Sales Tax and VAT Compliance Software Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436932 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Sales Tax and VAT Compliance Software Market Size

The Sales Tax and VAT Compliance Software Market is experiencing robust expansion driven by the exponential growth of e-commerce, increasingly complex global regulatory environments, and the mandatory adoption of real-time reporting mandates across major economies. The shift from on-premise solutions to scalable, cloud-based Software as a Service (SaaS) platforms is a primary factor influencing market valuation, allowing businesses of all sizes, especially Small and Medium-sized Enterprises (SMEs), to manage multi-jurisdictional tax obligations without significant capital expenditure. Furthermore, the digitalization of tax authorities globally, necessitating seamless integration and automated compliance checks, fundamentally underpins the market's trajectory towards higher growth rates, mitigating audit risks for multinational corporations.

The market's valuation reflects the continuous need for businesses to minimize operational risk associated with incorrect tax calculations and filings. Key drivers include landmark legislative changes, such as the US Supreme Court's Wayfair decision, which expanded sales tax nexus obligations, and the European Union’s push toward mandatory e-invoicing and digital VAT reporting (ViDA initiative). These regulatory pressures compel companies handling cross-border transactions or operating in multiple states/regions to invest heavily in automated compliance solutions, ensuring accuracy and timeliness across thousands of tax codes and rates that frequently change.

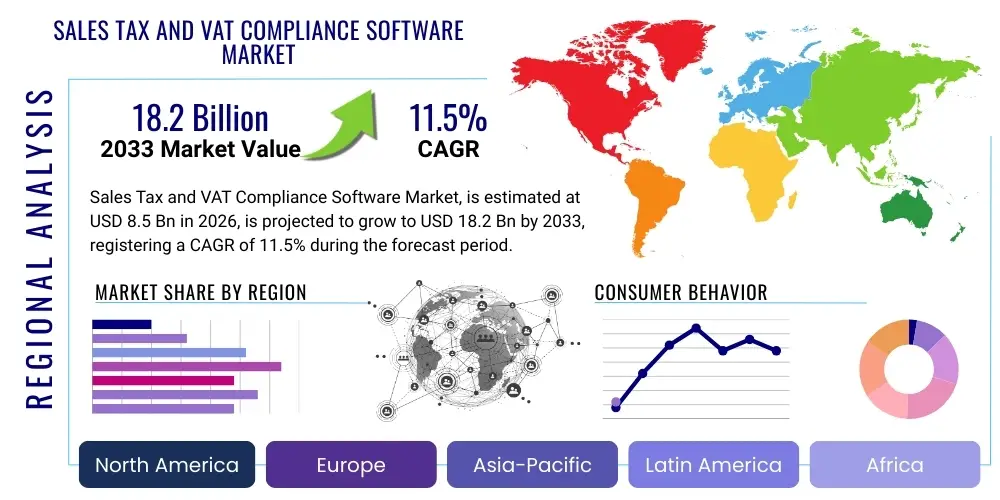

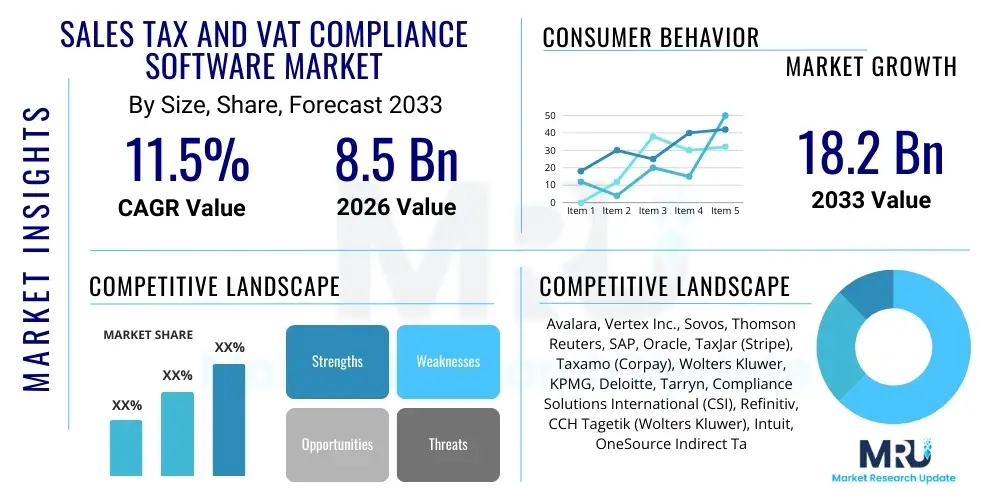

The Sales Tax and VAT Compliance Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at USD 8.5 Billion in 2026 and is projected to reach USD 18.2 Billion by the end of the forecast period in 2033, indicating strong investor confidence and essential business demand for automated tax management tools.

Sales Tax and VAT Compliance Software Market introduction

The Sales Tax and VAT Compliance Software Market encompasses digital solutions designed to automate and manage the entire lifecycle of indirect tax obligations, including calculation, determination, preparation, filing, and remittance of sales tax, Value Added Tax (VAT), and Goods and Services Tax (GST) across numerous global jurisdictions. These platforms integrate seamlessly with core enterprise systems, such as ERP (Enterprise Resource Planning), CRM (Customer Relationship Management), and e-commerce platforms, ensuring that the correct tax rate is applied at the point of transaction, regardless of location, product type, or specific tax holidays. The core product offering provides up-to-date tax content, regulatory monitoring, and reporting functionalities essential for businesses engaged in domestic and international trade.

Major applications of this software span various industries, including retail and e-commerce, manufacturing, financial services, and technology, particularly benefiting companies with high transaction volumes or complex cross-border supply chains. The primary benefits derived from adopting these systems include significant reduction in human error, enhanced accuracy in tax determination, minimized exposure to governmental penalties and fines, and substantial efficiency gains by replacing time-consuming manual processes with automated filing capabilities. Furthermore, the software provides comprehensive audit trails and documentation, bolstering a company's defense during tax authority reviews.

Driving factors sustaining market momentum include the digitalization of global commerce, which increases transaction complexity, and the continuous evolution of global tax policy, which mandates flexible and responsive compliance infrastructure. The regulatory trend towards mandatory digital reporting (e.g., e-invoicing mandates in Latin America and Europe) accelerates the need for real-time compliance capabilities. Additionally, the proliferation of subscription models and digital services creates new jurisdictional challenges, further solidifying the software's role as a critical component of modern financial infrastructure.

Sales Tax and VAT Compliance Software Market Executive Summary

The Sales Tax and VAT Compliance Software Market is characterized by a rapid technological transition toward cloud-native architectures, fueled by the demand for scalable, easily integrated, and frequently updated regulatory content. Current business trends indicate a strong preference for API-first solutions that allow for modular integration into existing legacy and modern IT ecosystems, enabling real-time tax calculation during complex checkout processes or supply chain events. Strategic consolidation through mergers and acquisitions is also a dominant trend, as large established providers seek to acquire niche specialists focusing on complex global VAT requirements or emerging technologies like Artificial Intelligence (AI) and blockchain to enhance their core offerings and expand geographic coverage.

Regional trends underscore differentiated growth trajectories, with North America maintaining market dominance primarily due to the intricate complexity of state and local sales tax rules and the vast number of taxing jurisdictions. However, the Asia Pacific (APAC) region is demonstrating the highest growth velocity, driven by robust economic expansion, rapid e-commerce adoption, and government mandates requiring standardization of tax systems, such as the unified GST implementation across India and digital tax transformations in Southeast Asia. Europe remains a critical growth area, particularly as the EU implements comprehensive digital VAT reporting and e-invoicing mandates designed to close the "VAT gap," driving urgent adoption among both large enterprises and SMEs.

Segment trends reveal that the SaaS delivery model dominates the landscape, offering accessibility and lower entry barriers compared to traditional on-premise solutions. Furthermore, the large enterprise segment remains the primary revenue generator due to the magnitude of their global operations, but the Small and Medium-sized Enterprise (SME) segment is projected to grow faster, leveraging streamlined, subscription-based solutions to manage their newly established digital nexus obligations. Functionally, compliance automation and filing services are seeing the most significant demand, followed closely by robust audit support and reconciliation tools, reflecting a strong focus on risk mitigation and process efficiency across all business sizes.

AI Impact Analysis on Sales Tax and VAT Compliance Software Market

Users frequently inquire about AI's capability to manage the volatility of global tax rules, particularly in real-time cross-border transactions. Key concerns revolve around whether AI can truly guarantee accuracy across constantly changing tax rates, product classifications, and specific regional exemptions, and how AI-driven predictive modeling can improve audit preparedness and defense strategies. Users also express interest in AI's role in processing unstructured data from invoices and receipts (OCR and NLP applications) to streamline reconciliation and identify discrepancies instantly. The overarching expectation is that AI integration will shift compliance from a reactive, historical reporting function to a proactive, predictive risk management system, reducing the reliance on manual tax expert intervention for routine tasks.

AI and Machine Learning (ML) are profoundly transforming the Sales Tax and VAT Compliance Software Market by enabling higher levels of automation, precision, and predictive capability. AI algorithms are crucial for maintaining the vast databases of global tax rules by autonomously monitoring legislative changes and instantly updating rate engines, ensuring real-time accuracy across diverse product and service classifications, which often require complex interpretations. Furthermore, AI is utilized in predictive modeling to analyze historical transaction data, flagging potential compliance risks before they trigger an audit, thereby allowing companies to proactively adjust their tax practices and improve internal controls.

The application of Robotic Process Automation (RPA), often integrated with AI/ML capabilities, is revolutionizing the tax filing and reporting processes. RPA bots can handle repetitive, rule-based tasks such as data aggregation from multiple systems, reconciliation of sales data with general ledger entries, and the electronic submission of tax returns to various governmental portals. This level of automation significantly reduces the labor costs associated with compliance, accelerates the closing process, and ensures timely adherence to strict submission deadlines, particularly critical in jurisdictions demanding continuous transaction controls (CTCs) or immediate digital reporting.

- AI-driven real-time rate determination across complex, granular jurisdictions.

- Predictive compliance modeling to identify potential audit risks and anomalies in transaction patterns.

- Enhanced product taxability classification using Natural Language Processing (NLP) to interpret product descriptions.

- Automation of data extraction and reconciliation from unstructured documents via Optical Character Recognition (OCR) and Machine Learning.

- Optimization of tax liability calculation based on evolving digital tax mandates and economic nexus laws.

- Improved audit defense by generating comprehensive, instantly accessible data trails validated by automated systems.

DRO & Impact Forces Of Sales Tax and VAT Compliance Software Market

The Sales Tax and VAT Compliance Software Market is significantly influenced by a powerful combination of drivers (D), restraints (R), and opportunities (O), collectively forming the impact forces shaping its evolution. Regulatory complexity and the globalization of commerce serve as primary drivers, forcing companies to adopt automated systems to manage multi-jurisdictional liabilities accurately. The continuous legislative upheaval, particularly the shift toward digital reporting and e-invoicing mandates worldwide, ensures sustained investment in these solutions. However, the high initial cost of implementation, particularly integrating software into disparate legacy enterprise resource planning (ERP) systems, often acts as a significant restraint, especially for mid-sized firms with limited IT budgets.

Opportunities abound in the development of specialized solutions for emerging markets and niche sectors, such as digital economy services (subscription models, SaaS) and cryptocurrency transactions, which present unique and rapidly evolving tax challenges. Furthermore, leveraging advanced technologies like AI, Blockchain, and API-based integrations presents avenues for vendors to offer differentiated, high-value services, moving beyond basic calculation to comprehensive strategic tax planning and audit readiness. The shift towards consumption-based taxation globally ensures a perpetual demand cycle for sophisticated compliance tools, amplifying the market's intrinsic stability.

The core impact forces are centered around efficiency and risk mitigation. The growing severity of penalties for non-compliance, coupled with tax authorities' enhanced data mining capabilities, elevates the risk factor for non-automated businesses. This pressure translates directly into market demand, making compliance software an essential rather than optional investment. The ongoing geopolitical instability and supply chain diversification further complicate cross-border tax scenarios, continually reinforcing the necessity for dynamic and highly adaptable compliance technology infrastructure that can handle fluctuating tariff and tax regimes seamlessly.

Segmentation Analysis

The Sales Tax and VAT Compliance Software Market is broadly segmented based on deployment type, enterprise size, component, and end-user industry. This segmentation reveals distinct adoption patterns and growth pockets across the global market. The segmentation by deployment model highlights the dominance of the cloud/SaaS segment, attributable to its flexibility, lower Total Cost of Ownership (TCO), and automatic regulatory updates, which are crucial in the fast-paced tax environment. The component segmentation emphasizes the growing demand for dedicated filing and reporting modules, moving beyond simple calculation tools. Enterprise size analysis confirms that while large enterprises remain the main revenue generators, SMEs represent the fastest-growing segment due to the accessibility and scalability offered by cloud solutions.

- By Component:

- Software (Tax Calculation, Determination, Document Management)

- Services (Consulting, Integration and Implementation, Training and Support)

- By Deployment Type:

- Cloud-based (SaaS)

- On-premise

- By Enterprise Size:

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

- By End-User Industry:

- Retail and E-commerce

- IT and Telecom

- Banking, Financial Services, and Insurance (BFSI)

- Manufacturing

- Healthcare

- Others (Logistics, Government)

- By Application:

- Tax Calculation and Reporting

- Tax Filing and Remittance

- Audit Management and Reconciliation

- License and Permit Management

Value Chain Analysis For Sales Tax and VAT Compliance Software Market

The value chain for Sales Tax and VAT Compliance Software begins with upstream activities focused on content acquisition and technical development. This includes gathering and standardizing global tax legislation, rates, boundaries, and rules, often sourced directly from government bodies or specialized content providers. The primary upstream challenge involves ensuring the completeness, accuracy, and timeliness of this vast tax data, which forms the engine's core intelligence. Successful vendors invest heavily in automated monitoring tools and legal expert networks to maintain these regulatory databases, ensuring that their software remains compliant in dynamic environments like the EU or complex multi-state US jurisdictions.

The midstream component centers on software development, integration, and service provision. Development focuses on building scalable cloud architectures, user-friendly interfaces, and robust API endpoints for seamless integration with client ERPs (e.g., SAP, Oracle), e-commerce platforms (e.g., Shopify, Magento), and proprietary financial systems. Integration services are critical, often involving specialized consultants who tailor the software to the client's specific business processes, product taxability matrix, and multi-entity structure. This phase ensures the software accurately captures all transactional data necessary for compliance determination.

Downstream activities involve distribution channels, deployment, and ongoing customer support, particularly audit defense. Distribution is primarily handled through direct sales channels for large enterprises and indirect channels, such as partnerships with accounting firms, system integrators, and channel partners, for the SME market. Post-deployment, continuous maintenance—including automated regulatory updates and customer support during tax authority audits—is essential. The ability of the vendor to provide comprehensive audit reports and historical data retrieval constitutes a significant differentiating factor, directly addressing the end-user need for risk mitigation and regulatory assurance.

Sales Tax and VAT Compliance Software Market Potential Customers

Potential customers for Sales Tax and VAT Compliance Software are defined primarily by their operational complexity, geographical reach, and volume of transactions. Any business that sells goods or services across multiple jurisdictional boundaries, including state lines (domestically) or national borders (internationally), constitutes a prime target. E-commerce platforms and online retailers are exceptionally high-priority customers, as they inherently manage vast numbers of transactions across diverse tax locales, often triggering economic nexus requirements in places where they lack physical presence. The necessity for real-time tax calculation during the checkout process makes this software indispensable for digital retailers.

Beyond retail, large multinational corporations (MNCs) in the manufacturing and technology sectors are significant buyers. These organizations require sophisticated solutions capable of handling complex supply chain tax determination, intercompany transfers, and adherence to varying customs and duty regulations in addition to sales tax and VAT. Financial institutions (BFSI) and insurance companies are increasingly adopting these platforms to manage unique financial transaction taxes and ensure regulatory reporting alignment across their service portfolios, especially as global finance becomes increasingly digitized and subject to specific regulatory reporting formats.

Furthermore, the Small and Medium-sized Enterprise (SME) segment represents a burgeoning customer base. Triggered by digital transformation and the expansion of economic nexus rules, many SMEs that previously managed tax manually now face compliance requirements as complicated as those of large enterprises. They seek affordable, cloud-based, scalable solutions that minimize administrative overhead, viewing the software not merely as a compliance tool but as a necessary operational safeguard against crippling governmental fines and operational disruptions stemming from non-compliance.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 8.5 Billion |

| Market Forecast in 2033 | USD 18.2 Billion |

| Growth Rate | CAGR 11.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Avalara, Vertex Inc., Sovos, Thomson Reuters, SAP, Oracle, TaxJar (Stripe), Taxamo (Corpay), Wolters Kluwer, KPMG, Deloitte, Tarryn, Compliance Solutions International (CSI), Refinitiv, CCH Tagetik (Wolters Kluwer), Intuit, OneSource Indirect Tax (Thomson Reuters), Taxdoo, TaxConnex, AccurateTax. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Sales Tax and VAT Compliance Software Market Key Technology Landscape

The technological foundation of the Sales Tax and VAT Compliance Software Market is increasingly centered on three pillars: advanced cloud infrastructure, powerful API integration, and machine learning capabilities. Modern compliance platforms are predominantly built on multi-tenant cloud architecture, often leveraging hyperscale providers (AWS, Azure, GCP) to ensure scalability, reliability, and security for processing massive volumes of transactional data across diverse geographies. This cloud environment facilitates the continuous, real-time updating of tax content, ensuring immediate application of the latest legislative changes globally without requiring client-side maintenance.

API (Application Programming Interface) integration is arguably the most crucial technological element, enabling seamless data flow between the compliance software and the customer's core business systems (e.g., e-commerce carts, payment gateways, and inventory management). API-first development strategies allow companies to determine tax liability instantly at the moment of transaction, crucial for digital commerce and cross-border sales. Microservices architecture supports these integrations, allowing vendors to offer specialized, modular components—such as specific tax engines for customs duties or digital service taxes—that can be independently scaled and updated, enhancing system resilience and accelerating feature deployment cycles.

The adoption of Machine Learning (ML) and Artificial Intelligence (AI) algorithms is accelerating technological maturity. ML is instrumental in automating complex tasks like product taxability mapping—classifying hundreds of thousands of different products into the correct tax category, a process historically reliant on manual expert knowledge. Furthermore, blockchain technology is emerging as a potential disruptor, offering immutable records of transactions, which could significantly simplify reconciliation and verification processes required by tax authorities, potentially lowering audit frequency and increasing overall trust in reported data integrity.

Regional Highlights

Regional dynamics in the Sales Tax and VAT Compliance Software Market are heavily dictated by local regulatory maturity, complexity, and the pace of digital transformation within governmental tax agencies. North America leads the market share, driven primarily by the unique complexity of the US sales tax system, involving thousands of state, county, and municipal jurisdictions, a situation dramatically heightened by the post-Wayfair economic nexus expansion. This fragmented and frequently changing regulatory landscape creates an absolute necessity for automated compliance software, fueling high adoption rates across retail, telecom, and technology sectors seeking comprehensive, real-time rate determination and filing solutions across 50+ states.

Europe represents the second-largest market, characterized by intense focus on Value Added Tax (VAT) compliance and cross-border transactions within the EU single market. European growth is being spurred by pivotal mandates, notably the VAT in the Digital Age (ViDA) initiative, which pushes for unified digital reporting and mandatory e-invoicing. This regulatory environment mandates that companies adopt software capable of real-time data submission, SAF-T (Standard Audit File for Tax) reporting, and managing various national e-invoicing standards, shifting the focus from simple calculation to transactional data governance and integration with governmental digital platforms.

Asia Pacific (APAC) is projected to be the fastest-growing region. This acceleration is linked to massive economic expansion, rapid e-commerce penetration, and the harmonization of tax systems (like GST in India and Malaysia) alongside the implementation of complex digital service taxes (DSTs) across countries like Australia and South Korea. Companies expanding into APAC require software that is highly scalable and adaptable to diverse languages and localized tax requirements. Latin America also contributes significantly, where continuous transaction controls (CTCs) and mandatory e-invoicing have been established regulatory requirements for years, driving the development of highly integrated and robust compliance solutions focusing intensely on government-mandated XML data standards and real-time validation.

- North America: Dominant market due to US state-level complexity, economic nexus requirements, and high e-commerce transaction volumes. Strong demand for sales tax determination and reporting tools.

- Europe: High growth driven by VAT compliance, ViDA, mandatory e-invoicing, and cross-border digital reporting requirements. Focus on automated SAF-T and real-time VAT calculation.

- Asia Pacific (APAC): Fastest-growing region, propelled by rapid adoption of GST regimes, digital service taxes, and general economic digitization. High demand for solutions integrated with diverse local tax portals.

- Latin America (LATAM): Mature adoption driven by strict government mandates for continuous transaction controls (CTCs), focusing on mandatory e-invoicing and digital ledger requirements.

- Middle East and Africa (MEA): Emerging market with increasing adoption spurred by the implementation of VAT in the Gulf Cooperation Council (GCC) countries and ongoing government efforts to modernize tax collection systems.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Sales Tax and VAT Compliance Software Market.- Avalara

- Vertex Inc.

- Sovos Compliance

- Thomson Reuters

- SAP

- Oracle

- Wolters Kluwer

- Intuit Inc. (TaxJar)

- Stripe

- Taxamo (Corpay)

- KPMG

- Deloitte

- Tarryn

- Compliance Solutions International (CSI)

- Refinitiv

- CCH Tagetik (Wolters Kluwer)

- Taxdoo

- TaxConnex

- AccurateTax

- Tax Slayer LLC

Frequently Asked Questions

Analyze common user questions about the Sales Tax and VAT Compliance Software market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Sales Tax and VAT compliance software?

Sales tax software primarily handles US state and local tax determination and filing based on complex origin/destination rules and economic nexus. VAT compliance software focuses on international requirements, specifically ensuring correct input/output tax application, managing cross-border transaction rules, e-invoicing compliance, and generating country-specific reports like SAF-T or ViDA reports for EU member states.

How do businesses manage the economic nexus challenges using compliance software?

Compliance software utilizes geo-location and transaction volume data tracking to continuously monitor a business's sales activity against current economic nexus thresholds in every US state. When a threshold is met, the software alerts the business, automatically calculates the relevant sales tax rate, and facilitates timely registration and filing in that new jurisdiction, ensuring immediate regulatory adherence.

Is Cloud (SaaS) or On-Premise deployment more suitable for multinational corporations?

Cloud (SaaS) deployment is overwhelmingly preferred by multinational corporations due to its rapid scalability, automatic, continuous tax content updates across thousands of jurisdictions, and ease of integration via APIs with global ERP and financial systems. SaaS models minimize internal IT overhead and ensure that regulatory changes are applied instantaneously, reducing global compliance risk.

What is the role of API integration in modern tax compliance platforms?

API integration is essential for embedding tax calculation directly into the point of sale (POS) or e-commerce checkout process, ensuring real-time, accurate tax determination based on the buyer's location and product classification. This integration allows for seamless data synchronization with financial systems, critical for automated reconciliation and accurate filing without manual data transfers.

How is AI impacting audit management and risk mitigation in the tax compliance market?

AI is significantly enhancing audit management by using machine learning to analyze historical transaction data, identify patterns indicative of non-compliance, and proactively flag high-risk transactions for review before filing. This predictive capability improves internal controls and ensures robust, instantly retrievable documentation, strengthening the business's defense during tax authority audits.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager