Sales Consulting Services Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432584 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Sales Consulting Services Market Size

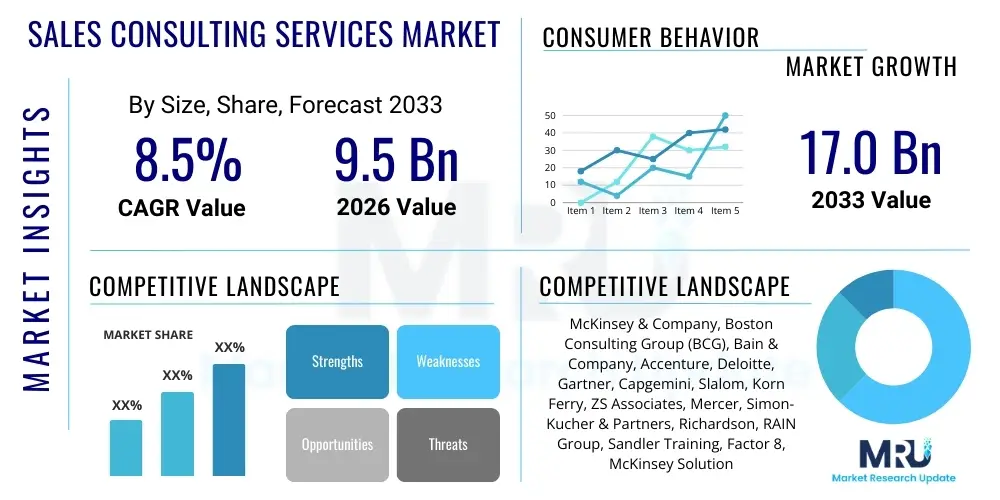

The Sales Consulting Services Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 9.5 Billion in 2026 and is projected to reach USD 17.0 Billion by the end of the forecast period in 2033.

Sales Consulting Services Market introduction

The Sales Consulting Services Market encompasses specialized professional assistance aimed at optimizing an organization's sales processes, strategies, structures, and technologies to achieve superior revenue generation and market penetration. These services address critical challenges such as sales force effectiveness, territory planning, compensation model optimization, customer relationship management (CRM) integration, and digital sales transformation. Consultants leverage deep industry expertise and proprietary methodologies to diagnose inefficiencies, design scalable solutions, and ensure successful implementation, thereby bridging the gap between existing sales performance and ambitious corporate growth objectives. The fundamental goal is to enhance predictability, productivity, and profitability across the entire sales lifecycle, from lead generation through deal closure and account management.

The core product offerings within this market are segmented across strategic planning, operational effectiveness, technology implementation, and training/coaching. Strategic consulting focuses on defining the market approach, segmentation, and ideal sales organization structure. Operational services streamline day-to-day activities and define key performance indicators (KPIs). Given the accelerated pace of digital adoption, technology implementation—particularly the integration of advanced CRM systems, sales enablement platforms, and predictive analytics tools—has become a significant revenue driver. Furthermore, the increasing complexity of B2B sales cycles necessitates specialized training and coaching services to upskill sales professionals in areas like consultative selling, virtual negotiation, and navigating multi-stakeholder purchasing committees.

Major applications for sales consulting services span virtually all industries, including but not limited to Banking, Financial Services, and Insurance (BFSI), Information Technology and Telecommunications, Healthcare, Manufacturing, and Retail. The primary benefits realized by clients include substantial improvements in conversion rates, reduced sales cycle length, optimized resource allocation, and a higher return on investment (ROI) from sales technology infrastructure. Key driving factors underpinning the market growth include the constant pressure on companies to maximize shareholder value, the necessity for rapid digital transformation post-pandemic, the globalization of sales operations requiring standardized processes, and the availability of sophisticated data analytics tools that require expert interpretation and integration into sales workflows.

Sales Consulting Services Market Executive Summary

The global Sales Consulting Services Market demonstrates robust growth, propelled primarily by the widespread necessity for organizations to navigate complex digital transformation mandates and sustain competitive advantage in volatile economic landscapes. Current business trends indicate a significant shift towards services focused on integrating Artificial Intelligence (AI) and machine learning into forecasting and pipeline management, moving beyond traditional strategic advice. Firms are increasingly demanding outcome-based consulting models, where compensation is partially linked to measurable improvements in revenue and sales efficiency metrics. Furthermore, there is a pronounced focus on Sales Enablement platforms as the cornerstone of modern sales operations, requiring consultants to possess deep expertise in technological deployment and change management to ensure end-user adoption and effective utilization.

Regional trends highlight North America’s dominance, driven by high technology adoption rates, the presence of numerous large multinational corporations, and a mature consulting services ecosystem. However, the Asia Pacific (APAC) region is emerging as the fastest-growing market, fueled by expanding industrial bases, rapid urbanization, and significant investment in digital infrastructure by emerging economies such as India and China. European markets maintain steady growth, emphasizing compliance with complex regulatory environments (like GDPR) and focusing on sustainable and ethical sales practices. Across all regions, the market is characterized by intense competition between established global consulting giants and specialized boutique firms offering highly niche expertise, particularly in industry verticals requiring specialized regulatory knowledge.

Segment trends underscore the rising importance of specialized service types. While traditional Strategy and Planning remain foundational, the Sales Technology Implementation segment is experiencing the most rapid acceleration, reflecting the massive investment poured into optimizing tech stacks. Cloud-based deployment of sales tools is becoming the overwhelming standard, driving demand for consulting services that facilitate seamless migration and integration into existing enterprise resource planning (ERP) and customer relationship management (CRM) systems. Small and Medium Enterprises (SMEs), previously underserved, are now representing a critical growth segment, as tailored, modular consulting packages become accessible, allowing them to leverage sophisticated methodologies that were once exclusive to large enterprises. This fragmentation of the consumer base necessitates flexible service delivery models.

AI Impact Analysis on Sales Consulting Services Market

User inquiries concerning the impact of Artificial Intelligence on the Sales Consulting Services Market frequently revolve around automation fears, the necessity for new skill sets, and the transformation of service delivery models. Common questions include: "Will AI automate sales strategy development, making consultants obsolete?", "What new AI tools must sales consultants master to remain relevant?", and "How can AI enhance the ROI of consulting engagements?" The collective expectation is that AI will fundamentally change the scope of consulting, shifting the focus from manual data analysis and report generation—tasks easily automated—to high-level strategic guidance, ethical deployment oversight, and complex organizational change management. Users are particularly concerned with how AI affects the human element of sales, such as coaching and client relationships, demanding insights on how consultants can integrate AI without compromising personalization or trust.

Based on these themes, the key takeaway is that AI is not a threat to consulting but a powerful augmenter of consulting value. AI tools are automating tedious tasks like lead scoring, forecasting adjustments, and personalized content generation, thereby freeing up consultants to focus on strategic insights derived from automated analysis. This pivot requires consulting firms to invest heavily in data science capabilities and proprietary AI models tailored for sales optimization. Furthermore, consultants are transitioning into roles as trusted advisors for AI governance, helping clients select, implement, and ethically manage complex predictive and generative AI platforms within their sales operations. The market is witnessing a divergence where commoditized analytical services decline, while strategic advisory services related to AI implementation and ethical use soar.

This transformative shift mandates a restructuring of consulting offerings, prioritizing services that leverage AI for prescriptive and predictive outcomes rather than merely diagnostic reporting. Sales consultants must become experts in integrating AI outputs—such as highly optimized territory maps or granular compensation plan simulations—directly into executive decision-making frameworks. The ultimate impact is the elevation of the consulting role from process optimization to strategic partnership, centered on ensuring the client’s technological investments yield demonstrable, sustainable improvements in revenue predictability and sales force morale. Firms neglecting AI integration risk being relegated to legacy status, while those embracing it become indispensable architects of future sales organizations.

- AI automates routine data processing, shifting consultant focus to strategic insight generation.

- Increased demand for AI implementation and governance consulting services.

- AI-powered tools enhance forecasting accuracy and personalized sales enablement content creation.

- Consultants must master proficiency in machine learning models and predictive analytics for sales.

- Transformation of compensation model design based on AI-derived performance metrics.

- Elevation of consulting value proposition from diagnostic to prescriptive and outcome-based advisory.

- Requirement for specialized knowledge in ethical AI deployment and data privacy compliance within sales.

DRO & Impact Forces Of Sales Consulting Services Market

The dynamics of the Sales Consulting Services Market are heavily influenced by a confluence of structural Drivers, critical Restraints, and transformative Opportunities, collectively shaping the Impact Forces defining competitive success. The primary driver is the accelerating pace of digital transformation across all industries, compelling organizations to modernize outdated sales models and integrate sophisticated technology stacks, thereby creating a sustained demand for expert guidance. Additionally, macroeconomic instability and fierce global competition mandate that companies relentlessly optimize operational efficiencies, viewing sales consulting not as a discretionary expense but as a necessary investment for sustainable growth and margin protection. These drivers amplify the long-term strategic relevance of sales consultants who can translate complex market shifts into actionable sales strategies and measurable ROI.

Conversely, significant restraints challenge market expansion. One major restraint is the high cost associated with premium sales consulting services, which often deters Small and Medium Enterprises (SMEs) and organizations facing tight budgetary constraints. Furthermore, the inherent difficulty in precisely measuring the return on investment (ROI) of strategic consulting engagements often leads to skepticism and elongated decision-making cycles among potential clients. Another critical restraint involves internal resistance to change; sales organizations, often resistant to external interference, may lack the internal bandwidth or cultural alignment necessary for successful implementation of consultants' recommendations, leading to execution failure and dissatisfaction. The market also faces the restraint of talent scarcity, as the demand for consultants skilled in both complex sales strategy and advanced sales technology integration (RevOps) far outstrips supply.

The foremost opportunities reside in the rapid expansion of the Revenue Operations (RevOps) model, which seeks to unify sales, marketing, and customer success functions under a single, streamlined process. Consulting firms are capitalizing on this by offering end-to-end RevOps transformation services. Furthermore, geographic expansion into high-growth markets like APAC and Latin America offers substantial untapped revenue potential. The ongoing shift toward specialized, modular, and technology-enabled remote consulting services presents an opportunity to serve the vast SME market cost-effectively. Impact forces, therefore, heavily favor firms capable of providing measurable, technology-centric, and vertically specialized consulting solutions that can demonstrably reduce friction and increase velocity within the client's revenue pipeline, while managing the inherent risks associated with high upfront costs and implementation resistance.

Segmentation Analysis

The Sales Consulting Services Market is meticulously segmented based on service type, deployment model, end-use industry, and enterprise size to accurately reflect the diverse needs of the global customer base. This granular segmentation aids both providers and consumers in targeting specific expertise and aligning consulting engagements with organizational scale and industry-specific challenges. The dominant segmentation factor remains the type of service provided, differentiating foundational strategic planning from advanced technological execution and human capital development. Understanding these segments is crucial for strategic positioning and customizing solution bundles that address the varying levels of maturity and complexity present across different organizations.

- By Service Type:

- Sales Strategy & Planning

- Sales Performance Management (SPM)

- Sales Training & Coaching

- Sales Technology Implementation & Integration

- Revenue Operations (RevOps) Consulting

- By Deployment:

- On-Premise

- Cloud-Based/Remote Consulting

- By End-Use Industry:

- Banking, Financial Services, and Insurance (BFSI)

- Information Technology (IT) & Telecommunications

- Healthcare & Pharmaceuticals

- Manufacturing

- Retail & E-commerce

- Others (Energy, Government, Education)

- By Enterprise Size:

- Small and Medium Enterprises (SMEs)

- Large Enterprises

Value Chain Analysis For Sales Consulting Services Market

The value chain for Sales Consulting Services begins with upstream analysis, which focuses on identifying core intellectual property (IP) and necessary resources. Upstream activities include developing proprietary methodologies, creating specialized sales diagnostic tools (often AI-enabled), cultivating deep vertical expertise, and recruiting/training highly specialized consultants proficient in both commercial strategy and technical execution (e.g., Salesforce, HubSpot). The quality and uniqueness of a firm's knowledge assets and talent pool directly determine its competitive advantage. Investment in continuous research and development to stay ahead of market trends, particularly in emerging areas like generative AI applications for sales, is critical at this stage.

The midstream phase involves service delivery, where consulting firms execute engagements based on client needs. This encompasses diagnostic assessment, solution design (e.g., designing new compensation plans or organizational structures), change management planning, and direct implementation support. Distribution channels are categorized into direct and indirect methods. Direct channels involve proprietary sales forces and relationship management teams that engage high-value enterprise clients directly. Indirect channels typically involve strategic partnerships with technology vendors (e.g., CRM providers) who recommend consulting partners for complex implementation projects, or through referral networks established with law firms, private equity groups, or accounting firms. The effectiveness of the delivery model—whether remote, on-site, or hybrid—significantly impacts client satisfaction and project success metrics.

Downstream analysis focuses on post-engagement activities, primarily centered on ensuring sustainable outcomes and securing repeat business. This includes post-implementation monitoring, measuring the efficacy of implemented strategies (e.g., tracking KPI improvements), and providing ongoing support or subscription-based advisory services. The downstream success is heavily reliant on client feedback loops and the consultant's ability to demonstrate tangible ROI, leading to strong brand reputation and long-term client relationships. The integration of modern data platforms allows firms to monitor long-term client performance remotely, providing proactive advice and fostering continuous service contracts, thereby maximizing the lifetime value of the customer relationship.

Sales Consulting Services Market Potential Customers

The primary purchasers and beneficiaries of Sales Consulting Services are organizational leaders seeking measurable improvements in revenue productivity, market coverage, and sales operational efficiency. The end-users range from Chief Executive Officers (CEOs) who require comprehensive market expansion strategies, to Chief Revenue Officers (CROs) and VPs of Sales who need tactical operational restructuring, pipeline optimization, and team performance enhancement. These buyers are typically characterized by pain points such as plateauing revenue growth, high sales force turnover, misalignment between marketing and sales, or underutilization of expensive sales technology investments. Specifically, companies undergoing significant transitions—such as mergers and acquisitions, digital transformation initiatives, or geographic expansion—represent highly engaged segments of potential customers requiring specialized consulting support.

Large Enterprises (defined as companies with annual revenues exceeding $1 billion) constitute the backbone of the market, demanding complex, multi-year engagements covering global sales restructuring, advanced compensation scheme design, and enterprise-wide CRM platform optimization. These customers seek established, large consulting firms known for their depth of industry expertise and capacity to handle large-scale organizational change management. Their purchasing decisions are often driven by the need for risk mitigation, guaranteed methodology, and established track records within their specific industry vertical, such as BFSI or global Manufacturing. The need for comprehensive solutions that integrate strategic vision with tactical implementation capability drives demand from this segment.

Small and Medium Enterprises (SMEs) are rapidly increasing their consumption of consulting services, especially those leveraging modular, affordable, and often cloud-based advisory services focusing on rapid operational improvements. Unlike large enterprises, SMEs often seek assistance in foundational areas, such as establishing core sales processes, selecting and implementing their first CRM system, or developing standardized training modules for a smaller sales team. Their potential is derived from the sheer volume of SMEs globally, and their purchasing decisions are heavily influenced by cost-effectiveness, speed of delivery, and the consultant's ability to offer specialized expertise without the overhead of a generalist approach. The rise of remote consulting models has significantly improved the accessibility of high-quality sales advice for this segment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 9.5 Billion |

| Market Forecast in 2033 | USD 17.0 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | McKinsey & Company, Boston Consulting Group (BCG), Bain & Company, Accenture, Deloitte, Gartner, Capgemini, Slalom, Korn Ferry, ZS Associates, Mercer, Simon-Kucher & Partners, Richardson, RAIN Group, Sandler Training, Factor 8, McKinsey Solutions, SiriusDecisions (Gartner), Challenger Inc., Sales Benchmark Index (SBI) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Sales Consulting Services Market Key Technology Landscape

The technology landscape underpinning the Sales Consulting Services Market is rapidly evolving, driven by the convergence of cloud computing, advanced analytics, and artificial intelligence. Core technologies include sophisticated Customer Relationship Management (CRM) platforms, notably Salesforce, Microsoft Dynamics, and HubSpot, whose effective implementation and customization form a major pillar of consulting engagements. Furthermore, the rise of specialized Sales Performance Management (SPM) software (e.g., incentive compensation management, quota management) and Sales Enablement platforms (e.g., content management, guided selling tools) requires specialized consultant expertise. The effective integration of these diverse systems into a unified RevOps tech stack is essential, moving beyond simple data silos to create a seamless flow of information that connects marketing activity, sales execution, and customer success outcomes.

A major technological imperative is the use of predictive and prescriptive analytics to enhance sales forecasting and pipeline health assessments. Consultants now leverage machine learning algorithms to identify high-propensity accounts, optimize territory design based on potential value rather than mere historical data, and simulate the impact of changes to compensation plans before implementation. This data-driven approach dramatically reduces the reliance on subjective managerial judgment. Moreover, the integration of Generative AI tools is beginning to reshape content creation and sales interaction analysis, offering consultants the opportunity to help clients deploy AI assistants for drafting personalized outreach emails or summarizing complex meeting transcripts, thereby significantly boosting sales force productivity and response times.

The technology utilized by the consultants themselves is also undergoing transformation. Leading firms are deploying proprietary platforms and intellectual property (IP) accelerators—cloud-based tools that allow them to quickly benchmark a client's sales performance against industry best practices, model organizational scenarios, and automate the configuration of complex sales processes within CRM environments. These internal technological assets allow consulting firms to reduce delivery timeframes, lower engagement costs for specific tasks, and provide a higher degree of analytical rigor. Cybersecurity and data governance expertise related to the storage and use of sensitive customer data within these sales technology systems are increasingly essential components of the technical consultation process, especially as sales operations become more interconnected and regulated globally.

Regional Highlights

North America continues its long-standing dominance in the Sales Consulting Services Market, driven primarily by the presence of a vast number of Fortune 500 companies, early and aggressive adoption of complex sales technologies, and a deeply ingrained culture of investing heavily in professional services to maintain competitive superiority. The United States market is characterized by high levels of technological sophistication, particularly in the deployment of Revenue Operations models and the early incorporation of AI/ML into B2B sales processes. Demand is robust across the IT, BFSI, and highly regulated Healthcare sectors, where the complexity of sales cycles mandates external expertise. Regulatory environments, while stringent, are relatively consistent, allowing consulting methodologies developed here to scale efficiently across the continent.

Europe represents a mature but fragmented market, characterized by diverse linguistic, cultural, and regulatory landscapes, which necessitates highly localized consulting approaches. Growth in Western Europe is steady, focused on optimizing sales channels in light of stringent data privacy regulations (GDPR) and navigating the transition to subscription-based models in various industries. The push toward sustainability and ethical business practices also influences sales strategy design, creating demand for consulting focused on Environmental, Social, and Governance (ESG) compliant sales frameworks. Eastern Europe, while smaller, offers rapid growth potential fueled by companies seeking to integrate their sales operations with global standards following expansion and modernization initiatives.

Asia Pacific (APAC) is projected to be the fastest-growing region, driven by rapid industrialization, burgeoning middle-class consumer bases, and massive governmental investments in digital infrastructure across economies like China, India, and Southeast Asia. The demand for sales consulting in APAC is often focused on foundational sales organization design, establishing standardized global processes, and training large, rapidly growing sales forces. Companies entering or expanding within APAC require specialized consulting to navigate complex cultural negotiation styles and highly fragmented distribution networks. Latin America and the Middle East and Africa (MEA) are emerging regions, exhibiting significant potential, particularly in the Telecommunications, Energy, and Financial Services sectors, though growth is often tempered by geopolitical volatility and localized economic fluctuations.

- North America: Market leader due to high technology adoption, concentration of large enterprises, and sophisticated RevOps implementation.

- Europe: Stable growth, driven by regulatory compliance needs (GDPR) and digital transformation mandates in mature economies; fragmentation requires local expertise.

- Asia Pacific (APAC): Fastest-growing region, fueled by rapid urbanization, foundational organization design needs, and increasing investments in digital infrastructure.

- Latin America: Emerging potential, strong demand in raw materials and financial services sectors, characterized by a focus on efficient resource allocation.

- Middle East and Africa (MEA): Growth concentrated in oil & gas, infrastructure, and financial hubs (e.g., UAE, Saudi Arabia) requiring complex strategy consulting.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Sales Consulting Services Market.- McKinsey & Company

- Boston Consulting Group (BCG)

- Bain & Company

- Accenture

- Deloitte Consulting LLP

- Gartner, Inc. (including former SiriusDecisions assets)

- Capgemini

- Slalom Consulting

- Korn Ferry

- ZS Associates

- Mercer LLC

- Simon-Kucher & Partners

- Richardson

- RAIN Group

- Sandler Training

- Factor 8

- Mercuri International

- Sales Benchmark Index (SBI)

- Challenger Inc.

- Vantage Point Performance

Frequently Asked Questions

Analyze common user questions about the Sales Consulting Services market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate for the Sales Consulting Services Market through 2033?

The Sales Consulting Services Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033, reaching a market valuation of USD 17.0 Billion by the end of the forecast period.

How is the rise of Revenue Operations (RevOps) impacting sales consulting engagements?

RevOps is profoundly impacting consulting by shifting the focus from siloed sales optimization to integrated revenue cycle management, requiring consultants to possess cross-functional expertise spanning sales, marketing, and customer success technology and strategy integration.

Which geographical region is expected to exhibit the fastest growth in this market?

The Asia Pacific (APAC) region is anticipated to exhibit the fastest growth, fueled by rapid digital adoption, extensive investments in establishing modern sales organizations, and industrial expansion across key economies like India and China.

What role does Artificial Intelligence (AI) play in the future delivery of sales consulting services?

AI is transforming sales consulting by automating data analysis and forecasting, enabling consultants to provide more prescriptive, data-driven strategy advice, and specializing in the ethical implementation and governance of advanced sales technology platforms for clients.

What are the primary factors restraining growth in the Sales Consulting Services Market?

Key restraints include the high costs associated with premium consulting services, challenges in definitively measuring the return on investment (ROI) from strategic engagements, and internal organizational resistance to implementing recommended structural changes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager