Sailing Apparel Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438722 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Sailing Apparel Market Size

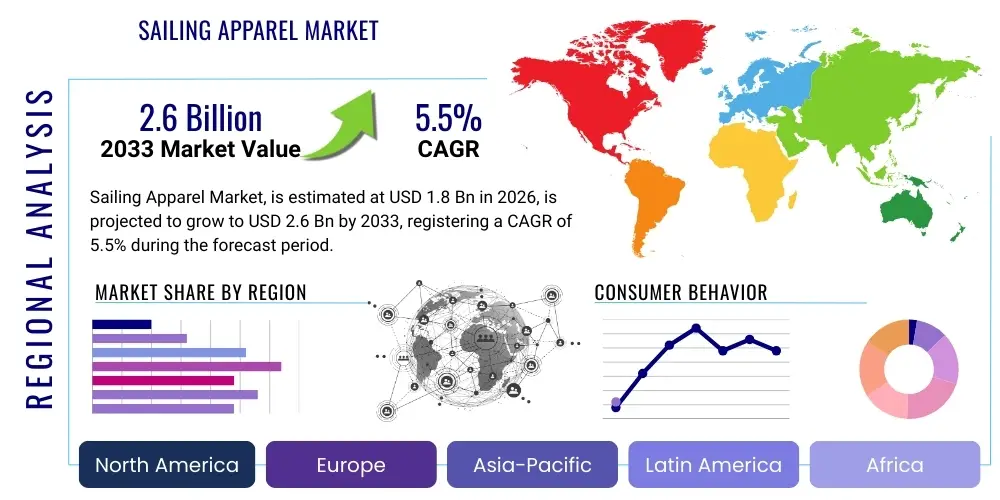

The Sailing Apparel Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.5% between 2026 and 2033. The market is estimated at USD 1.8 billion in 2026 and is projected to reach USD 2.6 billion by the end of the forecast period in 2033.

Sailing Apparel Market introduction

The Sailing Apparel Market encompasses specialized technical clothing designed to provide protection, comfort, and performance for individuals engaged in sailing, yachting, and watersports activities. This sector ranges from highly technical offshore gear, often featuring multi-layered waterproof and breathable membranes, to lightweight inshore and dinghy sailing attire focused on flexibility and quick-drying properties. Key products include foul weather gear (jackets and trousers), mid-layers, base layers, dry suits, buoyancy aids, and specialized footwear, all engineered to withstand extreme marine environments, including saltwater corrosion, high winds, and continuous exposure to moisture and UV radiation.

Major applications for sailing apparel span recreational sailing, competitive yacht racing (including events like the America's Cup and Volvo Ocean Race), and professional maritime operations. The primary benefit derived from high-quality sailing gear is enhanced safety and thermal regulation, preventing hypothermia in cold conditions and overheating in tropical climates. Advanced materials like Gore-Tex, proprietary waterproof coatings (such as DWR finishes), and high-tenacity fabrics (like Cordura) are increasingly utilized to offer superior hydrostatic head ratings and breathability, allowing moisture vapor to escape while blocking liquid water ingress.

Driving factors contributing to market expansion include the increasing global participation in competitive sailing events and recreational yacht chartering, particularly among affluent populations in North America and Europe. Furthermore, technological advancements in material science, leading to lighter, more durable, and environmentally sustainable apparel options, are fueling consumer upgrades. The growing emphasis on sustainability, with brands adopting recycled plastics and PFC-free durable water repellent treatments, also resonates strongly with environmentally conscious consumers, pushing market growth.

Sailing Apparel Market Executive Summary

The Sailing Apparel Market is characterized by robust business trends focusing on innovation in smart textiles and sustainable manufacturing practices. Leading market participants are heavily investing in research and development to integrate features such as sensor technology for monitoring physiological data and sophisticated layering systems that adapt to varying thermal requirements. A significant business trend involves strategic partnerships between apparel manufacturers and professional sailing teams, utilizing high-profile racing circuits as crucial testing and marketing platforms to validate product durability and performance under extreme conditions. Furthermore, the digitalization of retail channels, particularly specialized e-commerce platforms, is expanding market reach globally, allowing smaller, niche brands specializing in specific sailing disciplines (e.g., dinghy racing or ocean cruising) to compete effectively with established giants.

Regionally, Europe maintains its dominance due to a deeply ingrained sailing culture, high consumer purchasing power, and the presence of major competitive sailing circuits like the Mediterranean and Atlantic yacht races. North America, driven by strong recreational boating activity and the growing popularity of coastal cruising, represents a rapidly expanding market, especially for premium, high-tech offshore gear. Asia Pacific is emerging as the fastest-growing region, fueled by rising disposable incomes in coastal metropolitan areas, increased investment in marine infrastructure (marinas and yacht clubs), and the introduction of major international sailing events into countries like China and Australia. Manufacturers are adapting regional strategies to account for distinct climate differences, offering lightweight, high-UV-protection apparel in APAC versus heavy-duty foul weather gear in Northern Europe.

Segment trends indicate a strong polarization in demand. The technical offshore segment, representing the highest value products, is growing due to safety regulations and the adoption of cutting-edge materials. Simultaneously, the lifestyle/casual segment, which integrates performance features into aesthetically pleasing designs suitable for dockside wear, is seeing increased penetration, particularly among younger consumers. The material segment is witnessing a significant shift towards environmentally friendly alternatives, including bio-based polymers and recycled nylon, aligning with global corporate social responsibility mandates. This push for sustainability is not merely a niche requirement but is rapidly becoming a fundamental expectation across all pricing tiers, influencing purchasing decisions from base layers to high-end protective outerwear.

AI Impact Analysis on Sailing Apparel Market

Analysis of common user questions regarding AI's impact on the Sailing Apparel Market reveals key themes centered on personalized fit, supply chain resilience, and innovative product design. Users frequently inquire how AI can optimize inventory management to match highly seasonal demand patterns, predict necessary technical specifications based on regional climate data (e.g., required hydrostatic head for specific sailing routes), and enhance the online customization experience for tailored foul weather gear. Concerns often revolve around data privacy related to wearable tech integrated into apparel and the potential homogenization of design through algorithm-driven trends. Overall expectations highlight AI's role in driving hyper-efficient production, enabling mass customization of performance attributes (like optimal ventilation zones), and significantly improving predictive maintenance models for high-wear components of the gear, thereby extending product lifespan and reducing material waste.

- AI-Driven Design Optimization: Utilizing generative design models to simulate performance characteristics (e.g., aerodynamics, water shedding) and optimize material placement, reducing weight while maintaining protection levels.

- Personalized Sizing and Fit: Implementing 3D body scanning and machine learning algorithms to recommend highly accurate sizes and fit profiles, minimizing returns of expensive technical gear purchased online.

- Supply Chain Forecasting: AI-powered demand sensing and predictive analytics to manage complex global sourcing of specialized fabrics and components, ensuring timely production and minimizing stockouts during peak sailing seasons.

- Smart Textile Integration: Processing data collected from embedded sensors (monitoring temperature, heart rate, and fatigue) using AI to provide real-time thermal regulation advice to the wearer and feed back into future product iteration.

- E-commerce Experience Enhancement: AI-driven chatbots and virtual assistants specializing in complex technical product knowledge, guiding customers through the selection of appropriate layering systems for specific offshore conditions.

- Sustainability Optimization: Employing AI to track material traceability, optimize cutting patterns to minimize fabric waste, and analyze end-of-life recycling pathways for complex composite apparel.

DRO & Impact Forces Of Sailing Apparel Market

The dynamics of the Sailing Apparel Market are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively constitute the impact forces shaping its trajectory. Key drivers include the global expansion of watersports tourism and the inherent demand for high-performance, safety-critical gear necessary for competitive and long-distance cruising. Technological advancements in material science, particularly the development of lighter, stronger, and more sustainable waterproof and breathable membranes, continuously stimulate the replacement market and attract new users. Concurrently, the increasing awareness regarding marine safety standards and the mandatory requirement for certified personal flotation devices and specialized clothing in certain competitive environments further compel consumer adoption of premium products.

However, the market faces significant restraints. The high initial cost associated with premium technical sailing apparel, stemming from specialized manufacturing processes and patented materials, acts as a barrier to entry for casual sailors or price-sensitive consumers, often diverting them toward less durable, non-specialized alternatives. Furthermore, the inherent seasonality of sailing in many key geographical markets leads to fluctuating demand and complex inventory management challenges for manufacturers. The presence of counterfeit or low-quality imitation products, which fail to offer the critical protection required, also poses a risk to genuine market players and consumer safety, impacting brand integrity and pricing power.

Opportunities for growth are primarily centered on innovation and geographical expansion. The growing consumer demand for sustainable and circular economy products presents an opportunity for brands to differentiate themselves through eco-friendly materials and repair/refurbishment services. Penetrating emerging markets in Asia and Latin America, where sailing is gaining traction among the growing middle class, offers significant untapped revenue streams. Furthermore, the integration of smart technology into apparel, such as integrated communication systems and health monitoring, opens up lucrative avenues for product diversification and higher average selling prices. These forces combine to create a highly dynamic environment where rapid technological adoption and strategic market positioning are crucial for sustained success.

Segmentation Analysis

The Sailing Apparel Market is strategically segmented based on product type, application, end-user, and distribution channel, reflecting the diverse needs of the global sailing community. This segmentation allows manufacturers to tailor their material selection, design specifications, and pricing strategies to specific consumer cohorts, ranging from professional ocean racers requiring the highest level of foul weather protection to casual weekend sailors prioritizing comfort and style. Understanding these segments is vital for targeted marketing, inventory optimization, and achieving effective channel management, particularly given the specialized nature and high technical requirements of much of the gear.

The product type segmentation is heavily dictated by the sailing environment (offshore, coastal, inshore, or dinghy), requiring distinct performance attributes such as hydrostatic head ratings, abrasion resistance, and freedom of movement. Offshore gear is characterized by heavy-duty, multi-layer protection designed for sustained exposure to extreme conditions, justifying its high price point. Conversely, the segmentation by end-user distinguishes between competitive athletes, recreational consumers, and commercial operators (e.g., naval personnel or professional fishermen who use similar technical gear), each having unique volume requirements and purchasing criteria, such as regulatory compliance or professional sponsorship affiliations.

- By Product Type:

- Foul Weather Gear (Jackets, Trousers/Bibs)

- Mid-Layers (Fleece, Thermal Jackets)

- Base Layers (Technical Underwear)

- Footwear (Deck Shoes, Boots)

- Headwear and Gloves

- Personal Flotation Devices (PFDs) and Safety Harnesses

- By Application:

- Offshore Sailing (High-performance, extreme weather protection)

- Coastal Sailing (Moderate protection, versatility)

- Inshore/Day Sailing (Lightweight, quick-drying)

- Dinghy Racing (High flexibility, buoyancy focus)

- By End-User:

- Men

- Women

- Children

- Commercial/Professional Users

- By Distribution Channel:

- Online Retail (E-commerce platforms, brand websites)

- Offline Retail (Specialty Stores, Department Stores, Yachting Equipment Dealers)

Value Chain Analysis For Sailing Apparel Market

The value chain for the Sailing Apparel Market begins with intensive Upstream Analysis, dominated by specialized material suppliers. This phase involves sourcing advanced, often proprietary, textiles, including high-tech membranes (e.g., ePTFE, PU coatings), high-tenacity nylon and polyester, and synthetic insulation materials (e.g., Primaloft). The quality and performance of the final product are intrinsically linked to the material science R&D conducted at this stage. Key upstream players include chemical companies specializing in durable water repellent (DWR) treatments and textile innovators focused on achieving optimal balances between breathability, waterproofness, and environmental compliance (e.g., PFC-free solutions). Negotiations with these suppliers are critical, as many materials are patented, leading to substantial barriers to entry and dictating high initial production costs.

The mid-stream segment involves design, cutting, manufacturing, and quality control. Given the technical complexity of foul weather gear—often requiring specialized seam sealing, intricate panel construction, and ergonomic shaping—manufacturing frequently takes place in highly specialized facilities, sometimes in-house or through highly vetted third-party contractors that adhere to stringent quality standards like ISO certifications for waterproof performance. This stage is characterized by high precision assembly and rigorous hydrostatic testing. Downstream analysis focuses on effective distribution and market access. Due to the high-value nature of the product, distribution relies heavily on controlled channels, ensuring specialized knowledge transfer and customer service.

The Distribution Channel architecture is balanced between Direct and Indirect routes. Direct distribution involves sales through proprietary brand websites and flagship stores, offering higher margins and direct customer feedback essential for product iteration. This route is preferred for highly specialized, premium gear. Indirect channels primarily involve specialty marine outfitters, yacht equipment dealers, and carefully selected sporting goods department stores that can provide expert advice on technical layering systems. E-commerce platforms, particularly those specializing in niche outdoor gear, are playing an increasingly important role, offering global reach. The final stage involves after-sales support, including warranty services, repairs, and guidance on the maintenance of technical membranes, crucial for maintaining brand loyalty in a market where product longevity is a key expectation.

Sailing Apparel Market Potential Customers

Potential customers for the Sailing Apparel Market are highly segmented across recreational, competitive, and commercial spheres, requiring diverse product offerings tailored to specific maritime demands and budgetary constraints. The primary and highest-value end-user segment is the Recreational Sailor, which includes yacht owners, charter guests, and coastal cruisers, typically aged 45 and above, possessing high disposable income. These buyers prioritize comfort, durability, aesthetic appeal (for dockside socializing), and reliable performance for extended trips, often opting for high-end coastal or offshore gear from established, recognizable luxury brands. Their purchasing decisions are often influenced by brand heritage, sustainability credentials, and overall hydrostatic ratings, viewing the apparel as a necessary investment for safety and enjoyment.

A secondary, yet crucial, potential customer base consists of Competitive Sailors and professional racing teams. This segment, often younger and intensely focused on performance, demands the lightest, most flexible, and most technically advanced gear available, where every design element is optimized for speed and minimal friction, often incorporating specific proprietary textiles for increased maneuverability. Purchasing is often driven by sponsorship agreements and requirements for gear that can withstand the severe stresses of high-speed racing and continuous abrasive contact. This group acts as a key feedback mechanism for innovation, driving demand for experimental materials and rapid technological integration, although their volume requirements are generally lower than the recreational segment.

The third significant customer category comprises Commercial and Institutional Buyers, including professional maritime personnel (e.g., coast guard, naval forces, commercial fishing fleets, and training academies). These end-users purchase in bulk, prioritizing extreme durability, regulatory compliance (especially for buoyancy and reflective visibility), and cost-effectiveness over aesthetic luxury. Their apparel must often meet specific industrial safety standards and withstand much higher levels of daily wear and tear. Furthermore, Sailing Schools and Yacht Charter Operators represent a growing customer group, requiring durable, middle-tier gear that can withstand repeated use and harsh cleaning cycles, often necessitating specific branding and high visibility features for safety protocol enforcement and identification purposes.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 2.6 Billion |

| Growth Rate | 5.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Helly Hansen, Musto, Gill Marine, Henri Lloyd, Zhik, SLAM, North Sails, GUL Watersports, Patagonia, Columbia Sportswear (through specialized lines), Aigle, Burke Marine, Crewsaver, Sealine, Ronstan. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Sailing Apparel Market Key Technology Landscape

The Sailing Apparel Market is critically dependent on advancements in textile engineering, where the core technological focus is the optimization of the waterproof-breathable membrane balance. Key technologies include the utilization of expanded polytetrafluoroethylene (ePTFE) membranes, famously utilized in Gore-Tex Pro products, and advanced polyurethane (PU) coatings, which provide exceptional barrier properties while allowing water vapor to escape. Recent innovations center on reducing the environmental impact of these materials, leading to the development of PFC-free Durable Water Repellent (DWR) finishes and the integration of recycled or bio-based polymers. These material science breakthroughs enable the production of lighter, more packable gear that maintains high hydrostatic head ratings (a measure of waterproofing) essential for offshore safety.

Another significant technological advancement lies in the construction and manufacturing processes, specifically seam sealing and layering system integration. Utilizing ultrasonic welding and specialized heat-taped seams ensures that the garment's integrity is maintained even at stitch points, preventing water ingress under pressure. Furthermore, leading brands employ modular layering systems (base, mid, and outer) designed to work synergistically, optimizing thermal efficiency and moisture management across diverse climate conditions. This approach involves proprietary fabric constructions that maximize capillary action in base layers and thermal retention in mid-layers, leveraging technologies like hollow-core fibers and specialized fleece structures.

The market is also moving toward the integration of Smart Textiles and Wearable Technology. Although still nascent, this technology landscape includes embedded sensors for monitoring sailor vitals (heart rate, core temperature) and tracking performance data (GPS location, boat speed relative to apparel position). These data points are crucial for competitive sailing and safety. Future development is focusing on self-adjusting apparel components, such as fabrics that dynamically adjust insulation or ventilation in response to environmental or physiological changes, utilizing micro-encapsulation or electro-responsive materials, positioning the industry at the confluence of performance wear and high-tech safety equipment.

Regional Highlights

The regional analysis of the Sailing Apparel Market reveals highly differentiated growth drivers and consumer preferences influenced by climate, maritime culture, and economic development, with Europe and North America dominating consumption of premium gear, while APAC demonstrates the fastest expansion trajectory. Europe stands out due to its long-standing maritime heritage, hosting globally recognized yachting centers and major competitive races (e.g., the Vendée Globe and the Rolex Fastnet Race). Countries such as the UK, France, and Germany possess affluent consumer bases that prioritize established, high-end brands known for reliability and traditional craftsmanship. The European market demands robust, multi-season foul weather gear and is highly sensitive to sustainability credentials, particularly concerning material sourcing and ethical production, providing a strong growth driver for eco-friendly product lines.

North America, particularly the coastal regions of the United States (New England, California, and Florida), represents a vast and growing market driven by significant recreational boating ownership and luxury yachting segments. The key trend here is the high demand for versatile, lightweight, and high-visibility coastal and day sailing apparel, alongside specialized gear for extreme conditions in the Pacific Northwest and the Great Lakes. The market is highly influenced by branding and technical specifications, with American consumers often willing to pay a premium for proven technological innovation and strong warranty support. Furthermore, the large scale of domestic manufacturing and distribution capacity within the US allows for rapid adoption of new materials and quicker supply chain response compared to some international markets.

The Asia Pacific (APAC) region is earmarked as the future growth engine, characterized by dynamic expansion, particularly in Australia, New Zealand, China, and Southeast Asia. While Australia and New Zealand have mature, high-participation sailing cultures, the emerging markets of China and countries like Singapore and Hong Kong are witnessing explosive growth in luxury yacht ownership and the development of modern marina infrastructure. Demand in tropical APAC environments centers on high UV protection, lightweight construction, exceptional ventilation, and resistance to mildew, requiring manufacturers to adapt their product portfolios significantly. The rapidly expanding middle class in China is beginning to embrace watersports, providing immense potential for entry-level and mid-range sailing apparel, making targeted marketing and localized distribution strategies critical for market penetration in this highly diverse region.

Latin America and the Middle East & Africa (MEA) currently hold smaller market shares but present niche opportunities. Latin America's market is concentrated in coastal nations like Brazil and Argentina, focusing on domestic cruising and specialized local regattas. MEA growth is primarily driven by Gulf nations investing heavily in luxury tourism and high-profile sporting events, creating demand for high-end, branded apparel for participants and spectators. Overall, regional strategies must account for varying climate zones, from the intense heat of the Middle East requiring maximum UV and ventilation properties, to the severe oceanic conditions demanding certified, multi-layer foul weather protection in the North Atlantic territories, ensuring global product diversification is a core requirement for leading market players.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Sailing Apparel Market.- Helly Hansen

- Musto

- Gill Marine

- Henri Lloyd

- Zhik

- SLAM

- North Sails

- Patagonia

- Columbia Sportswear

- Aigle

- Burke Marine

- Crewsaver

- Ronstan

- Spinlock

- Harken

- Decathlon (Tribord/Subea)

- Dry Fashion

- Marinepool

- Sebago

- Dubarry of Ireland

Frequently Asked Questions

Analyze common user questions about the Sailing Apparel market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the technical Sailing Apparel Market?

The market growth is primarily driven by increasing global participation in recreational and competitive sailing, significant technological advancements in waterproof and breathable materials (like advanced PTFE membranes and sustainable DWR finishes), and a heightened focus on marine safety, which mandates the use of reliable, high-performance foul weather gear and certified safety equipment.

How is sustainability impacting material choices in offshore sailing gear?

Sustainability is a critical factor, driving the shift towards recycled materials, such as polyester derived from plastic waste, and the elimination of perfluorochemicals (PFCs) from durable water repellent (DWR) finishes. Leading brands are developing circular economy models, focusing on repairability and using bluesign-certified fabrics to reduce environmental footprint and appeal to eco-conscious consumers.

Which geographical region holds the largest market share for sailing apparel?

Europe currently holds the largest market share, characterized by a well-established sailing culture, high consumer purchasing power, and the concentration of major yachting events and maritime industries. However, the Asia Pacific region, driven by urbanization and rising disposable incomes in coastal cities, is projected to exhibit the highest Compound Annual Growth Rate (CAGR) during the forecast period.

What is the difference between coastal and offshore sailing apparel specifications?

Offshore apparel is designed for prolonged, extreme exposure and features the highest hydrostatic head ratings, multi-layer systems, heavy-duty abrasion resistance, and safety features (harness points, reflective strips). Coastal gear is lighter, offers moderate protection suitable for day-long trips, prioritizes flexibility, and features moderate waterproofing, balancing protection with comfort for less severe conditions.

How does smart technology integrate into modern sailing apparel?

Smart technology integration is emerging through embedded sensors that monitor physiological data (temperature, heart rate) and environmental conditions (UV exposure). This data assists in optimizing thermal regulation and enhancing safety, potentially leading to self-adjusting fabric components and better real-time communication capabilities in competitive and deep-sea cruising environments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager