Safe Load Indicators Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436410 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Safe Load Indicators Market Size

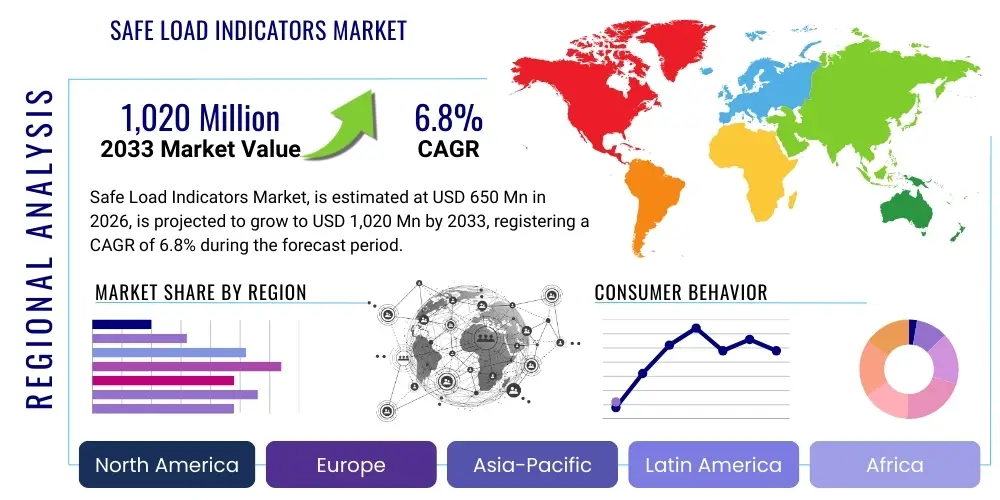

The Safe Load Indicators Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 650 Million in 2026 and is projected to reach USD 1,020 Million by the end of the forecast period in 2033.

Safe Load Indicators Market introduction

The Safe Load Indicators (SLI) Market encompasses systems designed to monitor the operational parameters of lifting equipment, primarily cranes and hoists, ensuring that loads remain within safe working limits (SWL). These crucial safety devices calculate and display critical information such as the weight of the load being lifted, the radius of the lift, the boom angle, and the rated capacity of the equipment under those specific conditions. The evolution of SLIs from simple mechanical systems to complex, microprocessor-based digital units reflects the growing emphasis on workplace safety, reducing catastrophic failures, and minimizing liability across industries.

SLI systems are indispensable across major applications including construction, maritime operations, oil and gas exploration, and logistics, particularly where heavy lifting and complex maneuvering are involved. The core benefit of integrating an SLI system is the proactive prevention of overloading and tipping, which are leading causes of accidents on construction sites and ports. Modern SLIs often integrate with other machine control systems, providing auditory and visual warnings to operators, and in advanced configurations, offering automated lockout features to prevent operation outside established safety margins.

The market growth is fundamentally driven by stringent international and regional safety regulations (such as OSHA and European directives) mandating the use of certified load monitoring devices on lifting machinery. Furthermore, the global surge in infrastructure development, particularly in Asia Pacific and the Middle East, necessitates the deployment of large-scale construction equipment equipped with reliable safety technologies. Technological advancements, including the adoption of wireless sensors, sophisticated telematics, and data logging capabilities for performance review and compliance auditing, are further accelerating the integration and demand for highly accurate SLI solutions.

Safe Load Indicators Market Executive Summary

The Safe Load Indicators Market is experiencing robust growth fueled by mandatory global safety certifications and a massive pipeline of infrastructure and industrial projects. Key business trends include the convergence of SLI systems with advanced telematics and IoT platforms, allowing for remote monitoring, predictive maintenance, and centralized fleet management. Manufacturers are focusing on developing highly durable, modular, and easy-to-calibrate wireless systems that minimize installation complexity and downtime, thereby increasing adoption rates across diverse fleet types and rental operations. The shift towards digitized reporting and data analytics provided by SLI systems is transforming risk management protocols for construction and logistics companies worldwide.

Regionally, the Asia Pacific (APAC) market is poised to demonstrate the highest growth trajectory, primarily driven by expansive urbanization efforts in China, India, and Southeast Asian nations, leading to significant demand for new cranes and associated safety gear. North America and Europe, characterized by mature markets, exhibit stable growth, focusing heavily on replacing older equipment with modern, AI-enabled SLI systems that comply with the latest functional safety standards. The Middle East and Africa (MEA) region also contributes significantly due to continuous investment in oil and gas infrastructure, maritime ports, and mega-construction projects requiring high-capacity, specialized SLI deployment.

Segment trends indicate strong preference for wireless SLI systems over traditional wired counterparts due to enhanced flexibility and reduced maintenance costs. The component segment shows increasing demand for sophisticated digital display units capable of integrating diverse data sources beyond just load measurements, such as wind speed and ground stability. Furthermore, the end-user market is dominated by the construction and material handling sectors, although the marine segment, requiring specialized anti-collision and complex multi-crane lift synchronization capabilities, is showing accelerated demand for advanced SLI solutions.

AI Impact Analysis on Safe Load Indicators Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Safe Load Indicators Market generally center on several key themes: how AI enhances predictive maintenance capabilities, whether it can improve dynamic load charting in unpredictable environments, and its role in automating safety interventions. Users are keen to understand if AI can move SLIs beyond reactive measurement systems into proactive risk mitigation tools, particularly concerning potential human error and environmental factors. Key expectations revolve around using machine learning algorithms to analyze historical lifting data, operator behavior, and real-time environmental inputs (like micro-climate changes or ground pressure readings) to dynamically recalculate and optimize safe working loads, significantly reducing the likelihood of critical incidents.

AI is transforming the SLI market by enabling predictive safety modeling. Traditional SLIs offer instantaneous data, but AI systems layered onto these platforms utilize deep learning to process massive datasets derived from years of operational telemetry. This allows the system to identify subtle patterns indicative of component fatigue, sensor drift, or risky operational sequences before they lead to an accident. For example, by learning the normal stress profile of a boom under various loads, the AI can detect anomalous stress indicators much earlier than a simple threshold alert, prompting timely maintenance or operational adjustments.

Furthermore, AI facilitates dynamic safety management, crucial for complex lifting operations, such as synchronizing multiple cranes or lifts near obstacles. Machine learning optimizes the decision-making process by considering hundreds of variables simultaneously—load position, wind shear, ground bearing pressure, and equipment wear—to provide instantaneous, optimized safety advisories or automatically limit motion to maintain stability. This evolution positions SLI systems not just as compliance tools but as integral components of fully digitized, intelligent heavy equipment management platforms, drastically improving operational efficiency and reducing insurance liabilities.

- AI enables predictive failure detection of critical SLI components and sensors.

- Machine Learning algorithms optimize dynamic load charts based on real-time environmental factors (e.g., wind speed, temperature variation).

- AI facilitates automated operator coaching and anomaly detection based on historical behavioral patterns.

- Integration with computer vision systems allows AI to verify load hook-up and surrounding clearance risks.

- AI processes telemetry data for sophisticated insurance risk assessment and regulatory compliance reporting.

DRO & Impact Forces Of Safe Load Indicators Market

The Safe Load Indicators Market is primarily driven by escalating regulatory pressures across the globe, demanding higher safety standards for heavy lifting equipment, particularly in high-risk sectors like infrastructure, energy, and construction. These mandates compel both new equipment manufacturers and existing fleet operators to invest in certified SLI systems. Counterbalancing this growth are restraints such as the high initial investment cost associated with advanced, high-precision wireless SLI systems, especially for smaller contractors, and the inherent complexity of integrating these modern digital systems with aging machinery. However, significant opportunities arise from the ongoing digital transformation of the construction industry, including the expansion of rental fleets requiring robust, easily transferable SLI units, and the increasing demand for integrated solutions offering telematics and real-time data logging for operational efficiency and compliance audits.

Impact forces in this market are notably strong and centered around external safety legislation and technological innovation. Safety regulations act as the primary accelerating force; non-compliance carries severe financial and legal penalties, making SLI adoption mandatory rather than optional. The technological force drives innovation toward wireless, IoT-enabled sensors and sophisticated software capable of complex calculations and remote diagnostics, thus enhancing product value. Economic factors, such as large-scale government infrastructure spending globally, directly correlate with increased demand for new lifting equipment and, consequently, SLI systems. The confluence of regulatory necessity and technical advancement defines the market's trajectory, emphasizing precision, reliability, and data integration.

Segmentation Analysis

The Safe Load Indicators Market is comprehensively segmented based on technology type, key components, lifting capacity of the equipment, and the diverse end-use industries. Understanding these segments is crucial for manufacturers to tailor product specifications—for instance, developing rugged, high-capacity wired systems for permanent installations in marine ports versus flexible, easy-to-install wireless systems for short-term construction projects or rental fleets. The dominance of specific technologies and end-user requirements dictates regional market dynamics and investment priorities in R&D, focusing on precision, wireless communication standards, and software analytics capabilities.

Segmentation by component helps in analyzing the supply chain and identifying high-growth areas, such as advanced sensor technologies (pressure sensors, strain gauges, boom angle sensors) and sophisticated digital interfaces. The shift toward higher lifting capacities, driven by super-heavy projects in energy and transport sectors, fuels the demand for ultra-precise and reliable SLI systems that can handle extreme loads. Ultimately, the segmentation structure provides a clear map of market demand, reflecting the necessity for specialized SLI solutions that meet the distinct operational and regulatory needs of construction, marine, and oil & gas sectors globally.

- By Type:

- Wired SLI Systems

- Wireless SLI Systems

- By Component:

- Load Cells (Pressure Transducers, Strain Gauges)

- Angle/Length Sensors (Inclinometers)

- Display Units and Control Systems (Microprocessors)

- Anti-Two Block (ATB) Systems

- Software and Telematics

- By Lifting Capacity:

- Below 50 Tons

- 50–150 Tons

- Above 150 Tons (Heavy Lift Applications)

- By End-User Industry:

- Construction and Infrastructure

- Oil and Gas (Onshore and Offshore)

- Marine and Shipbuilding (Ports and Shipyards)

- Mining and Material Handling

- Rental and Logistics

Value Chain Analysis For Safe Load Indicators Market

The value chain of the Safe Load Indicators Market initiates with upstream activities focused on the procurement and manufacturing of highly specialized electronic components. This phase involves key suppliers of high-precision microprocessors, robust load cells (often based on strain gauge technology), angle sensors, and specialized cabling or wireless communication modules (e.g., standardized Industrial IoT chips). Quality and certification of these foundational components are paramount, as the accuracy and reliability of the final SLI system directly depend on their performance. Strategic relationships with niche sensor manufacturers often provide competitive advantages in this segment, emphasizing durability and resistance to harsh operational environments.

The midstream segment involves the core manufacturing and system integration processes. Here, SLI manufacturers design the architecture, develop proprietary calibration software, assemble the various components into control boxes and display units, and rigorously test the integrated systems against international safety standards (such as EN 13000 and ANSI B30.5). Distribution channels play a critical role downstream; products are primarily channeled through direct sales to large Original Equipment Manufacturers (OEMs) of cranes, or indirectly through specialized heavy equipment dealers, distributors focusing on safety equipment, and certified installers who handle aftermarket retrofitting. The choice between direct and indirect distribution often hinges on the target customer—direct for global OEM agreements, indirect for servicing regional aftermarket demand and rental companies.

Post-installation services form a crucial part of the downstream value chain, providing substantial revenue opportunities. This includes regular calibration, system maintenance, software updates, and advanced data analytics services offered through telematics platforms. Authorized service centers ensure compliance and longevity of the SLI systems. Furthermore, the increasing adoption of cloud-based monitoring solutions has introduced a software-as-a-service (SaaS) component, allowing end-users to pay for enhanced features like predictive maintenance and detailed compliance reporting, thereby extending the value derived from the initial hardware sale and ensuring continuous customer engagement.

Safe Load Indicators Market Potential Customers

Potential customers for Safe Load Indicators are highly concentrated in sectors that utilize heavy lifting machinery and are subject to stringent operational safety regulations. The primary end-users are large civil engineering and infrastructure construction firms involved in high-rise building projects, bridge construction, and large industrial facilities. These companies require robust, reliable SLI systems to manage complex and high-value lifts, where equipment failure is prohibitively costly and dangerous. Furthermore, specialized subcontractors focusing on heavy hauling and rigging constitute a major buyer segment, demanding systems that are easily transferable and highly accurate across varied job sites.

Another significant customer base resides within the energy sector, encompassing both traditional oil and gas operators (onshore and offshore drilling platforms) and renewable energy project developers (wind farm construction and maintenance). These environments require SLIs capable of operating reliably under extreme conditions, including high humidity, marine corrosion, and explosive atmospheres, often necessitating specialized certification. Port authorities, maritime logistics companies, and shipbuilding yards also represent key buyers, focusing on SLIs for container cranes, ship-to-shore gantry cranes, and specialized shipyard lifting equipment, prioritizing anti-collision functionality alongside basic load monitoring.

Finally, the growing heavy equipment rental industry is a rapidly expanding segment of potential customers. Rental companies demand SLI systems that are rugged, simple to integrate across diverse equipment brands, and offer built-in data logging features for liability protection and utilization tracking. Governmental bodies responsible for public infrastructure maintenance, mining operations needing heavy material handling, and large manufacturing facilities with in-house logistics capabilities also contribute substantially to the overall demand for certified Safe Load Indicators.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 650 Million |

| Market Forecast in 2033 | USD 1,020 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Rayco Wylie Systems, Load Systems International (LSI), Hirschmann Automation and Control (Belden), Trimble (LOADRITE), Loadwise, PAT (Astec Industries), Greer Company (LSI), P&H MinePro Services, SkyAzúl, WIKA Group, VETEK, Robway, FUPIN, Weighing Technology, T. L. S. Electronics, Shanghai Fudan Load Cell Co., Ltd., Eilon Engineering, KANGRIM Industries, LMC (Load Moment Control), SensorData Technologies |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Safe Load Indicators Market Key Technology Landscape

The technological evolution within the Safe Load Indicators Market is rapidly moving towards digitalization, high-precision measurement, and interconnected systems, driven by the Industrial IoT (IIoT) framework. Core technology revolves around highly accurate load measurement sensors, primarily strain gauge load cells and pressure transducers, which must maintain precise calibration despite wide fluctuations in temperature and environmental stress. The shift is evident in the adoption of digital signal processing within these sensors, which minimizes noise and improves data integrity before transmission to the main control unit. Furthermore, the integration of advanced inclinometers and resolvers for precise boom angle and length measurement allows for highly sophisticated real-time calculation of the crane’s load moment and rated capacity envelope.

A major technological advancement is the widespread deployment of Wireless Sensor Networks (WSN) in SLI systems. Wireless solutions, utilizing robust protocols such as ZigBee, Bluetooth Low Energy (BLE), or proprietary industrial frequency bands, eliminate the complexity and failure points associated with extensive cabling, particularly for Anti-Two Block (ATB) sensors and external load cells. This wireless capability significantly simplifies retrofitting and improves the modularity of SLI components, making them ideal for dynamic construction sites and rental fleets where equipment configuration changes frequently. Edge computing capabilities are also becoming standard, allowing SLI control units to process complex data and execute real-time safety interventions locally, without dependence on immediate cloud connectivity.

Software and telematics platforms form the intellectual core of modern SLI technology. Manufacturers are embedding sophisticated diagnostics and cloud connectivity features that allow for remote monitoring of machine performance, health diagnostics, and automated compliance reporting. This technology transformation moves SLIs beyond simple safety cut-offs to comprehensive asset management tools. Data collected (operational hours, near-miss events, load cycles) feeds into predictive maintenance algorithms and AI analysis, enhancing operational safety and extending the lifespan of the machinery. Standardization efforts, particularly regarding data transmission formats and interoperability, are key focus areas for industry leaders to ensure seamless integration with broader enterprise asset management (EAM) systems.

Regional Highlights

Regional variations in market dynamics are strongly influenced by regulatory frameworks, the pace of infrastructure development, and the maturity of industrial safety practices. North America, encompassing the United States and Canada, represents a mature market characterized by extremely strict OSHA and local safety regulations, which drives demand for premium, highly certified SLI systems with comprehensive data logging and telematics capabilities. The focus here is on fleet optimization, replacing legacy equipment, and integrating SLIs with advanced driver assistance and autonomy features. The large fleet rental market in the US necessitates flexible, high-durability wireless systems for easy transfer between machinery.

Europe mirrors North America in its regulatory stringency, driven by EU directives and the EN 13000 standard, mandating advanced safety features for lifting equipment. The European market emphasizes precision engineering and low-power consumption, favoring high-end, integrated solutions from established local manufacturers. Germany, France, and the UK are key markets, investing heavily in modernizing port facilities and renewable energy infrastructure, thereby sustaining steady demand for specialized marine and construction SLIs. Furthermore, the push toward Industry 4.0 strongly encourages the adoption of networked SLI systems for centralized industrial monitoring.

Asia Pacific (APAC) stands out as the fastest-growing region, powered by unprecedented urban development and massive government investments in transportation networks and energy projects, particularly in China, India, and Southeast Asia. The demand is multifaceted, encompassing both cost-effective, reliable standard SLI systems for mass construction projects and specialized high-capacity systems for unique mega-projects. Regulatory enforcement is strengthening in several APAC countries, gradually shifting the market from basic load indicators to mandatory digital SLI compliance. This region provides significant opportunities for manufacturers offering scalable and locally supported systems.

Latin America (LATAM) and the Middle East and Africa (MEA) offer niche, high-growth opportunities. In the Middle East, substantial investment in oil & gas exploration, petrochemical plants, and mega-cities (like NEOM) requires the deployment of highly robust, often explosion-proof, SLI systems for extreme environmental conditions. The LATAM market, while smaller, shows potential due to mining operations and infrastructural upgrades, though adoption rates can be volatile due to economic instability. Africa’s SLI market growth is concentrated in key resource extraction areas and major port development projects along coastal regions, where the need for reliable, ruggedized equipment is critical for safety and operational continuity.

- Asia Pacific (APAC): Highest projected growth; driven by urbanization, infrastructure investment (China, India), and tightening safety mandates.

- North America: Stable, mature market; high adoption of telematics and AI integration due to stringent OSHA regulations and large rental fleets.

- Europe: Focus on high-end, certified systems compliant with EN 13000; strong demand from manufacturing and maritime sectors.

- Middle East & Africa (MEA): Growth centered on Oil & Gas projects, port expansion, and mega-construction requiring specialized, rugged SLI units.

- Latin America (LATAM): Developing market; demand driven primarily by mining, resources, and public works projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Safe Load Indicators Market.- Rayco Wylie Systems

- Load Systems International (LSI)

- Hirschmann Automation and Control (Belden)

- Trimble (LOADRITE)

- Loadwise

- PAT (Astec Industries)

- Greer Company (LSI)

- P&H MinePro Services

- SkyAzúl

- WIKA Group

- VETEK

- Robway

- FUPIN

- Weighing Technology

- T. L. S. Electronics

- Shanghai Fudan Load Cell Co., Ltd.

- Eilon Engineering

- KANGRIM Industries

- LMC (Load Moment Control)

- SensorData Technologies

Frequently Asked Questions

Analyze common user questions about the Safe Load Indicators market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a Safe Load Indicator (SLI) system?

The primary function of an SLI is to monitor and calculate the load moment of lifting equipment, such as cranes, relative to the machine's rated capacity under specific operating conditions (e.g., boom angle, radius). It provides visual and auditory warnings and typically prevents lifting operations that exceed the safe working limit, thereby safeguarding personnel and equipment.

Are wireless Safe Load Indicator systems more reliable than wired systems?

Wireless SLI systems offer significant advantages in installation flexibility and reduced cable maintenance issues compared to wired systems. Modern wireless systems use robust, secure industrial communication protocols, making them highly reliable, particularly in dynamic environments like construction sites where wired connections are prone to damage.

Which end-user industry drives the highest demand for SLI solutions?

The Construction and Infrastructure sector currently generates the highest volume demand for SLI solutions globally. This is closely followed by the Oil and Gas sector and the Marine/Port operations segment, which require high-capacity and specialized SLI systems for critical lifts.

How does AI technology enhance the performance of Safe Load Indicators?

AI enhances SLI performance by enabling predictive maintenance through sensor data analysis, optimizing dynamic load charts in real-time based on environmental inputs (like wind), and flagging complex operational anomalies that go beyond simple capacity thresholds, significantly improving proactive risk mitigation.

What regulatory standards primarily govern the use and certification of SLIs?

Globally, the use and certification of SLIs are primarily governed by standards such as EN 13000 (European Standard for Cranes), ANSI B30.5 (American National Standard for Mobile Cranes), and OSHA regulations, which mandate the presence and periodic calibration of load monitoring devices on lifting equipment.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager