and weapon sights requiring extreme durability.

- Automotive Vision Systems: Advanced Driver-Assistance Systems (ADAS), autonomous vehicle sensors, reverse cameras, and in-cabin monitoring for all weather conditions.

- Medical Imaging: Endoscopes, surgical microscopy, diagnostic tools, and robotic-assisted surgery equipment operating in sterile or chemically challenging environments.

- Aerospace: Satellite imaging, drone-based inspection, cockpit displays, and environmental monitoring from high altitudes or space.

- Robotics: Vision systems for industrial robots, autonomous mobile robots (AMRs), and service robots operating in diverse and unpredictable settings.

- Research and Development: Scientific experimentation, testing, and prototyping in laboratories or field conditions demanding robust optics.

- Traffic Monitoring: Automatic license plate recognition (ALPR), traffic flow analysis, and incident detection cameras exposed to constant outdoor elements.

- By End-Use Industry:

- Industrial Automation: Manufacturing plants, production lines, quality assurance, and automated material handling in demanding industrial settings.

- Automotive: OEM and aftermarket for vehicle vision systems, R&D for autonomous driving, and manufacturing automation.

- Healthcare: Hospitals, clinics, medical device manufacturers, and research institutions for robust diagnostic and surgical imaging.

- Aerospace and Defense: Government defense agencies, aerospace manufacturers, and security contractors for critical national security and space applications.

- Consumer Electronics (for rugged devices): Integration into outdoor cameras, action cameras, rugged smartphones, and other durable consumer gadgets.

- Oil and Gas: Inspection of pipelines, offshore platforms, and drilling equipment in corrosive, high-pressure, or explosive environments.

- Mining: Surveillance and automation in underground and open-pit mining operations characterized by dust, vibrations, and heavy machinery.

- Logistics and Warehousing: Automated guided vehicles (AGVs), drone inventory systems, and barcode readers in large, often uncontrolled environments.

- Infrastructure Inspection: Bridges, tunnels, power lines, and utilities inspection using drones and robotic systems in diverse outdoor conditions.

- By Spectral Range:

- Visible Light Lenses: Standard lenses operating in the human visible spectrum (400-700 nm), common in most industrial and general vision applications.

- Infrared (IR) Lenses: Designed for thermal imaging (e.g., long-wave IR, mid-wave IR) or near-IR applications (e.g., night vision, material inspection).

- Ultraviolet (UV) Lenses: Optimized for imaging in the ultraviolet spectrum (10-400 nm), used in specific industrial, medical, or scientific applications like defect detection or fluorescence.

- Hyperspectral/Multispectral Lenses: Capable of capturing imagery across multiple discrete or continuous spectral bands, providing rich data for advanced analysis in remote sensing, agriculture, and quality control.

- By Ruggedization Level/IP Rating:

- IP67 Rated Lenses: Fully protected against dust ingress and immersion in water up to 1 meter for 30 minutes, suitable for many outdoor and industrial applications.

- IP68 Rated Lenses: Fully protected against dust ingress and continuous immersion in water beyond 1 meter (depth specified by manufacturer), ideal for submersible or extremely wet environments.

- MIL-STD Compliant Lenses: Designed and tested to meet rigorous military standards (e.g., MIL-STD-810G for shock, vibration, temperature extremes, humidity), crucial for defense and aerospace.

- Custom Ruggedization: Tailored solutions for specific client requirements beyond standard ratings, addressing unique environmental challenges like radiation, chemical exposure, or extreme pressure.

- By Design:

- Sealed Lenses: Feature hermetically sealed housings and components to prevent ingress of dust, moisture, and gases, maintaining internal cleanliness and integrity.

- Hardened Coatings Lenses: Utilize specialized optical coatings (e.g., DLC - Diamond-Like Carbon) for extreme scratch resistance, chemical durability, and anti-abrasion properties.

- Shock and Vibration Resistant Lenses: Engineered with robust mechanical structures, reinforced mounts, and internal dampening systems to withstand high levels of mechanical stress.

- Radiation Hardened Lenses: Fabricated from radiation-resistant materials and designs to prevent optical degradation and maintain performance in high-radiation environments like space or nuclear facilities.

- By Material:

- Glass Lenses: Primarily Fused Silica, Sapphire, Germanium, Chalcogenide glasses chosen for their superior optical properties, hardness, thermal stability, and specific spectral transmission.

- Plastic Lenses: Utilized for specific applications where lightweight, impact resistance, and cost-effectiveness are prioritized, often with protective coatings.

- Hybrid Lenses: Combine elements of glass and plastic to leverage the advantages of both materials, optimizing performance and durability for diverse requirements.

Value Chain Analysis For Ruggedized Lenses Market

The value chain for the Ruggedized Lenses Market is a sophisticated and multi-stage process, commencing with critical upstream activities that lay the foundation for product quality and performance. This initial phase involves the meticulous sourcing of highly specialized raw materials, which are far more stringent than those for conventional optics. These materials include high-grade optical glasses with specific refractive indices and dispersion properties, robust sapphire for extreme hardness and scratch resistance, germanium and chalcogenide glasses essential for infrared applications, and advanced coating materials that provide anti-reflection, hydrophobic, or scratch-resistant properties. Alongside material procurement, the upstream segment is dominated by intensive research and development (R&D) and precision engineering. Optical designers and material scientists collaborate closely to innovate new lens architectures, optimize optical designs for demanding environments, and define intricate manufacturing processes that ensure both exceptional optical clarity and unparalleled environmental resilience. This stage is crucial for developing proprietary technologies and maintaining a competitive edge in a highly specialized market, involving extensive simulation, prototyping, and material characterization to meet specific performance benchmarks.

Midstream activities in the value chain are centered around the high-precision manufacturing, meticulous assembly, and exhaustive testing of ruggedized lenses. This phase involves state-of-the-art machinery and highly skilled technicians for processes such as ultra-precision grinding and polishing of lens elements to achieve exact geometries and surface finishes. Advanced coating deposition techniques, like physical vapor deposition (PVD) or chemical vapor deposition (CVD), are employed to apply multi-layer optical coatings that enhance transmission, reduce glare, and provide environmental protection. The assembly process is often conducted in cleanroom environments to prevent contamination, utilizing specialized bonding agents and hermetic sealing technologies, such as laser welding, to create airtight and watertight enclosures that prevent ingress of dust, moisture, and corrosive substances. Crucially, this stage is characterized by rigorous and multi-faceted quality control and testing protocols. Lenses undergo extensive environmental testing for shock, vibration, thermal cycling, humidity, salt spray, and pressure variations, often to military-grade standards like MIL-STD-810G, in addition to comprehensive optical performance verification, ensuring that each ruggedized lens meets the specified durability and imaging requirements under all anticipated operating conditions before it moves to the next stage.

Downstream activities in the value chain focus on the efficient distribution, strategic marketing, and seamless integration of ruggedized lenses into diverse end-user systems, culminating in post-sales support. Distribution channels are typically highly specialized, reflecting the technical nature and high value of these products. Direct sales models are prevalent for large industrial clients, government defense contractors, and major system integrators who frequently require custom-engineered solutions and direct technical collaboration with manufacturers. These direct relationships allow for precise specification matching, proprietary designs, and streamlined project management. Indirect channels involve a network of specialized distributors, value-added resellers (VARs), and system integrators who leverage their expertise to combine ruggedized lenses with other components, such as cameras, sensors, and lighting, to offer complete vision solutions to a broader and more diverse customer base, including smaller businesses or niche applications. This allows for wider market penetration and provides localized technical support and service. The final stage encompasses crucial post-sales support, including installation assistance, ongoing maintenance, and potential future upgrades or recalibrations, which are particularly vital for high-value, long-lifespan ruggedized products deployed in mission-critical applications. Effective post-sales service ensures customer satisfaction and builds long-term relationships, contributing significantly to brand loyalty and future sales within this demanding market segment.

Ruggedized Lenses Market Potential Customers

Potential customers for the Ruggedized Lenses Market comprise a diverse array of organizations and industries that operate within challenging or uncontrolled environments, where the failure of standard optical components would lead to significant operational disruptions, safety hazards, or compromised data integrity. These end-users prioritize extreme durability, unwavering reliability, and consistent high-performance imaging under the most adverse conditions, making ruggedization an absolute prerequisite rather than a mere preference for their critical vision systems. The primary buyers for these specialized lenses include large-scale industrial manufacturing enterprises that integrate sophisticated machine vision systems into their production lines for automated inspection, quality control, and robotic guidance, especially in sectors like automotive, electronics, and heavy machinery where environments are characterized by dust, vibrations, temperature extremes, and potential exposure to coolants or lubricants. Additionally, government defense agencies globally represent a significant customer segment, procuring ruggedized lenses for a vast range of military-grade equipment, including advanced surveillance platforms, reconnaissance aircraft, ground vehicle optics, targeting systems, and soldier-worn tactical devices, all of which must withstand the rigors of battlefield conditions and extreme operational stresses without failure.

Beyond these core segments, other substantial customer categories include major aerospace companies that utilize ruggedized optics for satellite imaging, drone-based inspection of critical infrastructure, and sophisticated instrumentation within aircraft and spacecraft, where extreme temperatures, radiation, and vacuum conditions are prevalent. The rapidly evolving automotive industry is another burgeoning customer base, as manufacturers heavily invest in advanced driver-assistance systems (ADAS) and the development of fully autonomous vehicles. These systems mandate highly reliable and resilient lenses capable of withstanding constant vibrations, wide temperature fluctuations, exposure to road debris, and various weather conditions to ensure accurate and continuous environmental perception. Furthermore, healthcare providers increasingly utilize medical imaging equipment in demanding clinical environments, such as sterile operating theaters or mobile diagnostic units, requiring optics that can endure frequent sterilization protocols and intense usage cycles. Niche but vital customer segments include companies in the oil and gas sector, mining operations, marine industries, and outdoor public safety and surveillance, all of which require vision systems that are impervious to corrosive agents, high pressures, extreme temperatures, and severe weather conditions to ensure continuous monitoring, inspection, and security without performance degradation, thereby guaranteeing mission continuity and protecting valuable assets and personnel.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.7 Million |

| Market Forecast in 2033 | USD 762.3 Million |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Carl Zeiss AG, Schneider Optics Inc., Navitar Inc., Tamron Co. Ltd., Fujifilm Holdings Corporation, Kowa Company Ltd., Edmund Optics Inc., Thorlabs Inc., Resolve Optics Ltd., Optec LLC, Qioptiq (Excelitas Technologies Corp.), Sill Optics GmbH & Co. KG, Opto Engineering S.p.A., VS Technology Corporation, Canon Inc., Nikon Corporation, Leica Camera AG, Teledyne Imaging, FLIR Systems, L3Harris Technologies |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ruggedized Lenses Market Key Technology Landscape

The Ruggedized Lenses Market is fundamentally shaped and driven by a sophisticated array of advanced technologies meticulously developed to enhance durability, optimize optical performance, and guarantee unwavering environmental resilience across diverse and challenging operational contexts. At the core of this technological landscape are ultra-precision optical manufacturing techniques, encompassing state-of-the-art processes such as diamond turning, advanced CNC grinding, and magneto-rheological finishing. These techniques enable the creation of highly accurate and geometrically perfect lens elements from robust and often exotic materials, ensuring minimal aberrations and superior image quality even under stress. Concurrently, specialized optical coatings represent a critical technology pillar. These include multi-layer anti-reflective (AR) coatings for maximum light transmission and reduced ghosting, hydrophobic and oleophobic coatings to repel water, oils, and dirt for clear visibility in harsh weather, and extremely durable scratch-resistant hard coatings like Diamond-Like Carbon (DLC) that protect optical surfaces from abrasion and chemical attack without compromising performance. These coatings are meticulously applied to ensure the longevity and reliability of the lens in aggressive environments.

Material science plays an absolutely pivotal role in the innovation and performance of ruggedized lenses. Manufacturers rigorously select and utilize advanced materials based on their specific properties tailored for extreme conditions. This includes high-grade optical glasses with superior thermal stability and radiation resistance, exceptionally hard sapphire for unparalleled scratch and impact resistance, and specialized infrared-transmitting materials such as germanium and chalcogenide glasses, essential for thermal imaging applications in dusty or obscured environments. Furthermore, robust mechanical designs are indispensable, involving the development of thermally stable and impact-resistant housings, often crafted from aerospace-grade aluminum or titanium alloys, that provide structural integrity and protect the sensitive optical train. Precision-engineered mounting mechanisms, along with sophisticated shock-absorbing and vibration-isolation systems, are integrated to ensure that the lens maintains its focus and alignment, even under severe mechanical stresses, thereby preserving optical performance and system reliability in dynamic operational settings like vehicles, drones, or industrial robots.

Beyond material and manufacturing precision, sealing and advanced integration technologies are crucial for full ruggedization. Hermetic sealing techniques, such as advanced laser welding, precision O-rings, and specialized bonding agents, are employed to create impenetrable barriers that prevent the ingress of moisture, dust, corrosive gases, and other environmental contaminants, thereby safeguarding internal components from degradation. Emerging technologies are also profoundly influencing the market's evolution, including the miniaturization of optical components through micro-optics and MEMS (Micro-Electro-Mechanical Systems) integration, allowing for compact, lightweight, and power-efficient ruggedized lens systems suitable for small form-factor devices and wearable technologies. The development of adaptive optics, which can actively compensate for environmental distortions or system misalignments in real-time, is gaining traction, further enhancing image clarity and data accuracy in highly dynamic or unpredictable conditions. These continuous technological advancements collectively empower ruggedized lenses to meet the increasingly stringent demands of cutting-edge applications, expanding their capabilities and enabling reliable vision in environments previously deemed insurmountable for standard optical equipment.

Regional Highlights

- North America: This region stands as a dominant force in the Ruggedized Lenses Market, driven by extensive investment in advanced defense and aerospace programs that inherently demand mission-critical, high-performance optical solutions capable of enduring extreme conditions. The presence of a robust industrial automation sector, particularly in manufacturing and logistics, also fuels significant demand for resilient machine vision systems. Furthermore, North America benefits from a strong ecosystem of research and development, fostering innovation and rapid adoption of cutting-edge ruggedized lens technologies, with key technology developers and early adopters contributing to its market leadership and continuous growth in specialized applications.

- Europe: Characterized by a highly advanced industrial base, particularly in Germany's precision manufacturing and machine vision sectors, Europe exhibits strong and consistent demand for ruggedized lenses. The automotive industry across the continent is a major consumer, integrating these optics into sophisticated Advanced Driver-Assistance Systems (ADAS) and autonomous vehicle technologies, which require absolute reliability in diverse European weather conditions. Stringent regulatory standards for operational safety and reliability across various industrial and defense applications further compel the adoption of high-quality, highly ruggedized optical components, contributing to the region's steady market expansion and technological advancements.

- Asia Pacific (APAC): Recognized as the fastest-growing region in the Ruggedized Lenses Market, APAC's expansion is fundamentally propelled by rapid industrialization, aggressive investment in smart city initiatives, and the booming growth of automotive and consumer electronics manufacturing hubs, particularly in economic powerhouses like China, Japan, South Korea, and India. These countries are witnessing an escalating need for automation, enhanced surveillance infrastructure, and modernized defense capabilities, driving substantial demand for both cost-effective and technologically advanced ruggedized optical solutions. The region's vast manufacturing capacity and increasing technological sophistication make it a critical market for future growth.

- Latin America: As an emerging market, Latin America shows growing potential, largely influenced by increasing investments in critical infrastructure, mining operations, and the oil and gas sector. These industries inherently operate in harsh and often remote environments, creating a compelling demand for ruggedized lenses that can withstand extreme temperatures, corrosive elements, and significant physical stresses. The region's ongoing economic development and increasing focus on industrial safety and efficiency are expected to drive steady, albeit moderate, growth in the adoption of durable vision systems and components.

- Middle East and Africa (MEA): This region is experiencing a notable surge in demand, primarily driven by substantial defense expenditures aimed at modernizing military capabilities, alongside ambitious smart city projects and expanding oil and gas exploration activities. These initiatives necessitate highly robust surveillance systems, inspection tools, and security optics capable of enduring the region's extreme climatic conditions, including intense heat, sand, and dust. The ongoing diversification efforts from oil-dependent economies and strategic investments in infrastructure development are creating new opportunities for the widespread deployment of ruggedized lens technologies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ruggedized Lenses Market.- Carl Zeiss AG

- Schneider Optics Inc.

- Navitar Inc.

- Tamron Co. Ltd.

- Fujifilm Holdings Corporation

- Kowa Company Ltd.

- Edmund Optics Inc.

- Thorlabs Inc.

- Resolve Optics Ltd.

- Optec LLC

- Qioptiq (Excelitas Technologies Corp.)

- Sill Optics GmbH & Co. KG

- Opto Engineering S.p.A.

- VS Technology Corporation

- Canon Inc.

- Nikon Corporation

- Leica Camera AG

- Teledyne Imaging

- FLIR Systems

- L3Harris Technologies

Frequently Asked Questions

Analyze common user questions about the Ruggedized Lenses market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are ruggedized lenses and how do they differ from standard optical lenses?

Ruggedized lenses are optical components specifically engineered to withstand harsh environmental conditions such as extreme temperatures, intense vibrations, mechanical shock, high humidity, dust, and corrosive chemicals. Unlike standard lenses, which are designed for controlled environments, ruggedized lenses incorporate robust housing materials, specialized coatings, sealed designs, and reinforced mounting mechanisms to ensure reliable and consistent optical performance in demanding industrial, military, aerospace, or outdoor applications, extending their operational lifespan significantly.

Which industries are the primary consumers of ruggedized lenses?

The primary consumers of ruggedized lenses span a wide range of industries including industrial automation for machine vision and robotics in factories, military and defense for surveillance and weapon systems, aerospace for aircraft and satellite imaging, and the automotive sector for advanced driver-assistance systems (ADAS) and autonomous vehicles. Other key industries include medical imaging in challenging clinical settings, public safety and surveillance in outdoor environments, and oil & gas/mining for inspection in hazardous conditions.

What are the key factors to consider when selecting a ruggedized lens for a specific application?

Key factors for selecting a ruggedized lens include the specific environmental conditions it will face (temperature range, vibration, shock, moisture, dust, chemicals), the required level of optical performance (resolution, focal length, aperture), the spectral range of operation (visible, IR, UV), the lens type (fixed focal, zoom, telecentric), and any specific ruggedization standards (e.g., IP ratings, MIL-STD compliance). Compatibility with the camera or sensor system and overall system integration requirements are also crucial considerations to ensure optimal performance and longevity.

How is artificial intelligence impacting the development and functionality of ruggedized lenses?

AI is profoundly impacting ruggedized lenses by enabling features such as predictive maintenance through real-time monitoring of lens health, intelligent image processing at the edge for faster data interpretation in autonomous systems, and AI-driven design tools that optimize lens architecture for durability and performance. It also facilitates autonomous calibration and adaptive optics to compensate for environmental distortions, moving lenses towards more intelligent, self-optimizing vision components crucial for modern AI-powered applications in harsh settings.

What are the emerging trends and future outlook for the Ruggedized Lenses Market?

Emerging trends include increasing demand for miniaturized and lightweight ruggedized lenses for drones and compact robotics, the integration of smart features like self-cleaning coatings and embedded sensors, and the expansion into new spectral ranges (e.g., hyperspectral imaging). The market outlook is highly positive, driven by continued growth in industrial automation, autonomous systems, defense modernization, and smart city infrastructure, fostering innovation towards more adaptive, intelligent, and versatile ruggedized optical solutions that can operate seamlessly in increasingly complex and demanding environments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager