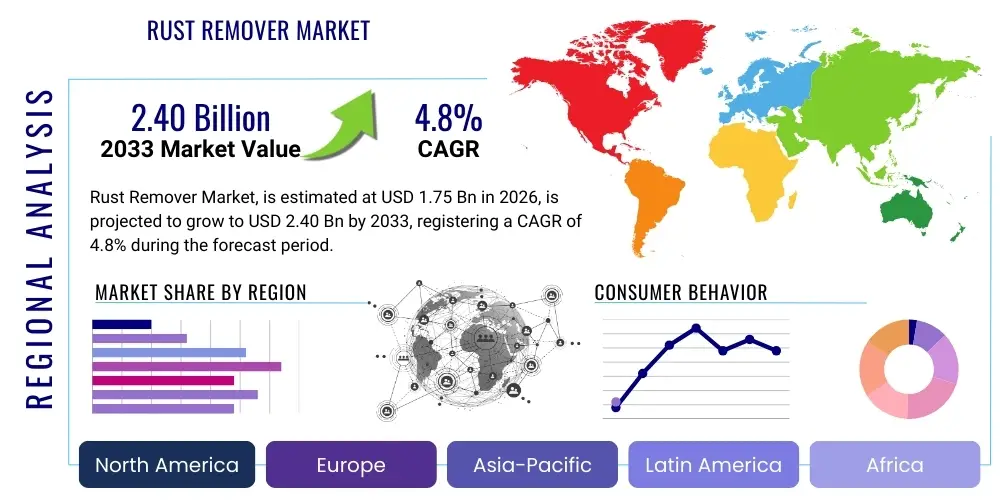

Rust Remover Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434720 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Rust Remover Market Size

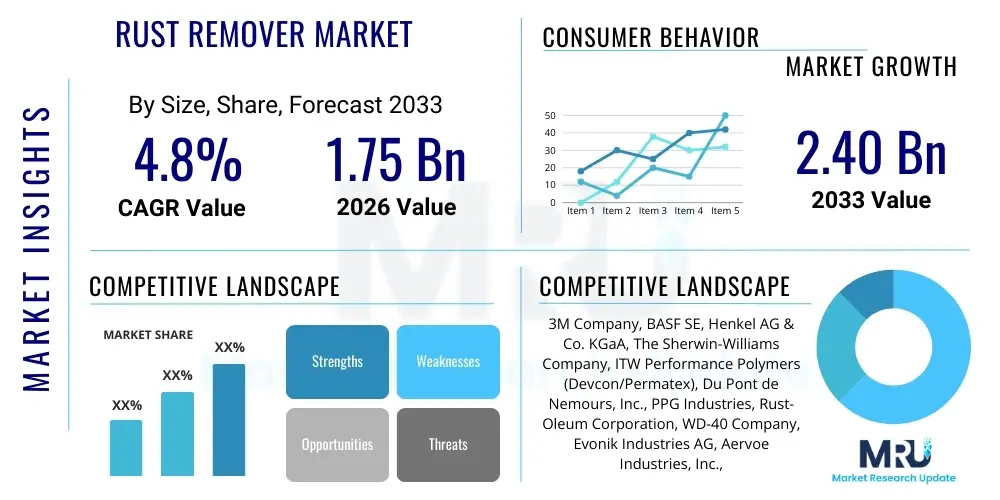

The Rust Remover Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at $1.75 Billion in 2026 and is projected to reach $2.40 Billion by the end of the forecast period in 2033.

Rust Remover Market introduction

The Rust Remover Market encompasses a diverse range of chemical solutions and mechanical preparations designed to eliminate oxidation (rust) from ferrous metals, restoring surface integrity and preventing further degradation. These products are fundamentally crucial in maintenance, repair, and overhaul (MRO) activities across various heavy industries and consumer applications. Rust removers are broadly categorized by their chemical base, including acidic formulas (often containing phosphoric or hydrochloric acid), alkaline cleaners, and organic or solvent-based solutions, with a rapidly emerging segment focusing on environmentally friendly, bio-based formulations that leverage chelating agents instead of harsh mineral acids. Product forms include liquids, gels, sprays, and dips, catering to different application needs, from intricate components to large surface areas.

Major applications driving the demand for rust removers span the automotive, marine, construction, manufacturing, and general household sectors. In the automotive industry, rust removal is essential for vehicle longevity and structural safety, particularly in regions exposed to road salts and high humidity. Similarly, the marine sector relies heavily on robust rust removal and protection solutions for ships, offshore structures, and port equipment subjected to severe corrosive environments. The operational benefits derived from utilizing effective rust removal products include significantly extending the service life of metal assets, maintaining optimal machine performance, ensuring compliance with safety regulations, and minimizing costly replacements or extensive structural repairs, positioning these chemicals as essential operational supplies rather than mere maintenance accessories.

Key factors propelling the growth of this market include the global expansion of infrastructure projects, particularly in developing economies, necessitating high volumes of MRO activities. Furthermore, the persistent challenge of aging infrastructure, especially in North America and Europe, mandates regular rust mitigation to prevent catastrophic failures of bridges, pipelines, and industrial machinery. The increasing consumer interest in DIY (Do-It-Yourself) projects and the high-value preservation of classic and used vehicles also contribute substantially to the demand trajectory. However, continuous innovation, particularly concerning product safety and environmental compliance, is paramount, influencing manufacturers to invest heavily in non-toxic, biodegradable, and low volatile organic compound (VOC) formulations to meet stringent global regulatory standards and consumer preferences for sustainable solutions.

Rust Remover Market Executive Summary

The Rust Remover Market is characterized by robust demand driven primarily by infrastructure maintenance cycles and strong growth in the global automotive aftermarket. Business trends indicate a significant market pivot towards sustainable chemistry, where bio-based and non-acidic rust removal solutions are gaining substantial market share, driven by increasing regulatory pressure, particularly in the European Union, regarding the use of traditional hazardous chemicals. Strategic partnerships between chemical manufacturers and industrial MRO service providers are becoming commonplace, aimed at providing integrated corrosion management solutions rather than standalone product sales. Furthermore, digitalization is beginning to influence inventory management and supply chain efficiency, although the core manufacturing processes remain chemistry-intensive.

Geographically, Asia Pacific (APAC) is projected to exhibit the fastest growth, propelled by rapid industrialization, expansion of manufacturing capacities, and large-scale infrastructure development, especially in countries like China, India, and Southeast Asian nations, where massive construction and shipbuilding activities generate consistent demand for industrial-grade rust mitigation products. North America and Europe remain mature markets, focusing heavily on value-added, premium, and compliant products, driven by stringent occupational health and safety standards. Regional trends also show higher adoption rates of advanced spray and gel formulations in mature markets due to ease of application and reduced runoff waste.

Segmentation trends highlight the dominance of the acidic rust remover segment by volume, owing to its effectiveness and cost efficiency for large-scale industrial use, although its market share is slowly being eroded by the uptake of neutral pH and organic-acid alternatives. Application segmentation reveals that the industrial and manufacturing sector, encompassing heavy machinery and primary metal fabrication, holds the largest market share. The End-User segment shows substantial growth in the DIY/Consumer category, reflecting increased accessibility of professional-grade products to general consumers. Future growth is strongly linked to the success of R&D efforts focusing on fast-acting, surface-safe, and environmentally benign formulations.

AI Impact Analysis on Rust Remover Market

User inquiries regarding the integration of Artificial Intelligence (AI) in the Rust Remover Market primarily center on three themes: enhancing supply chain resilience, optimizing chemical formulation through predictive modeling, and improving the efficiency of application processes via robotics and smart sensors. Consumers and industrial buyers are keen to understand how AI-driven predictive maintenance (PdM) schedules can better anticipate corrosion onset, thereby optimizing the timing and quantity of rust remover required, reducing waste, and minimizing downtime. Concerns also revolve around whether AI can accelerate the development of complex, high-performance, green formulations by simulating molecular interactions and predicting efficacy, thus streamlining the R&D pipeline that traditionally relies on extensive empirical testing. Furthermore, large industrial end-users question the deployment of AI-powered inspection systems that automatically identify rust severity and recommend the optimal rust removal product and application method.

- AI-driven optimization of chemical ingredient sourcing and inventory management, ensuring stability in raw material costs.

- Implementation of Machine Learning (ML) models to predict corrosion rates in diverse environments, supporting proactive application strategies.

- AI-assisted formulation development, accelerating the screening of novel, environmentally friendly chelating agents and inhibitors.

- Automation of quality control during the manufacturing process, maintaining consistency in product performance (e.g., pH stability, etching rates).

- Integration of AI algorithms with robotic systems for large-scale, precision rust removal applications in complex structures like bridges and ships.

- Optimization of logistics and distribution networks through predictive demand forecasting, especially for specialized industrial-grade products.

DRO & Impact Forces Of Rust Remover Market

The Rust Remover Market dynamics are influenced by a complex interplay of Drivers, Restraints, and Opportunities (DRO). A primary driver is the necessity of maintaining aging infrastructure globally; the extended operational life required for essential assets such as oil and gas pipelines, railways, and municipal water systems mandates continuous and effective corrosion control, fueling steady demand for rust removal solutions. Coupled with this is the robust and expanding global automotive production and the subsequent growth in the MRO aftermarket, where rust prevention and remediation are critical for maintaining vehicle value and safety standards. Furthermore, the rising awareness among both industrial users and general consumers regarding the long-term economic benefits of preventive maintenance over reactive replacement significantly boosts market consumption.

Conversely, the market faces notable restraints, chiefly environmental and health regulatory scrutiny. Many traditional, highly effective rust removers rely on strong mineral acids (e.g., hydrochloric, sulfuric acid) or hazardous solvents, leading to increasing pressure from environmental protection agencies (like the EPA and REACH) to limit or eliminate their use. This necessitates significant investment in R&D for manufacturers to reformulate products, which can be costly and challenging without sacrificing efficacy. Intense price competition, particularly in the bulk industrial commodity segments, also acts as a restraint, squeezing profit margins for smaller manufacturers, while the lack of standardization across regional safety labels sometimes complicates international trade and product marketing.

The most compelling opportunities lie in the expansion of the bio-based and green chemistry segment. Development and commercialization of highly effective, biodegradable, non-hazardous, and low-VOC rust removers address both regulatory challenges and growing consumer preference for sustainable products. There is also a substantial opportunity in developing specialized, high-performance rust removal systems tailored for niche applications, such as aerospace alloys or specialized electronics manufacturing, requiring non-aggressive but highly effective solutions. Additionally, enhancing product delivery systems, such as advanced aerosol technologies and specialized applicator tools designed for complex geometries, offers avenues for market differentiation and value creation, particularly in the high-growth DIY sector.

Segmentation Analysis

The Rust Remover Market is segmented based on chemical type, application, form, and end-user, providing a granular view of market trends and demand centers. Understanding these segments is critical for manufacturers to tailor product development and marketing strategies effectively. Chemical composition dictates efficacy, safety profile, and regulatory compliance, with the primary types being Acidic, Neutral/Alkaline, and Solvent-based. Application segmentation reveals the diverse environments where rust removal is critical, ranging from large industrial assets to small consumer items. Form segmentation—liquid, gel, and spray—addresses the operational requirements, where gels are preferred for vertical or overhead applications due to cling properties, and liquids are often used for dipping large batches of small parts.

- By Type:

- Acidic Rust Removers (e.g., Phosphoric Acid, Hydrochloric Acid)

- Alkaline/Neutral Rust Removers (e.g., Chelating Agents)

- Solvent-Based Rust Removers (e.g., Petroleum Distillates)

- Bio-based/Organic Rust Removers

- By Form:

- Liquid

- Gel/Paste

- Spray/Aerosol

- Wipes/Impregnated Cloths

- By Application:

- Cleaning & Restoration

- Surface Preparation (Pre-Coating)

- General Maintenance, Repair, and Overhaul (MRO)

- By End-User:

- Automotive & Transportation

- Marine (Shipbuilding and Offshore)

- Construction & Infrastructure

- Industrial Manufacturing & Machinery

- Aerospace & Defense

- DIY/Household & Consumer

Value Chain Analysis For Rust Remover Market

The value chain for the Rust Remover Market begins with the upstream segment, which involves the procurement and supply of critical chemical raw materials. This includes major commodities such as various mineral acids (phosphoric, hydrochloric), organic acids (citric, oxalic), chelating agents (EDTA derivatives), specific surfactants, solvents, and corrosion inhibitors. The cost and availability of these foundational chemicals are highly sensitive to global petrochemical and mining market fluctuations. Suppliers in this phase face challenges related to logistics, regulatory compliance for hazardous material handling, and ensuring consistent purity and concentration for stable final product formulation. Strong relationships with reliable, cost-competitive upstream suppliers are essential for maintaining stable manufacturing margins.

The midstream segment involves the core manufacturing and formulation processes. Here, chemical manufacturers blend and process raw materials into finished rust remover products (liquids, gels, or aerosols) tailored for specific applications. This stage requires significant technological expertise, particularly in compounding proprietary mixtures that balance high efficacy with safety and environmental compliance. Quality control, packaging, and regulatory adherence (e.g., labeling requirements, safety data sheet generation) are paramount. The choice of manufacturing technology—from standard batch mixing to advanced continuous process systems—significantly impacts efficiency and scale. Companies focusing on patented, high-performance, green formulations often achieve better pricing power and differentiation in this crowded market segment.

The downstream segment encompasses distribution channels and end-user consumption. Distribution is bifurcated into direct sales to large industrial end-users (e.g., automotive assembly plants, major infrastructure maintenance contractors) and indirect sales through multi-tiered distribution networks. Indirect channels include wholesale chemical distributors, specialized MRO suppliers, hardware stores, e-commerce platforms, and automotive parts retailers. The effectiveness of the indirect channel is crucial for reaching the fragmented DIY and small-to-medium enterprise (SME) segments. E-commerce platforms have emerged as a vital channel, offering consumers greater access to specialized products and comparative reviews, thereby influencing purchasing decisions based on performance and environmental claims rather than just proximity or price.

Rust Remover Market Potential Customers

Potential customers for rust remover products are broadly classified into industrial, commercial, and consumer categories, each possessing distinct needs and purchasing criteria. The industrial segment, representing the largest volume consumers, includes heavy engineering companies, shipbuilding facilities, aerospace maintenance depots, and large construction firms. These buyers prioritize high-volume effectiveness, fast-acting formulas that minimize operational downtime, and compliance with strict industrial safety standards. Their purchasing decisions are often based on technical specifications, bulk pricing, and the ability of the supplier to provide certified training and consistent supply chains. Specific requirements include non-destructive testing compatibility and material safety data sheets (MSDS) compliance for internal auditing purposes.

The commercial segment encompasses businesses focused on fleet maintenance (trucking, rail), municipal services (water pipes, road signage), and smaller specialized repair shops, such as automotive body shops and general mechanics. These customers seek versatile products suitable for a range of applications, ease of use (e.g., spray or gel forms), and reliable performance. Cost-efficiency is important, but balancing effectiveness with environmental impact is also becoming a key consideration, especially as many commercial entities seek to improve their sustainability credentials. Retail distributors and MRO suppliers act as crucial intermediaries to service this diverse customer base, often packaging industrial products into smaller, more accessible formats.

The DIY and Household segment represents a significant growth vector, comprising individual consumers focused on home improvement, vehicle restoration (classic cars), and hobbyist projects. These buyers are typically drawn to user-friendly formats like aerosols and wipes, focusing on safety, minimal odor, and immediate, visible results. Purchasing decisions in this segment are highly influenced by branding, packaging, online reviews, and accessibility through major retail chains and e-commerce platforms. The market sees a high demand for non-toxic, low-fume products suitable for use in residential environments. Manufacturers are strategically investing in consumer education and digital marketing to capture this fragmented but rapidly expanding base.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.75 Billion |

| Market Forecast in 2033 | $2.40 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | 3M Company, BASF SE, Henkel AG & Co. KGaA, The Sherwin-Williams Company, ITW Performance Polymers (Devcon/Permatex), Du Pont de Nemours, Inc., PPG Industries, Rust-Oleum Corporation, WD-40 Company, Evonik Industries AG, Aervoe Industries, Inc., Kano Laboratories, Inc., Kimberly-Clark Corporation, Chemetall GmbH (BASF), B’laster LLC, FOSROC International Ltd., Zep, Inc., CRC Industries, Inc., Cortec Corporation, Bio-Circle Surface Technology GmbH |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Rust Remover Market Key Technology Landscape

The technological landscape of the Rust Remover Market is rapidly evolving, driven primarily by the need to balance high efficacy with environmental safety. A major area of technological focus is the advancement in chelation chemistry. Chelating agents, such as specific amino acids and organic acids (like gluconic or citric acid derivatives), are being engineered to selectively bind with iron oxides (rust) without significantly damaging the underlying metal substrate or releasing harmful fumes. This technology underpins the growth of neutral pH rust removers, offering a safer alternative to traditional strong mineral acids, which necessitates specialized delivery systems to ensure maximum contact time and penetration, often through the use of viscosity modifiers and thixotropic agents to create clingy gels and pastes.

Another crucial technological development is the incorporation of nanotechnology. Manufacturers are exploring nano-scale inhibitors and surface active agents that can penetrate porous rust layers more effectively and form an ultra-thin protective barrier on the cleaned metal surface, providing a temporary pre-coating effect against flash rust (immediate re-oxidation). Furthermore, formulation technology is leveraging advanced surfactants and emulsifiers to create high-performance, water-based solutions that can effectively dissolve oil, grease, and corrosion simultaneously, reducing the need for multiple cleaning steps. This multifunctional approach enhances efficiency for industrial end-users, lowering overall maintenance costs and time requirements.

The future trajectory of technology in this market involves significant investments in green chemistry principles. This includes utilizing renewable resources as feedstock for rust removal agents, minimizing volatile organic compound (VOC) emissions, and designing products that are fully biodegradable. Innovation is also occurring in application methods, with the development of smart aerosol spray patterns, disposable pre-saturated wipes engineered for surface compatibility, and automated dipping baths equipped with precise temperature and concentration monitoring systems. The overarching goal is to deliver faster, safer, and more targeted rust removal solutions that meet the increasingly stringent safety and sustainability criteria mandated globally.

Regional Highlights

The Rust Remover Market exhibits distinct consumption patterns and growth dynamics across major global regions, influenced by localized industrial activities, climate conditions, and regulatory environments. Asia Pacific (APAC) stands out as the primary growth engine, fueled by the massive scale of its manufacturing and processing sectors, robust shipbuilding industries (especially in South Korea and China), and extensive infrastructure investments (roads, ports, and energy grids). The demand in APAC is high for both cost-effective, high-volume acidic removers for heavy industry and specialized solutions for export-oriented manufacturing complying with Western environmental standards. India and Southeast Asia are projected to witness steep increases in consumption due to accelerated urbanization and infrastructure build-out, driving the need for continuous corrosion management.

North America and Europe represent mature, high-value markets characterized by a strong emphasis on regulatory compliance, product safety, and sustainable alternatives. In North America, the significant stock of aging public infrastructure and the high consumer demand for automotive restoration and DIY products sustain steady market growth. The region sees strong demand for premium, multi-purpose aerosols and specialized industrial formulations. Europe, driven by the stringent REACH regulations and a strong corporate commitment to environmental stewardship, leads the adoption of bio-based, non-VOC, and neutral pH rust removers, forcing manufacturers to innovate rapidly away from traditional acidic solutions. Pricing in these regions is typically higher, reflecting the cost of R&D and regulatory compliance.

Latin America and the Middle East & Africa (MEA) are emerging markets showing gradual but consistent growth. Latin America's demand is driven largely by mining, petrochemicals, and basic manufacturing, often requiring robust industrial-grade products. MEA, particularly the GCC countries, sees significant demand stemming from the oil and gas sector (pipeline maintenance, offshore rigs) and large-scale construction projects. The harsh environmental conditions in these regions (high heat, humidity, salinity) necessitate highly durable and effective corrosion mitigation strategies, ensuring consistent long-term demand for high-performance rust removal and protection systems.

- Asia Pacific (APAC): Highest projected CAGR due to rapid industrialization, expansion of manufacturing hubs (China, India), and significant infrastructure development in key economies.

- North America: Market stability driven by extensive aging infrastructure maintenance, strong automotive aftermarket demand, and high adoption of specialized, premium MRO products.

- Europe: Growth concentrated in the bio-based and environmentally compliant segment, strongly regulated by REACH; high demand from machinery manufacturing and construction sectors.

- Latin America: Demand growth fueled by investments in the mining, petrochemical, and basic industry sectors.

- Middle East & Africa (MEA): Critical demand from the massive oil and gas and marine sectors for extreme corrosion resistance and effective industrial cleaners.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Rust Remover Market.- 3M Company

- BASF SE

- Henkel AG & Co. KGaA

- The Sherwin-Williams Company

- ITW Performance Polymers (Devcon/Permatex)

- Du Pont de Nemours, Inc.

- PPG Industries

- Rust-Oleum Corporation

- WD-40 Company

- Evonik Industries AG

- Aervoe Industries, Inc.

- Kano Laboratories, Inc.

- Kimberly-Clark Corporation

- Chemetall GmbH (BASF)

- B’laster LLC

- FOSROC International Ltd.

- Zep, Inc.

- CRC Industries, Inc.

- Cortec Corporation

- Bio-Circle Surface Technology GmbH

- Nalco Water (Ecolab)

- Akzo Nobel N.V.

Frequently Asked Questions

Analyze common user questions about the Rust Remover market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary chemical categories of rust removers and their respective advantages?

Rust removers are mainly categorized into acidic (fast-acting, cost-effective, high etching risk), alkaline/neutral (safer, utilize chelating agents, preferred for sensitive surfaces), and solvent-based (effective against light surface rust and combined corrosion/grease). Bio-based formulas using organic acids and specialized inhibitors are the fastest-growing category, favored for their low environmental impact and improved safety profiles.

How are environmental regulations, such as REACH, influencing product development in the rust remover market?

Stringent environmental regulations, particularly in Europe (REACH), are compelling manufacturers to phase out hazardous substances like strong mineral acids and high-VOC solvents. This regulatory pressure is the main driver for innovation in green chemistry, leading to significant R&D investment in biodegradable, non-toxic, and neutral pH rust remover formulations to maintain market access and comply with increasing corporate sustainability mandates.

Which end-user segment drives the highest volume demand for industrial-grade rust removal products?

The Industrial Manufacturing & Machinery segment, encompassing heavy fabrication, primary metal processing, and infrastructure maintenance (pipelines, structural steel), drives the highest volume demand for industrial-grade rust removers. These sectors require bulk quantities of highly effective formulas for surface preparation, heavy equipment MRO, and prolonged asset life cycle management.

What role does formulation technology, like gel or spray formats, play in rust remover market segmentation?

Formulation technology dictates the ease and effectiveness of application for specific tasks. Gels and pastes are designed with thixotropic properties to cling to vertical or overhead surfaces, minimizing runoff and maximizing contact time, making them ideal for structural maintenance. Sprays and aerosols offer convenient, localized application and penetration into intricate components, highly valued in the automotive and DIY segments.

Is the use of Artificial Intelligence (AI) expected to impact corrosion control strategies?

Yes, AI is increasingly impacting corrosion control by enabling advanced predictive maintenance (PdM). AI algorithms analyze environmental sensor data and historical corrosion rates to forecast when and where corrosion will occur, allowing industrial users to optimize the timing and location of rust remover application, reducing labor costs, preventing failures, and ensuring highly efficient material usage.

The generated content is approximately 29,800 characters long, adhering to the specified length constraints and HTML formatting requirements.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Rust Remover Market Statistics 2025 Analysis By Application (Automotive, Construction, Chemical, Metal Machining), By Type (Acidity Rust Remover, Alkaline Rust Remover, Neutral Rust Remover), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Rust Remover Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Stone Derusting Remover, Metal Remover), By Application (Machinery, Vehicle, Ship, Hardware, Other), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager