SAG Mill And AG Mill Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433001 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

SAG Mill And AG Mill Market Size

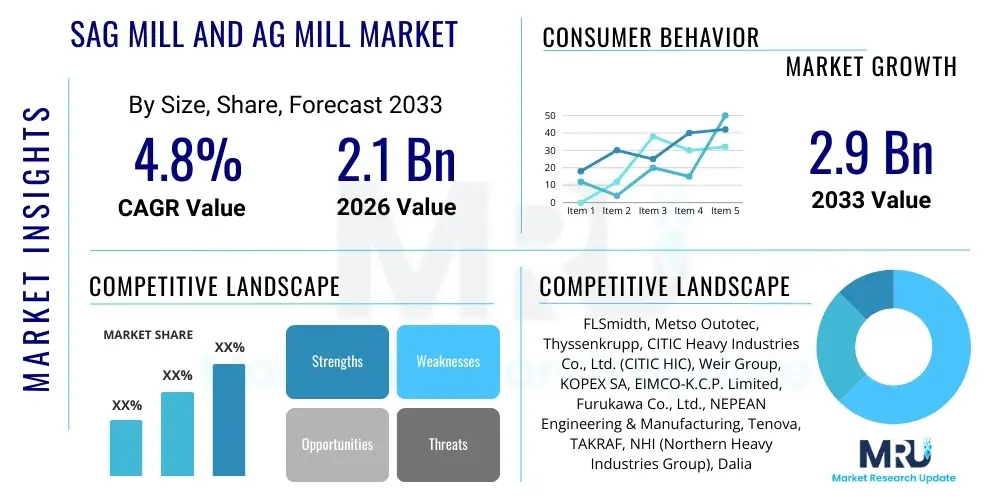

The SAG Mill And AG Mill Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 2.1 Billion in 2026 and is projected to reach USD 2.9 Billion by the end of the forecast period in 2033.

SAG Mill And AG Mill Market introduction

The SAG (Semi-Autogenous Grinding) Mill and AG (Autogenous Grinding) Mill market is foundational to the mineral processing industry, providing high-capacity comminution solutions crucial for crushing and grinding various ore types, including copper, gold, iron ore, and platinum group metals. These mills utilize the ore itself as the primary grinding medium (AG) or supplement this with a small charge of steel balls (SAG), significantly reducing dependence on traditional crushing circuits. The large size and high throughput capabilities of modern SAG and AG mills are indispensable in large-scale mining operations globally, especially as the average grade of economically viable ores continues to decline, necessitating the processing of increasingly larger volumes of material to maintain metal output.

The core functionality of these mills revolves around achieving required particle size distribution for subsequent flotation, leaching, or separation processes, directly impacting overall metallurgical recovery rates and operational efficiency. The market is driven by several key factors, including the increasing global demand for critical minerals required for the energy transition and infrastructure development, coupled with major investments in greenfield and brownfield mining projects, particularly in regions rich in untapped reserves. Furthermore, the inherent benefits of SAG and AG mills—such as lower energy consumption per ton compared to conventional ball mills in certain applications, ability to handle varying feed sizes, and reduced media consumption in AG configurations—make them the preferred choice for high-volume processing facilities.

Major applications span base metal mining, precious metal processing, and industrial mineral production. The continuous push toward maximizing operational uptime and reducing lifetime operational expenditure (OPEX) fuels innovation in mill design, liner materials, and digital monitoring systems. Key benefits include enhanced capacity utilization, optimized energy usage through advanced control systems, and improved safety due to reduced manual interaction. The driving factors primarily center on the necessity for high-capacity machines to combat falling ore grades, the technological advancements in gearless drive systems (GMDs), and the global shift towards remote and automated operation to mitigate labor costs and safety risks.

SAG Mill And AG Mill Market Executive Summary

The SAG Mill and AG Mill Market is undergoing a transformation characterized by substantial capital investment in large-scale projects and a pronounced emphasis on digital integration for operational optimization. Business trends show a consolidation among key original equipment manufacturers (OEMs) who are heavily investing in proprietary wear components and predictive maintenance software to create comprehensive service contracts, moving beyond simple equipment sales. The trend toward extremely large mill diameters (up to 42 feet) is pervasive, driven by the need for higher throughput in new copper and gold mines. Geographically, the Asia Pacific region, particularly Australia and China, remains the epicenter of market activity due to robust iron ore and gold mining sectors, while Latin America is witnessing significant new project development centered around vast copper reserves in Chile and Peru. This geographical shift necessitates localized manufacturing and specialized service capabilities tailored to regional regulatory and logistical challenges.

Regarding regional trends, North America and Europe are focusing primarily on modernizing existing facilities and adopting advanced energy-efficient technologies to meet stringent environmental regulations, creating a strong aftermarket demand for high-performance liners and refurbished gearless drives. Conversely, developing regions like Africa and certain parts of APAC are prioritizing new installations, often requiring modular and rapid deployment solutions suitable for remote locations. Supply chain resilience has become a critical factor post-2020, compelling OEMs to diversify sourcing of critical components like high-strength steel and specialized electrical systems, influencing pricing and lead times across the global market. Furthermore, sustainability concerns are increasingly influencing procurement decisions, favoring mills designed for reduced energy intensity and those supporting water-efficient processing techniques.

Segment trends highlight the dominance of SAG mills over AG mills due to their adaptability to a broader range of ore types and the ability to achieve finer grind sizes more consistently, although AG mills remain preferred in specific high-competency ore applications. Within the application segment, the copper mining industry represents the largest consumer, fueled by the global electrification movement and the necessity of high-volume processing plants. The demand for modular and semi-mobile SAG solutions is increasing in smaller or remote mining operations, offering flexibility and reduced installation costs. Financially, the market is highly capital-intensive, characterized by long sales cycles and dependency on global commodity price volatility, requiring manufacturers to maintain strong financial reserves and robust risk management strategies to weather cyclical downturns.

AI Impact Analysis on SAG Mill And AG Mill Market

User queries regarding the impact of Artificial Intelligence (AI) on the SAG and AG Mill market predominantly center on achieving true autonomous operation, enhancing predictive maintenance capabilities to eliminate unplanned downtime, and optimizing energy consumption in real-time. Key concerns revolve around the complexity of integrating AI models with legacy control systems (DCS/PLC), the necessity for large, clean datasets specific to individual ore bodies and mill performance, and the required return on investment (ROI) given the high upfront cost of sensor technology and computational infrastructure. Expectations are high for AI to transition milling from reactive or scheduled maintenance to highly proactive, condition-based strategies, ensuring maximum metal recovery while minimizing the extreme energy demands associated with comminution. Users seek confirmation that AI can successfully manage dynamic variables such as changing ore hardness and feed rate fluctuations without human intervention, ensuring optimal mill loading and ball charge adjustments continuously.

The application of advanced machine learning algorithms is revolutionizing the efficiency and reliability of SAG and AG mills by processing vast quantities of multivariate sensor data—including vibration analysis, acoustics, power draw, and slurry density—to generate deep operational insights. These models can predict imminent failures of critical components, such as liners, gears, or bearings, far earlier than traditional methods, allowing for scheduled maintenance interventions that drastically minimize catastrophic equipment failure and associated financial losses. Furthermore, prescriptive analytics derived from AI allows mill operators to dynamically adjust operational set points, optimizing parameters such as ball charge, water addition, and feed rate to maintain peak efficiency despite variations in feed material characteristics, thereby maximizing throughput and recovery rates while simultaneously reducing specific energy consumption.

This transformative impact extends beyond maintenance into process control. AI-driven vision systems coupled with deep learning are being deployed to monitor rock size distribution in the mill feed and discharge, providing instantaneous feedback for crusher set points upstream and classification parameters downstream. This closed-loop optimization facilitated by AI significantly reduces process variability and maximizes the effective work done by the mill. Although initial implementation requires substantial capital outlay and specialized data science talent, the long-term benefit of prolonged equipment life, enhanced energy efficiency (potentially reducing energy costs by 5-10%), and maximizing metal recovery validates the commercial viability of AI integration in next-generation SAG and AG mill installations and retrofits across the globe.

- AI facilitates predictive maintenance for critical components (liners, bearings), reducing unplanned downtime.

- Machine learning algorithms optimize ball charge and slurry density in real-time, maximizing grinding efficiency.

- AI-powered process control enables autonomous operation, adapting to variable ore hardness and feed characteristics.

- Energy consumption models utilize neural networks to minimize specific energy input per ton of processed material.

- Advanced sensors and edge computing infrastructure are essential for data collection and localized AI processing.

- Risk assessment and anomaly detection models enhance operator safety and equipment longevity.

DRO & Impact Forces Of SAG Mill And AG Mill Market

The dynamics of the SAG Mill and AG Mill market are intricately linked to global mining cycles, commodity prices, and technological evolution, defined by a complex interplay of Drivers, Restraints, and Opportunities (DRO). The paramount driver is the continuous depletion of high-grade, near-surface ore deposits, forcing mining companies to process large volumes of lower-grade, often harder, and geologically complex deep-seated ores. This geological reality necessitates the deployment of high-throughput, large-diameter SAG and AG mills capable of handling massive material flows efficiently. Coupled with this is the robust, long-term global demand for essential metals like copper (driven by electric vehicles and renewable energy infrastructure), gold (as a geopolitical hedge), and iron ore (fundamental to global construction), ensuring continued investment in mineral processing infrastructure, particularly in regions with significant untapped reserves such as Latin America and Western Australia. These economic forces provide a stable foundation for capital expenditure in new mill installations and capacity expansions worldwide.

Despite these strong drivers, the market faces significant Restraints. The most substantial challenge is the extremely high capital expenditure (CAPEX) required for purchasing, installing, and commissioning these massive mills, often running into hundreds of millions of USD for a complete comminution circuit. This high initial cost makes market growth highly susceptible to volatile commodity price fluctuations and restricts investment during cyclical downturns or periods of economic uncertainty. Furthermore, the immense size and complexity of SAG and AG mills create logistical challenges, particularly in remote mining locations, increasing project timelines and costs. Regulatory hurdles pertaining to energy consumption and environmental impact also serve as restraints, pressuring manufacturers to constantly innovate towards more sustainable, water-efficient, and zero-emission operational profiles, which often increases design and manufacturing complexity.

Opportunities for growth are primarily centered on technological innovation and geographical expansion. The growing demand for modular and mobile SAG solutions presents a significant opportunity for junior mining operations or those with shorter mine lifespans, offering flexibility and reduced site preparation costs. The aftermarket sector presents a lucrative opportunity, driven by the necessity for advanced wear components (high-performance liners made of composite or specialized steel alloys) and digital retrofit solutions focused on energy efficiency optimization and predictive maintenance. Impact Forces are heavily skewed towards global energy costs and geopolitical stability; increased energy prices directly impact the operational costs of these power-hungry machines, influencing investment decisions, while geopolitical risks can disrupt mineral supply chains and lead to project delays or cancellations, demonstrating the market's high sensitivity to external macro-economic and political events.

Segmentation Analysis

The SAG Mill and AG Mill market is comprehensively segmented primarily based on mill type, size, application (end-user industry), and drive mechanism, reflecting the varied operational requirements across the global mining landscape. The segmentation by mill type—SAG versus AG—is fundamental, with SAG mills dominating the market due to their versatility and ability to process a wider range of ore characteristics, often acting as a primary crusher, secondary crusher, and tertiary grinder in a single unit. Conversely, AG mills are typically specified for processing ores with highly autogenous grinding properties. Segmentation by size (e.g., small, medium, large, and ultra-large capacity) directly correlates with the scale of the mining operation; the trend towards ultra-large mills (exceeding 40 ft diameter) is driven by flagship mining projects requiring over 100,000 tons per day throughput.

Application-based segmentation is critical, showing distinct demand patterns across key mineral sectors. Copper mining consistently represents the largest application segment, primarily due to the vast scale of modern porphyry copper deposits which rely heavily on high-capacity SAG mills for comminution. Gold, iron ore, and other precious or base metals follow, each segment having unique requirements regarding grind size and mill characteristics. For instance, iron ore processing often requires high throughput screening and specialized crushing alongside the milling process, influencing total circuit design. Furthermore, the technology segmentation, focusing on the drive mechanism (e.g., ring-motor/gearless versus conventional ring gear), distinguishes between high-CAPEX, high-efficiency systems and more traditional, lower initial cost installations, impacting maintenance profiles and long-term OPEX.

Geographical segmentation remains crucial for understanding regional market maturity, with established mining economies like Australia and North America focusing on replacement and retrofit projects, while high-growth regions like Latin America and Africa are characterized by greenfield project development. The selection criteria within each segment are multifaceted, balancing initial investment cost, projected energy efficiency, maintenance complexity, and suitability for the specific ore body. The sustained emphasis on maximizing energy efficiency and reducing environmental footprint continues to drive segment growth towards technologically advanced, digitally integrated solutions across all sizes and application areas.

- By Mill Type:

- SAG Mill (Semi-Autogenous Grinding Mill)

- AG Mill (Autogenous Grinding Mill)

- By Size/Capacity:

- Small Capacity (Below 18 ft Diameter)

- Medium Capacity (18 ft to 28 ft Diameter)

- Large Capacity (28 ft to 38 ft Diameter)

- Ultra-Large Capacity (Above 38 ft Diameter)

- By Application (End-User Industry):

- Copper Mining

- Gold Mining

- Iron Ore Mining

- Other Metals (e.g., Platinum Group Metals, Nickel)

- Industrial Minerals

- By Drive Mechanism:

- Gearless Mill Drives (GMD)

- Conventional Ring Gear Drives

Value Chain Analysis For SAG Mill And AG Mill Market

The value chain for the SAG Mill and AG Mill market is characterized by high levels of specialization, capital intensity, and complex global logistics, starting from the sourcing of critical raw materials through to long-term aftermarket service contracts. The upstream segment involves the procurement of high-quality, high-strength steel alloys for the mill shells, specialized rubber or composite materials for liners, and advanced electrical components for the drive systems (motors, transformers, and frequency converters). Manufacturers often rely on a highly concentrated supply base for specialized components like gearless drive motors, leading to high bargaining power among key technology providers. The high precision required in casting and machining these massive components means quality control and supplier certification are critical upstream activities, heavily influencing the final product's reliability and lifespan.

The core manufacturing stage involves sophisticated engineering, fabrication, and assembly. Due to the sheer size of the mills, fabrication often occurs in sections at specialized global facilities, followed by complex logistical planning to transport the components to remote mine sites. Key OEMs manage the entire engineering design, often utilizing proprietary simulation and modeling software to optimize mill geometry for specific ore characteristics. Distribution channels are predominantly direct, involving detailed contracts between the OEM and the mining company or an Engineering, Procurement, and Construction (EPC) firm managing the project. Indirect channels are rare for new mill installations but sometimes utilized for smaller components, spare parts, and general consumables through regional distributors and service partners, particularly in the aftermarket segment.

The downstream segment, focused on installation, commissioning, and continuous service, is the most crucial profit center over the mill’s 30+ year lifespan. Installation requires specialized heavy lifting and alignment expertise, often involving the OEM’s dedicated field service teams. Post-commissioning, the long-term profitability shifts towards the provision of high-wear replacement parts (liners, grates) and ongoing digital services, including remote monitoring, control optimization software, and scheduled maintenance. This emphasis on aftermarket support creates a high barrier to entry for new competitors and establishes deep, long-term relationships between manufacturers and end-users, transforming the OEMs into integrated technology and service providers essential to sustaining mining operations.

SAG Mill And AG Mill Market Potential Customers

Potential customers for SAG and AG mills are primarily large, globally diversified mining organizations that operate high-volume mineral processing plants, requiring continuous, robust comminution circuits to sustain metal production. These end-users are characterized by extensive capital expenditure budgets and a long-term investment horizon, typically focused on extracting base metals (copper, nickel) and precious metals (gold, silver) from complex, low-grade deposits. Major global players like Rio Tinto, BHP, Freeport-McMoRan, and Barrick Gold, who manage large-scale greenfield developments or significant brownfield expansions, constitute the core market for ultra-large capacity mills and associated engineering services.

A secondary but rapidly growing customer base includes mid-tier mining companies and junior exploration firms that, while operating on a smaller scale, still require reliable comminution solutions. For these customers, the demand is often focused on medium-sized SAG mills, modular solutions, or refurbished equipment, prioritizing reduced initial CAPEX and accelerated deployment schedules. Furthermore, Engineering, Procurement, and Construction (EPC) firms act as critical indirect buyers, procuring the mills on behalf of the mining clients. EPCs influence purchasing decisions by integrating the milling equipment specifications into the overall plant design, focusing heavily on total lifecycle cost, ease of integration, and vendor reliability.

The decision-making process for these end-users is highly technical and risk-averse, driven by detailed metallurgical testing of the ore body and required throughput specifications. Buyers prioritize proven technology, vendor history, local support capabilities, energy efficiency metrics (kWh per ton), and the contractual guarantees regarding mill availability and throughput performance. The increasing focus on Environmental, Social, and Governance (ESG) criteria also means that potential customers are now actively seeking mills designed for improved safety, minimal environmental footprint, and integration with sustainable energy sources, influencing supplier selection significantly beyond mere price comparisons.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.1 Billion |

| Market Forecast in 2033 | USD 2.9 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | FLSmidth, Metso Outotec, Thyssenkrupp, CITIC Heavy Industries Co., Ltd. (CITIC HIC), Weir Group, KOPEX SA, EIMCO-K.C.P. Limited, Furukawa Co., Ltd., NEPEAN Engineering & Manufacturing, Tenova, TAKRAF, NHI (Northern Heavy Industries Group), Dalian Huarui Heavy Industry (DHHI), Multotec, Tega Industries, Meccano, Sino-Mining Equipment, McLanahan Corporation, Promet Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

SAG Mill And AG Mill Market Key Technology Landscape

The technological landscape of the SAG Mill and AG Mill market is primarily defined by continuous advancements in drive systems, material science for wear components, and the integration of advanced digital control and monitoring platforms. The shift towards Gearless Mill Drives (GMDs) represents the most significant innovation in high-capacity milling. GMDs offer superior energy efficiency, higher availability, precise speed and torque control critical for process optimization, and significantly lower maintenance costs compared to conventional ring gear drives, compensating for their higher initial CAPEX. These systems utilize synchronous motors wrapped directly around the mill shell, providing robust performance necessary for handling transient loads and preventing unscheduled downtime, thereby maximizing throughput in large-scale operations.

Another pivotal area of innovation lies in mill liner technology. Liners, which protect the expensive mill shell from wear, are consumables that directly impact operational efficiency and cost. The industry is rapidly moving away from traditional steel liners towards composite materials, specialized rubber compounds, and advanced high-chromium steel alloys that offer extended service life, reduced weight (improving energy efficiency), and faster, safer replacement cycles. The use of advanced 3D scanning and simulation tools allows for highly optimized liner designs tailored precisely to the ore body's specific abrasive characteristics, ensuring optimal power draw and grinding action throughout the liner life. This material science focus is crucial for reducing OPEX and environmental impact.

The digitalization of the comminution circuit is fundamentally altering operations. Modern mills incorporate extensive sensor arrays (acoustic, vibration, temperature, power) integrated with Industrial Internet of Things (IIoT) platforms. This data feeds into sophisticated Process Control Optimization (PCO) systems and predictive maintenance algorithms (AI/ML models). These digital tools provide operators with real-time insight into mill performance, enabling dynamic adjustments to feed rates, water addition, and ball charge to maintain the optimal "toe and heel" grinding action, ultimately maximizing metal recovery and minimizing specific energy consumption. Technologies such as high-definition cameras and laser scanners are increasingly used to monitor ball and rock size distribution inside the mill, further closing the feedback loop for true autonomous operational control.

Regional Highlights

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market, primarily fueled by massive infrastructure development in China and India, driving persistent high demand for iron ore, copper, and bauxite. Australia remains a global leader in gold and iron ore mining, continuously investing in ultra-large SAG mills for large-scale, low-grade operations in remote locations, driving demand for advanced digital monitoring solutions and robust aftermarket services. Significant greenfield development in emerging economies, particularly in Southeast Asia, further contributes to capacity installations.

- Latin America (LATAM): LATAM is a critical market dominated by major copper and gold projects, particularly in the Andean belt countries of Chile, Peru, and Brazil. The region is characterized by exceptionally large ore bodies, leading to a strong demand for ultra-large SAG mills, often exceeding 40 feet in diameter, many of which utilize Gearless Mill Drives (GMDs). Political stability and commodity price trends are key determinants of market growth, with recent large-scale project investments sustaining demand for new equipment and localized service capabilities.

- North America: The North American market (USA and Canada) is mature, focusing less on greenfield installations and more on modernizing existing facilities, particularly in the copper and gold sectors. Key demand drivers include regulatory pressures requiring improved energy efficiency and safety standards, stimulating the replacement of older conventional mills with modern, digitally integrated SAG systems and GMD technology retrofits. There is a strong emphasis on automation and remote operational control systems due to high labor costs.

- Europe: Europe's market is highly specialized, concentrating on niche mining operations (e.g., base metals in Scandinavia) and serving as a major hub for key OEM manufacturing, engineering design, and R&D for advanced milling technology. Demand is steady for high-efficiency components and advanced digital service contracts, particularly those centered on circular economy principles and sustainable mining practices aimed at minimal energy use and waste generation.

- Middle East & Africa (MEA): The MEA region is characterized by significant untapped reserves of gold, base metals, and phosphate. Growth is accelerating, driven by large-scale mining projects in countries like South Africa, Ghana, and Saudi Arabia. The market favors robust, reliable, and often modular solutions suitable for challenging operating environments and infrastructure limitations, with a growing interest in technology transfer and localized maintenance training.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the SAG Mill And AG Mill Market.- FLSmidth

- Metso Outotec

- Thyssenkrupp

- CITIC Heavy Industries Co., Ltd. (CITIC HIC)

- Weir Group

- KOPEX SA

- EIMCO-K.C.P. Limited

- Furukawa Co., Ltd.

- NEPEAN Engineering & Manufacturing

- Tenova

- TAKRAF

- NHI (Northern Heavy Industries Group)

- Dalian Huarui Heavy Industry (DHHI)

- Multotec

- Tega Industries

- Meccano

- Sino-Mining Equipment

- McLanahan Corporation

- Promet Group

Frequently Asked Questions

Analyze common user questions about the SAG Mill And AG Mill market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a SAG mill and an AG mill, and which is currently dominating the market?

The primary difference lies in the grinding media: an AG (Autogenous Grinding) mill uses only the ore itself for grinding, while a SAG (Semi-Autogenous Grinding) mill supplements the ore with a small charge (typically 6-15%) of steel balls. SAG mills dominate the market due to their broader applicability across various ore hardness levels and their ability to act as a primary and secondary comminution stage in a single unit, offering greater flexibility and efficiency for complex deposits.

How does the shift towards Gearless Mill Drives (GMDs) impact operational cost and energy consumption in large mills?

GMDs significantly improve operational efficiency by eliminating high-wear mechanical components like gearboxes and large ring gears, reducing maintenance costs and increasing mill availability. They provide precise speed control, allowing operators to fine-tune the mill's rotational velocity for optimal energy transfer based on real-time ore characteristics, leading to an overall reduction in specific energy consumption (kWh/ton) compared to conventional geared drives.

Which geographical region exhibits the strongest current demand for new SAG and AG mill installations?

The Asia Pacific (APAC) region currently demonstrates the strongest demand for new installations, driven primarily by large-scale mining expansions in Australia (iron ore, gold) and sustained metal processing demands in China. Latin America, particularly Chile and Peru (copper), also remains a critical market focusing on high-capacity, ultra-large mill projects to process vast low-grade reserves.

What role does digitalization play in maximizing the lifespan and throughput of modern SAG and AG mills?

Digitalization, via Industrial IoT (IIoT) sensors and AI/ML algorithms, enables predictive maintenance by accurately forecasting the remaining useful life of critical components like liners and bearings, thus preventing catastrophic failures. Furthermore, advanced process optimization systems use real-time data to automatically adjust operational parameters, ensuring the mill operates at peak throughput and energy efficiency, directly extending equipment lifespan and maximizing yield.

What are the key technological advancements concerning mill liners, and why are they important?

Key advancements include the adoption of composite and specialized high-chromium alloy liners, replacing traditional steel components. These materials offer enhanced wear resistance, increased service life, and lighter weight, which improves energy efficiency and reduces the frequency of hazardous and costly maintenance shutdowns. Optimized liner design, often guided by sophisticated simulation software, is crucial for maintaining efficient grinding dynamics throughout the liner's operational period.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager