Rum and Cachaca Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434879 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Rum and Cachaca Market Size

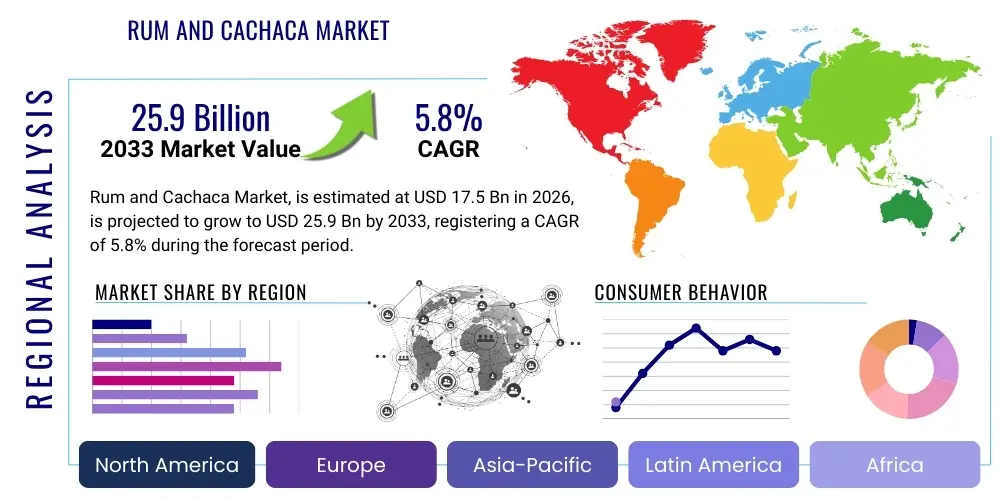

The Rum and Cachaca Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $17.5 Billion in 2026 and is projected to reach $25.9 Billion by the end of the forecast period in 2033.

Rum and Cachaca Market introduction

The Rum and Cachaca market encompasses the production, distribution, and sale of sugarcane-based distilled alcoholic beverages globally. Rum, traditionally produced in the Caribbean and Latin America, and Cachaca, exclusive to Brazil and recognized internationally as a distinct spirit, form a significant segment within the global spirits industry. The market’s dynamics are heavily influenced by shifting consumer preferences towards premium, aged, and artisanal spirits, moving away from standard value offerings. Growth is primarily sustained by the rising popularity of cocktail culture, particularly in developing economies, and increased spending on high-quality leisure and entertainment activities.

Major applications for both rum and cachaca extend across various consumption scenarios, including direct consumption (sipping), mixed drinks, and high-end cocktails. The key products range from white/light varieties used mainly in mixing, to dark, gold, and highly aged premium rums and cachacas that are often savored neat. The inherent benefits of these spirits include their versatility in mixology and the rich, complex flavor profiles developed through diverse aging processes, which appeal to a broad demographic of consumers seeking experiential drinking opportunities.

Driving factors for market expansion include the premiumization trend, where consumers are willing to pay higher prices for superior quality, traceability, and craft production narratives. Furthermore, robust marketing efforts positioning rum and cachaca as authentic and sophisticated alternatives to whiskey and vodka, along with the global expansion of Brazilian culture (driving cachaca demand), are pivotal. However, the market must navigate challenges posed by stringent governmental regulations concerning alcohol taxation and trade tariffs, alongside growing competition from alternative spirit categories like agave-based products.

Rum and Cachaca Market Executive Summary

The global Rum and Cachaca market exhibits robust growth driven by geographical expansion into emerging markets and a persistent consumer shift toward premium offerings. Business trends highlight strategic mergers and acquisitions among major multinational corporations seeking to consolidate market share and leverage specialized craft distilleries for innovation in flavor and production techniques. Sustainability and ethical sourcing have become central competitive factors, compelling producers to invest in environmentally friendly distillation processes and sugarcane agriculture, thereby addressing modern consumer demand for corporate social responsibility (CSR).

Regional trends indicate North America and Europe remain pivotal high-value markets due to established cocktail culture and high per capita consumption of premium spirits, while the Asia Pacific region, led by China and India, presents the highest growth potential, fueled by increasing disposable incomes and the Westernization of consumption habits. Latin America, particularly Brazil, retains its position as the largest production and consumption hub for cachaca, though internationalization efforts are broadening its global footprint, often leveraging its unique designation and use in popular cocktails like the Caipirinha.

Segment trends confirm the dominance of the premium and super-premium categories in driving revenue growth, especially within the aged rum segment which offers complex flavor profiles competitive with fine whiskies. The distribution landscape is evolving, with e-commerce platforms experiencing accelerated growth, particularly post-pandemic, offering consumers greater access to niche and international brands. Flavor innovation, including spiced and flavored rums, continues to attract younger consumers, ensuring market vibrancy and category relevance across diverse consumption occasions.

AI Impact Analysis on Rum and Cachaca Market

Common user questions regarding AI’s impact on the Rum and Cachaca market typically center on efficiency gains in manufacturing, personalization of marketing campaigns, and optimization of complex supply chains involving agricultural raw materials. Users frequently inquire about how AI can predict consumer flavor preferences, enhance quality control during aging and blending processes, and automate tedious tasks in warehousing and logistics. Concerns often revolve around the initial investment required for AI infrastructure, data privacy issues related to detailed consumer tracking, and the potential displacement of skilled human labor, such as master blenders, whose expertise is traditionally based on sensory experience.

The core themes emerging from this analysis confirm that AI is primarily viewed as a transformative tool for operational excellence and targeted consumer engagement. Producers are expected to leverage machine learning (ML) algorithms to analyze massive datasets related to climate patterns, sugarcane yield, fermentation parameters, and aging conditions, thereby optimizing resource use and ensuring batch consistency. Furthermore, Generative AI (GAI) is poised to revolutionize content creation for marketing, allowing brands to quickly generate personalized digital experiences and cocktail recipe recommendations tailored to individual user profiles, drastically improving return on ad spend (ROAS) and brand loyalty.

Expectations are high that AI integration will accelerate the trend toward hyper-premiumization by enabling precise flavor engineering and predicting optimal maturation timelines for high-value aged spirits. By analyzing sales data, social media sentiment, and demographic trends simultaneously, AI systems can guide new product development, ensuring alignment with emerging tastes. This technological infusion, however, necessitates a shift in workforce skills, requiring training in data science and digital platforms to effectively manage and utilize AI-driven insights across the entire value chain, from field to consumer glass.

- Supply Chain Optimization: AI algorithms predict optimal sugarcane harvesting times and manage logistics, minimizing spoilage and reducing transportation costs.

- Quality Control and Blending: Machine learning monitors fermentation temperature and humidity during aging, ensuring flavor consistency and predicting the ideal time for bottling.

- Personalized Marketing: AI segments consumers based on purchasing behavior and taste profiles, enabling hyper-targeted advertising and personalized cocktail recommendations.

- Demand Forecasting: Predictive analytics improve inventory management by accurately forecasting regional spikes in demand, especially for seasonal or limited-edition releases.

- New Product Development: AI analyzes consumer flavor preferences and market gaps, speeding up the innovation cycle for new spiced or flavored spirit variants.

DRO & Impact Forces Of Rum and Cachaca Market

The market for Rum and Cachaca is highly influenced by a complex interplay of internal dynamics (premiumization, flavor innovation) and external macro-economic factors (taxation, regulatory environment, globalization of consumer tastes). Drivers primarily stem from demographic changes, such as the increasing millennial and Generation Z populations who prioritize authentic, craft, and story-driven products, coupled with significant growth in disposable income across key emerging markets like Southeast Asia and Latin America. Restraints frequently involve the volatile pricing of sugarcane, the primary raw material, which is highly susceptible to climate change and agricultural policy shifts, alongside the intensive capital requirement for establishing long-term aging facilities necessary for producing high-value spirits.

Opportunities for growth are heavily concentrated in the ready-to-drink (RTD) cocktail segment, leveraging the mixability of rum and cachaca in convenient, pre-packaged formats that appeal to modern, on-the-go lifestyles. Furthermore, geographical expansion of cachaca beyond its traditional Brazilian stronghold, supported by trade agreements and focused marketing efforts positioning it as a versatile white spirit, presents substantial revenue potential. The impact forces indicate a strong positive influence from the 'experience economy,' where consumers value high-quality ingredients and branded experiences, pushing companies to invest heavily in distillery tourism and immersive marketing strategies to differentiate their products from mass-market competitors.

Crucially, the sustainability movement acts as both a driver and a restraint. While consumers demand eco-friendly production methods (a driver), achieving carbon neutrality and sustainable sourcing in tropical agriculture (sugarcane) requires significant and often costly operational overhauls (a restraint). The overall impact forces emphasize premiumization as the dominant paradigm, where price sensitivity is often secondary to perceived quality and brand heritage, thus favoring distillers capable of crafting complex, aged, and responsibly sourced products that command high margins and foster long-term brand loyalty among discerning consumers globally.

Segmentation Analysis

The Rum and Cachaca market is meticulously segmented across product type, quality grade, distribution channel, and geography, reflecting the diverse consumer base and complex production methodologies. Product segmentation differentiates between traditional rum categories—such as light, gold, dark, and flavored/spiced—and the uniquely regulated categories of cachaca, including artisanal (envelhecida) and industrial (tradicional). Quality grade segmentation is paramount in defining market revenue, with the super-premium and ultra-premium segments exhibiting the fastest growth rates, driven by connoisseurs seeking exclusive, limited-edition, or exceptionally aged expressions.

The importance of distribution channel segmentation has increased significantly, distinguishing between the dominance of the On-Trade (bars, restaurants, hotels) which drives brand discovery and consumption in social settings, and the Off-Trade (liquor stores, supermarkets) which accounts for the largest volume sales. A notable shift is the accelerated growth within the e-commerce segment, which allows niche brands to bypass traditional gatekeepers and reach global audiences directly, offering enhanced convenience and personalized purchasing experiences. Geographical segmentation remains crucial, outlining established consumption regions (North America, Europe) against high-growth potential regions (APAC, Latin America).

Understanding these segments allows market participants to tailor their portfolio strategies, focusing investments where consumer willingness to pay is highest. For instance, companies targeting the On-Trade segment often focus on developing specialized cocktail programs and training bartenders, while those emphasizing Off-Trade success concentrate on attractive packaging and high-visibility shelf placement. The sustained growth of the flavored/spiced rum segment, appealing largely to younger consumers entering the spirits market, highlights the need for continuous flavor innovation to maintain market share against competing spirit types.

- By Product Type:

- White/Light Rum

- Gold/Amber Rum

- Dark Rum

- Spiced and Flavored Rum

- Cachaca (Industrial, Artisanal)

- By Quality Grade:

- Standard

- Premium

- Super-Premium

- Ultra-Premium

- By Distribution Channel:

- Off-Trade (Retail Stores, Supermarkets, Hypermarkets)

- On-Trade (Hotels, Restaurants, Bars)

- E-commerce

- By Application:

- Cocktails and Mixed Drinks

- Neat Consumption/Sipping

- Culinary Use

Value Chain Analysis For Rum and Cachaca Market

The Rum and Cachaca value chain is intensive, starting with agricultural upstream activities focused on sugarcane cultivation and harvesting, which are highly sensitive to climatic conditions and global commodity prices. The initial stage involves processing the sugarcane into molasses (for most rums) or direct juice (for agricoles and certain cachacas), requiring specialized mill operations. Midstream activities encompass fermentation, distillation (pot still, column still, or combination), and, most critically, the prolonged aging process in oak barrels, which can last from a few years up to several decades for premium expressions, adding immense value and complexity to the final product. Quality control during blending and aging is paramount, heavily influenced by master blenders’ expertise.

Downstream analysis focuses on bottling, packaging, marketing, and distribution. Packaging innovations, especially for the high-end segment, often involve distinctive bottle designs and sustainable materials to communicate quality and heritage. The distribution network is bifurcated into direct and indirect channels. Direct channels, although less common, involve sales through distillery visitor centers or proprietary e-commerce sites, allowing for greater margin capture and direct consumer relationship building. Indirect distribution relies heavily on a multi-tiered system involving wholesalers, importers, and retailers (On-Trade and Off-Trade), necessary for broad market penetration and managing regional regulatory differences.

The efficiency of the distribution channel is a major determinant of market success, particularly in navigating complex international trade regulations and taxes. Logistics optimization, especially for temperature-sensitive long-distance shipping, is crucial. Furthermore, the role of specialized spirits distributors is increasing, as they possess the knowledge required to effectively position premium and craft brands within competitive retail environments. The value chain highlights that differentiation primarily occurs in the production and aging stages, while profitability is optimized through efficient, global distribution and sophisticated brand marketing.

Rum and Cachaca Market Potential Customers

The primary customers for the Rum and Cachaca market are diversified, ranging from casual spirit drinkers seeking versatile cocktail bases to discerning high-net-worth individuals who collect and consume rare, aged spirits. Key demographics include millennials and Generation Z, who are highly experimental and driven by craft narratives, ethical sourcing, and unique flavor profiles, making them prime targets for spiced rums and artisanal cachacas used in modern mixology. Consumers aged 35 and above, particularly in developed Western markets, represent the established segment for traditional, aged, and sipping rums, valuing brand heritage, complexity, and exclusivity.

Secondary but crucial customer groups include the hospitality sector (On-Trade), specifically high-end cocktail bars and restaurants globally, which utilize these spirits as foundational ingredients for classic and innovative drinks, thereby influencing consumer trends and introducing new brands. Furthermore, specific ethnic and regional groups heavily rooted in Caribbean and Latin American culture maintain high consumption rates. The growing trend of home mixology, catalyzed by shifts in lifestyle, has also expanded the customer base, driving demand for premium products that offer a high-quality at-home experience without compromising on ingredients or flavor.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $17.5 Billion |

| Market Forecast in 2033 | $25.9 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Diageo PLC, Bacardi Limited, Pernod Ricard, Gruppo Campari, Davide Campari-Milano N.V., Heaven Hill Brands, Angostura Holdings Limited, Destilería Serrallés Inc., William Grant & Sons Ltd., Tanduay Distillers, Inc., The Edrington Group, Suntory Holdings Limited, Allied Blenders and Distillers Pvt. Ltd., Captain Morgan Rum Co., Industrias Licoreras de Guatemala, Companhia Müller de Bebidas, Cachaça 51, Leblon Cachaça, Havana Club International S.A., National Rums of Jamaica Limited. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Rum and Cachaca Market Key Technology Landscape

The technological landscape in the Rum and Cachaca market is increasingly focused on enhancing efficiency, sustainability, and quality consistency. Modern distilleries are adopting advanced monitoring systems utilizing Internet of Things (IoT) sensors throughout the fermentation and distillation processes. These sensors provide real-time data on temperature, pH levels, and yeast activity, allowing for precise control and optimization of yield and flavor precursors. Furthermore, sophisticated column stills are employed by large producers for continuous, high-volume output, while smaller craft distillers often rely on traditional copper pot stills, leveraging material science to enhance the complexity and character of their spirits.

Aging technology represents a critical area of innovation, particularly with the introduction of climate-controlled warehouses that minimize the 'angel's share' (evaporation loss) and ensure consistent maturation regardless of external weather fluctuations. Spectrometry and chromatographic techniques are now routinely used by master blenders to analyze the chemical composition of aging spirits, ensuring batch consistency and predicting the optimal blending profile before the physical blend occurs. This combination of traditional craft knowledge augmented by precise analytical technology is crucial for maintaining the quality standards of super-premium aged rums.

Beyond production, technology heavily influences supply chain transparency and consumer interaction. Blockchain technology is emerging as a solution to provide end-to-end traceability, verifying the authenticity of high-value bottles, detailing their origin (from the sugarcane field to the aging barrel), and combating counterfeiting—a significant concern in the premium spirits segment. Additionally, augmented reality (AR) and virtual reality (VR) technologies are increasingly deployed in marketing, offering consumers virtual distillery tours or interactive experiences when scanning the product label, thereby driving engagement and strengthening brand loyalty.

Regional Highlights

The global consumption and production patterns of Rum and Cachaca vary significantly by region, driven by historical ties, local regulation, and economic development. North America, particularly the United States and Canada, represents the largest value market due to high consumer demand for premium aged rums, a vibrant craft cocktail scene, and strong purchasing power. The US market is characterized by diverse brand availability and a high adoption rate of flavored and spiced varieties, making it critical for global market leaders. Stringent import standards, however, require high levels of compliance from international producers.

Europe stands as the second-largest value market, with key centers in the UK, Spain, Germany, and France. The region is a major importer of Caribbean and Latin American rums and has also fostered its own culture of fine sipping rum consumption. Cachaca is gaining traction in European capital cities, often positioned as a versatile alternative white spirit. High competition from established spirits like Gin and Scotch whisky requires rum and cachaca brands to invest heavily in brand education and cultural marketing to capture consumer attention.

Asia Pacific (APAC) is projected to be the fastest-growing region, fueled by rapid urbanization and the expansion of the middle class in China, India, and Southeast Asia. While rum consumption is currently dominated by lower-priced domestic brands in countries like India, the trend toward Western premium spirits is opening vast opportunities for imported high-end rums. Cachaca is still niche but benefits from the growing demand for unique, internationally recognized cocktail ingredients. Latin America remains the core production and consumption hub, largely driven by Brazil (Cachaca) and the Caribbean islands (Rum), where production is often subsidized or protected by geographical indications (GI), maintaining strong regional market dominance and influencing global flavor profiles.

- North America: Dominant high-value market driven by premiumization, cocktail culture, and innovation in spiced rum categories.

- Europe: Strong importer market focusing on aged and artisanal rums; key gateway for internationalization of cachaca.

- Asia Pacific (APAC): Fastest-growing region, characterized by rising disposable income, urbanization, and increasing acceptance of Western premium spirits.

- Latin America: Largest production base; Brazil dominates cachaca consumption, while the Caribbean islands maintain global rum production leadership and heritage.

- Middle East and Africa (MEA): Emerging market with potential growth concentrated in urban centers and high-end tourism zones, despite regulatory hurdles in many nations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Rum and Cachaca Market.- Diageo PLC

- Bacardi Limited

- Pernod Ricard

- Gruppo Campari

- Davide Campari-Milano N.V.

- Heaven Hill Brands

- Angostura Holdings Limited

- Destilería Serrallés Inc.

- William Grant & Sons Ltd.

- Tanduay Distillers, Inc.

- The Edrington Group

- Suntory Holdings Limited

- Allied Blenders and Distillers Pvt. Ltd.

- Captain Morgan Rum Co.

- Industrias Licoreras de Guatemala

- Companhia Müller de Bebidas

- Cachaça 51

- Leblon Cachaça

- Havana Club International S.A.

- National Rums of Jamaica Limited

Frequently Asked Questions

Analyze common user questions about the Rum and Cachaca market and generate a concise list of summarized FAQs reflecting key topics and concerns.What factors are primarily driving the growth of the Rum and Cachaca market?

The primary drivers are the accelerating global trend toward premiumization and super-premiumization of spirits, the rising popularity of global cocktail culture, and increased consumer demand for authentic, craft-produced spirits with transparent sourcing and heritage narratives. Geographical expansion into high-growth APAC markets also contributes significantly.

How is the super-premium rum segment affecting overall market dynamics?

The super-premium segment is strategically crucial as it drives value growth and margin expansion, often outpacing volume growth. This segment is characterized by long aging periods, high-quality cask finishes, limited-edition releases, and bespoke packaging, positioning rum to compete directly with high-end whiskies and cognacs.

What is the main difference between Rum and Cachaca in terms of production?

While both are sugarcane-based spirits, Rum is typically fermented and distilled from molasses (a sugarcane byproduct). Cachaca, particularly the artisanal variety, is traditionally distilled directly from fresh, pressed sugarcane juice (garapa), resulting in a distinctively grassy, slightly vegetal flavor profile.

What impact is e-commerce having on the distribution of niche rum and cachaca brands?

E-commerce platforms are profoundly impacting distribution by lowering barriers to entry for niche, craft, and small-batch producers. These channels provide direct access to global consumers, facilitate personalized marketing, and allow brands to navigate traditional three-tier regulatory systems more efficiently, driving sales of specialized and limited-release products.

Which regions hold the highest potential for future market expansion?

The Asia Pacific (APAC) region, driven by countries like China and India, holds the highest potential for volume and value expansion due to significant demographic shifts, increasing middle-class income, and rising adoption of Western drinking habits. However, Latin America remains key for cachaca internationalization efforts.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager