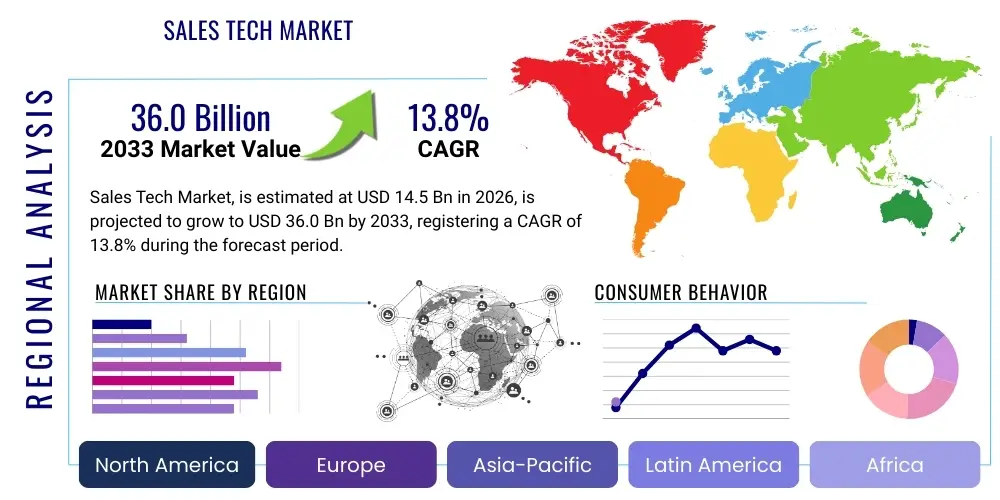

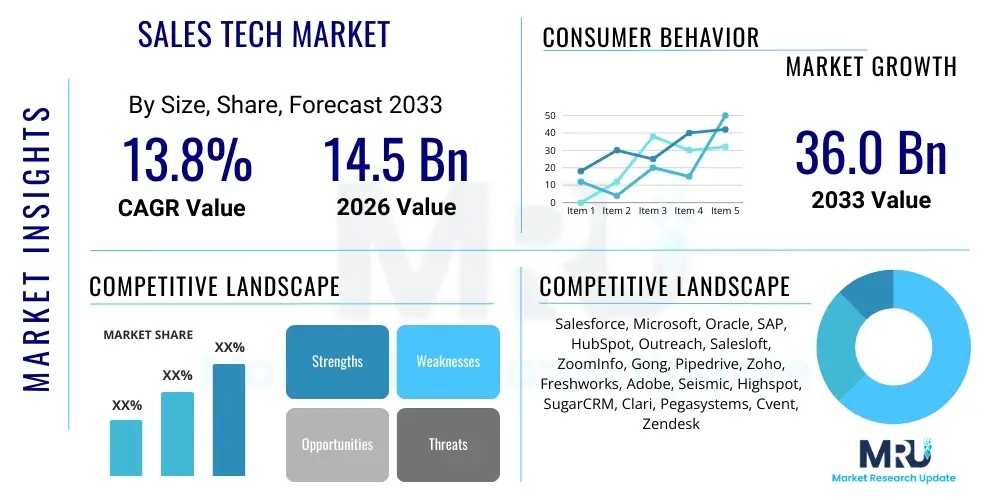

Sales Tech Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435188 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Sales Tech Market Size

The Sales Tech Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 13.8% between 2026 and 2033. This robust growth is driven by the increasing need for sales organizations to optimize efficiency, leverage predictive analytics, and streamline complex sales processes through automation. The market is estimated at $14.5 Billion in 2026 and is projected to reach $36.0 Billion by the end of the forecast period in 2033.

Sales Tech Market introduction

The Sales Technology Market encompasses a broad ecosystem of software applications, platforms, and services designed to enhance sales productivity, automate routine tasks, and provide actionable insights for sales teams across various organizational sizes and industry verticals. These solutions range from core Customer Relationship Management (CRM) systems to specialized tools for sales enablement, sales engagement, Configure, Price, Quote (CPQ), and predictive analytics. The primary objective of sales technology is to shorten sales cycles, improve forecasting accuracy, and ultimately drive higher revenue generation by ensuring sales professionals spend more time on selling activities and less on administrative tasks.

Major applications of Sales Tech include lead management, pipeline visualization, communication automation, contract lifecycle management, and performance management. Key benefits derived from the adoption of these technologies include enhanced data quality, improved communication consistency, better alignment between marketing and sales departments, and the ability to scale sales operations efficiently across global markets. Furthermore, the integration of Artificial Intelligence (AI) and Machine Learning (ML) capabilities is transforming Sales Tech from reactive recording systems into proactive advisory platforms, offering dynamic pricing recommendations and personalized engagement strategies.

The market is primarily driven by the digital transformation initiatives across industries, necessitating robust remote selling capabilities, especially following global shifts toward hybrid work models. Increasing investment in cloud-based SaaS solutions offers flexibility and scalability, making sophisticated tools accessible even to Small and Medium-sized Enterprises (SMEs). Regulatory compliance requirements, coupled with the pressure to deliver highly personalized customer experiences, further accelerate the demand for integrated Sales Tech stacks capable of handling complex data sets while ensuring security and privacy.

Sales Tech Market Executive Summary

The Sales Tech Market is experiencing a period of intense innovation, characterized by consolidation among major players seeking to offer unified, end-to-end platforms, alongside rapid development by niche providers specializing in hyper-focused solutions like conversational intelligence and sales content management. Business trends show a distinct shift toward platforms offering high levels of integration with existing enterprise software, focusing on user experience (UX) to ensure high adoption rates among sales teams. The primary investment focus for enterprises is moving beyond basic CRM toward advanced functionalities such as sales forecasting powered by ML, deep-dive sales analytics, and automated personalization at scale, ensuring every customer interaction is optimized for conversion.

Regionally, North America maintains market dominance due to high technological readiness, significant venture capital investment in sales enablement startups, and a strong culture of adopting cloud-first solutions. However, the Asia Pacific (APAC) region is demonstrating the highest growth trajectory, fueled by aggressive digital adoption in emerging economies and the rapid expansion of technology and e-commerce sectors which necessitate scalable sales infrastructure. Europe is characterized by stringent data protection regulations (like GDPR), which drives demand for compliant Sales Tech solutions focusing heavily on data governance and ethical AI application within sales processes.

Segment trends indicate that the Software component segment, particularly those offering subscription-based cloud deployment, accounts for the largest market share, driven by CRM systems and specialized Sales Engagement Platforms (SEPs). Within organizational sizes, Large Enterprises remain the primary revenue generators due to complex needs and higher budgetary allowances, yet the SME segment is projected to exhibit faster growth, facilitated by accessible, low-cost, modular SaaS offerings. Vertical segmentation highlights the significant adoption within the IT and Telecom sector, followed closely by the BFSI (Banking, Financial Services, and Insurance) sector, which leverages Sales Tech for complex compliance tracking and personalized customer service delivery.

AI Impact Analysis on Sales Tech Market

User queries regarding AI's influence on the Sales Tech Market typically center around automation efficiency, job displacement concerns, accuracy of predictive forecasting, and the ethical use of customer data for hyper-personalization. Users are keenly interested in understanding how AI-driven tools can move beyond simple task automation to actually enhance strategic decision-making and improve the quality of sales interactions. The key themes summarized across user concerns are the expectation for AI to provide unparalleled predictive accuracy—identifying optimal leads and mitigating pipeline risk—while addressing underlying anxieties about data security, integration complexity, and the necessity for sales professionals to adapt their skill sets to become 'AI collaborators' rather than just users of technology.

The consensus suggests that AI is moving the Sales Tech stack from a system of record to a system of intelligence. This transformation involves integrating Natural Language Processing (NLP) for conversational intelligence (analyzing sales calls and meetings), utilizing Machine Learning for dynamic pricing models, and employing deep learning to recommend the next best action in real time. This shift is critical for modern sales organizations operating in highly competitive, data-intensive environments where speed and relevance are paramount to securing a deal.

AI is fundamentally reshaping the role of the sales representative, automating low-value tasks like data entry, scheduling, and basic lead qualification, thereby allowing humans to focus on high-value activities such as complex negotiation, relationship building, and strategic account planning. The long-term expectation is that AI will democratize high-quality sales performance, embedding the best practices of top performers directly into the workflow of every team member through adaptive coaching and dynamic playbooks.

- AI-driven Predictive Analytics: Enhances sales forecasting accuracy by analyzing historical data, market trends, and internal sales activities to predict future outcomes and potential deal slippage.

- Conversational Intelligence: Utilizes NLP to analyze spoken and written interactions (calls, emails) to provide real-time coaching, identify risk flags, and extract key customer insights automatically.

- Intelligent Lead Scoring and Prioritization: Automatically ranks leads based on propensity to convert, reducing time wasted on unqualified prospects and optimizing resource allocation.

- Hyper-personalization Engines: Facilitates the delivery of highly customized content and messaging across various channels at specific stages of the sales journey, improving engagement rates.

- Automated Sales Process Optimization: Machine learning identifies bottlenecks in the sales pipeline and recommends structural or procedural changes to improve flow and efficiency.

- CRM Data Augmentation: AI automatically captures and updates data points (e.g., contact information, meeting notes) directly into the CRM, significantly reducing manual data entry burden.

- Dynamic Pricing and Configuration: Provides optimized quotes and pricing structures in real-time based on current market demand, inventory levels, and customer negotiation history.

DRO & Impact Forces Of Sales Tech Market

The Sales Tech Market is propelled by powerful drivers such as the mandate for digital transformation and the increasing adoption of cloud-based Software as a Service (SaaS) models, which lower implementation barriers and enhance scalability. Restraints include significant concerns over data privacy and security, particularly for multi-national corporations handling sensitive customer information across different regulatory jurisdictions, alongside the persistent challenge of integrating disparate Sales Tech tools into a seamless, unified platform. Opportunities abound in leveraging sophisticated AI and ML to deliver hyper-personalized customer experiences and expanding market penetration into high-growth verticals like healthcare and specialized manufacturing. These forces collectively define the market trajectory, accelerating innovation while simultaneously demanding greater compliance and seamless interoperability among solutions.

Key drivers center on improving sales productivity in an increasingly competitive environment. Organizations are under pressure to do more with less, driving investment into automation tools that handle repetitive tasks like email sequences, follow-ups, and data capture. The necessity for advanced analytical capabilities to move beyond lagging indicators (past performance) to leading indicators (predictive insights) is also a major force, particularly in complex B2B sales cycles. Furthermore, the global shift towards remote and hybrid selling models requires centralized, cloud-accessible platforms for sales enablement and collaboration, making robust Sales Tech indispensable for managing distributed teams effectively.

Significant restraints include the high initial investment required for comprehensive, enterprise-level CRM and Sales Tech implementation, coupled with the recurring costs of subscription licenses and specialized maintenance services. A substantial barrier remains the low adoption rate or resistance to change among seasoned sales professionals, often resulting in expensive tools being underutilized or bypassed entirely. The complexity inherent in integrating new Sales Tech applications with legacy systems, particularly in older financial or manufacturing firms, poses a technical challenge that can delay deployment and inflate total cost of ownership (TCO).

Opportunities are primarily generated through technological evolution, specifically the maturation of AI, which opens doors for new product categories such as revenue operations (RevOps) platforms designed to unify sales, marketing, and customer success data. Expanding geographical markets, especially in Latin America and Southeast Asia, offer untapped potential for scalable SaaS providers. Moreover, the demand for specialized Sales Tech tailored to vertical-specific workflows—such as regulatory compliance management in pharma sales or complex asset configuration in engineering sales—represents a lucrative area for focused product development.

Segmentation Analysis

The Sales Tech market is segmented broadly based on Component, Deployment Mode, Organization Size, and Vertical, allowing providers to target specific business needs with tailored solutions. The component segmentation differentiates between the core software platforms, such as CRM and sales force automation tools, and the vital professional and managed services required for implementation, integration, training, and ongoing support. Deployment mode is dominated by the Cloud (SaaS) model due to its scalability and lower operational expenditure, although on-premise solutions persist in sectors with extreme data security requirements, such as government and large banking institutions. Understanding these segmentations is critical for market players to develop targeted value propositions and pricing strategies.

The segmentation by Organization Size reflects distinct product needs; Small and Medium-sized Enterprises (SMEs) prioritize ease of use, rapid deployment, and affordability, often opting for all-in-one platforms with modular pricing. Conversely, Large Enterprises require robust customization capabilities, enterprise-grade security features, and extensive integration support for complex, multi-layered sales structures. Vertical specialization is becoming increasingly important, as generic Sales Tech platforms often fail to address the unique regulatory compliance, sales methodologies, and product complexities found in industries like pharmaceuticals, aerospace, or utilities. This drives the development of tailored sales acceleration tools that address niche requirements, contributing significantly to overall market growth.

- By Component:

- Software (CRM, Sales Force Automation, Sales Enablement, Sales Engagement, CPQ, Sales Analytics)

- Services (Consulting, Implementation, Training, Managed Services, Support)

- By Deployment Mode:

- Cloud (SaaS)

- On-Premise

- By Organization Size:

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

- By Vertical:

- IT and Telecom

- Banking, Financial Services, and Insurance (BFSI)

- Retail and Consumer Goods

- Healthcare and Pharmaceuticals

- Manufacturing

- Media and Entertainment

- Others (Government, Education, Logistics)

Value Chain Analysis For Sales Tech Market

The Sales Tech Value Chain begins with upstream activities focused on core platform development, including research and development (R&D) of proprietary AI algorithms, data structure design, and the creation of highly scalable cloud infrastructure. Key players in this stage are often technology providers specializing in platform-as-a-service (PaaS) or advanced analytics engines. This foundational stage dictates the technological sophistication and integration capability of the final product, requiring heavy investment in talent specializing in software engineering, data science, and user experience design.

Midstream activities involve the customization, integration, and packaging of the software components. Direct distribution occurs when major vendors like Salesforce or Microsoft sell their subscription services directly to end-users via internal sales teams and online marketplaces, offering immediate technical support. Indirect channels are crucial and involve partnerships with System Integrators (SIs), Value-Added Resellers (VARs), and specialized consulting firms that tailor the core Sales Tech platform to specific industry workflows (e.g., customizing CPQ for complex industrial machinery). These indirect channels provide necessary local expertise and implementation support that many enterprises require.

Downstream activities focus on the delivery, post-sales support, and continuous enhancement of the solution. This includes professional services for data migration, change management consulting to ensure high user adoption, and ongoing managed services for platform optimization and security updates. Customer success teams play a vital role here, ensuring the end-users—the sales representatives and managers—achieve measurable ROI, which is crucial for subscription renewal and long-term customer retention within the recurring revenue model characteristic of the SaaS market.

Sales Tech Market Potential Customers

Potential customers for Sales Tech solutions span virtually every sector of the economy where revenue generation and customer acquisition are central objectives. The primary buyers are typically C-level executives (Chief Revenue Officer, Chief Sales Officer), VP of Sales, and increasingly, specialized roles like the Head of Revenue Operations (RevOps), who focus on streamlining the entire revenue engine. These decision-makers seek technology that provides quantifiable improvements in pipeline velocity, forecast accuracy, and sales team efficiency.

Within specific verticals, customers in the BFSI sector prioritize solutions offering high-level security, detailed audit trails, and compliance features, integrating seamlessly with legacy banking systems. Manufacturing and industrial customers look for robust CPQ and field service management integrations. The IT and Telecom sector, being highly digital-native, demands cutting-edge AI for automated lead generation and complex account management. The versatility and specialization capability of the Sales Tech stack determine its appeal to these diverse end-users.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $14.5 Billion |

| Market Forecast in 2033 | $36.0 Billion |

| Growth Rate | 13.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Salesforce, Microsoft, Oracle, SAP, HubSpot, Outreach, Salesloft, ZoomInfo, Gong, Pipedrive, Zoho, Freshworks, Adobe, Seismic, Highspot, SugarCRM, Clari, Pegasystems, Cvent, Zendesk |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Sales Tech Market Key Technology Landscape

The foundational technology underpinning the modern Sales Tech market is Software as a Service (SaaS), delivered primarily through cloud infrastructure, which ensures rapid deployment, automatic updates, and cost scalability crucial for dynamic sales organizations. Beyond core cloud computing, the technological landscape is heavily influenced by advanced analytical tools. Machine Learning (ML) algorithms are fundamental for predictive lead scoring, opportunity management, and sophisticated sales forecasting, allowing businesses to move from descriptive analysis to prescriptive recommendations. Natural Language Processing (NLP) is increasingly vital, underpinning conversational intelligence platforms that analyze verbal and textual communications to provide actionable insights and coaching, automating the synthesis of meeting data directly into the CRM system.

Another pivotal area is the integration of proprietary Application Programming Interfaces (APIs) and unified data layers, which address the historical problem of data silos between marketing, sales, and customer success teams. Revenue Operations (RevOps) platforms leverage these advanced integration capabilities to provide a single source of truth for all revenue metrics, standardizing data definitions and automating workflow triggers across the entire customer lifecycle. Furthermore, the reliance on mobile technology is absolute; robust mobile CRM applications and sales enablement platforms are necessary to support field sales teams and remote workers, requiring responsive design and offline data synchronization capabilities.

Looking ahead, emerging technologies such as blockchain are beginning to be explored for secure and verifiable contract management and identity verification in high-trust sales environments. Edge computing is also being developed to handle localized data processing for real-time coaching and analytics, particularly relevant for in-person sales scenarios where immediate insights are required without latency. The market remains competitive based on the speed and efficacy of integrating these cutting-edge technologies into user-friendly interfaces that genuinely augment human sales performance.

Regional Highlights

Geographical analysis reveals significant variance in Sales Tech adoption rates, technological maturity, and market saturation across global regions. North America (NA) currently dominates the Sales Tech market, primarily driven by the presence of major technology vendors, high levels of digital readiness across all industries, and a robust investment climate that encourages the rapid development and scaling of specialized SaaS solutions. Enterprises in the US and Canada are early adopters of advanced technologies like AI-driven forecasting and conversational intelligence, viewing Sales Tech as a strategic imperative rather than a mere operational expense. The competitive landscape in North America necessitates continuous technological innovation to maintain market leadership, resulting in high Average Selling Prices (ASPs) for premium features and specialized platforms.

Europe represents a mature yet fragmented market, characterized by strong regulatory influence, particularly the General Data Protection Regulation (GDPR). This legislation drives demand for Sales Tech solutions that prioritize data sovereignty, explicit consent management, and ethical use of customer data. Western European countries (UK, Germany, France) show high adoption, particularly in BFSI and manufacturing, focusing on integration capabilities to connect specialized local systems. The European market tends to value robust, compliant solutions over pure speed, offering strong opportunities for vendors who can demonstrate clear adherence to privacy standards and offer localized language and currency support.

The Asia Pacific (APAC) region is projected to be the fastest-growing market, propelled by accelerating economic growth, rapid urbanization, and increasing mobile and internet penetration, especially in China, India, and Southeast Asia. Countries in APAC are quickly implementing cloud infrastructure, leapfrogging older on-premise deployments. This region demands highly scalable, modular Sales Tech solutions that can cater to vast geographical areas and diverse linguistic requirements. The growth is particularly pronounced in the e-commerce, tech, and financial services sectors, where customer acquisition volumes are exceptionally high, driving demand for automated lead management and highly efficient Sales Force Automation (SFA) tools. Latin America and the Middle East & Africa (MEA) are emerging markets, characterized by increasing SME digital transformation and rising foreign investment, signaling future opportunities for vendors offering localized SaaS solutions tailored to regional infrastructure limitations and economic structures.

- North America (NA): Market leader due to high tech adoption, early investment in AI, and headquarters of major Sales Tech innovators (Salesforce, Microsoft). Focus on maximizing efficiency and leveraging predictive analytics for complex B2B sales.

- Europe: High growth rate influenced by GDPR compliance requirements, favoring solutions with strong data governance features. Strong adoption in centralized markets like Germany (manufacturing) and the UK (financial services).

- Asia Pacific (APAC): Fastest-growing region driven by massive digital transformation in India and China, large e-commerce volumes, and rapid adoption of mobile-first Sales Tech solutions suitable for vast, dispersed markets.

- Latin America (LATAM): Emerging market characterized by increasing digitalization among SMEs and a growing need for sales collaboration tools to manage volatile economic landscapes.

- Middle East & Africa (MEA): Growth centered on oil & gas, financial hubs (UAE, Saudi Arabia), and increasing governmental push for digital economy diversification, leading to investment in robust CRM infrastructure.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Sales Tech Market.- Salesforce

- Microsoft (Dynamics 365)

- Oracle (CRM On Demand, Fusion CRM)

- SAP (Sales Cloud)

- HubSpot

- Outreach

- Salesloft

- ZoomInfo

- Gong

- Pipedrive

- Zoho Corporation

- Freshworks

- Adobe (Marketo Engage)

- Seismic

- Highspot

- Clari

- Pegasystems

- SugarCRM

- NICE

- Dialpad

Frequently Asked Questions

Analyze common user questions about the Sales Tech market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth trajectory for the Sales Tech Market through 2033?

The Sales Tech Market is projected to exhibit a Compound Annual Growth Rate (CAGR) of 13.8% from 2026 to 2033, reaching an estimated value of $36.0 Billion. This growth is primarily fueled by the accelerating adoption of AI in sales processes and the global shift towards remote and hybrid selling models that require advanced digital platforms.

How is Artificial Intelligence (AI) fundamentally changing sales technology platforms?

AI is transforming Sales Tech from systems of record into proactive systems of intelligence. Key changes include predictive analytics for highly accurate forecasting, conversational intelligence for real-time coaching and meeting analysis, and automation of low-value tasks like data entry, enabling sales professionals to focus on high-touch strategic engagement.

Which segmentation component holds the largest market share in the Sales Tech industry?

The Software component segment, particularly cloud-based Customer Relationship Management (CRM) and Sales Force Automation (SFA) platforms, commands the largest market share. This dominance is driven by high enterprise investment in core platforms essential for managing customer data and automating routine sales workflows.

What are the primary challenges restraining the widespread adoption of advanced Sales Tech solutions?

The primary restraints include significant concerns regarding data privacy and compliance (especially concerning GDPR and CCPA), the complexity and cost associated with integrating new tools with existing legacy enterprise systems, and persistent challenges related to low user adoption among sales teams resistant to process changes.

Which geographical region is expected to demonstrate the highest growth rate in the Sales Tech Market?

The Asia Pacific (APAC) region is forecasted to exhibit the highest growth rate. This rapid expansion is attributed to large-scale digital transformation initiatives across major economies, increasing internet penetration, and high investment in cloud infrastructure to support rapidly expanding e-commerce and technology sectors.

Competitive Landscape and Strategic Initiatives

The competitive landscape of the Sales Tech market is highly dynamic and characterized by intense competition between large platform providers offering comprehensive suites and specialized vendors focused on best-of-breed functionalities. Market leaders, such as Salesforce, Microsoft, and SAP, leverage their expansive ecosystems and deep integration capabilities across marketing, sales, and service clouds to lock in large enterprise customers. These platform giants continuously acquire niche technology companies to rapidly integrate new capabilities, particularly in the areas of AI, conversational intelligence, and revenue operations (RevOps), aiming to offer a unified, seamless user experience and a single pane of glass for all revenue-generating activities.

In contrast, specialized vendors, including Outreach, Salesloft, and Gong, maintain strong market positions by focusing exclusively on sales engagement, coaching, and sales enablement, offering highly sophisticated, purpose-built tools that often outperform general-purpose modules offered by the larger platforms. The strategic differentiator for these specialized providers is the depth of their proprietary data sets and the accuracy of their AI models, which are hyper-optimized for specific sales tasks. This creates a challenging environment for enterprises, often leading to a "best-of-suite versus best-of-breed" purchasing dilemma, where interoperability becomes a crucial factor for success.

Recent strategic initiatives across the market include a pronounced move toward horizontal integration, where companies are consolidating their offerings to provide full-cycle RevOps platforms that bridge the traditional gaps between Marketing Automation, CRM, and Customer Success software. Furthermore, there is a strong emphasis on developing embedded AI features that provide context-aware recommendations directly within the flow of work, minimizing the need for sales reps to navigate multiple screens or applications. Partnerships and co-development agreements, particularly for data sharing and API standards, are also key strategies employed to enhance platform compatibility and expand market reach into new industry verticals.

- Platform Consolidation: Large vendors prioritize mergers and acquisitions (M&A) to integrate niche AI and engagement capabilities, moving towards offering unified Revenue Operations (RevOps) platforms.

- Specialized Focus: Niche vendors maintain competitiveness by providing superior, high-accuracy tools (e.g., conversational intelligence) driven by proprietary, specialized data sets.

- Strategic Partnerships: Increased collaboration among vendors to ensure seamless API integration and data exchange, addressing customer demands for unified Sales Tech stacks.

- AI Embeddedness: Focus on embedding predictive and prescriptive AI directly into the sales workflow (e.g., in-line coaching, next best action prompts) to maximize user adoption and effectiveness.

- Expansion to SMEs: Development of more affordable, modular, and easy-to-deploy cloud solutions tailored specifically to the rapid scaling needs and budget constraints of small and medium enterprises.

Sales Tech Product Analysis and Innovation Trends

Product innovation in the Sales Tech market is primarily focused on enhancing intelligence, streamlining user experience, and improving cross-functional alignment. Core product evolution is seen in CRM systems moving beyond simple data repositories to complex, intelligent workflow orchestrators. Modern CRM solutions integrate advanced features like visual pipeline management, customized dashboards for executive insights, and automated data validation tools to ensure data integrity, which is essential for reliable forecasting. The emphasis is on building interfaces that require minimal manual input from the salesperson, reducing friction and maximizing time spent on customer interaction.

Significant innovation is also occurring within specialized product categories such as Sales Engagement Platforms (SEPs) and Sales Enablement tools. SEPs are evolving to handle multi-channel outreach strategies, seamlessly coordinating sequences across email, phone, and social media, often utilizing AI to dynamically optimize outreach timing and content based on prospect behavior. Sales Enablement platforms are moving beyond content libraries to offer sophisticated tools for prescriptive guidance, helping reps identify the right content, training, and subject matter experts needed for specific deal stages, directly impacting conversion rates in complex B2B sales cycles.

Furthermore, the emergence of dedicated Revenue Operations (RevOps) tooling represents a major product trend. These platforms are designed to sit above the traditional CRM, standardizing and automating processes across sales, marketing, and customer success teams. RevOps products focus heavily on governance, ensuring process consistency, optimizing territory and compensation plans, and providing unified analytics that track customer journey metrics from initial lead to renewal. This convergence of functions under RevOps signifies the market’s realization that siloed operations are inefficient and counterproductive to sustained revenue growth.

- Intelligent CRM Workflow: Evolution of CRM to include embedded AI for automated data capture, real-time activity scoring, and customized dynamic workflow routing based on deal progress.

- Conversational AI Maturity: Advanced NLP tools offering superior transcription, sentiment analysis, and the ability to automatically generate follow-up summaries and action items post-meeting.

- Integrated Sales Engagement: SEPs expanding their capabilities to manage complex, personalized outreach across multiple digital channels (email, LinkedIn, SMS) using automated decision-making logic.

- Content Personalization Engines: Sales Enablement platforms using machine learning to dynamically recommend sales content (pitch decks, case studies) tailored specifically to the prospect’s industry, role, and current stage in the buying cycle.

- Revenue Operations (RevOps) Platforms: New category of products focused on unified data governance, process standardization, and end-to-end performance analytics across all revenue teams.

Future Market Dynamics and Emerging Trends

The future trajectory of the Sales Tech market will be shaped by several critical dynamics, most notably the continued dominance of hyper-automation and the rise of data ethics as a core competitive factor. As AI tools become ubiquitous, the market will saturate with basic automation features; differentiation will shift towards sophisticated prescriptive intelligence that can provide strategic guidance beyond simple task execution. We anticipate a greater focus on "Explainable AI" (XAI) within sales forecasting tools, allowing sales leaders to understand the logic behind predictions, thereby increasing trust and adoption of advanced models, particularly in heavily regulated sectors like BFSI and healthcare.

Another powerful emerging trend is the democratization of sophisticated Sales Tech. Previously reserved for large enterprises, advanced tools are becoming accessible and affordable for Small and Medium-sized Businesses (SMBs) through simplified, low-code/no-code platforms. This democratization expands the total addressable market significantly, driving competition based on ease of use and speed of implementation. Furthermore, the growing complexity of remote and hybrid work models necessitates innovation in asynchronous sales collaboration tools, focusing on seamless integration with communication platforms like Slack and Microsoft Teams, ensuring sales reps remain connected regardless of location.

Finally, the movement towards "Sustainable Selling" is gaining traction. This involves leveraging Sales Tech to manage sales resources more efficiently, reduce unnecessary travel, and ensure sales efforts are directed only toward high-propensity leads, minimizing wasteful activity. This trend aligns with broader Environmental, Social, and Governance (ESG) mandates and will drive demand for tools that optimize sales routes, virtual meeting efficacy, and energy consumption associated with digital infrastructure. Vendors who can integrate ESG metrics or sustainability benefits into their value proposition are likely to capture new market segments.

- Explainable AI (XAI) in Forecasting: Increased demand for transparency in AI models to build trust and ensure compliance, moving beyond 'black box' predictions.

- No-Code/Low-Code Platforms: Enabling faster customization and easier deployment of sophisticated Sales Tech by users without deep technical expertise, fueling SME adoption.

- Asynchronous Collaboration Tools: Development of specialized features for sales teams working across different time zones and locations, optimizing information sharing and handoffs.

- Data Ethics and Governance Focus: Heightened importance of ethical data sourcing and processing, becoming a critical buying criterion for large global organizations.

- Vertical Specialization Depth: Continued development of Sales Tech solutions that are deeply embedded with the specific product catalogs, regulatory frameworks, and sales methodologies of niche industries.

Implementation Challenges and Mitigation Strategies

Implementing a comprehensive Sales Tech stack presents several systemic challenges that can hinder ROI realization. One of the most significant challenges is resistance to change among end-users, particularly seasoned sales representatives who may view new technologies as administrative burdens rather than performance enhancers. This resistance often results in low platform utilization, inconsistent data input (garbage in, garbage out), and reliance on parallel, unofficial systems, severely compromising the accuracy of centralized data required for effective forecasting and management. Mitigation requires robust change management strategies, involving early stakeholder input, comprehensive training tailored to specific sales roles, and demonstrating clear, immediate benefits (e.g., time saved, quota attainment assistance) to the sales team.

Another major hurdle is the complexity of integrating newly acquired Sales Tech tools with existing legacy infrastructure and disparate applications (e.g., ERP systems, older Marketing Automation platforms). Seamless data flow is crucial for accurate RevOps and customer lifecycle visibility. Integration failures lead to data silos, workflow fragmentation, and significant operational friction. Enterprises must mitigate this by prioritizing vendors with open APIs and proven integration success stories, utilizing specialized System Integrators (SIs) with deep domain expertise, and adopting an incremental, phased rollout strategy rather than attempting a large-scale, simultaneous deployment.

Finally, data security and compliance pose a perpetual implementation challenge, especially as sales activities increasingly involve sensitive customer information and multi-regional operations. Non-compliance with regulations like GDPR or CCPA can result in massive fines and reputational damage. Solutions must be implemented with security protocols and governance frameworks designed into the architecture from day one. Mitigation involves mandatory security training for all users, continuous auditing of data access permissions, and selecting cloud vendors (SaaS) that offer certifications and compliance features specific to the required regulatory environments of the operating regions.

- Low User Adoption: Address through early stakeholder involvement, role-specific training, executive sponsorship, and mandatory usage tied to performance metrics.

- Integration Failures: Mitigated by focusing on open architecture solutions, utilizing integration platform as a service (iPaaS) tools, and conducting thorough compatibility testing before deployment.

- Data Quality Issues: Solved by implementing AI-driven automated data validation, integrating data cleaning services, and simplifying the data input process to reduce manual error.

- High Total Cost of Ownership (TCO): Controlled by rigorous vendor negotiation, selecting modular solutions (pay-as-you-grow), and focusing on measurable ROI metrics (e.g., reduction in sales cycle time).

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager