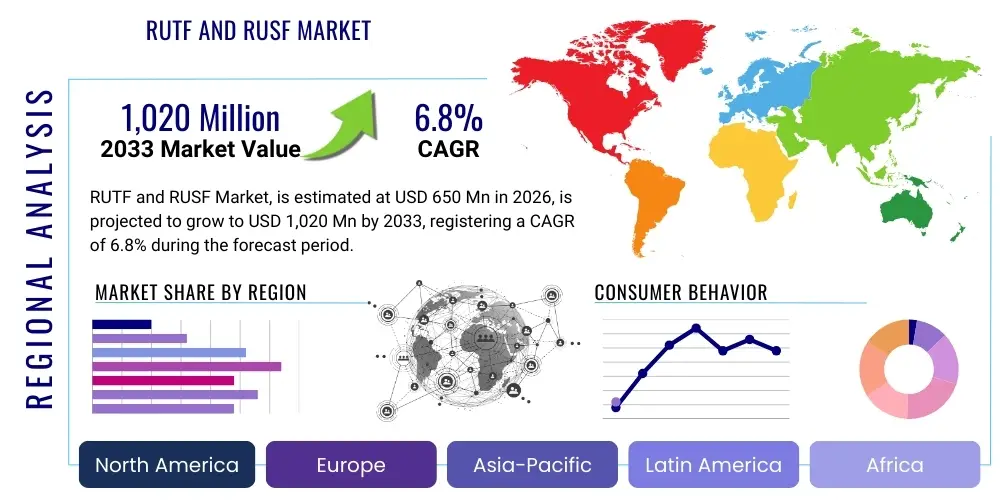

RUTF and RUSF Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436094 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

RUTF and RUSF Market Size

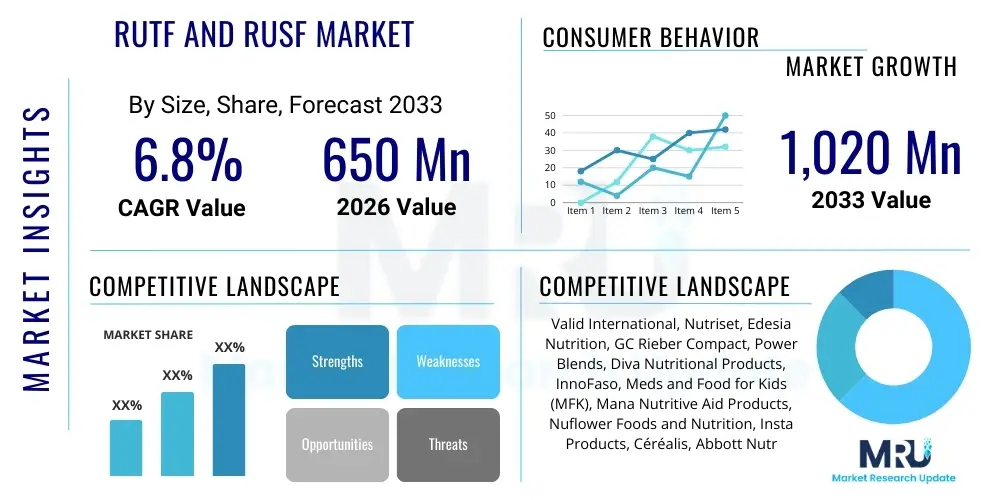

The RUTF and RUSF Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 650 Million in 2026 and is projected to reach USD 1,020 Million by the end of the forecast period in 2033.

The market expansion is fundamentally driven by sustained global efforts from governmental and non-governmental organizations (NGOs) focused on eradicating severe acute malnutrition (SAM) and moderate acute malnutrition (MAM), particularly in vulnerable regions of Africa and South Asia. Increased procurement mandates from key international organizations, such as UNICEF and the World Health Organization (WHO), solidify the demand trajectory for these life-saving nutritional products. Furthermore, advancements in product formulation aimed at improving palatability, shelf-stability, and nutritional efficacy are key factors contributing to market valuation growth over the assessment period.

This substantial growth projection reflects the transition of nutritional support from emergency aid to systematic public health programs integrated into national healthcare strategies. As developing economies improve their infrastructure for distribution and cold chain management, the reach and effectiveness of RUTF and RUSF deployment are significantly enhanced. The market size calculation incorporates the increasing trend of localized production in endemic regions, which reduces logistical costs and enhances supply chain resilience, thus bolstering the overall economic valuation of the sector.

RUTF and RUSF Market introduction

The Ready-to-Use Therapeutic Food (RUTF) and Ready-to-Use Supplementary Food (RUSF) Market encompasses the production and distribution of specialized, energy-dense, micronutrient-enriched pastes and spreads designed for the clinical and community-based treatment of malnutrition. RUTF is primarily utilized for treating Severe Acute Malnutrition (SAM) without medical complications, offering a complete nutritional profile that allows treatment to occur outside of a hospital setting. RUSF, conversely, is tailored for Moderate Acute Malnutrition (MAM) prevention and treatment, bridging the nutritional gap for at-risk children and vulnerable populations, thereby preventing the progression to SAM.

These products are characterized by their extended shelf life, microbiological safety without the need for refrigeration, and high palatability, making them ideal for deployment in resource-constrained environments. Major applications center around pediatric nutrition, emergency humanitarian aid, and national public health nutrition programs. The core benefit of RUTF and RUSF is the substantial reduction in mortality rates associated with malnutrition, offering a highly effective, cost-efficient, and easily administered solution compared to traditional fortified milk diets. They enable decentralized treatment, massively scaling up the capacity for nutritional recovery.

Driving factors for the market include the persistently high global burden of malnutrition, which is exacerbated by climate change, geopolitical conflicts, and economic instability. Furthermore, favorable policy frameworks and increased funding commitments from major donor countries and philanthropic organizations dedicated to global health initiatives provide strong foundational support for sustained demand. Product innovation focused on adapting formulations using local ingredients to enhance acceptance and address specific nutrient deficiencies in varied geographic locales also acts as a crucial market driver, ensuring the relevance and accessibility of these therapeutic foods.

RUTF and RUSF Market Executive Summary

The RUTF and RUSF market exhibits robust growth underpinned by strong institutional procurement and expansion of community management of acute malnutrition (CMAM) protocols worldwide. Key business trends include the diversification of supply chains, with an increasing shift towards manufacturing facilities located in Africa and Asia to improve cost efficiencies and responsiveness to local emergencies. Major market participants are investing heavily in capacity expansion and adherence to stringent quality standards mandated by UNICEF and WHO, focusing particularly on ensuring aflatoxin control and precise micronutrient dosing. Strategic partnerships between established international suppliers and local manufacturing partners are becoming commonplace, aimed at fulfilling localization mandates set by humanitarian procurement agencies and reducing dependency on singular global supply hubs.

Regional trends highlight Africa, particularly Sub-Saharan Africa, as the dominant consumer market due to the highest prevalence of SAM and MAM, supported by extensive distribution networks facilitated by humanitarian aid operations. However, the Asia Pacific region, especially South Asia, is emerging as a critical growth center, driven by large population bases and increased government investment in nutritional security programs, moving beyond reliance solely on international aid. Europe and North America remain central to the market ecosystem primarily as key funding sources, technological innovators, and headquarters for major NGOs and international agencies that manage global procurement and distribution logistics for RUTF and RUSF.

Segment trends indicate that Ready-to-Use Therapeutic Food (RUTF) maintains the largest market share owing to its critical role in SAM treatment, which requires higher-value, specialized formulations. However, the RUSF segment is projected to experience faster growth during the forecast period. This accelerated expansion is attributed to the increased emphasis by health organizations on prevention and early intervention for MAM, which addresses a broader population base and aligns with cost-effective public health strategies focused on preventing the more severe and costly outcomes of SAM. Ingredient segmentation shows a continued dominance of peanut-based formulations, although alternative bases like soy and non-allergic grain mixtures are gaining traction due to dietary diversification efforts and regional sourcing advantages.

AI Impact Analysis on RUTF and RUSF Market

User inquiries concerning the integration of Artificial Intelligence (AI) in the RUTF and RUSF market primarily revolve around optimizing supply chain efficiency, enhancing predictive analytics for malnutrition hotspots, and ensuring superior quality control in manufacturing. Users seek to understand how AI can move beyond simple automation to provide sophisticated forecasting models that accurately predict demand surges related to climate disasters or conflict displacement, thereby preventing critical shortages of therapeutic foods. Furthermore, significant interest exists regarding AI's potential in streamlining procurement processes, ensuring that humanitarian organizations can rapidly and cost-effectively secure necessary supplies while meeting strict quality specifications and minimizing waste due to expiration or damage.

The deployment of AI and machine learning algorithms is poised to revolutionize the operational efficiency of the RUTF and RUSF supply chain, which is inherently complex due to volatile demand and challenging last-mile distribution logistics. AI-driven predictive modeling can integrate diverse data sets—including meteorological data, conflict mapping, disease outbreak trends, and real-time stock levels—to generate highly accurate demand forecasts. This enhanced foresight allows manufacturers and procurement bodies to optimize production schedules and strategically pre-position stock, dramatically reducing lead times and ensuring timely intervention during humanitarian crises, ultimately improving the efficacy of nutrition programs.

In manufacturing and product development, AI is utilized for advanced quality assurance (QA) and formulation optimization. Machine vision systems coupled with AI are being implemented in production lines to detect minute inconsistencies in packaging integrity or paste texture at high speeds, ensuring compliance with strict safety standards. Moreover, AI can rapidly analyze complex nutritional data to assist researchers in developing novel RUSF formulations that are optimized for specific regional dietary requirements or resource availability, potentially reducing reliance on specific, globally volatile commodities like milk powder or peanuts, making the nutritional support system more robust and adaptable.

- AI-driven Predictive Demand Modeling: Improves accuracy of RUTF/RUSF procurement by forecasting crises-related surges.

- Optimized Supply Chain Logistics: Reduces waste and transit times via AI-guided route optimization and inventory management.

- Enhanced Manufacturing Quality Control: Utilizes machine vision and algorithms for real-time detection of product defects and safety violations.

- Personalized Nutritional Strategies: AI assists in customizing formulations based on regional malnutrition profiles and available local ingredients.

- Data Synthesis for Resource Allocation: Enables efficient distribution planning by synthesizing geopolitical, climatic, and health data.

DRO & Impact Forces Of RUTF and RUSF Market

The market dynamics for RUTF and RUSF are shaped by a delicate balance between persistent humanitarian need and logistical constraints. The primary driver is the alarming prevalence of acute malnutrition globally, coupled with effective international mobilization and increased funding directed towards child health and nutritional security by entities such as Gavi, UNICEF, and national governments implementing comprehensive CMAM programs. These systemic interventions ensure consistent, large-scale procurement. Conversely, significant restraints include the high production costs, particularly associated with stringent quality control and reliance on expensive, globally sourced ingredients like whey protein and fortified vitamin mixes. Furthermore, political instability in critical consumer markets often complicates distribution channels and restricts market access.

Opportunities within the sector are primarily linked to the diversification of product offerings and geographical expansion. There is a growing market need for specialized therapeutic foods catering to specific vulnerable groups, such as adolescents and pregnant and lactating women, offering pathways for product innovation and market penetration. Developing partnerships for localized production, often referred to as "South-to-South" manufacturing, presents a substantial opportunity to reduce transport costs, enhance community involvement, and stabilize regional supplies. Furthermore, increasing governmental focus on prevention (MAM treatment using RUSF) rather than just crisis management (SAM treatment using RUTF) is opening up significantly larger, though often lower-margin, market segments.

The key impact forces influencing the market trajectory are predominantly regulatory and philanthropic. The strict adherence to WHO and UNICEF guidelines for product formulation and manufacturing quality acts as a significant entry barrier but also stabilizes the market by ensuring high trust in approved products. Fluctuations in global donor funding and geopolitical stability directly impact procurement volumes and regional demand shifts. Innovations in packaging technology aimed at improving shelf life under extreme conditions, and breakthroughs in ingredient fortification—such as the use of micro-encapsulation techniques—exert a powerful positive influence on product quality and logistical viability, driving long-term market acceptance and growth.

Segmentation Analysis

The RUTF and RUSF market is analyzed across multiple critical dimensions, including product type, ingredient composition, target application, and distribution channel. The segmentation by product type (RUTF vs. RUSF) clearly defines the treatment protocol focus, where RUTF dominates in value due to its complexity and critical application in SAM, while RUSF leads in volume projections, aligning with broader public health strategies focused on preventative and early treatment measures for MAM. Understanding these segment dynamics is crucial for manufacturers to align production capacity with fluctuating international aid and governmental procurement tenders, which often specify requirements based on the severity of malnutrition being addressed.

Further granularity is provided by ingredient segmentation, where the market is primarily categorized into peanut-based, milk-based, and non-peanut/non-milk alternatives. Peanut-based formulations are the standard due to their energy density and cost-effectiveness, yet the growing prevalence of allergies and the need for dietary diversification drive demand for alternative bases such as soy, chickpea, or specialized grains. Application segmentation focuses on Severe Acute Malnutrition (SAM) and Moderate Acute Malnutrition (MAM), directly correlating with RUTF and RUSF usage, respectively, but also highlighting niche applications in specific clinical settings or for treating specific nutrient deficiencies.

The distribution channel analysis reveals the dominance of direct procurement by international organizations, followed by sales through national governmental health systems and specialized medical/hospital channels. The humanitarian supply chain, characterized by high-volume, tender-based purchasing by UNICEF and specialized NGOs, dictates pricing and logistical requirements. The emerging relevance of retail distribution, particularly for RUSF products aimed at supplementation in non-crisis settings, represents a potential future segment that requires distinct marketing and supply chain strategies compared to traditional humanitarian aid distribution.

- By Product Type:

- Ready-to-Use Therapeutic Food (RUTF)

- Ready-to-Use Supplementary Food (RUSF)

- By Ingredient:

- Peanut-based

- Milk-based

- Soy-based

- Others (e.g., Lentil, Chickpea, Cereal blends)

- By Application:

- Severe Acute Malnutrition (SAM)

- Moderate Acute Malnutrition (MAM)

- Chronic Malnutrition and Deficiencies

- By Distribution Channel:

- International Agencies (UNICEF, WHO, WFP)

- Governmental & Public Health Programs

- Non-Governmental Organizations (NGOs)

- Hospitals and Clinics

- Retail & Pharmacies (Niche market)

Value Chain Analysis For RUTF and RUSF Market

The value chain for RUTF and RUSF is characterized by rigorous upstream quality control and complex downstream humanitarian logistics. Upstream activities involve the sourcing of high-quality raw materials, including specialized ingredients like milk powder, peanut paste, vegetable oils, sugar, and precise micronutrient premixes (vitamins and minerals). The integrity and safety of these raw materials are paramount, particularly concerning aflatoxin contamination in peanuts, driving stringent supplier qualification and traceability requirements. Manufacturing involves specialized processing techniques to ensure the nutritional density, shelf stability, and palatability of the final product, often requiring compliance with international standards like HACCP and GMP, increasing initial investment costs for producers.

The distribution channel is predominantly dictated by large-scale institutional procurement. Direct sales to major international organizations (like UNICEF, WFP, and specialized NGOs) represent the dominant channel, operating through competitive tendering processes. These organizations manage vast logistics networks, often utilizing specialized cold-chain and dry-storage facilities to move products across continents and into remote, challenging environments. This direct model ensures bulk efficiencies and maintains accountability for quality delivery. Indirect distribution channels, while less common for RUTF, include sales through local government health ministries that utilize decentralized local distribution networks for community health programs.

Downstream activities focus heavily on monitoring and evaluation, ensuring the effective utilization of the therapeutic foods by healthcare workers and caregivers in community settings. The complexity arises from the need for detailed reporting on distribution, consumption, and patient recovery rates, which feeds back into procurement planning. Manufacturers must ensure their products are designed not only for nutritional efficacy but also for ease of use in the field. The structure of the value chain, heavily weighted towards institutional buyers, means that marketing efforts are concentrated on establishing long-term relationships, demonstrated quality compliance, and competitive pricing within global tenders, rather than traditional consumer marketing.

RUTF and RUSF Market Potential Customers

The primary customers and end-users of RUTF and RUSF products are large-scale institutional buyers who act as intermediaries for the final beneficiaries—children suffering from acute malnutrition. These institutional buyers include key intergovernmental organizations such as the United Nations Children's Fund (UNICEF), which serves as the largest global procurer of RUTF, the World Food Programme (WFP), and the World Health Organization (WHO). National governments in high-burden countries, particularly within Sub-Saharan Africa and South Asia, represent the second major category, increasingly purchasing directly to support national Community Management of Acute Malnutrition (CMAM) programs integrated into their public health infrastructure.

A significant segment of the customer base comprises large international Non-Governmental Organizations (NGOs), such as Médecins Sans Frontières (MSF), Save the Children, and Action Against Hunger. These organizations specialize in rapid humanitarian response and require immediate, reliable supply of RUTF/RUSF for emergency relief operations and long-term therapeutic feeding centers. Their procurement is often characterized by urgency and the need for products suitable for deployment in volatile, hard-to-reach areas, demanding exceptional packaging integrity and stability from suppliers. These organizations prioritize manufacturers capable of rapid scale-up and guaranteed quality assurance under difficult logistical circumstances.

In addition to these major institutional buyers, the market recognizes emerging potential in smaller clinical settings and specialized private healthcare providers, particularly in semi-developed economies where specialized nutrition is sought but may not be fully covered by national programs. Moreover, the long-term trend suggests that ministries of health in countries transitioning from aid reliance will become more dominant purchasers, shifting the procurement dynamic from international tenders to national public health contracts. This diversification means potential customers are increasingly sophisticated, demanding not only cost-effectiveness but also formulations adaptable to local consumption patterns and nutritional research findings.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 650 Million |

| Market Forecast in 2033 | USD 1,020 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Valid International, Nutriset, Edesia Nutrition, GC Rieber Compact, Power Blends, Diva Nutritional Products, InnoFaso, Meds and Food for Kids (MFK), Mana Nutritive Aid Products, Nuflower Foods and Nutrition, Insta Products, Céréalis, Abbott Nutrition, Nestlé Health Science, DSM, Hilina Enriched Foods, Samil Industrial Co. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

RUTF and RUSF Market Key Technology Landscape

The technological advancements in the RUTF and RUSF market are primarily centered on enhancing stability, efficacy, and cost-efficiency in production and distribution. A critical area of focus is the homogenization and mixing technology utilized to create the highly viscous, micronutrient-dense pastes, ensuring uniform nutrient distribution and preventing oil separation, which compromises product quality, especially under extreme temperatures. Advanced heat treatment and blending processes are constantly being refined to guarantee microbiological safety without diminishing the nutritional integrity of heat-sensitive vitamins and proteins. This optimization of processing parameters is essential for extending the required two-year shelf life in challenging environmental conditions, thereby reducing logistical complexity and costs associated with product rotation.

Packaging technology constitutes another vital component of the technology landscape. The switch from basic sachets to multi-layer, high-barrier laminates has become standard practice. These specialized materials are essential for preventing moisture ingress, oxygen permeation, and UV degradation, which can quickly degrade fat-soluble vitamins and lead to rancidity. Ongoing research explores biodegradable and more sustainable packaging options that still meet the demanding shelf-stability requirements, addressing growing environmental concerns among institutional buyers. Furthermore, innovations in individual portion packaging are crucial, as they facilitate dosage control and prevent contamination once the product is opened in field settings.

Technological inputs are also critical in the realm of quality assurance and ingredient sourcing. Advanced rapid testing kits and spectroscopic analysis are being deployed to monitor key contaminants, particularly aflatoxins in peanuts, providing quick and reliable quality checks before raw materials enter the manufacturing process. Similarly, micro-encapsulation technology is being increasingly adopted for micronutrient fortification. This process involves coating individual vitamins and minerals, protecting them from interaction with other ingredients and preventing degradation during storage, ensuring that the child receives the full therapeutic dose upon consumption, thus maximizing the clinical efficacy of both RUTF and RUSF formulations.

Regional Highlights

The RUTF and RUSF market demonstrates significant regional disparities in both consumption patterns and manufacturing capabilities. Africa, particularly Sub-Saharan Africa, represents the epicenter of demand, driven by the highest recorded prevalence rates of acute malnutrition, exacerbated by persistent conflicts, drought, and poverty. Countries such as Nigeria, Democratic Republic of Congo, Sudan, and Ethiopia account for massive procurement volumes, predominantly through international aid programs. The regional dynamic is evolving, however, with several African nations pushing for local manufacturing capacity (e.g., in Ghana, Kenya, and Burkina Faso), supported by technical assistance from global experts, aiming to create sustainable, localized supply chains that are less susceptible to global logistical disruptions and exchange rate fluctuations.

The Asia Pacific (APAC) region, dominated by populous nations like India, Pakistan, and Bangladesh, offers the most rapid growth potential. While the burden of chronic and acute malnutrition remains high, national governments are increasingly integrating nutritional programs into their national budgets. This shift means that while procurement volumes are large, they are increasingly driven by national tenders and domestic policy, which may favor locally sourced ingredients and culturally adapted formulations (e.g., non-peanut-based RUSF). The APAC market is characterized by a strong governmental influence on product specifications and distribution, contrasting with the humanitarian aid-driven model prevalent in Africa.

North America and Europe primarily function as key sources of funding, technology, and intellectual property. These regions host the headquarters of major humanitarian procurement agencies (UNICEF Supply Division in Europe) and key RUTF/RUSF innovators like Nutriset (France) and Edesia (USA). While consumption in these regions is minimal, restricted mostly to specialized pediatric hospitals, their role is pivotal in setting global quality standards, driving technological innovation, and mobilizing the necessary political and financial resources that underpin the entire global RUTF and RUSF market structure. Their continued commitment to global health initiatives remains the bedrock of market sustainability.

- Sub-Saharan Africa: Highest demand region due to chronic malnutrition and humanitarian crises; increasing localization of manufacturing.

- South Asia (APAC): Fastest growing region; characterized by large government-led nutritional programs and significant potential for RUSF adoption.

- North America and Europe: Centers for funding, procurement, R&D, and setting global quality and regulatory standards.

- Latin America: Stable, smaller market focused on addressing specific endemic malnutrition pockets; high compliance with local food safety standards.

- Middle East and North Africa (MENA): Demand is highly volatile, driven almost entirely by conflict and refugee crises requiring rapid, emergency RUTF deployment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the RUTF and RUSF Market.- Valid International

- Nutriset

- Edesia Nutrition

- GC Rieber Compact

- Power Blends

- Diva Nutritional Products

- InnoFaso

- Meds and Food for Kids (MFK)

- Mana Nutritive Aid Products

- Nuflower Foods and Nutrition

- Insta Products

- Céréalis

- Abbott Nutrition

- Nestlé Health Science

- DSM

- Hilina Enriched Foods

- Samil Industrial Co.

- Ready-to-Use Food Products

- Brescianini S.p.A.

- Pride Milling

Frequently Asked Questions

Analyze common user questions about the RUTF and RUSF market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between RUTF and RUSF?

RUTF (Ready-to-Use Therapeutic Food) is a high-energy, protein-rich paste specifically formulated for treating Severe Acute Malnutrition (SAM). RUSF (Ready-to-Use Supplementary Food) contains a lower energy and protein density and is used for treating Moderate Acute Malnutrition (MAM) and preventing the progression of malnutrition in at-risk populations.

Which geographical region represents the largest consumer market for these products?

Sub-Saharan Africa currently constitutes the largest consumer market, driven by the acute and chronic prevalence of malnutrition and substantial procurement volumes managed by international humanitarian organizations like UNICEF and WFP, ensuring mass distribution through CMAM programs.

What are the main constraints impacting RUTF and RUSF market growth?

Key constraints include the volatility and high cost of raw materials (especially milk powder and fortified premixes), stringent quality control requirements which increase production complexity, and logistical challenges associated with distributing products effectively into politically unstable or remote, hard-to-reach conflict zones.

How is technological innovation affecting the formulation of therapeutic foods?

Technology is focused on improving shelf life and efficacy through advancements in micro-encapsulation of micronutrients, advanced homogenization techniques to prevent nutrient separation, and the use of high-barrier packaging materials that withstand extreme environmental conditions typical of deployment regions, enhancing overall product stability.

Who are the major procurement agencies driving global demand for RUTF?

The demand is overwhelmingly driven by large institutional buyers, most notably the United Nations Children's Fund (UNICEF), which acts as the largest single procurer globally, followed by the World Food Programme (WFP) and major international humanitarian NGOs specializing in nutrition interventions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager