Sales Automation Software Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433190 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Sales Automation Software Market Size

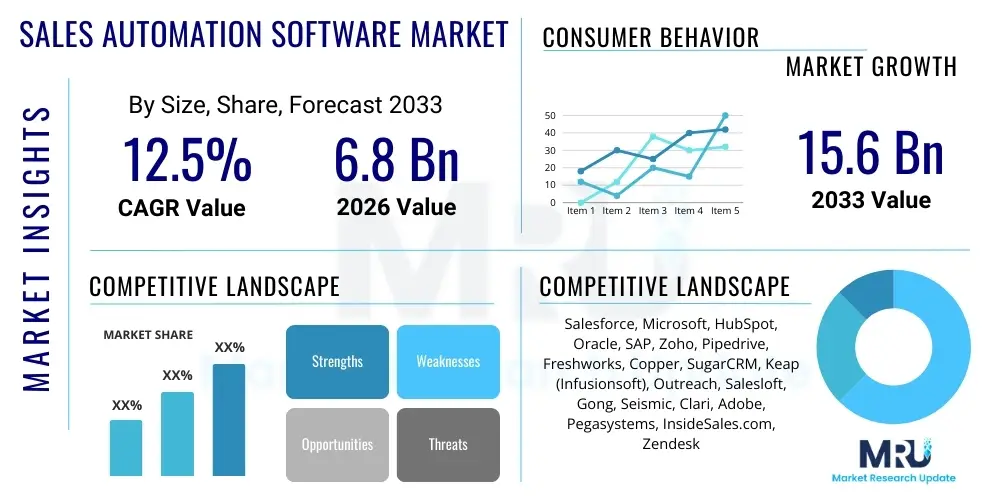

The Sales Automation Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 6.8 Billion in 2026 and is projected to reach USD 15.6 Billion by the end of the forecast period in 2033.

Sales Automation Software Market introduction

The Sales Automation Software Market encompasses applications and technologies designed to streamline and automate repetitive sales tasks, enabling sales professionals to focus on relationship building and high-value activities. These solutions are critical components of the broader Customer Relationship Management (CRM) ecosystem, moving beyond basic contact management to incorporate advanced features like lead scoring, automated email sequencing, territory management, and real-time sales reporting. The primary objective is to enhance operational efficiency, accelerate the sales cycle, and improve overall revenue predictability for businesses across various industries.

The product description for modern Sales Automation tools emphasizes intelligent workflow capabilities and integration with adjacent enterprise software, such as marketing automation and Enterprise Resource Planning (ERP) systems. Major applications include automating mundane data entry, scheduling appointments, tracking customer interactions across multiple channels, and generating accurate sales forecasts. These tools ensure data integrity and provide a unified view of the customer journey, crucial for personalized outreach and effective pipeline management. The continuous evolution towards mobile-first and platform-agnostic solutions further expands their applicability across remote and hybrid sales teams.

The market growth is primarily driven by the increasing need for digital transformation among enterprises seeking a competitive edge through enhanced productivity and efficiency. Key benefits include reduced administrative overhead, improved lead conversion rates due to timely follow-ups, and deeper insights into sales performance through robust analytics. Furthermore, the rising complexity of B2B sales cycles, which often involve multiple stakeholders and extended timelines, necessitates sophisticated automation tools capable of managing intricate processes and ensuring compliance with organizational policies.

Sales Automation Software Market Executive Summary

The Sales Automation Software Market is characterized by robust technological innovation, driven predominantly by the integration of Artificial Intelligence and machine learning capabilities. Business trends indicate a strong shift towards comprehensive, unified platforms that offer end-to-end automation, replacing disparate point solutions. Companies are prioritizing scalable cloud-based solutions (SaaS) that minimize upfront investment and facilitate rapid deployment, making these tools accessible even to small and medium-sized enterprises (SMEs). Competitive dynamics are focusing on specialized vertical solutions and superior user experience (UX), ensuring high adoption rates among sales representatives.

Regional trends highlight North America as the largest market, attributed to high technological adoption rates, the presence of major software vendors, and significant investment in digital infrastructure. However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth, fueled by rapid digitalization in emerging economies like India and China, coupled with expanding SME sectors adopting automation to manage burgeoning customer bases. Europe maintains steady growth, driven by stringent data privacy regulations (like GDPR) necessitating automated compliance features within sales technology stacks.

Segmentation trends reveal strong growth in the Services segment, reflecting the increasing demand for consulting, integration, and managed services required to customize and deploy complex automation workflows successfully. By organization size, the SME segment is a critical growth engine, as affordable SaaS models lower the barrier to entry for smaller organizations. Application-wise, lead management and sales forecasting segments are experiencing accelerated growth due to the immediate return on investment provided by optimized pipeline hygiene and predictive analytics.

AI Impact Analysis on Sales Automation Software Market

Users frequently question how Artificial Intelligence (AI) will fundamentally alter the sales professional's role, whether AI-driven automation will replace human intuition, and which specific AI functionalities—such as predictive lead scoring, conversational AI for initial qualification, or automated content generation—offer the highest ROI. Concerns often revolve around data privacy, the potential bias in AI algorithms influencing sales resource allocation, and the complexity of integrating advanced machine learning models into existing, often legacy, CRM systems. Conversely, expectations are high regarding AI's potential to provide hyper-personalized customer experiences at scale, automate deal closure forecasting with near-perfect accuracy, and significantly reduce the time spent on non-selling administrative tasks, thereby maximizing human capital.

The consensus among market participants is that AI acts as an augmentative force rather than a replacement. Advanced Natural Language Processing (NLP) is increasingly used for call transcript analysis and sentiment detection, enabling managers to coach sales representatives based on concrete, data-driven feedback derived from customer interactions. Furthermore, machine learning models are continuously refining sales playbooks by analyzing successful deal paths and suggesting optimal next steps, transforming sales automation from reactive task execution to proactive, prescriptive guidance. This shift towards prescriptive selling is a key differentiator in the modern sales technology landscape.

AI’s influence is pushing vendors to develop 'smart' automation platforms. These platforms can autonomously manage complex sequences, such as adjusting follow-up timing based on customer engagement metrics or prioritizing high-value leads by correlating external market signals with internal historical data. The shift from mere data storage (traditional CRM) to intelligent insight generation and automated action execution (AI-powered sales automation) is revolutionizing how sales organizations operate, necessitating new skills training and organizational restructuring focused on leveraging these intelligent tools effectively.

- AI enhances predictive lead scoring accuracy, focusing human effort on high-conversion prospects.

- Generative AI automates personalized email creation and initial conversational outreach, increasing engagement efficiency.

- Machine learning optimizes sales forecasting by analyzing historical data and external market factors, reducing forecast error.

- Conversational AI handles routine customer inquiries and qualification steps (chatbots, voice bots).

- AI-powered tools analyze sales call transcripts to provide actionable coaching insights and identify successful sales behaviors.

- Automation reduces administrative burdens, significantly improving sales representative productivity and job satisfaction.

DRO & Impact Forces Of Sales Automation Software Market

The Sales Automation Software Market growth is governed by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO), which collectively constitute the market’s impact forces. The primary driver is the accelerating global requirement for digital transformation, compelling organizations to optimize efficiency and minimize costs through technology. This is further amplified by the competitive imperative across industries to achieve sales velocity and predictability, pushing businesses to invest in sophisticated tools that offer real-time analytics and predictive capabilities. Opportunities arise from the untapped potential in emerging markets and the increasing adoption of mobile-based sales applications, catering to the growing remote and hybrid workforce.

However, the market faces significant restraints. High initial implementation costs, particularly for large-scale enterprise deployments requiring integration with complex legacy systems, remain a barrier. Furthermore, resistance to change among long-tenured sales teams accustomed to traditional methods presents a challenge to adoption, necessitating intensive training and change management protocols. Data security and privacy concerns, especially in regulated industries like BFSI and Healthcare, impose strict requirements on software vendors regarding compliance and data governance, slowing down procurement cycles and increasing development complexity.

The key impact forces driving market direction include technological advancements (AI/ML integration), evolving customer expectations for personalized interactions, and the shift towards subscription-based SaaS models, which democratize access to powerful automation tools. Regulatory frameworks influence solution design, while global economic conditions affect IT spending budgets. The need for seamless integration across the entire customer lifecycle—from marketing to sales to service—is also a significant force, favoring platform vendors who offer unified solutions over niche providers.

Segmentation Analysis

The Sales Automation Software Market is segmented comprehensively based on Component, Deployment Type, Organization Size, Application, and Industry Vertical, reflecting the diverse needs of the end-user base. This segmentation provides a granular view of market dynamics, highlighting areas of rapid growth and technological maturity. The underlying trend across all segmentations is the increasing demand for customized solutions that can adapt to specific business workflows, moving away from generic, one-size-fits-all software offerings. This specialization ensures higher utility and better ROI for the adopting organizations.

Analysis of the component segment shows that while the Software subsegment dominates in terms of absolute revenue, the Services subsegment (including implementation, maintenance, and consulting) is exhibiting the fastest growth rate. This accelerated growth is attributed to the complexity of integrating next-generation AI-powered automation tools and the necessity for specialized expertise in setting up advanced workflows, territory mapping, and sophisticated reporting structures. Furthermore, the shift towards cloud-based deployment (SaaS) continues its dominance due to lower Total Cost of Ownership (TCO) and inherent scalability, appealing strongly to the dynamic operational needs of modern enterprises and rapidly expanding startups.

From an organizational size perspective, the Large Enterprises segment holds the largest market share, driven by their extensive sales teams, global operations, and corresponding high volume of data requiring automation. Nevertheless, the Small and Medium-sized Enterprises (SMEs) segment is poised for significant future expansion, benefiting from pay-as-you-go subscription models and the availability of simplified, entry-level automation tools. Application segmentation indicates that Lead Management, followed closely by Sales Forecasting and Reporting & Analytics, are the most sought-after features, as businesses prioritize optimizing the top of the funnel and gaining reliable visibility into future revenues.

- Component: Software, Services (Consulting, Implementation, Training, Support & Maintenance)

- Deployment Type: Cloud-based (SaaS), On-Premise

- Organization Size: Small and Medium Enterprises (SMEs), Large Enterprises

- Application: Lead Management, Opportunity Management, Sales Forecasting, Workflow Automation, Reporting & Analytics, Territory Management, Customer Interaction Tracking

- Industry Vertical: BFSI (Banking, Financial Services, and Insurance), IT & Telecom, Retail & E-commerce, Healthcare & Life Sciences, Manufacturing, Media & Entertainment, Government & Public Sector, Others

Value Chain Analysis For Sales Automation Software Market

The value chain for the Sales Automation Software Market begins with the upstream activities centered on core technology development, including the creation of proprietary AI/ML algorithms, data security frameworks, and API infrastructure. This phase involves substantial R&D investment by software providers to ensure platform robustness, scalability, and compliance with global data standards. Key upstream suppliers include providers of cloud computing infrastructure (e.g., AWS, Azure, GCP), data warehousing solutions, and specialized third-party component developers contributing advanced functionalities like voice recognition or geospatial tracking integrated into sales tools.

The middle segment of the value chain focuses on software development, integration, and deployment. Here, major vendors design, test, and market their platforms, often customizing modules for specific verticals. Distribution channels play a critical role; direct sales channels involve vendors selling licenses or subscriptions directly to end-user organizations, offering high-touch support and complex integration services, typically catering to large enterprises. Indirect channels involve partnerships with Systems Integrators (SIs), Value-Added Resellers (VARs), and Managed Service Providers (MSPs), which are crucial for reaching SMEs and facilitating localized deployment and ongoing support, particularly in geographically fragmented markets.

The downstream analysis involves the end-user adoption, utilization, and feedback loop. After deployment, ongoing support, updates, and maintenance services are provided, ensuring the software remains effective and secure. Customer feedback loops are vital, driving continuous product iteration and feature enhancement. The final beneficiaries are the sales and marketing departments within the end-user organizations, leveraging the automation tools to enhance productivity and achieve strategic revenue goals. The efficiency of the value chain is increasingly dependent on seamless cloud infrastructure management and strong channel partner networks capable of delivering specialized consulting services.

Sales Automation Software Market Potential Customers

The potential customer base for Sales Automation Software is extensive and spans virtually every industry vertical that relies on structured sales processes to drive revenue. End-users, or buyers, of these products typically include Sales Directors, Chief Revenue Officers (CROs), Marketing Managers responsible for lead generation integration, and IT departments tasked with platform deployment and security. Historically, large enterprises in high-volume transaction sectors, such as BFSI and IT & Telecom, were the primary adopters due to the sheer necessity of managing millions of customer interactions and complex regulatory requirements.

However, the market expansion is now heavily focused on targeting SMEs across all verticals, driven by the democratization of technology through SaaS models. These smaller organizations require scalable, cost-effective solutions to compete effectively with larger counterparts without incurring prohibitive capital expenditure. Furthermore, organizations undergoing rapid scale-up, particularly in the tech startup ecosystem and e-commerce sectors, represent high-growth potential customers who prioritize agility and immediate deployment capabilities to handle explosive growth in lead volumes.

Specific niche verticals, such as Healthcare and Life Sciences, are becoming significant consumers, requiring specialized automation tools that integrate HIPAA or GDPR compliance features for managing patient data and pharmaceutical sales interactions. Manufacturing and logistics companies are also increasingly adopting sales automation to optimize complex B2B sales cycles involving customized product configurations and long-term contracts. The need for predictable revenue streams and optimized field sales operations makes these industries crucial potential customers for vendors specializing in complex B2B process automation.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 6.8 Billion |

| Market Forecast in 2033 | USD 15.6 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Salesforce, Microsoft, HubSpot, Oracle, SAP, Zoho, Pipedrive, Freshworks, Copper, SugarCRM, Keap (Infusionsoft), Outreach, Salesloft, Gong, Seismic, Clari, Adobe, Pegasystems, InsideSales.com, Zendesk |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Sales Automation Software Market Key Technology Landscape

The technology landscape underpinning the Sales Automation Software Market is rapidly evolving, driven by advancements in cloud infrastructure, sophisticated data analytics, and embedded AI capabilities. Modern platforms are built predominantly on microservices architectures, facilitating high scalability, rapid deployment of updates, and seamless integration with the wider enterprise technology stack through open APIs. Cloud infrastructure, primarily SaaS, is the foundational technology, offering flexibility and reducing the burden of maintenance and hardware management for end-users. Security technologies, including advanced encryption, multi-factor authentication, and robust data compliance tools (e.g., ensuring GDPR and CCPA adherence), are integral features that dictate platform viability, especially in regulated sectors.

A critical shift involves the deployment of Artificial Intelligence and Machine Learning (AI/ML) across all modules. This includes predictive analytics for lead scoring and churn probability, Natural Language Processing (NLP) for parsing unstructured customer data from emails and call transcripts, and robotic process automation (RPA) for automating complex, multi-step administrative tasks. These intelligent technologies move the software beyond simple task management toward providing prescriptive recommendations, such as suggesting the optimal time and channel for customer contact, or identifying potential deal roadblocks before they materialize. The incorporation of real-time data streaming and processing is essential to feed these AI models with fresh, accurate information, ensuring the generated insights are immediately actionable.

Furthermore, mobile technology continues to shape the landscape, with vendors heavily investing in developing intuitive, fully functional mobile applications that empower field sales representatives to manage their pipelines, update customer data, and access reporting tools while on the go. Integration technologies, particularly low-code/no-code platforms, are gaining prominence, allowing business users to customize workflows and connect automation tools with specific in-house applications without extensive developer resources. This focus on accessibility and customizability is lowering the barrier to entry and increasing the versatility of sales automation solutions across different organizational structures.

Regional Highlights

Regional dynamics play a significant role in shaping the demand and adoption patterns of Sales Automation Software, influenced by economic maturity, digital infrastructure, regulatory environments, and the competitive landscape of local industries. North America, comprising the United States and Canada, currently holds the largest market share. This dominance is attributable to the early adoption of advanced CRM solutions, the presence of major technology hubs and market leaders (e.g., Salesforce, Microsoft), and high enterprise spending on digital transformation initiatives. The market here is mature but characterized by continuous innovation, focusing heavily on AI-driven analytics and vertical-specific platforms tailored for complex B2B sales cycles.

Europe represents a highly fragmented yet rapidly evolving market. Adoption is strong in Western European economies such as the UK, Germany, and France, driven by the necessity to enhance sales efficiency in highly competitive mature markets. A key focus area in Europe is compliance with stringent data protection laws (GDPR). European businesses prioritize solutions that offer robust data governance and sovereignty features, influencing vendors to provide localized cloud hosting options and transparent data handling protocols. Central and Eastern Europe are emerging as growth pockets, driven by increased foreign investment and the digitalization of local SMEs.

The Asia Pacific (APAC) region is projected to be the fastest-growing market globally. This surge is fueled by rapid industrialization, massive digital infrastructure investment, and the rapid expansion of the SME sector across countries like China, India, Japan, and Australia. The sheer volume of mobile users and digital transactions necessitates automated sales processes. Unlike North America, APAC adoption is often leapfrogging older technologies, directly implementing cloud-native, mobile-first automation solutions. Latin America and the Middle East & Africa (MEA) are also exhibiting increasing potential, albeit from a smaller base, driven by regional economic diversification efforts and the strategic adoption of SaaS platforms to manage complex, multi-lingual sales environments and improve regional competitiveness.

- North America: Dominates the market share due to technological maturity, high SaaS adoption, and strong presence of key market players, prioritizing AI/ML integration.

- Europe: Growth driven by efficiency requirements and mandatory GDPR compliance; focus is on secure, localized, and regulatory-compliant automation platforms.

- Asia Pacific (APAC): Highest CAGR projected, fueled by rapid digitalization, expansive SME sector growth, and high demand for mobile-first automation tools in emerging economies.

- Latin America (LATAM): Growing adoption stimulated by economic stabilization and the need for scalable cloud solutions to manage diverse customer bases.

- Middle East & Africa (MEA): Market gaining momentum through government initiatives for digital transformation and increasing investment in IT infrastructure, particularly in the UAE and Saudi Arabia.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Sales Automation Software Market.- Salesforce (Sales Cloud)

- Microsoft (Dynamics 365 Sales)

- HubSpot

- Oracle (Sales Cloud)

- SAP (Sales Cloud)

- Zoho Corporation

- Pipedrive

- Freshworks

- Copper

- SugarCRM

- Keap (formerly Infusionsoft)

- Outreach

- Salesloft

- Gong

- Seismic

- Clari

- Adobe (Marketo Engage for Sales)

- Pegasystems

- InsideSales.com (Gears CRM)

- Zendesk (Zendesk Sell)

Frequently Asked Questions

Analyze common user questions about the Sales Automation Software market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Sales Automation Software Market?

The Sales Automation Software Market is projected to experience significant expansion, growing at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033, driven by global digital transformation initiatives and AI integration.

Which segmentation segment is driving the rapid market growth?

The Cloud-based (SaaS) deployment segment and the Small and Medium-sized Enterprises (SMEs) organization size segment are driving rapid market growth, primarily due to the low total cost of ownership and the necessity for scalable, accessible sales solutions.

How is Artificial Intelligence (AI) fundamentally changing sales automation platforms?

AI is transforming sales automation from reactive task management to proactive, prescriptive guidance. AI enables advanced features like predictive lead scoring, automated sales forecasting, and conversational intelligence, augmenting human sales capabilities significantly.

What are the primary restraints affecting the Sales Automation Software Market adoption?

Primary restraints include high initial implementation costs, complexity in integrating with older, legacy IT systems, and the persistent internal challenge of sales team resistance to adopting new workflows and training requirements.

Which geographical region is expected to show the fastest market expansion?

The Asia Pacific (APAC) region is forecasted to exhibit the fastest growth rate, fueled by substantial investment in digital infrastructure, rapid expansion of the SME sector, and an increasing propensity to adopt advanced cloud-native technologies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager