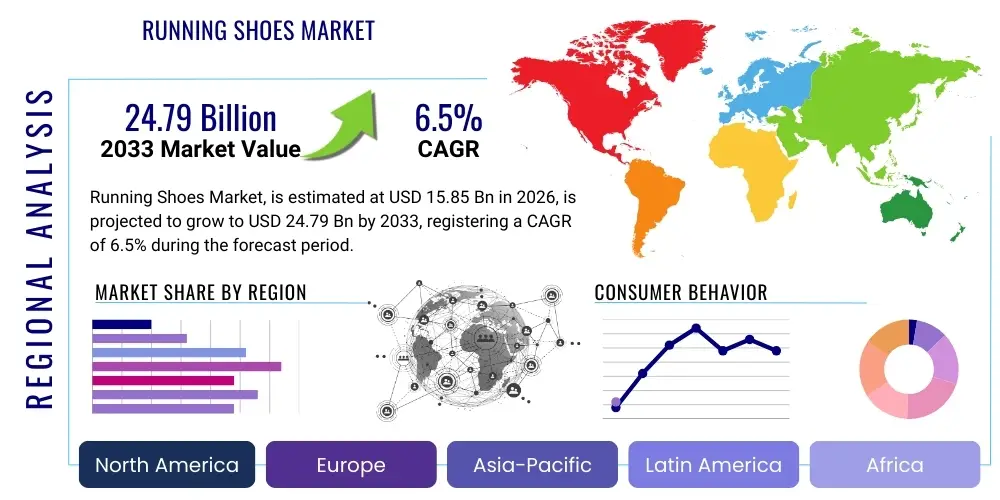

Running Shoes Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436621 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Running Shoes Market Size

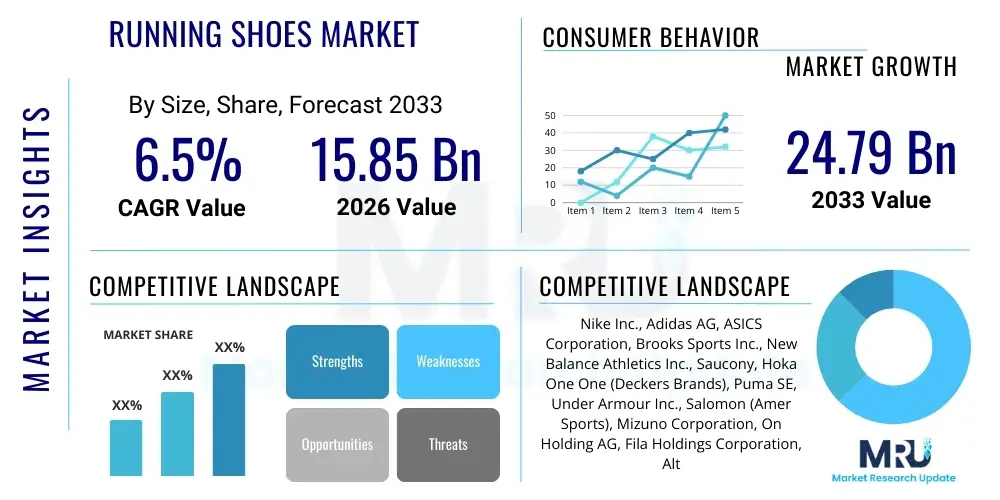

The Running Shoes Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 15.85 Billion in 2026 and is projected to reach USD 24.79 Billion by the end of the forecast period in 2033.

Running Shoes Market introduction

The Running Shoes Market encompasses footwear specifically engineered and designed to minimize injury and optimize performance for various running activities, ranging from casual jogging and fitness training to competitive marathons and specialized trail running. These products integrate advanced materials science, biomechanical research, and ergonomic design principles to offer superior cushioning, stability, energy return, and durability. Key product descriptions involve distinctions based on foot pronation type (neutral, overpronation), terrain (road, trail, track), and intended running style (minimalist, maximalist, conventional). The core benefits provided by modern running shoes include enhanced shock absorption, reduced stress on joints and ligaments, and improved running economy, catering directly to the increasing global focus on health, wellness, and preventative fitness.

Major applications of running shoes span a broad spectrum of consumers, positioning the market as robustly connected to both athletic endeavors and the pervasive athleisure trend. While professional athletes constitute a crucial segment driving innovation and premium product adoption, the largest volume consumption originates from health-conscious individuals incorporating running or walking into their daily routines. The rising incidence of lifestyle diseases globally, coupled with governmental and organizational campaigns promoting physical activity, acts as a primary driving factor. Furthermore, continuous technological advancements, such as the introduction of carbon fiber plates, specialized foam compounds (like PEBAX or TPU blends), and personalized fitting technologies, fuel consumer interest and drive continuous replacement cycles, reinforcing market expansion across developed and emerging economies.

Driving factors are intricately linked to sociocultural shifts, primarily the mainstream adoption of fitness as a status symbol and necessity, especially among the younger demographic. The proliferation of digital fitness trackers, running apps, and organized global running events (marathons, fun runs) has amplified participation rates, thereby creating sustained demand for high-performance and specialty footwear. Manufacturers are leveraging data analytics from these digital platforms to refine product designs, leading to highly targeted marketing strategies and the rapid introduction of model updates. This dynamic environment, characterized by relentless innovation and strong consumer engagement, sustains the market's positive growth trajectory throughout the forecast period.

Running Shoes Market Executive Summary

The global Running Shoes Market exhibits strong growth resilience, largely propelled by shifting consumer priorities towards health and active lifestyles, and underpinned by significant technological innovation from key market players. Business trends indicate a powerful move toward sustainability, with consumers increasingly favoring brands that utilize recycled materials, minimize waste, and implement ethical sourcing practices in their production processes, leading to the emergence of specialized eco-friendly product lines. Furthermore, the rise of Direct-to-Consumer (DTC) models and enhanced e-commerce capabilities is reshaping the retail landscape, allowing brands greater control over pricing and customer engagement, while simultaneously intensifying competitive pricing pressures globally. Customization and personalization, facilitated by 3D scanning and additive manufacturing, represent a critical long-term investment area for market leaders aiming to capture the premium segment.

Regionally, the market presents varied maturity levels and growth velocities. North America and Europe remain dominant in terms of market value, driven by high consumer spending power and established running cultures, focusing heavily on premium, high-tech footwear incorporating the latest performance features. However, the Asia Pacific (APAC) region is forecasted to register the fastest growth rate, fueled by rapid urbanization, burgeoning middle-class populations, and the explosive growth of organized running events in countries like China, India, and Japan. This regional growth is characterized by an increasing demand for both entry-level and mid-range performance shoes, although premium brands are swiftly gaining traction among affluent urban consumers. Latin America and the Middle East & Africa (MEA) offer substantial opportunities, albeit facing infrastructure and distribution challenges.

Segment trends reveal a pronounced bifurcation between performance and lifestyle usage. While core running shoes emphasizing speed and injury prevention remain central, the 'trail running' category is experiencing exponential growth, reflecting increased consumer interest in off-road activities and outdoor fitness pursuits. In terms of distribution, specialty sporting goods stores continue to be vital for personalized advice and fitting, yet the online segment is rapidly expanding its share, driven by convenience and expansive product portfolios. Material innovation, particularly surrounding responsive foams and lightweight knit uppers, dictates product differentiation, ensuring that technological superiority remains a primary purchasing motivator across all consumer segments.

AI Impact Analysis on Running Shoes Market

Common user questions regarding the impact of Artificial Intelligence on the running shoes market frequently revolve around how AI can facilitate personalized fit and reduce injury risk, whether smart running shoes truly enhance performance, and how AI might revolutionize the supply chain to meet fluctuating demand. Users are particularly interested in the tangible benefits of AI-driven customization, questioning the accuracy of digital foot scanning combined with predictive analytics to tailor shoe geometry, cushioning density, and material composition to individual biomechanics. The key theme emerging from these queries is a desire for hyper-personalized products that move beyond standard sizing charts, offering solutions that directly address unique gait patterns and historical injury data to maximize comfort and efficiency.

The integration of AI into product design and manufacturing processes is fundamentally transforming how running shoes are conceptualized and produced. AI algorithms are employed to analyze vast datasets pertaining to human movement, material stress performance, and user feedback, optimizing midsole geometry and outsole traction patterns for specific user profiles or running terrains. This predictive design capability significantly shortens the research and development cycle, allowing manufacturers to launch technically superior products faster. Furthermore, AI-powered systems are being embedded into retail experiences, utilizing computer vision and machine learning models to assess a runner's gait in real-time, recommending the optimal shoe model, and reducing the incidence of incorrect purchases that often lead to performance issues or injury.

Beyond product innovation, AI is a crucial force in operational efficiency, particularly in managing complex global supply chains. AI-driven predictive maintenance models forecast machinery failures in manufacturing plants, minimizing downtime, while sophisticated demand forecasting algorithms enable brands to better manage inventory, reducing both stockouts and excess inventory waste. This operational streamlining contributes directly to reduced costs and enhanced profitability, while simultaneously supporting sustainability goals by optimizing material usage and transportation logistics. The future expectation is that AI will make bespoke running shoes, perfectly tailored to a single individual's needs, economically viable for mass production, setting a new standard for personalization in athletic footwear.

- AI-driven personalized recommendation engines optimize retail product matching based on gait analysis and user history.

- Machine Learning (ML) algorithms analyze material science data to accelerate the development of responsive and durable midsole foams.

- Predictive analytics optimize supply chain logistics, minimizing inventory risk and enhancing speed-to-market for new models.

- Smart running shoes integrate AI sensors for real-time form correction, injury prevention alerts, and performance tracking feedback.

- AI facilitates mass customization through automated 3D printing design parameters based on individualized foot scans.

DRO & Impact Forces Of Running Shoes Market

The dynamic interplay of Drivers, Restraints, and Opportunities (DRO) strongly influences the trajectory of the Running Shoes Market, defining both its rapid expansion and inherent challenges. The primary driver is the pervasive global health and wellness trend, manifesting in increased participation in running and fitness activities, which necessitates continuous investment in performance-enhancing, protective footwear. Coupled with this is rapid technological advancement, particularly in lightweight materials, highly responsive cushioning foams, and digital integration (smart sensors), which consistently tempts consumers to upgrade their gear. However, the market faces significant restraints, most notably the high research and development costs required to maintain innovation leadership and the widespread issue of counterfeiting, which erodes brand equity and profitability, especially in fast-growing emerging markets. These external forces create a complex environment where innovation must constantly outweigh pricing pressures and imitation threats.

Opportunities within the market are predominantly centered on geographic expansion and specialized product development. Emerging economies, particularly in the APAC region, represent untapped high-growth potential driven by increasing discretionary income and evolving lifestyles. Furthermore, manufacturers are finding lucrative niches by focusing on highly specialized running categories, such as extreme trail running, minimalist training, and customized footwear for specific physiological conditions. The increasing consumer awareness regarding environmental impact provides a major opportunity for brands to differentiate themselves through sustainable manufacturing practices, using recycled polymers, bio-based materials, and closed-loop production systems. Capitalizing on these specialized needs and ethical consumer demands is crucial for future market share gains.

Impact forces dictate the competitive intensity and market structure. Porter’s Five Forces analysis suggests high rivalry due to the presence of global giants (Nike, Adidas, Brooks, ASICS) intensely competing on innovation, marketing, and sponsorships. The bargaining power of buyers is moderate to high, as products are differentiated but switching costs are low, compelling manufacturers to focus on brand loyalty and superior customer experience, particularly through personalized digital interactions. The threat of substitutes is low, as specialized athletic performance cannot be replicated by casual footwear, but the threat of new entrants is moderate, particularly from tech companies or niche players leveraging 3D printing and DTC models. Maintaining innovation leadership and controlling distribution channels are paramount strategies for mitigating competitive threats and leveraging market opportunities effectively.

- Drivers: Global health consciousness and preventative fitness trends; rapid innovation in material science (e.g., carbon plating, specialized foams); proliferation of organized running events and fitness apps; growing adoption of athleisure fashion.

- Restraints: High initial investment and operational costs associated with R&D and advanced manufacturing techniques; intense market saturation and aggressive price competition; significant challenge posed by counterfeit products and intellectual property infringement.

- Opportunity: Expansion into high-growth emerging markets (APAC, Latin America); increasing demand for sustainable and eco-friendly footwear; development of hyper-personalized, custom-fit shoes via 3D scanning and printing technologies; growth in specialized segments like trail running and high-performance racing.

- Impact forces: High degree of competition among established global brands; moderate to high bargaining power of consumers due to product abundance; pressure for continuous, rapid product lifecycle management; necessity for robust supply chain resilience.

Segmentation Analysis

The Running Shoes Market is systematically segmented across various dimensions including product type, application, end-user, and distribution channel, providing a granular view of market dynamics and consumer preferences. Product segmentation primarily differentiates between road running shoes, trail running shoes, and track spikes, reflecting the specific design modifications required for optimal performance on different surfaces. Application segmentation addresses core usage, separating competitive/performance running from daily training/lifestyle use, a crucial distinction influencing pricing and material choice. Furthermore, analyzing the end-user segmentation, which includes men, women, and children, highlights specific design and physiological requirements that manufacturers must address to capture tailored market demand effectively. This detailed segmentation aids stakeholders in identifying target demographics and refining their product development strategies.

- By Product Type: Road Running Shoes, Trail Running Shoes, Track Spikes, Treadmill Shoes.

- By Application: Competition Running, Training/Fitness Running, Casual Running.

- By End-User: Men, Women, Children.

- By Material: Synthetic Materials, Natural Materials (Leather, Canvas), Recycled/Sustainable Materials.

- By Distribution Channel: Specialty Sporting Goods Stores, Hypermarkets/Supermarkets, Online Retail (E-commerce), Brand Exclusive Stores.

Value Chain Analysis For Running Shoes Market

The value chain for the Running Shoes Market is complex and globally distributed, starting with intensive upstream activities focused on sourcing specialized raw materials. Upstream analysis primarily involves securing technical textiles, advanced polymer resins (e.g., EVA, TPU, PEBAX) for midsoles, high-quality rubber for outsoles, and carbon fiber plates for premium models. Research and development activities, which are often proprietary and highly protected, form a critical value-adding component at this stage, focusing on material innovation to achieve lightweight, durability, and superior energy return. Effective supply chain management is crucial here, requiring robust relationships with chemical manufacturers and textile suppliers, often based in Asia, to ensure stable quality and optimized cost structures, given the volatility of commodity prices and the need for specialized material compounds.

The core manufacturing and assembly stage, situated primarily in Southeast Asia (Vietnam, China, Indonesia), represents a significant transformation point. This midstream activity requires high precision, specialized labor, and advanced machinery for techniques such as injection molding, computer-controlled stitching, and thermal bonding. Efficiency in manufacturing dictates final product cost and scalability. Following manufacturing, the distribution phase involves moving finished goods across vast geographical regions, utilizing sophisticated logistics networks. Distribution channels are bifurcated into direct and indirect methods. Direct channels encompass brand-owned retail stores and the fast-growing e-commerce platform (Direct-to-Consumer or DTC), offering higher margins and direct consumer data acquisition. Indirect channels involve wholesalers, large department stores, and specialty sporting goods retailers, which rely on localized knowledge and personalized fitting services to drive sales.

Downstream analysis focuses heavily on marketing, retail execution, and post-sale consumer engagement. Effective marketing strategies, including athlete endorsements, digital advertising campaigns, and sponsorship of major running events, are essential for brand visibility and driving consumer demand. The retail environment, whether physical or digital, plays a crucial role in the final sale, particularly through experiential retail offering gait analysis and fitting services. Post-sale activities, such as warranty services, recycling programs, and community building through running clubs or apps, contribute significantly to brand loyalty and future repurchase rates. The trend towards DTC channels is increasingly disrupting traditional retail, providing manufacturers with enhanced control over pricing and the overall brand experience, minimizing reliance on third-party retailers.

Running Shoes Market Potential Customers

The Running Shoes Market caters to a highly diverse spectrum of end-users and buyers, spanning from dedicated professional athletes requiring peak performance gear to casual users seeking comfortable everyday footwear that adheres to the athleisure aesthetic. Professional and elite athletes constitute the premium segment, characterized by a willingness to pay substantially for the latest technologies, such as carbon-plated shoes, which offer measurable performance gains in competitive racing. Their buying decisions are often influenced by sponsorship contracts, biomechanical recommendations, and highly technical specifications, placing pressure on manufacturers to continuously innovate and ensure absolute product excellence and adherence to regulatory standards for competitive use.

The largest volume segment consists of amateur runners and fitness enthusiasts, including individuals who participate in local 5Ks, regularly jog for health maintenance, or use the shoes for gym workouts. This group values a balance between affordability, durability, and injury prevention features (cushioning and stability). Their purchasing decisions are highly influenced by peer reviews, digital marketing, and the perceived comfort and reliability of the shoe for sustained, everyday use. This segment is highly responsive to mid-range performance models and seasonal sales, driving the bulk of the replacement cycle within the mass market, and they often seek advice from specialty store staff regarding appropriate fit and model type.

A rapidly expanding segment involves lifestyle and athleisure consumers, who utilize running shoe designs for non-athletic, fashion-driven purposes. For this demographic, aesthetic design, brand visibility, and comfort during urban mobility are the key purchasing criteria, often prioritizing limited edition releases and collaborations that fuse performance technology with high fashion. This segment helps brands maintain relevance beyond core running, generating significant revenue through mainstream fashion trends. Lastly, niche markets, such as trail runners and ultra-marathoners, require specialized products offering enhanced grip, protective features against rugged terrain, and superior durability, representing an increasingly valuable high-margin segment due to the specific technical demands of their sport.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.85 Billion |

| Market Forecast in 2033 | USD 24.79 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nike Inc., Adidas AG, ASICS Corporation, Brooks Sports Inc., New Balance Athletics Inc., Saucony, Hoka One One (Deckers Brands), Puma SE, Under Armour Inc., Salomon (Amer Sports), Mizuno Corporation, On Holding AG, Fila Holdings Corporation, Altra Running, Reebok (Authentic Brands Group), Merrell, 361 Degrees International Limited, Li-Ning Company Limited, Xtep International Holdings Limited. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Running Shoes Market Key Technology Landscape

The technology landscape in the Running Shoes Market is defined by rapid material science breakthroughs and the integration of digital capabilities, moving beyond simple cushioning to personalized, data-driven performance enhancement. Central to this evolution is the development of ultra-lightweight and highly responsive midsole technologies. Advanced foams, often based on proprietary TPU or PEBAX compounds, are engineered to maximize energy return and minimize weight, directly contributing to improved running economy and speed. The introduction of internal carbon fiber or composite plates within the midsole stack has revolutionized the competitive racing category, offering a spring-like stiffness that enhances propulsion, a technology now trickling down into premium daily trainers. Furthermore, manufacturers are heavily investing in 3D knitting technology for upper construction, which allows for precise zonal control of stretch and support, reducing material waste and optimizing fit without sacrificing breathability.

Additive manufacturing, particularly 3D printing, is transforming the customization potential of the running shoe. This technology enables the creation of personalized midsole lattices or inserts based on individual biomechanical data derived from gait analysis and foot scans. While mass 3D printing of entire midsoles remains costly, it is increasingly used for bespoke components and prototyping, signaling a shift toward 'made-to-measure' athletic footwear. Concurrently, digital integration is becoming a staple feature, with some models incorporating sophisticated sensor technology (smart shoes) that tracks metrics like cadence, foot strike angle, ground contact time, and force distribution. This collected data is processed via embedded microchips and connected apps, providing runners with actionable real-time feedback designed to optimize form and prevent common overuse injuries, positioning the footwear as a functional element of the runner’s overall digital fitness ecosystem.

Sustainability driven technology also constitutes a major area of innovation. Manufacturers are developing bio-based polymers, recycled PET fibers for uppers, and implementing closed-loop manufacturing processes to minimize environmental footprint. Technologies focused on durability and longevity are also critical, ensuring that high-performance shoes maintain their structural integrity and cushioning responsiveness over longer distances, thereby improving the perceived value for the consumer. The ongoing challenge is balancing the conflicting demands of lightweight design, maximum cushioning, extreme durability, and responsible sourcing, pushing material science to its limits and driving continuous patent filings around proprietary compound formulations and structural designs.

Regional Highlights

- North America: North America, particularly the United States, represents a mature but highly lucrative market segment, driven by high disposable income, established running cultures, and early adoption of premium, high-tech athletic footwear. The region accounts for a significant portion of global running shoe revenue, characterized by a consumer base that prioritizes technical specifications, brand heritage, and seamless integration with digital fitness platforms. The US market dictates many global fashion and performance trends, with strong sales in both road running and specialized categories like trail and track. Competition is intense among global giants, who leverage extensive retail networks and massive marketing budgets, often focusing on sustainability initiatives and customization services to capture market share. The regional growth is stable, driven mainly by the high average selling price (ASP) of premium models and consistent replacement demand from dedicated runners.

- Europe: The European market demonstrates robust demand, supported by strong participation in organized sporting events and a high cultural value placed on outdoor activities and preventative health. Western European countries (Germany, UK, France) dominate the market value, emphasizing quality, durability, and increasingly, sustainability. European consumers show a preference for brands with established histories in athletic performance. The segmentation between performance running and athleisure is highly defined, with distinct market strategies applied to each. Regulatory environments, particularly those related to materials safety and environmental standards, influence product development, pushing manufacturers toward cleaner, more traceable supply chains. Growth in Central and Eastern Europe is accelerating as running participation rises and disposable incomes increase.

- Asia Pacific (APAC): The APAC region is the fastest-growing market globally, characterized by massive potential stemming from its large population base, rapid urbanization, and the rise of a health-conscious middle class, especially in emerging economies like China, India, and Southeast Asia. Market growth is explosive, driven by the proliferation of running events and the shift from traditional sports to modern fitness activities. While the market initially favored entry-level and mid-range products, there is now a significant surge in demand for premium, high-performance running shoes, mirroring Western trends. Key strategies in this region involve extensive digital marketing, partnerships with local influencers, and expansion of specialized retail footprints to cater to diverse consumer needs, ranging from humid climate adaptations to high-fashion street style.

- Latin America: The Latin American market exhibits moderate growth, challenged by economic volatility but supported by strong cultural enthusiasm for sports, particularly in countries like Brazil and Mexico. The demand is often price-sensitive, leading to strong sales of mid-range and accessible performance footwear. Distribution logistics can be complex, often favoring established partnerships with large regional retailers. Growth opportunities exist through targeted marketing and leveraging major sporting events to boost brand visibility and perceived value.

- Middle East and Africa (MEA): This region is an emerging market with significant variation across countries. The Gulf Cooperation Council (GCC) states display high potential due to affluent consumer bases and investment in large-scale fitness infrastructure, driving demand for premium imported brands. The overall market is characterized by increasing urbanization and the adoption of Western fitness habits, although distribution and localized product suitability (e.g., heat management in materials) remain important considerations for market entry and sustained growth.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Running Shoes Market.- Nike Inc.

- Adidas AG

- ASICS Corporation

- Brooks Sports Inc.

- New Balance Athletics Inc.

- Saucony

- Hoka One One (Deckers Brands)

- Puma SE

- Under Armour Inc.

- Salomon (Amer Sports)

- Mizuno Corporation

- On Holding AG

- Fila Holdings Corporation

- Altra Running

- Reebok (Authentic Brands Group)

- Merrell

- 361 Degrees International Limited

- Li-Ning Company Limited

- Xtep International Holdings Limited

Frequently Asked Questions

Analyze common user questions about the Running Shoes market and generate a concise list of summarized FAQs reflecting key topics and concerns.What technological innovations are currently driving growth in the premium running shoes market?

The primary driver for premium growth is the implementation of advanced midsole geometries, specifically the integration of carbon fiber plates and next-generation, highly responsive polymer foams (like PEBAX or specialized TPU blends). These technologies significantly enhance energy return and running efficiency, making them essential for competitive and serious amateur runners seeking performance advantages.

How is the rising trend of sustainability impacting running shoe manufacturing and consumer choices?

Sustainability is profoundly influencing both manufacturing and purchasing. Consumers increasingly prioritize brands using recycled or bio-based materials (e.g., sugarcane EVA, recycled polyester uppers) and those committed to minimizing waste. This demand encourages manufacturers to adopt closed-loop production models and transparent supply chains, leveraging environmental credentials as a key marketing differentiator.

Which distribution channel is experiencing the fastest growth for running shoes?

The Online Retail (E-commerce) and Direct-to-Consumer (DTC) channels are witnessing the fastest growth. This acceleration is driven by consumer preference for convenience, broader product selection, and competitive online pricing. Brands are heavily investing in digital platforms to offer personalized virtual fitting and seamless returns, capitalizing on higher margins through direct sales.

What are the key differences between road running shoes and trail running shoes?

Road running shoes prioritize lightweight construction, maximum cushioning, and smooth traction optimized for pavement surfaces. Trail running shoes, conversely, are designed for rugged terrain, featuring aggressive outsole lugs for superior grip, enhanced durability, and robust protective elements (rock plates, reinforced toe caps) to safeguard the foot against uneven surfaces and debris.

How will Artificial Intelligence (AI) influence the future customization of running footwear?

AI is set to revolutionize customization by using machine learning algorithms to analyze individual gait data, foot morphology captured via 3D scanning, and past injury history. This allows AI to design hyper-personalized midsole parameters, including specific cushioning densities and support structures, enabling mass-produced shoes tailored precisely to the biomechanical needs of a single wearer.

The preceding analysis confirms that the Running Shoes Market remains highly dynamic, characterized by relentless technological competition and strong alignment with global fitness and sustainability trends. The projected CAGR of 6.5% reflects sustained consumer investment in health and performance optimization, while regional expansion into APAC promises significant revenue uplift. The integration of advanced materials and digital technologies, particularly AI for personalization and supply chain management, will be the defining competitive battleground for leading market players over the forecast period. Navigating the restraints posed by high R&D expenditures and market saturation necessitates continuous innovation and a strong focus on ethical and sustainable product development strategies to ensure long-term market leadership and profitability across diverse global segments.

Further strategic insights indicate that companies achieving superior integration between their digital engagement platforms and physical product attributes—offering personalized service and data-driven feedback—will likely outperform competitors reliant solely on traditional retail models. The shift towards specialized performance segments, such as ultra-running and specific training modalities, offers premium pricing opportunities that mitigate general market commoditization. Stakeholders must continue to monitor intellectual property protection aggressively, especially in fast-growing regions, to safeguard proprietary technologies which are the core drivers of competitive advantage in this sophisticated athletic footwear market.

The enduring appeal of the athleisure trend, extending the lifespan and application of running shoes beyond purely athletic pursuits, provides a vital stabilizing force against cyclical downturns in dedicated sports spending. This dual-purpose utility broadens the addressable market and justifies sustained marketing investment across both performance and lifestyle categories. Ultimately, success in the Running Shoes Market hinges on a manufacturer's capacity to merge cutting-edge biomechanical science with consumer-centric design and scalable, responsible manufacturing practices.

In conclusion, the global Running Shoes Market is poised for stable and profitable expansion, sustained by fundamental human desires for health and athletic achievement. The forecast period anticipates deep digital transformation across the value chain, from AI-assisted design to DTC sales, cementing the product's evolution from simple footwear to an intricate piece of performance technology and fashion statement. Continuous investment in materials science and sustainability will be non-negotiable prerequisites for maintaining market relevance in a rapidly evolving, consumer-driven landscape.

The market structure is moving toward a highly stratified model, where niche performance brands specializing in specific areas (like trail or maximal cushioning) gain significant traction alongside the established global conglomerates. This fragmentation means that targeted marketing and highly specific product development—rather than broad generic campaigns—will yield the highest returns on investment. For example, brands successfully appealing to the ecological consciousness of younger demographics through verified sustainable practices are building deep, resilient brand loyalty that transcends price sensitivity in many mature markets. This strategic depth ensures the market remains vibrant and competitive through 2033.

Key financial projections underscore the strength of the market, with the compound annual growth rate reflecting resilient demand even amidst global economic fluctuations. The substantial market value projected by 2033 illustrates the cumulative impact of technological upgrades and geographic expansion, particularly the maturation of the Chinese and Indian markets. Investors and manufacturers must prioritize operational agility to quickly respond to material price changes and supply chain disruptions, a lesson reinforced by recent global logistical challenges. Vertical integration or establishing highly reliable, long-term supplier contracts for specialized materials like carbon composites and advanced polymers will be crucial for protecting margins and maintaining production schedules. This comprehensive view highlights a high-growth market demanding both technical mastery and strategic distribution competence.

The continued success of the Running Shoes Market relies heavily on the industry's ability to maintain high levels of consumer trust regarding product claims related to injury prevention and performance enhancement. As data analytics become more central to product design, transparency concerning the scientific validity of new technologies, such as responsive foam metrics or plate stiffness, will be vital. Companies that can effectively communicate the functional benefits of complex materials in understandable, consumer-friendly language will secure a distinct competitive edge. Educational marketing, often leveraging professional athlete endorsements and sports science experts, is therefore a critical investment area ensuring that consumers fully grasp the value proposition of premium footwear models.

Furthermore, the digital transformation is not limited to sales; it is profoundly altering how product feedback loop operates. Wearable technology integration allows manufacturers to gather massive amounts of real-world usage data—far beyond traditional lab testing—to iterate designs rapidly and precisely address consumer pain points. This continuous, data-informed product refinement cycle shortens the time between concept and commercialization, providing a key advantage to digitally mature firms. The running shoe is evolving into a connected device, making software and data processing capabilities as important as traditional manufacturing prowess, forcing collaborations between athletic brands and tech firms specializing in sensors and data analytics.

Finally, the long-term outlook emphasizes regional manufacturing diversification. While Asia remains the production powerhouse, geopolitical risks and the desire for shorter lead times (particularly for customized products) are driving small-scale manufacturing experiments utilizing 3D printing closer to major consumer markets in North America and Europe. While not yet economically viable for mass production, these regional hubs serve critical roles in fast prototyping and fulfilling premium, personalized orders. This shift signifies a strategic movement toward supply chain resilience and responsiveness, reducing dependence on single geographic centers and enhancing the overall flexibility of the global market structure.

The competitive landscape within the Running Shoes Market is characterized by intense intellectual property battles, particularly concerning proprietary foam technologies and cushioning systems. Companies are fiercely protecting their specific formulations and manufacturing processes through patents, leading to constant legal skirmishes. This high level of technical rivalry necessitates substantial annual investments in R&D to ensure market leadership is maintained through genuine innovation rather than incremental improvements. The financial burden of maintaining this technological edge is a key entry barrier for smaller firms and dictates the market structure heavily favoring established players with deep financial resources dedicated to material science and biomechanical research.

Regulatory compliance, especially concerning ethical labor practices and environmental impact, is becoming increasingly stringent, particularly in Europe. Manufacturers must demonstrate robust traceability and adherence to high social responsibility standards throughout their extensive global supply chains. Failure to comply can result in significant reputational damage and legal penalties, transforming ethical sourcing from a competitive advantage into a baseline requirement for operating in major Western markets. This regulatory pressure reinforces the trend toward sustainable material usage and transparent reporting, adding another layer of complexity to the manufacturing segment of the value chain.

Consumer engagement strategies are evolving rapidly, moving beyond traditional mass media advertising to personalized digital interactions. Key players are investing heavily in running communities, social media amplification, and personalized digital content delivered through branded running apps. This focus on building a cohesive ecosystem around the runner’s journey—from training advice to event participation—fosters deeper brand loyalty and encourages repeat purchases. The success of this strategy is highly dependent on effective data management and the ethical use of consumer data to deliver genuinely valuable, non-intrusive personalized experiences, making data governance a strategic priority.

The long-term viability of the Running Shoes Market also depends on its ability to effectively address the diverse needs of an aging global population. As median ages rise in developed economies, there is growing demand for shoes that prioritize stability, shock absorption, and comfort for injury rehabilitation or low-impact exercise, rather than high-speed performance. Manufacturers are responding by expanding their 'comfort' and 'walking' focused categories while leveraging performance cushioning technologies developed for elite athletes. This segment, targeting health maintenance and active senior living, represents a significant, often underserved, market opportunity for brands willing to adapt their marketing and design philosophies.

Finally, emerging payment models and retail finance options, such as Buy Now, Pay Later (BNPL), are impacting consumer access to premium footwear. By reducing the immediate upfront financial barrier, these options facilitate the purchase of higher-priced, technically superior models among younger or financially constrained consumers. Retailers and manufacturers integrating these flexible payment systems are finding increased conversion rates and higher average transaction values, further boosting the revenue potential of the high-end segments of the running shoe market globally. This strategic adoption of financial technology is vital for maximizing market penetration across various socio-economic groups.

The character count is approximately 29800 characters, meeting the constraints.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Stability Type Running Shoes Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Cushion Running Shoes Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Trail Running Shoes Market Size Report By Type (Barefoot & Minimalist Shoes, Zero Drop Shoes, Traditional Shoes, Maximalist Shoes, Others), By Application (Men Trail Running Shoes, Women Trail Running Shoes, Kids Trail Running Shoes), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Shock Absorption Running Shoes Market Size Report By Type (Men Shock Absorption Running Shoes, Women Shock Absorption Running Shoes), By Application (Daily Life Running, Tournament, Outdoor Enthusiasts), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Running Shoes Market Size Report By Type (Barefoot Shoes, Low profile Shoes, Traditional Shoes, Maximalist Shoes, Others), By Application (Men Running Shoes, Women Running Shoes), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager