Safety Net Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437687 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Safety Net Market Size

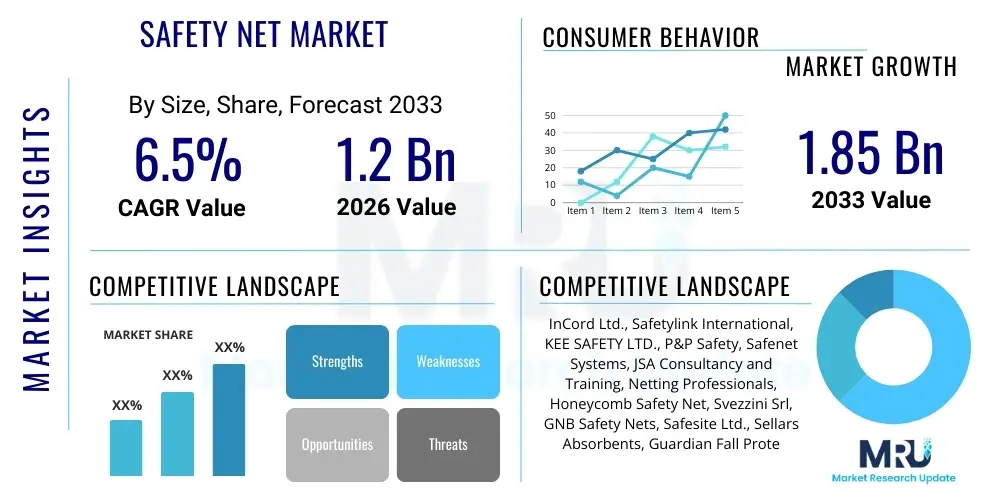

The Safety Net Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 1.85 Billion by the end of the forecast period in 2033. This substantial growth trajectory is underpinned by stringent regulatory mandates across major economies, particularly in construction and industrial sectors, compelling widespread adoption of high-performance safety netting solutions. The quantification reflects escalating infrastructure development globally and a heightened focus on worker safety and debris containment efficiency.

Safety Net Market introduction

The Safety Net Market encompasses a wide range of protective systems designed to prevent falls, contain debris, and establish secure barriers in hazardous environments, primarily construction, infrastructure, and industrial settings. These essential safety products are typically manufactured from high-strength synthetic polymers such as nylon, polyester, and polypropylene, selected for their durability, UV resistance, and energy absorption capabilities. The fundamental application lies in providing passive fall protection on construction sites, offering a robust safety mechanism that deploys below working areas to mitigate the risk of severe injuries associated with falls from heights. Beyond fall arrest, safety nets are crucial for scaffolding containment, protecting the public and workers below from falling tools, materials, and demolition debris, thereby enhancing overall site safety compliance and operational integrity across diverse projects.

Major applications of safety nets extend significantly into logistics, warehousing, and specialized sectors like mining and automotive manufacturing, where barrier netting secures stored goods or protects specialized equipment from environmental factors and accidental impacts. The core benefits derived from integrating these systems include compliance with international safety standards (such as EN 1263-1 and ANSI A10.11), substantial reduction in lost workdays due to accidents, and improved project timelines through enhanced worker confidence and operational continuity. Furthermore, modern safety nets incorporate treatments for fire retardancy and enhanced weather resistance, extending their utility in diverse climatic conditions and complex operational environments, cementing their status as indispensable components of modern industrial risk management strategies.

Driving factors propelling market expansion are fundamentally linked to global urbanization trends, necessitating accelerated infrastructure projects, especially in developing regions like Asia Pacific. Secondly, the increasing regulatory oversight by governmental bodies, such as OSHA in North America and equivalent agencies in Europe, mandating the use of certified safety measures, significantly boosts demand. Additionally, technological advancements leading to lighter, stronger, and easier-to-install netting systems, coupled with growing awareness regarding the cost of workplace injuries versus preventative investment, are collectively accelerating market penetration globally. The shift toward sustainable materials and intelligent monitoring systems integrated into netting infrastructure also acts as a crucial market impetus, optimizing maintenance cycles and ensuring continuous compliance.

Safety Net Market Executive Summary

The Safety Net Market is characterized by robust business trends driven primarily by strict governmental regulation regarding workplace safety and the global surge in large-scale civil engineering and commercial construction projects. Key industry players are increasingly focusing on product innovation, specifically the development of higher-tenacity polymers and modular installation systems that minimize setup time and enhance reusability across multiple projects. A notable business trend is the consolidation among smaller regional suppliers and large international manufacturers seeking to vertically integrate production capabilities and expand their geographical footprint, especially in high-growth emerging economies. Furthermore, the market exhibits a strong shift towards leasing and rental models for short-term construction projects, optimizing capital expenditure for contractors while ensuring access to the latest certified safety equipment, fostering both flexibility and compliance across the industry.

Regional trends indicate that North America and Europe maintain maturity, defined by stringent enforcement of existing safety laws and high adoption rates of premium, certified fall protection systems. The Asia Pacific region, conversely, represents the highest growth potential, fueled by massive investment in urbanization, transportation infrastructure (rail, highways), and rapid industrialization in countries like India and China. Regulatory bodies in APAC are gradually converging toward global standards, creating immediate opportunities for standardized safety net solutions. Latin America and the Middle East & Africa (MEA) are emerging markets, characterized by rapid, often less standardized, construction growth; however, increasing international contractor involvement is steadily driving the adoption of high-quality safety solutions to meet global project insurance and liability requirements.

Segmentation trends highlight the dominance of Fall Protection Netting, reflecting the critical need to address fatal fall accidents, the leading cause of death in the construction industry. The material segment is seeing a preference shift toward polyester and high-density polyethylene (HDPE) due to superior strength-to-weight ratios and enhanced longevity under harsh UV exposure compared to traditional nylon. Application-wise, the construction sector remains the largest consumer, though the warehousing and logistics segment is rapidly expanding its demand for barrier and pallet netting systems to manage inventory security and enhance operational safety within automated facilities. This trend indicates a diversification away from purely structural safety applications toward preventative measures in goods handling and storage optimization.

AI Impact Analysis on Safety Net Market

User inquiries regarding the intersection of AI and the Safety Net Market frequently revolve around three core themes: predictive maintenance, regulatory compliance monitoring, and the integration of smart sensors into traditional netting infrastructure. Users are concerned about how AI algorithms can predict material degradation or structural weakness in installed nets before failure, maximizing their service life and ensuring continuous safety compliance. Common questions also focus on automated compliance systems—specifically, whether AI vision systems can monitor construction sites in real-time to ensure safety nets are correctly installed and used, automatically identifying gaps in coverage or improper attachment points, thereby reducing human error and enhancing proactive risk management. Expectations are high for AI to transform passive safety equipment into active, monitored systems, shifting the industry paradigm from reactive inspection to predictive assurance, significantly improving overall worker safety protocols and operational efficiencies across large-scale projects.

The primary concern among potential users is the complexity and cost of retrofitting existing netting systems with required sensor technology and computational infrastructure capable of running sophisticated AI models. Users want clarification on the return on investment (ROI) associated with these high-tech deployments compared to traditional visual inspection methods, particularly regarding long-term cost savings in accident prevention and liability reduction. There is a general expectation that AI will streamline the regulatory documentation process, automatically generating audit trails and compliance reports based on continuous monitoring data, which is highly valued by contractors facing rigorous local and international safety audits. Furthermore, users are exploring the ethical implications and data privacy concerns associated with using AI-powered cameras or drones for continuous worker monitoring, ensuring technology enhances safety without infringing on privacy rights or creating unnecessarily punitive work environments, necessitating robust data governance frameworks.

The practical application of AI in this domain is currently centered on optimizing logistics and inventory management for large netting supplies, using algorithms to determine optimal replacement cycles based on environmental exposure data (UV intensity, temperature variations, stress loads) collected via embedded, low-power IoT sensors. This integration of smart netting materials facilitates condition-based monitoring, moving away from fixed replacement schedules, thereby enhancing material utilization and reducing waste. AI is also leveraged in designing customized netting systems, utilizing computational fluid dynamics (CFD) and structural analysis to model various fall scenarios and debris containment requirements specific to unique architectural designs, guaranteeing bespoke safety performance that meets or exceeds standard regulatory requirements, offering a significant value proposition in complex construction projects.

- Real-time monitoring of net integrity and structural load parameters using embedded IoT sensors and machine learning algorithms.

- Predictive maintenance schedules calculated by AI based on material exposure history, preventing catastrophic failures due to degradation.

- Automated compliance verification through AI-powered site monitoring (drones/CCTV) identifying gaps in safety net installation or improper usage.

- Optimization of material usage and cutting patterns during manufacturing via generative design algorithms, reducing waste.

- Enhanced regulatory reporting by automatically aggregating safety data and generating audit-ready compliance documentation.

DRO & Impact Forces Of Safety Net Market

The Safety Net Market is fundamentally driven by continuously intensifying global regulatory frameworks focused on occupational safety, mandating high-quality protective equipment in high-risk industries like construction and oil & gas. This regulatory pressure, exemplified by updates to European EN standards and stricter enforcement by OSHA, forms the primary impact force accelerating market adoption. A parallel driver is the increasing complexity and scale of modern infrastructure and skyscraper construction, which inherently introduces greater risks of falls and requires specialized, customized containment solutions far beyond standard scaffolding netting. The global expansion of urbanization and infrastructure investment, particularly in Asia Pacific and the Middle East, provides a substantial opportunity base for market players, especially those offering advanced composite materials with improved longevity and easier installation mechanisms.

However, the market faces significant restraints, including the high initial cost associated with purchasing, installing, and certifying advanced safety netting systems compared to conventional barrier methods. This cost factor often dissuades smaller contractors, particularly in price-sensitive developing markets, leading to reliance on less effective, non-certified alternatives, posing a constant challenge to market standardization. Furthermore, a major restraint involves the lack of skilled labor for proper installation and maintenance, as incorrect deployment significantly compromises the safety functionality of the netting system, leading to potential regulatory fines or, worse, safety incidents. This reliance on expert installation necessitates comprehensive training programs and certification pathways, which are often underdeveloped in emerging construction hubs, creating an adoption bottleneck that industry players must address through specialized training initiatives.

Opportunities in the market primarily reside in the development and proliferation of smart netting solutions integrating IoT and material science advancements, enabling real-time integrity monitoring and automated compliance checks. This technological integration offers a strong value proposition for premium pricing. Another significant opportunity lies in the burgeoning industrial safety sector, specifically high-rack warehouse logistics and robotic work cells, which increasingly require permanent, high-tenacity barrier netting to protect equipment and personnel from dynamic operational risks. The impact forces on the market are overwhelmingly positive, driven by zero-tolerance policies toward workplace fatalities across global corporations and the escalating financial and reputational costs associated with major site accidents, effectively mandating investment in best-in-class passive safety solutions across the industrial spectrum.

Segmentation Analysis

The Safety Net Market segmentation provides a granular view of product utilization, material preference, and application demand across various industrial environments. The segmentation is crucial for understanding specific technological and regulatory requirements that drive procurement decisions, allowing manufacturers to tailor products for specific performance needs, such as debris containment versus kinetic energy absorption in fall arrest systems. Key segmentation factors include the type of material used (determining strength and durability), the specific netting function (e.g., vertical barrier or horizontal fall arrest), and the end-user application, with construction being the dominant but increasingly diversified category. Analyzing these segments helps stakeholders track evolving trends, such as the increasing adoption of higher-grade, UV-stabilized materials across all major segments due to performance demands and longer service life expectations.

Material composition segmentation highlights the trade-offs between cost, longevity, and tensile strength, with Polyester and Nylon dominating high-performance fall protection applications due to their elasticity and superior energy dampening properties. Conversely, Polyethylene and Polypropylene are prevalent in cost-effective debris and perimeter barrier netting, where UV stability and ease of installation are prioritized over extreme load absorption. The segmentation by type, specifically between Fall Protection Netting (EN 1263-1 compliant) and Debris Netting, dictates the regulatory environment and certification requirements, with fall protection demanding rigorous testing and stringent adherence to load ratings. This functional distinction ensures that products meet the precise safety requirements needed for preventing critical injuries, contrasting sharply with the primary function of debris nets, which is site cleanliness and protecting external environments.

The application segmentation reveals the highest concentration of demand in commercial and residential construction, driven by height regulations and mandatory fall protection standards. However, the rapidly growing logistics and warehousing segment requires specialized netting for pallet rack safety, ensuring inventory stability and preventing goods from falling into aisles or damaging automation equipment. This diversification highlights the evolving market scope, extending beyond traditional outdoor site safety into controlled, internal industrial environments, necessitating highly durable, fire-retardant materials. Understanding these niche application requirements is essential for market penetration and product development, especially concerning bespoke dimensions and integration with automated material handling systems that demand high-visibility and low-profile netting solutions.

- By Material

- Nylon

- Polypropylene (PP)

- Polyester

- High-Density Polyethylene (HDPE)

- Other Synthetic Fibers

- By Type

- Fall Protection Netting (Personnel Safety)

- Debris Netting (Containment and Scaffolding)

- Barrier Netting (Perimeter Security, Pallet Rack Safety)

- Bird/Animal Control Netting

- By Application

- Construction (Commercial, Residential, Infrastructure)

- Industrial & Manufacturing

- Logistics & Warehousing

- Mining & Resources

- Sports & Recreation (Safety Barriers)

- Defense & Aerospace

Value Chain Analysis For Safety Net Market

The value chain for the Safety Net Market begins with the upstream segment, dominated by the procurement of raw synthetic polymer granules, primarily nylon, polyester, and polypropylene resin pellets, which are petroleum derivatives. Key activities here involve the synthesis of high-tenacity fibers with specific characteristics, such as UV stabilization, fire retardancy, and enhanced tensile strength, ensuring the material base meets rigorous performance standards required by international safety certifications. Suppliers in this phase are large chemical manufacturers and specialized polymer compounders who dictate the foundational quality and cost structure of the end product. Innovations at the upstream level, such as the introduction of more sustainable, recycled, or bio-based polymers, have a direct and significant impact on the final product's environmental footprint and regulatory compliance attractiveness, driving specialized sourcing decisions by net manufacturers.

Midstream activities encompass the manufacturing process itself, involving sophisticated weaving, knotting, and heat-setting techniques to produce the nets with precise mesh sizes and load-bearing capacities. Manufacturers invest heavily in automated machinery to ensure consistent quality, especially concerning knot strength and net border finishing, which are critical safety points. A pivotal element in the midstream is third-party testing and certification (e.g., CE marking, ANSI compliance), which adds substantial value and validates the product's fitness for purpose. The efficiency and scale of production, coupled with adherence to quality management systems, determine the manufacturer's competitive edge and their ability to service large, time-sensitive infrastructure projects that demand high volumes of certified netting quickly. Customization for project-specific dimensions and load requirements is a major midstream value-add.

Downstream distribution channels are crucial for market access and timely project delivery, encompassing both direct sales to major construction companies and indirect distribution through specialized safety equipment dealers, rental companies, and industrial supply houses. Rental channels are increasingly important for high-cost, high-performance fall protection systems, offering flexibility to contractors. Direct sales often handle large infrastructure bids where technical consultation and post-installation services are required. Furthermore, professional installation services, often provided or certified by the manufacturer, represent a significant downstream service component, ensuring the nets are erected according to engineering specifications. Effective supply chain management and logistical capabilities are paramount in this phase, given the large size and bulk of netted products requiring efficient transportation and warehousing solutions close to active construction hubs.

Safety Net Market Potential Customers

The primary end-users and buyers of safety net products are deeply rooted in the construction industry, encompassing general contractors, specialized subcontractors (e.g., scaffolding and roofing experts), and major infrastructure developers engaged in projects like bridge building, highway construction, and large commercial complex erection. These entities procure safety nets not just for regulatory compliance but as a fundamental risk mitigation strategy to protect their workforce, assets, and public liability, viewing it as a critical operational expenditure. Their buying decisions are heavily influenced by product certifications (EN, ANSI), ease of installation, durability, and the supplier's capacity to deliver customized netting solutions quickly to meet dynamic project schedules. Large contractors often prioritize long-term relationships with suppliers that can guarantee consistent quality and offer comprehensive technical support.

A rapidly expanding segment of potential customers includes operators in the logistics and warehousing sector, particularly those managing high-rack storage systems and automated facilities. These customers utilize barrier netting extensively for securing palletized goods against collapse, protecting personnel working in aisles, and preventing damage to high-value automation equipment from falling debris. Their specific requirements focus on fire resistance, material visibility, and compatibility with standardized racking systems. Additionally, the mining, oil and gas, and shipbuilding industries represent significant buyers, utilizing specialized, often chemical-resistant and flame-retardant, netting for equipment isolation, personnel protection in high-risk zones, and containment during maintenance or repair activities, reflecting a distinct need for extreme performance materials.

Furthermore, government bodies and municipal authorities are substantial indirect and direct customers. They enforce safety standards and also procure specialized netting for public infrastructure protection, such as barrier nets for bridges under repair, highway anti-litter netting, and temporary security barriers around public works sites. Finally, the sports and recreation sector, including major stadiums, indoor arenas, and specialized training facilities, uses safety and barrier netting extensively to separate spectators from play areas, protect users from projectiles (e.g., baseball, golf balls), and manage crowd control. This varied customer base demands a highly segmented product portfolio, ranging from high-tensile, certified fall protection systems to durable, cost-effective debris and barrier solutions, illustrating the broad applicability of safety netting technology across the modern economy.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 1.85 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | InCord Ltd., Safetylink International, KEE SAFETY LTD., P&P Safety, Safenet Systems, JSA Consultancy and Training, Netting Professionals, Honeycomb Safety Net, Svezzini Srl, GNB Safety Nets, Safesite Ltd., Sellars Absorbents, Guardian Fall Protection, NTS Safety Nets, TEUFELBERGER, Jakob Rope Systems, Safespan Platforms, Capital Safety Group, 3M Safety (Select Product Lines), MSA Safety Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Safety Net Market Key Technology Landscape

The technology landscape of the Safety Net Market is rapidly advancing, moving beyond traditional textile engineering toward integrated smart safety solutions. Core material innovation focuses on developing synthetic polymers with superior characteristics, specifically focusing on enhanced UV stability, minimizing degradation under continuous sunlight exposure, which is critical for long-term construction projects. Advances in extrusion and knitting technologies allow for the creation of lighter, yet stronger, high-tenacity fibers that improve net longevity and reduce installation weight. Furthermore, the development of specialized coatings, including advanced fire retardants compliant with increasingly strict codes (e.g., NFPA standards), ensures that netting systems maintain structural integrity and minimize fire risk in densely populated or high-hazard industrial environments. These material science breakthroughs enable manufacturers to offer products with extended warranties and compliance across a broader range of international standards, enhancing their competitive positioning and overall market value proposition.

The integration of digital technology, particularly IoT (Internet of Things) and RFID (Radio Frequency Identification) tagging, is fundamentally transforming how safety nets are managed and monitored on site. RFID tags embedded into the netting's perimeter allow for rapid inventory tracking, automated inspection logging, and verification of certification status, streamlining compliance checks and preventing the inadvertent use of expired or damaged equipment. Moreover, sophisticated load cell sensors and strain gauges are being developed and tested for integration into high-stress points of fall protection systems. These embedded sensors provide real-time data on the load bearing capacity and stress levels experienced by the net, transmitting alerts if predefined safety thresholds are approached or exceeded. This data allows site managers to proactively address potential safety compromises, such as excessive wind loading or material fatigue, transforming the net from a purely passive element into an active, monitored safety asset, significantly enhancing risk management capabilities.

Further technological refinement involves advanced computational modeling, including Finite Element Analysis (FEA) and Computational Fluid Dynamics (CFD), used during the design phase. FEA simulations allow engineers to accurately model the complex energy absorption dynamics of different mesh configurations and material combinations under various impact scenarios (e.g., impact velocity, mass, and angle), ensuring optimal performance and compliance with rigorous fall arrest standards. CFD modeling assists in designing netting for sites exposed to high wind loads, ensuring the netting remains stable and functional without causing undue structural stress on supporting structures, such as scaffolding. These modeling tools allow for highly customized, performance-optimized solutions for unique or challenging construction environments, significantly reducing the risks associated with non-standard installations and positioning technology as a critical differentiator in the high-stakes fall protection segment.

Regional Highlights

Regional dynamics play a crucial role in shaping the demand and technological adoption within the Safety Net Market, primarily driven by localized regulatory rigor, economic activity, and specific construction methodologies prevalent in each geography. North America and Europe, characterized by highly mature regulatory landscapes enforced by agencies like OSHA and EU bodies, are major consumers of certified, high-performance, and technologically advanced fall protection and debris containment systems. In these regions, the emphasis is heavily placed on long-term investment in reusable, high-quality netting and sophisticated installation systems, leading to a strong demand for polyester and high-grade nylon solutions with integrated tracking and monitoring capabilities to meet strict audit requirements and liability minimization strategies.

The Asia Pacific (APAC) region stands out as the global growth engine, propelled by massive governmental expenditure on infrastructure, urbanization, and industrial expansion in countries such as China, India, and Southeast Asian nations. While the market in APAC is currently price-sensitive, leading to a higher usage of more affordable Polypropylene (PP) and HDPE debris netting, there is a clear trend toward adopting international safety standards, especially in projects involving multinational contractors or foreign investment. This convergence is rapidly increasing the demand for certified fall protection netting, opening significant opportunities for international manufacturers capable of offering competitive pricing alongside certified products and localized technical support and training programs essential for compliance.

Latin America and the Middle East & Africa (MEA) represent emerging opportunity zones. The MEA market, driven by large-scale oil and gas projects and monumental construction developments in the UAE and Saudi Arabia, exhibits high demand for specialized, robust netting systems, often requiring high fire-retardancy and resistance to extreme environmental conditions (heat, dust). Latin America’s market growth is more localized but is benefiting from increased regulatory focus on worker safety in sectors like mining and large infrastructure projects. These regions require suppliers who can navigate complex import regulations and provide locally tailored logistical solutions, often necessitating partnerships with local distributors to ensure smooth market entry and efficient service delivery, reflecting the necessity of localized business strategies.

- North America: High regulatory compliance, dominance of certified fall protection netting, early adoption of smart netting technologies and robust demand in industrial and major infrastructure sectors.

- Europe: Driven by strict EN standards (EN 1263-1), strong preference for high-quality, reusable systems, significant market share in debris containment for dense urban construction environments, and strong focus on sustainability.

- Asia Pacific (APAC): Highest volume growth potential fueled by massive infrastructure projects, increasing push toward adopting global safety standards, large market for cost-effective debris netting, and rapidly expanding industrial segment.

- Middle East & Africa (MEA): Demand for high-performance, weather-resistant, and fire-retardant materials for large-scale construction projects (megacities, energy sector), driven by international contractors and high project value.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Safety Net Market.- InCord Ltd.

- Safetylink International

- KEE SAFETY LTD.

- P&P Safety

- Safenet Systems

- JSA Consultancy and Training

- Netting Professionals

- Honeycomb Safety Net

- Svezzini Srl

- GNB Safety Nets

- Safesite Ltd.

- Sellars Absorbents

- Guardian Fall Protection

- NTS Safety Nets

- TEUFELBERGER

- Jakob Rope Systems

- Safespan Platforms

- Capital Safety Group

- 3M Safety (Select Product Lines)

- MSA Safety Inc.

Frequently Asked Questions

Analyze common user questions about the Safety Net market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Type S and Type T safety nets in construction?

Type S nets are system U nets supported by structural steel or primary structures, offering horizontal fall protection across large areas. Type T nets, conversely, are supported by specialized temporary cantilevers or intermediate structures, used where edge protection is required, often focusing on catching workers falling near the perimeter or from a specific level. Compliance standards mandate distinct installation and testing procedures for each type based on their specific application and support mechanism.

How does regulatory compliance affect safety net material choice and market pricing?

Regulatory mandates (like EN 1263-1 or ANSI A10.11) necessitate the use of high-tenacity, certified materials (Nylon/Polyester) that undergo rigorous, documented testing for load absorption and UV degradation. This stringent requirement significantly increases production costs and, consequently, the market price of certified fall protection nets, differentiating them sharply from non-certified debris netting made from cheaper materials like standard Polypropylene.

What role does IoT technology play in modern safety net management?

IoT technology, through embedded sensors (e.g., RFID tags or strain gauges), enables real-time monitoring of safety net condition, usage, and installation status. This allows site managers to track the net's service history, verify its active certification status automatically, and monitor stress levels, thereby facilitating proactive maintenance and ensuring continuous compliance with safety protocols throughout the project lifecycle.

Which application segment offers the highest growth opportunity for safety net manufacturers?

The Logistics and Warehousing segment offers one of the highest growth opportunities, particularly in demand for barrier netting used for pallet rack safety and separating automated machinery zones. This growth is driven by the rapid expansion of e-commerce, increasing warehouse automation, and stricter internal safety policies regarding inventory security and equipment protection, requiring durable, fire-retardant netting solutions.

What are the key sustainability considerations influencing the safety net market?

Sustainability considerations focus primarily on extending product lifespan through enhanced UV resistance and reusability, minimizing waste. There is also an emerging trend toward utilizing recycled or bio-based polymers in non-critical debris netting and a demand for manufacturers to establish clear end-of-life recycling programs for spent synthetic fiber products, aligning with broader industry environmental, social, and governance (ESG) goals.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager