SaaS Online Video Platforms Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434610 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

SaaS Online Video Platforms Market Size

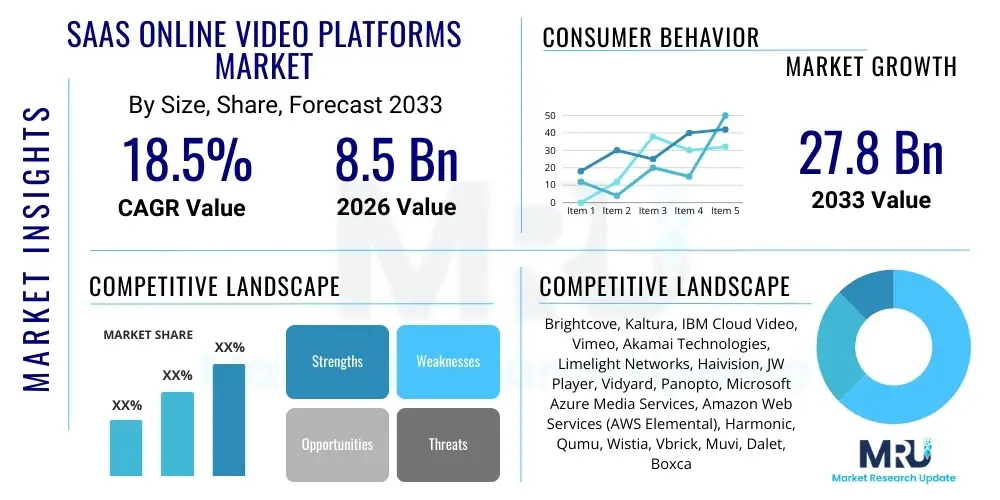

The SaaS Online Video Platforms Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 8.5 Billion in 2026 and is projected to reach USD 27.8 Billion by the end of the forecast period in 2033.

SaaS Online Video Platforms Market introduction

The SaaS Online Video Platforms (OVP) Market encompasses cloud-based solutions that facilitate the hosting, management, encoding, distribution, and monetization of digital video content across various devices and global networks. These platforms operate on a subscription model, offering scalability and reduced infrastructural overhead compared to traditional on-premise setups. OVPs are essential for businesses, media organizations, educational institutions, and content creators seeking professional-grade tools to deliver seamless video experiences, ranging from live streaming events and on-demand libraries to internal communication and e-learning modules. The underlying technology relies heavily on robust Content Delivery Networks (CDNs) and sophisticated media processing capabilities, ensuring high availability and low latency for global audiences.

Product offerings within the SaaS OVP space are highly diversified, catering to distinct organizational needs, such as enterprise video solutions (for internal training and communication), media and entertainment platforms (for direct-to-consumer streaming services), and marketing video platforms (for lead generation and customer engagement). Key product features typically include advanced analytics dashboards, integrated Content Management Systems (CMS), secure digital rights management (DRM), and application programming interfaces (APIs) for seamless integration with existing enterprise ecosystems like CRM and marketing automation software. The growing necessity for effective digital transformation strategies across industries, particularly in response to the sustained shift toward remote work and digital consumption, has fundamentally driven the demand for these versatile platforms.

Major applications span diverse sectors, including Broadcasting and Media, where platforms support complex live event delivery and VOD libraries; E-commerce, utilizing video for product demonstrations and enhancing conversion rates; and Healthcare, implementing platforms for telemedicine and specialized medical training. Benefits derived from adopting SaaS OVPs include significant cost savings on hardware and maintenance, enhanced scalability to handle peak traffic demands, superior content security, and access to sophisticated tools that improve content accessibility (e.g., automated closed captions and translation services). Driving factors include the explosion of consumer and enterprise bandwidth, the global proliferation of smartphones, the increasing sophistication of monetization models like AVOD and SVOD, and the imperative for organizations to maintain high levels of audience engagement through rich media.

SaaS Online Video Platforms Market Executive Summary

The SaaS Online Video Platforms market is experiencing rapid expansion, fueled by structural shifts toward digital consumption and the increasing complexity of global content distribution. Business trends indicate a strong move toward platform consolidation, where providers are integrating comprehensive toolsets—including AI-powered content recognition, advanced viewer analytics, and sophisticated low-latency live streaming capabilities—to offer end-to-end solutions rather than standalone services. A key commercial trend involves the growing adoption of hybrid monetization strategies that blend subscription, advertising, and transactional models, requiring OVPs to possess flexible billing and rights management features. Furthermore, the enterprise segment is showing explosive growth, with internal corporate communications and remote training necessitating secure, scalable video infrastructure, thereby shifting the competitive focus toward integration capabilities with existing IT stacks.

Segment trends reveal that the Live Streaming component is accelerating significantly faster than the Video on Demand (VOD) segment, driven by the demand for real-time interaction in fields like sports, finance, and education. Within application types, the Media & Entertainment segment maintains the largest market share, but the contribution from the Corporate Training and Education segments is expanding robustly due to the institutionalization of remote learning and upskilling initiatives globally. Technology preference shows a clear inclination toward cloud-native, API-first platforms that offer superior customization and microservices architecture, allowing organizations to deploy specialized features without vendor lock-in. Security and compliance features, especially pertaining to GDPR, CCPA, and industry-specific regulations, are becoming non-negotiable prerequisites for enterprise adoption.

Regionally, North America currently holds the dominant position, characterized by high digital infrastructure maturity, early adoption of cutting-edge streaming technologies, and the presence of numerous major technology providers and content creators. However, the Asia Pacific (APAC) region is forecasted to exhibit the highest CAGR during the projection period, driven by massive internet penetration in emerging economies, rapid expansion of local content creation ecosystems, and government investments in digital education and infrastructure. Europe remains a significant market, propelled by stringent data privacy regulations which necessitate robust platform features and strong demand from the professional sports broadcasting sector. Market participants are increasingly focusing investment on localized CDNs and language-specific support to penetrate high-growth regional markets effectively.

AI Impact Analysis on SaaS Online Video Platforms Market

Common user inquiries regarding AI's impact on SaaS Online Video Platforms primarily revolve around enhanced automation capabilities, improved monetization potential, and the necessity for sophisticated content indexing and discovery tools. Users frequently question how AI can move beyond basic transcription to provide contextual analysis of video content, automate complex editing tasks, and personalize viewer experiences on a massive scale. Concerns often center on the accuracy and bias of AI models, the computational cost associated with implementing deep learning algorithms for real-time processing, and the integration complexity with existing OVP architectures. Expectations are high regarding AI's role in fraud detection, optimizing video quality adaptation based on predictive network analysis, and generating highly personalized advertising placements, ultimately driving higher ROI for content owners.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is fundamentally transforming the value proposition of SaaS Online Video Platforms, shifting them from mere delivery systems to intelligent content ecosystems. AI algorithms are now crucial for automating tedious, time-consuming tasks such as content moderation, tagging, and metadata generation. By leveraging deep learning models, platforms can automatically recognize objects, scenes, and emotions within video frames, significantly improving searchability and discoverability, which is vital for large video libraries. This level of automation reduces operational costs for content owners and accelerates the time-to-market for new content, allowing staff to focus on creative strategy rather than manual processing.

Furthermore, AI plays a pivotal role in optimizing viewer engagement and monetization strategies. ML models analyze complex viewer behavioral patterns, including playback completion rates, interaction points, and demographic data, to dynamically recommend content and personalize user interfaces, thereby maximizing watch time. In advertising technology, AI is used for programmatic ad insertion (DAI), ensuring ads are contextually relevant and seamlessly integrated into the video stream, leading to higher click-through rates and premium ad inventory pricing. Predictive analytics, powered by AI, also enables OVPs to proactively manage network load and quality of service (QoS), adjusting transcoding profiles and CDN routes in real-time to maintain optimal playback quality even under variable network conditions.

- AI-Powered Content Indexing: Automated tagging, transcription, and scene recognition improving video discoverability.

- Personalized Content Recommendation: ML models driving higher viewer engagement and maximizing session duration.

- Dynamic Ad Insertion (DAI): Contextual and real-time ad placements optimizing monetization and ad revenue.

- Automated Quality of Experience (QoE): Predictive analysis to optimize adaptive bitrate streaming (ABS) and reduce buffering.

- Enhanced Content Moderation: AI detecting inappropriate or policy-violating content faster than human review.

- Advanced Video Compression: AI algorithms optimizing encoding efficiency, reducing storage and bandwidth costs without sacrificing quality.

DRO & Impact Forces Of SaaS Online Video Platforms Market

The dynamics of the SaaS Online Video Platforms market are governed by a robust interplay of driving forces (D), restrictive challenges (R), and significant opportunities (O), collectively shaping the impact forces. The primary drivers include the escalating global demand for high-quality video content across all devices, the imperative for enterprises to use video for remote collaboration and marketing, and continuous advancements in networking infrastructure (5G deployment). Restraints largely center on the challenges of maintaining secure Digital Rights Management (DRM) across fragmented distribution channels, the high costs associated with transcontinental data transfer and storage, and the complexity of ensuring regulatory compliance (e.g., data sovereignty laws) in global markets. Opportunities are abundant, primarily focused on the expansion into specialized verticals like professional eSports broadcasting, the integration of interactive video features (e.g., shoppable video), and leveraging edge computing to reduce latency for mission-critical live streams.

Impact forces dictate the velocity and direction of market growth. Technological adoption intensity is high, driven by competition among platform providers to offer superior features, such as 8K support, high dynamic range (HDR) compatibility, and sophisticated low-latency protocols like WebRTC and low-latency HLS. Infrastructure investment, particularly in CDN optimization and cloud infrastructure scalability, acts as a critical force, directly affecting the quality of service (QoS) platforms can guarantee. Furthermore, the regulatory environment presents both a barrier and a catalyst; while strict data protection laws increase compliance costs, they also favor established, security-focused SaaS providers over less secure, localized solutions. The economic force of increasing content production budgets globally ensures a steady flow of high-value media requiring professional OVP services.

The market also faces pressures related to vendor lock-in and pricing complexity, especially for large enterprises with diverse needs. However, the compelling force of superior analytics and data insights offered by modern SaaS platforms often justifies the investment. As monetization models evolve, the market is incentivized to develop more agile and integrated systems capable of handling complex hybrid revenue streams (SVOD, AVOD, TVOD). The underlying impact force remains the pervasive societal reliance on video as the primary medium for information consumption, entertainment, and professional interaction, guaranteeing sustained demand across the forecast period. Providers that effectively mitigate security risks and capitalize on AI-driven efficiency gains will secure market leadership.

Segmentation Analysis

The SaaS Online Video Platforms market is structurally segmented based on crucial attributes including platform type, deployment model, application, industry vertical, and geographic region, allowing for targeted market strategies. Analysis reveals that while the overall platform market is converging toward comprehensive solutions, specialized platforms focusing solely on enterprise streaming or dedicated live event management continue to command significant niche attention due to their optimized feature sets. The dominance of the cloud-based deployment model (which is intrinsic to SaaS) is almost absolute, though hybrid deployments remain relevant for organizations with sensitive legacy on-premise infrastructure. Understanding these segments is vital for assessing competitive intensity and identifying underserved growth areas, such as personalized video commerce and governmental communication platforms.

- By Platform Type:

- Video on Demand (VOD) Platforms

- Live Streaming Platforms

- Video Content Management Systems (CMS)

- Transcoding and Processing Solutions

- By Application:

- Broadcasting and Media Streaming

- Marketing and Corporate Communication

- E-learning and Education

- E-commerce and Retail

- Fitness and Wellness

- Security and Surveillance

- By End-User Industry:

- Media and Entertainment

- Education (K-12, Higher Ed, Corporate Training)

- BFSI (Banking, Financial Services, and Insurance)

- Healthcare and Pharmaceuticals

- IT and Telecom

- Government and Defense

- By Component:

- Platform Solutions (Software)

- Services (Professional Services, Managed Services, Integration Services)

Value Chain Analysis For SaaS Online Video Platforms Market

The value chain of the SaaS Online Video Platforms market begins with upstream activities centered on core technology development and infrastructure provision. This phase involves R&D into encoding codecs (H.265, AV1), low-latency protocols, and proprietary security features. Key upstream suppliers include cloud infrastructure providers (AWS, Azure, Google Cloud), which offer the computational backbone and storage, and technology specialists providing crucial components like advanced DRM systems and video processing algorithms. The efficiency and pricing of these upstream suppliers directly influence the final cost and scalability of the SaaS OVP offering. Strategic partnerships with major CDNs are also essential in the upstream segment to ensure widespread global content delivery capabilities.

The midstream involves the core OVP providers, who aggregate and integrate these upstream components into a comprehensive, user-friendly SaaS solution. This stage includes content ingestion and management (CMS), transcoding and adaptive bitrate streaming (ABS) preparation, advanced analytics integration, and the development of APIs for third-party integration. Value is added here through user experience design, platform security features, and continuous software updates that introduce new functionalities, such as AI-driven automation. Effective midstream operation requires robust engineering capabilities and a focus on maintaining platform uptime and scalability to handle massive concurrent viewership.

Downstream activities focus on distribution, customer acquisition, and support. The distribution channel is predominantly direct, utilizing platform subscription models sold directly to end-user organizations (Media companies, Enterprises, Educators). However, indirect channels, such as partnerships with system integrators (SIs), managed service providers (MSPs), and specialized technology resellers, are increasingly vital for penetrating the enterprise sector, especially in geographically diverse or regulatory-heavy markets. Downstream success relies heavily on highly skilled implementation and professional services teams to tailor the platform to complex client requirements, ensuring smooth adoption and high customer lifetime value (CLV).

SaaS Online Video Platforms Market Potential Customers

The potential customer base for SaaS Online Video Platforms is highly diverse, spanning any organization or individual requiring professional, scalable tools for managing and distributing high-quality video content. The largest segments of end-users/buyers are major Media and Entertainment (M&E) companies, including traditional broadcasters, major film studios, and independent content publishers transitioning to Direct-to-Consumer (D2C) models via subscription (SVOD) or ad-supported (AVOD) platforms. These customers prioritize features like advanced DRM, robust monetization options, and global CDN coverage to reach diverse audiences reliably.

The Enterprise sector represents the fastest-growing customer segment, encompassing large corporations across IT, Finance, Manufacturing, and Retail. These buyers utilize OVPs primarily for internal communication (town halls, CEO messages), employee training and onboarding (Corporate Education), and external marketing communications (Product Demonstrations, Webinars). Their purchasing criteria focus on integration with enterprise software (CRM, LMS), stringent security protocols, compliance certifications, and granular access controls to manage sensitive internal content. Educational institutions (universities, K-12 districts) are also significant buyers, leveraging OVPs for lecture capture, remote learning delivery, and secure archival of educational resources.

Niche but high-value customer groups include government agencies (for secure public communication and training), specialized professional associations (for continuing education and certifications), and the rapidly expanding ecosystem of independent content creators and mid-sized businesses that require professional-grade tools without the capital expenditure associated with building proprietary infrastructure. The core need across all these customer types is a platform that offers high reliability, ease of use, scalability on demand, and sophisticated analytical tools to measure the impact and reach of their video assets.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 8.5 Billion |

| Market Forecast in 2033 | USD 27.8 Billion |

| Growth Rate | CAGR 18.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Brightcove, Kaltura, IBM Cloud Video, Vimeo, Akamai Technologies, Limelight Networks, Haivision, JW Player, Vidyard, Panopto, Microsoft Azure Media Services, Amazon Web Services (AWS Elemental), Harmonic, Qumu, Wistia, Vbrick, Muvi, Dalet, Boxcast, SundaySky |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

SaaS Online Video Platforms Market Key Technology Landscape

The technology landscape underpinning the SaaS Online Video Platforms market is characterized by rapid innovation focused on optimizing delivery, enhancing security, and maximizing content intelligence. Core technologies include sophisticated Content Delivery Networks (CDNs) that utilize edge computing principles to cache and distribute content geographically closer to the end-user, minimizing latency and buffering. The shift from traditional HTTP-based streaming to newer, low-latency protocols like Low Latency HLS (LL-HLS) and Low Latency DASH (LL-DASH), alongside WebRTC adoption for ultra-low latency interactive applications, is critical. Furthermore, advanced video encoding and transcoding technologies, particularly those leveraging hardware acceleration and newer codecs like AV1, are essential for reducing bandwidth consumption while maintaining 4K and 8K quality standards.

Security and monetization technologies form another vital pillar. Digital Rights Management (DRM) solutions (e.g., Widevine, PlayReady, FairPlay) are standard requirements to protect premium content from piracy, integrated directly into the platform architecture. For monetization, the technological focus is on server-side Dynamic Ad Insertion (DAI), which allows for personalized, seamlessly inserted advertisements that are difficult for ad-blockers to intercept. This requires robust integration with Ad Exchanges and Supply-Side Platforms (SSPs). The adoption of microservices architecture is also defining the modern OVP, enabling platforms to offer scalable, highly resilient services where individual components (like analytics or transcoding) can be updated or scaled independently.

Artificial Intelligence and Machine Learning are increasingly integrated across the entire platform lifecycle. ML algorithms are used extensively in quality control (detecting video artifacting or audio issues automatically), metadata generation (as detailed previously), and predictive capacity planning. Furthermore, sophisticated analytics engines provide real-time insights into viewer behavior, content performance, and monetization efficiency, often integrating with third-party business intelligence tools. The ongoing evolution toward serverless computing within the cloud infrastructure further allows SaaS OVP providers to manage unpredictable scaling requirements more effectively and cost-efficiently.

Regional Highlights

- North America: Dominates the global market share due to high penetration of high-speed internet, significant investment in D2C streaming services by major media conglomerates, and strong adoption of enterprise video solutions. The presence of leading technology providers and a mature digital advertising ecosystem drives innovation in AI-powered monetization and low-latency delivery.

- Europe: A mature market characterized by stringent data protection laws (GDPR), influencing platform design towards enhanced security and compliance features. Demand is heavily concentrated in the professional sports broadcasting, corporate training, and educational sectors. The fragmentation of language markets necessitates advanced multi-language and subtitle support features.

- Asia Pacific (APAC): Expected to register the highest growth rate (CAGR), fueled by the rapid expansion of mobile internet accessibility, large youth populations demanding digital content, and the emergence of strong local content ecosystems in markets like India, China, and Southeast Asia. Market growth is sensitive to localization requirements and investment in local CDN capacity.

- Latin America (LATAM): Emerging market experiencing substantial growth, primarily driven by the increasing affordability of mobile devices and the rise of local D2C sports and entertainment services. Challenges include highly variable infrastructure quality and reliance on affordable, localized pricing models.

- Middle East and Africa (MEA): Represents a smaller but rapidly developing market, with growth concentrated in high-income Gulf Cooperation Council (GCC) countries investing heavily in digital education and smart city infrastructure. Demand is often centered around secure enterprise communications and religious broadcasting platforms.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the SaaS Online Video Platforms Market.- Brightcove

- Kaltura

- IBM Cloud Video

- Vimeo

- Akamai Technologies

- Limelight Networks

- Haivision

- JW Player

- Vidyard

- Panopto

- Microsoft Azure Media Services

- Amazon Web Services (AWS Elemental)

- Harmonic

- Qumu

- Wistia

- Vbrick

- Muvi

- Dalet

- Boxcast

- SundaySky

Frequently Asked Questions

Analyze common user questions about the SaaS Online Video Platforms market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the high growth rate of the SaaS Online Video Platforms Market?

The primary driver is the accelerating necessity for organizations globally—ranging from media companies to large enterprises—to implement scalable, secure, and highly reliable video delivery solutions to support remote work, digital marketing, and direct-to-consumer content monetization strategies.

How is Artificial Intelligence (AI) fundamentally changing the functionality of SaaS OVPs?

AI integration is enabling advanced automation across the platform, particularly in dynamic ad insertion (DAI), enhanced content indexing and metadata generation, proactive quality of service (QoS) management, and deep behavioral analytics for hyper-personalization of the viewer experience.

Which industry vertical is showing the fastest adoption of SaaS Online Video Platforms?

While Media and Entertainment remains the largest revenue segment, the Corporate Training and Enterprise Communication vertical is demonstrating the fastest adoption rate, driven by the global shift towards remote and hybrid work models requiring secure internal video infrastructure for training and large-scale communication.

What are the main security concerns associated with SaaS OVP adoption?

Key security concerns include content piracy, necessitating robust Digital Rights Management (DRM) and watermarking; data privacy compliance, especially concerning viewer data under regulations like GDPR and CCPA; and preventing unauthorized access to proprietary corporate video content.

Which geographic region is expected to lead market expansion by CAGR through 2033?

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR), attributed to rapidly increasing internet penetration, high mobile video consumption rates, and significant investments in digital infrastructure across emerging economies in the region.

The SaaS Online Video Platforms market continues to demonstrate robust resilience and dynamic expansion, reflecting its foundational role in the global digital economy. The competitive landscape is characterized by innovation focused on maximizing viewer quality of experience (QoE) and empowering content owners with flexible, scalable tools for monetization and management. The substantial growth projected is supported by continuous infrastructural advancements, particularly 5G rollout and edge computing integration, which collectively reduce operational bottlenecks associated with global video delivery. The shift towards API-first, microservices architecture among leading vendors ensures that platforms remain agile and adaptable to emerging technological standards and varying customer requirements, from simple VOD libraries to complex, interactive live streaming events.

In analyzing the strategic trajectories of major market players, a clear trend emerges toward specialization and deeper vertical integration. While some platforms focus on becoming comprehensive, all-in-one solutions catering to both enterprise and media clients, others are establishing dominance in niche areas like secure governmental communications, high-fidelity sports streaming, or interactive e-learning. This strategic divergence is healthy, ensuring that customer segments with highly specific compliance or quality needs can access purpose-built solutions. Furthermore, the imperative for global reach compels providers to invest heavily in geographically optimized CDNs and localized support teams, recognizing that consistent performance is paramount, especially in high-growth regions like APAC and LATAM where infrastructure maturity varies widely.

Looking ahead, the market's evolution will be heavily influenced by how effectively platforms integrate immersive technologies such as Virtual Reality (VR) and Augmented Reality (AR) streaming capabilities, providing new avenues for highly engaging content delivery. The intersection of video platforms with digital commerce, enabling "shoppable video," represents a significant revenue opportunity, particularly for platforms serving the retail and marketing sectors. Regulatory changes, especially those governing cross-border data transfer and content taxation, will continue to shape operational strategies. Success in this highly competitive arena hinges on continuous technological superiority, strong adherence to security standards, and the ability to convert complex viewer data into actionable content and monetization strategies.

The enterprise adoption segment specifically demands platforms that offer superior interoperability with existing customer relationship management (CRM), learning management system (LMS), and internal security frameworks. For enterprise use, video platforms are transitioning from being mere communication tools to integral components of the knowledge infrastructure, storing institutional knowledge and facilitating real-time decision-making. Consequently, features such as single sign-on (SSO), integration with Active Directory, and robust auditing capabilities are becoming standard requirements, signaling the mature adoption of SaaS OVPs within highly regulated corporate environments. This growing emphasis on corporate governance and data security elevates the entry barrier for new providers lacking robust compliance certifications and proven enterprise track records.

Monetization remains a critical innovation battleground. The move away from simplistic ad insertion towards sophisticated, AI-driven contextual advertising ensures higher CPMs and better viewer acceptance. Platforms are exploring advanced subscription tiers, offering features like early access or ad-free viewing, managed through flexible billing systems integrated into the OVP. The future of monetization is leaning toward complex hybrid models that maximize revenue from both advertising (AVOD) and subscriptions (SVOD), requiring platforms capable of highly granular user segmentation and dynamic packaging of content rights. The competitive edge is often secured by the platform providing the most comprehensive and transparent performance analytics, enabling content owners to precisely attribute revenue generation to specific content and viewer segments.

The technological evolution concerning latency is also defining competitive positions, especially in live streaming. The drive for near real-time interaction (sub-second latency) is essential for areas such as online auctions, sports betting integrated into broadcasts, and interactive e-learning sessions. Providers utilizing advanced protocols and edge-based processing are setting new performance benchmarks. This push for ultra-low latency requires significant and continuous investment in global peering agreements and optimized server configurations, underlining the capital-intensive nature of competing at the highest end of the market. The ability to deliver flawless, high-resolution, low-latency streams under variable global network conditions is rapidly becoming a mandatory differentiator for top-tier SaaS OVP vendors.

In conclusion, the SaaS Online Video Platforms market stands at the intersection of media consumption shifts, enterprise digitization, and cutting-edge cloud technology. The sustained double-digit growth forecast reflects the irreversible trend toward video as the dominant communication and consumption medium. Market participants must continually invest in AI/ML capabilities, strengthen security frameworks, and optimize global delivery infrastructure to capitalize on the vast opportunities presented by the evolving digital content landscape. Strategic positioning, centered on either broad, scalable utility or deep, vertical specialization, will be the key determinant of long-term success and market leadership in this dynamic sector.

The long-term viability of these platforms is intrinsically tied to their ability to provide end-to-end workflow solutions that streamline the entire content lifecycle, from production to delivery and monetization. Customers increasingly prefer platforms that reduce the need for multiple vendors, seeking integrated solutions for encoding, hosting, security, and analytics under a single unified dashboard. This demand for simplification and seamless integration is pushing many OVP vendors to acquire or partner with companies specializing in adjacent technologies, such as advanced video editing tools or sophisticated content recommendation engines. Furthermore, the commitment to open standards and robust API documentation is crucial for fostering an ecosystem of third-party developers, which ultimately adds value and flexibility to the core SaaS offering.

Geographically, while North America and Europe provide stable revenue streams based on established infrastructure and mature customer bases, the future acceleration of the market is anchored in the Asia Pacific region. Penetrating this diverse market requires more than just technical capability; it demands a nuanced understanding of local regulatory environments, cultural preferences regarding content format and access, and the unique challenges posed by mobile-first audiences. Successful expansion often involves partnerships with local telecommunication providers and content aggregators to ensure content is delivered affordably and efficiently across heterogeneous networks. Investments in data centers and localized customer support within APAC are strategic necessities for vendors aiming to capture this rapidly expanding demographic.

Finally, sustainability and efficient resource management are emerging as subtle yet important competitive factors. As video processing and distribution consume substantial energy, OVP providers that can demonstrate efficiency gains through optimized encoding algorithms and smart use of cloud resources may gain an advantage with environmentally conscious corporate clients. The development of greener streaming solutions, coupled with transparent reporting on energy consumption, aligns with broader corporate social responsibility goals and may influence procurement decisions in the coming years. This signals a shift where operational efficiency is not just about cost reduction, but also about ethical and sustainable practice within the digital supply chain.

The ongoing evolution of broadcasting standards, such as the transition to IP-based contribution and distribution workflows, also profoundly impacts the SaaS OVP market. Platforms must be adept at handling high-quality, professional-grade inputs and outputs that adhere to established broadcast industry standards while maintaining the scalability and agility of a cloud service. This hybrid requirement—merging broadcast reliability with cloud flexibility—demands advanced scheduling, monitoring, and quality control tools that satisfy the stringent demands of major media enterprises. Vendors successfully bridging this gap are positioned to capture the high-value traditional media clients who are migrating their linear services to digital platforms.

Another critical area of technological differentiation lies in accessibility features. Compliance with global accessibility standards (like WCAG) is mandatory for government, education, and many large enterprise clients. Modern SaaS OVPs are increasingly integrating automated accessibility tools, including highly accurate automatic captioning, translation services, and audio description generation, often powered by AI. Beyond mere compliance, these features enhance overall user engagement and expand the potential audience reach. The platform that provides the most seamless, high-quality, and cost-effective accessibility tooling holds a distinct advantage in serving public sector and multinational corporate clients.

The market faces constant pressure from proprietary closed ecosystems developed by large technology companies, which often bundle video services with their broader cloud offerings (e.g., AWS Media Services, Microsoft Azure Media Services). This dynamic forces independent SaaS OVP providers to focus intensely on delivering specialized functionality, superior user experience, and vendor-agnostic integration capabilities. The strategic response for independent players involves emphasizing flexibility, advanced feature sets tailored for specific workflows (like professional production pipelines), and commitment to non-lock-in policies, differentiating themselves from the generic, bundled services offered by hyperscale cloud providers.

Market growth is also intimately linked to the increasing penetration of 5G networks globally. 5G infrastructure not only guarantees faster mobile speeds but also drastically lowers latency, opening up new application possibilities, particularly in mobile-first markets and for high-demand services like augmented reality overlays in live streams. SaaS OVP providers are proactively optimizing their streaming protocols and content delivery architectures to fully leverage the capabilities of 5G, ensuring that mobile viewing quality matches or exceeds traditional fixed-line viewing. This focus on mobile performance is crucial, as the majority of new internet users, especially in APAC and Africa, access digital content primarily through mobile devices.

The proliferation of user-generated content (UGC) and micro-content platforms also influences the SaaS OVP space, though indirectly. While major social platforms handle basic UGC, professional creators and businesses often seek higher-quality, ad-free, and brand-controlled environments provided by SaaS OVPs. This drives demand for simplified content creation tools, integrated directly into the platform, allowing users to easily edit, brand, and publish professional-looking videos without needing separate complex software suites. The integration of basic video editing, graphical overlays, and call-to-action features within the OVP itself adds significant value for marketing and internal communication teams.

Finally, the economic impact of the "Great Resignation" and the associated focus on upskilling and professional development has created a massive, sustained demand for professional e-learning platforms. SaaS OVPs are essential components of Learning Management Systems (LMS), offering secure, trackable, and highly interactive video delivery for corporate training and higher education. The requirement here is less about mass broadcasting and more about secure, personalized access, progress tracking, and integration with certification mechanisms. Platforms optimized for secure educational delivery, complete with quizzing and interaction tools, are capturing this recession-proof growth segment.

The market's future innovation curve is heavily reliant on the adoption of advanced data processing techniques at the edge. Edge computing allows for specific video processing tasks, such as initial encoding, quality checking, or even personalized ad insertion, to occur closer to the source or the end-user. This reduces the load on core cloud infrastructure, significantly cuts down transmission latency, and improves overall cost efficiency. SaaS OVP vendors who effectively deploy hybrid cloud/edge architectures will be able to offer superior performance guarantees, especially critical for real-time and mission-critical video applications in industrial or financial sectors.

Furthermore, the competitive dynamic is shaped by pricing model innovation. While fixed subscription tiers remain common, there is a strong shift towards usage-based, consumption-metered pricing models, allowing customers to pay precisely for the bandwidth, storage, and processing minutes they utilize. This flexibility appeals particularly to small and medium-sized enterprises (SMEs) and organizations with highly seasonal or unpredictable video traffic. Vendors offering transparent and flexible consumption-based models gain a competitive advantage by aligning pricing directly with customer value and operational needs, minimizing perceived risk in adoption.

The need for interoperability extends beyond enterprise integration to multi-CDN strategy management. Large-scale content providers often utilize multiple CDNs to ensure global coverage, redundancy, and optimal cost management. Modern SaaS OVPs must offer integrated tools or sophisticated APIs that allow customers to manage and monitor content delivery across these multiple providers seamlessly. The ability to intelligently route traffic based on real-time performance metrics (multicasting optimization) is a sophisticated feature increasingly demanded by high-volume broadcasters, demonstrating the complexity and technical depth required to compete at the top end of the market.

In the domain of security, the rise of blockchain technology is being explored by some innovative OVP providers as a potential solution for enhanced Digital Rights Management (DRM) and transparent content ownership tracking. While still nascent, blockchain integration could provide immutable records of content usage and royalty payments, addressing long-standing pain points related to content piracy and complex rights management across multiple territories. This technological exploration signifies the industry's continuous search for next-generation security frameworks that move beyond traditional encryption methods to embrace decentralized trust models.

Another strategic avenue for market differentiation is the focus on platform ecosystem development. Leading SaaS OVP vendors are actively cultivating robust marketplaces or app stores where third-party developers can offer specialized extensions, such as advanced data visualization tools, niche marketing integrations, or specialized playback optimization plugins. This strategy leverages the innovation of the broader developer community, quickly expanding the feature set and utility of the core platform without requiring the OVP vendor to develop every component internally. A rich, well-supported ecosystem is a powerful factor in vendor selection, particularly for technically proficient customers seeking highly customized video solutions.

Finally, the growing sophistication of video analytics is transitioning from basic view counts and geographic data to deep behavioral economics insights. Modern OVPs provide tools to map viewing behavior against sales funnels, linking video engagement directly to conversion rates or training completion scores. This emphasis on ROI-driven analytics positions the SaaS OVP not just as a technology provider, but as a strategic business partner, delivering measurable metrics that justify the platform investment. The ability to integrate these proprietary analytics with large enterprise data lakes (using standardized APIs like Snowflake or Databricks) is crucial for securing high-value corporate contracts.

The sustained demand for high-quality, professional video production standards also ensures the relevance of advanced encoding and processing features within the SaaS OVP framework. Features supporting HDR (High Dynamic Range), wide color gamut (WCG), and higher frame rates (HFR) are transitioning from niche requirements to expected capabilities, especially in premium media and entertainment offerings. Platforms that can efficiently handle these computationally intensive formats at scale, while minimizing storage and delivery costs through intelligent compression, maintain a strong competitive edge. The complexity involved in maintaining quality across varied device ecosystems—from smart TVs to legacy mobile phones—requires sophisticated, cloud-native processing pipelines.

Furthermore, the trend toward personalization is accelerating beyond mere content recommendations. OVPs are developing tools that enable dynamic video personalization, where elements within a video—such as introductory messages, calls to action, or contact information—are automatically tailored based on the individual viewer's profile or geographic location. This capability is highly valuable for B2B marketing and sales teams seeking to create scalable, yet highly individualized video outreach campaigns, significantly boosting engagement rates compared to generic video content. This level of granular, on-the-fly customization is entirely dependent on the scalable architecture of modern SaaS platforms.

The regulatory fragmentation regarding content distribution rights and censorship remains a persistent challenge, particularly for vendors operating globally. OVPs must provide geo-blocking tools that are highly reliable and easily configurable, allowing content owners to strictly adhere to licensing agreements and territorial restrictions. Moreover, many countries enforce strict content filtering requirements, compelling platforms to offer robust content moderation and pre-screening workflows. The ability of a SaaS OVP to efficiently manage these complex, jurisdiction-specific compliance requirements without disrupting the global delivery pipeline is a key factor in securing contracts with international media organizations and multinational corporations.

The rise of live commerce, or "shoppable video," represents a significant revenue catalyst for the SaaS OVP market, particularly within the e-commerce vertical. Platforms are integrating interactive elements that allow viewers to click on products displayed in a live stream or VOD content, leading directly to a purchase checkout. This requires real-time inventory synchronization, robust low-latency delivery, and embedded e-commerce functionalities. Vendors successfully capturing this convergence of live broadcasting and retail will tap into a massive, previously inaccessible stream of transactional revenue, moving the OVP beyond merely an expense center into a direct profit driver for their retail clients.

Finally, the long-term competitive differentiation will increasingly come from the quality of customer support and managed services offered. Given the complexity of global video streaming and the high stakes associated with critical live events (e.g., major sports or corporate announcements), clients demand 24/7 proactive monitoring, dedicated technical account management, and rapid incident response capabilities. SaaS OVP providers that package their software solutions with robust professional and managed services, effectively acting as extensions of the client's internal media operations team, build strong trust and secure higher retention rates, insulating them from purely price-based competition.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager