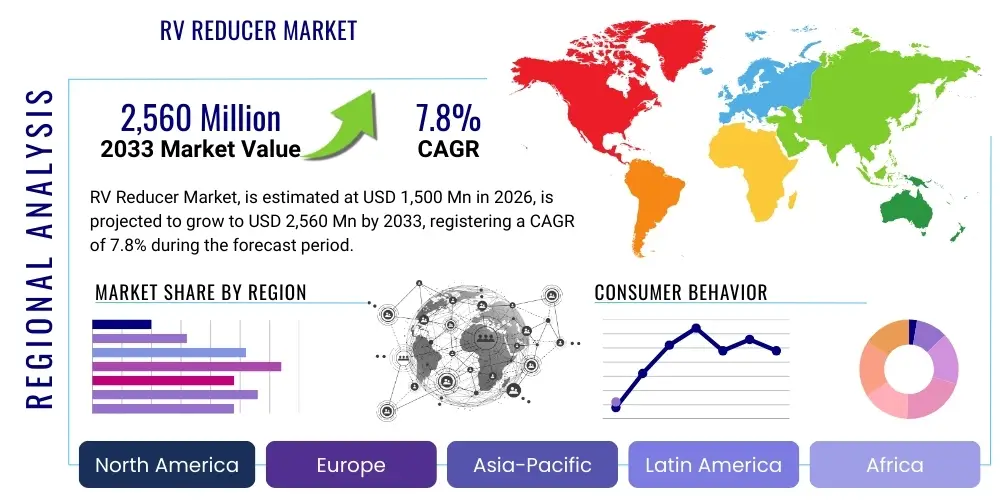

RV Reducer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436345 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

RV Reducer Market Size

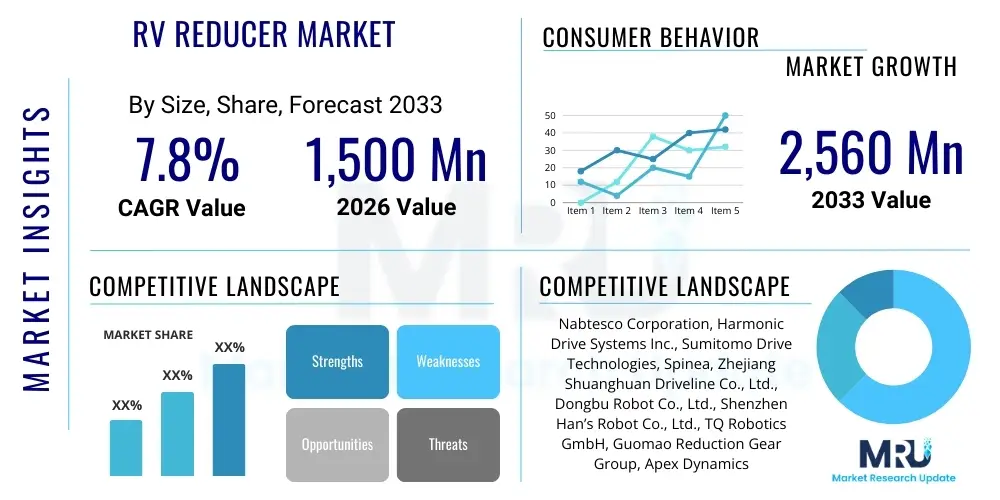

The RV Reducer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 1,500 Million in 2026 and is projected to reach USD 2,560 Million by the end of the forecast period in 2033. This robust expansion is fueled by the accelerating adoption of industrial automation, particularly in high-precision manufacturing sectors like automotive assembly, electronics production, and advanced robotics, where the superior torque density and minimal backlash of RV reducers are essential for ensuring operational accuracy and repeatability.

RV Reducer Market introduction

The RV Reducer Market encompasses high-precision gear reduction mechanisms, primarily Rotary Vector (RV) drives, designed to offer high rigidity, exceptional torque capacity, and ultra-low backlash compared to standard planetary gearboxes. These characteristics make RV reducers indispensable components in applications requiring precise motion control and heavy-duty operation, such as the major joints of articulated robots and high-speed CNC machine tools. The core function of these reducers is to significantly increase output torque while reducing speed from the motor, thereby enabling powerful and accurate manipulation tasks in automated environments, driving the current wave of industrial transformation globally.

The primary applications for RV reducers span across industrial robotics (especially six-axis robots), machine tools, precision testing equipment, and medical devices. Their inherent structural design, utilizing a cycloidal reduction principle combined with a large bearing capacity, allows them to withstand extremely high radial and axial loads while maintaining precise positioning accuracy over prolonged operational cycles. This reliability is a major benefit distinguishing them from other gearing technologies, contributing directly to higher productivity and reduced downtime in sophisticated manufacturing processes.

Key driving factors for market growth include the global push towards Industry 4.0, which mandates higher levels of automation and integration across supply chains. Furthermore, the rising demand for collaborative robots (cobots) and the continuous technological advancements leading to smaller, lighter, and more powerful RV reducer models are expanding their application scope. Geographically, rapid industrialization and government initiatives supporting robotics adoption in nations like China, Japan, and Germany are pivotal in shaping the demand landscape, ensuring sustained market momentum.

RV Reducer Market Executive Summary

The RV Reducer market is experiencing significant bullish business trends driven by global investments in smart factories and flexible automation systems. Companies are focusing heavily on vertical integration and optimizing manufacturing processes to meet escalating demand, particularly from the automotive and electronics sectors requiring high-throughput, high-accuracy production lines. A notable trend involves the development of hybrid RV reducers that combine magnetic or hydraulic dampening systems to further enhance shock resistance and reduce vibrational noise, catering to highly sensitive applications. Competition is intensifying among global leaders, pushing continuous innovation in material science—such as lighter alloys and advanced lubricants—to improve efficiency and lifetime while maintaining cost-effectiveness for mass production.

Regionally, Asia Pacific (APAC) stands as the undeniable growth engine, primarily led by massive deployments in China, South Korea, and Japan, which are global hubs for industrial robotics manufacturing and end-use applications in consumer electronics and automotive electric vehicle (EV) production. Europe, driven by stringent quality standards in Germany and Italy’s specialized machinery sectors, maintains a strong demand for high-end, customized RV reducers. North America focuses on technological leadership, with rapid adoption in aerospace manufacturing and advanced medical robotics, valuing robustness and precision above initial cost, suggesting a high-value, moderate-volume market trajectory in this region.

Segment trends reveal that the Harmonic Drive segment, while closely related, often competes with the RV segment, but RV reducers dominate applications requiring high-moment stiffness and large torque capacity (typically the first three axes of large industrial robots). By application, the demand for RV reducers in assembly and handling robots is soaring due to the shift towards automated material handling and sophisticated assembly processes in complex product manufacturing. Furthermore, there is a clear segment preference for medium-to-high reduction ratio units (100:1 to 180:1), as these provide the ideal balance between output torque and speed control necessary for most heavy-duty robotic tasks.

AI Impact Analysis on RV Reducer Market

User inquiries regarding AI's influence typically revolve around predictive maintenance, optimization of gear manufacturing, and enhancing robot calibration accuracy facilitated by machine learning algorithms. The core themes center on expectations for reduced operational downtime through condition monitoring (predicting gear failure before it occurs), improvement in the precision of highly complex assembly tasks via adaptive control systems managed by AI, and streamlining the design process of RV reducers to optimize load distribution and lifetime performance. Users are also concerned about the integration costs and the standardization of sensor integration necessary to feed real-time data for effective AI analysis, underscoring a high interest in 'smart' RV units equipped with integrated diagnostics capabilities.

- AI-driven Predictive Maintenance: Utilizing sensor data (vibration, temperature) to forecast wear and tear, significantly reducing unscheduled robot downtime.

- Optimized Manufacturing Processes: AI models fine-tuning CNC machining parameters during gear teeth production, resulting in higher precision and reduced backlash variability.

- Adaptive Backlash Compensation: AI algorithms continuously adjust control parameters to compensate for minute operational backlash changes, maintaining superior robotic accuracy over time.

- Robot Calibration Enhancement: Machine learning assists in faster and more accurate kinematic calibration of robotic arms utilizing RV reducers, maximizing precision upon installation.

- Digital Twin Simulation: AI aids in creating high-fidelity digital models of RV reducers under various load conditions, accelerating product development cycles and stress testing.

- Supply Chain Optimization: Leveraging AI for demand forecasting and inventory management of critical RV components, improving manufacturing efficiency and delivery timelines.

DRO & Impact Forces Of RV Reducer Market

The RV Reducer market is significantly influenced by powerful Drivers, yet constrained by high manufacturing complexity and cost, while simultaneously benefiting from substantial opportunities rooted in emerging automation sectors. Key drivers include the global expansion of industrial robotics, particularly in automotive and electronics manufacturing, driven by the need for high-speed, high-precision assembly lines. However, the high initial cost and the specialized expertise required for both manufacturing and maintenance act as notable restraints, limiting adoption in cost-sensitive, low-volume automation applications. The market is also subject to the immediate impact of global supply chain disruptions affecting raw materials like specialized alloys and precision bearing components.

Opportunities are abundant in emerging fields such as collaborative robotics (cobots), where the need for compact, high-torque density reducers is paramount, and in the burgeoning field of medical robotics (surgical and rehabilitation). Furthermore, the shift towards electric vehicles (EVs) mandates highly automated, precision battery manufacturing and assembly, creating substantial new demand streams for reliable RV reducers. The overall impact forces include rapid technological acceleration, where miniaturization and power density improvements are key differentiators, and regulatory pressures requiring safer, more efficient manufacturing environments, indirectly favoring the adoption of high-reliability components like RV reducers.

The competitive landscape is defined by the high barrier to entry due to stringent intellectual property rights and the necessity of vertical integration to control precision manufacturing tolerances. Impact forces related to substitution threat remain low, as few alternatives offer the combined benefits of high moment stiffness, zero backlash, and high torque output required for heavy-duty robot joints. Nonetheless, continuous development in high-precision planetary and strain wave (harmonic) gear systems occasionally pressures the RV market, especially in medium-load applications. Successfully navigating these forces requires manufacturers to focus on cost reduction through scale and enhancing product reliability through rigorous quality control and advanced material research.

Segmentation Analysis

The RV Reducer market segmentation provides a granular view of demand across various product attributes and end-use applications, crucial for targeted market strategies. Key parameters include the type of reduction mechanism, which primarily differentiates based on speed ratio and load capacity, and the capacity of the reducer, typically defined by rated output torque. Analysis of segmentation reveals strong growth in high-capacity reducers (over 5,000 Nm) necessary for large palletizing and welding robots, alongside rising demand for ultra-compact units tailored for collaborative robots and specialized medical equipment, showcasing a polarization of market requirements based on physical scale and load demands.

Segmentation by Application highlights the dominance of the Automotive Industry, which utilizes RV reducers extensively for car body welding, painting, and intricate assembly processes, especially in dedicated EV production lines. The Electronic & Semiconductor industry represents the fastest-growing application segment, driven by the intense precision required for micro-component handling and circuit board assembly. Understanding these segments allows suppliers to tailor product specifications, such as size constraints, operating temperature ranges, and material compatibility, ensuring optimal performance for highly specialized industrial needs.

Further segment analysis by sales channel indicates a strong reliance on Original Equipment Manufacturers (OEMs) who integrate these components directly into their robotic systems, making long-term contractual relationships vital. The aftermarket segment, including replacement and repair services, while smaller, is growing steadily as the installed base of industrial robots expands globally, necessitating reliable maintenance services and spare parts supply, offering an ancillary revenue stream for major manufacturers.

- By Reduction Ratio:

- Low Reduction Ratio (50:1 to 100:1)

- Medium Reduction Ratio (100:1 to 150:1)

- High Reduction Ratio (Above 150:1)

- By Rated Output Torque Capacity:

- Low Capacity (Under 500 Nm) - Used in light cobots and smaller specialized equipment.

- Medium Capacity (500 Nm to 5,000 Nm) - Standard for medium-sized industrial robots.

- High Capacity (Above 5,000 Nm) - Used in heavy-duty welding, palletizing, and large machine tools.

- By Application/End-Use Industry:

- Industrial Robotics (Articulated, SCARA, Delta Robots)

- Machine Tools (CNC Machining Centers, Lathes)

- Semiconductor & Electronics Manufacturing

- Automotive & EV Production

- Aerospace and Defense

- Medical Robotics and Healthcare Equipment

- By Sales Channel:

- Original Equipment Manufacturers (OEMs)

- Aftermarket/Service Providers

Value Chain Analysis For RV Reducer Market

The value chain for the RV Reducer market is characterized by a high reliance on upstream specialization and intensive precision manufacturing processes. The upstream segment involves the procurement of high-grade raw materials, including specialized steel alloys for gears and casings, high-precision bearings, and advanced lubricants. Key upstream activities include metallurgical refinement and highly specialized forging and casting, where control over material composition and stress resistance is critical. Suppliers in this segment, often large global material science companies and precision bearing manufacturers, wield significant influence due to the technical specifications required for RV reducers to achieve zero backlash and high rigidity under heavy loads.

The midstream segment involves the core manufacturing process, which is highly complex and capital-intensive. This includes highly accurate CNC gear cutting, heat treatment, grinding, and meticulous assembly in controlled environments to ensure the extremely tight tolerances required (often measured in arc-minutes of backlash). Distribution channels are predominantly direct-to-OEM, especially for major robotic manufacturers, which ensures technical support, quality control, and seamless integration into large-scale production lines. Indirect channels involve distributors or system integrators who supply smaller end-users or specific regional markets lacking direct manufacturer presence.

Downstream activities focus on integration, after-sales service, and maintenance. Given the critical role of RV reducers in continuous operation environments like automotive assembly plants, robust maintenance support and spare parts availability are essential components of the value proposition. Direct sales offer manufacturers greater control over branding and pricing, while indirect channels broaden market reach, particularly in emerging industrial sectors or geographically dispersed markets. Successful companies maintain strong relationships across the chain, especially with robotic OEMs, utilizing their feedback for continuous product iteration and quality improvements.

RV Reducer Market Potential Customers

The potential customers for RV Reducers are sophisticated industrial entities that require motion control solutions offering the highest levels of accuracy, load capacity, and reliability. The primary end-users are large Original Equipment Manufacturers (OEMs) specializing in industrial robots, particularly those producing high-payload, articulated robotic arms (typically 4-axis to 6-axis configurations) used in demanding applications such as welding, heavy material handling, and painting operations in the automotive sector. These OEMs represent the largest volume buyers, purchasing RV reducers as core components essential for their final product performance specifications.

Beyond traditional robotics, key customers include manufacturers of advanced CNC machine tools, particularly five-axis machining centers and high-speed precision grinders, where RV reducers are often used in the rotary axes to ensure precise indexing and continuous positioning. Furthermore, the electronics and semiconductor industry, driven by the need for micro-level assembly and wafer handling, constitutes a rapidly growing customer base, demanding smaller, high-speed, and extremely clean RV units suitable for cleanroom environments. These users prioritize repeatability and minimized vibration above almost all other factors.

Emerging customer segments include enterprises specializing in specialized automation equipment, such as automated guided vehicles (AGVs) requiring precision steering systems, large-scale medical device manufacturers focused on surgical robots, and aerospace manufacturers employing large-scale automation for composite material placement and fuselage assembly. These high-value customers necessitate customized or semi-customized RV solutions that meet stringent industry-specific certifications and performance metrics, often engaging in direct collaboration with RV reducer designers during the product development phase.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1,500 Million |

| Market Forecast in 2033 | USD 2,560 Million |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nabtesco Corporation, Harmonic Drive Systems Inc., Sumitomo Drive Technologies, Spinea, Zhejiang Shuanghuan Driveline Co., Ltd., Dongbu Robot Co., Ltd., Shenzhen Han’s Robot Co., Ltd., TQ Robotics GmbH, Guomao Reduction Gear Group, Apex Dynamics Inc., Hubei Sanneng Machinery Co., Ltd., Beijing CTKM, Liming Heavy Industry, Gearing International Ltd., Wuxi Aokman Gearbox, KHK Co., Ltd., STOBER Antriebstechnik GmbH, Wittenstein SE, Shanghai Dongfang Automation Instrument Co., Ltd., and Renk AG. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

RV Reducer Market Key Technology Landscape

The technological landscape of the RV Reducer market is intensely focused on achieving higher power density, improved motion accuracy, and extended operational lifetimes under extreme conditions. Core technology revolves around the precision machining of cycloidal gear components and eccentric bearing assemblies, requiring manufacturing tolerances often measured in microns. Advanced heat treatment processes, such as carburizing and nitriding, are crucial for enhancing the surface hardness and fatigue strength of the gear teeth, enabling the reducers to handle high intermittent loads without compromising backlash performance. Furthermore, optimizing the internal bearing arrangement, often utilizing large, highly rigid cross-roller bearings, is fundamental to absorbing the immense radial and axial forces experienced at the robot joint, directly contributing to the superior moment stiffness of RV units.

Recent technological advancements emphasize integrating smart functionalities into the reducer housing. This includes incorporating miniaturized sensors for monitoring key operational parameters such as temperature, vibration, and torque output in real-time. This sensor data is vital for enabling predictive maintenance protocols and sophisticated closed-loop control systems, which can compensate for minute errors and thermal expansion effects, thereby maintaining positional accuracy throughout the robot's duty cycle. Material science plays an increasing role, with ongoing research into lightweight, high-strength composite materials and novel low-friction coatings to reduce overall reducer weight and improve efficiency, addressing the growing demand for lighter, faster collaborative robots.

Furthermore, design methodologies are shifting towards modular and customized solutions. Manufacturers are utilizing advanced simulation software (FEA) to fine-tune gear geometry and housing stiffness, ensuring optimal performance for highly specific robotic applications. The development of specialized lubricants that maintain viscosity and stability across wide temperature ranges and under extreme pressure is also a vital technological area. The future of RV Reducers lies in seamless digital integration, where the reducer acts not just as a mechanical component, but as an intelligent, data-generating subsystem integral to the smart factory ecosystem, requiring expertise in both mechanical engineering and industrial IoT infrastructure.

To elaborate on the technical depth, manufacturers are continuously innovating in areas related to gear profile optimization, often utilizing non-involute tooth profiles to distribute load more evenly and reduce contact stress, minimizing wear and extending service life. The manufacturing process involves extremely tight control over the runout of the input and output shafts, essential for minimizing eccentric loading and ensuring precise alignment. The adoption of advanced measuring equipment, such as CMMs and optical inspection systems, during assembly is non-negotiable, ensuring that the critical backlash specification remains within the guaranteed range (often less than 1 arc-min for high-end models), validating the precision engineering inherent in these components.

Another crucial technological element involves noise and vibration reduction. As industrial environments trend towards collaborative human-robot workspaces, quieter operation becomes a critical design requirement. Techniques include optimizing the meshing pattern of the cycloidal gears, incorporating damping materials in the housing, and improving the smoothness of the internal rolling elements. Efficiency improvement, though secondary to accuracy and stiffness, is achieved through optimizing gear tooth contact and utilizing specialized low-viscosity synthetic oils. Overall, the technological edge in the RV Reducer market is sustained by mastery over material purity, ultra-precision manufacturing, and intelligent digital integration.

Regional Highlights

Regional dynamics play a crucial role in shaping the demand and supply landscape of the RV Reducer Market, reflecting varying levels of industrialization, technological adoption, and governmental support for automation across the globe. Each major region contributes uniquely to market growth, influenced by local manufacturing priorities, wage structures, and the maturity of the robotics industry.

- Asia Pacific (APAC): Dominates the global market share both in terms of consumption and production. This region is the primary manufacturing hub for industrial robots, led by countries like China, Japan, and South Korea. China's "Made in China 2025" strategy and high domestic demand for automation in electronics assembly and massive automotive EV manufacturing plants are key drivers. Japan remains a technological powerhouse, home to several leading RV reducer and robotics manufacturers, driving innovation in miniaturization and precision.

- North America: Characterized by high-value, moderate-volume demand, focused on specialized high-tech applications in aerospace, defense, and medical robotics. The US market emphasizes quality, durability, and customized solutions, often integrating sophisticated sensor technology for advanced control. Growth here is steady, driven by reshoring initiatives and continuous upgrades to existing industrial infrastructure, prioritizing advanced manufacturing techniques over cost arbitrage.

- Europe: A mature market defined by strong demand from Germany (machine tools, automotive production) and Italy (specialized machinery). European manufacturers prioritize compliance with stringent safety and environmental regulations, leading to demand for highly efficient, durable, and reliable RV reducers. The adoption of Industry 4.0 principles is widespread, driving investments in high-end automation across central and western Europe, maintaining strong growth in the high-precision segment.

- Latin America (LATAM): Represents an emerging market, with growth concentrated primarily in automotive manufacturing (Mexico and Brazil) and resource extraction industries. Market expansion is currently slower due to varying economic stability, but increasing foreign direct investment in manufacturing is gradually boosting the demand for automated solutions, offering future high-growth potential for standardized, cost-effective RV units.

- Middle East and Africa (MEA): Currently holds the smallest market share, with demand localized around oil and gas operations and planned large-scale infrastructure projects, such as those in Saudi Arabia and the UAE. Automation investments are strategic and focused on maximizing efficiency in labor-intensive sectors. Future growth hinges on successful economic diversification efforts away from traditional energy sectors and increased development of localized manufacturing capabilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the RV Reducer Market.- Nabtesco Corporation

- Harmonic Drive Systems Inc. (A major competitor with high overlap in precision motion control)

- Sumitomo Drive Technologies

- Spinea

- Zhejiang Shuanghuan Driveline Co., Ltd.

- Dongbu Robot Co., Ltd.

- Shenzhen Han’s Robot Co., Ltd.

- TQ Robotics GmbH

- Guomao Reduction Gear Group

- Apex Dynamics Inc.

- Hubei Sanneng Machinery Co., Ltd.

- Beijing CTKM

- Liming Heavy Industry

- Gearing International Ltd.

- Wuxi Aokman Gearbox

- KHK Co., Ltd.

- STOBER Antriebstechnik GmbH

- Wittenstein SE

- Shanghai Dongfang Automation Instrument Co., Ltd.

- Renk AG

Frequently Asked Questions

Analyze common user questions about the RV Reducer market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between an RV Reducer and a Harmonic Drive?

RV (Rotary Vector) reducers are primarily designed for higher rigidity and shock load resistance due to their cycloidal gear structure and larger bearing support, making them ideal for the first three axes (high-load joints) of heavy industrial robots. Harmonic drives (strain wave gears) offer excellent precision and compactness but generally suit lower torque applications and the outer axes (wrist joints) of robotic arms.

Which end-use industry drives the most demand for high-capacity RV Reducers?

The Automotive Industry, particularly sectors focused on electric vehicle (EV) manufacturing and traditional heavy vehicle assembly, drives the highest demand for high-capacity RV reducers. These reducers are critical for heavy-duty applications such as car body welding, large-scale material handling, and palletizing robots which require immense torque and superior stiffness.

How does the integration of Industry 4.0 technologies affect RV Reducer performance?

Industry 4.0 significantly impacts RV reducers by enabling predictive maintenance and enhanced operational efficiency. Integration of embedded sensors allows for real-time monitoring of vibration and temperature, feeding data to AI systems for failure prediction and adaptive backlash compensation, thereby maximizing uptime and positional accuracy in smart factory environments.

What are the key barriers to entry for new competitors in the RV Reducer Market?

The key barriers to entry include the extremely high initial capital investment required for ultra-precision manufacturing machinery, the necessity for deep intellectual property rights (patents on gear geometry), and the requirement for robust vertical integration to control the quality of specialized raw materials and bearings essential for achieving low backlash specifications.

Where is the fastest regional growth expected for the RV Reducer market?

The Asia Pacific (APAC) region, led by China, is expected to exhibit the fastest regional growth. This acceleration is fueled by immense governmental and private investments in industrial automation, rapid expansion of the consumer electronics manufacturing base, and the escalating demand for robots in the burgeoning domestic EV production sector.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- RV Reducer Market Size Report By Type (Spur Gear, Differential Gear), By Application (Industrial Robot Industry, Machine Tools Industry, Semiconductor Industry, LED and OLED Industry, Others Industry), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Rv Reducer Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Spur Gear, Differential Gear), By Application (Industrial Robot Industry, Machine Tools Industry, Semiconductor Industry, LED and OLED Industry, Others Industry), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager